- Reported net sales totaled $1.3

billion, up 16.6 percent. Sales grew 23.3 percent in constant

currency and adjusting for the extra week in the prior-year

period.

- GAAP earnings from continuing

operations doubled to $0.40 per diluted share. Non-GAAP adjusted

earnings from continuing operations1 rose 8.5 percent

to $0.51 per diluted share.

- Company reiterates fiscal 2017

guidance for adjusted earnings from continuing operations of $2.60

to $2.70 per diluted share.

Patterson Companies, Inc. (Nasdaq: PDCO) today reported

consolidated net sales of $1.3 billion (see attached Sales Summary

for further details) in its fiscal first quarter ended July 30,

2016, up 16.6 percent over the same period last year. Sales this

quarter include a full-quarter contribution from the Animal Health

International, Inc. acquisition. Sales in the year-ago quarter

included an extra sales week and only a six-week contribution from

Animal Health International, Inc.

Reported net income from continuing operations was $38.9

million, or $0.40 per diluted share, compared to $20.3 million, or

$0.20 per diluted share, in last year’s fiscal first quarter.

Adjusted net income from continuing operations1, which excludes

certain non-recurring and deal amortization costs, totaled $48.8

million for the first quarter of fiscal 2017, up 4.0 percent over

$46.9 million in the same quarter last year. Adjusted earnings per

diluted share from continuing operations1 totaled $0.51 in the 2017

first quarter, up 8.5 percent year-over-year.

“The business turned in a solid performance overall in the first

fiscal quarter. Enhancing our operational platform for growth is a

top priority for Patterson, and we moved forward with efforts to

boost our effectiveness and improve our ability to compete in an

evolving marketplace,” said Scott Anderson, chairman, president and

chief executive officer. “In Dental, we implemented steps to align

our go-to-market strategy with shifting customer needs. In Animal

Health, our ongoing integration initiatives and progress toward

planned synergies remained on track. We are confident in the

platform we are building for long-term growth and efficiency.”

Patterson DentalReported net sales for Patterson Dental,

which represents approximately 43 percent of total company sales,

were $555.0 million, down 3.5 percent. Sales grew 2.1 percent on a

constant currency basis and excluding the extra week from the 2016

first fiscal quarter. On that same basis, year-over-year sales by

category were as follows:

- Consumable dental supplies increased

0.9 percent

- Equipment sales improved 5.4

percent

- Other services and products, primarily

composed of technical service, parts and labor, software support

services and office supplies, rose 1.3 percent

Anderson said, “Our customers’ appetite for technology adoption

and equipment investment was strong, and we are well positioned to

address that demand. We also recognize that purchasing patterns of

our customers are evolving and our aim is to lead the industry in

addressing that change. While these sales force realignment actions

can cause some short-term sales disruption, we believe we were

competitive during the quarter in consumable sales and were pleased

with the growth in our equipment sales volumes.”

Patterson Animal HealthReported net sales for Patterson

Animal Health, which comprises approximately 57 percent of the

company’s total sales, were $762.6 million, up 36.8 percent.

Production animal sales contributed $361.9 million to the segment

during the quarter. Companion animal sales grew 11.7 percent on a

constant currency basis and excluding the extra week from the 2016

first fiscal quarter. U.S. companion animal sales grew 8.1 percent,

adjusting for the extra sales week in the same period last year and

normalizing for the changes in selling arrangements for certain

products.

Anderson added, “We are pleased with the performance of our U.S.

companion animal business and encouraged by the growth this quarter

in our production animal business. Livestock end markets are

starting to improve, and we believe our growth in the quarter

outpaced our end markets. We continue to make progress in our

integration and synergies, while remaining focused on sales

execution.”

Discontinued OperationsOn August 28, 2015, Patterson

Companies completed the sale of Patterson Medical to Madison

Dearborn Partners for approximately $717 million. As a result of

the sale, Patterson Medical is classified and reported as

discontinued operations for all periods presented.

