UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

CYTODYN INC.

(Name of Subject Company (Issuer))

CYTODYN INC.

(Name of

Filing Persons (Issuer))

Convertible Promissory Notes issued April 30, 2015 – May 15, 2015

(Title of Class of Securities)

N/A

(CUSIP Number of

Class of Securities)

Michael D. Mulholland

Chief Financial Officer

CytoDyn Inc.

1111 Main

Street, Suite 660

Vancouver, Washington 98660

Phone: (360) 980-8524

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

With copies to:

Michael J. Lerner, Esq.

Steven M. Skolnick, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

Phone: (212) 262-6700

CALCULATION

OF FILING FEE

|

|

|

| Transaction Valuation* |

|

Amount of Filing Fee |

| $4,045,464 |

|

$470.09 |

| |

| * |

The transaction value is estimated solely for purposes of calculating the amount of the filing fee, pursuant to Rule 0-11 under the Securities and Exchange Act of 1934. The calculation is based upon the value of the

Eligible Notes to be received by the Company in the Offer. Because there is no market for the Eligible Notes, the value is based upon the book value of the Eligible Notes, computed as of July 31, 2015, in accordance with Rule 0-11(a)4).

|

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: |

|

Filing Party: |

| Form or Registration No.: |

|

Date Filed: |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment

reporting the results of the tender offer: ¨

TABLE OF CONTENTS

This Tender Offer Statement on Schedule TO relates to the offer by CytoDyn Inc., a Colorado corporation (the

“Company” or “CytoDyn”), to exchange certain of its outstanding convertible promissory notes (the “Eligible Notes”) for (i) the issuance of restricted shares of its common stock, no par value per share (the

“Common Stock”) for the settlement of the balance of the Eligible Notes (including principal and interest) at $0.675 per share (the “Offer Price”) and (ii) the amendment of the related warrants to purchase common stock (the

“Eligible Warrants”) to reduce the exercise price of the Eligible Warrants to the Offer Price of $0.675 per share, in each case upon the terms and subject to the conditions set forth in the Offer to Exchange (the “Offering

Memorandum”), and the Election Form (the “Election Form”), which together, as each may be amended and supplemented from time to time, constitute the Offer (the “Offer”). The Offer Price represents a 10.0% discount to $0.75,

which is the current conversion price of the Eligible Notes and current exercise price of the Eligible Warrants. This Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The information contained in the Offering Memorandum and the Election Form, copies of which are attached to this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, is incorporated herein by reference in

response to all of the items of this Schedule TO as more particularly described below.

| Item 1. |

Summary Term Sheet. |

The information set forth in the Offering Memorandum under the caption

“Summary of Terms” is incorporated herein by reference.

| Item 2. |

Subject Company Information. |

(a) Name and Address. The name of the subject company is

CytoDyn Inc. The address of the principal executive offices of CytoDyn is 1111 Main Street, Suite 660, Vancouver, Washington, 98660. The telephone number of the principal executive offices of CytoDyn is (360) 980-8524.

(b) Securities. The information set forth in Section 10 of the Offering Memorandum under the caption “Description of Convertible

Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration” is incorporated herein by reference.

(c) Trading

Market and Price. The Eligible Notes and the Eligible Warrant do not trade on any market. The information set forth in Section 10 of the Offering Memorandum under the caption “Market for our Common Stock” is incorporated herein by

reference.

| Item 3. |

Identity and Background of Filing Person. |

This is an issuer tender offer. CytoDyn, the subject company,

is the filing person. CytoDyn’s address and telephone number are set forth in Item 2 above.

Pursuant to General Instruction C to Schedule TO,

the information set forth in Section 12 of the Offering Memorandum under the caption “Interests of Directors and Executive Officers; Transactions and Arrangements” is incorporated herein by reference.

| Item 4. |

Terms of the Transaction. |

(a) Material Terms. The following sections of the Offering

Memorandum contain information regarding the material terms of the transaction and are incorporated herein by reference.

| |

• |

|

Risks of Participating in the Offer; |

| |

• |

|

Section 1. Background and Purpose of the Offer; |

1

| |

• |

|

Section 2. Eligibility; |

| |

• |

|

Section 3. Exchange of Eligible Notes; |

| |

• |

|

Section 4. Procedures for Tendering Eligible Notes; |

| |

• |

|

Section 5. Acceptance of Eligible Notes; Issuance of Common Stock and Amendment of Eligible Warrants; |

| |

• |

|

Section 6. Extension of the Offer; Termination; Amendment; |

| |

• |

|

Section 7. Withdrawal Rights; |

| |

• |

|

Section 8. Conditions of the Offer; |

| |

• |

|

Section 10. Description of Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration; |

| |

• |

|

Section 11. Information Regarding CytoDyn; |

| |

• |

|

Section 12. Interests of Directors and Executive Officers; Transactions and Arrangements; |

| |

• |

|

Section 13. Accounting Consequences of the Offer; |

| |

• |

|

Section 14. Legal Matters; Regulatory Approvals; |

| |

• |

|

Section 15. Certain United States Federal Income Tax Considerations; |

| |

• |

|

Section 16. Fees and Expenses; and |

| |

• |

|

Section 17. Additional Information. |

(b) Purchases. The information set forth in

Section 12 of the Offering Memorandum under the caption “Interests of Directors and Executive Officers; Transactions and Arrangements” is incorporated herein by reference.

| Item 5. |

Past Contacts, Transactions, Negotiations and Agreements. |

The information set forth in Section 12

of the Offering Memorandum under the caption “Interests of Directors and Executive Officers; Transactions and Arrangements” is incorporated herein by reference.

| Item 6. |

Purposes of the Transaction and Plans or Proposals. |

(a) and (b) Purposes; Use of Securities

Acquired. The following sections of the Offering Memorandum, which contain information regarding the purposes of the transaction and use of securities acquired, are incorporated herein by reference:

| |

• |

|

Section 1: Background and Purpose of the Offer. |

2

(c) Plans. Except as disclosed in the Offering Memorandum, the Company currently has no plans,

proposals or negotiations that relate to or would result in:

| |

• |

|

any extraordinary transaction, such as a merger, reorganization or liquidation, involving CytoDyn or any of its subsidiaries; |

| |

• |

|

any purchase, sale or transfer of a material amount of assets of CytoDyn or any of its subsidiaries; |

| |

• |

|

any material change in the present dividend rate or policy, or indebtedness or capitalization of CytoDyn; |

| |

• |

|

any change in the present Board of Directors or management of CytoDyn, including, but not limited to, any plans or proposals to change the number or the term of directors or to fill any existing vacancies on the Board

or to change any material term of the employment contract of any executive officer; |

| |

• |

|

any other material change in CytoDyn’s corporate structure or business; |

| |

• |

|

any class of equity securities of CytoDyn to be delisted from a national securities exchange or cease to be authorized to be quoted in an automated quotation system operated by a national securities exchange;

|

| |

• |

|

any class of equity securities of CytoDyn becoming eligible for termination of registration under Section 12(g)(4) of the Exchange Act; |

| |

• |

|

the suspension of CytoDyn’s obligation to file reports under Section 15(d) of the Exchange Act; |

| |

• |

|

the acquisition by any person of additional securities of CytoDyn, or the disposition of securities of CytoDyn; or |

| |

• |

|

any changes in the CytoDyn’s charter, bylaws or other governing instruments or other actions that could impede the acquisition of control of CytoDyn. |

| Item 7. |

Source and Amount of Funds or Other Consideration. |

(a), (b) and (d) Source of Funds;

