UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 17, 2014

HALLIBURTON COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

| 001-03492 |

|

No. 75-2677995 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

| 3000 North Sam Houston Parkway East

Houston, Texas |

|

77032 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(281) 871-2699

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On November 17, 2014, Halliburton Company, a Delaware corporation

(the “Company”), and Baker Hughes Incorporated, a Delaware corporation (“Baker Hughes”), issued a joint press release. A copy of the press release is filed as Exhibit 99.1 hereto.

On November 17, 2014, the Company issued the following materials: a letter to its employees, a copy of which is filed as Exhibit 99.2

hereto; a letter to its customers, a copy of which is filed as Exhibit 99.3 hereto; talking points for use with customers, a copy of which is filed as Exhibit 99.4 hereto; FAQ for its sales force, a copy of which is filed as Exhibit 99.5 hereto; a

letter to its suppliers, a copy of which is filed as Exhibit 99.6 hereto; talking points for use with suppliers, a copy of which is filed as Exhibit 99.7 hereto; and talking points for use with its joint venture partners, a copy of which is filed as

Exhibit 99.8 hereto. A copy of the Company’s and Baker Hughes’ joint investor presentation is also filed as Exhibit 99.9 hereto, and a copy of the transcript of the joint conference call held at 7:00 a.m. Central Time on November 17,

2014 is filed as Exhibit 99.10 hereto.

* * *

Forward-Looking Statements

The statements in this Current Report on Form 8-K that are not historical statements, including statements regarding the expected timetable for

completing the proposed transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding the Company’s and Baker

Hughes’ future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These

statements are subject to numerous risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and

uncertainties include, but are not limited to: failure to obtain the required votes of the Company’s or Baker Hughes’ stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the

proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to

conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of the Company and Baker Hughes and the ultimate outcome of the

Company’s operating efficiencies applied to Baker Hughes’ products and services; the effects of the business combination of the Company and Baker Hughes, including the combined company’s future financial condition, results of

operations, strategy and plans; expected synergies and other benefits from the proposed transaction and the ability of the Company to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results

of litigation, settlements, and investigations; final court approval of, and the satisfaction of the conditions in, the Company’s September 2014 settlement relating to the Macondo well incident in the Gulf of Mexico; appeals of the

multi-district litigation District Court’s September 2014 ruling regarding Phase 1 of the trial, and future rulings of the District Court; results of litigation, settlements, and investigations not covered by the settlement or the District

Court’s rulings; actions by third parties, including governmental agencies, relating to the Macondo well incident; BP’s April 2012 settlement relating to the Macondo well incident, indemnification, and insurance matters; with respect to

repurchases of Company Common Stock, the continuation or suspension of the repurchase program, the amount, the timing and the trading prices of Company Common Stock, and the availability and alternative uses of cash; actions by third parties,

including governmental agencies; changes in the demand for or price of oil and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies

and legislative bodies and related publicity and potential adverse proceedings by such agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and

regulatory requirements, particularly those related to offshore oil and natural gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services and climate-related initiatives; compliance with laws related to income taxes

and assumptions regarding the generation of future taxable income; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international

trade and regulatory controls, and doing business with national oil companies; weather-related issues, including the effects of hurricanes and tropical storms; changes in capital spending by customers; delays or failures by customers to make

payments owed to us; execution of long-term, fixed-price contracts; impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; maintaining a highly skilled workforce; availability and cost of raw materials;

and integration of acquired businesses and operations of joint ventures. The Company’s and Baker Hughes’ respective reports on Form 10-K for the year ended December 31, 2013, Form 10-Q for the quarter ended September 30, 2014,

recent Current Reports on Form 8-K, and other U.S. Securities and Exchange Commission (the “SEC”) filings discuss some of the important risk factors identified that may affect these factors and the Company’s and Baker

Hughes’ respective business, results of operations and financial condition. The Company and Baker Hughes undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place

undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Information

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation

of any vote or approval. This communication relates to a proposed business combination between the Company and Baker Hughes. In connection with this proposed business combination, the Company and/or Baker Hughes may file one or more proxy

statements, registration statements, proxy statement/prospectus or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document the Company and/or

Baker Hughes may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND BAKER HUGHES ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER

DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of

the Company and/or Baker Hughes, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by the Company and/or Baker Hughes through the

website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s internet website at http://www.halliburton.com or by contacting the Company’s

Investor Relations Department by email at investors@Halliburton.com or by phone at +1-281-871-2688. Copies of the documents filed with the SEC by Baker Hughes will be available free of charge on Baker Hughes’ internet website at

http://www.bakerhughes.com or by contacting Baker Hughes’ Investor Relations Department by email at trey.clark@bakerhughes.com or alondra.oteyza@bakerhughes.com or by phone at +1-713-439-8039 or +1-713-439-8822.

Participants in Solicitation

The Company, Baker Hughes, their respective directors and certain of their respective executive officers may be considered participants in the

solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with

the SEC on February 7, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 8, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014, which was filed

with the SEC on October 24, 2014 and its Current Report on Form 8-K, which was filed with the SEC on July 21, 2014. Information about the directors and executive officers of Baker Hughes is set forth in its Annual Report on Form 10-K for the

year ended December 31, 2013, which was filed with the SEC on February 12, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 5, 2014, its Quarterly Report on Form 10-Q for the

quarter ended September 30, 2014, which was filed with the SEC on October 21, 2014 and its Current Reports on Form 8-K, which were filed with the SEC on June 10, 2014 and September 10, 2014. These documents can be obtained free

of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with the SEC when they become available.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Joint Press Release issued by the Company and Baker Hughes, dated November 17, 2014 |

