SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

CF Corporation

(Name of Issuer)

Class A ordinary shares, par value $0.0001 per share

(Title of Class of Securities)

G20307123

1

(CUSIP Number)

Eric Marhoun, Esq.

General Counsel & Secretary

Fidelity & Guaranty Life

601 Locust Street, 14

th

Floor

Des Moines, Iowa 50309-3738

With a copy to:

Todd E. Freed, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, New York 10036

(212) 735-2000

Christopher J. Ulery, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

1440 New York Avenue, N.W.

Washington D.C. 20005

(202) 393-5760

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 24, 2017

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d- 1(g), check the following box

o

.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

|

|

|

|

1

|

The Ordinary Shares have no CUSIP number. The CINS number for the Ordinary Shares is G20307123

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

Names of Reporting Persons.

Fidelity & Guaranty Life (“FGL”)

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

¨

|

|

|

|

|

(b)

|

¨

|

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

|

|

8.

|

Shared Voting Power

3,000,000*

|

|

|

|

9.

|

Sole Dispositive Power

0

|

|

|

|

10.

|

Shared Dispositive Power

3,000,000*

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,000,000

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

4.35%**

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Represents 3,000,000 Class A ordinary shares of CF Corporation (“CF Corp”) that are subject to the voting agreement, dated as of May 24, 2015 (the “Voting Agreement”), entered into by FGL and certain shareholders of CF Corp. Pursuant to Rule 13d-4, FGL expressly disclaims beneficial ownership of any such shares or other securities of CF Corp subject to the Voting Agreement, and nothing herein shall be deemed an admission by FGL as to the beneficial ownership of such shares or other securitie

s.

|

|

|

|

|

**

|

Such percentage is based upon 69,000,000 outstanding CF Corp Class A ordinary shares as of May 12, 2017 as reported in CF Corp’s Form 10-Q for the period ended March 31, 2017, and filed with the Securities and Exchange Commission (the “SEC”) on May 12, 2017.

|

Item 1. Security and Issuer

This statement on Schedule 13D (this “Schedule”) relates to the Class A ordinary shares of CF Corp, par value $0.0001 per share (the “CF Corp Shares”). CF Corp’s principal executive office is located at 1701 Village Center Circle, Las Vegas, Nevada 89134.

Item 2. Identity and Background

|

|

|

|

(a)

|

This Schedule is being filed by FGL.

|

|

|

|

|

(b)

|

The address and principal office of FGL is:

|

601 Locust Street 14

th

Floor

Des Moines, Iowa 50309-3738

United States of America

|

|

|

|

(c)

|

FGL is a national provider of fixed annuity and life insurance products to the middle-income market. Through independent marketing organizations and independent agents, FGL issues both immediate annuities as well as deferred fixed-indexed and fixed-rate annuities. FGL also currently offers indexed universal whole life policies while having previously sold term and whole life products. FGL maintains strong financial strength as evidenced by the ratings of B++ (Good) from A.M. Best (XIII size category) and BBB- (Good) from Standard and Poor’s.

|

The name, business address, present principal occupation or employment and citizenship of each director and executive officer of FGL are set forth on Annex A hereto and are incorporated by reference herein in their entirety.

|

|

|

|

(d)

|

During the past five years, none of FGL or, to the best of its knowledge, any person listed on Annex A attached hereto, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

|

|

(e)

|

During the past five years, none of FGL or, to the best of its knowledge, any person listed on Annex A attached hereto, has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was, or is, subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violation with respect to such laws.

|

Item 3. Source and Amount of Funds or Other Consideration

FGL entered into the Voting Agreement (as defined in Item 4 herein) in connection with the Merger Agreement (as defined in Item 4 herein). Other than entering into the Merger Agreement, FGL has not paid any consideration to CF Corp or to any Shareholder (as defined in Item 4 herein) as an inducement to entering into the Voting Agreement.

For a summary of certain provisions of the Merger Agreement, see Item 4 below, which summary is incorporated by reference in its entirety in the response to this Item 3. For a summary of the Voting Agreement, see Item 4 below, which summary is incorporated by reference in its entirety in the response to this Item 3. The Merger Agreement is filed as Exhibit 1 hereto and is incorporated herein by reference in its entirety. The Voting Agreement is filed as Exhibit 2 hereto and is incorporated herein by reference in its entirety.

Item 4. Purpose of Transaction.

(a), (b), (e) and (j)

Merger Agreement

On May 24, 2017, FGL, entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among CF Corp, FGL US Holdings Inc., a Delaware corporation and a newly formed, indirect wholly owned subsidiary of CF Corp (“Parent”), FGL Merger Sub Inc., a Delaware corporation and a newly formed, direct wholly owned subsidiary of Parent (“Merger Sub”). Subject to the terms and conditions of the Merger Agreement, at the time of the closing (the “Effective Time”), Merger Sub will merge with and into FGL (the “Merger”), with FGL continuing as the surviving entity, which will become an indirect, wholly owned subsidiary of CF Corp.

