U.S. SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

INCAPTA,

INC.

(Exact Name

of Company as Specified in Its Charter)

| Nevada |

|

47-3903460 |

| (State or Other Jurisdiction

of Incorporation |

|

(I.R.S. Employer |

| or Organization) |

|

Identification No.) |

| |

|

|

| 1950 Fifth

Avenue, Suite 100, San Diego, California |

|

92101 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

2015

Stock and Option Plan

(Full Title

of the Plan)

John Fleming,

Chief Executive Officer

InCapta, Inc.

1950 Fifth Avenue,

Suite 100

San Diego, California

92101

(619) 934-0586

(Name, Address, and Telephone Number of Agent for Service)

With a copy

to:

Brian F. Faulkner,

A Professional Law Corporation

27127 Calle

Arroyo, Suite 1923

San Juan Capistrano,

California 92675

(949) 240-1361

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| |

|

| Non-accelerated filer ¨ |

Smaller reporting company x |

CALCULATION

OF REGISTRATION FEE

Title of

Securities to be

Registered | |

Amount to be

Registered | | |

Proposed

Maximum

Offering Price

Per Share | | |

Proposed

Aggregate

Offering Price | | |

Amount of

Registration Fee | |

| Common Stock | |

| 30,000,000 | (1) | |

$ | 1.00 | (2) | |

$ | 30,000,000 | | |

$ | 3,021.00 | |

(1) This

registration statement on Form S-8 is being filed for the purpose of registering shares of the Registrant’s common stock

to be issued pursuant to the Registrant’s 2015 Stock and Option Plan (“Plan”) (which authorizes a total 30,000,000

shares of common stock). This registration statement shall also cover any additional shares of common stock which become issuable

under the Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the

Registrant’s receipt of consideration which results in an increase in the number of the outstanding shares of Registrant’s

common stock.

(2) This

offering price per share is calculated under Rule 457(h)(1) (reference to Rule 457(c)) as the offering price is not known: average

of the bid and ask prices as of December 11, 2015 (within five business days prior to the date of filing this registration statement).

See the Plan, attached as Exhibit 4 to this Form S-8.

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

ITEM 1. PLAN INFORMATION.

The

registrant shall deliver or cause to be delivered to each participant material information regarding the plan and its operations

that will enable participants to make an informed decision regarding investment in the plan. This information shall include, to

the extent material to the particular plan being described, but not be limited to, the disclosure specified in (a) through (j)

below. Any unusual risks associated with participation in the plan not described pursuant to a specified item shall be prominently

disclosed.

(a) General

Plan Information.

(1) InCapta,

Inc. 2015 Stock and Option Plan (“Plan”).

(2) The

general nature of the Plan is intended to allow designated directors, officers, employees, and certain non-employees, including

consultants, of the registrant and its subsidiaries which it may have from time to time, to receive certain options to purchase

the registrant’s common stock, one tenth of one cent ($0.001) par value, and to receive grants of common stock subject to

certain restrictions. The purpose of the Plan is to promote the interests of the registrant and its stockholders by attracting

and retaining employees capable of furthering the future success of the registrant and by aligning their economic interests more

closely with those of the registrant’s stockholders.

(3) The

Plan is not subject to any provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

(4) Address

and telephone number, including area code, which participants may use to obtain additional information about the plan and its

administrators: John Fleming, Chief Executive Officer, InCapta, Inc., 1950 Fifth Avenue, Suite 100, San Diego, California 92101;

(619) 934-0586. The Plan is administered by the registrant’s bard of directors. A majority of its members shall constitute

a quorum. The directors are governed by the provisions of the registrant’s bylaws and of Nevada law applicable to the directors,

except as otherwise provided herein or determined by the Directors.

The

directors shall have full and complete authority to construe and interpret the Plan, to establish, amend and rescind rules and

regulations relating to the Plan, and to take all such actions and make all such determinations in connection with the Plan as

it may deem necessary or desirable. The Directors shall, in their discretion, but subject to the express provisions of the Plan:

approve the employees nominated by the management of the registrant to be granted grants or stock options; to determine the number

of grants or stock options to be granted to an employee; to determine the time or times at which grants or stock options shall

be granted; to establish the terms and conditions upon which grants or stock options may be exercised; to remove or adjust any

restrictions and conditions upon grants or stock options; to specify, at the time of grant, provisions relating to exercisability

of stock options and to accelerate or otherwise modify the exercisability of any stock options; and to adopt such rules and regulations

and to make all other determinations deemed necessary or desirable for the administration of the Plan. All interpretations and

constructions of the Plan by the directors, and all of its actions hereunder, shall be binding and conclusive on all persons for

all purposes.

(b) Securities

to be Offered.

The

maximum number of shares of common stock that may be issued pursuant to the Plan is 30,000,000, subject to adjustment pursuant

to the provisions of paragraph 4.1 of the Plan. If shares of common stock granted or issued under the Plan are reacquired by the

registrant due to a forfeiture or for any other reason, such shares shall be cancelled and thereafter shall again be available

for purposes of the Plan. If a stock option expires, terminates or is cancelled for any reason without having been exercised in

full, the shares of common stock not purchased thereunder shall again be available for purposes of the Plan.

(c) Employees

Who May Participate in the Plan.

Designated

directors, officers, employees, and certain non-employees, including consultants, may participate in the Plan as determined by

the directors in their sole discretion.

