Birks Group Inc. (the “Company” or “Birks Group”) (NYSE MKT LLC:

BGI), which operates 46 luxury jewelry stores in Canada, Florida

and Georgia, reported financial results on June 23, 2017 for the

fiscal year ended March 25, 2017 (“fiscal 2017”). Net sales

increased by $1.1 million in fiscal 2017 and the Company recorded

net income of $4.9 million. All amounts are in U.S. dollars.

Jean-Christophe Bédos, President and Chief Executive Officer of

Birks Group, commented “Our fiscal 2017 results are reflective of

our resiliency as a Company to adapt in a constantly changing and

very challenging retail environment in North America. Despite

current retail conditions in Canada, our sales grew by $1.1 million

over last year. We posted net earnings of $4.9 million due to a

strong performance in the US, in line with our fiscal 2016 net

earnings of $5.4 million. Our continued successes are attributable

to our dedication to enhancing customer experiences through our new

store designs, our new collections and our creative marketing

campaigns. Management is focused on growing the Birks brand through

a consumer-centric approach involving creative marketing and the

launch of new jewelry collections. We believe that the execution of

our strategies will allow the Company to achieve its objectives in

fiscal 2018.”

Fiscal 2017 Financial Overview:

- Net sales were $286.9 million for

fiscal 2017, an increase of $1.1 million compared to net sales of

$285.8 million in fiscal year ended March 26, 2016 (“fiscal

2016”). Net sales were $3.6 million higher than last year on a

constant currency basis (see “Non-GAAP measures”) after excluding

$2.5 million of lower sales due to the translation of the Company’s

Canadian sales into U.S. dollars with a weaker Canadian

dollar;

- Comparable store sales and comparable

store sales calculated on a constant exchange rate basis (see

“Non-GAAP measures”) both increased by 1% compared to the prior

fiscal year ended March 26, 2016;

- The comparable store sales increase of

1% reflects a 9% comparable store sales increase in the U.S.,

mainly driven by higher timepiece sales reflecting the success of

our strategy to introduce new watch brands while expanding our

offering of select watch and fine jewelry brands, offset by an 8%

decrease in comparable store sales in Canada, primarily driven by

difficult economic conditions in Western Canada and decreased

spending by certain affluent tourists;

- Gross profit was $108.4 million, or

37.8% of net sales, for fiscal 2017, compared to

$109.4 million, or 38.3% of net sales, for fiscal 2016. The

reduction of 50 basis points in gross margin percentage is mainly

due to product sales mix and the impact of foreign exchange;

- Selling, general and administrative

expenses were $94.2 million, or 32.8% of net sales, in fiscal 2017

compared to $91.1 million, or 31.9% of net sales, in fiscal 2016.

The increase is mainly due to additional direct variable costs

driven by higher U.S. sales and due to the increased use of

in-house credit plans that attracted new customers during fiscal

2017, partially offset by the efficiencies that resulted from the

operational restructuring plan that was initiated in fiscal

2015;

- The Company’s fiscal 2017 reported

operating income was $8.3 million, a decrease of $7.2 million

compared to $15.5 million in fiscal 2016. Adjusted operating income

(see “Non-GAAP measures”), which excludes restructuring costs, was

$9.2 million, a decrease of $3.8 million compared to $13.0 million

in fiscal 2016 (excluding restructuring costs and gain on sale of

assets); and

- Net income for fiscal 2017 was

$4.9 million, or $0.27 per share, compared to net income of

$5.4 million, or $0.30 per share in fiscal 2016. Excluding the

impact of $0.8 million of restructuring charges recorded during

fiscal 2017, the Company’s net income for fiscal 2017 was $5.7

million, or $0.32 per share, compared to a net income of

$3.0 million, or $0.17 per share, for fiscal 2016 after

excluding the $0.8 million restructuring charges and the

$3.2 million of gain on sale of assets.

About Birks Group Inc.

Birks Group is a leading operator of luxury jewelry stores in

Canada and Southeastern United States. As of May 31, 2017, the

Company operated 26 stores under the Birks brand in most major

metropolitan markets in Canada, 17 stores in Florida and Georgia

under the Mayors brand, one store under the Rolex brand name and

two retail locations in Calgary and Vancouver under the Brinkhaus

brand. Birks was founded in 1879 and developed over the years into

Canada’s premier retailer and designer of fine jewelry, timepieces

and gifts. Mayors was founded in 1910 and has maintained the

intimacy of a family-owned boutique while becoming renowned for its

fine jewelry, timepieces and service. Additional information can be

found on Birks Group web site, www.birksgroup.com.

NON-GAAP MEASURES

The Company reports information in accordance with U.S.