Conditions; Borrowed Funds. The information set forth in Section 10 of the Offering Memorandum under the caption “Description of Convertible Promissory Notes and Common Stock Purchase Warrants; Source and Amount of Consideration”

is incorporated herein by reference.

| Item 8. |

Interest in Securities of the Subject Company. |

(a) and (b) Securities Ownership; Securities

Transactions. The information set forth in Section 12 of the Offering Memorandum under the caption “Interests of Directors and Executive Officers; Transactions and Arrangements” is incorporated herein by reference.

| Item 9. |

Persons/Assets Retained, Employed, Compensated or Used. |

The information set forth in Section 16 of

the Offering Memorandum under the caption “Fees and Expenses” is incorporated herein by reference.

| Item 10. |

Financial Statements. |

(a) and (b) Financial Information; Pro Forma Information. The

financial information set forth in Item 8 Financial Statements in the Company’s Annual Report on Form 10-K for the year ended May 31, 2015, filed with the SEC on July 10, 2015, and the financial information set forth in

Section 11 of the Offering Memorandum under the caption “Information Regarding CytoDyn,” Section 13 of the Offering Memorandum under the caption “Accounting Consequences of the Merger” and Section 17 of the

Offering Memorandum under the caption “Additional Information” is incorporated herein by reference.

3

| Item 11. |

Additional Information. |

(a) Agreements, Regulatory Requirements and Legal Proceedings. The

information set forth in the following sections of the Offering Memorandum is hereby incorporated by reference:

| |

• |

|

Section 11. Information Regarding CytoDyn; |

| |

• |

|

Section 12. Interests of Directors and Executive Officers; Transactions and Arrangements; |

| |

• |

|

Section 14. Legal Matters; Regulatory Approvals; and |

| |

• |

|

Section 15. Certain United States Federal Income Tax Considerations. |

(c) Other Material

Information. The information set forth in the Offering Memroandum and the Election Form, copies of which are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, as each may be amended or supplemented from time to time,

is incorporated herein by reference.

|

|

|

| (a)(1)(A) |

|

Offer to Exchange Convertible Promissory Notes and Amend Warrants to Purchase Common Stock Issued Between April 30, 2015- May 15, 2015, dated August 24, 2015 |

|

|

| (a)(1)(B) |

|

Election Form |

|

|

| (a)(1)(C) |

|

Withdrawal Form |

|

|

| (a)(1)(D) |

|

Letter from Michael D. Mulholland, Chief Financial Officer of the Company, to holders of Eligible Notes dated August 24, 2015 |

| Item 13. |

Information Required by Schedule 13E-3. |

Not applicable.

4

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

| Date: August 24, 2015 |

|

|

|

|

|

CytoDyn Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Michael D. Mulholland |

|

|

|

|

Name: |

|

Michael D. Mulholland |

|

|

|

|

Title: |

|

Chief Financial Officer |

[Signature Page to

Schedule TO]

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Exchange Convertible Promissory Notes and Amend Warrants to Purchase Common Stock Issued Between April 30, 2015- May 15, 2015, dated August 24, 2015 |

|

|

| (a)(1)(B) |

|

Election Form |

|

|

| (a)(1)(C) |

|

Withdrawal Form |

|

|

| (a)(1)(D) |

|

Letter from Michael D. Mulholland, Chief Financial Officer of the Company, to holders of Eligible Notes dated August 24, 2015 |

Exhibit (a)(1)(A)

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION OR PASSED UPON THE

MERITS OR FAIRNESS OF SUCH TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

OFFER TO EXCHANGE

CONVERTIBLE PROMISSORY NOTES AND

AMEND WARRANTS TO PURCHASE COMMON STOCK

ISSUED BETWEEN APRIL 30, 2015 – MAY 15, 2015

THE OFFER AND WITHDRAWAL RIGHTS

WILL EXPIRE

AT 11:59 P.M. (EASTERN TIME) ON SEPTEMBER 21, 2015, UNLESS THE OFFER IS EXTENDED

THE DATE OF THIS OFFER DOCUMENT IS AUGUST 24, 2015

CytoDyn Inc., a Colorado corporation (the “Company,” “CytoDyn,” “we” or “us”), is offering

to exchange certain of its convertible promissory notes and to reduce the exercise price of related warrants to purchase common stock, pursuant to the terms and conditions set forth in this tender offer statement (this “Offering

Memorandum”) and the related “Election Form,” as such documents may be amended or supplemented from time to time (together, the “Offer”).

The securities eligible for the Offer are the convertible promissory notes, having an aggregate outstanding principal amount of $3,981,050 (the

“Eligible Notes”) and related warrants (the “Eligible Warrants” and, together with the Eligible Notes, the “Eligible Securities”), which were issued together in connection with our private placement

financings to accredited investors that closed on April 30, 2015, May 6, 2015, May 13, 2015 and May 15, 2015. The Eligible Securities are described more fully in Section 10 of The Offer: “Description of

Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration.”

On the terms and subject to the conditions

of the Offer, we are offering to exchange the Eligible Notes for (i) the issuance of restricted shares of our common stock, no par value (the “Common Stock”), for the settlement of the balance of the Eligible Notes (principal

plus accrued interest through the expiration date of this Offer, which we currently expect to be September 21, 2015) at a price of $0.675 per share (the “Offer Price”) and (ii) the amendment of the Eligible Warrants to

reduce the exercise price of the Eligible Warrants to the Offer Price of $0.675 per share (as so amended, the “Amended Warrants”). The Offer Price represents a 10.0% discount to $0.75, which is the current conversion price of the

Eligible Notes and current exercise price of the Eligible Warrants.

We are making the Offer to settle the balances of the Eligible Notes and give the

holders of the Eligible Securities an opportunity to obtain shares of our Common Stock at a discount to the current conversion price and exercise price of the Eligible Securities. The principal and interest for Eligible Notes that are not exchanged

in the Offer, or otherwise converted pursuant to their terms, will become due and payable between October 30, 2015 and November 15, 2015, six months from their date of issuance. In order to repay the Eligible Notes on maturity, we will

need to raise additional capital, which may not be available at that time. The Offer permits us to relieve some of our outstanding debt and improve our capital structure as we seek to raise additional financing in the near term to finance our

operations.

Participation in the Offer is voluntary. The Offer is not conditioned upon any minimum number of holders electing to participate or any

minimum aggregate principal amount of Eligible Notes being tendered for exchange. However, if you elect to participate in the Offer, you must exchange the entire amount of your Eligible Note, and you may not exchange only a portion of your Eligible

Note in the Offer. If you elect not to participate in the Offer, your Eligible Note and Eligible Warrants will remain outstanding on the same terms and conditions under which they were originally issued, and the conversion price of your Eligible

Note and the exercise price of your Eligible Warrants will not be reduced to the Offer Price.

The offering period for the Offer will commence on August 24, 2015 and expire at 11:59 p.m. (Eastern

Time), on September 21, 2015, unless the Offer is extended (the “Expiration Date”). We may extend the Expiration Date at our discretion. If we extend the Offer, the term “Expiration Date” will refer to the time and

date at which the extended Offer expires.

Shares of our Common Stock are quoted on the OTCQB of the OTC Markets Group under the symbol “CYDY.”

On August 21, 2015, the closing price per share of our Common Stock was $0.81.

IMPORTANT

If you would like to accept the Offer, you must properly complete and sign the Election Form in accordance with the terms set forth in the offering

materials, and you must deliver it to us by mail or courier service at the following address:

CytoDyn Inc.

