Report of Foreign Issuer (6-k)

September 10 2014 - 8:20AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of September 2014

Commission File Number 001-32640

DHT HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

Clarendon House

2 Church Street, Hamilton HM 11

Bermuda

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

On September 9, 2014, DHT Holdings, Inc. (the “Company”) issued a press release announcing that the Company is planning an offering of shares of the Company’s common stock in a registered direct offering (the “Registered Direct Offering”), subject to market and other conditions.

On September 9, 2014, the Company issued a press release announcing that the Company is planning a private placement of convertible notes due 2019 (the “Private Placement”), subject to market and other conditions.

The Company intends to use the net proceeds of the Registered Direct Offering and the net proceeds of the Private Placement to fund its acquisition of Samco Shipholding Pte. Ltd., a private company limited by shares incorporated under the laws of the Republic of Singapore, the expansion of its fleet, its pending vessel acquisitions and shipbuilding contracts and for other general corporate purposes.

Attached hereto as Exhibit 99.1 is a copy of the Company’s press release announcing the Registered Direct Offering, dated September 9, 2014, and it is incorporated herein by reference.

Attached hereto as Exhibit 99.2 is a copy of the Company’s press release announcing the Private Placement, dated September 9, 2014, and it is incorporated herein by reference.

|

|

|

|

|

Exhibit

|

|

Description

|

| |

|

|

|

99.1

|

|

Press Release dated September 9, 2014

|

|

99.2

|

|

Press Release dated September 9, 2014

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

DHT Holdings, Inc.

|

|

| |

|

(Registrant)

|

|

| |

|

|

|

|

Date: September 10, 2014

|

By:

|

/s/ Eirik Ubøe

|

|

| |

|

Eirik Ubøe

Chief Financial Officer

|

|

| |

|

|

|

| |

|

|

|

Exhibit 99.1

DHT HOLDINGS, INC. ANNOUNCES PROPOSED REGISTERED DIRECT OFFERING OF COMMON STOCK

HAMILTON, BERMUDA, September 9, 2014 – DHT Holdings, Inc. (NYSE:DHT) (“DHT”) announced today that it is planning an offering of shares of its common stock in a registered direct offering, subject to market and other conditions. DHT intends to use the net proceeds from the proposed offering, together with the net proceeds of certain other financing, to fund its acquisition of Samco Shipholding Ptc. Ltd., a private company limited by shares incorporated under the laws of the Republic of Singapore (“Samco”), pursuant to a share purchase agreement with the shareholders of Samco, the expansion of its fleet, its pending vessel acquisitions and shipbuilding contracts and for other general corporate purposes.

DHT's common shares trade on the New York Stock Exchange under the symbol "DHT".

RS Platou Markets, Inc. is acting as lead manager and bookrunner, and RS Platou Markets AS and Fearnley Securities AS are acting as placement agents. RS Platou Markets AS is not a U.S. registered broker-dealers and to the extent that the offering is made within the United States, its activities will be effected only to the extent permitted by Rule 15a-6 under the Securities Exchange Act of 1934, as amended.

This offering is being made only by means of a prospectus supplement and accompanying base prospectus. A prospectus supplement related to the offering will be filed with the U.S. Securities and Exchange Commission (the “SEC”) and will be available on the SEC's website located at www.sec.gov. When available, copies of the prospectus supplement and the accompanying prospectus relating to this offering may be obtained from RS Platou Markets, Inc., 410 Park Avenue, 7th Floor, Suite 710, New York, NY 10022, Attention: Raquel Lucas, (or by e-mail at office@platou.com).

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities, in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

THE ISSUER HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE REGISTERED DIRECT OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND OTHER DOCUMENTS THE ISSUER HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT THE ISSUER AND THE REGISTERED DIRECT OFFERING. YOU MAY OBTAIN THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT WWW.SEC.GOV. ALTERNATIVELY, THE ISSUER OR ANY PLACEMENT AGENT FOR THE REGISTERED DIRECT OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS AND THE PROSPECTUS SUPPLEMENT IF YOU REQUEST THEM FROM RS PLATOU MARKETS, INC. BY CALLING (855) 864-2265.