Share Repurchases and DividendsIn the fiscal 2017 first

quarter, Patterson repurchased approximately 0.5 million shares of

its outstanding common stock, with a value of $25.0 million,

leaving approximately 16 million shares for repurchase under the

current authorization. The company also paid $24.2 million in cash

dividends to shareholders in the first quarter of fiscal 2017.

Business OutlookAnderson concluded, “We are positioning

Patterson Companies to achieve long-term growth and efficiency

goals that build on the platform we have created. We anticipate

that our range of initiatives, from our enterprise resource

planning system deployment, to our optimization efforts in Dental,

to our ongoing integration efforts in the Animal Health segment

will further enhance our competitiveness and shareholder value. We

will continue to closely monitor the conditions and variables in

our end markets. With this in mind, we reiterate our adjusted

earnings guidance for fiscal 2017 in the range of $2.60 to $2.70

per diluted share.”

The fiscal 2017 annual financial outlook and adjusted earnings

guidance:

- Assumes stable North American and

international markets

- Excludes the impact of additional share

repurchases

- Excludes new acquisitions

- Excludes transaction-related costs,

integration and business restructuring expenses and deal

amortization (See Reconciliation of GAAP and Non-GAAP Financial

Measures table below)

- Includes $25 million step up in

operating expense associated with the ERP implementation

1Reconciliation of GAAP and Non-GAAP Financial

MeasuresThe following non-GAAP table is provided to adjust

reported net income and diluted earnings per share for the impact

of tax affected one-time costs, current and prior-year deal

amortization costs and tax costs related to cash repatriation.

Management believes that the adjusted net income and diluted

earnings per share amounts may provide a helpful representation of

the company’s current quarter performance.

(Dollars in thousands, except EPS)

Three Months

Ended July 30, August 1, 2016

2015 Net income from continuing operations - reported $

38,906 $ 20,311 Transaction-related costs 216 9,302 Deal

amortization 6,637 4,612 Integration and business restructuring

expenses 3,032 871 Tax impact of repatriation of cash -

11,800 Net income from continuing operations -

adjusted $ 48,791 $ 46,896 Diluted earnings

per share from continuing operations - reported $ 0.40 $ 0.20

Transaction-related costs - 0.09 Deal amortization 0.07 0.05

Integration and business restructuring expenses 0.03 0.01 Tax

impact of repatriation of cash - 0.12

Diluted earnings per share from continuing operations - adjusted* $

0.51 $ 0.47 *May not foot due to rounding

Our guidance is presented on a non-GAAP basis. Due to the

difficulty in forecasting certain transaction and business

restructuring-related expenses and the tax impact thereof, the

company is unable to provide a reconciliation of adjusted earnings

guidance for fiscal 2017 without unreasonable effort. Because

the information necessary to provide such reconciliation is

unavailable, the company is unable to predict its probable

significance.

In addition, the term constant currency represents net sales

adjusted to exclude foreign currency impacts. Foreign currency

impact represents the difference in results that is attributable to

fluctuations in currency exchange rates the company uses to convert

results for all foreign entities where the functional currency is

not the U.S. dollar. The company calculates the impact as the

difference between the current period results translated using the

current period currency exchange rates and using the comparable

prior period’s currency exchange rates. The company believes the

disclosure of net sales changes in constant currency provides

useful supplementary information to investors in light of

significant fluctuations in currency rates.

First-Quarter Conference Call and ReplayPatterson’s

first-quarter earnings conference call will start at 10 a.m.

Eastern today. Investors can listen to a live webcast of the

conference call at www.pattersoncompanies.com. The conference call

will be archived on Patterson’s website. A replay of the

first-quarter conference call can be heard for one week at

888-203-1112 and by providing the Conference ID 9243479, when

prompted.

About Patterson Companies, Inc.Patterson Companies, Inc.

is a value-added distributor serving the dental and animal health

markets.

Dental MarketPatterson's Dental

segment provides a virtually complete range of consumable dental

products, equipment and software, turnkey digital solutions and

value-added services to dentists and dental laboratories throughout

North America.

Animal Health MarketPatterson's

Animal Health segment is a leading distributor of products,

services and technologies to both the production and companion

animal health markets in North America and the U.K.