Attention: Michael D. Mulholland

1111 Main Street, Suite 660

Vancouver, Washington 98660

We must

receive your Election Form before 11:59 p.m. (Eastern Time) on the Expiration Date. If we do not receive your Election Form by 11:59 p.m. (Eastern Time) on the Expiration Date, you will be deemed to have rejected the Offer. You may

direct questions about the Offer to our Chief Financial Officer, Michael D. Mulholland, by telephone at (360) 980-8524, by e-mail at mmulholland@cytodyn.com, or by mail or courier service at the foregoing address.

THE BOARD OF DIRECTORS OF THE COMPANY HAS APPROVED THE OFFER. HOWEVER, NEITHER THE COMPANY NOR OUR BOARD OF DIRECTORS MAKES ANY RECOMMENDATION TO

SECURITY HOLDERS AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING THEIR ELIGIBLE NOTES. YOU SHOULD CAREFULLY READ THE INFORMATION IN THIS OFFERING MEMORANDUM (INCLUDING OUR REASONS FOR MAKING THE OFFER) AND THE INFORMATION IN THE ELECTION

FORM BEFORE MAKING YOUR DECISION WHETHER TO TENDER YOUR ELIGIBLE NOTE IN THE OFFER.

WE HAVE NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR

BEHALF AS TO WHETHER OR NOT YOU SHOULD TENDER YOUR ELIGIBLE NOTE PURSUANT TO THE OFFER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS OFFERING MEMORANDUM.

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

Page |

|

| SUMMARY OF TERMS |

|

|

1 |

|

| IMPORTANT NOTICES |

|

|

5 |

|

| FORWARD-LOOKING STATEMENTS |

|

|

6 |

|

| RISKS OF PARTICIPATING IN THE OFFER |

|

|

7 |

|

| THE OFFER |

|

|

8 |

|

| 1. |

|

Background and Purpose of the Offer |

|

|

8 |

|

| 2. |

|

Eligibility |

|

|

8 |

|

| 3. |

|

Exchange of Eligible Notes |

|

|

9 |

|

| 4. |

|

Procedures for Tendering Eligible Notes |

|

|

9 |

|

| 5. |

|

Acceptance of Eligible Notes; Issuance of Common Stock; Amendment of Eligible Warrants |

|

|

10 |

|

| 6. |

|

Extension of the Offer; Termination; Amendment |

|

|

11 |

|

| 7. |

|

Withdrawal Rights |

|

|

11 |

|

| 8. |

|

Conditions of the Offer |

|

|

12 |

|

| 9. |

|

Market for Our Common Stock |

|

|

13 |

|

| 10. |

|

Description of Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration |

|

|

14 |

|

| 11. |

|

Information Regarding CytoDyn |

|

|

15 |

|

| 12. |

|

Interests of Directors and Executive Officers; Transactions and Arrangements |

|

|

17 |

|

| 13. |

|

Accounting Consequences of the Offer |

|

|

17 |

|

| 14. |

|

Legal Matters; Regulatory Approvals |

|

|

17 |

|

| 15. |

|

Certain United States Federal Income Tax Considerations |

|

|

17 |

|

| 16. |

|

Fees and Expenses |

|

|

23 |

|

| 17. |

|

Additional Information |

|

|

23 |

|

| 18. |

|

Miscellaneous |

|

|

24 |

|

i

SUMMARY OF TERMS

This Summary of Terms is designed to answer some of the questions that you may have about the Offer. You should carefully read this entire document and its

schedules. The Offer is made subject to the terms and conditions of these documents as they may be amended or supplemented from time to time. The information in this summary is not complete. Additional important information is contained in the

remainder of this Offering Memorandum and the accompanying Election Form. We have made references in this summary to other sections in this Offering Memorandum to help you find a more complete description of these topics.

Upon the terms and subject to the conditions described in this Offering Memorandum

and the related Election Form, we are offering to exchange certain Eligible Notes, which were issued in connection with our private placement financings to accredited investors that closed on April 30, 2015, May 6,

2015, May 13, 2015 and May 15, 2015, for (i) the issuance of restricted shares of our Common Stock at an Offer Price of $0.675 per share and (ii) the amendment of the Eligible Warrants, which were issued in the same private

placement financings as the Eligible Notes, to reduce the exercise price of the Eligible Warrants to the Offer Price of $0.675 per share. The Offer Price represents a 10% discount to $0.75, which is the current conversion price of the Eligible Notes

and the current exercise price of the Eligible Warrants. See the following sections of the Offer: Section 3 “Exchange of Eligible Notes” and Section 10 “Description of Convertible Promissory Notes and Warrants to Purchase

Common Stock; Source and Amount of Consideration.”

| 2. |

Why is the Company making the Offer? |

We are making the Offer in order to settle the balances of

Eligible Notes and give holders of Eligible Notes an opportunity to obtain shares of our Common Stock at a discount to the current conversion price and exercise price of the Eligible Securities. For Eligible Notes that are not exchanged in the

Offer, or otherwise converted pursuant to their terms, all outstanding principal and accrued but unpaid interest thereon will become due and payable between October 30, 2015 and November 15, 2015, on the dates that are six months from

their date of issuance. In order to repay the Eligible Notes on maturity, we will need to raise additional capital, which may not be available at that time. The Offer permits us to relieve certain of our outstanding debt relating to the Eligible

Notes and improve our capital structure, as we seek to raise additional financing in the near future term to finance our operations. See Section 1 of the Offer: “Background and Purpose of the Offer.”

| 3. |

Who is entitled to participate in the Offer? |

Only the holders of Eligible Securities described in this

Offering Memorandum are eligible to participate in the Offer. These Eligible Securities were issued to investors under a private placement to accredited investors that closed between April 30, 2015 and May 15, 2015. No other holders of

promissory notes, warrants, options or other securities to acquire shares of our Common Stock may participate in the Offer. See the following Sections of the Offer: Section 2 “Eligibility” and Section 10 “Description of

Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration in the Offer.”

| 4. |

How many Eligible Notes will the Company exchange? |

We are offering to exchange all of the Eligible

Notes for Common Stock at a discount to the current conversion price of the Eligible Notes and for the reduction in the exercise price of the related Eligible Warrants. The aggregate balance of the outstanding Eligible Notes is $3,981,050 in

principal amount plus $64,414 in accrued interest through July 31, 2015, and there are related Eligible Warrants outstanding to purchase an aggregate of 1,061,586 shares of our Common Stock. The Offer is not conditioned upon any minimum number

of holders electing to participate or any minimum aggregate principal amount of Eligible Notes being tendered for exchange. See Section 3 of the Offer: “Exchange of Eligible Notes.”

1

| 5. |

How long do I have to decide whether to tender in the Offer? |

You will have until 11:59 P.M. (Eastern

time) on September 21, 2015 to decide whether to tender your Eligible Note in the Offer unless the Offer is terminated or extended by us as described in this Offering Memorandum.

| 6. |

How do I choose to participate in the Offer? |

To tender your Eligible Note, you must deliver your

Eligible Note (or an Affidavit of Lost Note) together with a completed Election Form to us at the following address:

CytoDyn Inc.

Attention: Michael D. Mulholland

1111 Main Street, Suite 660

Vancouver, Washington 98660

See Section 4

of the Offer: “Procedures for Tendering Eligible Notes.”

This is a one-time offer and we will not accept late tenders under any circumstances.

