Trump's Win Leaves Health Insurers With Questions

November 09 2016 - 9:34AM

Dow Jones News

By Anna Wilde Mathews

Few companies had more at stake in this election than health

insurers, which are at the center of the changes brought by the

Affordable Care Act.

Donald Trump's victory leaves the industry with a huge question

mark, which is likely to immediately weigh on shares of the

companies. Many analysts think it is unlikely all of the ACA's

effects would be truly undone, but the lack of clarity would likely

pressure the industry. "A Trump victory just increases uncertainty,

which the market doesn't like, " said Thomas Carroll, an analyst

with Stifel Financial Corp.

Indeed, on Wednesday morning, analysts warned of a plunge in

health-care stocks, including insurers but also among hospital

companies. The near-term "impact and shock of the result will weigh

on stocks across our coverage until we get greater clarity on

agenda and details" around Mr. Trump's health-care policies, wrote

Ralph Giacobbe, a Citi analyst. Writes analyst Ana Gupte of

Leerink, "The unthinkable has happened."

Though Mr. Trump has committed to repeal the health law, he has

been vague about how he would do so and what would replace it. Like

other Republicans, he has endorsed policy ideas including selling

health plans across state lines and increased use of health-savings

accounts.

In a statement, America's Health Insurance Plans, the main

lobbying group for the industry, said it would "work across the

aisle -- with every policy maker and the new administration -- to

find solutions that deliver affordable coverage and high-quality

care for everyone."

The insurance industry's experience with the ACA has been a

mixed bag, with upsides and downsides. If Mr. Trump somehow did

away with the law's expansion of Medicaid, insurers could lose new

enrollees they have gained and the prospect of further growth in

that business from states that hadn't yet expanded their programs.

A rollback of the Medicaid expansion would also be a blow to

hospitals that have benefited from having more paying

customers.

It isn't clear what would happen to the law's signature

marketplaces and the widespread changes the ACA brought to the

individual insurance business. Many insurers have lost money in the

exchanges, and some major national players have pulled back from

them for next year, including UnitedHealth Group Inc. and Aetna

Inc. Others that retain major exchange footprints, including Anthem

Inc., have said they need to see reforms to assure the marketplaces

are sustainable.

The danger for insurers would be if Mr. Trump and Republicans

retained some politically popular elements of the ACA, such as the

requirements that insurers sell insurance to consumers regardless

of their health conditions, while dumping those less appealing to

voters, such as the penalties for those who lack insurance. That

could accelerate the unraveling of the health marketplaces, though

the earnings impact on insurers that already have largely withdrawn

would obviously be limited.

Still, if Mr. Trump chooses to take a pragmatic stance, leaving

parts of the ACA in place while easing some of its rules, the

industry could benefit, said Chris Rigg, an analyst with

Susquehanna Financial Group. "The political reality is much more

nuanced than the market might initially think," he said. Analysts

point to Republicans' traditional support for private companies'

role in government health programs, particularly Medicare, as a

possible silver lining for insurers.

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

November 09, 2016 09:19 ET (14:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

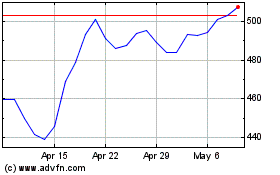

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024