WMS Industries Inc. (NYSE:WMS) today reported revenue of $162.2

million and net income of $16.1 million, or $0.29 per diluted

share, for its fiscal 2012 second quarter ended December 31, 2011.

The results include a benefit of $2.1 million pre-tax, or $0.02 per

diluted share, from settlement of litigation. These results showed

sequential growth over the September 2011 quarter in which the

Company reported revenues of $155.6 million and diluted earnings

per share of $0.07, inclusive of $0.17 of charges. In the December

2010 quarter, revenue was $199.9 million and net income was $27.0

million, or $0.46 per diluted share, including a $0.02 per diluted

share benefit due to the retroactive reinstatement of the U.S.

Federal Research and Development tax credit.

Recent Highlights:

- Initial jurisdictional approvals

received for more than 20 new for-sale games between October 1,

2011 and December 31, 2011, with approximately two-thirds of these

games featuring new, distinct math models.

- First jurisdictional approval received

in the December quarter for new Epic MONOPOLY™ participation game,

along with several game refresh themes for existing installed

participation products and additional jurisdictional approvals for

THE WIZARD OF OZ™ Journey to Oz™, MONOPOLY Party Train®,

BATTLESHIP™, Leprechaun’s Gold® and Pirate Battle® games.

- WMS’ networked gaming products

installed on approximately 900 gaming machines at more than 50

casino properties in North America, Europe, Asia, Africa and Latin

America, including previously approved Portal applications –

Jackpot Explosion®, Piggy Bankin® and Peng-Wins® – and the Remote

Configuration and Download functionality of the WAGE-NET® networked

gaming system.

- Reached agreement with a major

multi-site casino operator to replace 1,500 Bluebird® gaming

machines with Bluebird2 and Bluebird xD™ units by calendar 2012

year end, along with a commitment to increase WMS’ installed base

of participation gaming machines.

- Surpassed 800,000 unique log-in users

for Player’s Life® Web Services in January 2012.

“Reflecting the quarterly sequential improvements in unit

shipments, revenues, diluted EPS and cash flow from operations, and

the ongoing improvements in the pace of jurisdictional approvals

for our newest products, we believe the inflection point in our

operating and financial performance is now behind us,” said Brian

R. Gamache, Chairman and Chief Executive Officer. “Since the second

half of fiscal 2011, we have acted decisively to realign our

product plans to address near-term customer needs and revenue

opportunities, redirect resources to support the commercialization

of new products and right-size the organization to match current

operating conditions to position WMS for a return to growth. As a

result, we are now capturing revenue opportunities and attaining

operating margin benefits from our realignment, restructuring and

cost containment actions.”

“We expect quarterly sequential improvements in revenues and

operating margin to accelerate in the second half of fiscal 2012,

as the return to a more ratable schedule for the development and

ongoing commercialization of innovative new products continues, as

we realize the benefit of increased demand from new casino

openings, and as we maintain our disciplined focus on improving

operational execution and cost containment,” Gamache continued.

“These improvements are expected to drive year-over-year growth in

both total revenue and operating margin in the second half of

fiscal 2012. We believe the continued improvements and operational

progress will lead to an even stronger year in fiscal 2013 for

WMS.”

“We are encouraged by recent customer acceptance of our new,

innovative products, as evidenced by the Company’s new large

contract with a major multi-site customer that increases our share

of their casino slot floors in the United States, while creating a

refresh cycle that will ensure their gaming floor remains appealing

and highly productive,” Gamache added. “Additionally, momentum for

the commercialization of our forward-thinking network gaming system

continues to gain traction with more than 50 casinos around the

world now running our networked gaming solutions on their slot

floors.

“We believe that our talented workforce, Culture of Innovation

and portfolio of intellectual properties strongly position WMS to

capture a meaningful share of the long-term growth opportunities in

our industry in the coming years,” concluded Gamache.