We reserve the right to reject any and all tenders that we determine are incomplete, not in appropriate form or that we determine are unlawful to accept, subject to the judgment of a court of competent jurisdiction to the contrary.

| 7. |

Can the Offer be extended and under what circumstances? |

We are reserving the right to extend the Offer

at our discretion. Also, if we should materially amend the Offer we will ensure that the Offer remains open long enough to comply with applicable securities laws. It is possible that such changes could involve an extension of the Offer up to 10

additional business days in some cases.

| 8. |

How will I be notified if the Offer is extended? |

If we extend the Offer, we will make a public

announcement of the extension not later than 9:00 A.M. (Eastern time), on the next business day after the day on which the Offer was scheduled to expire.

| 9. |

If I elect to participate in the Offer, do I have to tender the entire balance of my Eligible Note or can I just tender a portion of my Eligible Note or Eligible Warrant? |

If you elect to participate in the Offer, you must tender the entire balance of your Eligible Note and cannot partially tender your Eligible Note. All of the

related Eligible Warrants that you hold will be amended to reduce the exercise price thereof, but only if you elect to participate in the Offer and tender your Eligible Note for exchange.

| 10. |

If I have already converted a portion of my Eligible Note or exercised a portion of my Eligible Warrants, may I still choose to participate in the Offer? |

Yes, the terms of the Offer will apply to the portion of your Eligible Securities that remains outstanding, unconverted and unexercised. See Section 4 of

the Offer: “Procedures for Tendering Eligible Notes.”

| 11. |

What will happen if I do not tender my Eligible Note in the Offer? |

If you elect not to participate in

the Offer, your Eligible Note and Eligible Warrants will remain outstanding on the same terms and conditions under which they were originally issued. The conversion price of your Eligible Note and the exercise price of your Eligible Warrants will

not be reduced to the Offer Price if you elect not to participate in the Offer.

| 12. |

Are there any conditions to the Offer and can the Company terminate the Offer? |

The Offer is not

conditioned upon any minimum number of holders electing to participate or any minimum aggregate principal amount of Eligible Notes being tendered for exchange. However, the Offer is subject to a

2

number of conditions with regard to events that could occur prior to the expiration of the Offer, and we can terminate the Offer upon notice to you if these events occur. See Section 6 of

the Offer: “Extension of the Offer; Termination; Amendment.”

| 13. |

Until what time can I withdraw previously tendered Eligible Notes? |

You may withdraw previously

tendered Eligible Notes at any time until the Offer has expired. To withdraw securities, you must deliver a completed Withdrawal Form to the Company while you still have the right to withdraw your Eligible Note. See Section 7 of the Offer:

“Withdrawal Rights.”

| 14. |

When will the Company issue the Common Stock and Amend the Eligible Warrants in exchange for tendered Eligible Notes? |

We will issue the Common Stock and deem the exercise price of the related Eligible Warrants to be amended in exchange for the tendered Eligible Notes promptly

after the expiration of the Offer and our acceptance of your Eligible Note.

| 15. |

Are there risks that I should consider in deciding whether to tender my Eligible Note in the Offer? |

Yes, accepting this offer has risk. You should review the discussion of these risks in the section entitled “Risks of Participating in the Offer.”

| 16. |

Will the Amended Warrants, the shares of Common Stock issued in exchange for the Eligible Notes in the Offer or the shares of Common Stock issued in exchange for the Amended Warrants be eligible for resale without

restriction? |

The Amended Warrants, the shares of Common Stock issued under the Offer, and the shares of Common Stock issuable upon

exercise of the Amended Warrants, are being issued in reliance upon exemptions from the Securities Act of 1933, as amended (the “Securities Act”). Therefore, the Amended Warrants, the shares of Common Stock issued under the Offer

and the shares of Common Stock issuable upon exercise of the Amended Warrants are “restricted securities” within the meaning of the Securities Act and cannot be resold except pursuant to an effective registration statement or an exemption

from registration under the Securities Act. However, the shares of Common Stock issued under the Offer shall be deemed to have been acquired at the time the Eligible Note was originally acquired and will be available for resale under Rule 144 under

the Securities Act, assuming that all requirements of Rule 144 are met, including the fact that six months has passed since your acquisition of the Eligible Note and the fact that we are current in our reporting obligations under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), at that time. See Section 10 of the Offer: “Description of the Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of

Consideration.”

| 17. |

Do any of the executive officers and directors have an interest in the Offer? |

None of our executive

officers or directors or their affiliates have an interest in the Offer other than as our stockholders. See Section 12 of the Offer: “Interests of Directors and Executive Officers; Transactions and Arrangements.”

| 18. |

What does the Company’s Board of Directors think of the Offer? |

Our Board of Directors has

approved the Offer. However, neither the Company nor our Board of Directors makes any recommendation to holders as to whether to tender or refrain from tendering their Eligible Notes.

| 19. |

Is there any information regarding the Company that I should be aware of before deciding to participate in the Offer? |

Yes. Your decision should take into account the information included in our Annual Report on Form 10-K for the fiscal year ended May 31, 2015 filed with

the Securities and Exchange Commission (the “SEC”). This report and other documents we file with the SEC are available for review at www.sec.gov. See Section 17 of the Offer: “Additional Information.” In addition,

before making your decision, you should review the section “Risks of Participating in the Offer.”

3

| 20. |

Will I have to pay federal income taxes if I participate in the Offer? |

We believe that the exchange of

the Eligible Securities should constitute a taxable exchange for U.S. Federal income tax purposes. Consequently, upon your exchange of your Eligible Note in the Offer, you should generally recognize short term capital gain or loss equal to the

difference between the fair market value of the Common Stock received and your tax basis in your Eligible Note.

You are encouraged to consult with your

own personal tax advisor if you have questions about the potential tax effects of participating in the Offer. See Section 15 of the Offer: “Certain United States Federal Income Tax Considerations.”

| 21. |

Who can I talk to if I have questions about the Offer? |

For additional information about the Offer or

to request assistance or additional copies of any materials we have provided regarding the Offer, you should contact our Chief Financial Officer, Michael D. Mulholland, by telephone phone at (360) 980-8524, by e-mail at mmulholland@cytodyn.com,

or by mail or courier service at CytoDyn Inc., 1111 Main Street, Suite 660, Vancouver, Washington 98660. See Section 17 of the Offer: “Additional Information.”

4

IMPORTANT NOTICES

The securities being offered pursuant to this Offering Memorandum are being offered pursuant to exemptions provided under the Securities Act, certain state

securities laws and certain rules and regulations promulgated thereunder. The Common Stock issued in exchange for the Eligible Notes and issuable upon exercise of the Amended Warrants will be subject to restrictions on transferability and resale and

may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws.

This Offering Memorandum has been

prepared solely for the benefit of holders of Eligible Securities. Distribution of this Offering Memorandum to any person other than such holders and those persons retained to advise such holders is unauthorized and any reproduction of this Offering

Memorandum or related documents, in whole or in part, is prohibited.

You should review this Offer carefully and consult with your own attorneys,

accountants and financial and tax advisors. You must make your own decision as to whether or not to exchange your Eligible Note. None of the Company, the directors, officers or any affiliated persons, advisors, representatives, counsel or other

agent is making any representation or recommendation to any holder regarding this Offer.

We have not authorized any person to make any recommendation on

our behalf as to whether you should tender or refrain from tendering your Eligible Note. You should rely only on the information contained in this Offering Memorandum or the other documents related to the offer referred to herein.

5

FORWARD-LOOKING STATEMENTS

This Offering Memorandum (and documents included in this mailing or incorporated by reference) may contain certain statements which are forward-looking in

nature and are based on the current beliefs of our management as well as assumptions made by and information currently available to management. In addition, when used in this Offering Memorandum, the words “may,” “could,”

“should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to us or our management,

may identify forward-looking statements. These statements reflect our judgment as of the date of this Offering Memorandum with respect to future events, the outcome of which is subject to risks. See “Risks of Participating in the Offer.”