(d) Purchase

of Securities Pursuant to the Plan and Payment for Securities Offered.

(1) The

designated directors, officers, employees, and certain non-employees, including consultants, may participate in the Plan during

the entire term of the Plan. The consideration for the shares or stock options granted under the Plan is services rendered to

the registrant as determined in the sole discretion of the directors. The amount of securities or options to be granted under

the Plan shall approximate the value of the services rendered by the person to whom they are granted.

(2) The

registrant shall provide a quarterly reports to each person participating in the Plan as to the amount and status of their accounts.

(e) Resale

Restrictions.

There will

be no restriction on resale of the securities purchased under the plan.

(f) Tax

Effects of Plan Participation.

The

tax effects that may accrue to participants in the Plan are that receipt of free trading Common Stock will likely be a taxable

event to the participant. Stock options granted will not be a taxable event until the option is exercised into free trading Common

Stock. Capital gains rules will apply to Common Stock held after the date of acquisition.

(g) Withdrawal

from the Plan; Assignment of Interest.

(1) There

are no provisions in the Plan under which a participating person employee may (i) withdraw from the plan and terminate his or

her interest therein; or (ii) withdraw funds or investments held for the employee’s account without terminating his or her

interest in the plan.

(2) There

are no terms under the Plan under which the Plan permits a participant to assign or hypothecate his or her interest in the Plan.

(h) Forfeitures

and Penalties.

Notwithstanding

any other provision of this Plan, if a participant in the Plan commits fraud or dishonesty toward the Company or wrongfully uses

or discloses any trade secret, confidential data or other information proprietary to the Company, or intentionally takes any other

action materially inimical to the best interests of the Company, as determined by the Directors, in its sole and absolute discretion,

such Employee shall forfeit all rights and benefits under this Plan.

(i) Charges

and Deductions and Liens.

(1) There

are no charges or deductions (other than withholding taxes) that may be made against employees participating in the plan or against

funds, securities or other property held under the Plan. thereunder.

(2) No

person or participant under the Plan may create a lien on any funds, securities, or other property held under the Plan.

ITEM 2.

COMPANY INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION.

The

documents containing the information specified in Part I, Items 1 and 2, shall be delivered to each of the participants in accordance

with Form S-8 and Rule 428 promulgated under the Securities Act of 1933. The participants shall be provided a written statement

notifying them that upon written or oral request they will be provided, without charge, (i) the documents incorporated by reference

in Item 3 of Part II of the registration statement, and (ii) other documents required to be delivered pursuant to Rule 428(b).

The statement will inform the participants that these documents are incorporated by reference in the Section 10(a) prospectus,

and shall include the address (giving title or department) and telephone number to which the request is to be directed.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS

BY REFERENCE.

The

documents listed in (a) through (c) below are incorporated by reference in this registration statement:

(a) The

Company’s latest amended Form 10, filed on December 4, 2015.

(b) All

other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Form

10 referred to in (a) above.

(c) A

description of the securities of the Company is contained in the amended Form 10 filed on December 4, 2015.

All

documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Securities Exchange Act of

1934, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters

all securities then remaining unsold, shall be deemed to be incorporated by reference in the registration statement and to be

part thereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated

by reference herein shall be deemed to be modified or superseded for purposes of this registration statement to the extent that

a statement contained herein or in any subsequently filed document which also is deemed to be incorporated by reference herein

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this registration statement.

ITEM 4. DESCRIPTION OF SECURITIES.

Not Applicable.

ITEM 5. INTEREST OF NAMED EXPERTS

AND COUNSEL.

Other

than as set forth below, no named expert or counsel was hired on a contingent basis, will receive a direct or indirect interest

in the small business issuer, or was a promoter, underwriter, voting trustee, director, officer, or employee of the Company. Brian

F. Faulkner, A Professional Law Corporation, counsel for the Company as giving an opinion on the validity of the securities being

registered, has previously received restricted shares of common stock pursuant to an attorney-client contract with the registrant,

and will received shares of common stock under this Form S-8 in compensation for legal services rendered, and to be rendered in

the future, to the registrant under this attorney-client contract. These legal services consist of advice and preparation work

in connection with reports of the Company filed under the Securities Exchange Act of 1934, and other general corporate and securities

work for the Company.

ITEM 6.

INDEMNIFICATION OF DIRECTORS AND OFFICERS.

The

following is a summary of the relevant provisions in the articles of incorporation, bylaws, and Nevada law with regard to limitation

of liability and indemnification of officers, directors and employees of the Company.

Limitation

of Liability.

Articles

of Incorporation and Bylaws.

There

are no provisions in the Company’s articles of incorporation or bylaws with regard to liability of a director

Nevada Revised Statutes.

“NRS

78.138 Directors and officers: Exercise of powers; performance of duties; presumptions and considerations; liability to corporation

and stockholders.

(7) Except

as otherwise provided in NRS 35.230, a director or officer is not individually liable to the corporation or its stockholders for

any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that:

(a)

His act or failure to act constituted a breach of his fiduciary duties as a director or officer; and

(b) His

breach of those duties involved intentional misconduct, fraud or a knowing violation of law.”

Indemnification.

Articles

of Incorporation and Bylaws.

