UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14C

OF THE

SECURITIES EXCHANGE ACT OF 1934

x

Filed by the Registrant

o

Filed by a Party other than the Registrant

Check the appropriate box:

|

o

|

Preliminary Information Statement

|

|

x

|

Definitive Information Statement Only

|

|

o

|

Confidential, for Use of the Commission (as permitted by Rule 14c)

|

CARDIFF INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

_______________________________________

Name of Person(s) Filing Information Statement,

if other than Registrant:

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14C-5(g) and 0-11.

|

(1) Title of each class of securities to which transaction

applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing fee is calculated

and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o

Fee paid previously with preliminary materials.

o

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing

for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

1)

|

Amount previously paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

3)

|

Filing Party: ____________________________

|

|

|

4)

|

Date Filed: ____________________________

|

CARDIFF INTERNATIONAL, INC.

2747 Paradise Road Unit 1103

Las Vegas, NV 89109

(818) 783-2100

NOTICE IS HEREBY GIVEN

that the Board

of Directors (the “Board”) of Cardiff International, Inc. a Colorado corporation (hereinafter the “Company”,”

“we,” or “our”), has approved, and the holders of a majority of the outstanding shares of our Common Stock,

$0.00001 par value (the “Stock”) have voted, to approve the following items:

PROPOSAL: To

amend the Company's

Articles of Incorporation (the "Certificate of Amendment"). This consent is sufficient to approve the Certificate of

Amendment under Colorado law and our Articles of Incorporation, Amend the Designations, Rights & Privileges of Series C Preferred

Stock and authorize four (4) additional classes of Preferred Stock having 5,000,000 Series H Preferred Stock authorized with a

par value of .001; 20,000,000 Series I Preferred Stock authorized with a par value of .001; 10,000,000 Series J Preferred Stock

authorized with a par value of .001; 10,000,000 Series K Preferred Stock authorized with a par value of .001 (This action will

become effective upon the filing of an amendment to our Articles of Incorporation with the Secretary of State of Colorado.)

Stockholders of record at the close of business

on June 30

th

, 2014 (the “

Record Date

”), are entitled to receive a copy of this Information Statement

by request: copy is also available on the Company website: www.cardiffusa.com and www.missiontuition.com.

This Information Statement (the “Information

Statement”) which describes the proposal in more detail, and provides our stockholders with other important information,

is being furnished to our stockholders for informational purposes only, pursuant to Section 14-C of the Securities Exchange Act

of 1934 (the Act), as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder. Pursuant

to Colorado law, our Articles of Incorporation and our Bylaws, stockholder action may be taken by written consent without a meeting

of stockholders. The written consent of a majority stock holder of the outstanding shares of our Common Stock is sufficient to

approve the proposal. As such, the stockholder approved to amend the Company's Articles of Incorporation (the "Certificate

of Amendment"). This consent is sufficient to approve the Certificate of Amendment under Colorado law and our Articles of

Incorporation, Amend the Designations, Rights & Privileges of Series B Preferred Stock and authorize 5 additional Series of

Preferred Stock having 10,000 Series C Preferred Stock authorized with a par value of .00001; 1,000,000 Series D Preferred Stock

authorized with a par value of .001; 2,000,000 Series E Preferred Stock authorized with a par value of .001; 1,000,000 Series F

Preferred Stock authorized with a par value of .001 and 2,000,000 Series G Preferred Stock authorized with a par value of .001

and will become effective upon the filing of an amendment to our Articles of Incorporation with the Secretary of State of Colorado.

Your consent regarding the proposals is not

required and is not being solicited in connection with this corporate action. This Information Statement will serve as the required

notice to stockholders pursuant to the Act, of the approval by less than the unanimous written consent of our stockholders with

respect to the proposal.

WE ARE NOT ASKING YOU FOR A PROXY, AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

/s/ Daniel Thompson

|

|

|

Daniel Thompson, Chairman and Director

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF INFORMATION STATEMENT MATERIALS IN CONNECTION WITH THIS NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT:

The

Information Statement is available at: www.missiontuition.com

and www.cardiffusa.com

CARDIFF INTERNATIONAL, INC.

2747 Paradise Road Unit 1103

Las Vegas, NV 89109

(818) 783-2100

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished

to the stockholders of Cardiff International, Inc., a Colorado corporation (the "Company," "we" or "us"),

to advise them of the corporate actions that have been authorized by written consent of the Company's majority stockholder, who

collectively owns 63% of the Company’s outstanding capital stock as of the record date of June 30

th

, 2014 (the

"Record Date"). These actions are being taken without notice, meetings or votes in accordance with the Colorado Business

Corporation and the Company’s Articles of Incorporation. This Information Statement is being made available to the stockholders

of the Company by means of public filing and available the on the company website or a hard copy may be requested

.

On June 30, 2014, the majority stockholder

holding 1,909,040,550 shares, or approximately 63%, of the issued and outstanding Common Stock shares with a par value of $0.00001

("Common Stock") consented in writing to amend the Company's Articles of Incorporation (the "Certificate of Amendment").

This consent is sufficient to approve the Certificate of Amendment under Colorado law and our Articles of Incorporation. The attached

Information Statement describes the Articles of Amendment that the Common Stock majority stockholder of the Company has approved,

and to Amend the Designations, Rights & Privileges of Series C and authorize 4 additional classes of Preferred Stock having

5,000,000 class H authorized with a par value of .001; 20,000,000 class I authorized with a par value of .001; 10,000,000 class

J authorized with a par value of .001; 10,000,000 class K authorized with a par value of .001 (This action will become effective

upon the filing of an amendment to our Articles of Incorporation with the Secretary of State of Colorado.)

On June 30

th

, 2014, the Majority

Stockholder holding 1,909,040,550 shares, or approximately 63% of our issued and outstanding Common Stock consented in writing

to the Articles of Amendment. This consent was sufficient to approve the Articles of Amendment under Colorado law.

NO VOTE REQUIRED

We are not soliciting consents to approve the

Articles of Amendment. Colorado law and our Articles of Incorporation permit the Company to take any action which may be taken

at an annual or special meeting of its stockholders by written consent, if the holders of a majority of the shares of its Common

Stock sign and deliver a written consent to the action to the Company.

NO APPRAISAL RIGHTS

Under Colorado corporate law, stockholders

have no appraisal or dissenters' rights in connection with the Articles of Amendment.

INTERESTS OF CERTAIN PARTIES IN THE MATTERS

TO BE ACTED UPON

None of the directors or executive officers

of the Company has any substantial interest resulting from the Articles of Amendment that is not shared by all other stockholders

pro rata, and in accordance with their respective interests.

COST OF THIS INFORMATION STATEMENT

The entire cost of furnishing this Information

Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward

this Information Statement to the beneficial owners of our Common Stock held of record by them.