Some of these risks include but are not limited to:

| |

• |

|

the anticipated impact of the Offer on our financial statements; |

| |

• |

|

the sufficiency of our cash position; |

| |

• |

|

our ability to meet our debt obligations; |

| |

• |

|

our ability to achieve approval of a marketable product; |

| |

• |

|

design, implementation and conduct of clinical trials; |

| |

• |

|

the results of our clinical trials, including the possibility of unfavorable clinical trial results; |

| |

• |

|

the market for, and marketability of, any product that is approved; |

| |

• |

|

the existence or development of vaccines, drugs, or other treatments for infection with the Human Immunodeficiency Virus that are viewed by medical professionals or patients as superior to our products;

|

| |

• |

|

regulatory initiatives, compliance with governmental regulations and the regulatory approval process; |

| |

• |

|

general economic and business conditions; and |

| |

• |

|

changes in foreign, political, and social conditions. |

You are cautioned that these forward-looking statements

are inherently uncertain. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described herein. In addition to the risk factors

contained herein, other factors are discussed in more detail in Part I, Item 1A entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended May 31, 2015.

6

RISKS OF PARTICIPATING IN THE OFFER

Any investment in the Company is subject to risks inherent to our business. You should carefully consider the following important risks and uncertainties as

well as those described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended March 31, 2015 filed with the SEC and listed in Section 17 of the Offer: “Additional Information” before

exchanging your Eligible Note in this Offer. If any of the events described in the following risks actually occur, our business, results of operations, financial condition and cash flows could be materially adversely affected, the trading price of

our Common Stock could decline significantly, and you might lose all or part of your investment.

Our Board of Directors makes no recommendation

with regard to whether you should accept the Offer.

Our Board of Directors approved the Offer, but it makes no recommendation as to whether

holders of Eligible Notes should accept the Offer. We have not retained and do not intend to retain any unaffiliated representative to act solely on behalf of the holders of Eligible Notes for purposes of negotiating the terms of the Offer. We

cannot assure you that the value of the shares issued upon exercise of the Amended Warrants received in the Offer will in the future equal or exceed the exercise price per share of the Amended Warrants.

We have not obtained and will not obtain any ruling from the Internal Revenue Service concerning the income tax consequences of participation in this

Offer to Exchange.

We have not obtained and do not intend to obtain a ruling from the Internal Revenue Service (“IRS”) regarding

the U.S. federal income tax consequences of exchanging the Eligible Securities for the Common Stock and Amended Warrants pursuant to the Offer. We believe that the exchange of the Eligible Securities should constitute a taxable exchange for U.S.

federal income tax purposes. Consequently, upon your exchange of your Eligible Note in the Offer, you should generally recognize short term capital gain or loss equal to the difference between the fair market value of the Common Stock received and

your tax basis in your Eligible Note. You should consult your own tax advisor for a full understanding of the tax consequences of participating in the Offer. See Section 15: “Certain United States Federal Income Tax Considerations.”

The Amended Warrants and the shares of Common Stock issued under the Offer and issuable upon exercise of the Amended Warrants are restricted

securities and can only be sold pursuant to an effective registration statement or an available exemption from registration under the Securities Act.

The Amended Warrants, the shares of Common Stock issued under the Offer and the shares of Common Stock issuable upon exercise of the Amended Warrants are

being issued in reliance upon exemptions from the Securities Act. Therefore, the Amended Warrants, the shares of Common Stock issued under the Offer and the shares of Common Stock issuable upon exercise of the Amended Warrants are “restricted

securities” within the meaning of the Securities Act and cannot be resold except pursuant to an effective registration statement or an exemption from registration under the Securities Act. However, the shares of Common Stock issued under the

Offer shall be deemed to have been acquired at the time the Eligible Note was originally acquired and will be available for resale under Rule 144 under the Securities Act, assuming that all requirements of Rule 144 are met, including the fact that

six months has passed since your acquisition of your Eligible Note and the fact that we are current in our reporting obligations under the Exchange Act at that time. See Section 10 of the Offer: “Description of the Convertible Promissory

Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration.” See Section 10 of the Offer: “Description of the Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of

Consideration.”

7

THE OFFER

| 1. |

Background and Purpose of the Offer. |

Background

As further described in Section 10: “Description of Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of

Consideration,” we issued convertible promissory notes, which we refer to as the Eligible Notes, and warrants to purchase our Common Stock, which we refer to as the Eligible Warrants, to accredited investors in connection with a private

placement between April 30, 2015 and May 15, 2015. All Eligible Notes mature six months from their date of issuance, and all Eligible Warrants expire on the fifth anniversary of their respective dates of issuance. Information concerning

the Eligible Notes and the Eligible Warrants, including the number outstanding, exercise price and expiration dates, are described in Section 10: “Description of Convertible Promissory Notes and Warrants to Purchase Common Stock; Source

and Amount of Consideration.” These Eligible Notes and Eligible Warrants are the only securities eligible to participate in the Offer.

Purpose of

the Offer

We are making the Offer to settle the balances of the Eligible Notes and give the holders of the Eligible Securities an opportunity to

obtain shares of our Common Stock at a discount to the current conversion price and exercise price of the Eligible Securities. The principal and interest for Eligible Notes that are not exchanged in the Offer, or otherwise converted pursuant to

their terms, will become due and payable between October 30, 2015 and November 15, 2015, six months from their date of issuance. In order to repay the Eligible Notes on maturity, we will need to raise additional capital, which may not be

available at that time. The Offer permits us to relieve some of our outstanding debt and improve our capital structure as we seek to raise additional financing in the near term to finance our operations.

We are offering holders of outstanding Eligible Securities, for a limited period of time,

the opportunity to voluntarily exchange their Eligible Notes for Common Stock at a discount to the current conversion price of the Eligible Notes and for the reduction in the exercise price of their Eligible Warrants, upon the terms and subject to

the conditions described in this Offering Memorandum and the related Election Form. This Offering Memorandum and the related Election Form will be mailed to record holders of Eligible Notes whose names appear in our corporate records as of the date

of this Offering Memorandum.

The securities eligible to participate in the Offer are the Convertible Promissory Notes and Warrants to Purchase Common

Stock (which are together herein referred to as the Eligible Securities), issued to accredited investors in a private placement between April 30, 2015 and May 15, 2015, as further described in Section 10: “Description of

Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration.” The table below sets forth the outstanding Eligible Securities as of the date of this Offering Memorandum, including the exercise and

conversion prices and expiration and maturity dates of such securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount

Outstanding |

|

|

Conversion

Price

per Share |

|

|

Maturity

Dates |

|

| Eligible Notes |

|

$ |

3,981,050 |

|

|

$ |

0.75 |

|

|

|

10/30/2015 –

11/15/2015 |

|

|

|

|

|

| |

|

Number

Outstanding |

|

|

Exercise

Price

per Share |

|

|

Expiration

Dates |

|

| Eligible Warrants |

|

|

1,061,585 |

|

|

$ |

0.75 |

|

|

|

4/30/2020 –5/15/2020 |

|

8

For additional information concerning the Eligible Securities see Section 10: “Description of

Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration.”

If you properly tender (and do not validly

withdraw) your Eligible Note on or prior to the expiration of the Offer, and the Offer is not otherwise terminated, we will issue you Common Stock and amend the price of your related Eligible Warrants promptly following the expiration of the Offer.

See Section 5: “Acceptance of Eligible Notes; Issuance of Common Stock; Amendment of Eligible Warrants.”

