UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the

Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive

Additional Materials

[ ] Soliciting Material Pursuant to Rule

14a-12

THE ALKALINE WATER COMPANY

INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No

fee required.

[ ] Fee computed on table below per Exchange Act

Rules 14a-6(i)(1) and 0-11.

| |

(1) |

Title of each class of securities to which transaction

applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of

transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

2

THE ALKALINE WATER COMPANY INC.

7730 E Greenway

Road Ste. 203

Scottsdale, AZ 85260

____________________________

Consent Solicitation Statement

Dear Stockholder:

The board of directors of The Alkaline Water Company

Inc. (“we,” “us,” “our” or “our company”) is

soliciting your consent on behalf of our company to approve an amendment to our

articles of incorporation to increase the number of authorized shares of our

common stock from 22,500,000 to 200,000,000 (the “Amendment”).

On <>, <>, our board of directors approved the

Amendment and we are now seeking stockholder approval, as discussed in more

detail in this consent solicitation statement.

We are soliciting your approval of the Amendment by written

consent in lieu of a meeting of stockholders because our board of directors

believes that it is in the best interests of our company and our stockholders to

solicit such approval in the most cost effective manner. A form of written

consent is enclosed for your use.

This consent solicitation statement and accompanying form of

written consent will be sent or given to our stockholders from whom we are

seeking consent on or about <>, <>. The eligible CUSIP to

participate is 01643A 207. Our board of directors has fixed the close of

business on <>, <> as the record date (the “Record Date”) for

determination of our stockholders that are entitled to give written consents.

Only the stockholders of record on the Record Date are entitled to give written

consent to the Amendment.

The written consent of stockholders representing a majority of

the voting power of our outstanding common stock and our Series A Preferred

Stock voting as a single class as of the Record Date is required to approve the

Amendment.

Your consent is important regardless of the number of shares of

our common stock or our Series A Preferred Stock that you hold. Although our

board of directors has approved the Amendment, the Amendment requires the

approval by the vote of our stockholders holding a majority of the voting power

of our outstanding common stock and our Series A Preferred Stock voting as a

single class as of the Record Date.

Our board of directors unanimously recommends that you

consent to the Amendment. The Amendment will be approved by our stockholders

when we have received written consents to the Amendment from stockholders

representing a majority of the voting power of our outstanding common stock and

Series A Preferred Stock voting as a single class. If you approve the Amendment,

please mark the enclosed written consent form to vote “For” the Amendment, and

complete, date, sign and return your written consent to us.

Please mail your written consent to us no later than <>,

<>, or such other date as determined by us in our sole discretion, to the

following address:

The Alkaline Water Company Inc.

7730 E Greenway Road Ste. 203

Scottsdale, AZ 85260

Attn: Richard A. Wright

If you hold your shares in “street name” and wish to send your

written consent, you must follow the instructions given by your broker, bank, or

other nominee or contact your broker, bank, or other nominee for information on

how to send your written consent.

Question and Answers about This Consent Solicitation

Why am I receiving these materials?

We are asking our stockholders to approve, by written consent,

an amendment to the articles of incorporation of our company to increase the

number of authorized shares of our common stock from 22,500,000 to 200,000,000,

as more particularly described in the consent solicitation statement.

On <>, <>, our board of directors approved the

Amendment and we are now seeking stockholder approval. Stockholder approval is

required to effect the Amendment.

What is included in these materials?

These materials include:

Important Notice Regarding the Availability of Materials for

This Consent Solicitation

The materials listed above are also available at

<>.

What do I need to do now?

We urge you to carefully read and consider the information

contained in this consent solicitation statement. We request that you send your

written consent to the Amendment described in this consent solicitation

statement.

Who can give the written consents?

Our board of directors has fixed the close of business on

<>, <> as the record date (the “Record Date”) for

determination of our stockholders entitled to give written consents. If you were

a stockholder of record on the Record Date, you are entitled to give written

consent to the Amendment. As of the Record Date, there were <> shares of

our common stock issued and outstanding and 20,000,000 shares of our Series A

Preferred Stock issued and outstanding.

How many votes do I have?

You have one vote for each share of our common stock that you

owned as of the Record Date and 0.2 votes for each share of our Series A

Preferred Stock that you owned as of the Record Date.

How do I send my written consent?

If you are a stockholder of record, please complete, date,

sign, and return the enclosed written consent form via mail to the following

address:

The Alkaline Water Company Inc.

