UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2014

CLEAN ENERGY FUELS CORP.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

|

001-33480 |

|

33-0968580 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

4675 MacArthur Court, Suite 800

Newport Beach, CA |

|

92660 |

|

(Address of Principal Executive Offices) |

|

Zip Code |

(949) 437-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2014, Clean Energy Fuels Corp. (the “Company”) issued a press release announcing financial results for its second quarter ended June 30, 2014. A copy of the Company’s press release containing this information is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

The information furnished in this report, including Exhibit 99.1, shall not be deemed to constitute an admission that such information or exhibit is required to be furnished pursuant to Regulation FD or that such information or exhibit contains material information that is not otherwise publicly available. In addition, the Company does not assume any obligation to update such information or exhibit in the future.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated August 7, 2014

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 7, 2014 |

Clean Energy Fuels Corp. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Richard R. Wheeler |

|

|

|

Name: Richard R. Wheeler |

|

|

|

Title: Chief Financial Officer |

2

Exhibit 99.1

4675 MacArthur Court, Suite 800

Newport Beach, California 92660 USA

949.437.1000 fax: 949.724.1397

www.cleanenergyfuels.com

Clean Energy Reports Gallons Delivered Rose 23% and Revenue up 19% During The Second Quarter of 2014

NEWPORT BEACH, Calif.—(BUSINESS WIRE) — Clean Energy Fuels Corp. (NASDAQ: CLNE) (Clean Energy or the Company) today announced operating results for the second quarter ended June 30, 2014.

Gallons delivered (defined below) for the second quarter of 2014 totaled 64.8 million gallons, up 23% from the 52.6 million gallons delivered in the same period a year ago. For the six months ended June 30, 2014, gallons delivered totaled 124.1 million gallons, up from 102.5 million gallons delivered in the six months ended June 30, 2013.

Revenue for the second quarter ended June 30, 2014 was $98.1 million, up from $88.1 million for the second quarter of 2013. Excluding the VETC (defined below) revenue recorded in the second quarter of 2013, revenue increased 19% between periods. For the six months ended June 30, 2014, revenue totaled $193.4 million, up from $181.2 million a year ago. When comparing periods, note that the Company recognize revenue attributable to the volumetric excise tax credit (VETC) of $6.0 million and $32.2 million in the second quarter and first six months of 2013, but did not recognized any revenue attributable to VETC in the second quarter and first six months of 2014 as the legislation under which the Company received such revenue expired on December 31, 2013.

Andrew J. Littlefair, Clean Energy’s President and Chief Executive Officer, stated “It was a very productive quarter at Clean Energy with the opening of the I-10 corridor from L.A. to Houston and the I-40 corridor from L.A. to Oklahoma City to heavy duty trucks fueling at our stations. Our nationwide network of natural gas fueling stations continues to expand as the number of trucking fleets that are either testing natural gas trucks or increasing their current count is rapidly expanding.”

Littlefair continued “We also opened a CNG station, which in addition to fueling vehicles, is providing natural gas to energy-intensive users that are beyond the reach of a pipeline in New England. After being opened for only a few weeks, we see it on track to become one of our highest volume stations. In addition to this new market, we also made additional inroads into two of our newer markets, ready mix and bulk fuel hauling, during the quarter. Lastly, our established businesses of refuse, transit and airports continue to produce record volume levels.”

Adjusted EBITDA for the second quarter of 2014 was $(4.7) million. This compares with Adjusted EBITDA of $11.1 million in the second quarter of 2013. For the six month period ended June 30, 2014, Adjusted EBITDA was $(11.5) million, compared with $31.2 million for the same period in 2013. Adjusted EBITDA in the second quarter of 2013 and in the first six months of 2013 included $6.0 million and $32.2 million, respectively, of VETC revenue. Additionally, Adjusted EBITDA in the three months and six months ended June 30, 2013 included a $15.5 million gain on the Company’s sale of one of its subsidiaries, and Adjusted EBITDA for the six month period ended June 30, 2013 also included a $4.7 million gain on the Company’s sale of its ownership interest in its Peruvian joint venture. Adjusted EBITDA is described below and reconciled to the GAAP measure net loss attributable to Clean Energy Fuels Corp.

