Insight Enterprises, Inc. Reports Second Quarter 2016 Results

August 03 2016 - 4:00PM

Insight Enterprises, Inc. (Nasdaq:NSIT) (the

“Company”) today reported results of operations for the quarter

ended June 30, 2016.

In the second quarter of 2016, consolidated net sales were $1.46

billion, up 2% year over year. This improvement was primarily

driven by an increase in net sales reported in the Company’s North

America operating segment, which generated more than $1 billion of

net sales during the second quarter.

Consolidated gross profit was $209.2 million in the second

quarter of 2016, up 9% year over year. This increase reflects

gross margin expansion in all three of the Company’s operating

segments.

Consolidated earnings from operations increased 35% year over

year to $58.1 million and diluted earnings per share increased to

$0.96 compared to $0.67 reported in the second quarter of

2015. Adjusted diluted earnings per share was $0.97 in the

second quarter of 2016 compared to $0.68 reported in the second

quarter of last year.*

“In the second quarter, I am pleased to report that our global

team came together exceptionally well to deliver on our financial

objectives. Each of our operating segments drove high single

digit or better gross profit growth year over year in constant

currency while continuing to control discretionary expenses, which

led to strong earnings growth for the quarter,” stated Ken Lamneck,

President and Chief Executive Officer. “As we enter the

second half of 2016, we believe we are well positioned to continue

to win in the marketplace and deliver on our commitments to our

clients, teammates and shareholders,” added Lamneck.

KEY HIGHLIGHTS

- Consolidated net sales of $1.46 billion for the second quarter

of 2016 increased 2% compared to the second quarter of 2015.

- Net sales in North America of $1.04 billion were up 6% year

over year;

- Net sales in EMEA of $361.7 million decreased 5% year to year;

and

- Net sales in APAC of $58.3 million decreased 10% year to

year.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated net sales increased 3% year over year, and net

sales in North America were up 6% year over year, while net sales

in EMEA and APAC decreased 2% and 7%, respectively, year to

year.

- Consolidated gross profit of $209.2 million increased 9%

compared to the second quarter of 2015, with consolidated gross

margin increasing approximately 100 basis points to 14.4% of net

sales.

- Gross profit in North America of $143.4 million (13.8% gross

margin) increased 12% year over year;

- Gross profit in EMEA of $55.1 million (15.2% gross margin)

increased 4% year over year; and

- Gross profit in APAC of $10.8 million (18.5% gross margin)

increased 4% year over year.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated gross profit increased 11% year over year, and

gross profit in North America, EMEA and APAC increased 12%, 8% and

7%, respectively, year over year.

- Consolidated earnings from operations increased 35% compared to

the second quarter of 2015 to $58.1 million, or 4.0% of net

sales.

- Earnings from operations in North America increased 42% year

over year to $41.5 million, or 4.0% of net sales;

- Earnings from operations in EMEA increased 22% year over year

to $11.7 million, or 3.2% of net sales; and

- Earnings from operations in APAC increased 19% year over year

to $4.9 million, or 8.5% of net sales.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated earnings from operations increased 37% year

over year, and earnings from operations in North America, EMEA and

APAC increased 42%, 29% and 21%, respectively, year over

year.

- Adjusted consolidated earnings from operations increased 35%

year over year to $58.7 million, or 4.0% of net sales for the

second quarter of 2016.*

- Consolidated net earnings and diluted earnings per share for

the second quarter of 2016 were $35.1 million and $0.96,

respectively, at an effective tax rate of 37.5%.

- Adjusted consolidated net earnings and Adjusted diluted

earnings per share were $35.5 million and $0.97, respectively, for

the second quarter of 2016.*

- The Company repurchased approximately 1.3 million shares of its

common stock at a total cost of approximately $35.0 million during

the second quarter of 2016.