This press release contains certain forward-looking statements,

as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

Patterson's ability to control. Forward-looking statements

generally can be identified by words such as "believes," "expects,"

"anticipates," "foresees," "forecasts," "estimates" or other words

or phrases of similar import. It is uncertain whether any of the

events anticipated by the forward-looking statements will transpire

or occur, or if any of them do, what impact they will have on the

results of operations and financial condition of Patterson or the

price of Patterson stock. These forward-looking statements involve

certain risks and uncertainties that could cause actual results to

differ materially from those indicated in such forward-looking

statements, including but not limited to the other risks and

important factors contained and identified in Patterson's filings

with the Securities and Exchange Commission, such as its Quarterly

Reports on Form 10-Q and Annual Reports on Form 10-K, any of which

could cause actual results to differ materially from the

forward-looking statements. Any forward-looking statement in this

press release speaks only as of the date on which it is made.

Except to the extent required under the federal securities laws,

Patterson does not intend to update or revise the forward-looking

statements.

PATTERSON COMPANIES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share

amounts) (Unaudited) Three Months Ended

July 30, August 1, 2016 2015 Net

sales $ 1,332,436 $ 1,142,870 Gross profit 317,178 288,244

Operating expenses 251,762 226,067

Operating income from continuing operations 65,416

62,177 Other expense, net (7,798 ) (11,473 )

Income from continuing operations before taxes 57,618 50,704

Income taxes 18,712 30,393

Net income from continuing operations 38,906 20,311 Net

income from discontinued operations - 9,392

Net income $ 38,906 $ 29,703 Basic

earnings per share: Continuing operations $ 0.41 $ 0.20

Discontinued operations - 0.10 Net

basic earnings per share $ 0.41 $ 0.30 Diluted

earnings per share: Continuing operations $ 0.40 $ 0.20

Discontinued operations - 0.10 Net

diluted earnings per share $ 0.40 $ 0.30

Shares: Basic 95,461 99,436 Diluted 96,090 100,162 Dividends

declared per common share $ 0.24 $ 0.22 Gross margin -

reported 23.8 % 25.2 Operating expenses as a % of net sales

- adjusted 17.7 % 18.0 Adjustments1 1.2 1.8

Operating expenses as a % of net sales - reported 18.9 %

19.8 Operating income as a % of net sales - adjusted 6.1 %

7.2 Adjustments1 (1.2 ) (1.8 ) Operating income as a

% of net sales - reported 4.9 % 5.4 Effective tax rate -

adjusted 33.0 % 34.4 Adjustments1 (0.5 ) 25.5

Effective tax rate - reported 32.5 % 59.9 1 Refer to the

press release for the definition of adjustments to reported results

PATTERSON COMPANIES, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands)

July 30, April 30, 2016 2016

(Unaudited) ASSETS Current assets: Cash and cash

equivalents $ 89,978 $ 137,453 Receivables 719,218 796,693

Inventory 799,176 722,140 Prepaid expenses and other current assets

82,696 91,255 Total current assets

1,691,068 1,747,541 Property and equipment, net 298,104 293,315

Goodwill and other intangible assets 1,309,188 1,325,889 Long-term

receivables, net and other 200,907 154,059

Total assets $ 3,499,267 $ 3,520,804

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 523,105 $ 566,253 Other accrued liabilities