The Offer is only being made for

outstanding, unexercised Eligible Notes issued to accredited investors in a private placement offering between April 30, 2015 and May 15, 2015. The Offer does not in any way apply to shares previously purchased, whether upon the conversion

or exercise of the Eligible Securities or otherwise, nor does it apply to any of our other outstanding convertible notes, warrants or stock options. Any portion of an Eligible Note or Eligible Warrant that you have previously converted or exercised

is no longer outstanding and is therefore not subject to the Offer. If you have converted an Eligible Note in part or exercised an Eligible Warrant in part, the remaining unconverted or unexercised portion that remains outstanding is eligible for

participation in the Offer. Eligible Securities for which you have properly submitted, prior to the date of the commencement of the Offer, a conversion notice or an exercise form, along with the applicable conversion price or exercise price, will be

considered to have been previously converted or exercised, whether or not you have received confirmation of the conversion or exercise of such securities.

| 3. |

Exchange of Eligible Notes. |

By properly tendering (and not validly withdrawing) your Eligible Note for

exchange, assuming your Eligible Note is accepted by the Company pursuant to the terms of the Offer and the Offer is not otherwise terminated, your Eligible Note will be considered to have been exchanged for Common Stock and for the amendment of

your Eligible Warrants concurrently with the expiration of the Offer.

We will issue the shares of our Common Stock for which your Eligible Note were

exchanged and deem the exercise price of your related Eligible Warrants amended promptly following the expiration of the Offer, and such Eligible Notes that are validly tendered will be cancelled. If you elect to participate in the Offer, you must

tender your Eligible Note in full – no partial tenders will be accepted. The Offer is not conditioned upon any minimum number of holders electing to participate or any minimum aggregate principal amount of Eligible Notes being tendered for

exchange, and is not conditioned upon any required financing. The Offer is, however, subject to certain conditions. See Section 8: “Conditions of the Offer.”

| 4. |

Procedures for Tendering Eligible Notes. |

You do not have to participate in the Offer, and there are no

repercussions if you choose not to participate in the Offer. If you decide not to participate in the Offer, you do not need to do anything and your Eligible Note and Eligible Warrants will remain outstanding on the same terms and conditions

(including the $0.75 conversion price and exercise price) under which they were originally issued.

We will not accept any Eligible Notes for exchange

that have not been properly tendered in accordance with the terms and conditions set forth in this Offering Memorandum and the related Election Form. We will return to the tendering security holders any Eligible Notes that we do not accept in the

Offer at our expense promptly after the expiration of the Offer.

Proper Tender of Eligible Notes

To participate in the Offer, you must properly complete, sign and date the Election Form included with this Offering Memorandum and mail or otherwise deliver

it to usin an acceptable manner described herein, with your Eligible Note (or an Affidavit of Lost Note), so that we receive them no later than the expiration of the Offer at 11:59 P.M. (Eastern time) on September 21, 2015 (or such later date

and time as we may extend the expiration of the Offer), at:

CytoDyn Inc.

Attention: Michael D. Mulholland

1111 Main Street, Suite 660

Vancouver, Washington 98660

9

PLEASE NOTE THAT DELIVERY OF THE ELECTION FORM BY FACSIMILE OR EMAIL WILL NOT BE ACCEPTED.

The Election Form should clearly indicate each Eligible Note you are tendering pursuant to the terms and conditions set forth in this Offering Memorandum.

The Election Form must be executed by the record holder of the tendered Eligible Note. However, if the signature is by a trustee, executor, administrator,

guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative capacity, the signer’s full title and proper evidence of the authority of such person to act in such capacity must be indicated on

the Election Form.

If you do not submit an Election Form for your Eligible Note prior to the expiration of the Offer, or if you submit an incomplete or

incorrectly completed Election Form, you will be considered to have rejected the Offer.

The only acceptable methods of delivery of all documents are by

mail or courier service and at your expense and risk. If you deliver by mail, we recommend that you use registered mail with return receipt requested. In all cases, you should allow sufficient time to ensure timely delivery on or prior to the

expiration of the Offer. Delivery will be deemed made only when actually received by us.

Determination of Validity; Rejection of Eligible Notes;

Waiver of Defects; No Obligation to Give Notice of Defects

We will determine, in our sole discretion, all questions as to form, validity, (including

time of receipt), and acceptance of any tender of Eligible Notes or withdrawal of tendered Eligible Notes. Our determination of these matters will be final and binding on all parties, subject to the judgment of a court of competent jurisdiction to

the contrary. We may reject any or all tenders of or withdrawals of tendered Eligible Notes that we determine are not in appropriate form or that we determine are unlawful to accept or not timely made, subject to the judgment of a court of competent

jurisdiction to the contrary. We may waive, as to all eligible security holders, any defect or irregularity in any tender with respect to any particular Eligible Notes. No tender of Eligible Notes or withdrawal of tendered Eligible Notes will be

deemed to have been properly made until all defects or irregularities have been cured by the tendering security holder or waived by us. Neither we nor any other person is obligated to give notice of any defects or irregularities in tenders

or withdrawals, and no one will be liable for failing to give notice of any defects or irregularities.

| 5. |

Acceptance of Eligible Notes; Issuance of Common Stock and Amendment of Eligible Warrants. |

Upon the

terms and subject to the conditions of the Offer, we expect, upon and as of the expiration of the Offer to:

| |

• |

|

accept for exchange all properly tendered and not validly withdrawn Eligible Notes; and |

| |

• |

|

treat all such tendered Eligible Notes as exchanged for Common Stock and for the amendment of the related Eligible Warrants as described in this Offering Memorandum. |

Promptly after the expiration of the Offer, we will issue shares of our Common Stock and deem the exercise price of your Eligible Warrants amended in exchange

for your Eligible Note, and such Eligible Notes that are validly tendered will be cancelled. If we withdraw the Offer or if, at the expiration of the Offer, we do not accept the tender of your Eligible Note for any valid reason described in this

Offering Memorandum, we will promptly return to you your tendered Eligible Note.

By properly tendering (and not validly withdrawing) your Eligible Note,

you will have accepted the Offer. Our acceptance of your Eligible Note for tender will form a binding agreement between you and us upon the terms and subject to the conditions set forth in this Offering Memorandum and the related Election Form upon

the expiration of the Offer.

10

If you elect not to participate in the Offer, your Eligible Note will remain outstanding on the same terms and

conditions (including the $0.75 conversion price and exercise price) under which they were originally issued.

| 6. |

Extension of the Offer; Termination; Amendment. |

The expiration of the Offer is currently scheduled to

be 11:59 P.M. (Eastern time) on September 21, 2015. Although we do not currently intend to do so, we may, at any time and at our discretion, extend the period of time during which the Offer is open and delay accepting any tendered Eligible

Notes. If we extend the Offer, we will continue to accept properly completed Election Forms until the new expiration date.

Amendments to the Offer may be

made at any time and from time to time by an announcement. In the case of an extension, the announcement must be issued no later than 9:00 A.M. (Eastern time) on the next business day after the last previously scheduled or announced expiration date.

Any announcement made pursuant to the Offer will be disseminated promptly to holders of Eligible Securities in a manner reasonably designed to inform such holders of such amendment. Without limiting the manner in which we may choose to make an

announcement, except as required by applicable law, we have no obligation to publish, advertise or otherwise communicate any such announcement other than by issuing a press release.