- On June 23, 2016, the Company entered into amendments to its

senior revolving credit facility and its accounts receivable

securitization financing facility that increased the combined

maximum borrowing capacity available to the Company by $50 million

and extended the maturity dates of the agreements to 2021 and 2019,

respectively. In addition, the Company entered into an

amendment to its inventory financing facility that increased the

maximum capacity available to the Company under the facility by $75

million and extended the maturity date to 2021.

* In this press release, the Company refers to financial

measures that are not prepared in accordance with United States

generally accepted accounting principles (“GAAP”) in discussing

financial results for the three and six months ended June 30, 2016

and 2015. When referring to non-GAAP measures, the Company

refers to such measures as “Adjusted.” Adjusted measures

exclude the gain recorded in the second quarter of 2016 on an asset

held for sale and severance and restructuring expenses recorded in

all periods. A tabular reconciliation of financial measures

prepared in accordance with GAAP to non-GAAP financial measures is

included at the end of this press release.

The Company refers to changes in net sales, gross profit and

earnings from operations on a consolidated basis and in North

America, EMEA and APAC excluding the effects of fluctuating foreign

currency exchange rates. In computing these changes and

percentages, the Company compares the current year amount as

translated into U.S. dollars under the applicable accounting

standards to the prior year amount in local currency translated

into U.S. dollars utilizing the weighted average translation rate

for the current period.

The tax effect of Adjusted amounts referenced herein were

computed using the statutory tax rate for the taxing jurisdictions

in the operating segment in which the related expenses were

recorded, adjusted for the effects of valuation allowances on net

operating losses in certain jurisdictions.

GUIDANCE

Given the Company’s first half 2016 financial performance, the

Company is maintaining its outlook that net sales in 2016 are

expected to grow in the low single digit range year over year, and

the Company is increasing its GAAP diluted earnings per share

outlook for the full year 2016 to a range of $2.33 to $2.43.

Excluding the gain recorded in the second quarter of 2016 on an

asset held for sale and severance and restructuring expenses

recorded during the six months ended June 30, 2016, Adjusted

diluted earnings per share for the full year 2016 is expected to be

between $2.37 and $2.47.*

This outlook reflects:

- an effective tax rate of approximately 37% - 38%; and

- capital expenditures of $10 to $15 million for the full

year.

The per share effects of the items excluded from Adjusted

diluted earnings per share are included in the tabular

reconciliation of financial measures prepared in accordance with

GAAP to non-GAAP financial measures at the end of this press

release.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live webcast today

at 5:00 p.m. ET to discuss second quarter 2016 results of

operations. A live web cast of the conference call (in

listen-only mode) will be available on the Company’s web site at

http://nsit.client.shareholder.com/events.cfm, and a replay of the

web cast will be available on the Company’s web site for a limited

time following the call. To listen to the live web cast by

telephone, call 1-877-402-8904 if located in the U.S., 678-809-1029

for international callers, and enter the access code 54135793.

USE OF NON-GAAP FINANCIAL

MEASURES

The non-GAAP financial measures (referred to as Adjusted

consolidated earnings from operations, Adjusted consolidated net

earnings and Adjusted diluted earnings per share) exclude severance

and restructuring expenses and a gain on the sale of real estate

for which a non-cash impairment charge was previously reported as

well as the tax effect of these items. The Company excludes

these items when internally evaluating earnings from operations,

tax expense, net earnings and diluted earnings per share for the

Company and earnings from operations for each of the Company’s

operating segments. These non-GAAP measures are used to

evaluate financial performance against budgeted amounts, to

calculate incentive compensation, to assist in forecasting future

performance and to compare the Company’s results to those of the

Company’s competitors. The Company believes that these

non-GAAP financial measures are useful to investors because they

allow for greater transparency, facilitate comparisons to prior

periods and the Company’s competitors’ results and assist in

forecasting performance for future periods. These non-GAAP

financial measures are not prepared in accordance with GAAP and may

be different from non-GAAP financial measures presented by other

companies. Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP.

