UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2017

Commission File Number: 001-36202

NAVIGATOR

HOLDINGS LTD

(Translation of registrant’s name into English)

c/o NGT Services

(UK) Ltd

10 Bressenden Place, London, SW1E 5DH

United Kingdom

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐.

Note

: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to

security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ☐.

Note

: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a

report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home

country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached to this Report on Form 6-K as Exhibit 1 is a copy of the press release issued by Navigator Holdings Ltd. (the “Company”) on May 8,

2017: Navigator Holdings Ltd. Preliminary First Quarter 2017 Results.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NAVIGATOR HOLDINGS LTD.

|

|

|

|

|

|

|

Date: May 8, 2017

|

|

|

|

By:

|

|

/s/ Niall Nolan

|

|

|

|

|

|

Name:

|

|

Niall Nolan

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Exhibit 1

N

AVIGATOR

H

OLDINGS

L

TD

.

ANNOUNCES

P

RELIMINARY

R

ESULTS

F

OR

THE

T

HREE

M

ONTHS

ENDED

M

ARCH

31, 2017

Highlights

|

|

◾

|

Navigator Holdings Ltd. reported net income of $2.7 million for the three months ended March 31, 2017 and earnings per share of $0.05, which included one-off costs totaling $4.2 million (or $0.07 per share)

associated with the redemption of the Company’s senior unsecured bonds that were due to mature in December 2017.

|

|

|

◾

|

Utilization increased to 92.4% for the three months ended March 31, 2017 compared to 87.6% for the three months ended March 31, 2016.

|

|

|

◾

|

Adjusted EBITDA

(1)

was $33.5 million for the three months ended March 31, 2017.

|

|

|

◾

|

Took delivery of

Navigator Nova

the third of our four midsize semi-refrigerated ethane/ethylene capable vessels from Jiangnan, on January 12, 2017.

Navigator Nova

commenced on a time charter following

delivery.

|

|

|

◾

|

Took delivery of

Navigator Luga

on January 24, 2017 and on April 5, 2017

Navigator Yauza,

a sister ship, was delivered

.

These two handysize semi-refrigerated vessels from HMD immediately

commenced on long term time charters.

|

|

|

◾

|

On February 10, 2017, the Company successfully issued 7.75% senior unsecured bonds in an aggregate principle amount of $100.0 million. The net proceeds of the issue together with the cash in hand were used to

redeem in full $125.0 million of outstanding 9.0% senior unsecured bonds.

|

|

|

◾

|

The Company has benefited from increasing demand for the transportation of petrochemicals gases, with the proportion of our total revenue from long-haul trade increasing from 20% in the first quarter 2016 to

approximately 52% in the first quarter 2017.

|

Charter revenue from the seaborne transportation of petrochemical gases continues to represent

a significant percentage of our total revenue. For the first quarter of 2017, our revenue from the seaborne transportation of petrochemical gases represented approximately 52% of our total charter revenue. This reflects our migration towards a

greater involvement in the olefins business, primarily through the seaborne transportation of ethylene, butadiene and propylene, which are used in the production process by the plastic industry. The ability to diversify into petrochemical olefins

gases in addition to liquefied petroleum gases has improved our utilisation rate, which averaged approximately 92.4% for the first quarter of 2017. We continue to experience competition from the larger fully-refrigerated gas carriers, limiting much

of the potential charter rate upside for the transportation of fully refrigerated LPG. We believe that the LPG freight environment must absorb a world orderbook of 38 Very Large Gas Carriers and 18 Medium Size Gas Carriers before we could begin to

see any meaningful sustained rise in charter rates for the transportation of LPG.

1

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA represents net income before net

interest expense, income taxes and depreciation and amortization. Adjusted EBITDA represents net income before net interest expense, income taxes, depreciation and amortization and other financing costs related to the redemption of debt. Management

believes that EBITDA and Adjusted EBITDA are useful to investors in evaluating the operating performance of the Company. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to any financial measure prepared in

accordance with U.S. GAAP, and our calculation of EBITDA and Adjusted EBITDA may not be comparable to that reported by other companies. See the table below for a reconciliation of EBITDA and Adjusted EBITDA to net income, our most directly

comparable financial measure calculated accordance with U.S. GAAP.