|

|

| 99.2 |

|

Letter to Employees, dated November 17, 2014 |

|

|

| 99.3 |

|

Letter to Customers, dated November 17, 2014 |

|

|

| 99.4 |

|

Talking Points to Customers, dated November 17, 2014 |

|

|

| 99.5 |

|

FAQ to Sales Force, dated November 17, 2014 |

|

|

| 99.6 |

|

Letter to Suppliers issued on November 17, 2014 |

|

|

| 99.7 |

|

Talking Points to Suppliers, dated November 17, 2014 |

|

|

| 99.8 |

|

Talking Points to Joint Venture Partners, dated November 17, 2014 |

|

|

| 99.9 |

|

Joint Investor Presentation, dated November 17, 2014 |

|

|

| 99.10 |

|

Transcript of Joint Conference Call held November 17, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HALLIBURTON COMPANY |

|

|

|

|

| Date: November 17, 2014 |

|

|

|

By: |

|

/s/ Bruce A. Metzinger |

|

|

|

|

|

|

Bruce A. Metzinger |

|

|

|

|

|

|

Assistant Secretary |

EXHIBIT INDEX

|

|

|

| EXHIBIT

NUMBER |

|

EXHIBIT DESCRIPTION |

|

|

| 99.1 |

|

Joint Press Release issued by the Company and Baker Hughes, dated November 17, 2014 |

|

|

| 99.2 |

|

Letter to Employees, dated November 17, 2014 |

|

|

| 99.3 |

|

Letter to Customers, dated November 17, 2014 |

|

|

| 99.4 |

|

Talking Points to Customers, dated November 17, 2014 |

|

|

| 99.5 |

|

FAQ to Sales Force, dated November 17, 2014 |

|

|

| 99.6 |

|

Letter to Suppliers issued on November 17, 2014 |

|

|

| 99.7 |

|

Talking Points to Suppliers, dated November 17, 2014 |

|

|

| 99.8 |

|

Talking Points to Joint Venture Partners, dated November 17, 2014 |

|

|

| 99.9 |

|

Joint Investor Presentation, dated November 17, 2014 |

|

|

| 99.10 |

|

Transcript of Joint Conference Call held November 17, 2014 |

Exhibit 99.1

FOR IMMEDIATE RELEASE

HALLIBURTON AND BAKER HUGHES REACH AGREEMENT TO COMBINE IN

STOCK AND CASH TRANSACTION VALUED AT $34.6 BILLION

Baker Hughes Stockholders to Receive 1.12 Halliburton Shares Plus $19.00 in Cash for Each Share They Own

Transaction Values Baker Hughes at $78.62 per Share as of November 12, 2014

Highly Complementary Product Lines, Global Presence and Cutting-Edge Technologies Will enable Combined Company to Create Added Value for

Customers

Accretive to Halliburton Cash Flow by the End of Year One, with Nearly $2 Billion in Synergies and Significant Cash Flow

to Support Future Returns of Capital to Stockholders

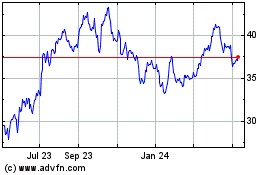

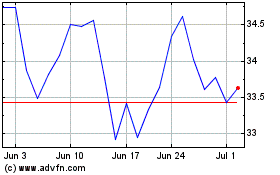

HOUSTON – November 17, 2014 - Halliburton Company (NYSE: HAL) and Baker Hughes

Incorporated (NYSE: BHI) today announced a definitive agreement under which Halliburton will acquire all the outstanding shares of Baker Hughes in a stock and cash transaction. The transaction is valued at $78.62 per Baker Hughes share, representing

an equity value of $34.6 billion and enterprise value of $38.0 billion, based on Halliburton’s closing price on November 12, 2014, the day prior to public confirmation by Baker Hughes that it was in talks with Halliburton regarding a

transaction. Upon the completion of the transaction, Baker Hughes stockholders will own approximately 36 percent of the combined company. The agreement has been unanimously approved by both companies’ Boards of Directors.

The transaction combines two highly complementary suites of products and services into a comprehensive offering to oil and natural gas customers. On a

pro-forma basis the combined company had 2013 revenues of $51.8 billion, more than 136,000 employees and operations in more than 80 countries around the world.

“We are pleased to announce this combination with Baker Hughes, which will create a bellwether global oilfield services company and offer compelling

benefits for the stockholders, customers and other stakeholders of Baker Hughes and Halliburton,” said Dave Lesar, Chairman and Chief Executive Officer of Halliburton. “The transaction will combine the companies’ product and service

capabilities to deliver an unsurpassed depth and breadth of solutions to our customers, creating a Houston-based global oilfield services champion, manufacturing and exporting technologies, and creating jobs and serving customers around the

globe.”

Lesar continued, “The stockholders of Baker Hughes will immediately receive a substantial premium and have

the opportunity to participate in the significant upside potential of the combined company. Our stockholders know our management team and know we live up to our commitments. We know how to create value, how to execute, and how to integrate in order

to make this combination successful. We expect the combination to yield annual cost synergies of nearly $2 billion. As such, we expect that the acquisition will be accretive to Halliburton’s cash flow by the end of the first year after closing

and to earnings per share by the end of the second year. We anticipate that the combined company will also generate significant free cash flow, allowing for the return of substantial capital to stockholders.”

Martin Craighead, Chairman and Chief Executive Officer of Baker Hughes said, “This brings our stockholders a significant premium and the opportunity to

own a meaningful share in a larger, more competitive global company. By combining two great companies that have delivered cutting-edge solutions to customers in the worldwide oil and gas industry for more than a century, we will create a new world

of opportunities to advance the development of technologies for our customers. We envision a combined company capable of achieving opportunities that neither company would have realized as well – or as quickly – on its own, all while

creating exciting new opportunities for employees.”

Lesar concluded, “We believe that the expertise of both companies’ employees and

leaders will be a competitive advantage for the combined company. Together with the people of Baker Hughes, we will establish a team to develop a detailed and thoughtful integration plan to make the post-closing transition as seamless, efficient and

productive as possible. We look forward to welcoming the talented employees of Baker Hughes and are pleased they will be joining the Halliburton team.”

