GOL Feb Traffic Impresses - Analyst Blog

March 24 2014 - 4:00PM

Zacks

Leading Latin American airline,

GOL Linhas Aereas SA (GOL) posted solid traffic

results for Feb 2014. Net passenger revenue per available seat

kilometer (PRASK) for the month increased 27% year over year on

better load factor.

Revenue passenger kilometers or RPK

– implying revenue generated per kilometer per passenger – for the

month increased 20.2% from the year-ago month to 2,905.3 million.

Both domestic and international RPK showed an improvement of 19.5%

and 25.4%, respectively.

Available seat kilometers (ASK) –

that measures an airline's passenger carrying capacity –increased

0.3% year over year to 3,788.8 million. Home ground capacity

increased 0.2%, while on the international front, ASK improved

1.6%.

Domestic and international load

factor increased 12.6% and 13.5%, respectively, while consolidated

load factor increased 12.7% to 76.7%. A weak domestic market supply

as compared to a high demand led to the solid load factor. As a

result, the company’s yield also grew 6% from the prior-year

quarter, leading to the improved performance.

The biggest impediment to GOL’s

2014 growth is persistent weakness in Brazilian currency, which

contributed to the 8% increase in fuel prices thus offsetting some

of the positives of the quarter.

However, Brazil will host the 2014

football world cup and 2016 summer Olympics, two of the biggest

sporting extravaganzas. The country is expected to get around

600,000 international visitors in addition to 3 million domestic

fans this year, presenting a big opportunity for passenger carriers

like GOL.

To tap these opportunities, GOL

recently announced an exclusive strategic partnership with European

giant Air France-KLM SA, to expand its operations between Brazil

and Europe. We believe that this would significantly improve its

international performance.

GOL – which operates with other

industry players such as LATAM Airlines Group S.A.

(LFL) – has a Zacks Rank #3 (Hold). Better-ranked stocks within

this sector include Southwest Airlines Co. (LUV)

and American Airlines Group Inc. (AAL). Both carry

a Zacks Rank #1 (Strong Buy).

AMER AIRLINES (AAL): Free Stock Analysis Report

GOL LINHAS-ADR (GOL): Free Stock Analysis Report

LATAM AIRLINES (LFL): Free Stock Analysis Report

SOUTHWEST AIR (LUV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

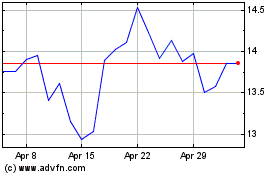

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

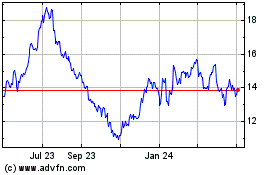

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Sep 2023 to Sep 2024