Fiscal 2012 Second Quarter Financial Review

The following table summarizes key components related to revenue

generation for the three and six months ended December 31, 2011 and

2010 (dollars in millions, except unit, per unit and per day

data):

Three Months Ended

December 31,

Six Months Ended

December 31,

Product Sales Revenues: 2011

2010 2011

2010 New unit sales revenues $ 79.1 $ 104.9 $ 144.0 $

193.0 Other product sales revenues 18.4 22.3

40.6 45.4 Total product sales

revenues $ 97.5 $ 127.2 $ 184.6 $ 238.4

New units shipped and recognized as product sales revenue

4,846 6,310 8,764 11,648 Average sales price per new unit $ 16,325

$ 16,620 $ 16,440 $ 16,567 Gross profit on product sales

revenues (1) $ 48.8 $ 64.1 $ 93.1 $ 118.2 Gross margin on product

sales revenues (1) 50.1 % 50.4 % 50.4 % 49.6 %

Gaming Operations

Revenues: Participation revenues $ 58.4 $ 69.4 $ 121.7 $ 142.3

Other gaming operations revenues 6.3 3.3

11.5 6.7 Total gaming operations

revenues $ 64.7 $ 72.7 $ 133.2 $ 149.0

Installed participation units at period

end, with

lease payments based on: Percentage of coin-in 3,582 3,755 3,582

3,755 Percentage of net win 2,673 3,282 2,673 3,282 Daily lease

rate (2) 3,027 3,137 3,027

3,137 Total installed participation units at

period end 9,282 10,174 9,282

10,174 Average installed participation

units 9,376 10,147 9,488 10,263 Average revenue per day per

participation unit $ 67.62 $ 74.39 $ 69.72 $ 75.38 Gross

profit on gaming operations revenues (1) $ 50.3 $ 57.1 $ 104.5 $

118.9 Gross margin on gaming operations revenues (1) 77.7 % 78.5 %

78.5 % 79.8 %

Total revenues $ 162.2

$ 199.9 $ 317.8

$ 387.4 Total gross profit (1) $

99.1 $ 121.2 $

197.6 $ 237.1 Total gross

margin (1) 61.1 % 60.6

% 62.2 % 61.2 %

(1) As used herein, gross profit and gross margin do not

include depreciation, amortization and distribution expenses. (2)

Includes only participation game theme units. Does not include

units with product sales game themes placed under fixed-term, daily

fee operating leases.

Total product sales revenues for the December 2011 quarter were

$97.5 million compared to $127.2 million in the year-ago period and

increased $10.4 million, or 12%, on a quarterly sequential basis.

Global new unit shipments totaled 5,803 new gaming machines in the

December quarter, of which WMS recognized revenue on 4,846 units,

including 2,759 units in the U.S. and Canada. New replacement units

totaled approximately 2,200 units in the U.S. and Canada, a

600-unit quarterly sequential increase, but were below a year ago.

Gaming machine sales for new casino openings and expansions in the

U.S. and Canada were approximately 600 units, not including 957

additional new units for new casino openings and expansions that

were shipped at the customers’ request, but not recognized as

revenue in the December 2011 quarter.

WMS shipped 2,087 units to international customers, or 43% of

total global unit shipments, compared with 2,389 units, or 38% of

total global unit shipments, in the year-ago period, primarily

reflecting a decline in shipments to customers in Mexico and

Australia. The average sales price for new units of $16,325 was

lower than the year-ago period, reflecting the competitive

marketplace and a lower mix of premium games. WMS’ Bluebird xD

units represented 34% of total global new unit shipments and

mechanical reel products were 13% of new unit sales in the December

2011 quarter.

Other product sales revenue declined $3.9 million year over year

to $18.4 million, reflecting lower revenue from sales of used

gaming machines, partially offset by higher conversion kit revenue.

Approximately 1,600 used gaming machines were sold in the December

2011 quarter, at lower average selling prices, compared with

approximately 3,100 used units in the prior-year quarter. Revenue

was recognized on approximately 5,000 conversion kits in the

December 2011 quarter compared to approximately 2,000 conversion

kits a year ago.

Gaming operations revenues were $64.7 million in the December

2011 quarter compared to $72.7 million in the year-ago period. The

average installed participation base for the December 2011 quarter

was 9,376 units compared to an average installed base of 10,147

units in the year-ago period. The ending installed base of 9,282

gaming machines at December 31, 2011, compares with 9,592 units at

September 30, 2011, and 10,174 units at December 31, 2010. Average

revenue per day was $67.62 compared to $74.39 in the year-ago

period. The year-over-year declines in the average and period-end

installed base and average revenue per day primarily reflect the

previously noted impact from delays in approvals of new

participation products that have recently eased. The 6% quarterly

sequential decline in average daily revenue from $71.70 in the

September 2011 quarter mostly reflects normal seasonal influences

during the December quarter.