HOUSEHOLDING OF STOCKHOLDER MATERIALS

If a “hardcopy” is requested, in

some instances we may deliver only one copy of this Information Statement to multiple stockholders sharing a common address. If

requested by phone or in writing, we will promptly provide a separate copy to a stockholder sharing an address with another stockholder.

Requests by phone should be directed to our CEO/President at (818) 783-2100, and requests in writing should be sent to Cardiff

International, Inc. 411 North New River Drive E, Unit 2202, Fort Lauderdale, FL 33301, USA, Attention CEO. Stockholders

sharing an address who currently receive multiple copies and wish to receive only a single copy should contact their broker or

send a signed, written request to us at the above address.

AMENDMENT TO THE ARTICLES OF INCORPORATION

AMENDMENT TO THE ARTICLES OF INCORPORATION

TO AMEND THE BY LAWS OF SERIES C PREFERRED STOCK AND AUTHORIZE 4 CLASSES OF PREFERED STOCK HAVING 5,000,000 CLASS H; 20,000,000

CLASS I; 10,000,000 CLASS J; 10,000,000 CLASS K.

The Board of Directors has approved an amendment

to the Articles of Incorporation to amend series C Preferred Stock Designations, Rights & Privileges and to authorize 4 additional

classes of Preferred Stock having 5,000,000 class H with a par value of .001; 20,000,000 class I with a par value of .001; 10,000,000

class J with a par value of .001; 10,000,000 class K with a par value of .001 (This action will become effective upon the filing

of an amendment to our Articles of Incorporation with the Secretary of State of Colorado.)

The Articles of Amendment provide Paragraph

1 of Article V shall be amended to read as follows:

“The Corporation shall have 12 classes

of Common Stock and Preferred Stock. The total number of shares of stock which this Corporation shall have authority to issue is

3,61,010,004, of which 3,000,000,000 shares shall be Common Stock, $0.00001 par value per share (the Common Stock"); and 4

shares shall be Series A Preferred Stock, $0.0001 par value $0.0001 per share (the "Series A Preferred Stock"); and 10,000,000

shares shall be Series B Preferred Stock, $0.001 par value per share (the "Series B Preferred Stock"), and 10,000 shares

shall be Series C Preferred Stock, $.00001 par value per share (the “Series C Preferred Shares”); and 1,000,000 shares

shall be Series D Preferred Shares, $.001 par value per share (the "Series D Preferred Stock"); and 2,000,000 shares

shall be Series E Preferred Shares, $.001 par value per share (the "Series E Preferred Stock"); 1,000,000 shares shall

be Series F Preferred Shares, $.001 par value per share (the "Series F Preferred Stock") and 2,000,000 class G with a

par value of .001, and 5,000,000 shares shall be Series H Preferred Shares, $.001 par value per share (the "Series H Preferred

Stock"), and 20,000,000 shares shall be Series I Preferred Shares, $.001 par value per share (the "Series I Preferred

Stock"), and 10,000,000 shares shall be Series J Preferred Shares, $.001 par value per share (the "Series J Preferred

Stock"), and 10,000,000 shares shall be Series K Preferred Shares, $.001 par value per share (the "Series K Preferred

Stock"); together this shall constitute the `Preferred Stock") of which the certificate of designation, preferences,

rights and limitations can be found in Exhibit A. Subject to the limitations prescribed by law and the provisions of this Certificate

of Incorporation, the Board of Directors of the Corporation is authorized to issue the Preferred Stock from time to time in one

or more series, each of such series to have such voting powers, full or limited, or no voting powers, and such designations, preferences

and relative, participating, optional, or other special rights, and such qualifications, limitations or restrictions thereof, as

shall be determined by the Board of Directors in a resolution or resolutions providing for the issue of such Preferred Stock. Subject

to the powers, preference, and rights of any Preferred Stock, including any series thereof, having any preference or priority over,

or rights superior to, the Common Stock and except as otherwise provided by law, the holders of Common Stock shall have and possess

all powers and voting and other rights pertaining to the stock of the Corporation and each share of Common Stock shall be entitled

to one vote..”

Reasons for the Increase in the Number of

Authorized Shares

As of October 30

th

,

2013, of the 16,010,004 shares of Preferred Stock authorized by our Articles of Incorporation, 4,686,696 shares were issued and

outstanding leaving 11,323,308 shares of Preferred Stock authorized for issuance.

We expect that our growth may require the use

of our Preferred Stock from time to time as part of financing transactions pursuant to which we would issue shares of our Preferred

Stock. Such shares are intended to be used in a Tax Free Exchange as we acquire revenue producing businesses, i.e. our

Preferred Shares in “Exchange” for 100% of the shares in a “Private” Company. We may also need to

have Common Stock available for transactions such as acquisitions or employee incentives. Our stockholders do not have any preemptive

rights to purchase additional shares of our Common or Preferred Stock. We presently have proposals, LOI’s and

arrangements in place making it necessary to issue the authorized shares of Preferred Stock.

Effects of the Increase to the Number of

Authorized Shares

Possible Dilution from Future Issuance of

Additional Shares.

The amendment will increase the number of authorized shares of Preferred Stock to 11,323,308

from 16,010,004 shares, and the interests of the holders of our Common Stock could be diluted should these Preferred Stock shares

be converted to Common Stock shares. Any future issuance of additional shares of our Common Stock could dilute future

earnings per share, book value per share and the voting power and percentage ownership of existing shareholders.

Possible Anti-Takeover Effect from Future

Issuances of Additional Shares.

Any future issuance of additional shares also may have an anti-takeover effect

by making it more difficult to engage in a merger, tender offer, proxy contest or assumption of control of a large voting block

of our Common Stock. Our Board of Directors could impede a takeover attempt by issuing additional shares and thereby

diluting the voting power of other outstanding shares and increasing the cost of a takeover. A future issuance of additional

shares of Common Stock could be made to render more difficult an attempt to obtain control of us, even if it appears the be desirable

to a majority of shareholders, and it may be more difficult for our shareholders to obtain and acquisition premium for their shares

or remove incumbent management. Although the increase in the number of authorized shares of our Common Stock may have

an anti-takeover effect, the amendment has been proposed for the reasons stated above under the heading “Reasons for Amendment.” Our

Board of Directors has no present intention to use the proposed increase in the authorized shares of our Common Stock as a measure

aimed at discouraging takeover efforts.

Neither our Articles of

Incorporation nor our Bylaws presently contain provisions having an anti-takeover effect and the amendment is not part of a plan

by management to adopt a series of such amendments. Although it may do so, management does not presently intend to propose

anti-takeover measures. Management currently has no knowledge of any specific effort to accumulate our securities or

to obtain control of our Company by means of a merger, tender offer, solicitation in opposition to management or otherwise.