About DHT Holdings, Inc.

DHT is an independent crude oil tanker company operating a fleet of crude oil tankers in the VLCC, Suezmax and Aframax segments. We operate through our wholly owned management companies in Oslo, Norway and Singapore. For further information: www.dhtankers.com.

Forward Looking Statements

This press release may contain assumptions, expectations, projections, intentions and beliefs about future events. When used in this document, words such as “believe,” “intend,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “potential,” “will,” “may,” “should” and “expect” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These statements reflect DHT’s current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent DHT’s estimates and assumptions only as of the date of this press release and are not intended to give any assurance as to future results. Investing in DHT’s securities involves risk, and investors should be able to bear the loss of their investment. For a detailed discussion of the risk factors that might cause future results to differ, please refer to DHT’s Annual Report on Form 20-F, filed with the SEC on March 3, 2014.

DHT undertakes no obligation to publicly update or revise any forward-looking statements contained in this press release, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this press release might not occur, and DHT’s actual results could differ materially from those anticipated in these forward-looking statements.

CONTACT:

Eirik Ubøe, CFO

Phone: +44 1534 639 759 and +47 412 92 712

E-mail: eu@dhtankers.com

Exhibit 99.2

DHT HOLDINGS, INC. ANNOUNCES PROPOSED PRIVATE PLACEMENT OF CONVERTIBLE SENIOR NOTES DUE 2019

HAMILTON, BERMUDA, September 9, 2014 – DHT Holdings, Inc. (NYSE:DHT) (“DHT”) announced today that it is planning a private placement of convertible senior notes due 2019, subject to market and other conditions. DHT intends to use the net proceeds from the proposed private placement, together with the net proceeds of a concurrent offering of common stock, to fund its acquisition of Samco Shipholding Ptc. Ltd., a private company limited by shares incorporated under the laws of the Republic of Singapore (“Samco”), pursuant to a share purchase agreement with the shareholders of Samco, the expansion of its fleet, its pending vessel acquisitions and shipbuilding contracts and for other general corporate purposes.

The notes will be offered to qualified institutional buyers under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”). The notes will not be registered under the Securities Act or any state securities laws, and, unless so registered, may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities, in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

About DHT Holdings, Inc.

DHT is an independent crude oil tanker company operating a fleet of crude oil tankers in the VLCC, Suezmax and Aframax segments. We operate through our wholly owned management companies in Oslo, Norway and Singapore. For further information: www.dhtankers.com.

Forward Looking Statements

This press release may contain assumptions, expectations, projections, intentions and beliefs about future events. When used in this document, words such as “believe,” “intend,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “potential,” “will,” “may,” “should” and “expect” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These statements reflect DHT’s current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent DHT’s estimates and assumptions only as of the date of this press release and are not intended to give any assurance as to future results. Investing in DHT’s securities involves risk, and investors should be able to bear the loss of their investment. For a detailed discussion of the risk factors that might cause future results to differ, please refer to DHT’s Annual Report on Form 20-F, filed with the SEC on March 3, 2014.

DHT undertakes no obligation to publicly update or revise any forward-looking statements contained in this press release, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this press release might not occur, and DHT’s actual results could differ materially from those anticipated in these forward-looking statements.

CONTACT:

Eirik Ubøe, CFO

Phone: +44 1534 639 759 and +47 412 92 712

E-mail: eu@dhtankers.com

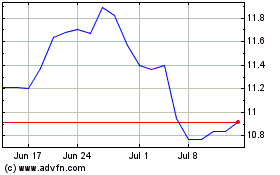

DHT (NYSE:DHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

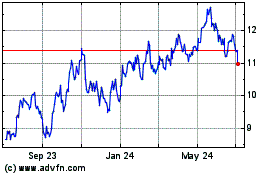

DHT (NYSE:DHT)

Historical Stock Chart

From Apr 2023 to Apr 2024