CMG Holdings Group Signs Letter of Intent to Acquire Transmit Program Management LLC

October 15 2015 - 1:42PM

InvestorsHub NewsWire

CMG Holdings Group Signs Letter of Intent to

Acquire Transmit Program Management LLC

CHICAGO, IL -- October 15, 2015 -- InvestorsHub

NewsWire -- CMG Holdings Group, Inc. (OTCQB:

CMGO) today announced it has signed a letter of intent to

acquire Transmit Program Management LLC ("TPM"), a provider of

wireless construction management and network maintenance and

monitoring services based in Cary, North Carolina. Transmit PM has

an operational footprint in the mid-Atlantic and Southeast,

including North Carolina, South Carolina, Alabama, Georgia,

Florida, and Virginia. The Company was founded to fill the void in

professional management in the wireless deployment industry, whilst

its solutions are also applicable to wireline environments. Since

inception, the Company's main focus has been the provision of

Program, Construction, Maintenance and Quality

management.

The Transmit PM Program Management Platform

enables the Transmit PM team to deploy a fully operational quick

response center anywhere in the country to lead a "Tiger Team"

based program recovery within 24 hours:

Asset & technical team dispatch, monitoring

and tracking,

Real time technical support of field forces to the ND-51

standard,

Logistics management, material procurement,

Accurate, real time activity, performance and closeout data

collection and metrics,

Real time national weather monitoring to move assets around

weather,

Experienced, program tested Tiger Teams trained to the ND-51

standard,

Highlight, document and prove systemic management issues and

classify as internal to each organization, customer or

vendor.

Transmit Program Management can get a MNO's

network back to work quickly and

effectively:

Survey failing or damaged sites,

Analyze and BOM subject sites,

Order, receive, manage & track materials inventory by site,

Ensure the work is performed completely and correctly the first

time,

Provide each customer with complete and correct close-out

documentation real time.

Recent projects include work for a leading

national wireless broadband provider (alarm clearing, maintenance);

UMTS work for the nation's largest incumbent communications

provider; LTE and UMTS alarm clearing for a $1BN run rate

communications project management firm in support of Tier I MNOs;

CDMA/LTE alarm clearing for a world renowned communications

equipment manufacturer; and numerous projects for regional carriers

in Transmit PM's footprint. The Company has a stellar reputation in

the industry. Since inception, Transmit PM has collected every

penny invoiced. Transmit PM has never had an invoiced challenged

and has never had an invoice unpaid.

Based on year-to-date results and before

anticipated synergies, BHC is on pace to generate substantial

profits, with EBITDA margins north of 40%. CMG is paying roughly

4.0x EBITDA in new class of preferred stock that will convert at

1.25 cents into common shares, seller notes and cash. Peak revenues

and EBITDA were substantially higher based on prior cycle higher

capital expenditure run rates across the wireless sector, during a

time when Transmit PM was involved in sizable construction projects

in addition to its highly profitable maintenance and support

business.

Said Glenn Laken, "Our planned acquisition of

Transmit PM is another hand in glove fit with our previously

announced acquisitions of E&E Enterprises and Blue Horizon

Concepts, located roughly three hours away from Transmit PM in

Virginia. With this trio of synergistic businesses, we expect to

move quickly to integrate the companies, diversify each business

through cross-selling and collaboration on large projects in

footprint and across the country, and achieve scale through a more

balanced revenue mix and cash-flow

profile.

As

with BHC, the devastation of the Carolinas after recent deluges

provides an opportunity for our family of companies to play a role

in rebuilding and repairing critical infrastructure in the region.

Looking ahead, we anticipate renewed investment activity by

wireless carriers throughout the country as a result of a

heightened focus on tower work and DAS spending, which should lead

to revenue acceleration for our communications infrastructure

group."

With these three businesses now under LOI, CMG's

Communications Infrastructure group will be on track to generate

substantial pro forma revenues during 2015, with the potential for

50%-100% annual top line growth for the next few years and positive

free cash flow.

Glenn Laken, CEO of CMG Holdings Group, commented

on the opportunities facing the organization: "We continue to be in

various stages of discussions, negotiations and due diligence on

several companies in the communications services, communications

infrastructure, value-added services, and cyber-security markets

that together represent a foundation off which we intend to build a

substantially larger company focused on cyber infrastructure. That

said, we believe these initial three businesses position us well to

achieve the scope and scale necessary to be self-sufficient while

attracting capital at reasonable costs. We are currently circling

capital from institutional investors and intend to provide

additional visibility on these companies' contracts and bookings to

investors, with a goal of putting CMG onto firmer footing as a

self-sufficient company. We aspire to become a leading player in

the high growth markets for secure communications, connectivity and

networking with anchor tenants in government, telco and enterprise

markets."

Safe Harbor Statement:

CMGO cautions that statements made in press

releases constitute forward-looking statements, and make no

guarantees of future performances and actual results/developments

may differ materially from projections in forward-looking

statements. Forward-looking statements are based on estimates and

opinions of management at the time statements are

made.

Source: CMG Holdings,

Inc

Tony Golden, CEO &

Founder

TackleBox Newswire

A division of Corporate Media

Enterprises, LLC

Atlanta

tgolden@tackleboxnewswire.com

678-878-3100

678-595-7449

TackleBox Newswire is a Marketwired

Business Partner

Connect on: Linkedin

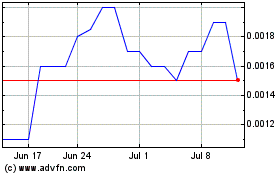

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Apr 2023 to Apr 2024