Our Common Stock is traded

on OTC Markets which is a quotation service, not an exchange. OTC Markets does not reserve the right to refuse to list

or to de-list any stock which has unusual voting provisions that nullify or restrict its voting nor does it have requirements calling

for shareholder vote on issuances of additional shares.

Advantages and Disadvantages of the increase

to the Authorized Shares

As noted above, increasing the number of additional

shares of Preferred Stock will provide us with the advantage of having greater flexibility in effecting possible future financings

without the delay and expense associated with obtaining the approval or consent of our shareholders at the same time the shares

are needed. It will also allow us to acquire assets that will increase shareholder stock value as we build our “Consolidated

Balance Sheet.” However; there is a disadvantage to our existing shareholders in that the issuance of additional shares

of Preferred Stock will dilute their holdings should these shares be converted to Common Shares. Furthermore, any future

issuance of additional shares also may have an anti-takeover effect by making it more difficult to engage in a merger, tender offer,

proxy contest or assumption of control of a large voting block of our Common Stock, even if our shareholders believe that such

action would be in their best interests.

Authorization of five additional classes

of Preferred Stock

The Board of Directors has determined that

it is advisable to protect management and its stock holders from the dilution in the open market, by amending the Bylaws of Series

B Preferred Stock and further, to issue five other classes of Preferred stock to attract investors and asset acquisition. The Articles

of Incorporation and Corporate Bylaws are hereby amended to include the following Rights and Privileges:

AMENDED CERTIFICATE OF DESIGNATION, PREFERENCES,

RIGHTS AND LIMITATION OF SERIES C PREFERRED STOCK

|

I.

|

|

DESIGNATION, AMOUNT & DIVIDENDS

|

A.

Designation

.

The designation of said series of Preferred Stock shall be Series

C

Convertible Preferred Stock, $.00001 par value per share

(the “

Series C Preferred Stock

”).

B.

Number of Shares

.

The number of shares of Series C Preferred Stock authorized shall be ten thousand (10,000). Shareholders will only be allowed to

own 1 (one) Series C Share. Each share of Series

C

Preferred Stock shall have a stated value equal to $.00001 (as may be

adjusted for any stock dividends, combinations or splits with respect to such shares) (the “

Series C Stated Value

”).

C.

Dividends

: Initially,

there will be no dividends due or payable on the Series C Preferred Stock. Any future terms with respect to dividends shall be

determined by the Board of Directors consistent with the Corporation’s Certificate of Incorporation. Any and all such future

terms concerning dividends shall be reflected in an amendment to this Certificate, which the Board of Directors shall promptly

file or cause to be filed.

|

II

.

|

|

Liquidation Rights

.

|

In the event of any liquidation, dissolution

or winding up of the affairs of the Corporation, whether voluntary or involuntary, the holder of Series

C

Preferred Stock

shall be entitled to receive, on parity with the holders Series D, E, F & G Preferred Stock, assets of the Corporation available

for distribution to the holders of capital stock of the Corporation. The Series

C

Preferred Stock shall have priority and

preference with respect to any distribution of any of the assets of the Corporation to Common Stock shareholders. Neither a consolidation

or merger of the Corporation with another corporation or other entity nor a sale, transfer, lease or exchange of all or part of

the Corporation's assets will be considered a liquidation, dissolution or winding up of the affairs of the Corporation for purposes

of this Article III.

III.

CONVERSION

AND NON-DILUTION

. In the event of a conversion of shares (the “

Conversion

”) of Series C Preferred Stock

to shares of Common Stock, par value $.00001 per share (the “

Common Stock

”), each one share of Series C Preferred

Stock can be converted to one hundred thousand shares of Common Stock (the “Conversion”).

A.

Conversion

at the Option of the Company:.

(a) Each share of Series C Preferred Stock is convertible, in whole only upon the Company

filing an “Approved Company Registration Statement/or Secondary Public Offering” at which time will convert into one

hundred thousand shares of Common Stock (the “

Conversion Rate

”).

B.

Mechanics of Conversion.

The conversion right of a holder shall be exercised by the Company by contacting the holder of shares of Series C Preferred Stock.

Once approved, the shares shall be included in the next upcoming Registration Statement. They shall surrender to the Corporation

of the certificates representing shares of Series C Preferred Stock to be converted at any time during usual business hours at

its principal place of business or the offices of the Transfer Agent, accompanied by written notice to the Corporation that the

holder elects to convert all of the shares of Series C Preferred Stock represented by such certificate and specifying the name

or names (with address) in which a certificate or certificates or other appropriate evidence of ownership representing shares of

Common Stock are to be issued and (if so required by the Corporation or the Transfer Agent) by a written instrument or instruments

of transfer in form reasonably satisfactory to the Corporation or the Transfer Agent duly executed by the holder of Series B Preferred

Stock or its duly authorized legal representative. The date on which a holder of Series C Preferred Stock satisfies the foregoing

requirements for conversion is referred to herein as the “

Conversion Date

.” The Corporation will deliver shares

of Common Stock due upon conversion. Immediately prior to the close of business on the Conversion Date, each converting holder

of Series B Preferred Stock shall be deemed to be the holder of record of the shares of Common Stock issuable upon conversion of

such holder’s Series C Preferred Stock notwithstanding that the share register of the Company shall then be closed or that

certificates or other appropriate evidence of ownership representing such Common Stock shall not then be actually delivered to

such holder. On the Conversion Date, all rights with respect to the shares of Series C Preferred Stock so converted, including

the rights, if any, to receive notices, will terminate, except the rights of Holders thereof to (a) receive certificates or other

appropriate evidence of ownership representing the number of whole shares of Common Stock into which such shares of Series C Preferred

Stock have been converted and (b) exercise the rights to which they are entitled as holders of Common Stock

C

.

Settlement

upon Conversion.

The Company shall satisfy its obligation to deliver shares of Common Stock upon conversion of Series C

Preferred Stock by delivering to holders of Series C Preferred Stock surrendering shares for conversion the applicable number of

shares in accordance with the Conversion Rate, as soon as practicable after the third Trading Day (but in no event later than the

fifth Business Day) following the Conversion Date.

D.

No Fractional

Shares

: No fractional shares of Common Stock will be issued from the Conversion of the Series C Preferred Stock. If the

Conversion of Series C Preferred Stock would result in the issuance of a fractional share of Common Stock to a holder (aggregating

all shares of Series C Preferred Stock being converted pursuant to a given Conversion), then the Corporation shall issue one share

of Common Stock to each holder of Series C Preferred Stock with a fractional share as the result of the Conversion.

E

.

Non-Dilution

:

Shares of Series C Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse split, are convertible

to the number of Common Shares after the reverse split as would have been equal to the ratio established in Section III prior to

the reverse split. The conversion rate of shares of Series C Preferred Stock, however, would increase proportionately in the case

of forward splits, and may not be diluted by a reverse split following a forward split.

