- Net Revenue Growth Drives Record 2Q

Operating Income of $34.9 Million, Broadcast Cash Flow of $58.7

Million, Adjusted EBITDA of $49.6 Million, and Free Cash Flow of

$30.4 Million -

Nexstar Broadcasting Group, Inc. (NASDAQ: NXST) (“Nexstar”)

today reported record financial results for the second quarter and

six months ended June 30, 2014 as summarized below:

Summary 2014 Second Quarter

Highlights

($ in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2014 2013

Change 2014

2013 Change Local Revenues $

70,461 $ 66,731 +5.59 % $ 136,103 $

126,665 +7.45 % National Revenues $ 26,075 $ 28,575

(8.75 )% $ 53,264 $ 51,950 +2.53 %

Local and National Core Revenue $ 96,536

$ 95,306 +1.29 %

$ 189,367 $

178,615 +6.02 % Political Revenues $ 6,746 $ 1,823

270.05 % $ 10,749 $ 2,585 +315.82 % Retransmission Fee Revenue $

34,960 $ 24,922 +40.28 % $ 70,089 $ 48,718 +43.87 % Digital Media

Revenue $ 13,248 $ 7,665 +72.84 % $ 19,525 $ 14,165 +37.84 % Other

$ 1,131 $ 1,099 +2.91 % $ 2,112 $ 2,224 (5.04 )% Trade and Barter

Revenue $ 7,701 $ 7,874 (2.20 )% $ 14,829

$ 15,292 (3.03 )%

Gross Revenue

$ 160,322 $ 138,689 +15.60 %

$

306,671 $ 261,599 +17.23 % Less: Agency

Commissions $ 13,392 $ 12,478 +7.32 % $ 25,908

$ 23,183 +11.75 %

Net Revenue $

146,930 $ 126,211 +16.42 %

$

280,763 $ 238,416 +17.76 %

Gross Revenue Excluding Political

Revenue

$ 153,576 $ 136,866

+12.21

$ 295,922

$

259,014

+14.25

%

Income from Operations $ 34,942 $ 28,192 +23.94 % $

62,642 $ 46,010 +36.15 %

Broadcast Cash

Flow(1) $ 58,701 $ 49,825 +17.81 % $ 109,313 $ 89,622

+21.97 %

Broadcast Cash Flow Margin(2) 39.95%

39.48% 38.93% 37.59%

Adjusted EBITDA(1) $

49,600 $ 42,946 +15.49 % $ 91,708 $ 76,010 +20.65 %

Adjusted

EBITDA Margin(2) 33.76% 34.03% 32.66% 31.88%

Free Cash Flow(1) $ 30,379 $ 20,464 +48.45 % $ 55,634

$ 33,133 +67.91 %

(1) Definitions and disclosures regarding

non-GAAP financial information are included on page 4, while

reconciliations are included on page 7.

(2) Broadcast cash flow margin is

broadcast cash flow as a percentage of net revenue. Adjusted EBITDA

margin is Adjusted EBITDA as a percentage of net revenue.

CEO CommentPerry A. Sook, Chairman, President and Chief

Executive Officer of Nexstar Broadcasting Group, Inc. commented,

“Nexstar’s long-term strategy to complete and integrate accretive

acquisitions while building complementary revenue streams that

leverage our local content and relationships drove record second

quarter net revenue, BCF, adjusted EBITDA and free cash flow. Our

year-to-date financial results are in-line with our expectations

and we remain confident that Nexstar will generate record free cash

flow in 2014 based on core advertising trends and rising political

spending in the second half of the year, contractual retransmission

revenue growth and our expanded digital media operations. In

addition, later this year we expect to close pending transactions

which will result in the addition of 27 stations and benefit

operating results in late 2014 and beyond.

“Our 16.4% rise in second quarter net revenue generated 17.8%

growth in BCF, a 15.5% increase in adjusted EBITDA, and a 48.5%

rise in free cash flow. During the second quarter, television ad

revenue inclusive of political advertising rose 6.3% with core

local and national spot revenue increasing 1.3%, including a 4.0%

rise in same station automotive advertising and year-over-year

increases in six of our top ten categories. Reflecting our expanded

platform and presence in states with high levels of political

spending activity, 2014 second quarter political revenue rose by

270% compared to the same period last year and by 12.8% over

comparable 2012 second quarter levels.