| FINANCIAL

SUMMARY TABLE |

| (DOLLARS IN

THOUSANDS, EXCEPT PER SHARE DATA) |

|

(UNAUDITED) |

| |

|

|

| |

Three

Months Ended June 30, |

|

Six Months

Ended June 30, |

| Insight Enterprises,

Inc. |

2016 |

|

2015 |

|

change |

|

2016 |

|

2015 |

|

change |

| Net sales |

$ |

1,456,234 |

|

|

$ |

1,424,031 |

|

|

|

2 |

% |

|

$ |

2,625,216 |

|

|

$ |

2,643,710 |

|

|

|

(1 |

%) |

| Gross profit |

$ |

209,217 |

|

|

$ |

191,415 |

|

|

|

9 |

% |

|

$ |

370,325 |

|

|

$ |

353,228 |

|

|

|

5 |

% |

| Gross margin |

|

14.4 |

% |

|

|

13.4 |

% |

|

100 bps |

|

14.1 |

% |

|

|

13.4 |

% |

|

70 bps |

| Selling and administrative

expenses |

$ |

150,186 |

|

|

$ |

148,004 |

|

|

|

1 |

% |

|

$ |

296,305 |

|

|

$ |

288,800 |

|

|

|

3 |

% |

| Severance and

restructuring expenses |

$ |

909 |

|

|

$ |

372 |

|

|

|

144 |

% |

|

$ |

2,265 |

|

|

$ |

1,095 |

|

|

|

107 |

% |

| Earnings from

operations |

$ |

58,122 |

|

|

$ |

43,039 |

|

|

|

35 |

% |

|

$ |

71,755 |

|

|

$ |

63,333 |

|

|

|

13 |

% |

| Net earnings |

$ |

35,067 |

|

|

$ |

25,499 |

|

|

|

38 |

% |

|

$ |

41,955 |

|

|

$ |

36,450 |

|

|

|

15 |

% |

| Diluted earnings per

share |

$ |

0.96 |

|

|

$ |

0.67 |

|

|

|

43 |

% |

|

$ |

1.13 |

|

|

$ |

0.93 |

|

|

|

22 |

% |

| |

|

|

|

|

|

|

| North America |

|

|

|

|

|

|

| Net sales |

$ |

1,036,254 |

|

|

$ |

978,650 |

|

|

|

6 |

% |

|

$ |

1,863,142 |

|

|

$ |

1,801,359 |

|

|

|

3 |

% |

| Gross profit |

$ |

143,368 |

|

|

$ |

128,216 |

|

|

|

12 |

% |

|

$ |

255,111 |

|

|

$ |

239,732 |

|

|

|

6 |

% |

| Gross margin |

|

13.8 |

% |

|

|

13.1 |

% |

|

70 bps |

|

13.7 |

% |

|

|

13.3 |

% |

|

40 bps |

| Selling and administrative

expenses |

$ |

101,261 |

|

|

$ |

99,033 |

|

|

|

2 |

% |

|

$ |

201,302 |

|

|

$ |

191,435 |

|

|

|

5 |

% |

| Severance and

restructuring expenses |

$ |

591 |

|

|

$ |

(150 |

) |

|

|

** |

|

|

$ |

1,808 |

|

|

$ |

255 |

|

|

|

609 |

% |

| Earnings from

operations |

$ |

41,516 |

|

|

$ |

29,333 |

|

|

|

42 |

% |

|

$ |

52,001 |

|

|

$ |

48,042 |

|

|

|

8 |

% |

| |

|

|

|

|

|

|

| EMEA |

|

|

|

|

|

|

| Net sales |

$ |

361,708 |

|

|

$ |

380,626 |

|

|

|

(5 |

%) |

|

$ |

665,068 |

|

|

$ |

735,468 |

|

|

|

(10 |

%) |

| Gross profit |

$ |

55,076 |

|

|

$ |

52,815 |

|

|

|

4 |

% |

|

$ |

98,502 |

|

|

$ |

97,626 |

|

|

|

1 |

% |

| Gross margin |

|

15.2 |

% |

|

|

13.9 |

% |

|

130 bps |

|

14.8 |

% |

|

|

13.3 |

% |

|

150 bps |

| Selling and administrative

expenses |

$ |

43,091 |

|

|

$ |

42,754 |

|

|

|

1 |

% |

|

$ |

83,770 |

|

|

$ |

85,511 |

|

|

|

(2 |

%) |

| Severance and

restructuring expenses |

$ |

318 |

|

|

$ |

522 |

|

|

|

(39 |

%) |

|

$ |

342 |

|

|

$ |

840 |

|

|

|

(59 |

%) |

| Earnings from

operations |

$ |

11,667 |

|

|

$ |

9,539 |

|

|

|

22 |

% |

|

$ |

14,390 |

|

|

$ |

11,275 |

|

|

|

28 |

% |

| |

|

|

|

|

|

|

| APAC |

|

|

|

|

|

|

| Net sales |

