Filed Pursuant to Rule 424(b)(2)

Registration No. 333-208813

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered

|

|

Proposed

Maximum Offering

Price Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

(1)

|

|

Common Stock, par value $0.001 per share

|

|

43,125,000

|

|

$13.25

|

|

$571,406,250

|

|

$66,226

|

|

|

|

|

|

(1)

|

The filing fee of $66,226 is calculated in accordance with Rules 457(o) and 457(r) of the Securities Act of 1933, as amended, and reflects the potential additional issuance of shares of common stock, $0.001 par value

per share, pursuant to underwriters’ option to purchase additional shares. This “Calculation of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in the registrant’s

Registration Statement on Form

S-3

(File

No. 333-208813).

|

PROSPECTUS SUPPLEMENT

(To

prospectus dated December 31, 2015)

37,500,000 Shares

Common Stock

We are selling 37,500,000

shares of our common stock.

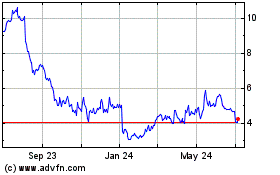

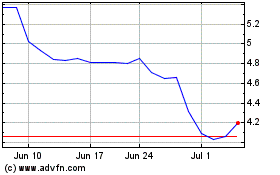

Our shares trade on the New York Stock Exchange under the symbol “MPW.” On April 24, 2017, the last sale

price of the shares as reported on the New York Stock Exchange was $13.81 per share. To ensure that we maintain our qualification as a real estate investment trust, our charter limits ownership by any person to 9.8% of the lesser of the number or

value of our outstanding common shares, with certain exceptions.

Investing in our common stock involves risks. See the risk factors set forth

under the heading “

Risk Factors

” beginning on page S-14 of this prospectus supplement and beginning on page 18 of our Annual Report on Form 10-K for the year ended December 31, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

13.25

|

|

|

$

|

496,875,000

|

|

|

Underwriting discount

|

|

$

|

0.53

|

|

|

$

|

19,875,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

12.72

|

|

|

$

|

477,000,000

|

|

We have granted the underwriters an option to purchase up to an additional 5,625,000 shares from us, at the public

offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about May 1, 2017 through the book-entry facilities of The Depository Trust Company.

Joint Bookrunning Managers

|

|

|

|

|

|

|

Goldman, Sachs & Co.

|

|

BofA Merrill Lynch

|

|

KeyBanc Capital Markets

|

|

|

|

|

|

Barclays

|

|

Credit Suisse

|

|

J.P. Morgan

|

|

|

|

|

|

RBC Capital Markets

|

|

SunTrust Robinson Humphrey

|

|

Wells Fargo Securities

|

Co-Lead Managers

|

|

|

|

|

|

|

BBVA

|

|

|

|

Credit Agricole CIB

|

|

|

|

|

|

MUFG

|

|

Scotiabank

|

|

Stifel

|

The date of this prospectus supplement is April 25, 2017

TABLE OF CONTENTS

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the

accompanying prospectus, gives more general information, some of which may not apply to this offering. You should read this entire document, including this prospectus supplement, the accompanying prospectus and the documents incorporated herein and

therein by reference. In the event that the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement. The accompanying

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (“SEC”) using a shelf registration statement. Under the shelf registration process, from time to time, we may offer and sell

securities in one or more offerings.

This prospectus supplement and the accompanying prospectus contain, or incorporate by reference,

forward-looking statements. Such forward-looking statements should be considered together with the cautionary statements and important factors included or referred to in this prospectus supplement, the accompanying prospectus and the documents

incorporated herein and therein by reference. Please see “Cautionary Language Regarding Forward-Looking Statements” in this prospectus supplement and “A Warning About Forward-Looking Statements” in the accompanying prospectus.

Unless otherwise stated in this prospectus supplement, we have assumed throughout this prospectus supplement that the underwriters’ option to

purchase additional shares from us is not exercised.

You should rely only on the information contained or incorporated by reference in this

prospectus supplement, the accompanying prospectus and any “free writing prospectus” we authorize to be delivered to you. We have not authorized anyone to provide information different from that contained or incorporated by reference in

this prospectus supplement, the accompanying prospectus and any such “free writing prospectus.” If anyone provides you with different or additional information, you should not rely on it. This prospectus supplement, the accompanying

prospectus and any authorized “free writing prospectus” are not an offer to sell or the solicitation of an offer to buy any securities other than the registered shares to which they relate, nor is this prospectus supplement, the

accompanying prospectus or any authorized “free writing prospectus” an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such

jurisdiction. You should assume that the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, any authorized “free writing prospectus” or information we previously filed with the

SEC is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

In this prospectus

supplement, the terms “MPT,” “MPW,” “Medical Properties,” “we,” “Company,” “us,” “our” and “our Company” refer to Medical Properties Trust, Inc. and its subsidiaries,

unless otherwise expressly stated or the context otherwise requires.

S-ii

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus supplement, the accompanying prospectus, any documents we incorporate by reference herein and therein

and in any free writing prospectus we authorize to be delivered to you constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of

1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) and are subject to risks and

uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. Statements regarding the following subjects,

among others, are forward-looking by their nature:

|

|

•

|

|

our projected operating results;

|

|

|

•

|

|

our ability to close the Steward Transactions, the remaining New MEDIAN Transactions, the Other U.S. Acquisitions and the Deerfield Restructuring (each as defined in “Prospectus Supplement Summary—Recent

Developments”) on the time schedule or terms described herein or at all;

|

|

|

•

|

|

our ability to acquire or develop additional facilities in the United States or Europe;

|

|

|

•

|

|

availability of suitable facilities to acquire or develop;

|

|

|

•

|

|

our ability to enter into, and the terms of, our prospective leases and loans;

|

|

|

•

|

|

our ability to raise additional funds through offerings of debt and equity securities and/or property disposals;

|

|

|

•

|

|

our ability to obtain future financing arrangements;

|

|

|

•

|

|

estimates relating to, and our ability to pay, future distributions;

|

|

|

•

|

|

our ability to service our debt and comply with all of our debt covenants;

|

|

|

•

|

|

our intended use of proceeds from this offering;

|

|

|

•

|

|

our ability to compete in the marketplace;

|

|

|

•

|

|

lease rates and interest rates;

|

|

|

•

|

|

projected capital expenditures; and

|

|

|

•

|

|

the impact of technology on our facilities, operations and business.