“While political ad spending in our markets will accelerate in

the second half of 2014, Nexstar’s gross revenue growth in the

second quarter excluding political was healthy at just over 12% and

reflects the 40.3% rise in retransmission fee revenue and 72.8%

increase in digital media revenue. Recently renegotiated

retransmission consent agreements combined with the growth of our

digital publishing platform and digital agency services offerings

resulted in a 47.9% increase in Nexstar’s total second quarter

retransmission fee and digital media revenue to $48.2 million.

Consistent with our revenue diversification objectives, these

higher margin revenue streams accounted for 32.8% of 2014 second

quarter net revenue up from 25.8% in the comparable period last

year and 22.2% in the 2012 second quarter, the last political

cycle.

“Looking forward, with distribution agreements representing over

40% of Nexstar’s subscribers up for renewal in 2014, we project

ongoing significant revenue growth from this source in the

remainder of 2014 and beyond. In addition, digital media revenue

growth in the second half of 2014 will benefit from the second

quarter accretive acquisitions of Internet Broadcasting Systems, a

digital publishing platform and digital agency services provider as

well as cloud-based content management solutions provider

Enterprise Technology Group (“ETG”). These strategic additions to

Nexstar’s existing digital platform and agency capabilities have

enabled us to expand the range of best of breed content publishing

and monetization tools that we offer to power our clients’ digital

media businesses and have expanded Nexstar’s digital business

portfolio to over $50 million in annual run rate revenues.

“During the second quarter, Nexstar remained active in executing

its long-term strategy to complete accretive transactions that

expand our operating and revenue base to drive free cash flow

growth. In this regard, we completed the acquisition of five

television stations in two markets for $35.0 million which follows

the completion in the first quarter of three stations in three

markets for $87.9 million.

“Throughout our history, Nexstar’s organization-wide commitment

to broadcasting excellence for local viewers and unparalleled

marketing results for our advertisers has been integral to our

success and growth. Reflecting this commitment, Nexstar and Mission

Broadcasting, Inc. stations have garnered over 340 broadcasting

awards over the past five years. We’ve also been market leaders in

addressing diversity in programming and the unique needs of the

communities where we operate. During the second quarter, Nexstar

initiated a transaction to promote diversity of media ownership

among minority operators through the sale and post-transaction

operational support of three network affiliated stations in three

markets to a minority controlled media company. We believe the

proposed transaction presents an innovative framework for

introducing and developing a new, minority-controlled entrant to

broadcasting, and for bringing additional news, information and

specialized programming to the Shreveport, LA, Odessa-Midland, TX

and Quad Cities, IA markets. This transaction is contingent upon

closing other pending transactions which we expect to complete

later this year.

“With our focus on generating free cash flow, we remain

disciplined in managing costs and in addressing our capital

structure, leverage and cost of capital. The rise in second quarter

station direct operating expenses (net of trade expense) and

SG&A primarily reflects higher variable costs related to the

higher core and political revenues and the operation of acquired

stations and digital assets. The second quarter corporate expense

was slightly ahead of our expectations and reflects approximately

$0.7 million of one-time expenses related to legal and professional

fees for acquisitions and related initiatives.

“With the addition of eight new stations in 2014 to date and

expectations that we will complete all other announced transactions

by year-end which will result in the net addition of 27 more

stations, Nexstar would generate pro-forma free cash flow in excess

of $350 million during the 2014/2015 cycle, or average pro-forma

free cash flow of approximately $5.85 per share per year. Our

current operations alone are pacing to generate blended free cash

flow of approximately $4.50 per share per year in the current

2014/2015 period and with the free cash flow generated from this

base of operations, we project that Nexstar’s net leverage will

decline to approximately 3.8x at the end of 2014.

“With significant and growing free cash flow, the benefit of

2014 political spending, the renewal by year-end of distribution

agreements covering over 40% of our subscribers, and the ongoing

expansion of our digital media platform, Nexstar remains well

positioned to selectively consolidate mid-sized markets, pursue

additional accretive digital media transactions and lower leverage

while returning capital to shareholders.”

The consolidated total debt of Nexstar, its wholly owned

subsidiaries, and Mission (collectively, the “Company”) at June 30,

2014, was $1,088.4 million and senior secured debt was $562.8

million. The Company’s total net leverage ratio at June 30, 2014

was 5.35x compared to a total permitted leverage covenant of 7.25x.

The Company’s first lien net leverage ratio at June 30, 2014 was

2.69x compared to the covenant maximum of 4.00x.