Transaction Terms and Approvals

Under the terms of the

agreement, stockholders of Baker Hughes will receive, for each Baker Hughes share, a fixed exchange ratio of 1.12 Halliburton shares plus $19.00 in cash. The value of the merger consideration as of November 12, 2014 represents 8.1 times current

consensus 2014 EBITDA estimates and 7.2 times current consensus 2015 EBITDA estimates. The transaction value represents a premium of 40.8 percent to the stock price of Baker Hughes on October 10, 2014, the day prior to Halliburton’s

initial offer to Baker Hughes. And over longer time periods, based on the consideration, this represents a one year, three year and five year premium of 36.3 percent, 34.5 percent, and 25.9 percent, respectively.

Halliburton intends to finance the cash portion of the acquisition through a combination of cash on hand and fully committed debt financing.

Page 2 of 8

The transaction is subject to approvals from each company’s stockholders, regulatory approvals and customary

closing conditions. Halliburton’s and Baker Hughes’ internationally recognized advisors have evaluated the likely actions needed to obtain regulatory approval, and Halliburton and Baker Hughes are committed to completing this combination.

Halliburton has agreed to divest businesses that generate up to $7.5 billion in revenues, if required by regulators, although Halliburton believes that the divestitures required will be significantly less. Halliburton has agreed to pay a fee of $3.5

billion if the transaction terminates due to a failure to obtain required antitrust approvals. Halliburton is confident that a combination is achievable from a regulatory standpoint.

The transaction is expected to close in the second half of 2015.

Compelling Strategic and Financial Benefits

| • |

|

Leverages complementary strengths to create a company with an unsurpassed breadth and depth of products and services. The companies are highly complementary from the standpoint of product lines, global presence

and cutting-edge technology in the worldwide oil and natural gas industry. The resulting company will provide a comprehensive suite of products and services to customers in virtually every oil and natural gas producing market in the world. This

strategic combination will create an oilfield services supplier with the ability to serve customers through strong positions in key business lines, a fully integrated product and services platform, increased capabilities in the unconventional,

deepwater and mature asset sectors, substantial and improved growth opportunities and continued high returns on capital. |

| • |

|

Generates significant opportunities for synergies. In addition to the compelling and immediate premium Baker Hughes stockholders will receive, the transaction will also yield significant synergies. The

combination will provide substantial efficiencies of scale and geographic scope, particularly in the Eastern Hemisphere, which will enhance fixed cost absorption. Once fully integrated, Halliburton expects the combination will yield annual cost

synergies of nearly $2 billion. These synergies are expected to come primarily from operational improvements, especially North American margin improvement, personnel reorganization, real estate, corporate costs, R&D optimization and other

administrative and organizational efficiencies. |

| • |

|

Enables increased cash returns to stockholders. Halliburton expects the transaction to be accretive to cash flow by the end of the first year after closing and to earnings per share by the end of the second year.

Halliburton expects that the combined company will maintain a strong investment grade credit profile and substantial financial flexibility. In addition, the combined company will generate significant free cash flow, allowing the return of cash to

the combined investor base through dividends, share repurchases and similar actions. |

Page 3 of 8

Headquarters, Management and Board of Directors

The combined company will maintain the Halliburton name and continue to be traded on the New York Stock Exchange under the ticker symbol “HAL.” The

company will be headquartered in Houston, Texas.

Dave Lesar will continue as Chairman and Chief Executive Officer of the combined company. Following the

completion of the transaction, the combined company’s Board of Directors is expected to expand to 15 members, three of whom will come from the Board of Baker Hughes.

Concurrently with the execution of the merger agreement, Halliburton withdrew its slate of directors nominated for the Board of Directors of Baker Hughes.

Advisors

Credit Suisse is serving as lead financial

advisor and BofA Merrill Lynch is also serving as financial advisor to Halliburton. Baker Botts L.L.P. and Wachtell, Lipton, Rosen & Katz are serving as Halliburton’s legal counsel. BofA Merrill Lynch, as lead arranger, and Credit

Suisse are providing fully committed debt financing in support of the cash portion of the consideration.

Goldman, Sachs & Co. is serving as

financial advisor to Baker Hughes. Davis Polk & Wardwell LLP and Wilmer Cutler Pickering Hale and Dorr LLP are serving as Baker Hughes’ legal counsel on this transaction.

Conference Call

Halliburton (NYSE: HAL) and Baker Hughes

(NYSE: BHI) will host a conference call on Monday, November 17, 2014, to discuss the proposed business transaction. The call will begin at 7:00 AM Central Time (8:00 AM Eastern Time).

An accompanying slide deck will be posted to both the Halliburton and Baker Hughes websites at www.halliburton.com and

www.bakerhughes.com/investor. Please visit either website to listen to the call live via webcast. In addition, you may participate in the call by dialing (866) 225-4091 within North America or (703) 639-1128 outside North America. A

passcode is not required. Attendees should log in to the webcast or dial in approximately 15 minutes prior to the call’s start time.

A replay of the

conference call will be available on both companies’ websites for seven days following the call. Also, a replay may be accessed by telephone at (888) 266-2081 within North America or (703) 925-2533 outside of North America, using the

passcode 1648003.

Page 4 of 8

About Halliburton

Founded in 1919, Halliburton is one of the world’s largest providers of products and services to the energy industry. With more than 80,000 employees,

representing 140 nationalities in over 80 countries, the company serves the upstream oil and gas industry throughout the lifecycle of the reservoir—from locating hydrocarbons and managing geological data, to drilling and formation evaluation,

well construction and completion, and optimizing production through the life of the field. Visit the company’s website at www.halliburton.com. Connect with Halliburton on Facebook, Twitter, LinkedIn, Oilpro

and YouTube.