|

The forward-looking statements are

based on our beliefs, assumptions and expectations of our future performance, taking into account information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all

of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you

make an investment decision with respect to our common stock, along with, among others, the following factors that could cause actual results to vary from our forward-looking statements:

|

|

•

|

|

factors referenced in this prospectus supplement, including those set forth under the section captioned “Risk Factors” and factors referenced in documents incorporated by reference in this prospectus

supplement, including those set forth under the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” in our Annual Report on Form

10-K for the year ended December 31, 2016 (our “2016 10-K”);

|

S-iii

|

|

•

|

|

the risk that a condition to closing under the agreements governing any or all of the Transactions (as defined in “Prospectus Supplement Summary—Recent Developments”) that have not closed as of the date

hereof may not be satisfied;

|

|

|

•

|

|

the possibility that the anticipated benefits from any or all of the Transactions will take longer to realize than expected or will not be realized at all;

|

|

|

•

|

|

U.S. (both national and local) and European (in particular Germany, the United Kingdom, Spain and Italy) political, economic, business, real estate, and other market conditions;

|

|

|

•

|

|

the competitive environment in which we operate;

|

|

|

•

|

|

the execution of our business plan;

|

|

|

•

|

|

acquisition and development risks;

|

|

|

•

|

|

potential environmental contingencies and other liabilities;

|

|

|

•

|

|

adverse developments affecting the financial health of one or more of our tenants, including insolvency;

|

|

|

•

|

|

other factors affecting the real estate industry generally or the healthcare real estate industry in particular;

|

|

|

•

|

|

our ability to maintain our status as a real estate investment trust (“REIT”) for U.S. federal and state income tax purposes;

|

|

|

•

|

|

our ability to attract and retain qualified personnel;

|

|

|

•

|

|

changes in foreign currency exchange rates;

|

|

|

•

|

|

U.S. (both federal and state) and European (in particular Germany, the United Kingdom, Spain and Italy) healthcare and other regulatory requirements; and

|

|

|

•

|

|

U.S. national and local economic conditions, as well as conditions in Europe and any other foreign jurisdictions where we own or may in the future own healthcare facilities, which may have a negative effect on the

following, among other things:

|

|

|

•

|

|

the financial condition of our tenants, our lenders, counterparties to our hedged transactions and institutions that hold our cash balances, which may expose us to increased risks of default by these parties;

|

|

|

•

|

|

our ability to obtain equity or debt financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities, refinance existing debt, comply with debt

covenants and our future interest expense; and

|

|

|

•

|

|

the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis.

|

When we use the words “believe,” “expect,” “may,” “potential,” “anticipate,” “estimate,”

“plan,” “will,” “could,” “intend” or similar expressions, we are identifying forward-looking statements. You should not place undue reliance on these forward-looking statements. Except as required by law, we

disclaim any obligation to update such statements or to publicly announce the result of any revisions to any of the forward-looking statements contained in this prospectus supplement, the accompanying prospectus, any documents we incorporate by

reference herein and therein or any free writing prospectus we authorize to be delivered to you to reflect future events or developments.

S-iv

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in the prospectus supplement, the accompanying prospectus or the documents

incorporated by reference herein and therein. This summary does not contain all of the information that may be important to you or that you should consider before making an investment decision. You should read carefully this entire prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including the information under the heading “Risk Factors,” the financial data and other information included in or incorporated by

reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus we authorize to be delivered to you before making an investment decision.

Our Company

We are a self-advised REIT

listed on the New York Stock Exchange (“NYSE”) focused on investing in and owning net-leased healthcare facilities across the United States and selectively in foreign jurisdictions. We acquire and develop healthcare facilities and lease

the facilities to healthcare operating companies under long-term net leases, which require the tenant to bear most of the costs associated with the property. We also make mortgage loans to healthcare operators collateralized by their real estate

assets. In addition, we selectively make loans to certain of our operators through our taxable REIT subsidiaries, the proceeds of which they typically use for acquisition and working capital purposes. Finally, from time to time, we acquire a profits

or other equity interest in our tenants that gives us a right to share in these tenants’ profits and losses.

As of March 31, 2017, our

portfolio consisted of 231 properties leased to or mortgaged by 31 operators, of which four properties were under development, 12 properties were in the form of mortgage loans and 32 properties were subject to long-term ground leases. As

of March 31, 2017, our properties located in the United States and Europe consisted of the following:

|

|

•

|

|

132 general acute care hospitals;

|

|

|

•

|

|

79 inpatient rehabilitation hospitals;

|

|

|

•

|

|

17 long-term acute care hospitals; and

|

|

|

•

|

|

3 medical office buildings.

|

We conduct substantially all of our business through our operating

partnership, MPT Operating Partnership, L.P. We have operated as a REIT since April 6, 2004, and elected REIT status upon the filing of our federal income tax return for our taxable year that ended on December 31, 2004.

Our principal executive offices are located at 1000 Urban Center Drive, Suite 501, Birmingham, Alabama 35242. Our telephone number is

(205) 969-3755. Our Internet address is

www.medicalpropertiestrust.com

. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this prospectus supplement, the

accompanying prospectus or any other report or document we file with the SEC that is incorporated by reference herein or therein. For additional information, see “Where You Can Find More Information” in the accompanying prospectus and

“Incorporation by Reference” in this prospectus supplement and “Incorporation of Certain Information by Reference” in the accompanying prospectus.