Reconciliation of Non-GAAP Financial Measures

The following table sets forth a reconciliation of net income to EBITDA and adjusted EBITDA for the three months ended March 31, 2017:

|

|

|

|

|

|

|

|

|

$

|

’000’s

|

|

|

Net income

|

|

$

|

2,738

|

|

|

Interest expense

|

|

|

8,927

|

|

|

Interest income

|

|

|

(113

|

)

|

|

Income taxes

|

|

|

159

|

|

|

Depreciation and amortization

|

|

|

17,634

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

29,345

|

|

|

Write off of call premium and redemption charges on 9% unsecured bond

|

|

|

3,517

|

|

|

Write off of deferred financing costs

|

|

|

653

|

|

|

Adjusted EBITDA

|

|

$

|

33,515

|

|

A Form 6-K with more detailed information on our first quarter 2017 financial results is being filed with the U.S. Securities

and Exchange Commission simultaneous with this release for the quarter ended March 31, 2017.

Conference Call Details:

Tomorrow, Tuesday, May 9, 2017, at 9:00 A.M. ET, the Company’s management team will host a conference call to discuss the financial results.

Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 1 (866) 819-7111 (US Toll Free Dial In), 0(800)

953-0329 (UK Toll Free Dial In) or +44 (0)1452-542-301 (Standard International Dial In). Please quote “Navigator” to the operator.

There will

also be a live, and then archived, webcast of the conference call, available through the Company’s website (www.navigatorgas.com). Participants to the live webcast should register on the website approximately 10 minutes prior to the start of

the webcast.

A telephonic replay of the conference call will be available until Tuesday, May 16, 2017 by dialing 1(866) 247-4222 (US Toll Free Dial

In), 0(800) 953-1533 (UK Toll Free Dial In) or +44 (0)1452 550-000 (Standard International Dial In). Access Code: 11870348#

Navigator Gas

Attention: Investor Relations Department

|

New York:

|

399 Park Avenue, 38th Floor, New York, NY 10022. Tel: +1 212 355 5893

|

|

London:

|

10 Bressenden Place, London, SW1E 5DH. Tel: +44 (0)20 7340 4850

|

About Us

Navigator Gas is the owner and operator of the world’s largest fleet of handysize liquefied gas carriers and provides international and regional seaborne

transportation of liquefied petroleum gas, petrochemical gases and ammonia for energy companies, industrial users and commodity traders. Navigator’s fleet consists of 38 semi- or fully-refrigerated liquefied gas carriers, including two

newbuildings scheduled for delivery by July 2017.

FORWARD LOOKING STATEMENTS

Statements included in this press release concerning plans and objectives of management for future operations or economic performance, or assumptions related

thereto, including our financial forecast, contain forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements that are also forward-looking statements. Such statements include, in

particular, statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate as described in this press release. In some cases, you can identify the forward-looking statements by the

use of words such as “may,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,”

“predict,” “propose,” “potential,” “continue,” or the negative of these terms or other comparable terminology. These risks and uncertainties include, but are not limited to:

|

•

|

|

future operating or financial results;

|

|

•

|

|

pending acquisitions, business strategy and expected capital spending;

|

|

•

|

|

operating expenses, availability of crew, number of off-hire days, drydocking requirements and insurance costs;

|

|

•

|

|

fluctuations in currencies and interest rates;

|

|

•

|

|

general market conditions and shipping market trends, including charter rates and factors affecting supply and demand;

|

|

•

|

|

our financial condition and liquidity, including our ability to refinance our indebtedness that matures in 2018 or obtain additional financing in the future to fund capital expenditures, acquisitions and other corporate

activities;

|

|

•

|

|

estimated future capital expenditures needed to preserve our capital base;

|

|

•

|

|

our expectations about the receipt of our two newbuildings and the timing of the receipt thereof;

|

|

•

|

|

our expectations about the availability of vessels to purchase, the time that it may take to construct new vessels, or the useful lives of our vessels;

|

|

•

|

|

our continued ability to enter into long-term, fixed-rate time charters with our customers;

|

|

•

|

|

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

•

|

|

potential liability from future litigation;

|

|

•

|

|

our expectations relating to the payment of dividends;

|

|

•

|

|

our expectation that we will continue to provide in-house technical management for some vessels in our fleet and our success in providing such in-house technical management; and

|

|

•

|

|

other factors detailed from time to time in other periodic reports we file with the Securities and Exchange Commission.

|

We expressly disclaim any obligation to update or revise any of these forward-looking statements, whether because of future events, new information, a change

in our views or expectations, or otherwise. We make no prediction or statement about the performance of our common stock.