About Baker Hughes

Baker Hughes

is a leading supplier of oilfield services, products, technology and systems to the worldwide oil and natural gas industry. The company’s 61,000 employees today work in more than 80 countries helping customers find, evaluate, drill, produce,

transport and process hydrocarbon resources. For more information on Baker Hughes, visit: www.bakerhughes.com.

Forward-Looking Statements

The statements in this press release that are not historical statements, including statements regarding the expected timetable for completing the

proposed transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding Halliburton’s and Baker Hughes’ future

expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject

to numerous risks and uncertainties, many of which are beyond the company’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are

not limited to: failure to obtain the required votes of Halliburton’s or Baker Hughes’ stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated;

the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Halliburton and Baker Hughes and the ultimate outcome of Halliburton’s operating efficiencies applied to

Baker Hughes’ products and services; the effects of the business combination of Halliburton and Baker Hughes, including the combined company’s future financial condition, results of operations, strategy and plans; expected synergies and

other benefits from the proposed transaction and the ability of Halliburton to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; final

court approval of, and the satisfaction of the conditions in, Halliburton’s September 2014 settlement relating to the Macondo well incident in the Gulf of Mexico; appeals of the multi-district litigation District Court’s September 2014

ruling regarding Phase 1 of the trial, and future rulings of the District

Page 5 of 8

Court; results of litigation, settlements, and investigations not covered by the settlement or the District Court’s rulings; actions by third parties, including governmental agencies,

relating to the Macondo well incident; BP’s April 2012 settlement relating to the Macondo well incident, indemnification, and insurance matters; with respect to repurchases of Halliburton common stock, the continuation or suspension of the

repurchase program, the amount, the timing and the trading prices of Halliburton common stock, and the availability and alternative uses of cash; actions by third parties, including governmental agencies; changes in the demand for or price of oil

and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies and legislative bodies and related publicity and potential adverse

proceedings by such agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to offshore oil and

natural gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services and climate-related initiatives; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income; risks

of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international trade and regulatory controls, and doing business with national oil

companies; weather-related issues, including the effects of hurricanes and tropical storms; changes in capital spending by customers; delays or failures by customers to make payments owed to us; execution of long-term, fixed-price contracts;

impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; maintaining a highly skilled workforce; availability and cost of raw materials; and integration of acquired businesses and operations of joint

ventures. Halliburton’s and Baker Hughes’ respective reports on Form 10-K for the year ended December 31, 2013, Form 10-Q for the quarter ended September 30, 2014, recent Current Reports on Form 8-K, and other U.S. Securities and

Exchange Commission (the “SEC”) filings discuss some of the important risk factors identified that may affect these factors and Halliburton’s and Baker Hughes’ respective business, results of operations and financial condition.

Halliburton and Baker Hughes undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date

hereof.

Additional Information

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between Halliburton and Baker Hughes.

In connection with this proposed business combination, Halliburton and/or Baker Hughes may file one or more proxy statements, registration statements, proxy statement/prospectus or other documents with the SEC. This communication is not a substitute

for any proxy statement, registration statement, proxy statement/prospectus or other document Halliburton and/or Baker Hughes may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HALLIBURTON AND BAKER

HUGHES ARE URGED TO READ THE

Page 6 of 8

PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Halliburton and/or Baker

Hughes, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Halliburton and/or Baker Hughes through the website maintained by the SEC

at http://www.sec.gov. Copies of the documents filed with the SEC by Halliburton will be available free of charge on Halliburton’s internet website at http://www.halliburton.com or by contacting Halliburton’s Investor Relations Department

by email at investors@Halliburton.com or by phone at +1-281-871-2688. Copies of the documents filed with the SEC by Baker Hughes will be available free of charge on Baker Hughes’ internet website at http://www.bakerhughes.com or by contacting

Baker Hughes’ Investor Relations Department by email at trey.clark@bakerhughes.com or alondra.oteyza@bakerhughes.com or by phone at +1-713-439-8039 or +1-713-439-8822.

Participants in Solicitation

Halliburton, Baker Hughes,

their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of

Halliburton is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 7, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the

SEC on April 8, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 24, 2014 and its Current Report on Form 8-K, which was filed with the SEC on July 21, 2014.

Information about the directors and executive officers of Baker Hughes is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 12, 2014, its proxy statement for its 2014

annual meeting of stockholders, which was filed with the SEC on March 5, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 21, 2014 and its Current Reports on Form

8-K, which were filed with the SEC on June 10, 2014 and September 10, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a

description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Page 7 of 8

|

|

|

| For Halliburton |

|

For Baker Hughes |

|

|

| Investors:

Kelly Youngblood Halliburton, Investor Relations

Investors@Halliburton.com 281-871-2688

Media:

Emily Mir Halliburton, Public Relations

PR@Halliburton.com 281-871-2601

or Joele Frank, Wilkinson Brimmer Katcher

Andrew Siegel / Meaghan Repko 212-355-4449 |

|

Investors:

Trey Clark Baker Hughes, Investor Relations

trey.clark@bakerhughes.com 713-439-8039

or Alondra Oteyza

Baker Hughes, Investor Relations

alondra.oteyza@bakerhughes.com 713-439-8822

Media:

Melanie Kania Baker Hughes, Media Relations

713-439-8303 or

Abernathy MacGregor, Tom Johnson, 212-371-5999

TBJ@abmac.com; Glen Orr, 713-205-7770 GLO@abmac.com |

Page 8 of 8

Exhibit 99.2

HAL Employee Letter & FAQ

|

|

|

| TO: |

|

All Halliburton employees |

|

|

| FROM: |

|

Dave Lesar, Chairman and CEO |

|

|

| SUBJECT: |

|

Company news |

I am excited to bring you news of an historic step by our company to advance our growth objectives, better serve our

customers, and create value for our stockholders. Today, Halliburton announced a definitive agreement to acquire all the outstanding shares of Baker Hughes. The resulting company will provide a comprehensive suite of products and services to

customers in virtually every oil and natural gas producing market in the world. A copy of the press release is attached.

