- Company On Track With 2014 Guidance &

Long-Term Growth Plan -

Silicom Ltd. (NASDAQ:SILC) (TASE:SILC), an

industry-leading provider of high-performance server/appliances

networking solutions, today reported its financial results for the

third quarter and nine months ended September 30, 2014.

Financial Results

Q3 2014: Revenues for the third quarter totalled $15.9

million compared with $17.2 million in the third quarter of

2013.

On a GAAP basis, operating income for the quarter totalled $3.1

million compared with $4.1 million in the third quarter of 2013.

Net income for the quarter totalled $2.5 million, or $0.34 per

diluted share ($0.35 per basic share), compared with $4.0 million,

or $0.55 per diluted share ($0.57 per basic share), in the third

quarter of 2013.

On a non-GAAP basis (as described and reconciled below),

operating income for the quarter totalled $3.5 million compared

with $4.2 million in the third quarter of 2013. Net income was $3.0

million, or $0.41 per basic and diluted share, compared with $4.2

million, or $0.58 per diluted share ($0.59 per basic share), in the

third quarter of 2013.

First Nine Months of 2014: Revenues for the first nine

months of 2014 increased by 10% to $52.8 million from $47.9 million

in the first nine months of 2013.

On a GAAP basis, operating income for the period totalled $11.6

million compared with $10.9 million in the first nine months of

2013. Net income totalled $9.9 million, or $1.35 per diluted share

($1.38 per basic share), compared with $10.4 million, or $1.44 per

diluted share ($1.47 per basic share), in the first nine months of

2013.

On a non-GAAP basis (as described and reconciled below),

operating income for the period totalled $12.5 million compared

with $11.4 million in the first nine months of 2013. Net income

totalled $10.8 million, or $1.48 per diluted share ($1.51 per basic

share), compared with $10.9 million, or $1.51 per diluted share

($1.54 per basic share), in the first nine months of 2013.

Comments of Management

Commenting on the results, Shaike Orbach, President and CEO,

said, “We continue to develop the Company in line with our model

for both the short-term and the long-term, positioning us to

achieve our financial and strategic objectives. During the quarter,

we were very pleased to announce a breakthrough Coleto Creek win as

well as a significant design win with a leading Application

Delivery provider, achievements that are enhancing the Company’s

penetration of its target markets. In parallel, we continue working

to deliver on the full potential of our multiple growth engines –

especially our 100+ customer base, industry insight, superior core

technologies and extensive existing product portfolio.”

##

Conference Call DetailsSilicom’s Management will host an

interactive conference today, October 23rd, at 9am Eastern Time

(6am Pacific Time, 4pm Israel Time) to review and discuss the

results.

To participate, please call one of the following

teleconferencing numbers. Please begin placing your calls at least

10 minutes before the conference call commences. If you are unable

to connect using the toll-free numbers, try the international

dial-in number.

US: 1 888 668 9141

UK: 0 800-917-5108

ISRAEL: 03 918 0609

INTERNATIONAL: +972 3 918 0609

At: 9:00am Eastern Time, 6:00am Pacific Time,

4:00pm Israel Time

For those unable to listen to the live call, a replay of the

call will be available for three months from the day after the call

under the investor relations section of Silicom’s website.

***

Non-GAAP Financial Measures

This release, including the financial tables below, presents

other financial information that may be considered "non-GAAP

financial measures" under Regulation G and related reporting

requirements promulgated by the Securities and Exchange Commission

as they apply to our company. These non-GAAP financial measures

exclude compensation expenses in respect of options and RSUs

granted to directors, officers and employees, as well as

amortization of intangible assets. Non-GAAP financial measures

should be evaluated in conjunction with, and are not a substitute

for, GAAP financial measures. The tables also present the GAAP

financial measures, which are most comparable to the non-GAAP

financial measures as well as reconciliation between the non-GAAP

financial measures and the most comparable GAAP financial measures.

The non-GAAP financial information presented herein should not be

considered in isolation from or as a substitute for operating

income, net income or per share data prepared in accordance with

GAAP.

About Silicom

Silicom Ltd. is an industry-leading provider of high-performance

networking and data infrastructure solutions. Designed primarily to

increase data center efficiency, Silicom’s solutions dramatically

improve the throughput and availability of networking appliances

and other server-based systems.

Silicom’s products are used by a large and growing base of OEM

customers, many of whom are market leaders, as performance-boosting

solutions for their offerings in the Application Delivery, WAN

Optimization, Security and other mission-critical segments within

the fast-growing virtualization, cloud computing and big data

markets. Silicom’s product portfolio includes multi-port 1/10

Gigabit Ethernet server adapters, Intelligent Bypass solutions,

Encryption accelerators and a variety of innovative Smart adapters.

These products are available for incorporation directly into our

OEM customers' systems, or provided as part of Silicom’s patented

SETAC (Server To Appliance Converter), a unique approach to the

provision of high quality standard platforms with modular front

connectivity.

For more information, please visit: www.silicom.co.il.

Statements in this press release which are not historical data

are forward-looking statements which involve known and unknown

risks, uncertainties, or other factors not under the Company's

control, which may cause actual results, performance, or

achievements of the Company to be materially different from the

results, performance, or other expectations implied by these

forward-looking statements. These factors include, but are not

limited to, those detailed in the Company's periodic filings with

the Securities and Exchange Commission. The Company disclaims any

duty to update such statements.