All shares of the Series C Preferred Stock

shall rank (i) senior to the Corporation’s Common Stock, par value $.00001 per share (the “

Common Stock

”),

(ii)

pari passu

with any class or series of capital stock of the Corporation hereafter created and specifically ranking,

by its terms, on par with the Series B Preferred Stock and (iii) junior to Series A Preferred Stock created specifically for ranking,

by its terms, senior to the Series C Preferred Stock, in each case as to distribution of assets upon liquidation, dissolution or

winding up of the Corporation, whether voluntary or involuntary.

Each one share of the Series C Preferred Stock

shall have voting rights equal to ten (10) votes of Common Stock. With respect to all matters upon which stockholders are entitled

to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of Series C Preferred Stock

shall vote together with the holders of Common Stock, without regard to class, except as to those matters on which separate class

voting is required by applicable law or the Corporation’s Certificate of Incorporation or Bylaws.

The initial price of each

share of Series C Preferred Stock shall be $2.50.

A.

Status of Converted or Redeemed Stock

: In case any shares of Series C Preferred Stock shall be redeemed or

otherwise repurchased or reacquired, the shares so redeemed, repurchased, or reacquired shall resume the status of authorized but

unissued shares of Preferred Stock, and shall no longer be designated as Series C Preferred Stock.

B.

Lost or

Stolen Certificates

: Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any

Preferred Stock Certificate(s) and (ii) in the case of loss, theft or destruction, indemnity (with a bond or other security) reasonably

satisfactory to the Corporation, or in the case of mutilation, the Preferred Stock Certificate(s) (surrendered for cancellation),

the Corporation shall execute and deliver new Preferred Stock Certificates at the cost of the shareholder. However, the Corporation

shall not be obligated to reissue such lost, stolen, destroyed or mutilated Preferred Stock Certificates if the holder of Series

C Preferred Stock contemporaneously requests the Corporation to convert such holder’s Series C Preferred Stock.

C.

Waiver

:

Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right

of the holders of Series C Preferred Stock granted hereunder may be waived as to all shares of Series C Preferred Stock (and the

holders thereof) upon the unanimous written consent of the holders of the Series C Preferred Stock.

D.

Notices

:

Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt

requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall

be effective five (5) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally

or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party as set forth

below, or such other address and telephone and fax number as may be designated in writing hereafter in the same manner as set forth

in this Section.

CERTIFICATE OF DESIGNATION, PREFERENCES,

RIGHTS AND LIMITATIONS OF SERIES H, I, J & K PREFERRED STOCK

|

I.

|

|

DESIGNATION, AMOUNT & DIVIDENDS:

|

A.

Designation

.

The designation of said series of Preferred Stock shall apply to Series H, I, J & K Convertible Preferred Stock, $.001 par

value per share (the “

Series Preferred Stock

”).

B.

Number of Shares

.

i. The number of shares of Series H Preferred Stock authorized shall be five million (5,000,000). Each share of Series H Preferred Stock shall have a stated value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the “

Series H Stated Value

”).

ii. The number of shares of Series I Preferred Stock authorized shall be twenty million (20,000,000). Each share of Series I Preferred Stock shall have a stated value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the

“Series I Stated Value”

).

iii. The number of shares

of Series J Preferred Stock authorized shall be ten million (10,000,000). Each share of Series J Preferred Stock shall have a stated

value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the

“Series

J Stated Value”

).

iv. The number of share of

Series K Preferred Stock authorized shall be ten million (10,000,000). Each share of Series K Preferred Stock shall have a stated

value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the

“Series

K Stated Value”

).

C.

Dividends

: Initially,

there will be no dividends due or payable on each class of Preferred Stock. Any future terms with respect to dividends shall be

determined by the Board of Directors consistent with the Corporation’s Certificate of Incorporation. Any and all such future

terms concerning dividends shall be reflected in an amendment to this Certificate, which the Board of Directors shall promptly

file or cause to be filed.

|

II

.

|

|

Liquidation Rights

.

|

In the event of any liquidation, dissolution

or winding up of the affairs of the Corporation, whether voluntary or involuntary, the holder of Series D, E, F, G, H, I, J and

K Preferred Stock Shares (the “Share Class”) shall be entitled to receive, on parity with the holders B Preferred Stock,

assets of the Corporation available for distribution to the holders of capital stock of the Corporation. Each Share Class of Preferred

shall have priority and preference with respect to any distribution of any of the assets of the Corporation to Common Stock Shareholders.

Neither a consolidation or merger of the Corporation with another corporation or other entity nor a sale, transfer, lease or exchange

of all or part of the Corporation's assets will be considered a liquidation, dissolution or winding up of the affairs of the Corporation

for purposes of this Article III.

III.

CONVERSION

.

In the event of a conversion of shares (the “

Conversion

”) of each Share Class of Preferred Stock to shares of

Common Stock, par value $.001 per share (the “

Common Stock

”), each one share of Series Share Class of Preferred

Stock shall be converted up to five (5) shares of Common Stock. Each Share Class shall be governed by a Lock-Up/Leak-Out Agreement

to assure the minority shareholders are protected; see Exhibit B

A.

Conversion

at the Option of the Holder.

(a) Each single “share” of each Share Class of Preferred Stock is convertible,

in whole or in part, at the option of the Holder thereof (“

Optional Conversion

”) in conjunction with an “Approved

Company Registration Statement”, into one share of Common Stock (the “

Conversion Rate

”).

B.

Mechanics of Conversion.

The conversion rights of a holder shall be exercised by the holder of shares of each Share Class of Preferred Stock by contacting

the Company. Once approved, they shall be included in the next upcoming Registration Statement. They shall surrender to the Corporation

of the certificates representing each Share Class of Preferred Stock to be converted at any time during usual business hours at

its principal place of business or the offices of the Transfer Agent, accompanied by written notice to the Corporation that the

holder elects to convert all or a portion of the shares in each Share Class of Preferred Stock represented by such certificate

and specifying the name or names (with address) in which a certificate or certificates or other appropriate evidence of ownership

representing shares of Common Stock are to be issued and (if so required by the Corporation or the Transfer Agent) by a written

instrument or instruments of transfer in form reasonably satisfactory to the Corporation or the Transfer Agent duly executed by

the holder of each Share Class of Preferred Stock or its duly authorized legal representative. The date on which a holder of each

Share Class of Preferred Stock satisfies the foregoing requirements for conversion is referred to herein as the “

Conversion

Date

.” The Corporation will deliver shares of Common Stock due upon conversion. Immediately prior to the close of business

on the Conversion Date, each converting holder of Series D, E, F or G Preferred Stock shall be deemed to be the holder of record

of the shares of Common Stock issuable upon conversion of such holder’s unique Share Class of Preferred Stock notwithstanding

that the share register of the Company shall then be closed or that certificates or other appropriate evidence of ownership representing

such Common Stock shall not then be actually delivered to such holder. On the Conversion Date, all rights with respect to the shares

of each Share Class of Preferred Stock so converted, including the rights, if any, to receive notices, will terminate, except the

rights of Holders thereof to (a) receive certificates or other appropriate evidence of ownership representing the number of whole

shares of Common Stock into which such shares of each Share Class of Preferred Stock have been converted and (b) exercise the rights

to which they are entitled as holders of Common Stock

C

.