S-1

Recent Developments

Preliminary Results for the Quarter Ended March 31, 2017

Management estimates a range of net income per diluted share and normalized funds from operations (“FFO”) per diluted share for the quarter

ended March 31, 2017 to be $0.20 - $0.22 and $0.32 - $0.34, respectively. These are estimates of the financial measures that we expect to report when we issue our financial statements for this period. Management prepared these estimates in good

faith based upon the most recent information available to us from our internal reporting procedures as of the date of this prospectus supplement. We and our independent auditors have not completed our normal quarterly review as of and for the

quarter ended March 31, 2017, and there can be no assurance that our final results for this period will not differ from the estimates given above and below.

Our consolidated financial statements and related notes as of and for the quarter ended March 31, 2017 are not expected to be filed with the SEC

until after this offering is completed. Our actual results may differ materially from the first quarter estimates set forth herein. Accordingly, you should not place undue reliance on these preliminary estimates. These estimates should not be viewed

as a substitute for full interim financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, these preliminary estimates for the quarter ended March 31, 2017, are not

necessarily indicative of the results to be achieved in any future period.

Reconciliation of Non-GAAP Financial Measures

The following table presents a reconciliation of net income attributable to our common stockholders to FFO and normalized FFO, on a per share basis, for

the quarter ended March 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, 2017

|

|

|

|

|

(Unaudited)

|

|

|

Per diluted share data:

|

|

|

|

|

|

|

|

|

|

|

|

Net income, less participating securities’ share in earnings

|

|

$

|

0.20

|

|

|

to

|

|

$

|

0.22

|

|

|

Depreciation and amortization

|

|

|

0.09

|

|

|

to

|

|

|

0.09

|

|

|

Gain on sale of real estate

|

|

|

(0.02

|

)

|

|

to

|

|

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations(1)

|

|

$

|

0.27

|

|

|

to

|

|

$

|

0.29

|

|

|

Write-off of straight-line rent and net acquisition costs

|

|

|

0.01

|

|

|

to

|

|

|

0.01

|

|

|

Unutilized financing fees/debt refinancing costs

|

|

|

0.04

|

|

|

to

|

|

|

0.04

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized funds from operations(1)

|

|

$

|

0.32

|

|

|

to

|

|

$

|

0.34

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

See footnote (4) on page S-11 for further information on these non-GAAP measures.

|

Acquisition of Steward

Expansion Portfolio

In February 2017, our current tenant Steward Health Care System LLC (“Steward”), the largest fully integrated

health care services organization and community hospital network in New England, agreed to purchase eight hospitals affiliated with Community Health Systems, Inc. (“CHS”) in Florida, Ohio and Pennsylvania. Also in February 2017, we entered

into agreements with Steward to acquire the real estate of these eight hospitals (“Steward Expansion Portfolio”) for an aggregate purchase price of $301.3 million and lease them to Steward. We expect to complete this transaction in the

second quarter of 2017. This transaction is subject to regulatory approval and customary closing conditions, and no assurance can be provided that it will be completed on the terms described, or at all.

S-2

The table below sets forth pertinent details with respect to the hospitals in the Steward Expansion

Portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital

|

|

Property Type

|

|

|

Location

|

|

|

Licensed

Beds

|

|

|

Wuesthoff Medical Center

|

|

|

Acute Care

|

|

|

|

Melbourne, FL

|

|

|

|

119

|

|

|

Wuesthoff Medical Center

|

|

|

Acute Care

|

|

|

|

Rockledge, FL

|

|

|

|

298

|

|

|

Sebastian River Medical Center

|

|

|

Acute Care

|

|

|

|

Sebastian, FL

|

|

|

|

154

|

|

|

Northside Medical Center

|

|

|

Acute Care

|

|

|

|

Youngstown, OH

|

|

|

|

389

|

|

|

Trumbull Memorial Hospital

|

|

|

Acute Care

|

|

|

|

Warren, OH

|

|

|

|

292

|

|

|

Hillside Rehabilitation Hospital

|

|

|

Inpatient Rehabilitation

|

|

|

|

Warren, OH

|

|

|

|

69

|

|

|

Sharon Regional Health System

|

|

|

Acute Care

|

|

|

|

Sharon, PA

|

|

|

|

251

|

|

|

Easton Hospital

|

|

|

Acute Care

|

|

|

|

Easton, PA

|

|

|

|

196

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Licensed Beds

|

|

|

|

|

|

|

|

|

|

|

1,768

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Steward Expansion Portfolio will be leased to Steward under our current master lease agreement with Steward that has

an initial term of 15 years with three 5-year extension options, plus annual inflation protected escalators. We expect that the initial GAAP yield of the Steward Expansion Portfolio under the master lease will be approximately 10.1%.

In this prospectus supplement, we refer to the transactions described above with respect to the Steward Expansion Portfolio as the “Steward

Transactions.”

Other U.S. Acquisition Activity and Divestiture

In January 2017, Alecto Healthcare Services LLC (“Alecto”) entered into a definitive agreement to purchase the operations of the Ohio Valley

Medical Center, a 218-bed acute care hospital located in Wheeling, West Virginia, and the East Ohio Regional Hospital, a 139-bed acute care hospital in Martins Ferry, Ohio, from Ohio Valley Health Services, a not-for-profit entity in West Virginia.

In March 2017, we agreed to purchase the real estate of these two acute care hospitals for an aggregate purchase price of $40.0 million and lease them to Alecto, which is the current operator of three facilities in our portfolio. We also agreed to

provide up to $20.0 million in capital improvement funding on these two facilities. The lease on these facilities is expected to have a 15-year initial term with 2% annual minimum increases and three 5-year extension options. We expect that the

initial GAAP yield under this lease will be approximately 10.8%. The facilities will be cross-defaulted and cross collateralized with our other hospitals currently operated by Alecto. With these acquisitions, we will also obtain a 20% interest in

the operator of these facilities. We expect to consummate this transaction in the second quarter of 2017.

As previously disclosed, in September

2016, we entered into a definitive agreement with RCCH HealthCare Partners (“RCCH”) to purchase the real estate of St. Joseph Regional Medical Center, a 145-bed acute care hospital in Lewiston, Idaho, and Lourdes Health, a 35-bed acute

care hospital in Pasco, Washington for an aggregate purchase price of approximately $105 million. We expect to consummate the acquisition of St. Joseph Regional Medical Center in the second quarter of 2017 and of Lourdes Health no later than the

fourth quarter of 2017, pending regulatory approval.