Non-GAAP loss per share for the second quarter of 2014 was $0.28, compared with non-GAAP loss per share for the second quarter of 2013 of $0.07. For the six months ended June 30, 2014, non-GAAP loss per share was $0.58, compared with non-GAAP loss per share of $0.03 for the first six months in 2013. Non-GAAP loss per share in the second quarter of 2013 and in the first six months of 2013 included $6.0 million and $32.2 million, respectively, of VETC revenue, and the non-GAAP loss per share amounts for the three and six month periods ended June 30, 2013 included a $15.5 million gain on the sale of one of the Company’s subsidiaries. Non-GAAP loss per share for the six month period ended June 30, 2013 also included a $4.7 million gain on the Company’s sale of its ownership interest in its Peruvian joint venture. Non-GAAP loss per share is described below and reconciled to the GAAP measure net loss attributable to Clean Energy Fuels Corp.

On a GAAP basis, net loss for the second quarter of 2014 was $32.3 million, or $0.34 per share, and included a non-cash loss of $2.3 million related to the accounting treatment that requires Clean Energy to value its Series I warrants and mark them to market, a non-cash charge of $3.0 million related to stock-based compensation, a $0.3 million gain on the fair value adjustment of the remaining shares the Company received from Westport Innovations, Inc. from the sale of its former subsidiary BAF Technologies, Inc. (WPRT Holdback Shares Write-Down or (Write Up)), and $0.8 million in additional lease exit charges related to the move of the Company’s headquarters (HQ Lease Exit). This compares with a net loss for the second quarter of 2013 of $11.9 million, or $0.13 per share, that included $5.5 million of non-cash stock-based compensation charges and foreign currency losses of $0.2 million on the Company’s purchase notes issued in September 2011 in connection with its acquisition of IMW Industries, Ltd. (“IMW”).

Net loss for the six month period ended June 30, 2014 was $60.9 million, or $0.64 per share, which included a non-cash gain of $2.2 million related to the valuation of the Series I warrants, non-cash stock-based compensation charges of $6.4 million, foreign currency losses of $0.3 million on the IMW purchase notes, a $0.1 million charge from the WPRT Holdback Shares Write-Down, and a $0.8 million charge related to the HQ Lease Exit. This compares with a net loss in the six months ended June 30, 2013 of $15.8 million, or $0.17 per share, which included a non-cash charge for the Series I warrants of $0.5 million, non-cash stock-based compensation charges of $11.7 million, and foreign currency losses of $0.4 million on the IMW purchase notes.

Non-GAAP Financial Measures

To supplement the Company’s condensed consolidated financial statements, which statements are prepared and presented in accordance with generally accepted accounting principles (GAAP), the Company uses non-GAAP financial measures called non-GAAP earnings per share (non-GAAP EPS or non-GAAP earnings/loss per share) and Adjusted EBITDA. Management has presented non-GAAP EPS and Adjusted EBITDA because it uses these non-GAAP financial measures to assess its operational performance, for financial and operational decision-making, and as a means to evaluate period-to-period comparisons on a consistent basis. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain non-cash or non-recurring expenses that are not directly attributable to its core operating results. In addition, management believes these non-GAAP financial measures are useful to investors because: (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making; (2) they exclude the impact of non-cash or, when specified, non-recurring items that are not directly attributable to the Company’s core operating performance and that may obscure trends in the core operating performance of the business; and (3) they are used by institutional investors and the analyst community to help them analyze the results of Clean Energy’s business. In future quarters, the Company may make adjustments for other non-recurring significant expenditures or significant non-cash charges in order to present non-GAAP financial measures that the Company’s management believes are indicative of the Company’s core operating performance.