We also expressly reserve the right, in our reasonable judgment, prior to the expiration of the Offer, to terminate or amend the Offer and to postpone our

acceptance of any tendered Eligible Notes upon the occurrence of any of the conditions specified under Section 8: “Conditions of the Offer” by, in addition to the procedure set forth herein, giving written notice of the

termination, amendment or postponement. Our reservation of the right to delay our acceptance of tendered Eligible Notes is limited by Rule 13e-4(f)(5) under the Exchange Act, which requires that we

must deliver the consideration offered or return the Eligible Notes tendered promptly after termination or withdrawal of a tender offer.

If we materially

change the terms of the Offer or the information set forth in this Offering Memorandum, or if we waive a material condition of the Offer, we will extend the Offer to the extent required by Rules 13e-4(d)(2) and 13e-4(e)(3) under the Exchange Act.

These rules require that the minimum period during which an offer must remain open following material changes in the terms of the Offer or information set forth in this Offering Memorandum, other than a change in percentage of securities sought,

will depend on the facts and circumstances, including the relative materiality of such terms or information.

You may change your election and withdraw from the Offer your tendered Election Form

and Eligible Notes only if you properly complete, sign and date the Withdrawal Form included with this Offering Memorandum and mail or otherwise deliver (in an acceptable manner described herein) the Withdrawal Form to us so that it is received no

later than the expiration of the Offer at 11:59 P.M. (Eastern time) on September 21, 2015 (or such later date and time as we may extend the expiration of the Offer), at:

CytoDyn Inc.

Attention: Michael

D. Mulholland

1111 Main Street, Suite 660

Vancouver, Washington 98660

PLEASE NOTE

THAT DELIVERY OF THE WITHDRAWAL FORM BY FACSIMILE OR EMAIL WILL NOT BE ACCEPTED.

The Withdrawal Form must be executed by the record holder of the

Eligible Notes to be withdrawn. However, if the signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative capacity, the signer’s full title

and proper evidence of the authority of such person to act in such capacity must be indicated on the Withdrawal Form.

11

You may also withdraw your tendered Election Form and Eligible Notes pursuant to Rule 13e-4(f)(2)(ii) under the

Exchange Act, if they have not been accepted by us for exchange within 40 business days from the commencement of the Offer. For the purposes of the Offer, a “business day” means any day other than Saturday, Sunday or a U.S. federal holiday

and consists of the time period from 12:01 A.M. through 12:00 midnight (Eastern time).

The only acceptable methods of delivery of all documents are by

mail or courier service and at your expense and risk. If you deliver by mail, we recommend that you use registered mail with return receipt requested. In all cases, you should allow sufficient time to ensure timely delivery on or prior to the

expiration of the Offer. Delivery will be deemed made only when actually received by us.

Once you have withdrawn your tendered Election Form and Eligible

Note, you may re-tender before the expiration of the Offer only by again following the delivery procedures described in this Offering Memorandum.

| 8. |

Conditions of the Offer. |

Conditions Applicable to all Eligible Notes

Notwithstanding any other provision of the Offer, we will not be required to accept any tendered Eligible Notes, and we may terminate or amend the Offer, or

postpone our acceptance of any tendered Eligible Notes, in each case, subject to Rule 13e-4(f)(5) under the Exchange Act, if at any time on or after the commencement of the Offer and before the expiration of the Offer, any of the following events

has occurred and, in our reasonable judgment and regardless of the circumstances giving rise to the event, the occurrence of such event or events (other than an act or omission to act by us) makes it inadvisable for us to proceed with the Offer or

with the acceptance of the tendered Eligible Notes:

| (a) |

there shall have been threatened in writing or instituted or be pending any action or proceeding by any government or governmental, regulatory or administrative agency, authority or tribunal or any other person,

domestic or foreign, before any court, authority, agency or tribunal that challenges the making of the Offer, the issuance of the Common Stock, the amendment of the Eligible Warrants, or otherwise relates in any manner to the Offer or that, in our

reasonable judgment, could materially and adversely affect our business, condition (financial or otherwise), income, operations or prospects, or otherwise materially impair in any way the contemplated future conduct of our business or materially

impair the contemplated benefits of the Offer to us; |

| (b) |

there shall have been any action threatened in writing, pending or taken, or approval withheld, or any statute, rule, regulation, judgment, order or injunction threatened in writing, proposed, sought, promulgated,

enacted, entered, amended, enforced or deemed to be applicable to the Offer or us, by any court or any authority, agency or tribunal that, in our reasonable judgment, would or might: |

| |

• |

|

make the acceptance of the Eligible Notes tendered for exchange illegal or otherwise restrict or prohibit consummation of the Offer or otherwise relate in any manner to the Offer; |

| |

• |

|

delay or restrict our ability, or render us unable, to accept for exchange, some or all of the Eligible Notes tendered for exchange; |

| |

• |

|

materially impair the benefits we hope to receive as a result of the Offer; or |

| |

• |

|

materially and adversely affect our business, condition (financial or other), income, operations or prospects, or otherwise materially impair in any way the contemplated future conduct of our business or materially

impair the contemplated benefits of the Offer to us, including any position adopted by the SEC that this Offer jeopardizes or invalidates the exemption from the requirement to register securities under the Securities Act upon which we relied when

selling the Eligible Securities; |

12

| (c) |

there shall have occurred: |

| |

• |

|

any general suspension of trading in, or limitation on prices for, securities on any national securities exchange or in the over-the-counter market; |

| |

• |

|

the declaration of a banking moratorium or any suspension of payments in respect of banks in the United States, whether or not mandatory; |

| |

• |

|

the commencement of a war, terrorist act, armed hostilities or other international or national crisis directly or indirectly involving the United States; |

| |

• |

|

any limitation, whether or not mandatory, by any governmental, regulatory or administrative agency or authority on, or any event that in our reasonable judgment might affect, the extension of credit by banks or other

lending institutions in the United States; or |

| |

• |

|

in the case of any of the foregoing existing at the time of the commencement of the Offer, a material acceleration or worsening thereof; or |

| (d) |

a tender or exchange offer with respect to some or all of our Common Stock, or a merger or acquisition proposal for us (other than the merger relating to our reincorporation in Delaware, which is discussed in

Section 11: “Information Regarding CytoDyn”), shall have been proposed, announced or made by another person or entity or shall have been publicly disclosed, or we shall have learned that: |

| |

• |

|

any person, entity or “group,” within the meaning of Section 13(d)(3) of the Exchange Act, shall have acquired or proposed to acquire beneficial ownership of more than 5% of the outstanding shares of our

Common Stock, or any new group shall have been formed that beneficially owns more than 5% of the outstanding shares of our Common Stock, other than any such person, entity or group that has filed a Schedule 13D or Schedule 13G with the SEC before

the date of this Offering Memorandum; |

| |

• |

|

any such person, entity or group that has filed a Schedule 13D or Schedule 13G with the SEC before the date of this Offering Memorandum shall have acquired or proposed to acquire beneficial ownership of an additional 2%

or more of the outstanding shares of our Common Stock; or |

| |

• |

|

any person, entity or group shall have filed a Notification and Report Form under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 or made a public announcement reflecting an intent to acquire us or any of the

assets or securities of us. |

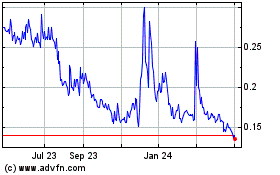

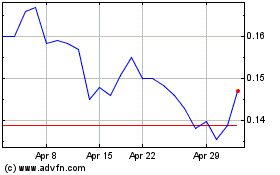

| 9. |

Market for Our Common Stock. |

Shares of our Common Stock are quoted on the OTCQB of the OTC Markets

Group under the symbol “CYDY.” As of August 14, 2015, the number of record holders of our Common Stock was approximately 330 and the number of shares of Common Stock outstanding was 79,604,624.