7730 E Greenway Road Ste.

203

Scottsdale, AZ 85260

Attn: Richard A. Wright

If you hold your shares in “street name” and wish to send your

written consent, you must follow the instructions given by your broker, bank, or

other nominee or contact your broker, bank, or other nominee for information on

how to send your written consent.

What is the difference between a stockholder of record and a

“street name” holder?

If your shares of common stock are registered directly in your

name with our transfer agent, Island Stock Transfer, or your shares of preferred

stock appear on the stock ledger for our preferred stock, then you are a

stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a

bank or other nominee, then the broker, bank, or other nominee is the

stockholder of record with respect to those shares. However, you still are the

beneficial owner of those shares, and your shares are said to be held in “street

name.” Street name holders generally cannot send their written consents directly

and must instead instruct the broker, bank, or other nominee on how to send

their written consents.

What vote is required for the approval of the Amendment?

The Amendment will be approved by our stockholders if we

receive written consents from stockholders holding a majority of the voting

power as of the Record Date, or written consents representing at least <>

votes from the holders of shares of our common stock and our Series A Preferred

Stock voting as a single class.

How are votes counted?

A written consent form that has been signed, dated and

delivered to us with the “For” box checked will constitute consent for the

Amendment. A written consent form that has been signed, dated and delivered to

us with the “Against” or “Abstain” boxes checked or without any of the boxes

checked will be counted as a vote against the Amendment. Abstentions and broker

non-votes will have the same effect as a vote against the Amendment.

A “broker non-vote” occurs when a broker, bank, or other

nominee holding shares for a beneficial owner in street name does not vote on a

particular proposal because it does not have discretionary voting power with

respect to that proposal and has not received instructions with respect to that

proposal from the beneficial owner of those shares, despite voting on at least

one other proposal for which it does have discretionary authority or for which

it has received instructions.

When is the approval of the Amendment effective?

The approval of our stockholders of the Amendment is effective

when we receive the written consents to the Amendment from our stockholders

representing a majority of the voting power of our outstanding common stock and

our outstanding Series A Preferred Stock voting as a single class as of the

Record Date.

How does the board of directors recommend that I

vote?

Our board of directors recommends that you vote “For” the

approval of the amendment of our articles of incorporation to increase the

number of authorized shares of our common stock from 22,500,000 to 200,000,000.

Can I revoke my written consent after sending it?

Yes. A written consent, once dated, signed and delivered to us,

will remain effective unless and until revoked by a written notice of revocation

dated, signed and delivered to us before the time that we have received written

consents to the Amendment from our stockholders representing a majority of the

voting power of our outstanding common stock as of the Record Date. Please send

your notice of revocation by mail via the same address that you would send your

written consent, as disclosed elsewhere in this consent solicitation statement.

Do I have rights of appraisal or similar rights of

dissenters with respect to the Amendment?

No. Neither Nevada law nor our articles of incorporation or

bylaws provide our stockholders with rights of appraisal or similar rights of

dissenters with respect to the Amendment.

Who pays for the expense of this consent solicitation?

We will be making the solicitation. We will pay for the expense

of soliciting the written consents and the cost of preparing, assembling and

mailing material in connection therewith. Copies of solicitation materials will

be furnished to banks, brokerage houses, fiduciaries and custodians holding in

their names shares of our common stock beneficially owned by others to forward

to the beneficial owners. We may reimburse persons representing beneficial

owners of our common stock for their costs of forwarding solicitation materials

to the beneficial owners. Original solicitation of written consents by mail may

be supplemented by telephone, facsimile, other approved electronic media or

personal solicitation by our directors, officers, or regular employees. These

individuals will receive no additional compensation for such services.

Forward-Looking Statements

This consent solicitation statement contains forward-looking

statements. These statements relate to future events. In some cases, you can

identify forward-looking statements by terminology such as “may”, “should”,

“expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or

“continue” or the negative of these terms or other comparable terminology. These

statements are only predictions and involve known and unknown risks,

uncertainties and other factors that may cause our company’s actual results,

levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or

implied by these forward-looking statements.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, we do not

intend to update any of the forward-looking statements to conform these

statements to actual results.

Voting Securities and Principal Holders Thereof

Security Ownership of Certain Beneficial Owners and

Management

The following table sets forth, as of <>, <>,

certain information with respect to the beneficial ownership of our common stock

and preferred stock by each stockholder known by us to be the beneficial owner

of more than 5% of any class of our voting securities and by each of our current

directors, our named executive officers and by our current executive officers

and directors as a group.