There

are no provisions in the articles of incorporation with regard to indemnification. The bylaws of the Company provide the following

with regard to indemnification:

“No

director shall be liable to the corporation or any of its stockholders for monetary damages for breach of fiduciary duty as a

director, except with respect to (1) a breach of the director’s duty of loyalty to the corporation or its stockholders,

(2) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) liability which

may be specifically defined by law or (4) a transaction from which the director derived an improper personal benefit, it being

the intention of the foregoing provision to eliminate the liability of the corporation’s directors to the corporation or

its stockholders to the fullest extent permitted by law. The corporation shall indemnify to the fullest extent permitted by law

each person that such law grants the corporation the power to indemnify.”

Nevada Revised

Statutes.

“NRS

78.7502 Discretionary and mandatory indemnification of officers, directors, employees and agents: General provisions.

1.

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending

or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the

right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or

is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid

in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he:

(a) Is

not liable pursuant to directors and officers duty to exercise their powers in good faith and

with a view to the interests of the corporation]; or

(b) Acted

in good faith and in a manner which he reasonably believed to be in or not opposed to the best

interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct

was unlawful.

The termination

of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent,

does not, of itself, create a presumption that the person is liable pursuant to or did

not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation,

or that, with respect to any criminal action or proceeding, he had reasonable cause to

believe that his conduct was unlawful.

2.

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or

completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as

a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses,

including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the

defense or settlement of the action or suit if he:

(a)

Is not liable pursuant to; or

(b) Acted

in good faith and in a manner that he reasonably believed to be in or not opposed to the best

interests of the corporation.

Indemnification

may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction,

after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation,

unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction

determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to

indemnity for such expenses as the court deems proper.

3. To

the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense

of any action, suit or proceeding referred to in subsections 1 and 2, or in defense of any claim, issue or matter therein, the

corporation shall indemnify him against expenses, including attorneys’ fees, actually and reasonably incurred by him in

connection with the defense.”

“NRS

78.751 Authorization required for discretionary indemnification; advancement of expenses; limitation on indemnification and

advancement of expenses.

1. Any

discretionary indemnification pursuant to NRS 78.7502, unless ordered by a court or advanced pursuant to subsection 2, may

be made by the corporation only as authorized in the specific case upon a determination that indemnification of the director,

officer, employee or agent is proper in the circumstances. The determination must be made:

(a) By

the stockholders;

(b) By

the board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding;

(c) If

a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent

legal counsel in a written opinion; or

(d) If

a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal

counsel in a written opinion.

2. The

articles of incorporation, the bylaws or an agreement made by the corporation may provide that the expenses of officers and directors

incurred in defending a civil or criminal action, suit or proceeding must be paid by the corporation as they are incurred and

in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director

or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer

is not entitled to be indemnified by the corporation. The provisions of this subsection do not affect any rights to advancement

of expenses to which corporate personnel other than directors or officers may be entitled under any contract or otherwise by law.

3.

The indemnification pursuant to NRS 78.7502 and advancement of expenses authorized in or ordered by a court pursuant to this section:

(a) Does

not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the

articles of incorporation or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, for either an

action in the person’s official capacity or an action in another capacity while holding office, except that indemnification,

unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses made pursuant to subsection 2, may not be

made to or on behalf of any director or officer if a final adjudication establishes that the director’s or officer’s

acts or omissions involved intentional misconduct, fraud or a knowing violation of the law and was material to the cause of action.

A right to indemnification or to advancement of expenses arising under a provision of the articles of incorporation or any bylaw

is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject

of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification or advancement of

expenses is sought, unless the provision in effect at the time of such act or omission explicitly authorizes such elimination

or impairment after such action or omission has occurred.

(b) Continues

for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and

administrators of such a person.”

“NRS

78.752 Insurance and other financial arrangements against liability of directors, officers, employees and agents.

(1) A

corporation may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer,

employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against

him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising out of his

status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses.

(2) The

other financial arrangements made by the corporation pursuant to subsection 1 may include the following:

(a) The

creation of a trust fund.

(b) The

establishment of a program of self-insurance.

(c) The

securing of its obligation of indemnification by granting a security interest or other lien on any assets of the corporation.

(d) The

establishment of a letter of credit, guaranty or surety.

No financial

arrangement made pursuant to this subsection may provide protection for a person adjudged by a court of competent jurisdiction,

after exhaustion of all appeals therefrom, to be liable for intentional misconduct, fraud or a knowing violation of law, except

with respect to the advancement of expenses or indemnification ordered by a court.

(3) Any

insurance or other financial arrangement made on behalf of a person pursuant to this section may be provided by the corporation

or any other person approved by the board of directors, even if all or part of the other person’s stock or other securities

is owned by the corporation.

(4) In

the absence of fraud:

(a) The

decision of the board of directors as to the propriety of the terms and conditions of any insurance or other financial arrangement

made pursuant to this section and the choice of the person to provide the insurance or other financial arrangement is conclusive;

and

(b) The

insurance or other financial arrangement:

(i) Is

not void or voidable; and

| (ii) | Does

not subject any director approving it to personal liability for his action, even if a

director approving the insurance or other financial arrangement is a beneficiary of the

insurance or other financial arrangement. |

(5) A

corporation or its subsidiary which provides self-insurance for itself or for another affiliated corporation pursuant to this

section is not subject to the provisions of Title 57 of NRS.”

ITEM 7.

EXEMPTION FROM REGISTRATION CLAIMED.

Not

Applicable

ITEM 8. EXHIBITS.

