Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 19 2015 - 6:01AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Dated May 18, 2015

Registration Statement No. 333-184198

McDONALD’S CORPORATION

USD 700 Million 2.200% Medium-Term Notes Due 2020

Summary of Terms

|

Issuer: |

|

McDonald’s Corporation |

|

Ratings: |

|

Moody’s: A3 (Stable), S&P: A– (Stable), Fitch: BBB+ (Stable)* |

|

Trade Date: |

|

May 18, 2015 |

|

Settlement Date: |

|

May 26, 2015 (T + 5) |

|

Maturity Date: |

|

May 26, 2020 |

|

Security Description: |

|

SEC-Registered Senior Unsecured Fixed Rate Medium-Term Notes |

|

Total Principal Amount: |

|

USD 700,000,000 |

|

Coupon: |

|

2.200% |

|

Issue Price: |

|

99.812% of the principal amount |

|

Yield to Maturity: |

|

2.240% |

|

Spread to Benchmark Treasury: |

|

T + 70 basis points |

|

Benchmark Treasury: |

|

1.375% 5-year note due April 30, 2020 |

|

Benchmark Treasury Yield: |

|

1.540% |

|

Coupon Payments: |

|

Pays Semi-Annually on the 26th day of May and November, beginning November 26, 2015 |

|

Day Count: |

|

30 / 360 |

|

Redemption Provision: |

|

The 2020 Notes will be redeemable at any time prior to April 26, 2020 (one month prior to the maturity date), at the option of McDonald’s Corporation, in whole or in part, at a redemption price equal to the greater of: (1) 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest on those Notes to the redemption date; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed (not including any portion of payments of interest accrued as of the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 12.5 basis points, plus accrued and unpaid interest on those Notes to the redemption date. The 2020 Notes will be redeemable in whole or in part, at any time on or after April 26, 2020 (one month prior to the maturity date) at the Company’s option, at a redemption price equal to 100% of the principal amount of such series of the Notes to be redeemed, plus accrued |

* A credit rating is not a recommendation to buy, sell or hold securities. It may be subject to revision or withdrawal at any time by the assigning credit rating agency. Each credit rating is applicable only to the specific security to which it applies. Investors should make their own evaluation as to whether an investment in the security is appropriate.

|

|

|

and unpaid interest on those Notes to the redemption date. |

|

Joint Bookrunners: |

|

Citigroup Global Markets Inc. |

|

|

|

Goldman, Sachs & Co. |

|

|

|

J.P. Morgan Securities LLC |

|

|

|

Merrill Lynch, Pierce, Fenner & Smith |

|

|

|

Incorporated |

|

|

|

Mizuho Securities USA Inc. |

|

|

|

Morgan Stanley & Co. LLC |

|

|

|

Wells Fargo Securities, LLC |

|

CUSIP: |

|

58013MET7 |

|

ISIN: |

|

US58013MET71 |

USD 700 Million 3.375% Medium-Term Notes Due 2025

Summary of Terms

|

Issuer: |

|

McDonald’s Corporation |

|

Ratings: |

|

Moody’s: A3 (Stable), S&P: A– (Stable), Fitch: BBB+ (Stable)* |

|

Trade Date: |

|

May 18, 2015 |

|

Settlement Date: |

|

May 26, 2015 (T + 5) |

|

Maturity Date: |

|

May 26, 2025 |

|

Security Description: |

|

SEC-Registered Senior Unsecured Fixed Rate Medium-Term Notes |

|

Total Principal Amount: |

|

USD 700,000,000 |

|

Coupon: |

|

3.375% |

|

Issue Price: |

|

99.848% of the principal amount |

|

Yield to Maturity: |

|

3.393% |

|

Spread to Benchmark Treasury: |

|

T + 115 basis points |

|

Benchmark Treasury: |

|

2.125% 10-year note due May 15, 2025 |

|

Benchmark Treasury Yield: |

|

2.243% |

|

Coupon Payments: |

|

Pays Semi-Annually on the 26th day of May and November, beginning November 26, 2015 |

|

Day Count: |

|

30 / 360 |

|

Redemption Provision: |

|

The 2025 Notes will be redeemable at any time prior to February 26, 2025 (three months prior to the maturity date), at the option of McDonald’s Corporation, in whole or in part, at a redemption price equal to the greater of: (1) 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest on those Notes to the redemption date; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed (not including any portion of payments of interest accrued as of the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury |

* A credit rating is not a recommendation to buy, sell or hold securities. It may be subject to revision or withdrawal at any time by the assigning credit rating agency. Each credit rating is applicable only to the specific security to which it applies. Investors should make their own evaluation as to whether an investment in the security is appropriate.

