Current Report Filing (8-k)

August 16 2016 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 16, 2016

BOISE CASCADE COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

|

001-35805

(Commission

File Number)

|

|

20-1496201

(IRS Employer

Identification No.)

|

1111 West Jefferson Street, Suite 300

Boise, Idaho 83702-5389

(Address of principal executive offices) (Zip Code)

(208) 384-6161

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01

Other Events

On August 16, 2016, Boise Cascade Company issued a press release made pursuant to Rule 135c promulgated under the Securities Act of 1933, as amended (the “Securities Act”), announcing that it had priced the offering of $350,000,000 in aggregate principal amount of 5.625% senior notes due 2024 (the “Notes”). The offering was upsized from the previously announced $300,000,000 aggregate principal amount. The Notes were priced at par.

The Notes and related guarantees will not be registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. This current report on Form 8-K is neither an offer to sell nor the solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering, solicitation or sale would be unlawful. A copy of the press release announcing the pricing of the private offering of the Notes is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

Exhibit 99.1

|

|

Press Release, dated August 16, 2016, issued by the Company

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

BOISE CASCADE COMPANY

|

|

|

|

|

|

|

By

|

/s/ Wayne Rancourt

|

|

|

|

Wayne Rancourt

Executive Vice President,

Chief Financial Officer, and Treasurer

|

|

Date: August 16, 2016

|

|

|

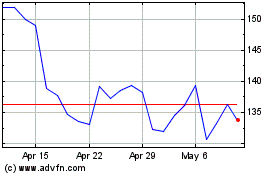

Boise Cascade (NYSE:BCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

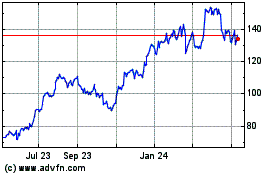

Boise Cascade (NYSE:BCC)

Historical Stock Chart

From Apr 2023 to Apr 2024