Valspar Votes on Sale to Sherwin-Williams

June 28 2016 - 10:10PM

Dow Jones News

By Bob Tita

Paint maker Sherwin-Williams Co. could move a step closer to

expanding access to do-it-yourself house painters if shareholders

from Valspar Corp. approve the sale of their company Wednesday for

as much as $9.3 billion.

The monthlong balloting by Valspar investors will culminate with

a special meeting Wednesday morning when results of the vote will

be revealed.

But even if shareholders approve the sale of Valspar to

Sherwin-Williams, it could take months for them to find out how

much they will actually receive.

Cleveland-based Sherwin-Williams has agreed to pay up to $113 a

share for Valspar's. The offer represents about a 35% premium to

Valspar's share price before the all-cash deal was revealed in

March.

Valspar shares closed Tuesday at $107.61, but the final payout

is contingent on regulatory review.

Federal antitrust regulators are combing through the two

companies' business lines in paint and industrial coatings for

potentially unfair market concentrations. If the Federal Trade

Commission demands that certain businesses be shed as a condition

for approving the sale, Sherwin-Williams would lower its purchase

price.

If Sherwin-Williams is forced to divest businesses with more

$650 million of annual revenue, the purchase price would fall to

$105 a share. Sherwin-Williams could abandon the purchase entirely

if the required business divestments amount to least $1.5 billion a

year in revenue.

"Both companies want to get the deal done," said Ghansham

Panjabi, an analyst at Milwaukee-based Robert W. Baird. "But they

would not have structured the deal that way if there wasn't a

potential for antitrust."

Executives from both companies have said they believe the

probability of having to shed business is low. Although both

companies make paint, their retailing strategies are different.

The companies are counting on the distinctions to help keep the

deal intact.

Minneapolis-based Valspar mostly sells paint through a variety

of consumer-focused store chains, including do-it-yourself home

improvement retailers, such as Lowe's Co. and Ace Hardware

stores.

Sherwin-Williams, meanwhile, relies on more than 4,000

company-owned stores in the U.S. and Canada to sell paint,

primarily to professional painters and contractors. These specialty

paint stores have come under increasing competitive pressure in

recent years from big-box retailers.

With Valspar, Sherwin-Williams would get more exposure to the

major retailers. Sherwin's consumer-market paint brands include

Dutch Boy, HGTV Home and Minwax wood stains.

The two companies combined would account for about 20% of the

paint revenue at do-it-yourself retailers in the U.S., according to

stock research firm Morningstar Inc. That is slightly above

competitors PPG Industries Inc. and Masco Corp, the maker of Home

Depot's Behr brand.

Valspar's international business would decrease Sherwin's heavy

reliance on the U.S. market. Valspar also generates about $2.5

billion annually from the sales of coatings to the packaging

industry and other industrial users.

Overall, Sherwin-Williams expects its annual revenue from paint

and coatings to grow by about 38% to $15.6 billion. The company

anticipates pretax income increasing about 55% to $2.8 billion.

Reaching the profit target will hinge on the Sherwin-Williams'

ability to shrink overhead expenses, material costs and other

shared expenses. Sherwin is forecasting cost reductions of $280

million a year by 2018 and increasing to $320 million annually

later on.

"Most of the savings is achievable," said David Wang, a

Morningstar equity analyst.

Representatives for the two companies declined to comment

Tuesday about the sale or the shareholder vote.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

June 28, 2016 21:55 ET (01:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

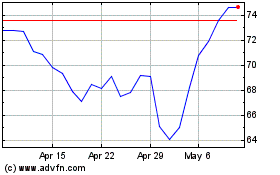

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

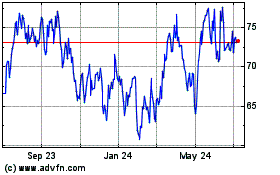

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024