Generally Accepted Accounting Principles (“U.S. GAAP”). The

Company’s performance is monitored and evaluated using various

sales and earnings measures that are adjusted to include or exclude

amounts from the most directly comparable GAAP measure (“non-GAAP

measures”). The Company presents such non-GAAP measures in

reporting its financial results to investors and other external

stakeholders to provide them with useful complimentary information

which will allow them to evaluate the Company’s operating results

using the same financial measures and metrics used by the Company

in evaluating performance. The Company does not, nor does it

suggest that investors and other external stakeholders should,

consider non-GAAP measures in isolation from, or as a substitute

for, financial information prepared in accordance with U.S. GAAP.

These non-GAAP measures may not be comparable to similarly-titled

measures presented by other companies.

Constant currency basis

The Company evaluates its sales performance using non-GAAP

measures which eliminates the foreign exchange effects of

translating net sales, comparable store sales and gross profit made

in Canadian dollars to U.S. dollars (constant currency basis or

constant exchange rate basis). Net sales, comparable store sales

and gross profit on a constant exchange rate basis are calculated

by taking the current period’s sales and gross profit in local

currency and translating them into U.S. dollars using the prior

period’s foreign exchange rates. The Company believes that such

measures provide useful supplemental information with which to

assess the Company’s performance relative to the corresponding

period in the prior year. The following tables reconcile the net

sales, comparable store sales and gross profit increases

(decreases) from GAAP to non-GAAP versus the previous fiscal

year:

Constant Exchange RateBasis

Reconciliation

Fiscal 2017 vs. Fiscal 2016 Fiscal 2016 vs.

Fiscal 2015 GAAP

TranslationEffect

ConstantExchange

RateBasis

GAAP TranslationEffect

ConstantExchange

RateBasis

Net Sales (in $ 000's) Net sales

- Retail 1,867 (2,619) 4,486 (11,206) (19,606) 8,400 Net sales -

Other (772) 146 (918) (4,605)

(556) (4,049) Total Net Sales 1,095 (2,473) 3,568 (15,811)

(20,162) 4,351

Gross Profit (in $ 000's)

Total Gross Profit (953) (383) (570)

(8,418) (8,349) (69)

Constant Exchange RateBasis

Reconciliation

Fiscal 2017 vs. Fiscal 2016

ComparableStore Sales

TranslationEffect

ComparableStore Sales on

aConstant Exchange RateBasis

Comparable Store

Sales (in %)

Canada -8% 0% -8% U.S 9% 0% 9% Total 1%

0% 1%

Fiscal

2016 vs. Fiscal 2015

ComparableStore Sales

TranslationEffect

ComparableStore Sales on

aConstantExchange RateBasis

Comparable Store

Sales (in %)

Canada -8% -14% 6% U.S 1% 0% 1% Total

-4% -7% 3%

Fiscal 2015 vs. Fiscal 2014

ComparableStore Sales

TranslationEffect

ComparableStore Sales on

aConstantExchange RateBasis

Comparable Store

Sales (in %)

Canada -8% -20% 12% U.S 19% 0% 19%

Total 1% -15% 16%

Adjusted operating expenses and adjusted operating

income

The Company evaluates its operating performance using financial

measures which exclude expenses associated with operational

restructuring plans, a non-recurring gain on disposal of the

corporate sales division and impairment losses. The Company

believes that such measures provide useful supplemental information

with which to assess the Company’s results relative to the

corresponding period in the prior year and can result in a more

meaningful comparison of the Company’s performance between the

periods presented. The table below provides a reconciliation of the

non-GAAP measures presented to the most directly comparable

financial measures calculated with GAAP.

Reconciliation of

non-GAAPmeasures

Year ended March 25, 2017

($'000) GAAP Restructuringcosts (a)

One-timegain (b)

Impairmentloss (c)

Non-GAAP

Operating expenses 100,102 (842) - - 99,260 as a % of net

sales 34.9%

34.6% Operating income 8,332 842 - - 9,174 as a % of net

sales 2.9%

3.2%

Reconciliation of

non-GAAPmeasures

Year ended March 26, 2016

($'000) GAAP Restructuringcosts

(a) One-timegain (b)

Impairmentloss (c)

Non-GAAP

Operating expenses 93,879 (754) 3,229 - 96,354 as a % of net

sales 32.8%

33.7% Operating income 15,508 754 (3,229) - 13,033 as

a % of net sales 5.4%

4.6%

Reconciliation of

non-GAAPmeasures

Year ended March 28, 2015 ($'000)

GAAP Restructuringcosts (a)

One-timegain (b)

Impairmentloss (c)

Non-GAAP

Operating expenses 112,509 (2,604) - (238) 109,667 as a % of

net sales 37.3%

36.4% Operating income 5,296 2,604 - 238 8,138

as a % of net sales 1.8%

2.7%

(a) Expenses associated with the Company’s operational

restructuring plan(b) Non-recurring gain on disposal of assets

resulting from the Company’s sale of its corporate sales division

in fiscal 2016(c) Non-recurring loss associated with the decision

to abandon a software project and a Birks retail shop-in-shop in

fiscal 2015

The Company did not present such non-GAAP measures in prior

years.