We are confident that the

combined company, under Halliburton’s leadership, will be a stronger, more diversified organization with the scale and resources to provide additional opportunities to employees. For almost 100 years, the Halliburton culture has achieved its

goals through execution, innovation, integrity and the professional development of our people. As we move forward with this transaction, it is imperative to continue with the same dedication and outstanding performance that has brought us to this

exciting new chapter for our Company.

I ask that you continue your focus on providing superior service while conducting safe and environmentally

responsible operations. Our customers are counting on us to continue to deliver on our solution themes and to consistently meet their needs in the safest and most efficient manner. Our strategy is clearly working as demonstrated by our strong

quarterly results and improved safety and service quality performance. Now, it is our job to remain focused on consistent execution, generating superior financial performance and delivering best-in-class results.

We believe that the combined company will benefit from the expertise of both companies’ employees and leaders. Together with the people of Baker Hughes,

we will establish a team to develop a detailed and thoughtful integration plan to make the post-closing transition as seamless, efficient and productive as possible. We appreciate your sustained focus and commitment to making Halliburton one of the

world’s largest and most successful providers of products and services to the energy industry.

To help answer some of the questions you may have

about today’s announcement, please review the attached FAQ. We will make every effort to keep you informed throughout this process, keeping in mind that there are certain legal and regulatory requirements that we must follow. I know that I can

count on you to maintain the same high level of professionalism that has made Halliburton an industry leader. If you have additional questions, please do not hesitate to reach out to your supervisor.

It is likely that this announcement will generate interest from media and other outside parties, and it is important that the Company speaks with one voice.

If you receive any inquiries, please refer them to our PR department at PR@Halliburton.com or 281-871-2601 in accordance with company policy.

On

behalf of our Board of Directors and management team, we thank you for your continued hard work and dedication to Halliburton. I look forward to leading the great new organization with our excellent, well-prepared management team.

FAQs

| 1. |

Why is Halliburton acquiring Baker Hughes? |

| |

• |

|

The transaction will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to our customers. |

| |

• |

|

This announcement is well aligned with Halliburton’s strategy to pursue accretive, value-creating growth opportunities and is extremely compelling for Baker Hughes’ and Halliburton’s stockholders,

customers and other stakeholders. |

| |

• |

|

We believe the transaction will advance our growth objectives, position Halliburton to better serve customers, create value for stockholders and create career development and advancement opportunities for employees.

|

| 2. |

How will this transaction impact employees? |

| |

• |

|

As we move forward with the acquisition of Baker Hughes, this news should have no impact on employees’ day-to-day responsibilities or performance. |

| |

• |

|

At this time, the most important thing you can do is continue to focus on increased service quality while conducting safe and environmentally responsible operations. Our customers are counting on us to deliver on our

solution themes and to consistently meet their needs in the safest and most efficient manner. |

| |

• |

|

We expect that the combined company will be a stronger, more diversified organization with the scale and resources to provide additional opportunities to employees of the combined company. |

| |

• |

|

We appreciate your continued focus and commitment to making Halliburton one of the world’s largest and most successful providers of products and services to the energy industry. |

| |

• |

|

The merger agreement has been unanimously approved by both companies’ Boards of Directors. |

| |

• |

|

Together with the people of Baker Hughes, we will establish a team to develop a detailed and thoughtful integration plan to make the post-closing transition as seamless, efficient and productive as possible.

|

| |

• |

|

We will provide updates on our progress, as appropriate. |

| 4. |

What should we communicate to our customers and other stakeholders? |

| |

• |

|

You can tell customers and other business partners that we remain absolutely focused on service delivery and that we will continue to deliver outstanding solutions and services to our customers. |

| |

• |

|

You can also say that the combination of the companies’ product and service capabilities will allow us to deliver an unsurpassed breadth and depth of solutions to our customers. |

| 5. |

What is the integration plan and timeline? When will the deal close? |

| |

• |

|

Together with the people of Baker Hughes, we will establish an integration team to develop a detailed and thoughtful integration plan to make the post-closing integration as seamless, efficient and productive as

possible. |

| |

• |

|

The transaction is subject to approvals from each company’s stockholders, regulatory approvals and customary closing conditions. |

| |

• |

|

The transaction is expected to close in the second half of 2015. In the interim, we remain focused on providing reliable service and innovative products. |

| 6. |

How will this impact the workforce? |

| |

• |

|

We will carefully evaluate the opportunities to combine these two great companies in a manner that builds on our collective past successes and enables us to create a greater organization going forward.

|

| |

• |

|

There are still many details to work through as this transaction gets finalized, but it is important to note that we are committed to keeping you informed. |

| 7. |

How are we going to handle the overlapping of both companies’ products, services and locations? Do Baker Hughes’ business lines match with ours? |

| |

• |

|

At this point, it is premature to outline potential integration plans and unproductive to do anything other than focus on our day-to-day responsibilities. |

| |

• |

|

The companies are highly complementary from the standpoint of product lines, global presence and cutting-edge technology in the worldwide oil and natural gas industry. |

| 8. |

What should I say if I am contacted by the media or another third party? |

| |

• |

|

If you receive any inquiries, please refer them to our PR department at PR@Halliburton.com or 281-871-2601. |

| 9. |

What information can I share with my friends and family? |

| |

• |

|

Don’t speculate or make any assumptions; however you should feel free to voice your excitement for this transaction and tell people that this strategic combination will create a bellwether global oilfield services

company. |

| 10. |

What can I do to help? |

| |

• |

|

The best way you can help is by staying focused on the task at hand – executing on our processes (BAP, PSL work, People and Lifecycle) and carrying out your day-to-day responsibilities in the same manner as always.