Following execution of the Merger Agreement, FS Holdco II Ltd., a corporation organized under the laws of the Cayman Islands (“FS Holdco”), which is a wholly owned subsidiary of HRG Group, Inc., a Delaware corporation, holding a majority of the issued and outstanding shares of common stock of FGL (the “Common Stock”), executed and delivered to FGL a written consent (the “Consent”), approving and adopting the Merger Agreement and the transactions contemplated thereby, including the Merger. As a result of the execution and delivery of the Consent, the holders of at least a majority of the outstanding shares of Common Stock have adopted and approved the Merger Agreement.

Pursuant to the Merger Agreement, at the Effective Time, each issued and outstanding share of Common Stock will be cancelled and converted automatically into the right to receive $31.10 in cash, without interest (the “Merger Consideration”), other than any shares of Common Stock owned by FGL as treasury stock or otherwise or owned by CF Corp, Parent or Merger Sub (which will be cancelled and no payment will be made with respect thereto), shares of Common Stock granted pursuant to the Company Equity Plan (as defined in the Merger Agreement) and those shares of Common Stock with respect to which appraisal rights under Delaware law are properly exercised and not withdrawn (“Appraisal Shares”). The Merger Agreement permits FGL to pay out a regular quarterly cash dividend on its Common Stock prior to the closing of the transaction in an amount not in excess of $0.065 per share, per quarter (the per share amount of FGL’s most recently declared quarterly dividend).

At the Effective Time, each (i) option to purchase shares of Common Stock (a “Company Stock Option”), (ii) restricted share of Common Stock and (iii) performance-based restricted stock unit relating to shares of Common Stock (an “RSU”), in each case whether vested or unvested, will become fully vested and automatically converted into the right to receive a cash payment equal to the product of (1) the number of shares subject to the award (for RSUs, determined at the target performance level) multiplied by (2) the Merger Consideration (less the exercise price per share in the case of Company Stock Options). In addition, at the Effective Time, each stock option (“FGLH Stock Option”) and restricted stock unit relating to shares of Fidelity & Guaranty Life Holdings, Inc., a subsidiary of FGL (“FGLH”), whether vested or unvested, will become fully vested and automatically converted into the right to receive a cash payment equal to the product of (A) the number of shares of FGLH stock subject to the award multiplied by (B) $176.32 (less the exercise price in the case of such FGLH Stock Options), and each dividend equivalent held in respect of a share of FGLH stock (a “DER”), whether vested or unvested, will become fully vested and automatically converted into the right to receive a cash payment equal to the amount accrued with respect to such DER.

Pursuant to the Merger Agreement, the consummation of the Merger is subject to satisfaction or waiver of certain closing conditions, including, among others: (i) the information statement to be filed by FGL with the SEC in connection with the Merger shall have been cleared by the SEC and shall have been sent to stockholders of FGL (in accordance with Regulation 14C under the Exchange Act) at least twenty (20) days prior to the closing; (ii) the shareholders of CF Corp adopting the Merger Agreement and approving the issuance of shares of CF Corp in connection with the transactions contemplated by the Merger Agreement, as required by the rules of Nasdaq; (iii) the absence of any law or order enacted, issued or enforced that is in effect and that prevents or prohibits the consummation of the Merger; (iv) obtaining the requisite approvals from the Iowa Insurance Division, the New York Department of Financial Services and the Vermont Department of Financial Regulation and (v) the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The Merger Agreement does not contain any financing condition or contingency.

The Merger Agreement includes customary representations, warranties and covenants of FGL, CF Corp, Parent and Merger Sub. Among other things, FGL and its subsidiaries are required to conduct their respective businesses and operations in the ordinary course of business until the Merger is consummated.

The Merger Agreement contains certain provisions giving each of CF Corp, Parent and FGL rights to terminate the Merger Agreement under certain circumstances. Upon termination of the Merger Agreement, under specified circumstances, FGL may be required to pay a termination fee to CF Corp in an aggregate amount of $50,000,000.

Voting Agreement

In connection with entering into the Merger Agreement, FGL and certain shareholders of CF Corp representing in aggregate 18.7% of the issued and outstanding common shares of CF Corp entered into a voting agreement pursuant to which such shareholders agreed to, among other things, vote or cause to be voted at any meeting of the shareholders of CF Corp called to seek (i) the adoption of the Merger Agreement and (ii) all shareholder approvals required by the rules of Nasdaq with respect to the issuance of CF Corp Shares in connection with the Merger, all of their shares in favor of such proposals.

Other than as set forth in this Item 4, FGL has no present plans or intentions which would result in or relate to any of the transactions described in subparagraphs (a), (b), (e) and (j) of Item 4 of Schedule 13D of the Securities Exchange Act of 1934, as amended.

