Current Report Filing (8-k)

May 15 2014 - 9:26AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 15, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 15, 2014

B&G Foods, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

001-32316 |

|

13-3918742 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of Incorporation) |

|

File Number) |

|

Identification No.) |

|

Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (973) 401-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On May 15, 2014, B&G Foods, Inc. issued a press release announcing a proposed refinancing of its senior secured credit facility. A copy of the press release is attached to this report as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release dated May 15, 2014

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

B&G FOODS, INC. |

|

|

|

|

|

|

|

Dated: May 15, 2014 |

By: |

/s/ Scott E. Lerner |

|

|

|

Scott E. Lerner

Executive Vice President,

General Counsel and Secretary |

3

Exhibit 99.1

B&G Foods Announces Proposed Credit Agreement Refinancing

Parsippany, N.J., May 15, 2014 — B&G Foods, Inc. (NYSE: BGS) announced today that it intends to refinance existing indebtedness under its senior secured credit facility by establishing a new senior secured credit facility, consisting of $300 million of tranche A term loans and a $500 million revolving credit facility. The proceeds of the new credit facility will be used by B&G Foods to repay $122 million of tranche A term loans and approximately $203 million of revolving credit loans under the existing credit agreement, to pay transaction fees and expenses and for general corporate purposes. Immediately following the completion of the proposed refinancing, B&G Foods expects to have approximately $345 million of borrowings outstanding under the new credit facility. The new credit facility is expected to mature in 2019.

B&G Foods expects that the proposed refinancing, if completed, would lower its cost of debt and provide greater flexibility in its capital structure. The consummation of the refinancing is subject to completion of definitive agreements as well as customary closing conditions, and is subject to market conditions. There can be no assurance that the refinancing will occur, or, if it does, as to the terms of the refinancing.

This press release is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of securities in any state or jurisdiction in which the offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About B&G Foods, Inc.

B&G Foods and its subsidiaries manufacture, sell and distribute a diversified portfolio of high-quality, branded shelf-stable foods across the United States, Canada and Puerto Rico. Based in Parsippany, New Jersey, B&G Foods’ products are marketed under many recognized brands, including Ac’cent, B&G, B&M, Baker’s Joy, Bear Creek Country Kitchens, Brer Rabbit, Canoleo, Cary’s, Cream of Rice, Cream of Wheat, Devonsheer, Don Pepino, Emeril’s, Grandma’s Molasses, JJ Flats, Joan of Arc, Las Palmas, MacDonald’s, Maple Grove Farms, Molly McButter, Mrs. Dash, New York Flatbreads, New York Style, Old London, Original Tings, Ortega, Pirate’s Booty, Polaner, Red Devil, Regina, Rickland Orchards, Sa-són, Sclafani, Smart Puffs, Spring Tree, Sugar Twin, Trappey’s, TrueNorth, Underwood, Vermont Maid and Wright’s. B&G Foods also sells and distributes two branded household products, Static Guard and Kleen Guard.

Forward-Looking Statements

Statements in this press release that are not statements of historical or current fact constitute “forward-looking statements.” The forward-looking statements contained in this press release include without limitation statements about the proposed refinancing, including the anticipated amount and maturity date of the proposed refinancing, the ability of the Company to lower its cost of debt and achieve capital structure flexibility and prospects for consummating the proposed refinancing transaction. Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the actual results of B&G Foods to be materially different from the historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties readers are urged to consider statements labeled with the terms “believes,” “belief,” “expects,”

“projects,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in B&G Foods’ filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s Annual Report on Form 10-K for fiscal 2013 filed on February 26, 2014. B&G Foods undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Contacts:

|

Investor Relations: |

|

Media Relations: |

|

ICR, Inc. |

|

ICR, Inc. |

|

Don Duffy |

|

Matt Lindberg |

|

866-211-8151 |

|

203-682-8214 |

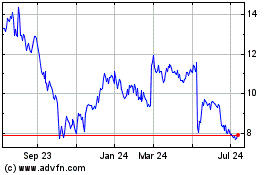

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Aug 2024 to Sep 2024

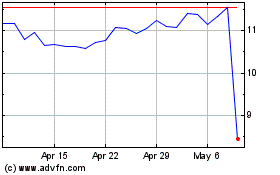

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Sep 2023 to Sep 2024