Non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, the Company’s GAAP results. The Company expects to continue reporting non-GAAP financial measures, adjusting for the items described below (or other items that may arise in the future as the Company’s management deems appropriate), and the Company expects to continue to incur expenses similar to the non-cash, non-GAAP adjustments described below. Accordingly, unless otherwise stated, the exclusion of these and other similar items in the presentation of non-cash, non-GAAP financial measures should not be construed as an inference that these costs are unusual, infrequent or non-recurring. Non-GAAP EPS and Adjusted EBITDA are not recognized terms under GAAP and do not purport to be an alternative to GAAP earnings/loss per share or operating income (loss) as an indicator of operating performance or any other GAAP measure. Moreover, because not all companies use identical measures and calculations, the presentation of non-GAAP EPS or Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Management compensates for these limitations by using non-GAAP EPS and Adjusted EBITDA in conjunction with traditional GAAP operating performance and cash flow measures.

Non-GAAP EPS

Non-GAAP EPS is defined as net income (loss) attributable to Clean Energy Fuels Corp., plus stock-based compensation charges, net of related tax benefits, plus or minus any mark-to-market losses or gains on the Company’s Series I warrants, plus or minus the foreign currency losses or gains on the Company’s IMW purchase notes, plus or minus the WPRT Holdback Shares Write-Down or Write-Up, and plus the HQ Lease Exit, the total of which is divided by the Company’s weighted average shares outstanding on a diluted basis. The Company’s management believes that excluding non-cash charges related to stock-based compensation provides useful information to investors because the varying available valuation methodologies, the volatility of the expense (which depends on market forces outside of management’s control), and the subjectivity of the assumptions and the variety of award types that a company can use under the relevant accounting guidance may obscure trends in the Company’s core operating performance. Similarly, the Company’s management believes that excluding the non-cash, mark-to-market losses or gains on the Company’s Series I warrants is useful to investors because the valuation of the Series I warrants is based on a number of subjective assumptions, the amount of the loss or gain is derived from market forces outside management’s control, and it enables investors to compare the Company’s performance with other companies that have different capital structures. The Company’s management believes that excluding the foreign currency gains and losses on the IMW purchase notes provides useful information to investors as the amounts are based on market conditions outside of management’s control and the amounts relate to financing the acquisition of the IMW business as opposed to the core operations of the Company. The Company’s management believes that excluding the WPRT Holdback Shares Write-Down or Write-Up and the HQ Lease Exit amounts is useful to investors because they are not part of the core operations of the Company.

The table below shows non-GAAP EPS and also reconciles these figures to the GAAP measure net loss attributable to Clean Energy Fuels Corp.:

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

(in 000s, except per-share amounts) |

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

|

Net Loss Attributable to Clean Energy Fuels Corp. |

|

$ |

(11,943 |

) |

$ |

(32,306 |

) |

$ |

(15,814 |

) |

$ |

(60,899 |

) |

|

Stock Based Compensation, Net of Tax Benefits |

|

5,451 |

|

2,978 |

|

11,663 |

|

6,398 |

|

|

Mark-to-Market (Gain) Loss on Series I Warrants |

|

39 |

|

2,286 |

|

505 |

|

(2,169 |

) |

|

Foreign Currency Loss on IMW Purchase Notes |

|

249 |

|

— |

|

441 |

|

343 |

|

|

WPRT Holdback Shares Write-Down or (Write Up) |

|

— |

|

(341 |

) |

— |

|

122 |

|

|

HQ Lease Exit |

|

— |

|

757 |

|

— |

|

812 |

|

|

Adjusted Net Loss |

|

$ |

(6,204 |

) |

$ |

(26,626 |

) |

$ |

(3,205 |

) |

$ |

(55,393 |

) |

|

Diluted Weighted Average Common Shares Outstanding |

|

93,985,438 |

|

94,859,587 |

|

93,561,302 |

|

94,768,462 |

|

|

Non-GAAP Loss Per Share |

|

$ |

(0.07 |

) |

$ |

(0.28 |

) |

$ |

(0.03 |

) |

$ |

(0.58 |

) |

Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss) attributable to Clean Energy Fuels Corp., plus or minus income tax expense or benefit, plus or minus interest expense or income, net, plus depreciation and amortization expense, plus or minus the foreign currency losses or gains on the Company’s IMW purchase notes, plus stock-based compensation charges, net of related tax benefits, plus or minus any mark-to-market losses or gains on the Company’s Series I warrants, plus or minus the WPRT Holdback Shares Write-Down or Write-Up, and plus the HQ Lease Exit. The Company’s management believes that Adjusted EBITDA provides useful information to investors for the same reasons discussed above for Non-GAAP EPS. In addition, management internally uses Adjusted EBITDA to determine elements of executive and employee compensation.