Following initial jurisdictional approvals for new participation

games near the end of the September 2011 quarter and additional

approvals subsequently received in other jurisdictions, coupled

with recent initial approvals for several new participation games,

as expected, the Company began to replace and refresh its

participation footprint in the December 2011 quarter. With the

expected commercialization of additional new participation products

in the second half of the fiscal 2012, WMS expects to achieve

sequential growth in its installed participation base and average

revenue per day in both the March and June 2012 quarters.

Other gaming operations revenue increased $3.0 million over the

year-ago period, primarily reflecting continued growth in the

online gaming business in the United Kingdom and incremental

revenue from networked gaming solutions.

Total gross profit, excluding depreciation, amortization and

distribution expense as used herein, was $99.1 million for the

December 2011 quarter compared to $121.2 million in the year-ago

period. Total gross margin was 61.1% compared to 60.6% in the

year-ago period. Product sales gross margin was 50.1% in the

December 2011 quarter, just below the 50.4% in the December 2010

quarter, reflecting a lower average selling price partially offset

by ongoing improvements to reduce costs. The gross margin benefit

from increased revenues of higher-margin conversion kit and parts

sales was partially offset by the lower margin on used gaming

machine sales. Gaming operations gross margin was 77.7% in the

December 2011 quarter compared with 78.5% in the year-ago quarter,

reflecting unfavorable jackpot expense experience and increased

costs from the networked gaming and online gaming businesses that

were launched within the last twelve months.

The following table summarizes key components of operating

expenses and operating income for the three and six months ended

December 31, 2011 and 2010 ($ in millions):

Three Months Ended Six Months Ended

December 31, December 31, Operating Expenses

2011 2010

2011 2010 Research and

development $ 23.7 $ 30.1 $ 48.1 $ 58.8 As a percentage of revenues

14.6 % 15.1 % 15.1 % 15.2 % Selling and administrative 33.2 38.1

71.5 76.4 As a percentage of revenues 20.5 % 19.1 % 22.5 % 19.7 %

Impairment and restructuring charges — — 9.7 3.8 As a percentage of

revenues — — 3.1 % 1.0 % Depreciation and amortization 21.2 16.3

43.8 32.1 As a percentage of revenues 13.1 % 8.1 %

13.8 % 8.3 %

Total operating expenses $

78.1 $ 84.5 $

173.1 $ 171.1 Operating

expenses as a percentage of revenues 48.2 %

42.3 % 54.5 % 44.2 %

Operating income $ 21.0 $

36.7 $ 24.5 $ 66.0

Operating margin 12.9 % 18.4

% 7.7 % 17.0 %

WMS continued to realize benefits in the December 2011 quarter

from previously implemented restructuring and realignment

initiatives, as well as from ongoing cost management efforts. The

Company recorded no new impairment or restructuring charges during

the December 2011 quarter. For the six months ended December 31,

2011, total research and development and selling and administrative

expenses, inclusive of the $4.3 million of incremental bad debt

expense recorded in the September quarter, were $15.6 million lower

than the comparable six-month period a year ago.

Research and development expenses in the December 2011 quarter

were $23.7 million, or $6.4 million lower on a year-over-year basis

and just below the September 2011 quarter. The decrease reflects

lower non-payroll-related expenses due to cost containment measures

coupled with savings realized from the workforce reduction

announced in August 2011. Consistent with the changes announced in

August 2011, the Company has prioritized development initiatives

aimed at improving the ratable commercialization of new products

for core businesses, focusing on near-term revenue opportunities,

as well as continuing support for emerging opportunities such as

portal applications for networked gaming, WMS’ award-winning

Player’s Life Web Services and online gaming.

Selling and administrative expenses in the December 2011 quarter

were $33.2 million, or $4.9 million lower than the year-ago period,

primarily reflecting a decline in payroll-related expenses

reflecting lower levels of staffing and lower non-payroll-related

expenses.

Depreciation and amortization expense was $21.2 million in the

December 2011 quarter compared with $16.3 million in the year-ago

quarter, primarily reflecting increased depreciation from capital

spending on gaming operations equipment as the Company continues to

transition its installed base of participation units to Bluebird2

and Bluebird xD cabinets, and amortization related to the Company’s

investment in the development of its WAGE-NET networked gaming

system and online gaming system following initial commercialization

during the June 2011 quarter and December 2010 quarter,

respectively.

Interest income and other income and expense, net was $4.2

million in the December 2011 quarter compared with $2.4 million in

the year-ago quarter, principally reflecting $2.1 million of other

income related to the settlement of litigation.