$ |

58,272 |

|

|

$ |

64,755 |

|

|

|

(10 |

%) |

|

$ |

97,006 |

|

|

$ |

106,883 |

|

|

|

(9 |

%) |

| Gross profit |

$ |

10,773 |

|

|

$ |

10,384 |

|

|

|

4 |

% |

|

$ |

16,712 |

|

|

$ |

15,870 |

|

|

|

5 |

% |

| Gross margin |

|

18.5 |

% |

|

|

16.0 |

% |

|

250 bps |

|

17.2 |

% |

|

|

14.8 |

% |

|

240 bps |

| Selling and administrative

expenses |

$ |

5,834 |

|

|

$ |

6,217 |

|

|

|

(6 |

%) |

|

$ |

11,233 |

|

|

$ |

11,854 |

|

|

|

(5 |

%) |

| Severance and

restructuring expenses |

$ |

- |

|

|

$ |

- |

|

|

|

** |

|

|

$ |

115 |

|

|

$ |

- |

|

|

** |

| Earnings from

operations |

$ |

4,939 |

|

|

$ |

4,167 |

|

|

|

19 |

% |

|

$ |

5,364 |

|

|

$ |

4,016 |

|

|

|

34 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North

America Three Months Ended June

30, |

|

EMEA Three Months Ended June

30, |

|

APAC

Three Months Ended June 30, |

| Sales Mix |

|

2016 |

|

2015 |

|

%

change* |

|

2016 |

|

2015

|

|

%

change* |

|

2016 |

|

2015 |

|

% change* |

| Hardware |

|

61 |

% |

|

60 |

% |

|

|

8 |

% |

|

31 |

% |

|

32 |

% |

|

|

(8 |

%) |

|

9 |

% |

|

5 |

% |

|

|

49 |

% |

| Software |

|

32 |

% |

|

33 |

% |

|

|

2 |

% |

|

66 |

% |

|

66 |

% |

|

|

(5 |

%) |

|

87 |

% |

|

92 |

% |

|

|

(15 |

%) |

| Services |

|

7 |

% |

|

7 |

% |

|

|

11 |

% |

|

3 |

% |

|

2 |

% |

|

|

34 |

% |

|

4 |

% |

|

3 |

% |

|

|

21 |

% |

| |

|

100 |

% |

|

100 |

% |

|

|

6 |

% |

|

100 |

% |

|

100 |

% |

|

|

(5 |

%) |

|

100 |

% |

|

100 |

% |

|

|

(10 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Represents growth/decline in

category net sales on a U.S. dollar basis and does not exclude the

effects of foreign currency movements. |

| ** Percentage change not considered

meaningful. |

| |

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference

call and webcast are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements, including the Company’s

expected 2016 financial results, including top-line growth rates

and diluted earnings per share, and the assumptions relating

thereto, including the Company’s effective tax rate and capital

expenditures, and the Company’s position in the IT industry,

ability to deliver on its commitments and trends and opportunities

relating thereto, are inherently subject to risks and

uncertainties, some of which cannot be predicted or

quantified. Future events and actual results could differ

materially from those set forth in, contemplated by, or underlying

the forward-looking statements. There can be no assurances

that the results discussed by the forward-looking statements will

be achieved, and actual results may differ materially from those

set forth in the forward-looking statements. Some of the

important factors that could cause the Company’s actual results to

differ materially from those projected in any forward-looking

statements, include, but are not limited to, the following, which

are discussed in “Risk Factors” in Part I, Item 1A of the Company’s

Annual Report on Form 10-K for the year ended December 31,

2015:

