Southern Co.'s New 'Clean Coal' Plant May Not Be Cost-Efficient -- Update

February 22 2017 - 5:26PM

Dow Jones News

By Russell Gold

Southern Co. said it has nearly completed a first-of-its-kind

"clean coal" power plant, though a new analysis suggests it might

not make sense to burn coal in it.

After taking nearly seven years and $7.1 billion to build, the

Kemper County, Miss., facility, which can burn coal and capture

much of the carbon-dioxide output, should be fully operational by

the middle of next month, the company said.

But a required economic analysis of the project, the most

expensive fossil-fuel power plant ever built in the U.S., found

that lower natural gas prices and higher-than-expected operating

costs "negatively impact the economic viability" of the

facility.

The company analysis, disclosed this week, concludes that only

if natural gas prices are high would the economics of the

clean-coal plant compare favorably to a gas-burning plant. The

Kemper facility was initially forecast to cost $3 billion in

2010.

Southern updated the status of the troubled plant as it posted a

sharp decline in profit in the final quarter of 2016 to $197

million, or 20 cents a share, down from $271 million, or 30 cents,

a year prior. It said its earnings were helped by retail revenue at

its traditional electric operating companies and weather-related

revenue impacts, but offset by higher operations and maintenance

costs, increased share issuances and lower customer usage.

The company declined to specify the gas price assumptions it

used in its scenario for the Kemper plant's viability, but said on

a conference call with investors Wednesday that the scenario

included a price above $5 per million British thermal units in 2020

and trending upward.

By comparison, the U.S. Energy Information Administration's

forecast doesn't anticipate gas prices to top $5 until 2030.

Southern Chief Executive Thomas Fanning said that in 2010, it

had promised to build a plant that would be a hedge against rising

gas prices.

"I cannot imagine the company is going to be held accountable

for a changing gas-price forecast," he said.

The project looks to be a very expensive hedge. If Southern had

built a natural gas power plant of comparable size, it would have

cost about $700 million -- one-tenth of the facility's overall

cost, according to widely used capital construction cost

estimates.

Southern is now headed toward a showdown over who should pay for

the plant's extra costs.

It plans to ask state officials to approve passing on $4.2

billion in costs to ratepayers of Mississippi Power. But the

company has critics who contend the plant was ill conceived and

poorly executed, and are expected to ask regulators to approve only

a portion of those costs.

In recent weeks, Chevron Corp., which owns and operates a large

refinery in southeastern Mississippi, has made several filings

questioning the plant's price tag, which has more than doubled

since 2010. Chevron would be among the ratepayers who could be

asked to bear the costs of the facility.

Southern already faces a lawsuit over the plant and an

investigation by the Securities and Exchange Commission.

Charles Grayson, a retired chemical industry executive in

Brandon, Miss., and a critic of the plant, says he thinks

Southern's estimates about operations remain overly optimistic.

"For the plant to have a chance to be economical, you need

natural gas prices to go way higher than anyone is anticipating and

you have to have very high reliability year in and year out," he

said.

The Kemper plant was proposed as a showcase of clean-coal

technology. It can turn locally mined coal into a synthetic gas,

capturing the majority of the carbon dioxide. It plans to sell the

carbon dioxide to oil companies that will inject it into older oil

fields to extract more hydrocarbons.

At the time the facility was conceived, few predicted the impact

that added natural gas supplies would have on the economics of U.S.

electricity production. Government and business officials were also

eager to test technology to burn inexpensive coal while limiting

the carbon dioxide emissions.

Mr. Fanning said Wednesday that he was glad the Kemper facility

was close to finished.

"It has been a painful process. Getting to this point we

certainly have taken our lumps," he said.

--Anne Steele contributed to this article.

Write to Russell Gold at russell.gold@wsj.com

(END) Dow Jones Newswires

February 22, 2017 17:11 ET (22:11 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

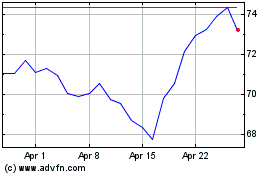

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

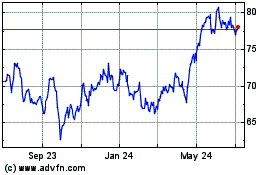

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024