The effective tax rate for the December 2011 quarter was 35%

compared to 31% for the December 2010 quarter. The December 2011

quarter reflects the benefit from the U.S. Federal Research &

Development Tax Credit which more than offset an increase in the

Illinois corporate tax rate that became effective January 1, 2011,

and the impact of certain international subsidiary start-up

operating losses that did not benefit the effective global tax

rate. The December 2010 quarter included a 530-basis point

favorable impact on the effective tax rate as a result of the

retroactive reinstatement of the U.S. Federal Research &

Development Tax Credit legislation. As the U.S. Federal Research

& Development Tax Credit legislation expired December 31, 2011,

the Company expects its effective tax rate in the second half of

fiscal 2012 to be 36%-to-37%.

Cash flow provided by operating activities for the six months

ended December 31, 2011, increased 48% to $65.7 million from $44.5

million in the prior-year period. The increase primarily reflects a

substantially smaller increase in operating assets and liabilities,

an increase in depreciation and amortization, and higher other

non-cash charges, partially offset by the impact of lower net

income, less favorable tax-related items and a decrease in

share-based compensation. Total receivables, net of $333.0 million

at December 31, 2011, were down $33.2 million from June 30, 2011,

levels, and declined $1.6 million from September 30, 2011, even as

revenue increased $6.6 million on a quarterly sequential basis.

Long-term notes receivable, net were $87.0 million at December 31,

2011, compared with $81.6 million at June 30, 2011, and $75.3

million at December 31, 2010, largely reflecting higher sales

during the past twelve months into markets such as certain Latin

American countries that historically have depended upon extended

financings. Inventory was $4.7 million higher on a quarterly

sequential basis, primarily reflecting an increase in finished

goods inventory for upcoming new casino openings. Total current

liabilities at December 31, 2011, were down $28.1 million from June

30, 2011, primarily due to higher payments for income taxes and the

timing on payments of accounts payable.

Net cash used in investing activities for the six months ended

December 31, 2011, was $73.5 million compared to $71.2 million in

the year-ago period due to the $4.7 million increase in capital

deployed for additions to gaming operations equipment as the

Company continues to transition its installed participation base

from original Bluebird units to the next-generation of Bluebird2

and Bluebird xD gaming machines, partially offset by a $4.3 million

decrease in capital to acquire or license intangible and other

non-current assets. Capital expenditures for property, plant and

equipment increased $1.9 million compared with the prior-year

period. Net cash used in financing activities decreased to $2.3

million compared to $33.9 million in the prior year, primarily due

to $35.0 million in proceeds from borrowings under the Company’s

line of credit and lower stock repurchase activity in the six

months ended December 31, 2011, compared to the 2010 period,

partially offset by lower cash received and tax benefits from stock

option activity.

Adjusted EBITDA, a non-GAAP financial metric (see reconciliation

to net income schedule near the end of this release), was $57.7

million in the December 2011 quarter compared with $66.0 million in

the prior-year period. The adjusted EBITDA margin for the December

2011 quarter was 35.6%, an increase over the 33.0% in the year-ago

period.

Total cash, cash equivalents and restricted cash was $92.8

million at December 31, 2011, a quarterly sequential increase of

$10.4 million, inclusive of $9.6 million used for share repurchases

during the quarter. Total cash, cash equivalents and restricted

cash was $105.0 million at June 30, 2011.

Share Repurchase Program Update

During the three months ended December 31, 2011, the Company

purchased $9.6 million of its common stock, or 500,449 shares,

under its share repurchase authorization. During the six months

ended December 31, 2011, WMS repurchased 1.8 million shares, or

over 3% of its outstanding shares, for an aggregate $37.1 million.

Reflecting $138.6 million in share repurchases over the last six

quarters, approximately $161.4 million remains available on WMS’

repurchase authorization. At December 31, 2011, WMS had 55.3

million shares outstanding and 4.4 million shares held in the

Company’s treasury.

Fiscal 2012 Outlook

Reflecting ongoing progress in obtaining approvals on new

participation and for-sale products, favorable customer response to

new products and continuing benefits from the restructuring and

realignment initiatives, WMS expects to achieve further quarterly

sequential growth in revenue and operating margin in both the March

and June 2012 quarters, leading to year-over-year growth in the

second half of fiscal 2012. Notwithstanding these expectations, WMS

continues to believe fiscal 2012 annual revenue will be below

fiscal 2011 revenue reflecting the lower comparable results

generated in the first half of fiscal 2012, while annual operating

margin is expected to improve year over year due to the Company’s

cost containment and restructuring initiatives. WMS continues to

expect that sequential growth in the second-half of the fiscal year

will be driven by improvements in the flow of approvals for new

products, modest growth in the gaming operations business and an

improvement in new unit demand from new casino openings. The

Company does not expect revenue in fiscal 2012 from the opening of

the Illinois VLT market or from the VLT market in Italy. WMS

believes that the challenged economic and industry environment will

continue resulting in only limited improvement in the industry

replacement cycle in calendar 2012. R&D spending in fiscal 2012

is targeted to approximate 13-to-14% of total annual revenues.