The table below summarizes the Company’s debt obligations:

($ in millions)

6/30/2014

12/31/2013 First Lien Term Loans $ 562.8 $ 545.4

6.875% Senior Notes due 2020 $ 525.6 $

525.7

Total Debt $ 1,088.4 $ 1,071.1

Cash

on hand $ 32.1 $ 40.0

DividendsOn July 25, 2014 the Board of Directors declared

a quarterly cash dividend of $0.15 per share of its Class A common

stock which will be paid on August 29, 2014 to shareholders of

record on August 15, 2014.

Second Quarter Conference CallNexstar will host a

conference call at 10:00 a.m. ET today. Senior management will

discuss the financial results and host a question and answer

session. The dial in number for the audio conference call is

719/325-2435, conference ID 6333592 (domestic and international

callers). In addition, a live audio webcast of the call will be

accessible to the public on Nexstar’s web site, www.nexstar.tv and

a recording of the webcast will be archived on the site for 90 days

following the live event.

Definitions and Disclosures Regarding non-GAAP Financial

InformationBroadcast cash flow is calculated as income from

operations, plus corporate expenses, depreciation, amortization of

intangible assets and broadcast rights (excluding barter) and loss

(gain) on asset disposal, net, minus broadcast rights payments.

Adjusted EBITDA is calculated as broadcast cash flow less

corporate expenses.

Free cash flow is calculated as income from operations plus

depreciation, amortization of intangible assets and broadcast

rights (excluding barter), loss (gain) on asset disposal, net, and

non-cash stock option expense, less payments for broadcast rights,

cash interest expense, capital expenditures and net cash income

taxes.

Broadcast cash flow, adjusted EBITDA and free cash flow results

are non-GAAP financial measures. Nexstar believes the presentation

of these non-GAAP measures are useful to investors because they are

used by lenders to measure the Company’s ability to service debt;

by industry analysts to determine the market value of stations and

their operating performance; by management to identify the cash

available to service debt, make strategic acquisitions and

investments, maintain capital assets and fund ongoing operations

and working capital needs; and, because they reflect the most

up-to-date operating results of the stations inclusive of pending

acquisitions, TBAs or LMAs. Management believes they also provide

an additional basis from which investors can establish forecasts

and valuations for the Company’s business.

For a reconciliation of these non-GAAP financial measurements to

the GAAP financial results cited in this news announcement, please

see the supplemental tables at the end of this release.

About Nexstar Broadcasting Group, Inc.Nexstar

Broadcasting Group is a leading diversified media company that

leverages localism to bring new services and value to consumers and

advertisers through its traditional media, digital and mobile media

platforms. Nexstar owns, operates, programs or provides sales and

other services to 80 television stations and 20 related digital

multicast signals reaching 46 markets or approximately 13.1% of all

U.S. television households. Nexstar’s portfolio includes affiliates

of NBC, CBS, ABC, FOX, MyNetworkTV, The CW, Telemundo, Bounce TV,

Me-TV, Live Well, LATV and an independent station. Nexstar’s 48

community portal websites offer additional hyper-local content and

verticals for consumers and advertisers, allowing audiences to

choose where, when and how they access content while creating new

revenue opportunities.

Pro-forma for the completion of all announced transactions

Nexstar will own, operate, program or provides sales and other

services to 107 television stations and related digital multicast

signals reaching 56 markets or approximately 16.0% of all U.S.

television households.

Forward-Looking StatementsThis news release includes

forward-looking statements. We have based these forward-looking

statements on our current expectations and projections about future

events. Forward-looking statements include information preceded by,

followed by, or that includes the words "guidance," "believes,"

"expects," "anticipates," "could," or similar expressions. For

these statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements contained in this news release, concerning, among other

things, changes in net revenue, cash flow and operating expenses,

involve risks and uncertainties, and are subject to change based on

various important factors, including the impact of changes in

national and regional economies, our ability to service and

refinance our outstanding debt, successful integration of acquired

television stations (including achievement of synergies and cost

reductions), pricing fluctuations in local and national

advertising, future regulatory actions and conditions in the

television stations' operating areas, competition from others in

the broadcast television markets served by the Company, volatility

in programming costs, the effects of governmental regulation of

broadcasting, industry consolidation, technological developments

and major world news events. Unless required by law, we undertake

no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this news release might not

occur. You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this release. For

more details on factors that could affect these expectations,

please see our filings with the Securities and Exchange

Commission.