- actions of the Company’s competitors, including manufacturers

and publishers of products the Company sells;

- the Company’s reliance on partners for product availability,

competitive products to sell and related marketing funds and

purchasing incentives;

- changes in the IT industry and/or rapid changes in

technology;

- possible significant fluctuations in the Company’s future

operating results;

- general economic conditions;

- the risks associated with the Company’s international

operations;

- the security of the Company’s electronic and other confidential

information;

- disruptions in the Company’s IT systems and voice and data

networks;

- failure to comply with the terms and conditions of the

Company’s commercial and public sector contracts;

- the Company’s reliance on commercial delivery services;

- the Company’s dependence on certain personnel;

- exposure to changes in, interpretations of, or enforcement

trends related to tax rules and regulations; and

- intellectual property infringement claims and challenges to the

Company’s registered trademarks and trade names.

Additionally, there may be other risks that are otherwise

described from time to time in the reports that the Company files

with the Securities and Exchange Commission. Any

forward-looking statements in this release should be considered in

light of various important factors, including the risks and

uncertainties listed above, as well as others. The Company

assumes no obligation to update, and, except as may be required by

law, does not intend to update, any forward-looking

statements. The Company does not endorse any projections

regarding future performance that may be made by third parties.

| INSIGHT

ENTERPRISES, INC. AND SUBSIDIARIES |

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (IN THOUSANDS,

EXCEPT PER SHARE DATA) |

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

Three

Months Ended June

30, |

|

|

Six Months

Ended June

30, |

|

|

|

|

2016 |

|

2015 |

|

|

2016 |

|

2015 |

|

| Net sales |

|

$ |

1,456,234 |

|

$ |

1,424,031 |

|

|

$ |

2,625,216 |

|

$ |

2,643,710 |

|

| Costs of goods sold |

|

|

1,247,017 |

|

|

1,232,616 |

|

|

|

2,254,891 |

|

|

2,290,482 |

|

| Gross profit |

|

|

209,217 |

|

|

191,415 |

|

|

|

370,325 |

|

|

353,228 |

|

| Operating expenses: |

|

|

|

|

|

| Selling and administrative

expenses |

|

|

150,186 |

|

|

148,004 |

|

|

|

296,305 |

|

|

288,800 |

|

| Severance and restructuring

expenses |

|

|

909 |

|

|

372 |

|

|

|

2,265 |

|

|

1,095 |

|

| Earnings from operations |

|

|

58,122 |

|

|

43,039 |

|

|

|

71,755 |

|

|

63,333 |

|

| Non-operating (income)

expense: |

|

|

|

|

|

| Interest income |

|

|

(216 |

) |

|

(192 |

) |

|

|

(466 |

) |

|

(346 |

) |

| Interest expense |

|

|

1,992 |

|

|

1,718 |

|

|

|

3,840 |

|

|

3,456 |

|

| Net foreign currency exchange

(gain) loss |

|

|

(153 |

) |

|

20 |

|

|

|

463 |

|

|

633 |

|

| Other expense, net |

|

|

359 |

|

|

281 |

|

|

|

627 |

|

|

612 |

|

| Earnings before income taxes |

|

|

56,140 |

|

|

41,212 |

|

|

|

67,291 |

|

|

58,978 |

|

| Income tax expense |

|

|

21,073 |

|

|

15,713 |

|

|

|

25,336 |

|

|

22,528 |

|

| Net earnings |

|

$ |

35,067 |

|

$ |

25,499 |

|

|

$ |

41,955 |

|

$ |

36,450 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Net earnings per

share: |

|

|

|

|

|

| Basic |

|

$ |

0.96 |

|

$ |

0.67 |

|

|

$ |

1.14 |

|

$ |

0.94 |

|

| Diluted |

|

$ |

0.96 |

|

$ |

0.67 |

|

|

$ |

1.13 |

|

$ |

0.93 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Shares used in per share