|

| |

• |

|

It is important that we continue to deliver on our solution themes (Deepwater, unconventionals and mature asset sectors), and stay focused on our Journey to ZERO. |

| |

• |

|

We are counting on you to remain focused on serving our customers and advancing our company’s business goals, just like you always have. |

| 11. |

Is there anything I shouldn’t do? |

| |

• |

|

First and foremost, you should not let this announcement be a distraction. |

| |

• |

|

Don’t speculate or make any assumptions. If you receive an inquiry from any of the following stakeholders, please refer the call to the below Halliburton contacts: |

| |

• |

|

Suppliers – evelyn.angelle@halliburton.com or 281-575-4770 |

| |

• |

|

Investors – Investors@Halliburton.com or 281-871-2688 |

| |

• |

|

Media – PR@Halliburton.com or 281-871-2601 |

| |

• |

|

Please be careful to discuss only the facts as they were announced. Do not improvise or deviate from these guidelines. Also, don’t talk about tenders, pricing lists/policies or market share. We are independent

competitors until closing. |

Forward-Looking Statements

The statements in this communication that are not historical statements, including statements regarding the expected timetable for completing the proposed

transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding Halliburton’s and Baker Hughes’ future

expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject

to numerous risks and uncertainties, many of which are beyond the company’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are

not limited to: failure to obtain the required votes of Halliburton’s or Baker Hughes’ stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated;

the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Halliburton and Baker Hughes and the ultimate outcome of Halliburton’s operating efficiencies applied to

Baker Hughes’ products and services; the effects of the business combination of Halliburton and Baker Hughes, including the combined company’s future financial condition, results of operations, strategy and plans; expected synergies and

other benefits from the proposed transaction and the ability of Halliburton to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; final

court approval of, and the satisfaction of the conditions in, Halliburton’s September 2014 settlement relating to the Macondo well incident in the Gulf of Mexico; appeals of the multi-district litigation District Court’s September 2014

ruling regarding Phase 1 of the trial, and future rulings of the District Court; results of litigation, settlements, and investigations not covered by the settlement or the District Court’s rulings; actions by third parties, including

governmental agencies, relating to the Macondo well incident; BP’s April 2012 settlement relating to the Macondo well incident, indemnification, and insurance matters; with respect to repurchases of Halliburton common stock, the continuation or

suspension of the repurchase program, the amount, the timing and the trading prices of Halliburton common stock, and the availability and alternative uses of cash; actions by third parties, including governmental agencies; changes in the demand for

or price of oil and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies and legislative bodies and related publicity and potential

adverse proceedings by such agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to offshore oil

and natural gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services and climate-related initiatives; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income;

risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international trade and regulatory controls, and doing business with national oil

companies; weather-related issues, including the effects of hurricanes and tropical storms; changes in capital spending by customers; delays or failures by customers to make payments owed to us; execution of long-term, fixed-price contracts;

impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; maintaining a highly skilled workforce; availability and cost of raw materials; and integration of acquired businesses and operations of joint

ventures. Halliburton’s and Baker Hughes’ respective reports on Form 10-K for the year ended December 31, 2013, Form 10-Q for the quarter ended September 30, 2014, recent Current Reports on Form 8-K, and other U.S. Securities and

Exchange Commission (the “SEC”) filings discuss some of the important risk factors identified that may affect these factors and Halliburton’s and Baker Hughes’ respective business, results of operations and financial condition.

Halliburton and Baker Hughes undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date

hereof.

Additional Information

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or

approval. This communication relates to a proposed business combination between Halliburton and Baker Hughes. In connection with this proposed business combination, Halliburton and/or Baker Hughes may file one or more proxy statements, registration

statements, proxy statement/prospectus or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document Halliburton and/or Baker Hughes may file

with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HALLIBURTON AND BAKER HUGHES ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE

FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Halliburton and/or

Baker Hughes, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Halliburton and/or Baker Hughes through the website maintained by the

SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Halliburton will be available free of charge on Halliburton’s internet website at http://www.halliburton.com or by contacting Halliburton’s Investor Relations

Department by email at investors@Halliburton.com or by phone at +1-281-871-2688. Copies of the documents filed with the SEC by Baker Hughes will be available free of charge on Baker Hughes’ internet website at http://www.bakerhughes.com or by

contacting Baker Hughes’ Investor Relations Department by email at trey.clark@bakerhughes.com or alondra.oteyza@bakerhughes.com or by phone at +1-713-439-8039 or +1-713-439-8822.

Participants in Solicitation

Halliburton, Baker Hughes,

their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of

Halliburton is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 7, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the

SEC on April 8, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 24, 2014 and its Current Report on Form 8-K, which was filed with the SEC on July 21, 2014.

Information about the directors and executive officers of Baker Hughes is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 12, 2014, its proxy statement for its 2014

annual meeting of stockholders, which was filed with the SEC on March 5, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 21, 2014 and its Current Reports on Form

8-K, which were filed with the SEC on June 10, 2014 and September 10, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a

description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Exhibit 99.3

HAL Customer Letter and FAQ

[Dear NAME]:

I am excited to bring you news of an historic step by our company to advance the breadth and technical capabilities of the service and product offerings needed

to better serve our customers. This morning, we announced a definitive agreement to acquire all of the outstanding shares of Baker Hughes in a stock and cash transaction. The transaction will combine the companies’ product and service

capabilities to deliver an unsurpassed depth and breadth of solutions to our customers. Additionally, the combined company will allow us to be the most efficient and lowest cost service provider. A copy of the press release is attached.

We are confident that the combined company will be a stronger, more diversified organization with the scale and resources in more markets to better serve our

valued customers. Further, this strategic combination will create an oilfield services supplier with the ability to serve customers through strong positions in key business lines, a fully integrated product and services platform, and increased

capabilities in the unconventional, deepwater and mature asset sectors.