WMS Industries is hosting a conference call and webcast at 4:30

PM ET today, Thursday, January 26, 2012. The conference call

numbers are 212/231-2900 or 415/226-5357. To access the live call

on the Internet, log on to www.wms.com (select “Investor

Relations”). Following its completion, a replay of the call can be

accessed for thirty days on the Internet via www.wms.com.

About WMS

WMS is engaged in serving the gaming industry worldwide by

designing, manufacturing and marketing games, video and mechanical

reel-spinning gaming machines, video lottery terminals and in

gaming operations, which consists of the placement of leased

participation gaming machines in legal gaming venues. WMS is

proactively addressing the next stage of casino gaming floor

evolution with its WAGE-NET networked gaming solution, a suite of

systems technologies and applications designed to increase

customers’ revenue generating capabilities and operational

efficiency. The Company’s interactive gaming operations develop and

market products and solutions that address global online and mobile

gaming opportunities. More information on WMS can be found at

www.wms.com or visit the Company on Facebook, Twitter or

YouTube.

Product names mentioned in this release are trademarks of WMS,

except for the following:

BATTLESHIP and MONOPOLY are trademarks of Hasbro. Used with

permission. ©2012 Hasbro. All rights reserved.

THE WIZARD OF OZ and all related characters and elements are

trademarks of and © Turner Entertainment Co. (s12) Judy Garland as

Dorothy from THE WIZARD OF OZ. (s12)

This press release contains forward-looking statements

concerning our future business performance, strategy, outlook,

plans, products and liquidity, including, but not limited to, the

statements set forth under the caption “Fiscal 2012 Outlook.”

Forward-looking statements may be typically identified by such

words as “may,” “will,” “should,” “expect,” “anticipate,” “plan,”

“likely,” “believe,” “estimate,” “project,” and “intend,” among

others. These forward-looking statements are subject to risks and

uncertainties that could cause our actual results to differ

materially from the expectations expressed in the forward-looking

statements. Although we believe that the expectations reflected in

our forward-looking statements are reasonable, any or all of our

forward-looking statements may prove to be incorrect. Consequently,

no forward-looking statements may be guaranteed. Factors which

could cause our actual results to differ from expectations include

(1) delay or refusal by regulators to approve our new gaming

platforms, cabinet designs, game themes and related hardware and

software; (2) changes in regulations or regulatory interpretations

that may adversely affect existing product placements or future

placements; (3) an inability to introduce in a timely manner new

games and gaming machines that achieve and maintain market

acceptance; (4) a decrease in the desire of casino customers to

upgrade gaming machines or allot floor space to leased or

participation games, resulting in reduced demand for our products;

(5) a reduction in capital spending or interruption in payments by

casino customers associated with business weakness or economic

uncertainty that adversely affects our customers' ability to make

purchases or pay; (6) a greater-than-expected demand for operating

leases by customers over outright product sales or sales financing

leases that shift revenue recognition from a single period to the

term of such operating leases; (7) future costs relating to our

planned restructuring and other charges that may be higher than

currently estimated, including additional charges related to

actions at a later time not presently contemplated; (8) ability to

realize in full, or part, the anticipated savings and expense

reductions from restructuring and lower staffing; (9) adverse

affects on product development, innovation and the ability to

retain and attract key personnel following the restructuring and

reorganization actions; (10) a reduction in play levels of our

participation games by casino patrons, whether due to economic

conditions or increased placements of competitive product; (11)

inability of suppliers of key components to timely meet our

requirements to fulfill customer orders; (12) increased pricing or

promotional competitive activity that adversely affects our average

selling price or product revenues; (13) a failure to obtain and

maintain our gaming licenses and regulatory approvals; (14) failure

of customers or players to adapt to the new technologies that we

introduce in new product concepts; (15) a software anomaly or

fraudulent manipulation of our gaming machines and software; (16) a

failure to obtain the right to use or an inability to adapt to

rapid development of new technologies; (17) an infringement claim

seeking to restrict our use of material technologies; (18) risks of

doing business in international markets, including political and

economic instability, terrorist activity and foreign currency

fluctuations; and (19) the unfavorable outcome of any legal

proceedings in which we may be involved from time to time. These

factors and other factors that could cause actual results to differ

from expectations are more fully described under “Item 1.