In this prospectus supplement, we refer to the Alecto and RCCH acquisitions as the “Other

U.S. Acquisitions.”

S-3

On March 31, 2017, we completed the sale of the real estate of EASTAR Health System, a

320-bed

acute care hospital in Muskogee, Oklahoma, for $64.3 million. We expect to report a net gain on sale of approximately $7.4 million in the first quarter of 2017 as a result of this divestiture, partially

offset by a $0.6 million non-cash charge to write-off related straight-line rent receivables on this property.

European Acquisition Activity

In July and September 2016, we entered into agreements to acquire the real estate assets of 26 non-acute hospitals in Germany, which will be leased to

affiliates of Median Kliniken S.a.r.l. (“MEDIAN”), one of our current tenants. The acquisitions are subject to certain closing conditions and regulatory approvals. We expect the acquisition of the real estate (along with the additional

investment in the equity of MEDIAN to maintain our current 5.1% interest) to approximate

€

270 million (exclusive of any acquisition costs such as real estate transfer taxes). The properties

are expected to be joined to the existing master lease or a new master lease agreement with MEDIAN that will have terms similar to the existing master lease. The existing master lease has an initial term of 27 years with annual escalators at the

greater of one percent or 70% of the German consumer price index. As of the date of this prospectus supplement, we have closed on the acquisitions of 13 of these facilities for a total of approximately

€

94 million, and we expect the remaining transactions to close in the second quarter of 2017. In this prospectus supplement, we refer to these transactions as the “New MEDIAN

Transactions.”

In April 2017, we completed the acquisition of the long leasehold interest of a development site in Birmingham, England from

the Circle Health Group (the tenant of our existing site in Bath, England) for a purchase price of approximately £2.72 million (GBP). Simultaneously with the acquisition we entered into contracts with the property freeholder and the

Circle Health Group committing us to construct an acute care hospital on the site. Our total development costs are anticipated to be approximately £30 million (GBP). Circle Health Group is contracted to enter into a lease of the hospital

following completion of construction for an initial 15 year term with rent to be calculated based on our total development costs.

Restructuring of Adeptus

Leases

On April 4, 2017, we announced that we had agreed in principle with Deerfield Management Company, L.P. (“Deerfield”),

a healthcare-only investment firm, to the restructuring in bankruptcy (the “Restructuring”) of Adeptus Health, Inc., a current tenant and operator of facilities representing approximately 6% of our total gross assets after giving effect to

the transactions in this Recent Development section. In furtherance of the Restructuring, Adeptus and certain of its subsidiaries filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code on April 19, 2017.

Funds advised by Deerfield acquired Adeptus’ outstanding bank debt and Deerfield has agreed to provide additional financing, along with operational and managerial support, to Adeptus as part of the Restructuring.

The Restructuring and terms of our agreement with Deerfield provide for the payment to us of 100% of the rent payable during the Restructuring, and the

assumption by Deerfield of approximately 80% of the master leased facilities at current rental rates. We have agreed to provide a one-time rental credit of approximately $3.1 million during the 12 months commencing upon Adeptus’ emergence from

bankruptcy.

On April 4, 2017, we also announced that our Louisiana freestanding emergency facilities currently operated by Adeptus (with a

total budgeted investment of up to approximately $24.5 million)

S-4

have been re-leased to Ochsner Clinic Foundation (the “Ochsner Leases”), a health care system in the New Orleans area. The Ochsner Leases provide for 15-year initial terms with a 9.2%

average minimum lease rate based on our total development and construction cost. Under these leases, Ochsner also has the right to purchase the freestanding emergency facilities (i) at our cost within two years of rent commencement or

(ii) for the greater of fair market value or our cost after such two-year period. With this transaction, we expect to incur a non-cash charge of $0.5 million to write-off the straight-line rent receivables associated with the previous Adeptus

lease on these properties.

In addition, we expect to re-lease or sell certain Texas facilities that are not being assumed as part of the

Restructuring representing approximately 15% of the current Adeptus master-leased portfolio. These lease or sale transactions are expected to be completed by the end of 2018, and Adeptus is obligated to pay contractual rent to us under the master

lease until the earlier of (a) transition to a new operator is complete, or (b) one year following Adeptus’ emergence from bankruptcy (for approximately 60 percent of the Texas facilities) or 90 days following Adeptus’ emergence

from bankruptcy (for the remainder of the Texas facilities).

Financing Transactions

On February 1, 2017, we entered into a new revolving credit and term loan facility (the “Senior Credit Facilities”), comprised of a $1.3

billion unsecured revolving credit facility, a $200 million unsecured term loan facility (the “USD term loan facility”), and a

€

200 million unsecured term loan (the “EUR term

loan facility”). The Senior Credit Facilities replaced our then existing $1.3 billion senior unsecured revolving credit facility and $250 million unsecured term loan facility. The new unsecured revolving credit facility matures February 1,

2021 and can be extended for an additional 12 months at our option. The USD term loan facility matures on February 1, 2022. The EUR term loan facility matures on January 31, 2020, and can be extended for an additional 12 months at our

option. The term loan and the revolving loan commitments under the Senior Credit Facilities may be increased in an aggregate amount not to exceed $500 million.

On March 4, 2017, we redeemed in full

€

200 million aggregate principal amount of our

5.750% Senior Notes due 2020 using the proceeds from the EUR term loan facility, together with cash on hand.

On March 24, 2017, we issued

€

500 million of 3.325% Senior Notes due 2025 to finance the remaining New MEDIAN transactions, including the related costs, expenses and real estate transfer taxes and to pay off the EUR term loan

facility.

With the Senior Credit Facilities and the redemption of the 5.750% Senior Notes due 2020, we expect to incur a one-time debt refinancing

charge of approximately $14 million in the first quarter of 2017 (of which $9 million relates to a redemption premium paid with respect to the 5.750% Senior Notes due 2020).