calculations: |

|

|

|

|

|

| Basic |

|

|

36,380 |

|

|

38,067 |

|

|

|

36,728 |

|

|

38,870 |

|

| Diluted |

|

|

36,612 |

|

|

38,326 |

|

|

|

36,999 |

|

|

39,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSIGHT

ENTERPRISES, INC. AND SUBSIDIARIES |

| CONSOLIDATED

BALANCE SHEETS |

| (IN

THOUSANDS) |

|

(UNAUDITED) |

| |

|

|

|

|

|

| |

|

June

30, |

|

December

31, |

|

| |

|

2016 |

|

2015 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

175,145 |

|

$ |

187,978 |

|

| Accounts receivable, net |

|

|

1,476,184 |

|

|

1,315,094 |

|

| Inventories |

|

|

145,929 |

|

|

119,820 |

|

| Inventories not available for

sale |

|

|

51,613 |

|

|

51,756 |

|

| Other current assets |

|

|

89,323 |

|

|

77,011 |

|

| Total current assets |

|

|

1,938,194 |

|

|

1,751,659 |

|

| |

|

|

|

| Property and equipment,

net |

|

|

80,737 |

|

|

88,281 |

|

| Goodwill |

|

|

55,688 |

|

|

56,195 |

|

| Intangible assets,

net |

|

|

20,507 |

|

|

26,983 |

|

| Deferred income taxes |

|

|

61,213 |

|

|

62,986 |

|

| Other assets |

|

|

30,201 |

|

|

27,913 |

|

| |

|

$ |

2,186,540 |

|

$ |

2,014,017 |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable – trade |

|

$ |

1,030,869 |

|

$ |

905,464 |

|

| Accounts payable – inventory

financing facility |

|

|

155,683 |

|

|

106,327 |

|

| Accrued expenses and other current

liabilities |

|

|

148,671 |

|

|

144,633 |

|

| Current portion of long-term

debt |

|

|

1,288 |

|

|

1,535 |

|

| Deferred revenue |

|

|

50,179 |

|

|

50,166 |

|

| Total current liabilities |

|

|

1,386,690 |

|

|

1,208,125 |

|

| |

|

|

|

| Long-term debt |

|

|

86,045 |

|

|

89,000 |

|

| Deferred income taxes |

|

|

155 |

|

|

239 |

|

| Other liabilities |

|

|

32,900 |

|

|

30,911 |

|

| |

|

|

1,505,790 |

|

|

|

1,328,275 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

|

- |

|

|

- |

|

| Common stock |

|

|

355 |

|

|

371 |

|

| Additional paid-in capital |

|

|

304,455 |

|

|

316,686 |

|

| Retained earnings |

|

|

417,814 |

|

|

408,721 |

|

| Accumulated other comprehensive

loss – foreign currency translation adjustments |

|

|

(41,874 |

) |

|

(40,036 |

) |

| Total stockholders’ equity |

|

|

680,750 |

|

|

685,742 |

|

|

|

|

$ |

2,186,540 |

|

$ |

2,014,017 |

|

| |

|

|

|

|

|

|

|

| INSIGHT

ENTERPRISES, INC. AND SUBSIDIARIES |

| CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (IN

THOUSANDS) |

|

(UNAUDITED) |

| |

|

|

|

Six Months Ended June 30, |

|

| |

2016 |

|

|

2015 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

| Net earnings |

$ |

41,955 |

|

|

$ |

36,450 |

|

| Adjustments to reconcile net

earnings to net cash (used in) provided by operating

activities: |

|

|

| Depreciation and amortization |

|

20,462 |

|

|

|

19,001 |

|

| Provision for losses on accounts

receivable |

|

1,255 |

|

|

|

1,962 |

|

| Write-downs of inventories |

|

1,164 |

|

|

|

1,473 |

|

| Non-cash stock-based

compensation |

|

5,283 |

|

|

|

4,627 |

|

| Excess tax benefit from employee

gains on stock-based compensation |

|

(286 |

) |

|

|

(543 |

) |