The Exhibits

required by Item 601 of Regulation S-K, and an index thereto, are attached.

ITEM 9. UNDERTAKINGS.

The

undersigned Company hereby undertakes:

(a) (1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

iii.

Include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(6)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned

registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser,

if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| i. | Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering

required to be filed pursuant to Rule 424; |

| ii. | Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned

registrant or used or referred to by the undersigned registrant; |

| iii. | The

portion of any other free writing prospectus relating to the offering containing material

information about the undersigned registrant or its securities provided by or on behalf

of the undersigned registrant; and |

| iv. | Any

other communication that is an offer in the offering made by the undersigned registrant

to the purchaser. |

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933,

each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act

of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the

Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

(h)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and

controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy

as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorize, in the City of San Diego, State of California, on December 11, 2015.

| |

InCapta, Inc. |

| |

|

|

| |

By: |

/s/ John Fleming |

| |

John Fleming, |

| |

Chief Executive Officer |

Special Power

of Attorney

The

undersigned constitute and appoint John Fleming their true and lawful attorney-in-fact and agent with full power of substitution,

for him and in his name, place, and stead, in any and all capacities, to sign any and all amendments, including post-effective

amendments, to this Form S-8 registration statement, and to file the same with all exhibits thereto, and all documents in connection

therewith, with the Securities and Exchange Commission, granting such attorney-in-fact the full power and authority to do and

perform each and every act and thing requisite and necessary to be done in and about the premises, as fully and to all intents

and purposes as he might or could do in person, hereby ratifying and confirming all that such attorney-in-fact may lawfully do

or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the

capacities and on the date indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ John

Fleming |

|

Chief Executive Officer/Director |

|

December 11, 2015 |

| John Fleming |

|

|

|

|

| |

|

|

|

|

EXHIBIT INDEX

| Number |

|

Description |

| |

|

|

| 4 |

|

2015 Stock and Option

Plan, dated December 8, 2015 (filed herewith). |

| |

|

|

| 5 |

|

Opinion of Brian F. Faulkner, A Professional Law Corporation

(filed herewith). |

| |

|

|

| 23.1 |

|

Consent of Anton & Chia, LLP (filed herewith). |

| |

|

|

| 23.2 |

|

Consent of Brian F. Faulkner, A Professional Law Corporation

(filed herewith). |

Exhibit 4

INCAPTA, INC.

2015 STOCK AND OPTION PLAN

The InCapta, Inc. 2015

Stock and Option Plan (“Plan”) is intended to allow designated directors, officers, employees, and certain non-employees,

including consultants (all of whom are sometimes collectively referred to herein as “Employees”) of InCapta, Inc.,

a Nevada corporation (“Company”) and its Subsidiaries (as that term is defined below) which it may have from time to

time, to receive certain options (“Stock Options”) to purchase the Company’s common stock, one tenth of one cent

($0.001) par value (“Common Stock”), and to receive grants of Common Stock subject to certain restrictions (“Grants”).

As used in this Plan, the term “Subsidiary” shall mean each corporation which is a “subsidiary corporation”

of the Company within the meaning of Section 424(f) of the Internal Revenue Code of 1986, as amended (“Code”). The

purpose of the Plan is to promote the interests of the Company and its shareholders by attracting and retaining Employees capable

of furthering the future success of the Company and by aligning their economic interests more closely with those of the Company’s

shareholders. The services that shall be compensated for with such Stock Option and Grants shall be bone fide services to be performed

for the Company, which such services shall neither be in connection with a capital raising function for the Company nor in connection

with making a market in the Common Stock.

1.2.1 The

Plan shall be administered by the Company’s Board of Directors (“Directors”). A majority of its members shall

constitute a quorum. The Directors shall be governed by the provisions of the Company’s Bylaws and of Nevada law applicable

to the Directors, except as otherwise provided herein or determined by the Directors.

1.2.2 The

Directors shall have full and complete authority to construe and interpret the Plan, to establish, amend and rescind rules and

regulations relating to the Plan, and to take all such actions and make all such determinations in connection with the Plan as

it may deem necessary or desirable. The Directors shall, in their discretion, but subject to the express provisions of the Plan:

approve the Employees nominated by the management of the Company to be granted Grants or Stock Options; to determine the number

of Grants or Stock Options to be granted to an Employee; to determine the time or times at which Grants or Stock Options shall

be granted; to establish the terms and conditions upon which Grants or Stock Options may be exercised; to remove or adjust any

restrictions and conditions upon Grants or Stock Options; to specify, at the time of grant, provisions relating to exercisability

of Stock Options and to accelerate or otherwise modify the exercisability of any Stock Options; and to adopt such rules and regulations

and to make all other determinations deemed necessary or desirable for the administration of the Plan. All interpretations and

constructions of the Plan by the Directors, and all of its actions hereunder, shall be binding and conclusive on all persons for

all purposes.