Settlement

upon Conversion.

The Company shall satisfy its obligation to deliver shares of Common Stock upon conversion of each Share

Class of Preferred Stock by delivering to the holders of each Share Class Common Stock equal to the amount of surrendering shares

for conversion governed by the applicable number of shares in accordance with the Conversion Rate, as soon as practicable after

the third Trading Day (but in no event later than the fifth Business Day) following the Conversion Date.

D.

No Fractional

Shares

: No fractional shares of Common Stock will be issued from the Conversion of each Share Class of Preferred Stock.

If the Conversion of one or all of the Share Class of Preferred Stock would result in the issuance of a fractional share of Common

Stock to a holder (aggregating all shares of each Share Class of Preferred Stock being converted pursuant to a given Conversion),

then the Corporation shall issue one share of Common Stock to each holder of each Share Class of Preferred Stock with a fractional

share as the result of the Conversion.

E

.

Non-Dilution:

Shares of Series H, I , J and K of Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse

split, are convertible to the number of Common Stock Shares after the reverse split as would have been equal to the ratio established

in Section III prior to the reverse split. The conversion rate of shares of Series H, I, J & K of Preferred Stock, however,

would increase proportionately in the case of forward splits, and may not be diluted by a reverse split following a forward split.

All shares of the Share Class of Preferred

Stock shall rank (i) senior to the Corporation’s Common Stock, par value $.00001 per share (the “

Common Stock

”),

(ii)

pari passu

with any class or series of capital stock of the Corporation hereafter created and specifically ranking,

by its terms, on par with the Series B Preferred Stock and (iii) junior to Series A Preferred Stock created specifically for ranking,

by its terms, senior to the Series B, C, D, E, F, G, H, I, J & K Preferred Stock, in each case as to distribution of assets

upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

Each one share of the Series Share Class of

Preferred Stock shall have voting rights equal to five (5) votes of Common Stock. With respect to all matters upon which stockholders

are entitled to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of the Share

Class of Preferred Stock shall vote together with the holders of Common Stock, without regard to class, except as to those matters

on which separate class voting is required by applicable law or the Corporation’s Certificate of Incorporation or Bylaws.

The initial price of each

share of Series D, E, F & G of Preferred Stock shall be $2.50.

A.

Status

of Converted or Redeemed Stock

: In case any shares of Series the Share Class of Preferred Stock shall be redeemed or otherwise

repurchased or reacquired, the shares so redeemed, repurchased, or reacquired shall resume the status of authorized but unissued

shares of Preferred Stock, and shall no longer be designated as Series H, I, J or K in part or as a whole of Preferred Stock.

B.

Lost or

Stolen Certificates

: Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any

Preferred Stock Certificate(s) and (ii) in the case of loss, theft or destruction, indemnity (with a bond or other security) reasonably

satisfactory to the Corporation, or in the case of mutilation, the Preferred Stock Certificate(s) (surrendered for cancellation),

the Corporation shall execute and deliver new Preferred Stock Certificates. However, the Corporation shall not be obligated to

reissue such lost, stolen, destroyed or mutilated Preferred Stock Certificates if the holder of the Share Class of Preferred Stock

contemporaneously requests the Corporation to convert such holder’s Series of Preferred Stock.

C.

Waiver

:

Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right

of the holders of each Share Class of Preferred Stock granted hereunder may be waived as to all shares of each Share Class of Preferred

Stock (and the holders thereof) upon the unanimous written consent of the holders of each Share Class of Preferred Stock.

D.

Notices

:

Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt

requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall

be effective five (5) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally

or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party as set forth

below, or such other address and telephone and fax number as may be designated in writing hereafter in the same manner as set forth

in this Section.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table, together with the accompanying

footnotes, sets forth information regarding the beneficial ownership of the Common Stock of the Company as of October 30

th

,

2013, for (i) each person known by the Company to own beneficially more than 5% of the Company's Common Stock, (ii) each of the

Company's Executive Officers, (iii) each of the Company's Directors and (iv) all Directors and Executive Officers as a group. Applicable

percentage ownership in the following table is based on 2,069,435,924 shares of Common Stock outstanding for issuance as of November

18, 2013.

Beneficial ownership is determined in accordance

with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to the securities.

Subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect

to all shares of Common Stock shown as beneficially owned by them. In addition, shares of Common Stock issuable upon exercise of

options, warrants and other convertible securities beneficially owned that are exercisable within sixty days of November 18, 2013,

are deemed outstanding for the purpose of computing the percentage ownership of the person holding those securities, and the group

as a whole, but are not deemed outstanding for computing the percentage ownership of any other person.

|

Shareholder(4)

|

|

Common

Stock (1)

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

Daniel Thompson (2)

|

|

1,909,040,550

|

|

(3)

|

|

|

63.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

1,909,040,550

|

|

|

|

|

100%

|

|

|

|

(1)

|

For purposes of this table “beneficial ownership” is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, pursuant to which a person or group of persons is deemed to have “beneficial ownership” of any Common Stock shares that such person or group has the right to acquire within 60 days after October 30

th

, 2013. For purposes of computing the percentage of outstanding Common Stock shares held by each person or group of persons named above, any shares that such person or group has the right to acquire within 60 days after October 30

th

, 2013 are deemed outstanding but are not deemed to be outstanding for purposes of computing the percentage ownership of any other person or group.

|

|

|

(2)

|

These are the Officers and Directors of the Company.

|

|

|

(3)

|

Includes

1,909,040,550

shares owned by the Daniel Thompson and the Thompson Family Trust.

|

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This Information Statement may contain "forward-looking

statements." All statements other than statements of historical fact are "forward-looking statements" for purposes

of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives

of management for future operations, and any statement of assumptions underlying any of the foregoing. These statements may contain

words such as "expects," "anticipates," "plans," "believes," "projects," and

words of similar meaning. These statements relate to our future business and financial performance.

