UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 19, 2016

CytoDyn Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-49908 |

|

75-3056237 |

| (State or other jurisdiction

of incorporation) |

|

(SEC

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 1111 Main Street, Suite 660

Vancouver, Washington |

|

98660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (360) 980-8524

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 19, 2016, CytoDyn Inc., a Delaware

corporation (the “Company”) entered into an amendment (the “Amendment”) to its existing Consulting Agreement with Denis R. Burger, Ph.D., dated February 21, 2014, as previously amended November 3, 2014 (the

“Consulting Agreement”).

The Amendment names Dr. Burger, who is currently a member of the Board of Directors, to the non-executive

position of Chief Science Officer and increases Dr. Burger’s advisory responsibilities in that capacity. The Amendment also increases the compensation payable to Dr. Burger under the Consulting Agreement to $20,000 in cash per month,

which is in addition to any fees that Dr. Burger currently earns as a director. The Amendment was approved by the Audit Committee of the Board of Directors.

A copy of the Amendment is filed as Exhibit 10.1 to this Form 8-K and is incorporated into this Item 1.01 by reference.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

Between December 29, 2015 and January 22, 2016, the

Company issued in private placements to accredited investors an aggregate of 4,832,321 shares of its common stock, par value $0.001 per share (the “Common Stock”), together with warrants to purchase an aggregate of 2,416,151 shares of

Common Stock at an exercise price of $0.75 per share, for aggregate gross proceeds to the Company of approximately $3.6 million. The Company also became obligated to issue warrants to purchase an aggregate of 519,002 shares of Common Stock, along

with a cash payment of approximately $0.4 million, as a fee to the placement agent in certain of the transactions. All of the foregoing warrants have a five-year term, running from their respective dates of issuance, and are immediately exercisable.

The Company relied on the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) in connection with the foregoing transactions.

In addition, on December 21, 2015 and January 4, 2016, the Company issued to certain third-party consultants warrants to purchase an aggregate of 290,000

shares of Common Stock, as consideration for services provided to the Company. One warrant covering 50,000 shares has an exercise price of $0.81 per share and a 10-year term, vesting in two equal semi-annual installments beginning on May 21,

2016. The other warrant covering 240,000 shares has an exercise price of $0.92 per share and a 10-year term, vesting in four equal quarterly installments commencing on January 4, 2016. The Company relied on the exemption provided by Section 4(a)(2)

of the Securities Act in connection with the foregoing transactions.

After giving effect to all of the foregoing transactions, the number of shares of

Common Stock outstanding as of January 22, 2016 was 102,938,421.

On January 20, 2016, the Company issued a press release announcing the Amendment to

the Consulting Agreement with Dr. Burger. A copy of the press release is filed as Exhibit 99.1 to this Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed herewith:

|

|

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Amendment No. 2 to Consulting Agreement, dated January 19, 2016, between CytoDyn Inc. and Denis R. Burger, Ph.D. |

|

|

| 99.1 |

|

Press Release dated January 20, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CytoDyn Inc. |

|

|

|

|

| January 22, 2016 |

|

|

|

By: |

|

/s/ Michael D. Mulholland |

|

|

|

|

Name: |

|

Michael D. Mulholland |

|

|

|

|

Title: |

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Amendment No. 2 to Consulting Agreement, dated January 19, 2016, between CytoDyn Inc. and Denis R. Burger, Ph.D. |

|

|

| 99.1 |

|

Press Release dated January 20, 2016. |

Exhibit 10.1

CYTODYN INC.

AMENDMENT

NO. 2 TO CONSULTING AGREEMENT

This Amendment No. 2 to Consulting Agreement (this “Agreement”) is made and entered into

on January 19, 2016 and effective as of January 19, 2016 (the “Effective Date”), by and between CytoDyn Inc., a Delaware corporation (the “Company”), and Denis R. Burger, Ph.D., an individual (“Consultant”).

WHEREAS, Consultant has served as an outside director of the Company’s Board of Directors (the “Board”) since

February 7, 2014; and

WHEREAS, Consultant has over 25 years of experience managing scientific, operational, financial, and executive

responsibilities in the biotech industry; and

WHEREAS, Company and Consultant entered into a Consulting Agreement on February 14,

2014 (the “Agreement”), pursuant to which the Company retained Consultant to advise the Company’s executive management team (the “Team”) and perform such other services as set forth in the Agreement);

WHEREAS, Company and Consultant entered into an amendment to the Agreement effective November 3, 2014 (“Amendment No. 1”);

WHEREAS, Company and Consultant wish to amend again certain terms of the Agreement, as amended:

NOW, THEREFORE, in consideration of the material promises set forth herein and for other good and valuable consideration, the parties agree as

follows:

1. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Original Agreement.

2. Amendment to Section 2. Section 2 of the Agreement is hereby further amended by adding a new Section 2(f) as follows:

2(f) Consultant shall be appointed the Company’s Chief Science Officer and shall provide the Company with strategic

advice with respect to scientific matters and leadership to explore and evaluate expanded opportunities for PRO 140.

