Current Report Filing (8-k)

July 22 2014 - 10:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 18, 2014

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50865 |

|

13-3607736 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 28903 North Avenue Paine

Valencia, California |

|

91355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (661) 775-5300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant.

As previously reported, we entered into a facility agreement (as amended, the “Facility Agreement”) with

Deerfield Private Design Fund II, L.P. and Deerfield Private Design International II, L.P. (collectively, “Deerfield”) on July 1, 2013, providing for the sale by us of up to $160.0 million principal amount of our 9.75% senior secured

convertible notes due 2019 (the “2019 notes”) to Deerfield in four equal tranches.

On July 18, 2014, following our receipt of approval of

AFFREZZA® from the U.S. Food and Drug Administration on June 27, 2014 and the satisfaction of certain other conditions, Deerfield purchased the fourth and final tranche of 2019 notes (the

“Tranche 4 Notes”) in the aggregate principal amount of $40.0 million in accordance with the terms of the Facility Agreement. Although the Facility Agreement provided for the conversion of a portion of the 2019 notes into shares of our

common stock at Deerfield’s election (the “Conversion Option”), Deerfield previously exercised the Conversion Option in full and accordingly the Tranche 4 Notes are not convertible by their terms.

The Tranche 4 Notes accrue interest at a rate of 9.75% per annum until maturity in 2019 or their earlier repayment or repurchase. We are required to

repay 25% of the original principal amount of the Tranche 4 Notes on each of July 18, 2017, July 18, 2018 and July 18, 2019, and the entire outstanding principal amount of all Tranche 4 Notes will become due and payable on

December 31, 2019. Under the Facility Agreement, in the event of a Major Transaction, as defined in the Facility Agreement, the holders of the Tranche 4 Notes have the option to require us to repurchase the outstanding Tranche 4 Notes at a

repurchase price of 100% of the principal amount of such notes to be repurchased plus accrued and unpaid interest, if any. In addition, pursuant to the Facility Agreement, if one or more events of default occur and continue beyond any applicable

cure period, the holders of the Tranche 4 Notes may declare all or any portion of the outstanding Tranche 4 Notes to be immediately due and payable. Events of default under the Facility Agreement include: our failure to timely make payments due

under any outstanding 2019 notes or tranche B notes issued pursuant to the Facility Agreement; inaccuracies in our representations and warranties to Deerfield; our failure to comply with any of our covenants under any of the Facility Agreement, our

Milestone Rights Purchase Agreement with Deerfield Private Design Fund and Horizon Santé FLML SÁRL dated July 1, 2013, or certain other related security agreements and documents entered into in connection with the Facility

Agreement, subject to a cure period with respect to most covenants; our insolvency or the occurrence of certain bankruptcy-related events; certain judgments against us; the suspension, cancellation or revocation of governmental authorizations that

are reasonably expected to have a material adverse effect on our business; the acceleration of a specified amount of our indebtedness; and our cash and cash equivalents, including amounts available to us under our loan arrangement with The Mann

Group LLC, falling below $25.0 million as of the last day of any fiscal quarter.

The foregoing description of the Tranche 4 Notes does not purport to be

complete and is qualified in its entirety by reference to the form of 2019 note, a copy of which is attached as Exhibit 99.2 to our Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on July 1, 2013;

the Facility Agreement, a copy of which is attached as Exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on July 1, 2013; and the First Amendment to Facility Agreement and Registration Rights Agreement, dated as of

February 28, 2014, a copy of which is attached as Exhibit 10.39 to our Annual Report on Form 10-K filed with the SEC on March 3, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MannKind Corporation |

|

|

|

|

| Dated: July 22, 2014 |

|

|

|

By: |

|

/s/ DAVID THOMSON, PH.D., J.D. |

|

|

|

|

|

|

Name: David Thomson, Ph.D., J.D. |

|

|

|

|

|

|

Title: Corporate Vice President, General Counsel and Secretary |

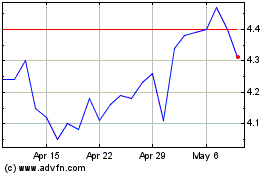

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

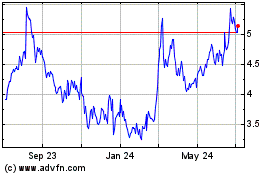

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024