Business and Financial Highlights:

- Generated quarterly revenue of $73.8

million

- Introduced R+ DDR4 server memory

chipset, RB26, for RDIMMs and LRDIMMs

- Cryptography Research Division has been

selected by the Secure Content Storage Association (SCSA) to run

and manage the VIDITY™ Key Issuance Center

- GAAP diluted net income per share of

$1.52; non-GAAP diluted net income per share of $0.14

Rambus Inc. (NASDAQ:RMBS) today reported financial results for

the third quarter ended September 30, 2015.

GAAP Financial Results:

Revenue for the third quarter of 2015 was $73.8 million, which

was up 1% over the second quarter of 2015 primarily due to higher

royalty revenue offset by lower sales of security products. As

compared to the third quarter of 2014, revenue was up 6% primarily

due to higher royalty revenue due to the extension of the license

agreement with SK hynix in the second quarter of 2015 and higher

revenue from a new license agreement signed with IBM during the

first quarter of 2015, offset by lower royalty revenue from ST

Microelectronics.

Revenue for the nine months ended September 30, 2015 was $219.5

million, which was down 2% over the prior year period, primarily

due to lower royalty revenue from ST Microelectronics and NVIDIA

Corporation, offset by higher revenue from a new license agreement

signed with IBM during the first quarter of 2015 as well as higher

sales of security and lighting products.

Total operating costs and expenses for the third quarter of 2015

were $56.1 million, 2% lower than the previous quarter and 2%

higher than the third quarter of 2014. Third quarter operating

costs and expenses of $56.1 million included $3.6 million of

stock-based compensation expenses and $6.3 million of amortization

expenses. In comparison, total operating costs and expenses for the

second quarter of 2015 of $57.3 million included $4.4 million of

stock-based compensation expenses and $6.3 million of amortization

expenses. Total operating costs and expenses for the third quarter

of 2014 were $55.2 million, which included $3.4 million of

stock-based compensation expenses and $6.7 million of amortization

expenses. The change in total operating costs and expenses in the

third quarter of 2015 as compared to the second quarter of 2015 was

primarily due to lower prototyping costs, lower costs of sales due

to lower sales of security and lighting products and lower

stock-based compensation costs partially offset by lower gain from

sale of intellectual property. The change in total operating costs

and expenses in the third quarter of 2015 as compared to the third

quarter of 2014 was primarily attributed to higher expenses related

to software design tools, higher headcount related costs and higher

cost of sales due to higher sales of security and lighting products

offset by lower consulting costs.

Total operating costs and expenses for the nine months ended

September 30, 2015 were $168.4 million, 1% higher than the nine

months ended September 30, 2014. The operating costs and expenses

for the first nine months of 2015 of $168.4 million included $11.7

million of stock-based compensation expenses and $18.9 million of

amortization expenses. This is compared to total operating costs

and expenses for the nine months ended September 30, 2014 of $166.8

million, which included $11.2 million of stock-based compensation

expenses, $20.3 million of amortization expenses and $2.5 million

of retention bonus expense from acquisitions. The change in total

operating costs and expenses was primarily attributable to higher

headcount related costs, higher expenses related to software design

tools, higher cost of sales due to higher sales of security and

lighting products and higher prototyping costs offset by higher

gain from sale of intellectual property, lower retention bonus

expense from acquisitions and lower consulting costs.

Net income for the third quarter of 2015 was $182.0 million

as compared to net income of $6.9 million in the second

quarter of 2015 and net income of $5.5 million in the third quarter

of 2014. Diluted net income per share for the third quarter of 2015

was $1.52 as compared to diluted net income per share of $0.06 in

the second quarter of 2015 and diluted net income per share of

$0.05 in the third quarter of 2014, respectively. The change in net

income for the third quarter of 2015 as compared to the prior

quarter and the third quarter of 2014 included a tax benefit of

$174 million related to the release of the Company's deferred tax

asset valuation allowance against its U.S. deferred tax assets.

Net income for the nine months ended September 30, 2015 was

$198.4 million as compared to a net income of $18.4 million for the

same period of 2014. Diluted net income per share for the nine

months ended September 30, 2015 was $1.67 as compared to a diluted

net income per share of $0.16 for the same period of 2014. The

change in net income is due to the same reason as indicated

above.

Non-GAAP Financial Results (1):

Total non-GAAP operating costs and expenses in the third quarter

of 2015 were $46.3 million, which was relatively flat as compared

to the previous quarter, and 3% higher than the third quarter of

2014.

