By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The biggest heavyweight in the "gig" economy is putting its

considerable capital and research capabilities behind self-driving

trucks. Uber Technologies Inc. is buying Silicon Valley trucking

startup Ottomotto LLC, the WSJ's Greg Bensinger and John Stoll

report, in a deal worth around $680 million that promises to

accelerate the push toward autonomous technology in trucking. The

agreement comes as Uber is stepping on the accelerator In its

broader push toward self-driving technology, laying out a plan to

offer autonomous vehicles for passenger rides in Pittsburgh. The

move into trucking may have a more immediate impact, however.

Ottomoto believes regulators would look more favorably on vehicles

that operate primarily on highways, rather than through dense urban

streets. And Uber's new interest in trucking will likely spur other

truck manufacturers already researching autonomous technology to

step up those efforts.

DP World is moving ahead cautiously in its capacity growth even

after a banner financial start to this year. The global container

terminal operator is pulling back expansion at its flagship Jebel

Ali port in Dubai and stressing "disciplined investment, improving

efficiencies and managing costs" in a tough market for global

trade. The wary outlook comes even after DP World posted a 50% gain

in first-half profit, to $608 million, on a 10.2% gain in revenue,

the WSJ's Nikhil Lohade reports. The gains were largely built on DP

World's big acquisitions, however, and growth excluding those

purchases was far more modest, in line with what the operator calls

a "challenging trade environment." Still, DP World's strong

financial footing and a healthy budget for capital spending suggest

the business may still bulk up -- whether at its existing sites or

new shipping terminals that it may bring on board.

Home Depot Inc. says it is reaping the benefits of using stores

for online sales fulfillment . Some 42% of online orders and 90% of

returns were handled at the home-improvement giant's stores in the

second quarter, a strong show of efficiency that helped push the

business to 9.3% profit growth in a tough retail environment. Many

in the retail industry believe fulfilling online orders from

physical stores is a critical weapon in the battle for market share

and to serve e-commerce demands while preserving profit margins.

WSJ Logistics Report's Loretta Chao writes that is easier said than

done, but that Home Depot may have an advantage with its

warehouse-like stores and sprawling inventory. Home Depot says the

ability to order from specific stores is proving popular with

customers, and that is pushing the company to look at how to adjust

its supply chain to meet that demand.

SUPPLY CHAIN STRATEGIES

The shipping industry is bracing for what could be a longer-term

effect from the Blue Cut fire even as businesses try to adjust amid

a spreading disaster zone in Southern California. Commercial

operators have been scrambling to keep goods moving as a massive

wildfire east of Los Angeles shut down one of the nation's major

freight corridors for nearly two days this week, the WSJ's Erica E.

Phillips and Jennifer Calfas report. The fire has pinched access in

and out of Southern California's busy seaports and inland

distribution centers, interrupted freight rail service and sent

truckers scrambling for paths around the hard-hit area. The bigger

worry for shippers may come if inbound goods pile up over time,

creating backlogs that ripple across distribution operations far

from the scene of the fire.

QUOTABLE

IN OTHER NEWS

Nike Inc. struck a pact with Apollo Global Management LLC to

overhaul its manufacturing and supply chain. (WSJ)

Volkswagen AG may cut work at five German plants due to a labor

dispute at a part supplier that has disrupted production. (WSJ)

Wal-Mart Stores Inc. raised its profit outlook for the year and

said same-store U.S. sales would rise 1% to 1.5% in the third

quarter. (WSJ)

British retail sales rose strongly in July, helped in part by a

weak pound that lured overseas visitors to snap up goods. (WSJ)

A federal judge rejected a proposed $100 million settlement

between Uber and drivers in two states, reviving the debate over

the company's freelance labor model. (WSJ)

Gap Inc. cut its outlook for the rest of 2016 after reporting a

sales decline and saying efforts to improve its supply chain were

still continuing. (WSJ)

Cisco Systems Inc. is cutting 5,500 employees as the networking

company responds to market shifts that have customers favoring

software over hardware. (WSJ)

Perry Ellis International Inc. will close 15 stores in the U.S.,

the latest sign of a shrinking physical retail presence as

consumers increasingly shop online. (WSJ)

Mass-market sweets giant Nestlé SA plans to push into the

high-end chocolate market, chasing growth as overall chocolate

volumes decline. (WSJ)

Carlyle Group LP will focus its Asia real estate investing on

China logistics and office projects, pointing to warehouse growth

from e-commerce demand. (Reuters)

Retailer American Apparel may move from its downtown Los Angeles

manufacturing facility for a lower-wage part of the country. (Los

Angeles Times)

XPO Logistics Inc. refinanced $1.64 billion of its debt,

reducing its debt-service load. (Logistics Management)

China's Sinotrans Shipping lost $40.2 million in the first half

of 2016, more than double the loss of a year ago as revenue tumbled

20.6%. (Journal of Commerce)

Amazon.com Inc. will place its 13th fulfillment center in the

U.K. about 30 miles east of London, in Tilbury. (Tech News

Today)

Pfizer Ltd. will close four U.S. distribution centers that came

with the pharmaceutical giant's purchase last year of Hospira.

(Fierce Pharma)

International Consolidated Airlines Group SA is adding regional

freighter services through Milan, Amsterdam and Paris under a deal

with DHL. (Air Cargo News)

Container throughput at Germany's Port of Hamburg fell 1.2% in

the first half of the year. (Container Management)

European shipping and logistics group DFDS raised its outlook

after reporting strong freight volume and revenue growth in the

second quarter. (Lloyd's Loading List)

IKEA International A/S will test the use of online sales for its

furniture in China. (China Daily)

A.P. Moller-Maersk A/S will scrap 20 vessels and cut 400 workers

from its Maersk Supply Service oil services subsidiary. (Splash

24/7)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

August 19, 2016 06:28 ET (10:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

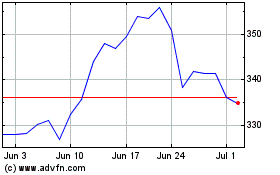

Home Depot (NYSE:HD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Sep 2023 to Sep 2024