Item 5. Interest in Securities of the Issuer

|

|

|

|

(a) - (b)

|

As of the date of this Schedule (i) 0 CF Corp Shares are owned by FGL and (ii) as a result of the Voting Agreement, FGL may be deemed to be the beneficial owner of and to have the shared voting power with respect to 3,000,000 CF Corp Shares. To FGL’s knowledge, based upon 69,000,000 outstanding CF Corp Shares as of May 12, 2017 as reported in CF Corp’s Form 10-Q for the period ending March 31, 2017, and filed with the SEC on May 12, 2017, the Shareholders own or control in the aggregate approximately 4.35% of the outstanding CF Corp Shares. FGL expressly disclaims beneficial ownership of any CF Corp Shares or other securities of CF Corp that are subject to the Voting Agreement, and nothing herein shall be deemed an admission by FGL as to the beneficial ownership of such shares or other securities.

|

|

|

|

|

(c) - (d)

|

Except as described herein, none of FGL, nor to the best of its knowledge, any other person referred to in Annex A attached hereto, has acquired or disposed of any CF Corp Shares during the past 60 days. Furthermore, FGL knows of no other person having the right to receive the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities covered by this Schedule.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The information set forth in Items 2, 3 and 4 is incorporated herein by reference in its entirety.

Item 7. Material to Be Filed as Exhibits.

|

|

|

|

Exhibit 1

|

Agreement and Plan of Merger, dated as of May 24, 2017, by and among CF Corporation, FGL US Holdings Inc., FGL Merger Sub Inc. and Fidelity & Guaranty Life (incorporated herein by reference to 2.1 to the Current Report on Form 8-K filed by FGL with the Securities and Exchange Commission on May 24, 2017).

|

|

|

|

|

Exhibit 2

|

Voting Agreement, dated as of May 24, 2017, by and among Fidelity & Guaranty Life, CF Capital Growth, LLC, Fidelity National Financial, Inc., CFS Holdings (Cayman), L.P., CC Capital Management, LLC, BilCar, LLC, Richard N. Massey and James A. Quella (incorporated herein by reference to 2.2 to the Current Report on Form 8-K filed by FGL with the Securities and Exchange Commission on May 24, 2017).

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 24, 2017

FIDELITY & GUARANTY LIFE

By:

/s/ Eric Marhoun

Name: Eric Marhoun

Title: General Counsel & Secretary

Annex A

FIDELITY & GUARANTY LIFE

The following table sets forth the name, present occupation or employment and citizenship of each director and executive officer of FGL as of May 24, 2017. The principal business address of each person listed below is c/o Two Ruan Center, 601 Locust Street 14th Floor, Des Moines, Iowa 50309-3738, United States of America.

|

|

|

|

|

|

|

DIRECTORS OF FIDELITY & GUARANTY LIFE

|

|

Name

|

Present Occupation

|

Citizenship

|

|

Christopher J. Littlefield

|

President and Chief Executive Officer at Fidelity & Guaranty Life

|

United States

|

|

Joseph S. Steinberg

|

Chairman of the Board of Directors at Fidelity & Guaranty Life

|

United States

|

|

William J. Bawden

|

Director and Chairman of the Audit Committee of Fidelity & Guaranty Life

|

United States

|

|

James M. Benson

|

President and CEO of Benson Botsford

|

United States

|

|

Andrew McKnight

|

Partner & Managing Director of Fortress Investment Group, LLC

|

United States

|

|

William P. Melchionni

|

Director of Fidelity & Guaranty Life

|

United States

|

|

John H. Tweedie

|

Chief Executive Officer of Front Street

|

United Kingdom

|

|

|

|

|

|

|

|

EXECUTIVE OFFICERS OF FIDELITY & GUARANTY LIFE

|

|

Name

|

Present Occupation

|

Citizenship

|

|

Chris Littlefield

|

President and Chief Executive Officer

|

United States

|

|

Raj Krishnan

|

Executive Vice President and Chief Investment Officer

|

United States

|

|

Eric Marhoun

|

Executive Vice President and General Counsel

|

United States

|

|

Dennis Vigneau

|

Executive Vice President and Chief Financial Officer

|

United States

|

|

John Phelps

|

Senior Vice President and Chief Distribution Officer

|

United States

|

|

John O’Shaughnessy

|

Senior Vice President, International Markets and Business Development

|

United States

|

|

Rose Boehm

|

Senior Vice President. Human Resources

|

United States

|

|

Wendy JB Young

|

Senior Vice President and Chief Risk Officer

|

United States

|

|

Chris Fleming

|

Senior Vice President, Operations & Technology

|

United States

|

|

John Currier

|

Senior Vice President and Chief Actuary

|

United States

|

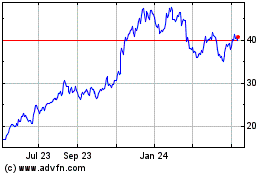

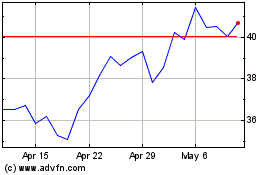

FGL (NYSE:FG)

Historical Stock Chart

From Mar 2024 to Apr 2024

FGL (NYSE:FG)

Historical Stock Chart

From Apr 2023 to Apr 2024