MUMBAI—A wave of foreign money is helping put Indian stocks

among the world's best performing this year, with investors

confident the market can withstand any reversal of this year's

global rush into emerging-market equities.

The benchmark S&P BSE Sensex is up 8.3% so far this year,

and is now less than 5% below its all-time closing high set in

January 2015. Among major emerging markets, Brazilian and Russian

stocks have performed better—but both are rebounding from three

years of losses.

The fever for Indian stocks is evident from the country's

booming initial public offerings. Last week's $900 million float of

ICICI Prudential Life Insurance Co., an Indian insurance company,

was the country's largest in six years—yet it was oversubscribed by

10 times.

Overseas investors have caught the bug: Around $7 billion of

foreign money has flowed into the Indian market this year, up from

$4 billion over the same period in 2015, according to regulatory

data.

That could leave India vulnerable if the "global search for

yield" goes into reverse, the trend by which investors have scoured

the world for higher returns. Some fear any future series of rate

increases by the U.S. Federal Reserve could trigger such a

reversal. On Monday, the Sensex fell 1.3%, in line with other Asian

markets.

But investors and analysts say India—where annual growth reached

7.5% in the first half of 2016, beating China's 6.7%

expansion—could eventually prove better placed than other emerging

markets if global capital flows turn. They cite factors including

government reforms under Prime Minister Narendra Modi as reasons to

remain optimistic.

"India is in a Goldilocks situation," which is attracting global

investors, said Sumit Jalan, co-head of investment banking at

Credit Suisse in India. "Foreign investors are driving [Indian]

markets."

Once lumped in with a block of emerging markets termed the

BRIC—Brazil, Russia, India and China—India has lately diverged from

the group, in part thanks to its heavy weighting toward domestic

consumption. By contrast, Brazil and Russia have been hit by the

slump in global commodity prices, while China's exports have

suffered from a slowdown in world trade.

Over the past three years, Indian shares have gained a

cumulative 44%, beating the 37.5% rise in China's Shanghai

Composite, and well ahead of the 8% rise in Brazilian shares and

the 31% drop in Russia.

India's inflation has eased, its trade deficit has narrowed

thanks to lower oil prices, and the rupee has been relatively

stable against the U.S. dollar this year. Recent good monsoon rains

could help boost agricultural productivity, and thus consumer

demand from rural India.

India's government has delivered on some planned reforms:

Parliament this year approved a long-pending bill to replace myriad

federal and state taxes with a national goods-and-services tax. It

also cleared a new bankruptcy law which could make it easier to

wind up a failing business.

Some reckon investors will continue to differentiate India from

other leading emerging markets, in the belief that Indian consumers

would keep buying new cars, televisions and mobile phones. Shares

of consumer-goods companies, auto makers, banks, and cement

companies have risen sharply this year, with some gaining as much

as 60% in recent months.

"They're all very clear: India is the stable part of my

portfolio, I keep it. The rest I'm trading around," said Bharat

Iyer, head of equity research at J.P. Morgan in India.

"Things look aligned for a fairly sustainable cycle for India

going forward," said Matthew Dreith, a fund manager at U.S.

money-management firm Wasatch Advisors, which has $6.8 billion

invested in emerging markets. Its allocation to India has increased

to $1.2 billion over the past two years.

With a market capitalization of more than $1.6 trillion each,

India's main stock exchanges—BSE Ltd. and the National Stock

Exchange—now rank 10th and 11th in the world, respectively,

according to the World Federation of Exchanges. Only around half of

the listed stocks is available for purchase by investors, since

company founders often hold the majority of their shares. Foreign

investors own around one-quarter of all shares issued by India's

top 200 companies.

One concern is that Indian stocks have become overvalued. The

Sensex currently trades at around 18.5 expected company earnings

for the year ending March 2017, above its 15.5 times long-run

average forward price-to-earnings ratio, according to local

brokerage Sharekhan Ltd.

Still, analysts believe that higher profits will justify the

high valuations. J.P. Morgan said it expects profits for companies

in the benchmark Nifty 50 index to rise by 8% to 10% for the

financial year ending March 31, 2017, and by 15% in 2018.

Indian companies are capitalizing on investor demand by

launching a flurry of new equity issuance. While IPO issuance has

fallen this year globally, total deal values in India have nearly

tripled to $2.8 billion, according to Dealogic. Bankers say other

large flotations in the coming year include those for the Indian

unit of U.K. mobile-phone company Vodafone Group PLC, and India's

largest securities exchange, the National Stock Exchange of India

Ltd.

Write to Shefali Anand at shefali.anand@wsj.com and Debiprasad

Nayak at debi.nayak@wsj.com

(END) Dow Jones Newswires

September 26, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

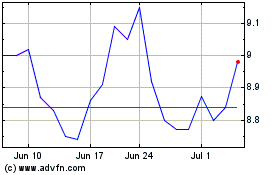

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Aug 2024 to Sep 2024

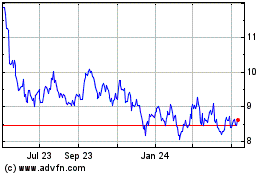

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Sep 2023 to Sep 2024