Current Report Filing (8-k)

November 05 2015 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2015 (October 30, 2015)

CENTRAL FEDERAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

0-25045

|

34-1877137

|

|

(State or other jurisdiction of

|

(Commission

|

(IRS Employer

|

|

incorporation)

|

File Number)

|

Identification Number)

|

|

|

|

|

|

7000 N. High Street, Worthington, Ohio

|

43085

|

(614) 334-7979

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s Telephone Number)

|

|

|

|

|

|

(former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On October 15, 2015, Central Federal Corporation (“CFC”) announced the resignation of Thad Perry as President of CFC and its wholly-owned subsidiary, CFBank, effective as of October 9, 2015 (the “Resignation Date”). On October 30, 2015, CFBank and Mr. Perry executed a Resignation Agreement and General Release setting forth the terms of Mr. Perry’s separation from service with CFC and CFBank (the “Resignation Agreement”). Pursuant to the Resignation Agreement, Mr. Perry confirmed his resignation of employment with CFBank and as an officer of CFC and CFBank, effective as of the Resignation Date, and resigned as a member of the Boards of Directors of CFC and CFBank effective as of October 30, 2015.

Under the terms of the Resignation Agreement, Mr. Perry will be entitled to (a) continue to receive his base salary, in the amount of $16,667 per month, for a period of nine months following the Resignation Date (but will not be entitled to receive any other compensation or benefits, including but not limited to any bonus payments), (b) reimbursement for up to $5,000 of actual costs incurred by Mr. Perry for outplacement services, and (c) immediate vesting of the remaining unvested portion of the incentive stock options previously granted to Mr. Perry under the Central Federal Corporation 2009 Equity Compensation Plan, as amended. Pursuant to the Resignation Agreement, Mr. Perry agreed to abide by confidentiality and non-disparagement covenants. Mr. Perry also agreed to a release of any and all claims against CFBank and its affiliates (including CFC) and related parties relating to Mr. Perry’s employment and association with CFBank or the termination of that employment and association.

The foregoing description of the Resignation Agreement is qualified in its entirety by reference to the Resignation Agreement, which is filed with this Current Report on Form 8-K as Exhibit 10.1.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Resignation Agreement described under Item 1.01 above, Mr. Perry resigned as a member of the Boards of Directors of CFC and CFBank effective as of October 30, 2015. The Board of Directors of CFC intends to evaluate potential director candidates to fill the vacancy on the Board of Directors resulting from the resignation of Mr. Perry.

Item 9.01. Financial Statements and Exhibits.

(a)through (c): Not applicable.

(d)Exhibits:

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Resignation Agreement and General Release between CFBank and Thad Perry, executed on October 30, 2015 and effective as of October 9, 2015

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Central Federal Corporation

|

|

|

|

|

|

|

Date: November 5, 2015

|

|

By:

|

/s/ Timothy T. O’Dell

|

|

|

|

|

Timothy T. O’Dell

|

|

|

|

|

Chief Executive Officer

|

RESIGNATION AGREEMENT AND GENERAL RELEASE

THIS AGREEMENT is entered into to be effective as of this 9th day of October, 2015, by and between Thad Perry, for and on behalf of himself and his successors, heirs, family and assigns (“Perry”), and CFBank, a federally chartered savings association (“CFBank”);

WHEREAS, the purpose of this Agreement is to set forth certain understandings which have been reached between Perry and CFBank;

WHEREAS, Perry has been an employee of CFBank;

WHEREAS, after discussion between Perry and CFBank, the parties have concluded that it would be in Perry’s best interest to pursue employment opportunities elsewhere; and

WHEREAS, both Perry and CFBank desire to end the employment relationship between them with a minimum of hardship to Perry and disruption to CFBank.

NOW, THEREFORE, IT IS AGREED AS FOLLOWS:

|

1.

Perry shall be permitted to resign his employment with CFBank effective at the close of business on October 9, 2015 (the “Resignation Date”). Perry’s resignation as an employee of CFBank will also constitute his resignation as an officer of both CFBank and Central Federal Corporation and his resignation from the Loan Committee and any other committee of CFBank and/or Central Federal Corporation on which he serves by virtue of his employment with CFBank. |

|

2.

CFBank will pay to Perry his base salary from and after the Resignation Date through July 9, 2016 (the “Severance Period”), less all applicable payroll deductions, including deductions for federal, state, local and Social Security taxes. Except as expressly provided herein, Perry will not be entitled to receive any other benefits, including but not limited to any bonus payment, from CFBank or Central Federal Corporation following the Resignation Date. |

|

3.

CFBank agrees to reimburse Perry in the amount of Five Thousand Dollars ($5,000.00) or less, for actual costs incurred by Perry for outplacement services actually used by Perry from his Resignation Date through July 9, 2016. In order to be eligible for this reimbursement, Perry must use an outplacement service approved in advance by CFBank, which approval shall not be unreasonably withheld. CFBank will not pay cash to Perry in lieu of the outplacement services. |

|

4.