Name and Address of

Beneficial

Owner |

Title of Class |

Amount and Nature of

Beneficial

Ownership(1) |

Percentage of

Class(2) |

Steven P. Nickolas

14301 North 87 St., Suite

109

Scottsdale, AZ 85260 |

Common Stock |

954,000(4) |

<>% |

| Series A Preferred

Stock(3) |

10,000,000 |

50% |

Richard A. Wright

14301 N. 87th Street, Suite

119

Scottsdale, AZ 85260 |

Common Stock |

148,000(5) |

<>% |

| Series A Preferred

Stock(3) |

10,000,000 |

50% |

Directors and Officers as a

group

(2 individuals)

|

Common Stock |

1,102,000 |

<>% |

| Series A Preferred Stock

(3) |

20,000,000 |

100%

|

| (1) |

Except as otherwise indicated, we believe that the

beneficial owners of the common stock listed above, based on information

furnished by such owners, have sole investment and voting power with

respect to such shares, subject to community property laws where

applicable. Beneficial ownership is determined in accordance with the

rules of the Securities and Exchange Commission and generally includes

voting or investment power with respect to securities. Common stock

subject to options or warrants currently exercisable or exercisable within

60 days, are deemed outstanding for purposes of computing the percentage

ownership of the person holding such option or warrants, but are not

deemed outstanding for purposes of computing the percentage ownership of

any other person. |

| |

|

| (2) |

Percentage of common stock is based on <> shares of

our common stock issued and outstanding as of <>, <>.

Percentage of Series A Preferred Stock is based on 20,000,000 shares of

Series A Preferred Stock issued and outstanding as of <>,

<>. |

| |

|

| (3) |

The Series A Preferred Stock has 0.2 votes per share and

is not convertible into shares of our common stock. |

| |

|

| (4) |

Consists of 148,000 stock options exercisable within 60

days, 430,000 shares of our common stock owned by WiN Investments, LLC and

376,000 shares of our common stock owned by Lifewater Industries, LLC.

Steven P. Nickolas exercises voting and dispositive power with respect to

the shares of our common stock that are beneficially owned by WiN

Investments, LLC and Lifewater Industries, LLC. |

| |

|

| (5) |

Consists of 148,000 stock options exercisable within 60

days. |

Changes in Control

We are unaware of any contract or other arrangement the

operation of which may at a subsequent date result in a change of control of our

company.

PROPOSAL

Approval of the Amendment of Our Articles of Incorporation to

Increase the Number of Authorized Shares of Our Common Stock from 22,500,000 to

200,000,000

Our board of directors is asking our stockholders to approve an

amendment to our articles of incorporation to increase the number of authorized

shares of our common stock from 22,500,000 to 200,000,000. On <>,

<>, our board of directors proposed the amendment of our articles of

incorporation to change the first paragraph of Article 3 thereof so that, as

amended, the first paragraph of said article will be and read substantially as

follows:

The aggregate number of shares that the

Corporation will have authority to issue is 300,000,000, of which 200,000,000

shares will be common stock, with a par value of $0.001 per share (“Common

Stock”), and 100,000,000 shares will be preferred stock, with a par value of

$0.001 per share (“Preferred Stock”).

On December 30, 2015, we effected a 50-for-1 reverse stock

split of our authorized and issued and outstanding shares of common stock. As a

result of the reverse stock split, the number of authorized shares of common

stock of our company decreased from 1,125,000,000 to 22,500,000 and the number

of issued and outstanding shares of common stock of our company decreased

correspondingly. Accordingly, our articles of incorporation currently provide

for authorized capital stock consisting of 22,500,000 shares of common stock,

with a par value of $0.001 per share, and 100,000,000 shares of preferred stock,

with a par value of $0.001 per share. As of <>, <>, we had <>

shares of our common stock issued and outstanding. As of <>, <>, we

had <> stock options and <> share purchase warrants outstanding.

Our board of directors believes that it is necessary and

prudent to amend our articles of incorporation to increase the number of

authorized shares of our common stock from 22,500,000 to 200,000,000 to allow us

to issue additional shares of our common stock for the purposes described below,

and for any other lawful purpose. We have no current intention, plans or

agreements to issue an amount of shares of common stock in excess of the

22,500,000 shares currently authorized.

Our board of directors recommends that you vote “For” the

approval of the amendment of our articles of incorporation to increase the

number of authorized shares of our common stock from 22,500,000 to 200,000,000.