-- FINANCIAL TABLES FOLLOW –

Silicom Ltd. Consolidated Balance Sheets

(US$ thousands)

September 30,

December 31, 2014 2013 Assets

Current assets Cash and cash equivalents

$

19,572 $ 12,997 Short-term bank deposits

- 3,000

Marketable securities

15,449 14,871 Accounts receivables:

Trade, net

15,045 14,866 Accounts receivables: Other

682 2,460 Inventories

26,531 28,778 Deferred tax

assets

498 274

Total current

assets 77,777 77,246

Marketable securities

23,469 24,370

Assets held for employees’ severance

benefits 1,494 1,543

Deferred tax assets

390 439

Property, plant and equipment, net

2,415 1,479

Intangible assets, net

130 180

Total assets $

105,675 $ 105,257

Liabilities and

shareholders' equity Current liabilities Trade

accounts payable

$ 3,144 $ 6,814 Other accounts

payable and accrued expenses

4,913

5,134

Total current liabilities 8,057 11,948

Liability for employees’ severance benefits

2,528 2,618

Total

liabilities 10,585 14,566

Shareholders' equity Ordinary shares and additional

paid-in capital

40,346 38,647 Treasury shares

(38)

(38) Retained earnings

54,782

52,082

Total shareholders' equity

95,090 90,691

Total liabilities and

shareholders' equity $ 105,675 $

105,257

Silicom Ltd. Consolidated Statements of Operations

(US$

thousands, except for share and per share data)

Three-month period Nine-month period ended

September 30, ended September 30, 2014 2013

2014 2013 Sales $

15,866 $ 17,200 $

52,788 $

47,945 Cost of sales

9,432

10,183

31,428 28,598 Gross

profit

6,434 7,017

21,360 19,347 Research and development

expenses

1,668 1,305

4,712 3,894 Selling and

marketing expenses

1,034 1,004

3,096 2,717 General

and administrative expenses

673

636

1,958 1,863 Total operating

expenses

3,375 2,945

9,766 8,474 Operating income

3,059 4,072

11,594 10,873 Financial income,

net

7 100

170 280 Income before income taxes

3,066 4,172

11,764 11,153 Income taxes

558 152

1,881

741 Net income $

2,508 $ 4,020 $

9,883 $ 10,412 Basic income per

ordinary share (US$) $

0.35 $ 0.57 $

1.38 $ 1.47

Weighted average number of ordinary shares

used tocompute basic income per share (in thousands)

7,183 7,115

7,180 7,098 Diluted income per

ordinary share (US$) $

0.34 $ 0.55 $

1.35 $ 1.44

Weighted average number of ordinary shares

used tocompute diluted income per share (in thousands)

7,290 7,276

7,323 7,238

Silicom Ltd. Reconciliation of

Non-GAAP Financial Results

(US$ thousands, except for share and

per share data)

Three-month period Nine-month

period ended September 30, ended September 30,

2014 2013

2014 2013 GAAP gross profit

$

6,434 $ 7,017

$ 21,360 $ 19,347 (1)

Share-based compensation (*)

39

26

98 77 Non-GAAP gross profit

$ 6,473 $ 7,043

$

21,458 $ 19,424 GAAP operating income

$

3,059 $ 4,072

$ 11,594 $ 10,873 (1)

Share-based compensation (*)

433 170

900 502 (2)

Amortization of intangible assets

17

3

50 3 Non-GAAP operating

income

$ 3,509 $ 4,245

$

12,544 $ 11,378 GAAP net income

$

2,508 $ 4,020

$ 9,883 $ 10,412 (1) Share-based

compensation (*)

433 170

900 502 (2) Amortization of

intangible assets

17 3

50 3 Non-GAAP net income

$

2,958 $ 4,193

$ 10,833 $

10,917 GAAP basic income per ordinary share

(US$)

$ 0.35 $ 0.57

$ 1.38 $ 1.47 (1)

Share-based compensation (*)

0.06 0.02

0.12 0.07 (2)

Amortization of intangible assets

-

-

0.01 - Non-GAAP basic

income per ordinary share (US$)

$ 0.41 $

0.59

$ 1.51 $ 1.54

GAAP diluted income per ordinary share (US$)

$ 0.34 $

0.55

$ 1.35 $ 1.44 (1) Share-based compensation (*)

0.07 0.03

0.12 0.07 (2) Amortization of intangible

assets

- -

0.01 - Non-GAAP diluted income per ordinary

share (US$)

$ 0.41 $ 0.58

$

1.48 $ 1.51 (*) Adjustments

related to share-based compensation expenses according to ASC topic

718 (SFAS 123 (R))

Eran Gilad, CFOSilicom Ltd.Tel: +972-9-764-4555E-mail:

erang@silicom.co.ilorInvestor relations contact:Kenny Green / Ehud

HelftGK Investor RelationsTel: +1 646 201 9246E-mail :

silicom@gkir.com

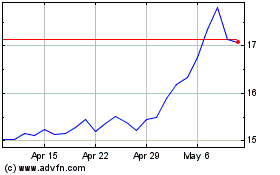

Silicom (NASDAQ:SILC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Silicom (NASDAQ:SILC)

Historical Stock Chart

From Apr 2023 to Apr 2024