We collectively refer to all of the transactions described in this “—Recent Developments” section and the funding of approximately $40

million of development projects and capital additions since December 31, 2016, along with

€

23.5 million of contingent consideration to be paid to MEDIAN in connection with the original

transactions, as the “Transactions.” See “Risk Factors—We may fail to consummate the Steward Transactions, the remaining New MEDIAN Transactions, the Other U.S. Acquisitions or the Deerfield Restructuring or may not consummate

them on the terms described herein.”

S-5

Benefits of the Transactions

Enhances Size and Quality of our Portfolio and Improves Leverage.

As described in more detail below, we believe that

the Transactions described above will enhance the size and quality of our healthcare portfolio and improve our leverage, while maintaining strong diversity by property type, operator and geographic location. The following shows our portfolio as of

December 31, 2016, after giving effect to the Transactions and assumes all committed development activities are fully funded:

Global

Property Type

U.S. Property Type

S-6

By Operator

|

|

|

|

|

International Diversification

|

|

U.S. Geographic Diversification

(B)

|

|

(A)

|

Includes free standing ERs.

|

|

(B)

|

Percentages aggregate to 79.6%, which equals our U.S. concentration.

|

|

*

|

Percentages in all charts are based on our total gross assets. Total gross assets is total assets at December 31, 2016 plus accumulated depreciation/amortization and reflects the consummation of the Transactions

and assumes all committed development activities and commenced capital improvement projects are fully funded.

|

Decreases

Leverage.

We intend to finance a portion of the Transactions with proceeds from this offering. We estimate that our leverage will decrease following this offering, even if the underwriters’ option to purchase

additional shares from us is not exercised.

Expands Our Size and Scale

.

When fully consummated and

development projects are fully funded, the Transactions will expand our total gross assets to $7.5 billion, increase the total number of properties in our portfolio to 257, and increase our total number of beds to approximately 29,000.

Further Increases Portfolio Diversification.

Pro forma for the Transactions, no single asset in our portfolio of

healthcare investments will represent more than 3.2% of total gross assets and our largest tenant will represent 21% of total gross assets.

S-7

Extends Our Lease and Mortgage Loan Maturity Schedule.

The

Transactions will have the effect of extending our overall weighted average lease and mortgage loan expiration to 14.14 years, pro forma as of December 31, 2016. Pro forma for the Transactions, as of December 31, 2016, approximately 70% of

the total annualized rent/interest of our portfolio of healthcare properties will have lease and mortgage loan expirations beyond 2026, with average annual lease and mortgage loan maturities of approximately 2.8% per annum through 2026.

Pipeline

As a key component of our growth strategy,

we continually evaluate healthcare property acquisition and development opportunities as they arise. At any given point in time, we typically have a number of potential acquisition and development transactions under active consideration, which are

in varying stages of negotiation and due diligence review. One or more of the acquisition transactions we are currently pursuing may be material, individually or in the aggregate. Each of these potential transactions is contingent

upon, among other things, the negotiation and execution of definitive agreements and the completion of satisfactory due diligence. We are not party to any binding agreements in respect of any such transactions as of the date of this prospectus

supplement and we cannot assure you that we will successfully enter into any such binding agreements or that, if we do, that we will be able to successfully close on the transactions.

We expect to initially fund the contractual purchase price for any potential transactions that we consummate with any remaining net proceeds to us from

this offering, together with cash on hand and funds from additional financing arrangements, which may include borrowings under our revolving credit facility, borrowings from other senior debt facilities, net proceeds from other issuances of debt or

equity securities, or a combination thereof.

S-8

The Offering

|

|

|

|

|

|

|

|

Issuer

|

|

Medical Properties Trust, Inc.

|

|

|

|

|

Shares of common stock to be offered by us in this offering

|

|

37,500,000 shares. We have also granted the underwriters a 30-day option to

purchase up to 5,625,000 additional shares of our common stock.

|

|

|

|

|

Shares of common stock to be outstanding after this offering

|

|

358,303,182 shares (363,928,182 shares if the underwriters exercise their

option to purchase additional shares from us in full).

|

|

|

|

|

NYSE symbol

|

|

MPW

|

|

|

|

|

Restrictions on ownership

|

|

Our charter contains restrictions on the ownership and transfer of our capital stock that are intended to assist us in complying with these requirements and continuing to qualify as a REIT. Specifically, without the approval of our

Board of Directors, no person or persons acting as a group may own more than 9.8% of the number or value, whichever is more restrictive, of the outstanding shares of our common stock. See “Description of Capital Stock” in the accompanying

prospectus.

|

|

Use of Proceeds

|

|

We estimate that the net proceeds from this offering will be approximately $476.0 million ($547.6 million if the underwriters exercise their option to purchase additional shares from us in full), after deducting underwriting

discounts and commissions and our estimated offering expenses. We intend to use the net proceeds from this offering to fund the cash purchase price payable by us in connection with the Transactions, with the balance of the net proceeds to be used to

repay borrowings under our revolving credit facility. We may use any remaining net proceeds from this offering to partially fund the contractual purchase price for any potential transactions that we consummate in the future. Pending such use of the

net proceeds from this offering, we intend to invest the net proceeds in short-term interest-bearing securities. This offering is not conditioned upon the successful completion of the Steward Transactions, the remaining New MEDIAN Transactions or

the Other U.S. Acquisitions and there is no assurance that the conditions required to consummate the Steward Transactions, the remaining New MEDIAN Transactions or the Other U.S. Acquisitions will be satisfied on the anticipated schedule or at all.

See “Use of Proceeds” and “Risk Factors.”

|

The number of shares of common stock to be outstanding after this offering is based upon 320,803,182 shares outstanding

as of April 24, 2017. The number of shares of common stock to be outstanding after this offering does not include, as of April 24, 2017, 4.8 million shares reserved for issuance in connection with equity-based compensation awards

under our 2013 Equity Incentive Plan.

S-9

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The summary historical consolidated financial data presented below as of December 31, 2015 and 2016 and for the years ended December 31, 2014,

2015 and 2016, have been derived from our audited consolidated financial statements and accompanying notes appearing in our 2016 10-K, which is incorporated by reference into this prospectus supplement.