The following table contains information about the range of high and low sale prices for our Common Stock based upon reports of transactions on the OTCQB.

13

|

|

|

|

|

|

|

|

|

| Period |

|

High |

|

|

Low |

|

| Fiscal Year Ended May 31, 2014: |

|

|

|

|

|

|

|

|

| First quarter ended August 31, 2013 |

|

$ |

1.10 |

|

|

$ |

0.65 |

|

| Second quarter ended November 30, 2013 |

|

$ |

1.50 |

|

|

$ |

0.70 |

|

| Third quarter ended February 28, 2014 |

|

$ |

1.40 |

|

|

$ |

0.79 |

|

| Fourth quarter ended May 31, 2014 |

|

$ |

1.00 |

|

|

$ |

0.54 |

|

|

|

|

| Fiscal Year Ended May 31, 2015: |

|

|

|

|

|

|

|

|

| First quarter ended August 31, 2014 |

|

$ |

1.12 |

|

|

$ |

0.54 |

|

| Second quarter ended November 30, 2015 |

|

$ |

1.25 |

|

|

$ |

0.66 |

|

| Third quarter ended February 28, 2015 |

|

$ |

1.30 |

|

|

$ |

0.68 |

|

| Fourth quarter ended May 31, 2015 |

|

$ |

1.09 |

|

|

$ |

0.63 |

|

|

|

|

| Subsequent Interim Period: |

|

|

|

|

|

|

|

|

| June 1, 2015 through August 21, 2015 |

|

$ |

1.08 |

|

|

$ |

0.76 |

|

The source of these high and low prices was the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up,

markdown or commissions and may not represent actual transactions.

| 10. |

Description of Convertible Promissory Notes and Warrants to Purchase Common Stock; Source and Amount of Consideration. |

Eligible Securities

The securities eligible to

participate in the Offer are the Convertible Promissory Notes and Warrants to Purchase Common Stock (which are together herein referred to as the Eligible Securities), issued to accredited investors in a private placement between April 30, 2015

and May 15, 2015. The table below sets forth the outstanding Eligible Securities as of the date of this Offering Memorandum, including the exercise and conversion prices and expiration and maturity dates of such securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount

Outstanding |

|

|

Conversion

Price

per Share |

|

|

Maturity

Dates |

|

| Eligible Notes |

|

$ |

3,981,050 |

|

|

$ |

0.75 |

|

|

|

10/30/2015 –

11/15/2015 |

|

|

|

|

|

| |

|

Number

Outstanding |

|

|

Exercise

Price

per Share |

|

|

Expiration

Dates |

|

| Eligible Warrants |

|

|

1,061,585 |

|

|

$ |

0.75 |

|

|

|

4/30/2020 –

5/15/2020 |

|

Terms of the Eligible Notes

The Eligible Notes were issued between April 30, 2015 and May 15, 2015. The Eligible Notes are the general unsecured obligations of the Company and

rank pari passu with the Company’s other existing unsecured convertible promissory notes. The principal amount of the Eligible Notes plus unpaid accrued interest is convertible at the election of the holders into shares of Common Stock

at any time prior to maturity at an initial conversion price of $0.75 per share. The Eligible Notes bear simple interest at the annual rate of 7.0%. Principal and accrued interest, to the extent not previously paid in cash or converted, is due and

payable in full six months from the date of issuance of the Eligible Notes.

14

Terms of the Eligible Warrants

The Eligible Warrants are exercisable for 20% of the shares into which the Eligible Notes were convertible at issuance (based upon an initial conversion price

of $0.75). The Eligible Warrants are exercisable at a price of $0.75 per share. The Eligible Warrants are currently exercisable in full and will expire five years from the date of issuance.

Effect of Exchange of Notes on the Availability of Rule 144

The shares of Common Stock issuable under the Offer are being issued in reliance upon exemptions from the Securities Act of 1933, as amended (which we refer to

as the Securities Act in this Offering Memorandum). Therefore, the shares of Common Stock issuable under the Offer are “restricted securities” within the meaning of the Securities Act and cannot be resold except pursuant to an effective

registration statement or an exemption from registration under the Securities Act. However, the shares of Common Stock issued under the Offer shall be deemed to have been acquired at the time the Eligible Notes were acquired and could be available

for resale under Rule 144 under the Securities Act upon the expiration of the applicable holding period, which is at least six months from the date of the original issuance of the Eligible Notes, assuming that all requirements of Rule 144 are met

and we are current in our reporting obligations under the Securities Exchange Act of 1934, as amended (which we refer to herein as the Exchange Act), at that time. The exchange of Eligible Notes for the shares of Common Stock under the Offer would

not have any effect on the availability of a holder to sell the shares of Common Stock acquired under Rule 144. For purposes of this discussion, we refer to the period of time that a person is deemed to have beneficially owned the shares of our

Common Stock issuable under the Offer or upon exercise of and Eligible Warrant as the “holding period.”

In general, under Rule 144, as

currently in effect, a person (or persons whose shares are aggregated) who is not deemed to have been an affiliate of ours at any time during the three months preceding a sale of the shares of our Common Stock issued upon conversion of a convertible

note would be entitled to sell those shares under Rule 144 after a holding period of at least six months (including any period of consecutive ownership of preceding non-affiliated holders), subject to the availability of current public information

about us and provided that we have filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months, other than Current Reports on Form 8-K. For purposes of

determining the holding period under Rule 144, you are permitted to “tack” the holding period of the Eligible Notes to the shares of Common Stock issued in this transaction.

The Amended Warrants and shares of Common Stock issuable upon exercise of the Amended Warrants are being issued in reliance upon exemptions from the

Securities Act. Therefore, the Amended Warrants and the shares of Common Stock issuable upon exercise of the Amended Warrants are “restricted securities” within the meaning of the Securities Act and cannot be resold except pursuant to an

effective registration statement or an exemption from registration under the Securities Act. When you exercise the purchase of shares under your Amended Warrant for cash, the holding period for the shares of Common Stock acquired upon such exercise

would begin on the date of such exercise.

Consideration for the Exchange

We will issue the shares of Common Stock and amend the exercise price Eligible Warrants in the manner described in this Offering Memorandum in exchange for

Eligible Notes properly elected to be exchanged, and not validly withdrawn, by you and accepted by us for such exchange.

| 11. |

Information Regarding CytoDyn. |

Overview

CytoDyn Inc. is a publicly traded biotechnology company focused on the clinical development and potential commercialization of humanized monoclonal antibodies

to treat Human Immunodeficiency Virus (“HIV”) infection. Our lead product candidate, PRO 140, belongs to a class of HIV therapies known as entry inhibitors. These therapies block HIV from entering into and infecting certain cells.

Although CytoDyn intends to focus its efforts on PRO 140, we also hold certain rights in two proprietary platform technologies: Cytolin®, a humanized monoclonal antibody targeting HIV with a

mechanism of action which may prove to be synergistic to that of PRO 140 and other treatments, and CytoFeline™, a felinized-monoclonal antibody targeting Feline Immunodeficiency Virus.

15

Our Common Stock is traded on the OTCQB under the symbol “CYDY.” Our principal executive offices are

located at 1111 Main Street, Suite 660, Vancouver, Washington 98660, and our telephone number is (360) 980-8524. Our internet address is http://www.cytodyn.com/. Information contained on our website does not constitute a part of the

Offer.

For additional information regarding the Company, you should also review the materials that we have filed with the SEC and have listed in

Section 17: “Additional Information.”

Reincorporation in Delaware