Nexstar Broadcasting Group,

Inc.Condensed Consolidated Statements of Operations -

UNAUDITED(in thousands, except per share amounts)

Three Months EndedJune

30,

Six Months EndedJune 30,

2014 2013 2014

2013 Net revenue $ 146,930 $ 126,211 $ 280,763

$ 238,416 Operating expenses: Corporate

expenses 9,101 6,879 17,605 13,612

Station direct operating expenses, net of

trade, depreciation and amortization

43,185 34,408 83,564 66,999 Station selling, general, and

administrative expenses, net of depreciation and amortization

34,695 30,686 67,231 59,453 Trade and barter expense 7,581 7,608

14,723 14,965 Depreciation 8,543 8,213 16,962 16,193 Amortization

of intangible assets 6,112 6,914 12,305 14,904 Amortization of

broadcast rights, excluding barter 2,771 3,311

5,731 6,280

Total operating expenses

111,988

98,019 218,121 192,406

Income from operations 34,942 28,192 62,642 46,010 Interest

expense, net (15,339 ) (16,903) (30,509 ) (33,452 ) Loss on

extinguishment of debt (71 ) - (71 ) -

Other expenses

(127 ) (84) (255 ) (168 ) Income before

income taxes 19,405 11,205 31,807 12,390 Income tax expense

(8,461 ) (4,838) (13,510 ) (5,318 ) Net

income 10,944 6,367 18,297

7,072 Basic net income per share 0.36

0.22 0.60 0.24 Basic weighted average number of common shares

outstanding 30,641 29,604 30,622 29,533 Diluted net income

per share 0.34 0.20 0.57 0.23

Diluted weighted average number of common

shares outstanding

31,932 31,325 31,921 31,189

Nexstar Broadcasting Group,

Inc.Reconciliation of Broadcast Cash Flow and Adjusted

EBITDA (Non-GAAP Measures)UNAUDITED(in thousands)

Three Months EndedJune

30,

Six Months EndedJune 30,

Broadcast Cash Flow and Adjusted EBITDA: 2014

2013 2014 2013 Income

from operations $ 34,942 $ 28,192 $ 62,642 $

46,010 Add: Depreciation 8,543 8,213 16,962 16,193

Amortization of intangible assets 6,112 6,914 12,305 14,904

Amortization of broadcast rights, excluding barter

2,771

3,311

5,731

6,280

Loss (gain) on asset disposal, net 161 (5 ) 146 2 Corporate

expenses 9,101 6,879 17,605 13,612 Less: Payments for

broadcast rights 2,929 3,679

6,078 7,379

Broadcast cash flow 58,701 49,825 109,313 89,622 Less:

Corporate expenses 9,101 6,879

17,605 13,612

Adjusted EBITDA $ 49,600 $ 42,946

$ 91,708 $ 76,010

Nexstar Broadcasting Group,

Inc.Reconciliation of Free Cash Flow (Non-GAAP

Measure)UNAUDITED(in thousands)

Three Months EndedJune

30,

Six Months EndedJune 30,

Free Cash Flow: 2014 2013 2014

2013 Income from operations $ 34,942 $

28,192 $ 62,642 $ 46,010 Add:

Depreciation 8,543 8,213 16,962 16,193 Amortization of intangible

assets 6,112 6,914 12,305 14,904 Amortization of broadcast rights,

excluding barter 2,771 3,311 5,731 6,280 Loss (gain) on asset

disposal, net 161 (5 ) 146 2 Non-cash stock option expense 1,913

499 3,556 994 Less: Payments for broadcast rights 2,929

3,679 6,078 7,379 Cash interest expense 14,677 16,054 29,157 31,772

Capital expenditures 5,063 5,703 9,032 9,976 Cash income taxes, net

of refunds 1,394 1,224

1,441 2,123 Free

cash flow $ 30,379 $ 20,464 $

55,634 $ 33,133

Nexstar Broadcasting Group, Inc.Thomas E. Carter,

972-373-8800Chief Financial OfficerorJCIRJoseph Jaffoni,

212-835-8500nxst@jcir.comorJennifer Neuman,

212-835-8500nxst@jcir.com

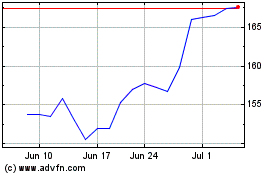

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

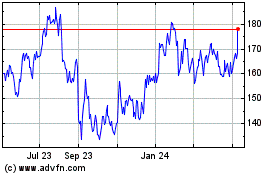

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024