Actual outcomes may differ materially from

these statements. The risks listed in this Information Statement as well as any cautionary language in this Information Statement,

provide examples of risks, uncertainties and events that may cause our actual results to differ materially from any expectations

we describe in our forward-looking statements. There may be other risks that we have not described that may adversely affect our

business and financial condition. We disclaim any obligation to update or revise any of the forward-looking statements contained

in this Information Statement. We caution you not to rely upon any forward-looking statement as representing our views as of any

date after the date of this Information Statement. You should carefully review the information and risk factors set forth in other

reports and documents that we file from time to time with the SEC.

ADDITIONAL INFORMATION

This Information Statement should be read in

conjunction with certain reports that we previously filed with the SEC, including our:

* Quarterly

Reports on Form 10-Q for the periods ended March 31, 2013, June 30, 2013 and September 30, 2013.

The reports we file with the SEC and the accompanying

exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington,

DC 20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that

contains reports, proxy and information statements and other information regarding public companies that file reports with the

SEC. Copies of the Reports may be obtained from the SEC's EDGAR archives at http://www.sec.gov. We will also mail copies of our

prior reports to any stockholder upon written request.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

/s/ Daniel Thompson

|

|

|

Daniel Thompson, Chairman, and Director

|

|

|

Fort Lauderdale, Florida

|

|

|

June 30, 2014

|

APPENDIX “A”

Articles of Amendment

To the

Articles of Incorporation

Pursuant to the provisions of the Colorado Business Corporation

Act, the undersigned corporation adopts the following Articles of Amendment to its Articles of Incorporation:

FIRST: The name of the corporation is

CARDIFF INTERNATIONAL,

INC.

SECOND: The following amendment to the Articles of Incorporation

was adopted on June 1, as prescribed by the Colorado Business Corporation Act, in the manned marked by an “X” below:

Paragraph 1 of Article V of the Articles of Incorporation shall

be amended to read as follows:

On June 30, 2014, majority stockholder holding

1,909,040,550 shares, or approximately 63%, of our issued and outstanding par value $0.00001 Common Stock ("Common Stock")

consented in writing to amend the Company's Articles of Incorporation (the "Certificate of Amendment"). This consent

was sufficient to approve the Certificate of Amendment under Colorado law and our Articles of Incorporation. The attached Information

Statement describes the Articles of Amendment that the Common Share majority stockholders of the Company have approved, and to

amend the By Laws of Series C Preferred Stock and to authorize 4 additional classes of Preferred Stock having 5,000,000 Class H

authorized with a par value of .001; 20,000,000 Class I authorized with a par value of .001; 10,000,000 Class J authorized with

a par value of .001; 10,000,000 Class K authorized with a par value of .001 (This action will become effective upon the filing

of an amendment to our Articles of Incorporation with the Secretary of State of Colorado.)

AMENDED CERTIFICATE OF DESIGNATION, PREFERENCES,

RIGHTS AND LIMITATION OF SERIES C PREFERRED STOCK

|

I.

|

|

DESIGNATION, AMOUNT & DIVIDENDS

|

A.

Designation

.

The designation of said Series of Preferred Stock shall be Series C Convertible Preferred Stock, $.001 par value per share (the

“

Series C Preferred Stock

”).

B.

Number of Shares

.

The number of shares of Series C Preferred Stock authorized shall be ten thousand (10,000). Each share of Series C Preferred Stock

shall have a stated value equal to $.00001 (as may be adjusted for any stock dividends, combinations or splits with respect to

such shares) (the “

Series C Stated Value

”).

C.

Dividends

: Initially,

there will be no dividends due or payable on the Series C Preferred Stock. Any future terms with respect to dividends shall be

determined by the Board consistent with the Corporation’s Certificate of Incorporation. Any and all such future terms concerning

dividends shall be reflected in an amendment to this Certificate, which the Board shall promptly file or cause to be filed.

|

II

.

|

|

Liquidation Rights

.

|

In the event of any liquidation, dissolution

or winding up of the affairs of the Corporation, whether voluntary or involuntary, the holder of Series C Preferred Stock shall

be entitled to receive, on parity with the holders Series B, D, E, F, G, H, I, J & K Preferred Stock, assets of the Corporation

available for distribution to the holders of capital stock of the Corporation. The Series C Preferred shall have priority and preference

with respect to any distribution of any of the assets of the Corporation to Common Shareholders. Neither a consolidation or merger

of the Corporation with another corporation or other entity nor a sale, transfer, lease or exchange of all or part of the Corporation's

assets will be considered a liquidation, dissolution or winding up of the affairs of the Corporation for purposes of this Article

III.

III.

CONVERSION

.

In the event of a conversion of shares (the “

Conversion

”) of Series C Preferred Stock to shares of Common Stock,

par value $.00001 per share (the “

Common Stock

”), each one share of Series C Preferred Stock can be converted

to one hundred thousand shares of Common Stock for one share of Preferred Stock (the “Conversion”).

A.

Conversion

at the Option of the Company.

(a) Each share of Series C Preferred Stock is convertible, in whole or in part, at the option

of the Company (“

Optional Conversion

”) in conjunction with an “Approved Company Registration Statement”,

into one hundred thousand shares of Common Stock (the “

Conversion Rate

”).

B.

Mechanics of Conversion.

The conversion right of the Company shall be exercised by contacting the holder of shares of Series C Preferred Stock to inform

them of a up and coming qualified registration statement.. Once approved, the shares shall be included in the next upcoming Registration

Statement. They shall surrender to the Corporation of the certificates representing shares of Series C Preferred Stock to be converted

at any time during usual business hours at its principal place of business or the offices of the Transfer Agent, accompanied by

written notice to the Corporation that the holder elects to convert all shares of Series C Preferred Stock represented by such

certificate and specifying the name or names (with address) in which a certificate or certificates or other appropriate evidence

of ownership representing shares of Common Stock are to be issued and (if so required by the Corporation or the Transfer Agent)

by a written instrument or instruments of transfer in form reasonably satisfactory to the Corporation or the Transfer Agent duly

executed by the holder of Series C Preferred Stock or its duly authorized legal representative. The date on which a holder of Series

C Preferred Stock satisfies the foregoing requirements for conversion is referred to herein as the “

Conversion Date

.”

The Corporation will deliver shares of Common Stock due upon conversion. Immediately prior to the close of business on the Conversion

Date, each converting holder of Series B Preferred Stock shall be deemed to be the holder of record of the shares of Common Stock

issuable upon conversion of such holder’s Series C Preferred Stock notwithstanding that the share register of the Company

shall then be closed or that certificates or other appropriate evidence of ownership representing such Common Stock shall not then

be actually delivered to such holder. On the Conversion Date, all rights with respect to the shares of Series C Preferred Stock

so converted, including the rights, if any, to receive notices, will terminate, except the rights of Holders thereof to (a) receive

certificates or other appropriate evidence of ownership representing the number of whole shares of Common Stock into which such

shares of Series C Preferred Stock have been converted and (b) exercise the rights to which they are entitled as holders of Common

Stock

C

.