The table below shows Adjusted EBITDA and also reconciles these figures to the GAAP measure net loss attributable to Clean Energy Fuels Corp.:

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

(in 000s) |

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

|

Net Loss Attributable to Clean Energy Fuels Corp. |

|

$ |

(11,943 |

) |

$ |

(32,306 |

) |

$ |

(15,814 |

) |

$ |

(60,899 |

) |

|

Income Tax Expense |

|

293 |

|

147 |

|

2,098 |

|

1,109 |

|

|

Interest Expense, Net |

|

6,282 |

|

10,130 |

|

11,353 |

|

19,640 |

|

|

Depreciation and Amortization |

|

10,777 |

|

11,608 |

|

20,935 |

|

23,123 |

|

|

Foreign Currency Loss on IMW Purchase Notes |

|

249 |

|

— |

|

441 |

|

343 |

|

|

Stock Based Compensation, Net of Tax Benefits |

|

5,451 |

|

2,978 |

|

11,663 |

|

6,398 |

|

|

Mark-to-Market (Gain) Loss on Series I Warrants |

|

39 |

|

2,286 |

|

505 |

|

(2,169 |

) |

|

WPRT Holdback Shares Write-Down or (Write Up) |

|

— |

|

(341 |

) |

— |

|

122 |

|

|

HQ Lease Exit |

|

— |

|

757 |

|

— |

|

812 |

|

|

Adjusted EBITDA |

|

$ |

11,148 |

|

$ |

(4,741 |

) |

$ |

31,181 |

|

$ |

(11,521 |

) |

Gallons Delivered

The Company defines “gallons delivered” as its gallons of compressed natural gas (CNG), liquefied natural gas (LNG) and renewable natural gas (RNG), along with its gallons associated with providing operations and maintenance services, delivered to its customers during the applicable period.

Today’s Conference Call

The Company will host an investor conference call today at 4:30 p.m. Eastern time (1:30 p.m. Pacific). Investors interested in participating in the live call can dial 1.877.407.4018 from the U.S., and international callers can dial 1.201.689.8471. A telephone replay will be available approximately two hours after the call concludes, through Sunday, September 7, 2014, which can be reached by dialing 1.877.870.5176 from the U.S., or 1.858.384.5517 from international locations, and entering Replay Pin Number 13587467. There also will be a simultaneous, live webcast available on the Investor Relations section of the Company’s web site at www.cleanenergyfuels.com, which will be available for replay for 30 days.

About Clean Energy Fuels

Clean Energy Fuels Corp. (Nasdaq: CLNE) is the largest provider of natural gas fuel for transportation in North America. We build and operate CNG and LNG fueling stations; manufacture CNG and LNG equipment and technologies for ourselves and other companies; develop RNG production facilities; and deliver more CNG, LNG, and Redeem RNG fuel than any other company in the U.S. For more information, visit www.cleanenergyfuels.com.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks, uncertainties and assumptions, such as statements regarding the transition of the heavy-duty truck market to natural gas, opening new natural gas fueling stations and adding incremental volume to the Company’s fueling infrastructure, the Company establishing relationships with new customers and expanding relationships with existing customers, and future growth and sales opportunities in all of the Company’s markets, which include trucking, refuse, airport, taxi, transit, ready mix and off-system sales. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors including, but not limited to, changes in the prices of natural gas relative to gasoline and diesel, the Company’s ability to recognize the anticipated benefits of building CNG and LNG stations, the availability and deployment of, as well as the demand for, natural gas engines that are well-suited for the U.S. long-haul, heavy-duty truck market, future availability of equity or debt financing needed to fund the growth of the Company’s business, the Company’s ability to efficiently manage any growth it might experience and retain and hire key personnel, the acceptance and availability of natural gas vehicles in the Company’s markets, changes to federal, state or local fuel emission standards, the Company’s ability to capture a substantial share of the anticipated growth in the market for natural gas fuel and otherwise compete successfully, the Company’s ability to manage risks and uncertainties related to its international operations, construction and permitting delays at station construction projects, the Company’s ability to integrate acquisitions, the availability of tax and related government incentives for natural gas fueling and vehicles, compliance with governmental regulations, the Company’s ability to source and supply sufficient LNG to meet the needs of its business, the Company’s ability to effectively manage its current LNG plants and the construction of new LNG plants, and the Company’s ability to manage and grow its RNG business. The forward-looking statements made herein speak only as of the date of this press release and the Company undertakes no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by law. Additionally, the Company’s Form 10-Q, filed on May 8, 2014 with the SEC (www.sec.gov), contains risk factors that may cause actual results to differ materially from the forward-looking statements contained in this press release.