Business”, “Item 1A. Risk Factors” and “Legal Proceedings” in our

Annual Report on Form 10-K for the year ended June 30, 2011, and

our more recent reports filed with the U.S. Securities and Exchange

Commission.

- financial tables follow -

WMS INDUSTRIES INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME For the Three and Six Months Ended

December 31, 2011 and 2010 (in millions of U.S. dollars and

millions of shares, except per share amounts)

(unaudited) Three Months Ended

Six Months Ended

December 31,

December 31,

2011 2010

2011 2010

REVENUES: Product sales $ 97.5 $ 127.2 $ 184.6 $ 238.4

Gaming operations 64.7 72.7

133.2 149.0

Total revenues 162.2

199.9 317.8 387.4

COSTS AND EXPENSES:

Cost of product sales (1) 48.7 63.1 91.5 120.2 Cost of gaming

operations (1) 14.4 15.6 28.7 30.1 Research and development 23.7

30.1 48.1 58.8 Selling and administrative 33.2 38.1 71.5 76.4

Impairment and restructuring charges — — 9.7 3.8 Depreciation and

amortization (1) 21.2 16.3 43.8

32.1

Total costs and expenses

141.2 163.2 293.3

321.4 OPERATING INCOME

21.0 36.7 24.5 66.0 Interest expense

(0.4 ) (0.2 ) (0.8 ) (0.6 ) Interest income and other income and

expense, net 4.2 2.4 6.9

3.9 Income before income taxes 24.8 38.9 30.6 69.3

Provision for income taxes 8.7 11.9

10.7 22.8

NET INCOME

$

16.1

$

27.0

$

19.9

$

46.5

Earnings per share:

Basic $ 0.29 $ 0.47 $ 0.36 $ 0.80

Diluted $ 0.29 $ 0.46 $ 0.35 $ 0.78

Weighted-average common shares:

Basic common stock outstanding 55.6 57.8

55.9 58.0 Diluted common stock

and common stock equivalents 55.8 59.1

56.2 59.3 (1) Cost of

product sales and cost of gaming operations exclude the following

amounts of depreciation and

amortization, which are included in the

depreciation and amortization line item:

Cost of product sales $ 1.4 $ 1.2 $ 2.8 $ 2.4 Cost of gaming

operations $ 13.1 $ 9.2 $ 27.2 $ 18.7

WMS INDUSTRIES

INC. CONDENSED CONSOLIDATED BALANCE SHEETS December

31 and June 30, 2011 (in millions of U.S. dollars and

millions of shares) December 31,

June 30, ASSETS 2011

2011 CURRENT ASSETS: (unaudited) Cash and cash

equivalents $ 79.3 $ 90.7 Restricted cash and cash equivalents

13.5 14.3

Total cash, cash

equivalents and restricted cash 92.8 105.0

Accounts and notes receivable, net of allowances of $7.1 and $5.5,

respectively 246.0 284.6 Inventories 69.1 67.1 Other current assets

46.8 40.8

Total current assets

454.7 497.5 NON-CURRENT ASSETS:

Long-term notes receivable, net 87.0 81.6

Gaming operations equipment, net of

accumulated depreciation and amortization of

$210.6 and $270.5, respectively 96.9 86.8

Property, plant and equipment, net of

accumulated depreciation and amortization of

$127.0 and $115.7, respectively 189.9 171.5 Intangible assets, net

148.1 153.9 Deferred income tax assets 46.5 43.1 Other assets, net

18.6 11.9

Total non-current

assets 587.0 548.8

TOTAL ASSETS $ 1,041.7 $

1,046.3

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES: Accounts payable $ 58.7 $ 66.2