Settlement

upon Conversion.

The Company shall satisfy its obligation to deliver shares of Common Stock upon conversion of Series C

Preferred Stock by delivering to holders of Series C Preferred Stock surrendering shares for conversion the applicable number of

shares in accordance with the Conversion Rate, as soon as practicable after the third Trading Day (but in no event later than the

fifth Business Day) following the Conversion Date.

D.

No Fractional

Shares

: No fractional shares of Common Stock will be issued from the Conversion of the Series C Preferred Stock. If the

Conversion of Series C Preferred Stock would result in the issuance of a fractional share of Common Stock to a holder (aggregating

all shares of Series C Preferred Stock being converted pursuant to a given Conversion), then the Corporation shall issue one share

of Common Stock to each holder of Series C Preferred Stock with a fractional share as the result of the Conversion.

E.

Non-Dilution:

Shares of Series C Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse split, are convertible

to the number of Common Stock Shares after the reverse split as would have been equal to the ratio established in Section III prior

to the reverse split. The conversion rate of shares of Series C Preferred Stock, however, would increase proportionately in the

case of forward splits, and may not be diluted by a reverse split following a forward split.

All shares of the Series B Preferred Stock

shall rank (i) senior to the Corporation’s Common Stock, par value $.001 per share (the “

Common Stock

”),

(ii)

pari passu

with any class or series of capital stock of the Corporation hereafter created and specifically ranking,

by its terms, on par with the Series B, D, E, F, G, H, I, J & K Preferred Stock and (iii) junior to Series A Preferred Stock

created specifically for ranking, by its terms, senior to the Series C Preferred Stock, in each case as to distribution of assets

upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

Each one share of the Series C Preferred Stock

shall have voting rights equal to ten (10) votes of Common Stock. With respect to all matters upon which stockholders are entitled

to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of Series C Preferred Stock

shall vote together with the holders of Common Stock, without regard to class, except as to those matters on which separate class

voting is required by applicable law or the Corporation’s Certificate of Incorporation or Bylaws.

The initial price of each

share of Series B Preferred Stock shall be $2.50.

A.

Status of Converted or Redeemed Stock

: In case any shares of Series C Preferred Stock shall be redeemed or

otherwise repurchased or reacquired, the shares so redeemed, repurchased, or reacquired shall resume the status of authorized but

unissued shares of Preferred Stock, and shall no longer be designated as Series C Preferred Stock.

B.

Lost or

Stolen Certificates

: Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any

Preferred Stock Certificate(s) and (ii) in the case of loss, theft or destruction, indemnity (with a bond or other security) reasonably

satisfactory to the Corporation, or in the case of mutilation, the Preferred Stock Certificate(s) (surrendered for cancellation),

the Corporation shall execute and deliver new Preferred Stock Certificates at the cost of the shareholder. However, the Corporation

shall not be obligated to reissue such lost, stolen, destroyed or mutilated Preferred Stock Certificates if the holder of Series

C Preferred Stock contemporaneously requests the Corporation to convert such holder’s Series C Preferred Stock.

C.

Waiver

:

Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right

of the holders of Series C Preferred Stock granted hereunder may be waived as to all shares of Series C Preferred Stock (and the

holders thereof) upon the unanimous written consent of the holders of the Series C Preferred Stock.

D.

Notices

:

Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt

requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall

be effective five (5) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally

or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party as set forth

below, or such other address and telephone and fax number as may be designated in writing hereafter in the same manner as set forth

in this Section.

CERTIFICATE OF DESIGNATION, PREFERENCES,

RIGHTS AND LIMITATIONS OF SERIES H, I, J & K PREFERRED STOCK

|

I.

|

|

DESIGNATION, AMOUNT & DIVIDENDS:

|

A.

Designation

.

The designation of said series of Preferred Stock shall apply to Series H, I, J & K Convertible Preferred Stock, $.001 par

value per share (the “

Series Preferred Stock

”).

B.

Number of Shares

.

i. The number of shares of

Series H Preferred Stock authorized shall be five million (5,000,000). Each share of Series H Preferred Stock shall have a stated

value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the “

Series

H Stated Value

”).

ii. The number of shares

of Series I Preferred Stock authorized shall be twenty million (20,000,000). Each share of Series I Preferred Stock shall have

a stated value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares)

(the

“Series I Stated Value”

).

iii. The number of shares

of Series J Preferred Stock authorized shall be ten million (10,000,000). Each share of Series J Preferred Stock shall have a stated

value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the

“Series

J Stated Value”

).

iv. The number of share of

Series K Preferred Stock authorized shall be ten million (10,000,000). Each share of Series K Preferred Stock shall have a stated

value equal to $.001 (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the

“Series

K Stated Value”

).

C.

Dividends

: Initially,

there will be no dividends due or payable on each class of Preferred Stock. Any future terms with respect to dividends shall be

determined by the Board consistent with the Corporation’s Certificate of Incorporation. Any and all such future terms concerning

dividends shall be reflected in an amendment to this Certificate, which the Board shall promptly file or cause to be filed.

|

II

.

|

|

Liquidation Rights

.

|

In the event of any liquidation, dissolution

or winding up of the affairs of the Corporation, whether voluntary or involuntary, the holder of Series H, I, J & K Preferred

Stock (the “Share Class”) shall be entitled to receive, on parity with the holders B, D, E, F & G Preferred Stock,

assets of the Corporation available for distribution to the holders of capital stock of the Corporation. Each Share Class of Preferred

Stock shall have priority and preference with respect to any distribution of any of the assets of the Corporation to Common Stock

Shareholders. Neither a consolidation or merger of the Corporation with another corporation or other entity nor a sale, transfer,

lease or exchange of all or part of the Corporation's assets will be considered a liquidation, dissolution or winding up of the

affairs of the Corporation for purposes of this Article III.

III.

CONVERSION

.

In the event of a conversion of shares (the “

Conversion

”) of Series H, I, J & K Preferred Stock to shares

of Common Stock, par value $.001 per share (the “

Common Stock

”), each one share of Series H, I, J & K Preferred

Stock can be converted to five shares of Common Stock for one share of Preferred Stock (the “Conversion”). The Common

Stock shares shall be governed by a Lock-Up/Leak-Out Agreement to assure our minority shareholders are protected. See Exhibit B.

A.

Conversion

at the Option of the Holder.

(a) Each single “share” of each Share Class of Preferred Stock is convertible,

in whole or in part, at the option of the Holder thereof (“

Optional Conversion

”) in conjunction with an “Approved

Company Registration Statement”, into one share of Common Stock (the “

Conversion Rate

”).

B.

Mechanics of Conversion.