1.2.3 The

Company hereby agrees to indemnify and hold harmless each member of the Directors and each Employee of the Company, and the estate

and heirs of such member of the Directors or Employee, against all claims, liabilities, expenses, penalties, damages or other pecuniary

losses, including legal fees, which such member of the Directors or Employee, his or her estate or heirs may suffer as a result

of his or her responsibilities, obligations or duties in connection with the Plan, to the extent that insurance, if any, does not

cover the payment of such items. No member of the Directors or the Directors shall be liable for any action or determination made

in good faith with respect to the Plan or any Grant or Stock Option granted pursuant to the Plan.

| 1.3 | Eligibility and Participation. |

Employees eligible

under the Plan shall be approved by the Directors from those Employees who, in the opinion of the management of the Company, are

in positions that enable them to make significant and extraordinary contributions to the long-term performance and growth of the

Company. In selecting Employees to whom Stock Options or Grants may be granted, consideration shall be given to factors such as

employment position, duties and responsibilities, ability, productivity, length of service, morale, interest in the Company and

recommendations of supervisors.

| 1.4 | Shares Subject to the Plan. |

The maximum number

of shares of Common Stock that may be issued pursuant to the Plan shall be One Billion (1,000,000,000) subject to adjustment pursuant

to the provisions of paragraph 4.1. If shares of Common Stock Granted or issued under the Plan are reacquired by the Company due

to a forfeiture or for any other reason, such shares shall be cancelled and thereafter shall again be available for purposes of

the Plan. If a Stock Option expires, terminates or is cancelled for any reason without having been exercised in full, the shares

of Common Stock not purchased thereunder shall again be available for purposes of the Plan.

| 2. | GRANTS OF STOCK OPTIONS. |

| 2.1 | Grants of Stock Options. |

The Directors may grant

Stock Options in such amounts, at such times, and to such Employees nominated by the management of the Company as the Directors,

in their discretion, may determine. Stock Options granted under the Plan shall constitute “Incentive Stock Options”

within the meaning of Section 422 of the Code, if so designated by the Directors on the date of grant. The Directors shall also

have the discretion to grant Stock Options which do not constitute incentive stock options, and any such Stock Options shall be

designated non-statutory stock options by the Directors on the date of grant. The aggregate fair market value (determined as of

the time an incentive stock option is granted) of the Common Stock with respect to which incentive stock options are exercisable

for the first time by any Employee during any one calendar year (under all plans of the Company and any parent or subsidiary of

the Company) may not exceed the maximum amount permitted under Section 422 of the Code (currently one hundred thousand dollars

($100,000.00)). Non-statutory stock options shall not be subject to the limitations relating to incentive stock options contained

in the preceding sentence. Each Stock Option shall be evidenced by a written agreement (“Option Agreement”) in a form

approved by the Directors, which shall be executed on behalf of the Company and by the Employee to whom the Stock Option is granted,

and which shall be subject to the terms and conditions of this Plan. In the discretion of the Directors, Stock Options may include

provisions (which need not be uniform), authorized by the Directors in their discretion, that accelerate an Employee’s rights

to exercise Stock Options following a “Change in Control,” as such term is defined in paragraph 3.1 hereof. The holder

of a Stock Option shall not be entitled to the privileges of stock ownership as to any shares of Common Stock not actually issued

to such holder.

The purchase price

(“Exercise Price”) of shares of Common Stock subject to each non-statutory Stock Option (“Option Shares”)

shall be equal to a thirty percent (30%) discount to the previous ten (10) day (from the date of exercise) average closing price

of the Common Stock on the exchange the Common Stock is traded. For an Employee holding stock possessing more than ten percent

(10%) percent of the total combined voting power of all classes of stock of the Company, the Exercise Price of an incentive Stock

Option shall be at least one hundred ten percent (110%) of the fair market value of the Common Stock and such option.

The Stock Option period

(“Term”) shall commence on the date of grant of the incentive Stock Option and shall be ten (10) years or such shorter

period as is determined by the Directors; the Term for an incentive Stock Option granted to an Employee holding stock possessing

more than ten percent (10%) of the total combined voting power of all classes of stock of the Company shall be five (5) years from

the date such option is granted. The Term for Non-statutory Stock Options shall be whatever period, if any, is set by the Directors.

Each Stock Option shall provide that it is exercisable over its term in such periodic installments as the Directors in its sole

discretion may determine. Such provisions need not be uniform. Notwithstanding the foregoing, but subject to the provisions of

paragraphs 1.2.2 and 2.1, Stock Options granted to Employees who are subject to the reporting requirements of Section 16(a) of

the Exchange Act (“Section 16 Reporting Persons”) shall not be exercisable until at least six (6) months and one day

from the date the Stock Option is granted.

2.4.1 Each

Stock Option may be exercised in whole or in part (but not as to fractional shares) by delivering it for surrender or endorsement

to the Company, attention of the Corporate Secretary, at the principal office of the Company, together with payment of the Exercise

Price and an executed Notice and Agreement of Exercise in the form prescribed by paragraph 2.4.2. Payment may be made (i) in cash,

(ii) by cashier’s or certified check, (iii) by surrender of previously owned shares of the Company’s Common Stock valued

pursuant to paragraph 2.2 (if the Directors authorize payment in stock in their discretion), (iv) by withholding from the Option

Shares which would otherwise be issuable upon the exercise of the Stock Option that number of Option Shares equal to the exercise

price of the Stock Option, if such withholding is authorized by the Directors in their discretion, (v) in the discretion of the

Directors, by the delivery to the Company of the optionee’s promissory note secured by the Option Shares, bearing interest

at a rate sufficient to prevent the imputation of interest under Sections 483 or 1274 of the Code, and having such other terms

and conditions as may be satisfactory to the Directors, or (vi) cashless exercise program as established by the Company.