You should read the following summary historical consolidated financial data in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and our audited consolidated financial statements and accompanying notes included in our 2016 10-K, which is incorporated by reference herein. See “Where You Can Find More Information” in

the accompanying prospectus and “Incorporation by Reference” in this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

|

|

2014(1)

|

|

|

2015(1)

|

|

|

2016(1)

|

|

|

|

|

In thousands, except per share data

|

|

|

Operating data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

312,532

|

|

|

$

|

441,878

|

|

|

$

|

541,137

|

|

|

Real estate depreciation and amortization (expense)

|

|

|

(53,938

|

)

|

|

|

(69,867

|

)

|

|

|

(94,374

|

)

|

|

Property-related and general and administrative (expenses)

|

|

|

(39,125

|

)

|

|

|

(47,431

|

)

|

|

|

(51,623

|

)

|

|

Acquisition expenses(2)

|

|

|

(26,389

|

)

|

|

|

(61,342

|

)

|

|

|

(46,273

|

)

|

|

Impairment (charge)

|

|

|

(50,128

|

)

|

|

|

—

|

|

|

|

(7,229

|

)

|

|

Interest and other income (expense)

|

|

|

5,183

|

|

|

|

175

|

|

|

|

(1,618

|

)

|

|

Gain on sale of real estate and other dispositions, net

|

|

|

2,857

|

|

|

|

3,268

|

|

|

|

61,224

|

|

|

Debt refinancing/unutilized financing (expense)

|

|

|

(1,698

|

)

|

|

|

(4,367

|

)

|

|

|

(22,539

|

)

|

|

Interest (expense)

|

|

|

(98,156

|

)

|

|

|

(120,884

|

)

|

|

|

(159,597

|

)

|

|

Income tax benefit (expense)(3)

|

|

|

(340

|

)

|

|

|

(1,503

|

)

|

|

|

6,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

|

50,798

|

|

|

|

139,927

|

|

|

|

225,938

|

|

|

Income (loss) from discontinued operations

|

|

|

(2

|

)

|

|

|

—

|

|

|

|

(1

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

50,796

|

|

|

|

139,927

|

|

|

|

225,937

|

|

|

Net income attributable to non-controlling interests

|

|

|

(274

|

)

|

|

|

(329

|

)

|

|

|

(889

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to MPT common stockholders

|

|

$

|

50,522

|

|

|

$

|

139,598

|

|

|

$

|

225,048

|

|

|

Income from continuing operations attributable to MPT common stockholders per diluted share

|

|

$

|

0.29

|

|

|

$

|

0.63

|

|

|

$

|

0.86

|

|

|

Income from discontinued operations attributable to MPT common stockholders per diluted share

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to MPT common stockholders per diluted share

|

|

$

|

0.29

|

|

|

$

|

0.63

|

|

|

$

|

0.86

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares—diluted

|

|

|

170,540

|

|

|

|

218,304

|

|

|

|

261,072

|

|

S-10

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

2015

|

|

|

2016

|

|

|

|

|

In thousands

|

|

|

Balance sheet data

|

|

|

|

|

|

|

|

|

|

Real estate assets—at cost

|

|

$

|

3,924,701

|

|

|

$

|

4,965,968

|

|

|

Real estate accumulated depreciation / amortization

|

|

|

(257,928

|

)

|

|

|

(325,125

|

)

|

|

Mortgage and other loans

|

|

|

1,422,403

|

|

|

|

1,216,121

|

|

|

Cash and cash equivalents

|

|

|

195,541

|

|

|

|

83,240

|

|

|

Other assets

|

|

|

324,634

|

|

|

|

478,332

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

5,609,351

|

|

|

$

|

6,418,536

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt, net

|

|

$

|

3,322,541

|

|

|

$

|

2,909,341

|

|

|

Other liabilities

|

|

|

179,545

|

|

|

|

255,967

|

|

|

Total equity

|

|

|

2,107,265

|

|

|

|

3,253,228

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$

|

5,609,351

|

|

|

$

|

6,418,536

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

|

|

2014(1)

|

|

|

2015(1)

|

|

|

2016(1)

|

|

|

|

|

In thousands, except per share data

|

|

|

Other Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share

|

|

$

|

0.84

|

|

|

$

|

0.88

|

|

|

$

|

0.91

|

|

|

FFO information:(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations

|

|

$

|

106,682

|

|

|

$

|

205,168

|

|

|

$

|

253,478

|

|

|

Normalized funds from operations

|

|

$

|

181,741

|

|

|

$

|

274,805

|

|

|

$

|

334,826

|

|

|

FFO information per diluted share:(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations

|

|

$

|

0.63

|

|

|

$

|

0.94

|

|

|

$

|

0.97

|

|

|

Normalized funds from operations

|

|

$

|

1.06

|

|

|

$

|

1.26

|

|

|

$

|

1.28

|

|

|

(1)

|

Cash paid for acquisitions and other related investments totaled $767.7 million, $1.8 billion and $1.5 billion in 2014, 2015 and 2016, respectively. The results of operations resulting from these investments are

reflected in our consolidated financial statements from the dates invested. See Note 3 in Item 8 of our 2016 10-K for further information on acquisitions of real estate, new loans and other investments. We funded these investments generally

from issuing common stock, utilizing additional amounts of our revolving facility, incurring additional debt or from the sale of facilities. See Notes 3, 4 and 9 in Item 8 of our 2016 10-K for further information regarding our property

disposals, our debt, and our common stock, respectively.

|

|

(2)

|

Includes $5.8 million, $37.0 million and $30.1 million in transfer and capital gains taxes in 2014, 2015 and 2016, respectively, related to our property acquisitions in foreign jurisdictions.

|

|

(3)

|

Includes a $9.1 million tax benefit generated from the reversal of foreign valuation allowances and acquisition expenses incurred by certain international subsidiaries in 2016.

|

|

(4)

|

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with

market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition

provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets,

plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

|

S-11

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized

FFO, which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations potentially less meaningful to investors

and analysts.