3. Amendment to

Section 4(a). Section 4(a) of the Agreement is hereby amended by deleting the existing paragraph 4(a) in its entirety and substituting the following in lieu thereof:

4(a) Monthly Fee. Consultant will receive as compensation hereunder monthly payments of $20,000, in cash, payable on or before the 15th

day of each month, beginning on the Effective Date and for the term of this Agreement.

4. No Other Amendments. Except as expressly

amended herein, the Agreement, as amended shall continue in full force and effect.

1

5. Governing Law. This Amendment shall be governed by, and construed in accordance with,

the laws of the state of Washington without giving effect to the choice of law provisions thereof.

6. Counterparts. For the

convenience of the parties hereto, this Amendment may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all such counterparts shall together constitute the same agreement.

7. Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and each of their

successors and assigns, including, without limitation, any successors or surviving entities thereto by operation of merger.

8. Entire

Agreement. The Agreement, as amended hereby, constitutes the entire agreement of all parties hereto with respect to the subject matter hereof and supersedes all prior agreements and undertakings, both written and oral, among the parties hereto

with respect to the subject matter hereof. All references in the Agreement to “this Agreement”, “hereof”, “hereby” and words of similar import shall refer to the Agreement as amended hereby.

IN WITNESS WHEREOF, the parties have set their hands as of the Effective Date.

|

|

|

|

|

|

|

|

|

| THE COMPANY CytoDyn

Inc. |

|

|

|

|

|

CONSULTANT Denis R. Burger,

Ph.D. |

|

|

|

|

|

| By: |

|

/s/ Nader Z. Pourhassan |

|

|

|

|

|

/s/ Denis R. Burger, Ph.D. |

|

|

Nader Z. Pourhassan President and Chief

Executive Officer |

|

|

|

|

|

Denis R. Burger, Ph.D. |

2

Exhibit 99.1

CYTODYN APPOINTS DENIS R. BURGER, PH.D., AS CHIEF SCIENCE OFFICER

Dr. Burger, former Chairman and CEO of several successful biotechnology companies, named to expanded leadership role

Vancouver, Washington – January 20, 2016 – CytoDyn Inc. (OTC.QB: CYDY), a biotechnology company focused on the development of new

therapies for combating human immunodeficiency virus (HIV) infection, today announced that it had named Denis R. Burger, Ph.D., who is currently a member of the Company’s Board of Directors, as Chief Science Officer (CSO) of CytoDyn. In this

capacity, through an expansion of Dr. Burger’s existing consulting relationship with the Company, Dr. Burger will assist with the development of PRO 140 for HIV and non-HIV clinical indications, including transplantation, autoimmune

diseases and cancer. He recently initiated the Company’s evaluation of PRO 140 for Graft vs. Host Disease (GvHD) and the Company’s Phase 2 protocol for this transplantation indication for patients requiring bone marrow stem cell

transplants. On December 11, 2015, the FDA cleared CytoDyn to proceed into a clinical trial for GvHD. PRO 140 is currently in a pivotal Phase 3 trial for adjunct therapy for HIV patients with FDA approval for this indication expected in 2017.

Dr. Burger was appointed a Director of CytoDyn in February 2014 and named Vice Chairman of the Board of Directors of CytoDyn in August 2014. He is a

life sciences executive with over 30 years of extensive scientific, operational and financial experience in the biotech industry. As CEO or chairman of several biotechnology companies, Dr. Burger has led numerous corporate financing

transactions and public securities offerings and has experience leading R&D, GMP manufacturing and clinical development functional areas. Dr. Burger is currently lead director of Aptose Biosciences Inc., a cancer therapeutics, NASDAQ-listed

company. Dr. Burger co-founded Trinity Biotech, a NASDAQ-listed diagnostic company, in June 1992, served as its Chairman from June 1992 to May 1995, and is currently lead independent director. Until March 2007, he was Chairman and Chief

Executive Officer of AVI Biopharma Inc. (now Sarepta Therapeutics), a NASDAQ-listed RNA therapeutics company. He was also a co-founder of Epitope Inc. (now Orasure Technologies, NASDAQ listed), serving as its Chairman from 1981 to 1990.

Dr. Burger previously held a professorship in the Department of Microbiology and Immunology and Surgery (Surgical Oncology) at the Oregon Health and Sciences University in Portland. Dr. Burger received his undergraduate degree in

Bacteriology and Immunology from the University of California in Berkeley and his Master of Science and Ph.D. degrees in Microbiology and Immunology from the University of Arizona.

Dr. Nader Pourhassan, President and CEO, commented: “We are delighted that Dr. Burger has decided to accept this expanded leadership role with

CytoDyn. With our excellent clinical development team at Amarex and a team of leading scientific and medical advisors, we now have a solidified team with Dr. Burger accepting this key role for CytoDyn.”

“I am honored to be selected for this crucial role in the expansion of PRO 140 into immunologic indications,” said Dr. Burger. “The target

for PRO 140, CCR5, plays an important role in a vast array of immune mechanisms and CytoDyn is positioned to expand the potential market for PRO 140 by pursuing these non-HIV clinical indications including transplantation, chronic inflammation,

autoimmunity and cancer.”