| Deferred income taxes |

|

1,662 |

|

|

|

94 |

|

| Gain on sale of real estate |

|

(338 |

) |

|

|

- |

|

| Changes in assets and

liabilities: |

|

|

| Increase in accounts

receivable |

|

(178,019 |

) |

|

|

(167,600 |

) |

| Increase in inventories |

|

(28,604 |

) |

|

|

(48,376 |

) |

| Increase in other assets |

|

(12,563 |

) |

|

|

(11,542 |

) |

| Increase in accounts payable |

|

131,886 |

|

|

|

263,120 |

|

| Increase (decrease) in deferred

revenue |

|

1,208 |

|

|

|

(438 |

) |

| Increase (decrease) in accrued

expenses and other liabilities |

|

10,027 |

|

|

|

(1,904 |

) |

| Net cash (used in) provided by

operating activities |

|

(4,908 |

) |

|

|

96,324 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

(4,974 |

) |

|

|

(6,552 |

) |

| Proceeds from sale of real estate,

net |

|

1,378 |

|

|

|

- |

|

| Acquisition of BlueMetal, net of

cash acquired |

|

507 |

|

|

|

- |

|

| Net cash used in investing

activities |

|

(3,089 |

) |

|

|

(6,552 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

| Borrowings on senior revolving

credit facility |

|

261,920 |

|

|

|

243,910 |

|

| Repayments on senior revolving

credit facility |

|

(261,920 |

) |

|

|

(227,410 |

) |

| Borrowings on accounts receivable

securitization financing facility |

|

962,000 |

|

|

|

781,100 |

|

| Repayments on accounts receivable

securitization financing facility |

|

(966,000 |

) |

|

|

(808,100 |

) |

| Repayments under other financing

agreements |

|

(632 |

) |

|

|

- |

|

| Payments on capital lease

obligations |

|

(100 |

) |

|

|

(110 |

) |

| Net borrowings under inventory

financing facility |

|

49,356 |

|

|

|

28,171 |

|

| Payment of deferred financing

fees |

|

(2,819 |

) |

|

|

- |

|

| Excess tax benefit from employee

gains on stock-based compensation |

|

286 |

|

|

|

543 |

|

| Payment of payroll taxes on

stock-based compensation through shares withheld |

|

(2,126 |

) |

|

|

(2,117 |

) |

| Repurchases of common stock |

|

(48,467 |

) |

|

|

(85,951 |

) |

| Net cash used in financing

activities |

|

(8,502 |

) |

|

|

(69,964 |

) |

| Foreign currency exchange

effect on cash and cash equivalent balances |

|

3,666 |

|

|

|

(8,824 |

) |

| (Decrease) increase in

cash and cash equivalents |

|

(12,833 |

) |

|

|

10,984 |

|

| Cash and cash equivalents

at beginning of period |

|

187,978 |

|

|

|

164,524 |

|

| Cash and cash equivalents

at end of period |

$ |

175,145 |

|

|

$ |

175,508 |

|

| |

|

|

|

|

|

|

|

| INSIGHT

ENTERPRISES, INC. AND SUBSIDIARIES |

| RECONCILIATION

OF GAAP TO NON-GAAP FINANCIAL MEASURES |

| (IN THOUSANDS,

EXCEPT PER SHARE DATA) |

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June

30, |

|

|

Six

Months Ended June 30, |

|

|

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Consolidated

Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

58,122 |

|

|

$ |

43,039 |

|

|

$ |

71,755 |

|

|

$ |

63,333 |

|

| Severance and

restructuring expenses |

|

|

909 |

|

|

|

372 |

|

|

|

2,265 |

|

|

|

1,095 |

|

| Gain on sale of real

estate for which a non-cash impairment charge was previously