Total non-GAAP operating costs and expenses for the nine months

ended September 30, 2015 were $137.8 million as compared to $132.8

million in the same period of 2014 due primarily to higher

headcount related costs, higher expenses related to software design

tools, higher cost of sales due to the sale of security and

lighting products and higher prototyping costs offset by higher

gain from sale of intellectual property, lower retention bonus

expense from acquisitions and lower consulting costs.

Non-GAAP net income in the third quarter of 2015 was $17.0

million, 6% higher than the prior quarter and 14% higher than the

third quarter of 2014. Non-GAAP diluted net income per share was

$0.14 in the third quarter of 2015 as compared to $0.13 in the

prior quarter and $0.13 in the third quarter of 2014.

Non-GAAP net income for the nine months ended September 30, 2015

was $50.0 million as compared to $53.4 million in the same period

of 2014. Non-GAAP diluted net income per share was $0.42 for the

nine months ended September 30, 2015 as compared to non-GAAP

diluted net income per share of $0.45 in the same period of

2014.

Other Financial Highlights:

Cash, cash equivalents, and marketable securities as of

September 30, 2015 were $362.9 million, an increase of

$14.8 million from June 30, 2015. The increase in cash

was driven by operating activities.

During the third quarter of 2015, the Company recorded an income

tax benefit of approximately $167.0 million. The Company's tax

benefit includes $174 million tax benefit related to the release of

its deferred tax asset valuation allowance against its U.S.

deferred tax assets.

During the third quarter of 2015, the Company did not repurchase

any shares of its common stock under its share repurchase program

that authorizes the repurchase of up to an aggregate of 20.0

million shares.

Additionally, the Company announced that on October 16, 2015,

its Board of Directors approved the commitment for a restructuring

and a plan of termination resulting in a reduction of 8% of the

Company’s headcount. The restructuring is expected to save

approximately $10 million in 2016, from the current run rate, and

the reductions in expense and associated workforce are expected to

be completed by the first quarter of 2016. The total estimated cash

payout related to the reduction in force will be approximately $3.5

million, which is related to severance and termination benefits.

The estimated non-cash expense is expected to be approximately $1

million.

Fourth Quarter 2015 Outlook:

For the fourth quarter of 2015, the Company expects revenue to

be between $71 million and $77 million. Achieving revenue in this

range will require that the Company sign new customer agreements

for patent and solutions licensing among other matters.

Conference Call:

The Company will host a conference call at 2:00 p.m. PT today to

discuss its financial results. The call, audio and slides will be

available online at investor.rambus.com. A replay will be available

following the call as a webcast on the Rambus Investor Relations

website and for one week at the following numbers: (855) 859-2056

(domestic) or (404) 537-3406 (international) with ID# 55741229.

(1) Non-GAAP Financial Information:

In the commentary set forth above and in the financial

statements included in this earnings release, the Company presents

the following non-GAAP financial measures: operating costs and

expenses, operating income (loss) and net income (loss). In

computing each of these non-GAAP financial measures, the following

items were considered as discussed below: stock-based compensation

expenses, acquisition-related transaction costs and retention bonus

expense, amortization expenses, restructuring charges, non-cash

interest expense and certain other one-time adjustments. The

non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations from these

results should be carefully evaluated. Management believes the

non-GAAP financial measures are appropriate for both its own

assessment of, and to show investors, how the Company’s performance

compares to other periods. The non-GAAP financial measures used by

the Company may be calculated differently from, and therefore may

not be comparable to, similarly titled measures used by other

companies. Reconciliation from GAAP to non-GAAP results is included

in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments

based on the following items:

Stock-based compensation expense. These expenses primarily

relate to employee stock options, employee stock purchase plans,

and employee non-vested equity stock and non-vested stock units.

The Company excludes stock-based compensation expense from its

non-GAAP measures primarily because such expenses are non-cash

expenses that the Company does not believe are reflective of

ongoing operating results. Additionally, given the fact that other

companies may grant different amounts and types of equity awards

and may use different option valuation assumptions, excluding

stock-based compensation expense permits more accurate comparisons

of the Company’s results with peer companies.

Acquisition-related transaction costs and retention bonus

expense. These expenses include all direct costs of certain

acquisitions and the current periods’ portion of any retention

bonus expense associated with the acquisitions. The Company

excludes these expenses in order to provide better comparability

between periods.

Restructuring charges. These charges may consist of severance,

contractual retention payments, exit costs and other charges and

are excluded because such charges are not directly related to

ongoing business results and do not reflect expected future

operating expenses.

Amortization expense. The Company incurs expenses for the

amortization of intangible assets acquired in acquisitions. The

Company excludes these items because these expenses are not

reflective of ongoing operating results in the period incurred.