About CytoDyn

CytoDyn

is a biotechnology company focused on the clinical development and potential commercialization of humanized monoclonal antibodies for the treatment and prevention of Human Immunodeficiency Virus (HIV) infection. The Company has one of the leading

monoclonal antibodies under development for HIV infection, PRO 140, which has finished Phase 2 clinical trials with demonstrated antiviral activity in man and is currently in Phase 3. PRO 140 blocks the HIV co-receptor CCR5 on T-cells which prevents

viral entry. Clinical trial results thus far indicate that PRO 140 does not negatively affect the normal immune functions that are mediated by CCR5. Results from six Phase 1 and Phase 2 human clinical trials have shown that PRO 140 can significantly

reduce viral burden in people infected with HIV. A recent Phase 2b clinical trial demonstrated that PRO 140 can prevent viral escape in patients during several weeks of interruption from conventional drug therapy. CytoDyn intends to continue to

develop PRO 140 as a therapeutic anti-viral agent in persons infected with HIV. For more information on the Company, please visit www.cytodyn.com.

About PRO 140

PRO 140 belongs to a new class of HIV/AIDS

therapeutics – viral-entry inhibitors – that are intended to protect healthy cells from viral infection. PRO 140 is a fully humanized IgG4 monoclonal antibody directed against CCR5, a molecular portal that HIV uses to enter T-cells. PRO

140 blocks the predominant HIV (R5) subtype entry into T-cells by masking this required co-receptor, CCR5. Importantly PRO 140 does not appear to interfere with the normal function of CCR5 in mediating immune responses. PRO 140 does not have agonist

activity towards CCR5 but does have antagonist activity to CCL5 which is a central mediator in inflammatory diseases. PRO 140 has been the subject of seven clinical trials, each demonstrating efficacy by significantly reducing or controlling HIV

viral load in human test subjects. PRO 140 has been designated a “fast track” product candidate by the FDA. The PRO 140 antibody appears to be a powerful antiviral agent leading to potentially fewer side effects and less frequent dosing

requirements as compared to daily drug therapies currently in use.

Forward-Looking Statements

This press release includes forward-looking statements and forward-looking information within the meaning of United States securities laws, including

statements regarding the Company’s Phase 3 and other current and proposed studies and their results and completion. These statements and information represent CytoDyn’s intentions, plans, expectations, and beliefs and are subject to risks,

uncertainties and other factors, many beyond CytoDyn’s control. These factors could cause actual results to differ materially from such forward-looking statements or information. The words “believe,” “estimate,”

“expect,” “intend,” “attempt,” “anticipate,” “foresee,” “plan,” and similar expressions and variations thereof identify certain of such forward-looking statements or forward-looking

information, which speak only as of the date on which they are made.

CytoDyn disclaims any intention or obligation to publicly update or revise any

forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking

statements or forward-looking information. While it is impossible to identify or predict all such matters, these differences may result from, among other things, the inherent uncertainty of the timing and success of and expense associated with

research, development, regulatory approval, and commercialization of CytoDyn’s products and product candidates, including

the risks that clinical trials will not commence or proceed as planned; products appearing promising in early trials will

not demonstrate efficacy or safety in larger-scale trials; future clinical trial data on CytoDyn’s products and product candidates will be unfavorable; funding for additional clinical trials may not be available; CytoDyn’s products may not

receive marketing approval from regulators or, if approved, may fail to gain sufficient market acceptance to justify development and commercialization costs; competing products currently on the market or in development may reduce the commercial

potential of CytoDyn’s products; CytoDyn, its collaborators or others may identify side effects after the product is on the market; or efficacy or safety concerns regarding marketed products, whether or not scientifically justified, may lead to

product recalls, withdrawals of marketing approval, reformulation of the product, additional pre-clinical testing or clinical trials, changes in labeling of the product, the need for additional marketing applications, or other adverse events.

CytoDyn is also subject to additional risks and uncertainties, including risks associated with the actions of its corporate, academic, and other collaborators

and government regulatory agencies; risks from market forces and trends; potential product liability; intellectual property litigation; environmental and other risks; and risks that current and pending patent protection for its products may be

invalid, unenforceable, or challenged or fail to provide adequate market exclusivity. There are also substantial risks arising out of CytoDyn’s need to raise additional capital to develop its products and satisfy its financial obligations; the

highly regulated nature of its business, including government cost-containment initiatives and restrictions on third-party payments for its products; the highly competitive nature of its industry; and other factors set forth in CytoDyn’s Annual

Report on Form 10-K for the fiscal year ended May 31, 2015 and other reports filed with the U.S. Securities and Exchange Commission.

Media:

Nader Pourhassan, Ph.D.

Office: 360-980-8524

E-mail:

npourhassan@cytodyn.com

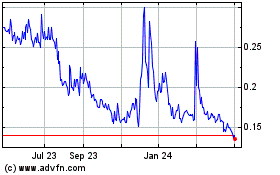

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

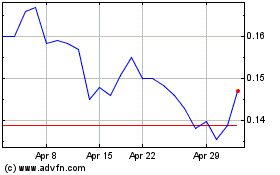

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024