2.4.2 Exercise

of each Stock Option is conditioned upon the agreement of the Employee to the terms and conditions of this Plan and of such Stock

Option as evidenced by the Employee’s execution and delivery of a Notice and Agreement of Exercise in a form to be determined

by the Directors in their discretion. Such Notice and Agreement of Exercise shall set forth the agreement of the Employee that:

(a) no Option Shares will be sold or otherwise distributed in violation of the Securities Act of 1933 (“Securities Act”)

or any other applicable federal or state securities laws, (b) each Option Share certificate may be imprinted with legends reflecting

any applicable federal and state securities law restrictions and conditions, (c) the Company may comply with said securities law

restrictions and issue “stop transfer” instructions to its Transfer Agent and Registrar without liability, (d) if the

Employee is a Section 16 Reporting Person, the Employee will furnish to the Company a copy of each Form 4 or Form 5 filed by said

Employee and will timely file all reports required under federal securities laws, and (e) the Employee will report all sales of

Option Shares to the Company in writing on a form prescribed by the Company.

2.4.3 No

Stock Option shall be exercisable unless and until any applicable registration or qualification requirements of federal and state

securities laws, and all other legal requirements, have been fully complied with. The Company will use reasonable efforts to maintain

the effectiveness of a Registration Statement under the Securities Act for the issuance of Stock Options and shares acquired thereunder,

but there may be times when no such Registration Statement will be currently effective. The exercise of Stock Options may be temporarily

suspended without liability to the Company during times when no such Registration Statement is currently effective, or during times

when, in the reasonable opinion of the Directors, such suspension is necessary to preclude violation of any requirements of applicable

law or regulatory bodies having jurisdiction over the Company. If any Stock Option would expire for any reason except the end of

its term during such a suspension, then if exercise of such Stock Option is duly tendered before its expiration, such Stock Option

shall be exercisable and exercised (unless the attempted exercise is withdrawn) as of the first day after the end of such suspension.

The Company shall have no obligation to file any Registration Statement covering resales of Option Shares.

| 2.5 | Restrictions on Transfer. |

Each Stock Option granted

under this Plan shall be transferable only by will or the laws of descent and distribution. No interest of any Employee under the

Plan shall be subject to attachment, execution, garnishment, sequestration, the laws of bankruptcy or any other legal or equitable

process. Each Stock Option granted under this Plan shall be exercisable during an Employee’s lifetime only by such Employee

or by such Employee’s legal representative.

Subject to the provisions

of the Plan, the Directors shall have full and complete authority, in their discretion, but subject to the express provisions of

this Plan, to (i) grant shares pursuant to the Plan; (ii) determine the number of shares of Common Stock subject to each Grant

(“Grant Shares”); (iii) determine the terms and conditions (which need not be identical) of each Grant, including the

consideration to be paid by the Employee for such Common Stock; (iv) establish and modify performance criteria for Grants; and

(v) make all of the determinations necessary or advisable with respect to Grants under the Plan. Each Grant under the Plan shall

consist of a grant of shares of Common Stock.

Each Grant granted

under the Plan shall be evidenced by a written agreement (“Agreement”) in a form approved by management and executed

by the Company and the Employee to whom the Grant is granted. Each Agreement shall be subject to the terms and conditions of the

Plan and other such terms and conditions as management may specify.

| 3.3 | Waiver of Restrictions. |

The Directors may modify

or amend any Grant under the Plan or waive any restrictions or conditions applicable to such Grants; provided, however, that the

Directors may not undertake any such modifications, amendments or waivers if the effect thereof materially increases the benefits

to any Employee, or adversely affects the rights of any Employee without his or her consent.

| 3.4 | Terms and Conditions of Grants. |

Upon receipt of a Grant

of shares of Common Stock under the Plan, an Employee shall be the holder of record of the shares and shall have all the rights

of a shareholder with respect to such shares, subject to the terms and conditions of the Plan and the Grant.

| 4. | MISCELLANEOUS PROVISIONS. |

| 4.1 | Adjustments Upon Change in Capitalization. |

4.1.1 The

number and class of shares subject to each outstanding Stock Option, the Exercise Price thereof (but not the total price), the

maximum number of Stock Options that may be granted under the Plan, the minimum number of shares as to which a Stock Option may

be exercised at any one time, and the number and class of shares subject to each outstanding Grant, shall be proportionately

adjusted in the event of any increase or decrease in the number of the issued shares of Common Stock which results from a split-up

or consolidation of shares, payment of a stock dividend or dividends exceeding a total of five percent (5%) for which the record

dates occur in any one fiscal year, a recapitalization (other than the conversion of convertible securities according to their

terms), a combination of shares or other like capital adjustment, so that (i) upon exercise of the Stock Option, the Employee shall

receive the number and class of shares such Employee would have received had such Employee been the holder of the number of shares

of Common Stock for which the Stock Option is being exercised upon the date of such change or increase or decrease in the number

of issued shares of the Company, and (ii) upon the lapse of restrictions of the Grant Shares, the Employee shall receive the number

and class of shares such Employee would have received if the restrictions on the Grant Shares had lapsed on the date of such change

or increase or decrease in the number of issued shares of the Company.