Accrued compensation and related benefits 7.0 12.3 Other accrued

liabilities 58.6 73.9

Total current

liabilities 124.3 152.4 NON-CURRENT

LIABILITIES: Long-term debt 35.0 —

Deferred income tax liabilities

25.8 23.9 Other non-current liabilities 14.4

14.1

Total non-current liabilities 75.2

38.0 Commitments, contingencies and indemnifications — —

STOCKHOLDERS’ EQUITY: Preferred stock (5.0 shares

authorized, none issued) — — Common stock (200.0 shares authorized

and 59.7 shares issued) 29.8 29.8 Additional paid-in capital 436.8

437.9 Treasury stock, at cost (4.4 and 2.9 shares, respectively)

(132.8 ) (104.9 ) Retained earnings 510.7 490.0 Accumulated other

comprehensive income (loss) (2.3 ) 3.1

Total stockholders’ equity 842.2

855.9 TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY $ 1,041.7 $ 1,046.3

WMS INDUSTRIES INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS For the Six Months Ended December

31, 2011 and 2010 (in millions of U.S. dollars)

(unaudited) Six Months Ended

December 31, CASH FLOWS FROM OPERATING ACTIVITIES

2011 2010 Net

income $ 19.9 $ 46.5 Adjustments to reconcile net income to net

cash provided by (used in) operating activities: Depreciation 37.1

32.1 Amortization of intangible and other non-current assets 14.2

9.9 Share-based compensation 7.6 10.6 Other non-cash items 10.2 5.0

Deferred income taxes (2.0 ) 10.9 Tax benefit from exercise of

stock options (0.2 ) (6.5 ) Change in operating assets and

liabilities (21.1 ) (64.0 )

Net cash provided by

operating activities 65.7 44.5

CASH FLOWS FROM

INVESTING ACTIVITIES Additions to gaming operations equipment

(35.6 ) (30.9 ) Purchase of property, plant and equipment (31.1 )

(29.2 ) Payments to acquire or license intangible and other

non-current assets (6.8 ) (11.1 )

Net cash used in

investing activities (73.5 ) (71.2 )

CASH FLOWS FROM

FINANCING ACTIVITIES Purchase of treasury stock (37.1 ) (50.0 )

Proceeds from borrowings under revolving credit facility 35.0 —

Debt issuance costs (2.5 ) — Cash received from exercise of stock

options 2.1 9.6 Tax benefit from exercise of stock options

0.2 6.5

Net cash used in financing

activities (2.3 ) (33.9 )

Effect of Exchange Rates on Cash

and Cash Equivalents (1.3 ) 0.7

DECREASE IN CASH AND CASH EQUIVALENTS (11.4 ) (59.9 )

CASH AND CASH EQUIVALENTS, beginning of period 90.7

166.7

CASH AND CASH EQUIVALENTS, end of

period $ 79.3 $ 106.8

WMS INDUSTRIES

INC. Supplemental Data – Earnings per Share (in

millions of U.S. dollars and millions of shares, except per share

amounts) (unaudited) Three Months

Ended Six Months Ended December 31,

December 31, 2011 2010 2011

2010 Net income $ 16.1 $ 27.0 $ 19.9 $ 46.5

Basic weighted average common shares outstanding 55.6 57.8

55.9 58.0 Dilutive effect of stock options 0.1 1.0 0.2 1.0 Dilutive

effect of restricted common stock and warrants 0.1

0.3 0.1 0.3

Diluted weighted average common stock and

common stock

equivalents 55.8 59.1 56.2 59.3

Basic earnings per share of common stock $ 0.29 $ 0.47 $ 0.36 $

0.80

Diluted earnings per share of common stock

and common stock

equivalents

$ 0.29 $ 0.46 $ 0.35 $ 0.78

Supplemental Data – Reconciliation

of Net Income to Adjusted EBITDA (in millions of U.S.

dollars) (unaudited) Three Months

Ended Six Months Ended December 31,

December 31, 2011

2010 2011

2010 Net income $ 16.1 $ 27.0

$ 19.9 $ 46.5 Net income $ 16.1 $ 27.0

$ 19.9 $ 46.5 Depreciation 17.8 16.3 37.1 32.1 Amortization of

intangible and other non-current assets 7.6 4.6 14.2 9.9 Provision

for income taxes 8.7 11.9 10.7 22.8 Interest expense 0.4 0.2 0.8

0.6 Share-based compensation 5.0 5.5 7.6 10.6 Other non-cash items

2.1 0.5 10.2 5.0

Adjusted EBITDA $ 57.7 $ 66.0 $ 100.5

$ 127.5

Adjusted EBITDA margin 35.6 %

33.0 % 31.6 % 32.9 %

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, share-based compensation and other non-cash items,

including non-cash impairment and restructuring charges) and

adjusted EBITDA margin are supplemental non-GAAP financial metrics

used by our management and commonly used by industry analysts to

evaluate our financial performance. Adjusted EBITDA and adjusted

EBITDA margin provide additional useful information to investors

regarding our ability to service debt and are commonly used

financial analysis metrics for measuring and comparing gaming

companies in areas of liquidity, operating performance, valuation

and leverage. Adjusted EBITDA and adjusted EBITDA margin should not

be construed as an alternative to operating income (as an indicator

of our operating performance) or net cash from operations (as a

measure of liquidity) as determined in accordance with U.S.

generally accepted accounting principles. All companies do not

calculate adjusted EBITDA and adjusted EBITDA margin in necessarily

the same manner, and WMS’ presentation may not be comparable to

those presented by other companies.