The entire unvested portion of any Incentive Stock Options previously awarded to Perry under the Central Federal Corporation 2009 Equity Compensation Plan, as amended (the “Equity Plan”), shall immediately vest on the Resignation Date, and all such Incentive Stock Options shall be exercisable in accordance with the terms of the Equity Plan and the applicable option award agreement(s); provided, however, that notwithstanding the terms of the Equity Plan or any option award agreement to the contrary, all such Incentive Stock Options shall remain exercisable until the expiration of the applicable option term(s). In accordance with the Equity Plan and applicable law, any Incentive Stock Options that are exercised by Perry after three months following the Resignation Date will be treated as nonqualified stock options at the time of exercise. |

|

5.

Perry shall resign as a member of the Boards of Directors of CFBank and Central Federal Corporation, upon execution of this Agreement. |

|

6.

Immediately upon the Resignation Date, Perry shall return to CFBank any and all property of CFBank in his possession including, but not limited to, keys, equipment, all documents and computer files. Perry agrees that he shall not take, copy, use or reveal to any person in any form or manner, any documents, computer files or information which CFBank deems confidential or proprietary, including, but not limited to, financial information, business and strategic plans, and other confidential materials or information. |

|

7.

Perry hereby releases and forever discharges CFBank, its operating companies or entities, subsidiary companies or entities, its parent companies or entities (including but not limited to Central Federal Corporation), its affiliated companies or entities, their shareholders, officers, directors, trustees, employees, associates, agents, benefit plans, successors and assigns (the “Released Parties”) from any and all claims, demands or rights of action which exist as of the date this Agreement is executed, whether contractual, common law or statutory, whether known or unknown, including but not limited to claims which may in any way relate to Perry’s employment and association with CFBank or the termination of that employment and association, including, but not limited to claims arising under the Age Discrimination in Employment Act. |

|

8.

Perry shall keep confidential and not disclose to any person or any entity or encourage or facilitate the disclosure to any person or entity the terms of this Agreement, including but not limited to the monetary amount of this Agreement. |

|

9.

Perry shall not voluntarily make any oral or written statements or reveal any information to any person, company, or agency which may be construed to be negative, disparaging or damaging to the reputation or business of any of the Released Parties, or which would interfere in any way with CFBank’s business relations with the general public. |

|

10.

Perry acknowledges that he has been advised by this writing to consult with an attorney and has had the opportunity to take at least 21 days in which to review and consider this Agreement and to consult with legal counsel with respect thereto. Perry further acknowledges that he has entered into this Agreement voluntarily and of his own free will. Perry acknowledges his right to revoke this Agreement within seven days following the execution hereof by giving written notice thereof to CFBank. In the event of such revocation, this Agreement shall become null and void and no party hereto shall have any rights or obligations hereunder. |

|

11.

This Agreement shall not be construed in any manner as an admission by CFBank that it has violated any law, policy or procedure or acted wrongfully with respect to Perry or any other person, or that Perry has any rights whatsoever against CFBank. Perry acknowledges that CFBank specifically disclaims any liability to Perry arising from his employment relationship with CFBank or the termination of that relationship. |

|

12.

This Agreement shall be construed under the laws of the State of Ohio. |

|

13.

If any amount otherwise payable to Perry pursuant to this Agreement is prohibited or limited by any statute, regulation, order or similar limitation in effect at the time the payments would otherwise be paid, including, without limitation, the requirements of 12 U.S.C. §1828(k) and/or 12 C.F.R. Part 359 (a “Regulatory Limitation”): (i) CFBank shall pay the maximum amount that may be paid under the Regulatory Limitation; and (ii) shall use commercially reasonable efforts to obtain the consent of the appropriate agency or body to pay any amounts that cannot be paid due to the application of the Regulatory Limitation. |

|

14.

For federal income tax purposes, the payments and other benefits provided under this Agreement are intended to comply with, or be exempt from, the requirements of Section 409A of the Code, and this Agreement shall be interpreted, operated and administered in a manner consistent with this intention. |

Signed as of this 30th day of October, 2015.

/s//s/ Thad Perry

Witness Thad Perry

CFBank

/s/By: /s/ Robert E. Hoeweler

WitnessRobert E. Hoeweler

Its: Chairman, Board of Directors

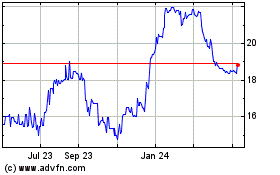

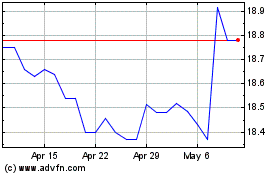

CF Bankshares (NASDAQ:CFBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CF Bankshares (NASDAQ:CFBK)

Historical Stock Chart

From Apr 2023 to Apr 2024