The conversion rights of a holder shall be exercised by the holder of shares of each Share Class of Preferred Stock by contacting

the Company. Once approved, shall be included in the next upcoming Registration Statement. They shall surrender to the Corporation

of the certificates representing each Share Class of Preferred Stock to be converted at any time during usual business hours at

its principal place of business or the offices of the Transfer Agent, accompanied by written notice to the Corporation that the

holder elects to convert all or a portion of the shares in each Share Class of Preferred Stock represented by such certificate

and specifying the name or names (with address) in which a certificate or certificates or other appropriate evidence of ownership

representing shares of Common Stock are to be issued and (if so required by the Corporation or the Transfer Agent) by a written

instrument or instruments of transfer in form reasonably satisfactory to the Corporation or the Transfer Agent duly executed by

the holder of each Share Class of Preferred Stock or its duly authorized legal representative. The date on which a holder of each

Share Class of Preferred Stock satisfies the foregoing requirements for conversion is referred to herein as the “

Conversion

Date

.” The Corporation will deliver shares of Common Stock due upon conversion. Immediately prior to the close of business

on the Conversion Date, each converting holder of Series H, I, J or K Preferred Stock shall be deemed to be the holder of record

of the shares of Common Stock issuable upon conversion of such holder’s unique Share Class of Preferred Stock notwithstanding

that the share register of the Company shall then be closed or that certificates or other appropriate evidence of ownership representing

such Common Stock shall not then be actually delivered to such holder. On the Conversion Date, all rights with respect to the shares

of each Share Class of Preferred Stock so converted, including the rights, if any, to receive notices, will terminate, except the

rights of Holders thereof to (a) receive certificates or other appropriate evidence of ownership representing the number of whole

shares of Common Stock into which such shares of each Share Class of Preferred Stock have been converted and (b) exercise the rights

to which they are entitled as holders of Common Stock

C

.

Settlement

upon Conversion.

The Company shall satisfy its obligation to deliver shares of Common Stock upon conversion of each Share

Class of Preferred Stock by delivering to the holders of each Share Class Common Stock equal to the amount of surrendering shares

for conversion governed by the applicable number of shares in accordance with the Conversion Rate, as soon as practicable after

the third Trading Day (but in no event later than the fifth Business Day) following the Conversion Date.

D.

No Fractional

Shares

: No fractional shares of Common Stock will be issued from the Conversion of each Share Class of Preferred Stock.

If the Conversion of one or all of the Share Class of Preferred Stock would result in the issuance of a fractional share of Common

Stock to a holder (aggregating all shares of each Share Class of Preferred Stock being converted pursuant to a given Conversion),

then the Corporation shall issue one share of Common Stock to each holder of each Share Class of Preferred Stock with a fractional

share as the result of the Conversion.

E.

Non-Dilution:

Shares of Series H, I, J, & K of Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse

split, are convertible to the number of Common Shares after the reverse split as would have been equal to the ratio established

in Section 1.3(a) prior to the reverse split. The conversion rate of shares of Series H, I, J, & K Preferred Stock, however,

would increase proportionately in the case of forward splits, and may not be diluted by a reverse split following a forward split.

All shares of the Share Class of Preferred

Stock shall rank (i) senior to the Corporation’s Common Stock, par value $.00001 per share (the “

Common Stock

”),

(ii)

pari passu

with any class or series of capital stock of the Corporation hereafter created and specifically ranking,

by its terms, on par with the Series B, C, D, E, F, & G Preferred Stock and (iii) junior to Series A Preferred Stock created

specifically for ranking, by its terms, senior to the Series H, I, J,& K Preferred Stock, in each case as to distribution of

assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary.

Each one share of the Series Share Class of

Preferred Stock shall have voting rights equal to five (5) votes of Common Stock. With respect to all matters upon which stockholders

are entitled to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of the Share

Class of Preferred Stock shall vote together with the holders of Common Stock, without regard to class, except as to those matters

on which separate class voting is required by applicable law or the Corporation’s Certificate of Incorporation or Bylaws.

The initial price of each

share of Series H, I, J & K of Preferred Stock shall be $2.50.

A.

Status

of Converted or Redeemed Stock

: In case any shares of Series the Share Class of Preferred Stock shall be redeemed or otherwise

repurchased or reacquired, the shares so redeemed, repurchased, or reacquired shall resume the status of authorized but unissued

shares of Preferred Stock, and shall no longer be designated as Series H, I, J or K in part or as a whole of Preferred Stock.

B.

Lost or

Stolen Certificates

: Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any

Preferred Stock Certificate(s) and (ii) in the case of loss, theft or destruction, indemnity (with a bond or other security) reasonably

satisfactory to the Corporation, or in the case of mutilation, the Preferred Stock Certificate(s) (surrendered for cancellation),

the Corporation shall execute and deliver new Preferred Stock Certificates. However, the Corporation shall not be obligated to

reissue such lost, stolen, destroyed or mutilated Preferred Stock Certificates if the holder of the Share Class of Preferred Stock

contemporaneously requests the Corporation to convert such holder’s Series of Preferred Stock.

C.

Waiver

:

Notwithstanding any provision in this Certificate of Designation to the contrary, any provision contained herein and any right

of the holders of each Share Class of Preferred Stock granted hereunder may be waived as to all shares of each Share Class of Preferred

Stock (and the holders thereof) upon the unanimous written consent of the holders of each Share Class of Preferred Stock.

D.

Notices

:

Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt

requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall

be effective five (5) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally

or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party as set forth

below, or such other address and telephone and fax number as may be designated in writing hereafter in the same manner as set forth

in this Section.

|

___

|

|

No shares have been issued or Directors Elected – Action by Incorporators.

|

|

___

|

|

No shares have been issued but Directors Elected – Action by Directors.

|

|

___

|

|

Such amendment was adopted by the Board of Directors where shares have been issued

and shareholder action was not required.

|

|

X

|

|

Such amendment was adopted by a vote of the shareholders. The number of

shares voted for the amendment was sufficient for approval.

|

THIRD: If changing the corporate name, the new name of the corporation

is: __________

FOURTH: The manner, if not set forth in such amendment, in which

any exchange, reclassification, or cancellation of issued shares provided for in the amendment shall be affected, is as follows:

___________________________________________________

If these amendments are to have a delayed effective date, please

list that date:________

(Not to exceed 90 days from the date of filing)

|

|

CARDIFF INTERNATIONAL, INC.

|

|

|

|

|

|

By:_____________________________

|

|

|

Title:____________________________

|

A-1

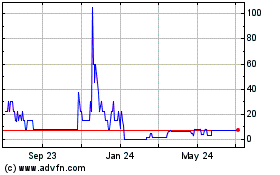

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

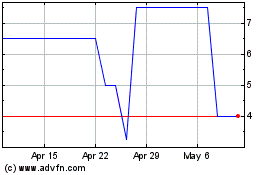

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024