Purpose and Effect of the Increase in the Number of

Authorized Shares of Our Common Stock

Our board of directors believes that an increase in the number

of authorized shares of our common stock will provide us with the flexibility to

meet business needs as they arise, to take advantage of favorable opportunities

and to respond to a changing corporate environment. The increased reserve of

shares available for issuance would give us the flexibility of using our common

stock to raise capital and/or as consideration in acquiring other businesses.

The increased reserve of shares available for issuance may also

be used to facilitate public or private financings. If sufficient operating

funds cannot be generated by operations, we may need to, among other things,

issue and sell our common stock, or securities convertible into our common

stock, in private transactions. Such transactions might not be available on

terms favorable to us, or at all. We may sell our common stock at prices less

than the public trading price of our common stock at the time, and we may grant

additional contractual rights to purchase our common stock not available to

other holders of our common stock, such as warrants to purchase additional

shares of our common stock or anti-dilution protections. We have no intentions,

plans or agreements at this time to issue any of the additional available

authorized shares of our common stock for any financing if this proposal is

approved.

In addition, the increased reserve of shares available for

issuance may be used for our equity incentive plan for grants to our directors,

officers, employees and consultants, and those of our subsidiaries. Our board of

directors believes that it is critical to incentivize our directors, officers,

employees and consultants, and those of our subsidiaries through equity

incentive awards. Such equity incentive plans may also be used to attract and

retain employees or in connection with potential acquisitions if we grant

options to the employees of the acquired companies. Our board of directors

believes that our ability to achieve our growth strategy may be impaired without

additional authorized shares of our common stock that could be used to provide

such equity incentives. We have no intentions, plans or agreements at this time

to issue any of the additional available authorized shares of our common stock

under our equity incentive plans if this proposal is approved.

The flexibility given to our board of directors to issue

additional shares of our common stock could also have an anti-takeover effect

and enhance our ability to negotiate on behalf of our stockholders in a takeover

situation. The authorized but unissued shares of our common stock could be used

by our board of directors to discourage, delay or make more difficult a change

in the control of our company. For example, such shares could be privately

placed with purchasers who might align themselves with our board of directors in

opposing a hostile takeover bid. The issuance of additional shares could serve

to dilute the stock ownership of persons seeking to obtain control and thereby

increase the cost of acquiring a given percentage of the outstanding stock.

Stockholders should therefore be aware that approval of this proposal could

facilitate future efforts by our board of directors to deter or prevent changes

in control of our company, including transactions in which our stockholders

might otherwise receive a premium for their shares over then current market

prices. The increase in our authorized capital stock, however, is not being

proposed in response to any effort of which we are aware to accumulate shares of

our common stock or to obtain control of our company.

The availability of additional shares of our common stock is

particularly important in the event that our board of directors needs to

undertake any of the foregoing actions on an expedited basis and therefore needs

to avoid the time (and expense) of seeking stockholder approval in connection

with the contemplated action. If this proposal is approved by our stockholders,

our board of directors does not intend to solicit further stockholder approval

prior to the issuance of any additional shares of our common stock, except as

may be required by applicable laws or rules.

The possible future issuance of shares of equity securities

consisting of our common stock or securities convertible into our common stock

could affect our current stockholders in a number of ways, including the

following:

-

diluting the voting power of our current stockholders;

-

diluting the market price of our common stock, to the extent that the

shares of our common stock are issued and sold at prices below current trading

prices of our common stock, or if the issuance consists of equity securities

convertible into our common stock, to the extent that the securities provide

for the conversion into our common stock at prices that could be below current

trading prices of our common stock;

-

diluting the earnings per share and book value per share of the outstanding

shares of our common stock; and

-

making the payment of dividends on our common stock potentially more

expensive.

We have no intentions, plans, or agreements at this time to

issue any of the additional available authorized shares of our common stock if

this proposal is approved.

Effective Date of Increase in the Number of Authorized

Shares of Our Common Stock

If the proposal to amend our articles of incorporation to

increase the number of authorized shares of our common stock from 22,500,000 to

200,000,000 is approved by our stockholders, we have to file a Certificate of

Amendment with the Nevada Secretary of State to effect the amendment of our

articles of incorporation. If we obtain stockholder approval of this proposal,

we intend to file the certificate as soon as practicable.

Our board of directors reserves, notwithstanding stockholder

approval of this proposal, the right not to proceed with the amendment of our

articles of incorporation to increase the number of authorized shares of our

common stock without further action by our stockholders at any time before the

effective date of the amendment of our articles of incorporation to increase the

number of authorized shares of our common stock.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED

UPON

No director or executive officer and no associate of any of the

foregoing persons has any substantial interest, direct or indirect, by security

holding or otherwise, in any matter to be acted upon.