Navigator Holdings Ltd.

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

2016

|

|

|

March 31,

2017

|

|

|

|

|

(in thousands except

share data)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

57,272

|

|

|

$

|

45,648

|

|

|

Accounts receivable, net

|

|

|

7,059

|

|

|

|

12,270

|

|

|

Accrued income

|

|

|

13,134

|

|

|

|

13,780

|

|

|

Prepaid expenses and other current assets

|

|

|

8,541

|

|

|

|

11,387

|

|

|

Inventories

|

|

|

6,937

|

|

|

|

7,283

|

|

|

Insurance recoverable

|

|

|

855

|

|

|

|

370

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

93,798

|

|

|

|

90,738

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

Vessels in operation, net

|

|

|

1,480,359

|

|

|

|

1,601,279

|

|

|

Vessels under construction

|

|

|

150,492

|

|

|

|

96,932

|

|

|

Property, plant and equipment, net

|

|

|

194

|

|

|

|

1,309

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

1,631,045

|

|

|

|

1,699,520

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

1,724,843

|

|

|

$

|

1,790,258

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt, net of deferred financing costs

|

|

$

|

78,464

|

|

|

$

|

215,526

|

|

|

Senior unsecured bond

|

|

|

25,000

|

|

|

|

—

|

|

|

Accounts payable

|

|

|

6,388

|

|

|

|

5,618

|

|

|

Accrued expenses and other liabilities

|

|

|

11,377

|

|

|

|

12,395

|

|

|

Accrued interest

|

|

|

2,932

|

|

|

|

3,434

|

|

|

Deferred income

|

|

|

3,522

|

|

|

|

3,095

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

127,683

|

|

|

|

240,068

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

Secured term loan facilities, net of current portion and deferred financing costs

|

|

|

540,680

|

|

|

|

490,538

|

|

|

Senior unsecured bond

|

|

|

100,000

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

640,680

|

|

|

|

590,538

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

768,363

|

|

|

|

830,606

|

|

|

Commitments and contingencies (see note 9)

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock – $.01 par value; 400,000,000 shares authorized; 55,531,831 shares issued and

outstanding, (2016: 55,436,087)

|

|

|

554

|

|

|

|

555

|

|

|

Additional paid-in capital

|

|

|

588,024

|

|

|

|

588,432

|

|

|

Accumulated other comprehensive loss

|

|

|

(287

|

)

|

|

|

(262

|

)

|

|

Retained earnings

|

|

|

368,189

|

|

|

|

370,927

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

956,480

|

|

|

|

959,652

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

1,724,843

|

|

|

$

|

1,790,258

|

|

|

|

|

|

|

|

|

|

|

|

Navigator Holdings Ltd.

Consolidated Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

March 31,

|

|

|

|

|

2016

|

|

|

2017

|

|

|

|

|

(in thousands except

share data)

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

Operating revenue

|

|

$

|

76,375

|

|

|

$

|

77,320

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

Brokerage commissions

|

|

|

1,502

|

|

|

|

1,525

|

|

|

Voyage expenses

|

|

|

7,093

|

|

|

|

15,000

|

|

|

Vessel operating expenses

|

|

|

22,405

|

|

|

|

23,905

|

|

|

Depreciation and amortization

|

|

|

14,575

|

|

|

|

17,634

|

|

|

General and administrative costs

|

|

|

2,957

|

|

|

|

2,752

|

|

|

Other corporate expenses

|

|

|

550

|

|

|

|

623

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

49,082

|

|

|

|

61,439

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

27,293

|

|

|

|

15,881

|

|

|

Other income/(expense)

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(7,783

|

)

|

|

|

(8,927

|

)

|

|

Write off of call premium and redemption charges on 9% unsecured bond

|

|

|

—

|

|

|

|

(3,517

|

)

|

|

Write off of deferred financing costs

|

|

|

—

|

|

|

|

(653

|

)

|

|

Interest income

|

|

|

78

|

|

|

|

113

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

19,588

|

|

|

|

2,897

|

|

|

Income taxes

|

|

|

(194

|

)

|

|

|

(159

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

19,394

|

|

|

$

|

2,738

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

Basic:

|

|

$

|

0.35

|

|

|

$

|

0.05

|

|

|

Diluted:

|

|

$

|

0.35

|

|

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic:

|

|

|

55,365,557

|

|

|

|

55,445,661

|

|

|

Diluted:

|

|

|

55,743,997

|

|

|

|

55,819,401

|

|

|

|

|

|

|

|

|

|

|

|

Navigator Holdings Ltd.