As we move forward with this transaction, I want to emphasize that we remain

committed to providing the same reliable services and innovative products that you have come to expect from Halliburton. Our focus on increasing service quality and conducting safe and environmentally responsible operations will continue, and our

employees remain dedicated to consistently and efficiently meeting your needs.

If you have any questions, please do not hesitate to reach out to your

regular Halliburton contact, me at 281-871-2653 or one of our following executive leaders:

| |

• |

|

Jim Brown, president of Western Hemisphere at 303-308-4220 |

| |

• |

|

Joe Rainey, president of Eastern Hemisphere at +97143036657 |

| |

• |

|

Brady Murphy, senior vice president of Business Development & Marketing at 281-575-3228 |

We will

continue to update you as we move through this process, as appropriate.

On behalf of Halliburton’s Board of Directors and management team, we thank

you for your loyalty and ongoing business. We are very excited about the prospect of blending the considerable talents and services of Halliburton and Baker Hughes to better serve you.

Sincerely,

Jeff Miller

Halliburton President and Chief Health, Safety and Environment Officer

FAQs

| 1. |

Why is Halliburton acquiring Baker Hughes? |

| |

• |

|

The transaction will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to our customers. |

| |

• |

|

This strategic combination will create an oilfield services supplier with the ability to serve customers through strong positions in key business lines, a fully integrated product and services platform, and increased

capabilities in the unconventional, deepwater and mature asset sectors. |

| |

• |

|

We believe the transaction will advance our growth objectives, position Halliburton to better serve customers, create value for stockholders, and create career development and advancement opportunities for employees.

|

| 2. |

What is the impact of the transaction for customers? |

| |

• |

|

The transaction will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to our customers, creating a Houston-based global oilfield services champion,

manufacturing and exporting technologies, and creating jobs and serving customers around the globe. |

| |

• |

|

We are confident that the combined company will be a stronger, more diverse organization with the scale and resources to better serve our valued customers. |

| |

• |

|

Our focus on increasing service quality and conducting safe and environmentally responsible operations will continue. We remain focused on consistently and efficiently meeting your needs. |

| |

• |

|

The combined company allows us to be the most efficient and lowest cost service provider. |

| |

• |

|

Both companies’ Boards of Directors have unanimously approved this transaction, which is also subject to approval from both companies’ stockholders, regulatory approvals and customary closing conditions.

|

| |

• |

|

The transaction is expected to close in the second half of 2015. In the interim, we remain focused on providing reliable service and innovative products. |

| |

• |

|

We will provide updates on our progress, as appropriate. |

| 4. |

Who can I contact if I have more questions? |

| |

• |

|

We appreciate your business and will update you as we move through this process, as appropriate. |

| |

• |

|

In the meantime, if you have any questions, please do not hesitate to reach out to your regular Halliburton contact or one of our following executive leaders: |

| |

• |

|

Jeff Miller, president and chief health, safety and environment officer at 281-871-2653 |

| |

• |

|

Jim Brown, president of Western Hemisphere at 303-308-4220 |

| |

• |

|

Joe Rainey, president of Eastern Hemisphere at +9-714-303-6657 |

| |

• |

|

Brady Murphy, senior vice president of Business Development & Marketing at 281-575-3228 |

Forward-Looking Statements

The statements in this communication that are not historical statements, including statements regarding the expected timetable for completing the proposed

transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding Halliburton’s and Baker Hughes’ future

expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject

to numerous risks and uncertainties, many of which are beyond the company’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are

not limited to: failure to obtain the required votes of Halliburton’s or Baker Hughes’ stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated;

the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Halliburton and Baker Hughes and the ultimate outcome of Halliburton’s operating efficiencies applied to

Baker Hughes’ products and services; the effects of the business combination of Halliburton and Baker Hughes, including the combined company’s future financial condition, results of operations, strategy and plans; expected synergies and

other benefits from the proposed transaction and the ability of Halliburton to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; final

court approval of, and the satisfaction of the conditions in, Halliburton’s September 2014 settlement relating to the Macondo well incident in the Gulf of Mexico; appeals of the multi-district litigation District Court’s September 2014

ruling regarding Phase 1 of the trial, and future rulings of the District Court; results of litigation, settlements, and investigations not covered by the settlement or the District Court’s rulings; actions by third parties, including

governmental agencies, relating to the Macondo well incident; BP’s April 2012 settlement relating to the Macondo well incident, indemnification, and insurance matters; with respect to repurchases of Halliburton common stock, the continuation or

suspension of the repurchase program, the amount, the timing and the trading prices of Halliburton common stock, and the availability and alternative uses of cash; actions by third parties, including governmental agencies; changes in the demand for

or price of oil and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies and legislative bodies and related publicity and potential

adverse proceedings by such agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to offshore oil

and natural gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services and climate-related initiatives; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income;

risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international trade and regulatory controls, and doing business with national oil

companies; weather-related issues, including the effects of hurricanes and tropical storms; changes in capital spending by customers; delays or failures by customers to make payments owed to us; execution of long-term, fixed-price contracts;

impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; maintaining a highly skilled workforce; availability and cost of raw materials; and integration of acquired businesses and operations of joint

ventures. Halliburton’s and Baker Hughes’ respective reports on Form 10-K for the year ended December 31, 2013, Form 10-Q for the quarter ended September 30, 2014, recent Current Reports on Form 8-K, and other U.S. Securities and

Exchange Commission (the “SEC”) filings discuss some of the important risk factors identified that may affect these factors and Halliburton’s and Baker Hughes’ respective business, results of operations and financial condition.

Halliburton and Baker Hughes undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date

hereof.

Additional Information

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between Halliburton and Baker Hughes.