|

|

|

Rate plus 20 basis points, plus accrued and unpaid interest on those Notes to the redemption date. The 2025 Notes will be redeemable in whole or in part, at any time on or after February 26, 2025 (three months prior to the maturity date) at the Company’s option, at a redemption price equal to 100% of the principal amount of such series of the Notes to be redeemed, plus accrued and unpaid interest on those Notes to the redemption date. |

|

Joint Bookrunners: |

|

Citigroup Global Markets Inc. |

|

|

|

Goldman, Sachs & Co. |

|

|

|

J.P. Morgan Securities LLC |

|

|

|

Merrill Lynch, Pierce, Fenner & Smith |

|

|

|

Incorporated |

|

|

|

Mizuho Securities USA Inc. |

|

|

|

Morgan Stanley & Co. LLC |

|

|

|

Wells Fargo Securities, LLC |

|

CUSIP: |

|

58013MEU4 |

|

ISIN: |

|

US58013MEU45 |

USD 600 Million 4.600% Medium-Term Notes Due 2045

Summary of Terms

|

Issuer: |

|

McDonald’s Corporation |

|

Ratings: |

|

Moody’s: A3 (Stable), S&P: A– (Stable), Fitch: BBB+ (Stable)* |

|

Trade Date: |

|

May 18, 2015 |

|

Settlement Date: |

|

May 26, 2015 (T + 5) |

|

Maturity Date: |

|

May 26, 2045 |

|

Security Description: |

|

SEC-Registered Senior Unsecured Fixed Rate Medium-Term Notes |

|

Total Principal Amount: |

|

USD 600,000,000 |

|

Coupon: |

|

4.600% |

|

Issue Price: |

|

99.968% of the principal amount |

|

Yield to Maturity: |

|

4.602% |

|

Spread to Benchmark Treasury: |

|

T + 155 basis points |

|

Benchmark Treasury: |

|

2.500% 30-year bond due February 15, 2045 |

|

Benchmark Treasury Yield: |

|

3.052% |

|

Coupon Payments: |

|

Pays Semi-Annually on the 26th day of May and November, beginning November 26, 2015 |

|

Day Count: |

|

30 / 360 |

|

Redemption Provision: |

|

The 2045 Notes will be redeemable at any time prior to November 26, 2044 (six months prior to the maturity date), at the option of McDonald’s Corporation, in whole or in part, at a redemption price equal to the greater of: (1) 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest on those |

* A credit rating is not a recommendation to buy, sell or hold securities. It may be subject to revision or withdrawal at any time by the assigning credit rating agency. Each credit rating is applicable only to the specific security to which it applies. Investors should make their own evaluation as to whether an investment in the security is appropriate.

|

|

|

Notes to the redemption date; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed (not including any portion of payments of interest accrued as of the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 25 basis points, plus accrued and unpaid interest on those Notes to the redemption date. The 2045 Notes will be redeemable in whole or in part, at any time on or after November 26, 2044 (six months prior to the maturity date) at the Company’s option, at a redemption price equal to 100% of the principal amount of such series of the Notes to be redeemed, plus accrued and unpaid interest on those Notes to the redemption date. |

|

Joint Bookrunners: |

|

Citigroup Global Markets Inc. |

|

|

|

Goldman, Sachs & Co. |

|

|

|

J.P. Morgan Securities LLC |

|

|

|

Merrill Lynch, Pierce, Fenner & Smith |

|

|

|

Incorporated |

|

|

|

Mizuho Securities USA Inc. |

|

|

|

Morgan Stanley & Co. LLC |

|

|

|

Wells Fargo Securities, LLC |

|

CUSIP: |

|

58013MEV2 |

|

ISIN: |

|

US58013MEV28 |

Concurrent Offerings:

The issuer is offering, and expects to issue on May 26, 2015, under its Global Medium-Term Note Program pursuant to Regulation S under the Securities Act of 1933, as amended, (i) EUR 600 million Floating Rate Notes Due 2019; (ii) EUR 800 million 1.125% Notes Due 2022; and (iii) EUR 600 million 1.875% Notes Due 2027. The closing of the offering of the Notes offered hereby is not contingent on the concurrent offerings.

United States Tax Considerations:

The text under “United States Tax Considerations—U.S. Holders” in the Prospectus Supplement, dated September 28, 2012, summarizes certain U.S. federal income tax considerations that may be relevant to a holder of a note that is a “U.S. holder” (as defined therein). The paragraph under the caption “United States Tax Considerations—U.S. Holders—Information Reporting and Backup Withholding” is amended to read in its entirety as follows:

The paying agent or other reporting agent will be required to file information returns with the IRS with respect to payments made to certain U.S. holders. In addition, certain U.S. holders may be subject to a backup withholding tax (currently at a rate of 28%) in respect of these payments if they do not provide their taxpayer identification numbers to the paying agent or other reporting agent.