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months ended

March 31,

2016

|

|

|

Three Months ended

March 31,

2017

|

|

|

|

|

(in thousands)

|

|

|

(in thousands)

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

19,394

|

|

|

$

|

2,738

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

14,575

|

|

|

|

17,634

|

|

|

(Payment) / credit of drydocking costs

|

|

|

(2,030

|

)

|

|

|

9

|

|

|

Insurance claim debtor

|

|

|

(418

|

)

|

|

|

—

|

|

|

Call option on redemption of 9.00% unsecured bond

|

|

|

—

|

|

|

|

2,500

|

|

|

Amortization of share-based compensation

|

|

|

395

|

|

|

|

409

|

|

|

Amortization of deferred financing costs

|

|

|

732

|

|

|

|

1,345

|

|

|

Unrealized foreign exchange

|

|

|

17

|

|

|

|

17

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(2,208

|

)

|

|

|

(5,211

|

)

|

|

Inventories

|

|

|

(1,197

|

)

|

|

|

(346

|

)

|

|

Accrued income and prepaid expenses and other current assets

|

|

|

(6,795

|

)

|

|

|

(3,492

|

)

|

|

Accounts payable, accrued interest and other liabilities

|

|

|

(5,347

|

)

|

|

|

323

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

|

17,118

|

|

|

|

15,926

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Payment to acquire vessels

|

|

|

(247

|

)

|

|

|

(636

|

)

|

|

Payment for vessels under construction

|

|

|

(39,212

|

)

|

|

|

(84,597

|

)

|

|

Purchase of other property, plant and equipment

|

|

|

(17

|

)

|

|

|

(1,160

|

)

|

|

Receipt of shipyard penalty payments

|

|

|

417

|

|

|

|

280

|

|

|

Insurance recoveries

|

|

|

4,700

|

|

|

|

486

|

|

|

Capitalized costs for the repairs of Navigator Aries

|

|

|

(8,351

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(42,710

|

)

|

|

|

(85,627

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from secured term loan facilities

|

|

|

31,150

|

|

|

|

106,808

|

|

|

Issuance of 7.75% senior unsecured bonds

|

|

|

—

|

|

|

|

100,000

|

|

|

Repayment of 9.00% senior unsecured bonds

|

|

|

—

|

|

|

|

(127,500

|

)

|

|

Issuance costs of 7.75% senior unsecured bonds

|

|

|

—

|

|

|

|

(1,798

|

)

|

|

Direct financing costs of senior term loan facilities

|

|

|

(155

|

)

|

|

|

—

|

|

|

Repayment of secured term loan facilities

|

|

|

(16,051

|

)

|

|

|

(19,433

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

14,944

|

|

|

|

58,077

|

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(10,648

|

)

|

|

|

(11,624

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

87,779

|

|

|

|

57,272

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

77,131

|

|

|

$

|

45,648

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Information

|

|

|

|

|

|

|

|

|

|

Total interest paid during the period, net of amounts capitalized

|

|

$

|

5,527

|

|

|

$

|

6,329

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax paid during the period

|

|

$

|

77

|

|

|

$

|

82

|

|

|

|

|

|

|

|

|

|

|

|

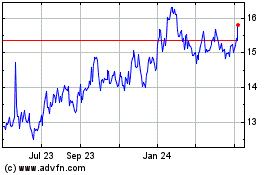

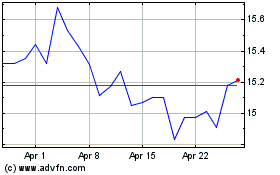

Navigator (NYSE:NVGS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Navigator (NYSE:NVGS)

Historical Stock Chart

From Sep 2023 to Sep 2024