187,336 226,582 Current maturities of long-term debt 18,563 16,500

Borrowings on revolving credit 108,000 20,000

Total current liabilities 837,004 829,335 Long-term debt

1,016,184 1,022,155 Other non-current liabilities 228,042

227,568 Total liabilities 2,081,230 2,079,058

Stockholders' equity 1,418,037 1,441,746

Total liabilities and stockholders' equity $ 3,499,267

$ 3,520,804

PATTERSON COMPANIES, INC. SALES SUMMARY (Dollars

in thousands) (Unaudited) Total

Foreign Animal Health July 30, August

1, Sales Exchange International

Internal 2016 2015 Growth Impact

Impact Growth

Three Months

Ended

Consolidated net sales Consumable $ 1,076,221 $ 895,307 20.2

% (2.0 ) % 22.0 % 0.2 % Equipment and software 160,946 153,483 4.9

(0.4 ) - 5.3 Other 95,269 94,080 1.3

(0.7 ) (0.2 ) 2.2 Total $ 1,332,436 $

1,142,870 16.6 % (1.7 ) % 17.2 % 1.1 %

Dental Consumable $ 332,948 $ 358,052 (7.0 ) % (0.4 ) % - %

(6.6 ) % Equipment and software 150,882 143,670 5.0 (0.4 ) - 5.4

Other 71,185 73,395 (3.0 ) (0.3 ) -

(2.7 ) Total $ 555,015 $ 575,117 (3.5 ) % (0.4

) % - % (3.1 ) % Animal Health Consumable $ 743,273 $

537,255 38.3 % (3.0 ) % 36.6 % 4.7 % Equipment and software 10,064

9,813 2.6 (0.2 ) - 2.8 Other 9,294 10,229

(9.1 ) (4.6 ) (1.7 ) (2.8 ) Total $ 762,631 $ 557,297

36.8 % (3.0 ) % 35.3 % 4.5 %

Corporate Other $ 14,790 $ 10,456 41.4 % -

% - % 41.4 % Total $ 14,790 $ 10,456

41.4 % - % - % 41.4 %

PATTERSON COMPANIES, INC. SUPPLEMENTARY FINANCIAL

DATA (In thousands, except per share data)

(Unaudited) Three Months Ended July

30, August 1, 2016 2015 Operating

income (loss) Dental $ 60,295 $ 67,252 Animal Health 14,829 12,972

Corporate (9,708 ) (18,047 ) Total $ 65,416 $

62,177 Other income (expense) Interest income $ 1,295

$ 789 Interest expense (10,162 ) (12,143 ) Other 1,069

(119 ) Total $ (7,798 ) $ (11,473 )

PATTERSON COMPANIES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited) Three Months Ended July

30, August 1, 2016 2015 Operating

activities: Net income $ 38,906 $ 29,703 Net income from

discontinued operations - 9,392 Net

income from continuing operations 38,906 20,311

Adjustments to reconcile net income from

continuing operations to net cash provided by operating

activities:

Depreciation & amortization 20,359 15,247 Non-cash employee

compensation 9,184 6,965 Change in assets and liabilities, net of

acquired (141,228 ) (34,829 ) Net cash (used in)

provided by operating activities- continuing operations (72,779 )

7,694 Net cash used in operating activities- discontinued

operations - (2,270 ) Net cash (used in)

provided by operating activities (72,779 ) 5,424 Investing

activities: Additions to property and equipment, net of disposals

(15,042 ) (17,064 ) Acquisitions and equity investments -

(1,104,730 ) Other investing activities 9,337

- Net cash used in investing activities- continuing

operations (5,705 )

(1,121,794 ) Net cash used in investing activities- discontinued

operations -

(54 ) Net cash used in investing activities (5,705 )

(1,121,848 ) Financing activities: Dividends paid (24,197 )

(23,128 ) Repurchases of common stock (25,000 ) - Proceeds from

issuance of long-term debt, net - 988,400 Retirement of long-term

debt (4,125 ) - Draw on revolver 88,000 - Other financing

activities (506 ) (745 ) Net cash provided by

financing activities 34,172 964,527 Effect of exchange rate

changes on cash (3,163 ) (8,923 ) Net change in cash

and cash equivalents $ (47,475 ) $ (160,820 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160825005158/en/

Patterson Companies, Inc.Ann B. Gugino, 651-686-1600Executive

Vice President & CFOorJohn M. Wright, 651-686-1364Vice

President, Investor Relations

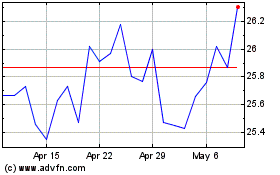

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

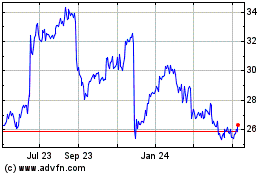

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Sep 2023 to Sep 2024