We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results

among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and

financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs

necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss)

(computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

The following tables present a reconciliation of net income attributable to MPT common stockholders to FFO and normalized FFO for the

years ended December 31, 2014, 2015 and 2016 (in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

FFO information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to MPT common stockholders

|

|

$

|

50,522

|

|

|

$

|

139,598

|

|

|

$

|

225,048

|

|

|

Participating securities’ share in earnings

|

|

|

(895

|

)

|

|

|

(1,029

|

)

|

|

|

(559

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, less participating securities’ share in earnings

|

|

$

|

49,627

|

|

|

$

|

138,569

|

|

|

$

|

224,489

|

|

|

Depreciation and amortization

|

|

|

53,938

|

|

|

|

69,867

|

|

|

|

96,157

|

|

|

Real estate impairment charge

|

|

|

5,974

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain on sale of real estate

|

|

|

(2,857

|

)

|

|

|

(3,268

|

)

|

|

|

(67,168

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations

|

|

$

|

106,682

|

|

|

$

|

205,168

|

|

|

$

|

253,478

|

|

|

Write-off of straight line rent and other

|

|

|

2,818

|

|

|

|

3,928

|

|

|

|

3,063

|

|

|

Transaction costs from non-real estate dispositions

|

|

|

—

|

|

|

|

—

|

|

|

|

5,944

|

|

|

Unutilized financing fees/debt refinancing costs

|

|

|

1,698

|

|

|

|

4,367

|

|

|

|

22,539

|

|

|

Impairment charges

|

|

|

44,154

|

|

|

|

—

|

|

|

|

7,229

|

|

|

Acquisition expenses, net of tax benefit

|

|

|

26,389

|

|

|

|

61,342

|

|

|

|

46,529

|

|

|

Release of valuation allowance

|

|

|

—

|

|

|

|

—

|

|

|

|

(3,956

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized funds from operations

|

|

$

|

181,741

|

|

|

$

|

274,805

|

|

|

$

|

334,826

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

December 31,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

Per diluted share data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, less participating securities’ share in earnings

|

|

$

|

0.29

|

|

|

$

|

0.63

|

|

|

$

|

0.86

|

|

|

Depreciation and amortization

|

|

|

0.31

|

|

|

|

0.32

|

|

|

|

0.37

|

|

|

Real estate impairment charge

|

|

|

0.04

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain on sale of real estate

|

|

|

(0.01

|

)

|

|

|

(0.01

|

)

|

|

|

(0.26

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations

|

|

$

|

0.63

|

|

|

$

|

0.94

|

|

|

$

|

0.97

|

|

|

Write-off of straight line rent and other

|

|

|

0.02

|

|

|

|

0.02

|

|

|

|

0.01

|

|

|

Transaction costs from non-real estate dispositions

|

|

|

—

|

|

|

|

—

|

|

|

|

0.02

|

|

|

Unutilized financing fees/debt refinancing costs

|

|

|

—

|

|

|

|

0.02

|

|

|

|

0.09

|

|

|

Impairment charges

|

|

|

0.26

|

|

|

|

—

|

|

|

|

0.03

|

|

|

Acquisition expenses, net of tax benefit

|

|

|

0.15

|

|

|

|

0.28

|

|

|

|

0.18

|

|

|

Release of valuation allowance

|

|

|

—

|

|

|

|

—

|

|

|

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized funds from operations

|

|

$

|

1.06

|

|

|

$

|

1.26

|

|

|

$

|

1.28

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-13

RISK FACTORS

An investment in our common stock involves various risks, including those set forth below as well as the risk factors included in our 2016 10-K,

which is incorporated by reference into this prospectus supplement and the accompanying prospectus. You should carefully consider these risk factors, together with the information contained or incorporated by reference in this prospectus supplement

and the accompanying prospectus, before making an investment in our common stock. These risks are not the only ones we face. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business

operations. These risks could materially adversely affect, among other things, our business, financial condition or results of operations, and could cause the trading price of our common stock to decline, resulting in the loss of all or part of your

investment.

We may fail to consummate the Steward Transactions, the remaining New MEDIAN Transactions or the Other U.S. Acquisitions or may not

consummate them on the terms described herein.

This offering is expected to be consummated prior to the closing of the Steward Transactions,

the remaining New MEDIAN Transactions and the Other U.S. Acquisitions. We closed on 13 of the New MEDIAN Transactions prior to the date of this prospectus supplement. We expect the Steward Transactions and the remaining New MEDIAN

Transactions to close in the second quarter of 2017 and the Other U.S. Acquisitions to close during 2017. We intend to apply a portion of the net proceeds from this offering to fund the purchase price and related costs and expenses of the

Steward Transactions and the Other U.S. Acquisitions. The consummation of the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions are subject to certain customary regulatory and other closing

conditions and there can be no assurance that such conditions will be satisfied on the anticipated schedules or at all.

This offering is not

conditioned on completion of the Steward Transactions, the remaining New MEDIAN Transactions or the Other U.S. Acquisitions and by purchasing the common stock in this offering you are investing in us on a standalone basis and recognize that we may

not consummate the Steward Transactions, the remaining New MEDIAN Transactions or the Other U.S. Acquisitions or realize the expected benefits from the New MEDIAN Transactions and the other Transactions that closed prior to the date of this

prospectus supplement or, if consummated, the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions. In the event that we fail to consummate the Steward Transactions, the remaining New MEDIAN Transactions or the

Other U.S. Acquisitions, we will have incurred a significant amount of indebtedness and expenses and we will not have acquired all of the assets that are expected to produce the earnings and cash flow we anticipated. As a result, failure to

consummate the Steward Transactions, the remaining New MEDIAN Transactions or the Other U.S. Acquisitions would adversely affect our business, financial condition and cash flows, and could cause the trading price of our common stock to decline.