STOCKHOLDER PROPOSALS

The deadline for submitting stockholder proposals for inclusion

in our proxy statement and form of proxy for the next annual meeting of

stockholders is a reasonable time before we begin to print and send our proxy

materials. Proposals received after such time will be considered untimely. In

addition, the acceptance of such proposals is subject to the Securities and

Exchange Commission guidelines.

HOUSEHOLDING OF PROXY MATERIALS

The Securities and Exchange Commission permits companies and

intermediaries such as brokers to satisfy the delivery requirements for proxy

materials with respect to two or more stockholders sharing the same address by

delivering a single set of proxy materials addressed to those stockholders. This

process, which is commonly referred to as “householding”, potentially provides

extra conveniences for stockholders and cost savings for companies.

Although we do not intend to household for our stockholders of

record, some brokers household our proxy materials, delivering a single set of

proxy materials to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. Once you have

received notice from your broker that they will be householding materials to

your address, householding will continue until you are notified otherwise or

until you revoke your consent. If, at any time, you no longer wish to

participate in householding and would prefer to receive a separate set of proxy

materials, or if you are receiving multiple sets of proxy materials and wish to

receive only one from your broker, please notify your broker.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of

the Securities Exchange Act of 1934 and in accordance with that act, we file

periodic reports, documents and other information with the Securities and

Exchange Commission relating to our business, financial statements and other

matters. These reports and other information may be inspected and are available

for copying at the offices of the Securities and Exchange Commission, 100 F.

Street NE, Washington, DC 20549 or may be accessed at www.sec.gov.

| |

By Order of the Board of Directors

|

| |

|

| |

|

| |

|

| |

Steven P. Nickolas |

| |

President, Chief Executive Officer and Director

|

| |

<>, <> |

WRITTEN CONSENT SOLICITED

ON BEHALF OF THE BOARD

OF DIRECTORS

OF THE ALKALINE WATER COMPANY INC.

This written consent is solicited on behalf of the board of

directors of The Alkaline Water Company Inc. When properly executed, shares

represented by this written consent will be voted as designated by the

undersigned.

The undersigned hereby acknowledges receipt of the consent

solicitation statement (the “Consent Solicitation Statement”) of The

Alkaline Water Company Inc. (the “Company”) dated <>, <>,

and, without the formality of convening a meeting, does hereby vote via written

consent, as designated below, all of the shares of common stock or Series A

Preferred Stock of the Company held by the undersigned:

The Board of Directors of the Company recommends a vote “For”

the proposal.

| 1. |

Approval of an amendment to the articles of incorporation

of the Company to increase the number of authorized shares of common stock

from 22,500,000 to 200,000,000, provided, however, that, notwithstanding

such approval, the board of directors of the Company may, by resolution,

abandon such amendment at any time before the effective date of the

amendment without further action by the stockholders of the

Company. |

| For |

Against |

Abstain |

| |

|

|

| [ ] |

[ ] |

[ ] |

The undersigned represents that the undersigned owns the

following number of shares of common stock of the Company (please insert the

number of shares): ________________.

The undersigned represents that the undersigned owns the

following number of shares of Series A Preferred Stock of the Company (please

insert the number of shares): ________________.

Please sign exactly as the name or names appear on your stock

certificate(s). If the shares are issued in the names of two or more persons,

all such persons should sign the written consent. A written consent executed by

a corporation should be signed in its name by its authorized officers.

Executors, administrators, trustees, and partners should indicate their titles

when signing.

| Date: |

|

|

| |

|

|

| Stockholder Name (printed): |

|

|

| |

|

|

| Signature: |

|

|

| |

|

|

| Title (if applicable): |

|

|

| |

|

|

| Signature (if held jointly): |

|

|

| |

|

|

| Title (if applicable): |

|

|

Important: Please complete, sign and date your written

consent promptly

and mail it to:

The Alkaline Water Company Inc.

7730 E Greenway Road

Ste. 203

Scottsdale, AZ 85260

Attn: Richard A. Wright

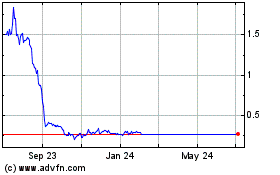

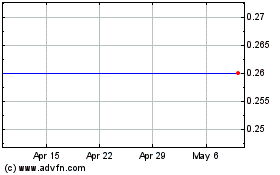

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Apr 2023 to Apr 2024