SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [X]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[X] Soliciting Material under Rule 14a-12

BIGLARI HOLDINGS INC.

(Name of Registrant as Specified in its Charter)

Nicholas J. Swenson

Groveland Capital LLC

Groveland Hedged Credit Fund LLC

Groveland Master Fund Ltd.

Seth G. Barkett

Thomas R. Lujan

James W. Stryker

Ryan P. Buckley

Stephen J. Lombardo III

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

1.

|

Title of each class of securities to which transaction applies:

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4.

|

Proposed maximum aggregate value of transaction:

|

[ ] Fee paid previously with preliminary materials.

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1.

|

Amount Previously Paid:

|

|

2.

|

Form, Schedule or Registration Statement No.:

|

Filed by Groveland Group

The Groveland Group (as defined herein) recently issued a press release. A copy of the press release is attached hereto. The press release is being filed herewith under Rule 14a-12 of the Securities Exchange Act of 1934, as amended, by the Groveland Group.

Important Information

This filing is not a solicitation of a proxy from any security holder of Biglari Holdings Inc. (the “Company”). The Groveland Group (whose members are identified below) has nominated Nicholas J. Swenson, Seth G. Barkett, Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley as nominees to the Company’s board of directors and presently intends to solicit votes for the election of Nicholas J. Swenson, Seth G. Barkett, Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley as members of the Company’s board of directors (the “Groveland Nominees”). The Groveland Group will send a definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of the Groveland Nominees at the Company’s 2015 Annual Meeting of Shareholders. Shareholders are urged to read the definitive proxy statement and WHITE proxy card when they become available, because they will contain important information about the Groveland Group, the Groveland Nominees, the Company and related matters. Shareholders may obtain a free copy of the definitive proxy statement and WHITE proxy card (when available) and other documents filed by the Groveland Group with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement (when available) and other related SEC documents filed by the Groveland Group with the SEC may also be obtained free of charge from the Groveland Group.

Participants in Solicitation

The “Groveland Group” currently consists of the following persons who will be participants in the solicitation from the Company’s shareholders of proxies in favor of the Groveland Nominees: Groveland Master Fund Ltd. (formerly known as Groveland Hedged Credit Master Fund Ltd.), Groveland Hedged Credit Fund LLC, Groveland Capital LLC, Nicholas J. Swenson, and Seth G. Barkett. Along with the Groveland Group, the following are also participants in the solicitation: Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley. The participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the Notice of Intent to Nominate Directors and Submit Nominees for Election that the Groveland Group sent to the Company on November 21, 2014, as filed with the SEC on that same date, which is incorporated herein by reference.

Groveland Calls for Improved Corporate Governance at Biglari Holdings

MINNEAPOLIS, Jan. 22, 2015 /PRNewswire/ -- Groveland Capital LLC announced today that it has sent a letter to the Board of Directors of Biglari Holdings Inc. (NYSE: BH) proposing corporate governance reform. Groveland Capital believes that good corporate governance practices can drive significant value to all shareholders. The body of the letter is as follows:

Dear Members of the Board of Directors:

We believe that good corporate governance practices can drive significant value to all shareholders, as well as accrue to the benefit of management over the long-term. In this regard, we are concerned that board practices of Biglari Holdings Inc. (the “Company”) have ranked at the bottom of the possible range of the ISS Governance QuickScore, and that ISS has commented repeatedly on the outsized Chief Executive Officer (CEO) compensation not being in alignment with company performance. So, we are proposing a corporate governance reform plan to the Board of Directors. Specifically, we believe the Board should implement the following actions as soon as possible:

|

●

|

Redeem the Company’s limited partner interests in The Lion Fund, L.P. and The Lion Fund II, L.P. (collectively, the “investment partnerships”), with the redemption being effected in-kind.

