Oracle to Call Off NetSuite Deal Unless Shareholder Support Increases

October 07 2016 - 10:50AM

Dow Jones News

Oracle Corp. said its deal to buy NetSuite Inc. would be called

off next month unless enough shares are tendered by an extended

deadline.

NetSuite shares fell 4.2% to $104.72 in morning trading in New

York, while Oracle shares rose 0.4% to $38.87.

NetSuite shareholders now have until Nov. 4 to tender 20.4

million shares, a majority of unaffiliated shares. So far, 4.6

million unaffiliated shares, or less than a quarter of those

needed, have been tendered.

Oracle said Friday that if the required number of unaffiliated

tendered shares isn't reached by Nov. 4, then it would "respect the

will of NetSuite's unaffiliated shareholders and terminate its

proposed acquisition."

Last month, T. Rowe Price Group Inc. notified NetSuite that it

would oppose Oracle's $9.3 billion acquisition of the

cloud-software provider, noting the "unique relationship" between

the company and Oracle Chairman Larry Ellison.

Mr. Ellison is the biggest shareholder in both companies.

Entities owned by Mr. Ellison or his family held nearly 40% of

NetSuite's common shares as of April, according to regulatory

filings.

Including affiliated shares, a majority of all shares have been

tendered.

In July, Oracle agreed to pay $9.3 billion, or $109 a share, for

the cloud-computing pioneer. The deal was seen helping Oracle to

catch up in a key area where it has lagged behind, but also raised

questions about the influence of Mr. Ellison.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 07, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

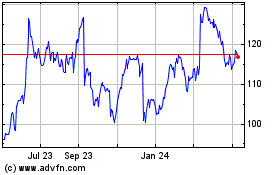

Oracle (NYSE:ORCL)

Historical Stock Chart

From Aug 2024 to Sep 2024

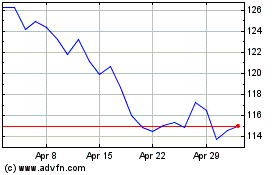

Oracle (NYSE:ORCL)

Historical Stock Chart

From Sep 2023 to Sep 2024