Discovery Profit Rises, but Content Costs Weigh on Europe--Update

February 14 2017 - 2:54PM

Dow Jones News

By Keach Hagey and Austen Hufford

Discovery Communications Inc. posted profit growth in the

December quarter, thanks in part to one-time items, but its

operating results were nearly flat owing to higher sports and other

content costs in Europe.

Known for inexpensive nonfiction content on such channels as

Discovery, Animal Planet and TLC in the U.S., Discovery has pursued

a different strategy in Europe. It bought the pan-European sports

channel Eurosport and went after the European rights to the

Olympics beginning in 2018 and, on rare occasions, expensive soccer

rights like the Bundesliga in Germany.

The latest results showed some of the potential risks of this

strategy, as adjusted operating income at Discovery's international

networks dropped 12% owing to the increased cost of sports rights

for Eurosport and a more than $20 million write-down at Discovery's

Nordics business. That write-down was caused by a pivot from more

expensive Hollywood content toward more local fare after

competition from services like Netflix Inc. and HBO caused

viewership to decline about 20% over the last 2 1/2 years,

Discovery Chief Executive David Zaslav said in a call with

analysts.

The latest results showed some of the potential risks of this

strategy, as adjusted operating income at Discovery's international

networks dropped 12% due, among other things, to the impact of

currency swings and the increased cost of sports rights for

Eurosport. The company also took a more than $20 million write-down

at Discovery's Nordics business as it pivoted from more expensive

Hollywood content toward more local fare after competition from

services like Netflix and HBO caused viewership to decline about

20% over the last 2 1/2 years, Mr. Zaslav said.

However, Mr. Zaslav fiercely defended the broader Eurosport

strategy, saying that in general the channel has steered clear of

snapping up expensive soccer rights in Europe. He also said that

having sports is helping Discovery sell its roughly 10-channel

bundle across the continent and fetching higher ratings.

"Eurosport helped us grow international affiliate revenues in

2016 by 10%," he said on the call. "Our local premium and exclusive

sports rights drove Eurosport viewership up 23% in the fourth

quarter."

During the quarter ended in December, international networks'

revenue grew 0.4%, with currency fluctuations reducing growth by

5%. International distribution revenue was up 3%, or 10% excluding

currency impacts. International advertising declined 2% or,

excluding currency effects, increased 3%.

In the U.S., revenue grew 3% to $812 million, owing to a 6%

increase in distribution revenue and a 1% increase in advertising

revenue. Distribution revenue was driven by higher rates, partially

offset by a decline in subscribers, while advertising was driven by

higher prices, offset by lower ratings.

On the call, Discovery's departing Chief Financial Officer Andy

Warren said that there had been an acceleration of the subscriber

declines at the networks that aren't fully distributed, but that

the company's "economics aren't embedded in those networks."

"We got out in front of this idea of focusing our channels," Mr.

Zaslav said, in a reference to the news last week that Viacom Inc.

was shifting its strategic focus to six core networks out of a

portfolio of roughly two dozen. "Our deals [with distributors]

provide about 85% of the economics against five of our

channels."

Those channels are Discovery, Animal Planet, TLC, Science and

ID.

Mr. Zaslav said Discovery is also focusing on "niche categories"

where it has "dominant consumer and brand advantage," such as ID

and Velocity.

"We see huge potential to expand these genres on and off the

traditional TV screen such as through dedicated digital-only

content verticals, [subscription online video on demand] channels

and through partnerships such as our recent agreement with Amazon,"

where the companies launched True Crime Files last November and

already have 10,000 subscribers paying $4 a month, Mr. Zaslav

said.

"This is just the first of several niche verticals we plan to

introduce as we continue to monetize our library content on a

direct-to-consumer basis," Mr. Zaslav said.

In all, Discovery reported a profit of $304 million, or 52 cents

a share, up from $219 million, or 34 cents, a year earlier. On an

adjusted basis, earnings per share were 56 cents.

Total revenue rose 1.6% to $1.67 billion.

Analysts polled by Thomson Reuters had expected revenue of $1.69

billion and adjusted earnings per share of 47 cents.

Discovery shares were down 1.4% in early afternoon trading.

Write to Keach Hagey at keach.hagey@wsj.com and Austen Hufford

at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 14, 2017 14:39 ET (19:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

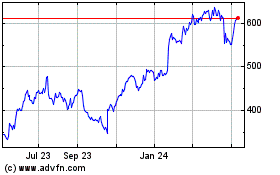

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

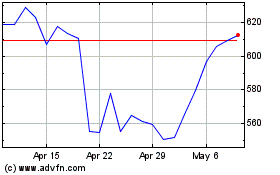

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024