Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 26 2017 - 6:04AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement Nos. 333-204470

333-204470-01

PRICING TERM

SHEET

EMBRAER NETHERLANDS FINANCE B.V.

U.S.$750,000,000 5.400% NOTES DUE 2027

GUARANTEED BY

EMBRAER

S.A.

January 25, 2017

|

|

|

|

|

|

|

|

Issuer:

|

|

Embraer Netherlands Finance B.V.

|

|

|

|

|

Guarantor:

|

|

Embraer S.A.

|

|

|

|

|

Security:

|

|

5.400% Notes due 2027

|

|

|

|

|

Ranking:

|

|

The notes and the guarantee will be general, senior, unsecured obligations and will rank equal in right of payment with all of the Issuer’s and the Guarantor’s existing and future senior unsecured indebtedness,

respectively. The notes and the guarantee will be (i) effectively subordinated to all of the Issuer’s and the Guarantor’s existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness,

respectively, and (ii) structurally subordinated to all of the existing and future liabilities of the Guarantor’s subsidiaries (other than the Issuer).

|

|

|

|

|

Format:

|

|

SEC Registered

|

|

|

|

|

Currency:

|

|

U.S. Dollars

|

|

|

|

|

Principal Amount:

|

|

U.S.$750,000,000

|

|

|

|

|

Maturity:

|

|

February 1, 2027

|

|

|

|

|

Settlement Date*:

|

|

February 1, 2017 (T+5)

|

|

|

|

|

Coupon:

|

|

5.400% per annum

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Interest Payment Dates:

|

|

February 1 and August 1, commencing on August 1, 2017

|

|

|

|

|

Issue Price:

|

|

100.000% of principal amount

|

|

|

|

|

Benchmark Treasury:

|

|

2.000% due November 15, 2026

|

|

|

|

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

95-15+; 2.523%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+287.7 basis points

|

|

|

|

|

Yield:

|

|

5.400%

|

|

|

|

|

Make-Whole Call:

|

|

Treasury Rate plus 45 basis points

|

|

|

|

|

Optional Redemption Provisions:

|

|

The Issuer may, at its option, redeem the notes, in whole or in part, at any time, by paying the greater of (i) 100% of the principal amount of the notes and (ii) the applicable “make-whole” amount, as described under

“Description of the Notes—Redemption and Repurchase—Optional Redemption With Make-Whole Amount” in the prospectus supplement.

|

|

|

|

|

Tax Redemption Provisions:

|

|

Either the Issuer or the Guarantor (as the case may be) may, at its option, redeem the notes, in whole but not in part, at 100% of the principal amount plus accrued and unpaid interest and additional amounts, if any, upon the

occurrence of specified events relating to Brazilian or Dutch tax law. See “Description of the Notes—Redemption and Repurchase—Optional Tax Redemption” in the prospectus supplement.

|

|

|

|

|

Ratings**:

|

|

BBB / BBB- (S&P / Fitch)

|

|

|

|

|

Denomination:

|

|

Minimum denominations of U.S.$2,000 and integral multiples of U.S.$1,000 in excess thereof

|

|

|

|

|

Governing Law:

|

|

State of New York

|

|

|

|

|

Clearing:

|

|

The Depository Trust Company

|

|

|

|

|

Listing:

|

|

The Issuer will apply to list the notes on the New York Stock Exchange

|

|

|

|

|

CUSIP/ISIN:

|

|

CUSIP: 29082H AB8

ISIN:

US29082HAB87

|

|

|

|

|

Joint Book-Running Managers:

|

|

BB Securities Ltd.

J.P. Morgan Securities

LLC

Santander Investment Securities Inc.

|

* Delivery of the notes will be made to investors on or about February 1, 2017, which will be the fifth business day

following the date hereof. Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in three business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to

trade notes on the date of pricing or the next succeeding business day will be required, by virtue of the fact that the notes initially will settle in T+5, to specify alternative settlement arrangements to prevent a failed settlement.

** A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The information in this Pricing Term Sheet supplements the preliminary prospectus supplement, dated January 18, 2017 (the

“Preliminary Prospectus Supplement”), and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. Unless otherwise indicated, terms used

but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus Supplement.

The Issuer and the Guarantor have filed a

registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer and the Guarantor have

filed with the SEC for more complete information about the Issuer, the Guarantor and this offering. You may access these documents without charge by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Underwriters can arrange to

send you the prospectus supplement and prospectus if you request it by calling BB Securities Ltd. at +44 (20) 7367 5800, att. Operations Department, J.P. Morgan Securities LLC at +1 (866) 846-2874, or Santander Investment Securities

Inc. at +1 (855) 403-3636.

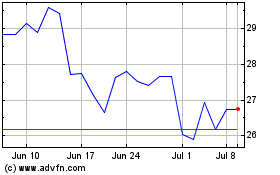

Embraer (NYSE:ERJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

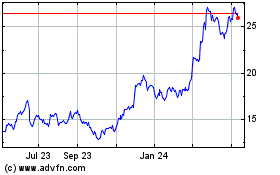

Embraer (NYSE:ERJ)

Historical Stock Chart

From Sep 2023 to Sep 2024