If the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions are not completed, we could be subject to a number of

risks that may adversely affect our business, financial condition, cash flows and the trading price of our common stock, including:

|

|

•

|

|

our management’s attention may be diverted from our day-to-day business and our employees and our relationships with customers may be disrupted as a result of efforts relating to attempting to consummate the

Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions;

|

|

|

•

|

|

the trading price of our common stock may decline to the extent that the issue price of our common stock reflects a market assumption that the Steward Transactions, the remaining New MEDIAN Transactions and the Other

U.S. Acquisitions will be completed;

|

S-14

|

|

•

|

|

we must pay certain costs related to the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions, such as legal and accounting fees and expenses, regardless of whether the Steward

Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions are consummated; and

|

|

|

•

|

|

we would not realize the benefits we expect to realize from consummating the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions.

|

We are subject to additional risks as a result of the completion of the New MEDIAN Transactions and the other transactions that have closed to date, and, if the

Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions are completed, we may be subject to additional risks.

In addition to the risks described in our 2016 10-K relating to healthcare facilities that we may purchase from time to time, we are subject to

additional risks as a result of the completion of the New MEDIAN Transactions and the other transactions that have closed to date, and, if the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions are completed,

we would also be subject to additional risks, including without limitation the following:

|

|

•

|

|

we have no previous business experience with the facilities that we acquired in the completed New MEDIAN Transactions and the other transactions and the facilities that we expect to acquire in the Steward Transactions,

the remaining New MEDIAN Transactions and the Other U.S. Acquisitions, and we may face difficulties in successfully integrating them with our current portfolio and operating structure;

|

|

|

•

|

|

underperformance of the facilities acquired in the completed New MEDIAN Transactions and the other transactions and/or the facilities we expect to acquire in the Steward Transactions, the remaining New MEDIAN

Transactions and the Other U.S. Acquisitions due to various factors, including unfavorable terms and conditions of any existing financing arrangements, the master lease or mortgage loans relating to the facilities, disruptions caused by the

integration of such facilities or changes in economic conditions;

|

|

|

•

|

|

the properties to be acquired in the Steward Transactions and leased to Steward are located in states where Steward has never operated before, and Steward may incur costs or setbacks as they gain experience in new

markets and geographic regions;

|

|

|

•

|

|

diversion of our management’s attention away from other business concerns; and

|

|

|

•

|

|

exposure to any undisclosed or unknown potential liabilities relating to the facilities that we acquired in the completed New MEDIAN Transactions and the other transactions and the facilities that we expect to acquire

in the Steward Transactions, the remaining New MEDIAN Transactions and the Other U.S. Acquisitions.

|

Our indebtedness may affect our ability to

operate our business, and may have a material adverse effect on our financial condition and results of operations, and our ability to make distributions to our stockholders. We and our subsidiaries may incur additional indebtedness, including

secured indebtedness.

As of December 31, 2016, after giving effect to the Transactions, the issuance of the common stock offered hereby

and application of the proceeds from this offering as described in “Use of Proceeds,” we would have had $3.2 billion of indebtedness (none of which would have been secured indebtedness) and our subsidiaries would have had $13 million of

indebtedness. In addition, as of December 31, 2016, after giving effect to the Transactions, the issuance of the common stock offered hereby and the application of the proceeds from this offering as described in “Use of Proceeds,” we

would have had approximately $0.4 billion of borrowings outstanding and approximately $0.9 billion of availability under our revolving credit facility.

S-15

Our indebtedness could have significant adverse consequences to our business and the holders of our common

stock, such as:

|

|

•

|

|

requiring us to use a substantial portion of our cash flow from operations to service our indebtedness, which would reduce the available cash flow to fund working capital, capital expenditures, development projects and

other general corporate purposes;

|

|

|

•

|

|

limiting our ability to obtain additional financing to fund our working capital needs, acquisitions, capital expenditures or other debt service requirements or for other purposes;

|

|

|

•

|

|

limiting our ability to compete with other companies who are not as highly leveraged, as we may be less capable of responding to adverse economic and industry conditions;

|

|

|

•

|

|

restricting us from making strategic acquisitions, developing properties or exploiting business opportunities;

|

|

|

•

|

|

restricting the way in which we conduct our business because of financial and operating covenants in the agreements governing our and our subsidiaries’ existing and future indebtedness, including, in the case of

certain indebtedness of subsidiaries, certain covenants that restrict the ability of subsidiaries to pay dividends or make other distributions to us;

|

|

|

•

|

|

exposing us to potential events of default (if not cured or waived) under financial and operating covenants contained in our or our subsidiaries’ debt instruments that could have a material adverse effect on our

business, financial condition and operating results;

|

|

|

•

|

|

increasing our vulnerability to a downturn in general economic conditions; and

|

|

|

•

|

|

limiting our ability to react to changing market conditions in our industry and in our tenants’ and borrowers’ industries.

|

Furthermore, as of December 31, 2016, after giving effect to the Transactions, the issuance of the common stock offered hereby and the application

of the proceeds from this offering as described in “Use of Proceeds,” we would have had approximately $0.6 billion of indebtedness, in the form of borrowings outstanding under our Senior Credit Facilities, that bore interest at variable

rates. In addition, our future borrowings may bear interest at variable rates. If interest rates increase significantly, our ability to borrow additional funds may be reduced and the risk related to our indebtedness would intensify.

In addition to our debt service obligations, our operations may require substantial investments on a continuing basis. Our ability to make scheduled

debt payments, to refinance our obligations with respect to our indebtedness and to fund capital and non-capital expenditures necessary to maintain the condition of our operating assets and properties (to the extent not paid by our tenants), as well

as to provide capacity for the growth of our business, depends on our financial and operating performance, which, in turn, is subject to prevailing economic conditions and financial, business, competitive, legal and other factors.

Subject to the restrictions that are contained in many of our debt instruments, including our Senior Credit Facilities and the indentures governing our

4.000% senior notes due 2022, our 6.375% senior notes due 2022, our 6.375% senior notes due 2024, our 5.500% senior notes due 2024, our 5.250% senior notes due 2026 and our 3.325% senior notes due 2025 (collectively, the “Existing Notes”),