|

|

●

|

After the in-kind redemption of the Company’s limited partner interests in the investment partnerships, retire or treat as treasury shares all of the Company’s shares formerly held by the investment partnerships, and implement a binding Company policy that all shares of the Company that are held by affiliates of the Company, where the Company funded, directly or indirectly, the purchase of such shares, are either not voted on matters brought before shareholders of the Company, or are mirror voted based on the votes cast by shareholders unaffiliated with such affiliates.

|

|

●

|

Eliminate the licensing agreement between the Company and its CEO.

|

|

●

|

Establish a binding Company policy that all direct and indirect compensation of Mr. Sardar Biglari, including compensation and fees received from investment partnerships in which the Company (or any of its subsidiaries) is a limited partner, and Mr. Biglari or his affiliate is the general partner, be approved by a Committee of the Board of Directors that is comprised of (1) members who have no long-time association with Mr. Biglari or any members of management of the Company, and (2) members who are independent in accordance with the director independence standards of the New York Stock Exchange.

|

|

●

|

Restructure the composition of the Company’s Board of Directors by appointing to the Board (a) two members elected by the Company’s current management; (b) two members elected by Groveland Master Fund Ltd., formerly known as Groveland Hedged Credit Master Fund Ltd. (“Groveland”), with both such members being independent in accordance with the director independence standards of the New York Stock Exchange; and (c) two members elected jointly by the Company’s current management and Groveland, with both such members being independent in accordance with the director independence standards of the New York Stock Exchange and both being selected from a list of 10 candidates prepared by a nationally recognized director search firm.

|

We request that the Board of Directors adopt the governance reform plan outlined above, in advance of the 2015 Annual Meeting. This will save the Company the time and expense of a proxy contest and allow management to focus on the day to day management of the Company.

Please feel free to call me at anytime at 612-843-4302. Please distribute a copy of this letter to every member of the Board of Directors. We look forward to a prompt response from the Board.

******

Important Information

This press release is not a solicitation of a proxy from any security holder of Biglari Holdings Inc. (the “Company”). The Groveland Group (whose members are identified below) has nominated Nicholas J. Swenson, Seth G. Barkett, Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley as nominees to the Company’s board of directors and presently intends to solicit votes for the election of Nicholas J. Swenson, Seth G. Barkett, Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley as members of the Company’s board of directors (the “Groveland Nominees”). The Groveland Group will send a definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of the Groveland Nominees at the Company’s 2015 Annual Meeting of Shareholders. Shareholders are urged to read the definitive proxy statement and WHITE proxy card when they become available, because they will contain important information about the Groveland Group, the Groveland Nominees, the Company and related matters. Shareholders may obtain a free copy of the definitive proxy statement and WHITE proxy card (when available) and other documents filed by the Groveland Group with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement (when available) and other related SEC documents filed by the Groveland Group with the SEC may also be obtained free of charge from the Groveland Group.

Participants in Solicitation

The “Groveland Group” currently consists of the following persons who will be participants in the solicitation from the Company’s shareholders of proxies in favor of the Groveland Nominees: Groveland Master Fund Ltd. (formerly known as Groveland Hedged Credit Master Fund Ltd.), Groveland Hedged Credit Fund LLC, Groveland Capital LLC, Nicholas J. Swenson, and Seth G. Barkett. Along with the Groveland Group, the following are also participants in the solicitation: Thomas R. Lujan, James W. Stryker, Stephen J. Lombardo III, and Ryan P. Buckley. The participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the Notice of Intent to Nominate Directors and Submit Nominees for Election that the Groveland Group sent to the Company on November 21, 2014, as filed with the SEC on that same date. These materials may be accessed from the SEC’s website free of charge.

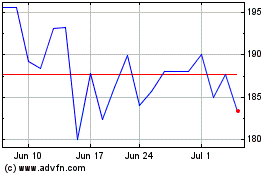

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

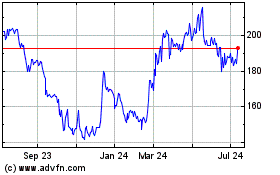

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024