The text under “United States Tax Considerations—Non-U.S. Holders” in the Prospectus Supplement, dated September 28, 2012, summarizes certain U.S. federal income tax considerations that may be relevant to a holder of a note that is a “non-U.S. holder” (as defined therein). The paragraph under the

caption “United States Tax Considerations—Non-U.S. Holders” is amended to read in its entirety as follows:

If a holder is a non-resident alien individual or a foreign corporation that is the beneficial owner of the notes (a “non-U.S. holder”):

(a) payments of interest (including any original issue discount) on a note made to such non-U.S. holder will not be subject to withholding of U.S. federal income tax, provided that, with respect to payments of interest on a note, (i) the non-U.S. holder does not actually or constructively own 10 percent or more of the combined voting power of all classes of our stock and is not a controlled foreign corporation related to us through stock ownership; (ii) the beneficial owner provides a statement signed under penalties of perjury (typically, on IRS Form W-8BEN or W-8BEN-E) that includes its name and address and certifies that it is a non-U.S. holder in compliance with applicable requirements (or satisfies certain documentary evidence requirements for establishing that it is a non-U.S. holder); (iii) the non-U.S. holder has provided any direct or indirect information with respect to its direct and indirect U.S. owners; and (iv) if the non-U.S. holder or any intermediary through which it holds notes is a “foreign financial institution” (as defined below), each such entity has entered into an agreement with the U.S. government, pursuant to which it agrees, among other responsibilities, to collect and provide to the U.S. tax authorities information about its direct and indirect U.S. accountholders and investors, or otherwise establishes an exemption; and

(b) such non-U.S. holder will not be subject to U.S. federal income tax on gain realized on the sale, exchange or redemption of the note, provided that, (i) the gain of such holder is not effectively connected with the holder’s conduct of a trade or business in the United States (and, if certain treaties apply, is not attributable to a permanent establishment maintained by the non-U.S. holder within the United States); (ii) if the non-U.S. holder is an individual holder, such holder is not present in the United States for 183 days or more in the taxable year of the sale, exchange or redemption (and does not satisfy certain other conditions); and (iii) in the case of a sale, exchange, redemption or other taxable disposition of a note effected on or after January 1, 2017, (x) the non-U.S. holder has provided any direct or indirect information with respect to its direct and indirect U.S. owners; and (y) if the non-U.S. holder or any intermediary through which it holds notes is a “foreign financial institution” (as defined below), each such entity has entered into an agreement with the U.S. government, pursuant to which it agrees, among other responsibilities, to collect and provide to the U.S. tax authorities information about its direct and indirect U.S. accountholders and investors, or otherwise establishes an exemption.

If U.S. tax is imposed as a result of a failure to comply with the documentation requirements described in clauses (a)(iii) and (iv) or (b)(iii) above, the beneficial owner may be entitled to a refund if the required information is provided to the IRS.

For purposes of the discussion in paragraphs (a) and (b) above, a “foreign financial institution” generally is a non-U.S. entity that (i) accepts deposits in the ordinary course of a banking or similar business; (ii) as a substantial portion of its business, holds financial assets for the account of others; or (iii) is engaged (or holds itself out as being engaged) primarily in the business of investing, reinvesting, or trading in securities, partnership interests or commodities, or interests in securities, partnership interests or commodities.

U.S. information reporting requirements and backup withholding tax will not apply to payments on a note made to a non-U.S. holder if the statement described in paragraph (a)(ii) above is duly provided.

Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a holder’s U.S. federal income tax liability. A holder may obtain a refund of any excess amounts withheld under the backup withholding rules by filing the appropriate claim for a refund with the IRS and furnishing the required information.

Legal Matters

The text under “Legal Matters” in both the Prospectus, dated September 28, 2012, and the Prospectus Supplement, dated September 28, 2012, is amended and restated in its entirety to read as follows:

Either Gloria Santona, our Corporate Executive Vice President, General Counsel and Secretary, or Robert L. Switzer, our Corporate Vice President – Associate General Counsel and Assistant Secretary, will pass upon the validity of the notes for us. Ms. Santona and Mr. Switzer, each of whom is a full-time employee of ours, own, and have the right to acquire, through the exercise of options or otherwise, shares of our common stock directly and as a participant in various employee benefit plans.

Sidley Austin LLP, Chicago, Illinois, will pass upon the validity of the notes for the agents.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer or any agent participating in the offering will arrange to send you the prospectus if you request it by calling McDonald’s Corporation toll-free at 1-800-228-9623; Goldman, Sachs & Co. toll-free at 1-866-471-2526; J.P. Morgan Securities LLC collect at 1-212-834-4533; Merrill Lynch, Pierce, Fenner & Smith Incorporated toll-free at 1-800-294-1322; or Morgan Stanley & Co. LLC toll-free at 1-866-718-1649.

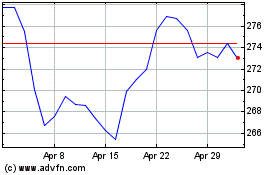

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024