4..1.2 Upon

a reorganization, merger or consolidation of the Company with one or more corporations as a result of which is not the surviving

corporation or in which the Company survives as a wholly-owned subsidiary of another corporation, or upon a sale of all or substantially

all of the property of the Company to another corporation, or any dividend or distribution to shareholders of more than ten percent

(10%) of the Company’s assets, adequate adjustment or other provisions shall be made by the Company or other party to such

transaction so that there shall remain and/or be substituted for the Option Shares and Grant Shares provided for herein, the shares,

securities or assets which would have been issuable or payable in respect of or in exchange for such Option Shares and Grant Shares

then remaining, as if the Employee had been the owner of such shares as of the applicable date. Any securities so substituted shall

be subject to similar successive adjustments.

The Company shall have

the right at the time of exercise of any Stock Option or the grant of shares to make adequate provision for any federal, state,

local or foreign taxes which it believes are or may be required by law to be withheld with respect to such exercise (“Tax

Liability”), to ensure the payment of any such Tax Liability. The Company may provide for the payment of any Tax Liability

by any of the following means or a combination of such means, as determined by the Directors in its sole and absolute discretion

in the particular case: (i) by requiring the Employee to tender a cash payment to the Company, (ii) by withholding from the Employee’s

salary, (iii) by withholding from the Option Shares which would otherwise be issuable upon exercise of the Stock Option, or from

the Grant Shares on their grant or date of lapse of restrictions, that number of Option Shares or Grant Shares having an aggregate

fair market value (determined in the manner prescribed by paragraph 2.2) as of the date the withholding tax obligation arises in

an amount which is equal to the Employee’s Tax Liability or (iv) by any other method deemed appropriate by the Directors.

Satisfaction of the Tax Liability of a Section 16 Reporting Person may be made by the method of payment specified in clause (iii)

above only if the following two conditions are satisfied:

(a) the

withholding of Option Shares or Grant Shares and the exercise of the related Stock Option occur at least six (6) months and one

day following the date of grant of such Stock Option or Grant; and

(b) the

withholding of Option Shares or Grant Shares is made either (i) pursuant to an irrevocable election (“Withholding Election”)

made by such Employee at least six months in advance of the withholding of Options Shares or Grant Shares, or (ii) on a day within

a ten (10) day “window period” beginning on the third business day following the date of release of the Company’s

quarterly or annual summary statement of sales and earnings.

Anything herein to the contrary notwithstanding,

a Withholding Election may be disapproved by the Directors at any time.

| 4.3 | Relationship to Other Employee Benefit Plans. |

Stock Options and Grants

granted hereunder shall not be deemed to be salary or other compensation to any Employee for purposes of any pension, thrift, profit-sharing,

stock purchase or any other employee benefit plan now maintained or hereafter adopted by the Company.

| 4.4 | Amendments and Termination. |

The Directors may at

any time suspend, amend or terminate this Plan. For incentive stock options only, no amendment or modification of this Plan may

be adopted, except subject to stockholder approval, which would: (a) materially increase the benefits accruing to Employees under

this Plan, (b) materially increase the number of securities which may be issued under this Plan (except for adjustments pursuant

to paragraph 4.1 hereof), or (c) materially modify the requirements as to eligibility for participation in the Plan.

| 4.5 | Successors in Interest. |

The provisions of this

Plan and the actions of the Directors shall be binding upon all heirs, successors and assigns of the Company and of Employees.

All documents prepared,

executed or delivered in connection with this Plan (including, without limitation, Option Agreements and Incentive Agreements)

shall be, in substance and form, as established and modified by the Directors; provided, however, that all such documents shall

be subject in every respect to the provisions of this Plan, and in the event of any conflict between the terms of any such document

and this Plan, the provisions of this Plan shall prevail.

| 4.7 | No Obligation to Continue Employment. |

This Plan and grants

hereunder shall not impose any obligation on the Company to continue to employ any Employee. Moreover, no provision of this Plan

or any document executed or delivered pursuant to this Plan shall be deemed modified in any way by any employment contract between

an Employee (or other employee) and the Company.

| 4.8 | Misconduct of an Employee. |

Notwithstanding any

other provision of this Plan, if an Employee commits fraud or dishonesty toward the Company or wrongfully uses or discloses any

trade secret, confidential data or other information proprietary to the Company, or intentionally takes any other action materially

inimical to the best interests of the Company, as determined by the Directors, in its sole and absolute discretion, such Employee

shall forfeit all rights and benefits under this Plan.

This Plan was adopted

by the Directors effective December 8, 2015. No Stock Options or Grants may be granted under this Plan after December 8, 2025.

This Plan shall be

construed in accordance with, and governed by, the laws of the State of Nevada.

| 4.11 | Stockholder Approval. |

No Stock Option shall

be exercisable, or Grant granted, unless and until the Directors of the Company have approved this Plan and all other legal requirements

have been fully complied with. In addition, no Incentive Stock Option shall be granted until approved by a majority of the issued

and outstanding Common Stock of the Company.

| 4.12 | Assumption Agreements. |

The Company will require

each successor, (direct or indirect, whether by purchase, merger, consolidation or otherwise), to all or substantially all of the

business or assets of the Company, prior to the consummation of each such transaction, to assume and agree to perform the terms

and provisions remaining to be performed by the Company under each Incentive Agreement and Stock Option and to preserve the benefits

to the Employees thereunder. Such assumption and agreement shall be set forth in a written agreement in form and substance satisfactory

to the Directors (an “Assumption Agreement”), and shall include such adjustments, if any, in the application of the

provisions of the Incentive Agreements and Stock Options and such additional provisions, if any, as the Directors shall require

and approve, in order to preserve such benefits to the Employees. Without limiting the generality of the foregoing, the Directors

may require an Assumption Agreement to include satisfactory undertakings by a successor:

(a) to

provide liquidity to the Employees on the exercise of Stock Options;

(b) if

the succession occurs before the expiration of any period specified in the Incentive Agreements for satisfaction of performance

criteria applicable to the Common Stock Granted thereunder, to refrain from interfering with the Company’s ability to satisfy

such performance criteria or to agree to modify such performance criteria and/or waive any criteria that cannot be satisfied as

a result of the succession;

(c) to

require any future successor to enter into an Assumption Agreement; and

(d) to

take or refrain from taking such other actions as the Directors may require and approve, in their discretion.

| 4.13 | Compliance With Rule 16b-3. |

Transactions under

the Plan are intended to comply with all applicable conditions of Rule 16b-3. To the extent that any provision of the Plan or action

by the Directors fails to so comply, it shall be deemed null and void, to the extent permitted by law and deemed advisable by the

Board.

IN WITNESS WHEREOF,

this Plan has been executed as of the 8th day of December 2015.

| InCapta Inc. |

|

| |

|

| By: |

/s/ John Fleming |

|

| John Fleming, Chief Executive Officer |

|

Exhibit 5

Brian F. Faulkner

A Professional Law Corporation

27127 Calle Arroyo, Suite 1923

San Juan Capistrano, California 92675

(949) 240-1361

December 11, 2015

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| Re: | InCapta, Inc. 2015 Stock and Option Plan |

Dear Sir/Madame:

I have acted as counsel to InCapta, Inc.,

a Nevada corporation (“Company”), in connection with its registration statement on Form S-8 relating to the registration

of 30,000,000 shares of its common stock (“Shares”), $0.001 par value per Share, which are issuable pursuant to the

Company’s 2015 Stock and Option Plan.

In my representation I have examined such

documents, corporate records, and other instruments as we have deemed necessary or appropriate for purposes of this opinion, including,

but not limited to, the Articles of Incorporation, and all amendments thereto, and Bylaws of the Company.

Based upon and in reliance on the foregoing,

and subject to the qualifications and assumptions set forth below, it is my opinion that the Company is duly organized and validly

existing as a corporation under the laws of the State of Nevada, and that the Shares, when issued and sold, will be validly issued,

fully paid, and non-assessable.

My opinion is limited by and subject to

the following:

(a) In rendering my opinion I have assumed

that, at the time of each issuance and sale of the Shares, the Company will be a corporation validly existing and in good standing

under the laws of the State of Nevada.

(b) In my examination of all documents,

certificates and records, I have assumed without investigation the authenticity and completeness of all documents submitted to

me as originals, the conformity to the originals of all documents submitted to me as copies and the authenticity and completeness

of the originals of all documents submitted to me as copies. I have also assumed the genuineness of all signatures, the legal capacity

of natural persons, the authority of all persons executing documents on behalf of the parties thereto other than the Company, and

the due authorization, execution and delivery of all documents by the parties thereto other than the Company. As to matters of

fact material to this opinion, I have relied upon statements and representations of representatives of the Company and of public

officials and have assumed the same to have been properly given and to be accurate.

(c) My opinion is based solely on and limited

to the federal laws of the United States of America and the Nevada laws. I express no opinion as to the laws of any other jurisdiction.

| |

Sincerely, |

| |

|

| |

/s/ Brian F. Faulkner |

| |

Brian F. Faulkner, Esq. |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors

InCapta, Inc.

We hereby consent to the incorporation by reference of our report

dated August 5, 2015, with respect to the financial statements of InCapta, Inc (formerly known as TBC Global News Network, Inc.)

for the years ended December 31, 2013 and 2014, appearing in the amended Form 10 of InCapta, Inc. filed on December 4, 2015, in

the registration statement of InCapta, Inc. on Form S-8 to be filed on or about December 11 2015. We also consent to the use of

our name and the references to us included in the registration statement

| /s/ Anton & Chia, LLP |

|

| Newport Beach, California |

|

| December 11, 2015 |

|

Exhibit 23.2

Brian F. Faulkner

A Professional Law Corporation

27127 Calle Arroyo, Suite 1923

San Juan Capistrano, California 92675

(949) 240-1361

December 11, 2015

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| Re: | InCapta, Inc. 2015 Stock and Option Plan |

Dear Sir/Madame:

I have acted as counsel to InCapta, Inc.,

a Nevada corporation (“Company”), in connection with its registration statement on Form S-8 relating to the registration

of 30,000,000 shares of its common stock (“Shares”), $0.001 par value per Share, which are issuable pursuant to the

Company’s 2015 Stock and Option Plan. I hereby consent to all references to my firm included in this registration statement,

including the opinion of legality.

| |

Sincerely, |

| |

|

| |

/s/ Brian F. Faulkner |

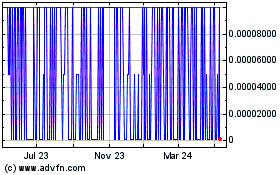

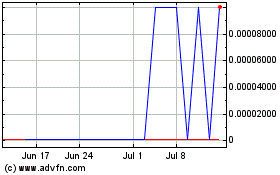

Incapta (PK) (USOTC:INCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Incapta (PK) (USOTC:INCT)

Historical Stock Chart

From Apr 2023 to Apr 2024