Investor Contact:

Tony Kritzer

Director of Investor Communications

949.437.1403

News Media Contact:

Gary Foster

Senior Vice President, Corporate Communications

949.437.1113

Clean Energy Fuels Corp. and Subsidiaries

Condensed Consolidated Balance Sheets

December 31, 2013 and June 30, 2014

(Unaudited)

(In thousands, except share data)

|

|

|

December 31,

2013 |

|

June 30,

2014 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

240,033 |

|

$ |

124,700 |

|

|

Restricted cash |

|

8,403 |

|

12,249 |

|

|

Short-term investments |

|

138,240 |

|

152,113 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $832 and $908 as of December 31, 2013 and June 30, 2014, respectively |

|

53,473 |

|

70,245 |

|

|

Other receivables |

|

26,285 |

|

17,876 |

|

|

Inventory, net |

|

33,822 |

|

39,204 |

|

|

Prepaid expenses and other current assets |

|

20,840 |

|

20,918 |

|

|

Total current assets |

|

521,096 |

|

437,305 |

|

|

Land, property and equipment, net |

|

487,854 |

|

532,574 |

|

|

Notes receivable and other long-term assets |

|

73,697 |

|

71,260 |

|

|

Goodwill |

|

88,548 |

|

88,406 |

|

|

Intangible assets, net |

|

79,770 |

|

75,934 |

|

|

Total assets |

|

$ |

1,250,965 |

|

$ |

1,205,479 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt and capital lease obligations |

|

$ |

23,401 |

|

$ |

17,724 |

|

|

Accounts payable |

|

33,541 |

|

34,256 |

|

|

Accrued liabilities |

|

46,745 |

|

48,348 |

|

|

Deferred revenue |

|

16,419 |

|

15,997 |

|

|

Total current liabilities |

|

120,106 |

|

116,325 |

|

|

Long-term debt and capital lease obligations, less current portion |

|

532,017 |

|

543,416 |

|

|

Long-term debt, related party |

|

65,000 |

|

65,000 |

|

|

Other long-term liabilities |

|

15,304 |

|

13,093 |

|

|

Total liabilities |

|

732,427 |

|

737,834 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.0001 par value. Authorized 1,000,000 shares; issued and outstanding no shares |

|

— |

|

— |

|

|

Common stock, $0.0001 par value. Authorized 224,000,000 shares; issued and outstanding 89,364,397 shares and 89,863,439 shares at December 31, 2013 and June 30, 2014, respectively |

|

9 |

|

9 |

|

|

Additional paid-in capital |

|

883,045 |

|

893,876 |

|

|

Accumulated deficit |

|

(367,782 |

) |

(428,681 |

) |

|

Accumulated other comprehensive loss |

|

(700 |

) |

(1,188 |

) |

|

Total Clean Energy Fuels Corp. stockholders’ equity |

|

514,572 |

|

464,016 |

|

|

Noncontrolling interest in subsidiary |

|

3,966 |

|

3,629 |

|

|

Total stockholders’ equity |

|

518,538 |

|

467,645 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,250,965 |

|

$ |

1,205,479 |

|

Clean Energy Fuels Corp. and Subsidiaries

Condensed Consolidated Statements of Operations

For the Three Months and Six Months Ended June 30, 2013 and 2014

(In thousands, except share and per share data)