Forward Looking

Statements

This press release contains certain “forward-looking” statements

concerning the Company’s performance and strategies, including that

the execution of its strategies will allow the Company to continue

to produce positive results in fiscal 2018 and that it’s Non-GAAP

measures provide useful supplemental information with which to

assess the Company’s performance relative to the corresponding

period in the prior year. Because such statements include various

risks and uncertainties, actual results might differ materially

from those projected in the forward-looking statements and no

assurance can be given that we will meet the results projected in

the forward-looking statements. These risks and uncertainties

include, but are not limited to the following: (i) economic,

political and market conditions, including the economies of the

U.S. and Canada, which could adversely affect our business,

operating results or financial condition, including our revenue and

profitability, through the impact of changes in the real estate

markets (especially in the state of Florida), changes in the equity

markets and decreases in consumer confidence and the related

changes in consumer spending patterns, the impact on store traffic,

tourism and sales; (ii) the impact of fluctuations in foreign

exchange rates, increases in commodity prices and borrowing costs

and their related impact on the Company’s costs and expenses; (iii)

the Company’s ability to maintain and obtain sufficient sources of

liquidity to fund its operations, to achieve planned sales, gross

margin and net income, to keep costs low, to implement its business

strategy, maintain relationships with its primary vendors, to

mitigate fluctuations in the availability and prices of the

Company’s merchandise, to compete with other jewelers, to succeed

in its marketing initiatives, and to have a successful customer

service program. Information concerning factors that could cause

actual results to differ materially are set forth under the

captions “Risk Factors” and “Operating and Financial Review and

Prospects” and elsewhere in our Annual Report on Form 20-F filed

with the Securities and Exchange Commission on June 23, 2017 and

subsequent filings with the Securities and Exchange Commission. The

Company undertakes no obligation to update or release any revisions

to these forward-looking statements to reflect events or

circumstances after the date of this statement or to reflect the

occurrence of unanticipated events, except as required by law.

BIRKS GROUP INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED(In

thousands, except per share amounts)

Fiscal YearEndedMarch

25,2017

Fiscal YearEndedMarch

26,2016

Net sales $ 286,921 $ 285,826 Cost of sales 178,487

176,439 Gross profit 108,434 109,387 Selling, general

and administrative expenses 94,226 91,125 Restructuring charges 842

754 Depreciation and amortization 5,034 5,229 Gain on sale of

assets - (3,229) Total operating expenses

100,102 93,879 Operating income 8,332 15,508 Interest

and other financing costs 8,681 10,020 Debt extinguishment charges

- - Income (loss) before income taxes (349) 5,488

Income tax expense (5,277) 50 Net income $ 4,928 $

5,438 Weighted average shares outstanding: Basic 17,961

17,961 Diluted 18,418 17,961 Net income (loss) per share:

Basic $ 0.27 $ 0.30 Diluted $ 0.27 $ 0.30

BIRKS GROUP INC.CONDENSED

CONSOLIDATED BALANCE SHEETS – UNAUDITED(In

thousands)

March 25, 2017 March 26,

2016 Assets Current assets: Cash and cash

equivalents $ 1,944 $ 2,344 Accounts receivable 13,561

10,293 Inventories 132,069 137,839 Prepaids and other current

assets 2,191 1,793 Total current assets 149,765

152,269 Property and equipment 22,990 29,419 Intangible

assets 690 792 Other assets 190 493 Deferred income taxes

5,303 - Total non-current assets 29,173 30,704

Total assets $ 178,938 $ 182,973

Liabilities and

Stockholders’ Equity Current liabilities: Bank indebtedness $

70,434 $ 62,431 Accounts payable 46,657 46,730 Accrued liabilities

8,386 9,040 Current portion of long-term debt 2,810

5,634 Total current liabilities 128,287 123,835 Long-term

debt 30,525 46,651 Other long-term liabilities 7,330

4,783 Total long-term liabilities 37,855 51,434

Stockholders’ equity: Common stock 69,601 69,601 Additional paid-in

capital 16,372 16,216 Accumulated deficit (73,921) (78,849)

Accumulated other comprehensive income 744 736 Total

stockholders’ equity 12,796 7,704 Total liabilities

and stockholders’ equity $ 178,938 $ 182,973

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170623005084/en/

Birks Group Inc.Financial:Pat Di Lillo,

1-514-397-2592Vice President, Chief Financial & Administrative

Officerpdilillo@birksgroup.comorMedia:Eva Hartling,

1-514-397-2496Vice President, Birks Brand & Chief Marketing

Officerehartling@birksgroup.com

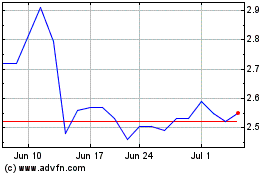

Birks (AMEX:BGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

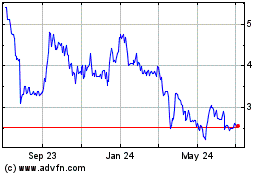

Birks (AMEX:BGI)

Historical Stock Chart

From Apr 2023 to Apr 2024