reported |

|

|

(338 |

) |

|

|

- |

|

|

|

(338 |

) |

|

|

- |

|

| Non-GAAP |

|

$ |

58,693 |

|

|

$ |

43,411 |

|

|

$ |

73,682 |

|

|

$ |

64,428 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Net

Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

35,067 |

|

|

$ |

25,499 |

|

|

$ |

41,955 |

|

|

$ |

36,450 |

|

| Severance and

restructuring expenses |

|

|

909 |

|

|

|

372 |

|

|

|

2,265 |

|

|

|

1,095 |

|

| Gain on sale of real

estate for which a non-cash impairment charge was previously

reported |

|

|

(338 |

) |

|

|

- |

|

|

|

(338 |

) |

|

|

- |

|

| Income taxes on non-GAAP

adjustments |

|

|

(135 |

) |

|

|

36 |

|

|

|

(637 |

) |

|

|

(131 |

) |

| Non-GAAP |

|

$ |

35,503 |

|

|

$ |

25,907 |

|

|

$ |

43,245 |

|

|

$ |

37,414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated

Diluted EPS: |

|

|

|

|

|

| GAAP |

|

$ |

0.96 |

|

|

$ |

0.67 |

|

|

$ |

1.13 |

|

|

$ |

0.93 |

|

| Severance and

restructuring expenses |

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.06 |

|

|

|

0.03 |

|

| Gain on sale of real

estate for which a non-cash impairment charge was previously

reported |

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

| Income taxes on non-GAAP

adjustments |

|

|

- |

|

|

|

0.00 |

|

|

|

(0.01 |

) |

|

|

0.00 |

|

| Non-GAAP |

|

$ |

0.97 |

|

|

$ |

0.68 |

|

|

$ |

1.17 |

|

|

$ |

0.96 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America

Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

41,516 |

|

|

$ |

29,333 |

|

|

$ |

52,001 |

|

|

$ |

48,042 |

|

| Severance and

restructuring expenses |

|

|

591 |

|

|

|

(150 |

) |

|

|

1,808 |

|

|

|

255 |

|

| Gain on sale of real

estate for which a non-cash impairment charge was previously

reported |

|

|

(338 |

) |

|

|

- |

|

|

|

(338 |

) |

|

|

- |

|

| Non-GAAP |

|

$ |

41,769 |

|

|

$ |

29,183 |

|

|

$ |

53,471 |

|

|

$ |

48,297 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA Earnings from

Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

11,667 |

|

|

$ |

9,539 |

|

|

$ |

14,390 |

|

|

$ |

11,275 |

|

| Severance and

restructuring expenses |

|

|

318 |

|

|

|

522 |

|

|

|

342 |

|

|

|

840 |

|

| Non-GAAP |

|

$ |

11,985 |

|

|

$ |

10,061 |

|

|

$ |

14,732 |

|

|

$ |

12,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| APAC Earnings from

Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

4,939 |

|

|

$ |

4,167 |

|

|

$ |

5,364 |

|

|

$ |

4,016 |

|

| Severance and

restructuring expenses |

|

|

- |

|

|

|

- |

|

|

|

115 |

|

|

|

- |

|

| Non-GAAP |

|

$ |

4,939 |

|

|

$ |

4,167 |

|

|

$ |

5,479 |

|

|

$ |

4,016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACTS:

GLYNIS BRYAN

CHIEF FINANCIAL OFFICER

TEL. 480.333.3390

EMAIL glynis.bryan@insight.com

HELEN JOHNSON

SENIOR VP, FINANCE

TEL. 480.333.3234

EMAIL helen.johnson@insight.com

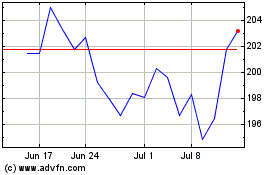

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Aug 2024 to Sep 2024

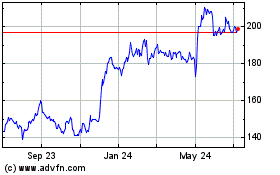

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Sep 2023 to Sep 2024