In connection with this proposed business combination, Halliburton and/or Baker Hughes may file one or more proxy statements, registration statements, proxy statement/prospectus or other documents with the SEC. This communication is not a substitute

for any proxy statement, registration statement, proxy statement/prospectus or other document Halliburton and/or Baker Hughes may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF HALLIBURTON AND BAKER

HUGHES ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders

of Halliburton and/or Baker Hughes, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the

SEC by Halliburton and/or Baker Hughes through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Halliburton will be available free of charge on Halliburton’s internet website at

http://www.halliburton.com or by contacting Halliburton’s Investor Relations Department by email at investors@Halliburton.com or by phone at +1-281-871-2688. Copies of the documents filed with the SEC by Baker Hughes will be available free of

charge on Baker Hughes’ internet website at http://www.bakerhughes.com or by contacting Baker Hughes’ Investor Relations Department by email at trey.clark@bakerhughes.com or alondra.oteyza@bakerhughes.com or by phone at +1-713-439-8039 or

+1-713-439-8822.

Participants in Solicitation

Halliburton, Baker Hughes, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of

proxies in connection with the proposed transaction. Information about the directors and executive officers of Halliburton is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on

February 7, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 8, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC

on October 24, 2014 and its Current Report on Form 8-K, which was filed with the SEC on July 21, 2014. Information about the directors and executive officers of Baker Hughes is set forth in its Annual Report on Form 10-K for the year ended

December 31, 2013, which was filed with the SEC on February 12, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 5, 2014, its Quarterly Report on Form 10-Q for the quarter

ended September 30, 2014 which was filed with the SEC on October 21, 2014 and its Current Reports on Form 8-K, which were filed with the SEC on June 10, 2014 and September 10, 2014. These documents can be obtained free of charge

from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Exhibit 99.4

HAL Extensive Talking Points for Use with Customers

| |

• |

|

I am calling to provide additional information regarding an historic step we are taking to create a bellwether global oilfield services company and better serve our customers. |

| |

• |

|

To recap, Halliburton announced an agreement to acquire Baker Hughes in a transaction that will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to

our customers. Further, the combined company will allow us to be the most efficient and lowest cost service provider. |

| |

• |

|

One objective of the deal was the need to fill service and product offering gaps in Halliburton’s portfolio required for the increasingly integrated solutions our customers request of us. The combined entity will

also have the scale required to ensure we continue to commit appropriate levels of investment in the technologies required to support more efficient development of oil and gas assets around the world. |

| |

• |

|

Our focus on increasing service quality and conducting safe and environmentally responsible operations will continue, and our employees remain dedicated to consistently and efficiently meeting your needs.

|

| |

• |

|

This strategic combination will create an oilfield services supplier with the ability to serve customers through strong positions in key business lines, a fully integrated product and services platform, and increased

capabilities in the unconventional, deepwater and mature asset sectors. |

| |

• |

|

Now more than ever, we are focused on consistent, efficient process execution. In order to achieve this goal, we are focusing on five key areas: |

| |

• |

|

Safe evaluation and risk mitigation in planning and execution |

| |

• |

|

Competency of our people and compliance to our processes |

| |

• |

|

Collaboration in our overall approach |

| |

• |

|

Technological innovation to help solve your toughest challenges |

| |

• |

|

Deep commitment to delivering on all of your business objectives |

| |

• |

|

One of the many reasons we are excited about this transaction is because we believe that applying Halliburton’s efficiency programs to Baker Hughes’ products and service offerings, in areas such as logistics

and equipment utilization, will result in reduced costs that generate improvements in both service delivery and efficiency. |

| |

• |

|

We are confident that the combined company will be a stronger, more diversified organization with the scale and resources to better serve you – our valued customer. |

| |

• |

|

As we move forward with our combination with Baker Hughes, I want to emphasize that we remain committed to providing the same reliable services and innovative products that you have come to expect from Halliburton.

|

| |

• |

|

Our commitment to providing outstanding service quality and conducting safe and environmentally responsible operations will continue, and our employees remain dedicated to consistently and efficiently meeting your

needs. |

| |

• |

|

If you have any questions, please do not hesitate to reach out to your regular Halliburton contact or one of our following executive leaders: |

| |

• |

|

Jeff Miller, president and chief health, safety and environment officer at 281-871-2653 |

| |

• |

|

Jim Brown, president of Western Hemisphere at 303-308-4220 |

| |

• |

|

Joe Rainey, president of Eastern Hemisphere at +97143036657 |

| |

• |

|

Brady Murphy, senior vice president of Business Development & Marketing at 281-575-3228 |

| |

• |

|

We will update you as we move through this process, as appropriate. |

Forward-Looking Statements

The statements in this communication that are not historical statements, including statements regarding the expected timetable for completing the proposed

transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding Halliburton’s and Baker Hughes’ future

expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject

to numerous risks and uncertainties, many of which are beyond the company’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are

not limited to: failure to obtain the required votes of Halliburton’s or Baker Hughes’ stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated;

the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Halliburton and Baker Hughes and the ultimate outcome of Halliburton’s operating efficiencies applied to

Baker Hughes’ products and services; the effects of the business combination of Halliburton and Baker Hughes, including the combined company’s future financial condition, results of operations, strategy and plans; expected synergies and

other benefits from the proposed transaction and the ability of Halliburton to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; final

court approval of, and the satisfaction of the conditions in, Halliburton’s September 2014 settlement relating to the Macondo well incident in the Gulf of Mexico; appeals of the multi-district litigation District Court’s September 2014

ruling regarding Phase 1 of the trial, and future rulings of the District Court; results of litigation, settlements, and investigations not covered by the settlement or the District Court’s rulings; actions by third parties, including

governmental agencies, relating to the Macondo well incident; BP’s April 2012 settlement relating to the Macondo well incident, indemnification, and insurance matters; with respect to repurchases of Halliburton common stock, the continuation or

suspension of the repurchase program, the amount, the timing and the trading prices of Halliburton common stock, and the availability and alternative uses of cash; actions by third parties, including governmental agencies; changes in the demand for

or price of oil and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies and legislative bodies and related publicity and potential

adverse proceedings by such agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to offshore oil