WMS INDUSTRIES INC. Supplemental Data – Items

Impacting Comparability: Net Charges (Credits) For the Three

and Six Months Ended December 31, 2011 and 2010 (in millions

of U.S. dollars, except per share amounts) (unaudited)

Three Months Ended

December 31, 2011

Three Months Ended

December 31, 2010

Six Months Ended

December 31, 2011

Six Months Ended

December 31, 2010

Per Per Per

Pre-tax diluted Pre-tax diluted

Pre-tax Per diluted Pre-tax diluted

DESCRIPTION OF

NET CHARGES (CREDITS)

amount share amount share amount

share amount share IMPAIRMENT AND

RESTRUCTURING CHARGES Non-cash Charges Impairment of

property, plant and equipment $ — $ — $ — $ — $ 0.6 $ 0.01 $ 2.4 $

0.03

Cash Charges Restructuring charges —

— — — 9.1

0.11 1.4 0.01

Total

Impairment and Restructuring Charges — — — —

$

9.7 0.12 3.8 0.04 OTHER

CHARGES

Non-cash charges to write-down Mexican

customer receivables (recorded in selling

and

administrative expenses) — — —

— 4.3 0.05 —

—

TOTAL IMPAIRMENT, RESTRUCTURING AND

OTHER CHARGES $ —

$ —

$

— $ — $ 14.0

$ 0.17 $3 .8 $

0.04 CASH BENEFITS:

Proceeds from litigation settlement

(recorded

in interest income and other income

and

expense, net) $ (2.1 ) $ (0.02 ) — — $ (2.1 ) $ (0.02 ) — —

Prior period impact from retroactive

reinstatement of the Federal research

and

development tax credit (recorded in

provision

for income taxes) — — —

(0.02 ) — — — (0.02 )

TOTAL CASH BENEFITS $ (2.1 )

$ (0.02 ) —

$ (0.02

) $ (2.1 ) $ (0.02

) —

$ (0.02 ) TOTAL

NET CHARGES (CREDITS) $ (2.1 ) $

(0.02 ) $ — $ (0.02

) $ 11.9 $ 0.15

$ 3.8 $ 0.02

The three-month period ended December 31, 2011, includes a

pre-tax benefit of $2.1 million, or $0.02 per diluted share, from

litigation settlement included in interest income and other income

and expense, net. The three-month period ended December 31, 2010

includes a $0.02 per diluted share benefit from the retroactive

reinstatement of the Federal research and development tax credit

related to the period January 1, 2010 through September 30,

2010.

The six-month period ended December 31, 2011, includes $14.0

million of pre-tax charges, or $0.17 per diluted share, which

includes $9.7 million pre-tax of impairment and restructuring

charges, including $5.9 million pre-tax of separation-related costs

and $3.8 million pre-tax of costs related to the decision to close

two facilities; and $4.3 million pre-tax, or $0.05 per diluted

share, of non-cash charges to write-down receivables following

government enforcement actions at certain casinos in Mexico. This

six-month period also includes a pre-tax cash benefit of $2.1

million from litigation settlement. The six-month period ended

December 31, 2010, includes $3.8 million of pre-tax impairment and

restructuring charges, or $0.04 per diluted share, that previously

had been included in selling and administrative expense, which

includes $2.4 million pre-tax of asset impairment charges and $1.4

million pre-tax of separation-related restructuring charges related

to closing WMS’ main facility in the Netherlands. The six-month

period includes a $0.02 per diluted share benefit recorded in

income taxes in the December 2010 quarter related to the period

January 1, 2010 through September 30, 2010 from the retroactive

reinstatement of the Federal research and development tax

credit.

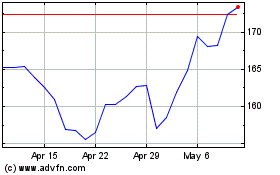

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Apr 2024 to May 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From May 2023 to May 2024