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

|

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

Product revenues |

|

$ |

78,375 |

|

$ |

86,473 |

|

$ |

161,858 |

|

$ |

172,262 |

|

|

Service revenues |

|

9,741 |

|

11,660 |

|

19,301 |

|

21,146 |

|

|

Total revenues |

|

88,116 |

|

98,133 |

|

181,159 |

|

193,408 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation and amortization shown separately below): |

|

|

|

|

|

|

|

|

|

|

Product cost of sales |

|

58,925 |

|

69,175 |

|

105,739 |

|

137,042 |

|

|

Service cost of sales |

|

3,016 |

|

4,080 |

|

6,943 |

|

7,844 |

|

|

Derivative (gains) losses: |

|

|

|

|

|

|

|

|

|

|

Series I warrant valuation |

|

39 |

|

2,286 |

|

505 |

|

(2,169 |

) |

|

Selling, general and administrative |

|

35,187 |

|

34,400 |

|

68,063 |

|

67,890 |

|

|

Depreciation and amortization |

|

10,777 |

|

11,608 |

|

20,935 |

|

23,123 |

|

|

Total operating expenses |

|

107,944 |

|

121,549 |

|

202,185 |

|

233,730 |

|

|

Operating loss |

|

(19,828 |

) |

(23,416 |

) |

(21,026 |

) |

(40,322 |

) |

|

Interest expense, net |

|

(6,282 |

) |

(10,130 |

) |

(11,353 |

) |

(19,640 |

) |

|

Other income (expense), net |

|

(1,103 |

) |

1,121 |

|

(1,493 |

) |

(165 |

) |

|

Loss from equity method investment |

|

— |

|

— |

|

(76 |

) |

— |

|

|

Gain from sale of equity method investment |

|

— |

|

— |

|

4,705 |

|

— |

|

|

Gain from sale of subsidiary |

|

15,498 |

|

— |

|

15,498 |

|

— |

|

|

Loss before income taxes |

|

(11,715 |

) |

(32,425 |

) |

(13,745 |

) |

(60,127 |

) |

|

Income tax expense |

|

(293 |

) |

(147 |

) |

(2,098 |

) |

(1,109 |

) |

|

Net loss |

|

(12,008 |

) |

(32,572 |

) |

(15,843 |

) |

(61,236 |

) |

|

Loss of noncontrolling interest |

|

65 |

|

266 |

|

29 |

|

337 |

|

|

Net loss attributable to Clean Energy Fuels Corp. |

|

$ |

(11,943 |

) |

$ |

(32,306 |

) |

$ |

(15,814 |

) |

$ |

(60,899 |

) |

|

Loss per share attributable to Clean Energy Fuels Corp.: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.13 |

) |

$ |

(0.34 |

) |

$ |

(0.17 |

) |

$ |

(0.64 |

) |

|

Diluted |

|

$ |

(0.13 |

) |

$ |

(0.34 |

) |

$ |

(0.17 |

) |

$ |

(0.64 |

) |

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

93,985,438 |

|

94,859,587 |

|

93,561,302 |

|

94,768,462 |

|

|

Diluted |

|

93,985,438 |

|

94,859,587 |

|

93,561,302 |

|

94,768,462 |

|

Included in net loss are the following amounts (in millions):

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

|

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

|

Construction Revenues |

|

$ |

12.1 |

|

$ |

14.7 |

|

$ |

15.0 |

|

$ |

31.0 |

|

|

Construction Cost of Sales |

|

(10.0 |

) |

(12.6 |

) |

(12.7 |

) |

(26.0 |

) |

|

Fuel Tax Credits |

|

6.0 |

|

— |

|

32.2 |

|

— |

|

|

Stock-based Compensation Expense, Net of Tax Benefits |

|

(5.5 |

) |

(3.0 |

) |

(11.7 |

) |

(6.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

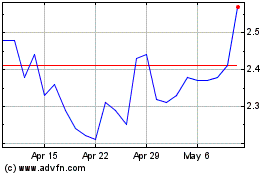

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Aug 2024 to Sep 2024

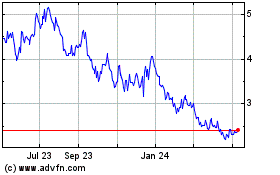

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Sep 2023 to Sep 2024