These amounts arise from the Company’s prior acquisitions and have

no direct correlation to the operation of the Company’s core

business.

Non-cash interest expense on convertible notes. The Company

incurs non-cash interest expense related to its convertible notes.

The Company excludes non-cash interest expense related to its

convertible notes to provide more accurate comparisons of the

Company’s results with other peer companies and to more accurately

reflect the Company’s ongoing operations.

Income tax adjustments. For purposes of internal forecasting,

planning and analyzing future periods that assume net income from

operations, the Company estimates a fixed, long-term projected tax

rate of approximately 36 percent, which consists of estimated U.S.

federal and state tax rates, and excludes tax rates associated with

certain items such as withholding tax, tax credits, deferred tax

asset valuation allowance and the release of any deferred tax asset

valuation allowance. Accordingly, the Company has applied the 36

percent tax rate to its non-GAAP financial results for all periods

to assist the Company’s planning for future periods. The Company

has provided below a reconciliation of its GAAP provision for

income taxes and GAAP effective tax rate to the assumed non-GAAP

provision for income taxes and non-GAAP effective tax rate.

On occasion in the future, there may be other items, such as

impairments and significant gains or losses from contingencies that

the Company may exclude in deriving its non-GAAP financial measures

if it believes that doing so is consistent with the goal of

providing useful information to investors and management.

Forward-Looking Statements

This release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995 including relating

to Rambus’ restructuring and plan of termination and expectations

regarding revenue for the fourth quarter of 2015 and estimated,

fixed, long-term projected tax rates. Such forward-looking

statements are based on current expectations, estimates and

projections, management’s beliefs and certain assumptions made by

Rambus’ management. Actual results may differ materially. Rambus’

business generally is subject to a number of risks which are

described more fully in Rambus’ periodic reports filed with the

Securities and Exchange Commission. Rambus undertakes no obligation

to update forward-looking statements to reflect events or

circumstances after the date hereof.

About Rambus Inc.

Rambus brings invention to market. Our customizable IP cores,

architecture licenses, tools, services, and training improve the

competitive advantage of our customers’ products while accelerating

their time-to-market. Rambus products and innovations capture,

secure and move data. For more information, visit

www.rambus.com.

RMBSFN

Rambus Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

September 30,

2015

December 31,

2014

ASSETS Current assets: Cash and cash equivalents $

216,553 $ 154,126 Marketable securities 146,325 145,983 Accounts

receivable 10,314 6,001 Prepaids and other current assets 10,859

8,541 Deferred taxes 17,896 187 Total current assets 401,947

314,838 Intangible assets, net 70,426 89,371 Goodwill 116,899

116,899 Property, plant and equipment, net 59,077 64,023 Deferred

taxes, long-term 143,834 536 Other assets 3,690 2,612 Total

assets $ 795,873 $ 588,279

LIABILITIES &

STOCKHOLDERS’ EQUITY Current liabilities: Accounts

payable $ 5,928 $ 6,962 Accrued salaries and benefits 9,362 14,840

Other accrued liabilities 12,320 12,856 Total current

liabilities 27,610 34,658 Long-term liabilities: Convertible notes,

long-term 119,414 115,089 Long-term imputed financing obligation

38,751 39,063 Other long-term liabilities 4,242 7,847 Total

long-term liabilities 162,407 161,999 Total stockholders’

equity 605,856 391,622 Total liabilities and stockholders’

equity $ 795,873 $ 588,279

Rambus Inc.

Condensed Consolidated Statements of

Operations

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2015 2014 2015

2014 Revenue: Royalties $ 66,823 $

64,009 $ 196,173 $ 207,387 Contract and other revenue 6,956

5,703 23,332 17,131 Total revenue 73,779

69,712 219,505 224,518 Operating costs

and expenses: Cost of revenue (1) 11,111 10,540 34,004 31,199

Research and development (1) 27,784 27,014 85,506 81,580 Sales,

general and administrative (1) 17,860 18,200 53,701 55,639 Gain

from sale of intellectual property (106 ) — (3,262 ) (170 ) Gain

from settlement (510 ) (510 ) (1,530 ) (1,530 ) Restructuring

charges — — — 39 Total operating costs

and expenses 56,139 55,244 168,419 166,757

Operating income 17,640 14,468 51,086 57,761 Interest income

and other income (expense), net 539 (549 ) 874 (432 ) Interest

expense (3,117 ) (3,059 ) (9,291 ) (21,755 ) Interest and other

income (expense), net (2,578 ) (3,608 ) (8,417 ) (22,187 ) Income

before income taxes 15,062 10,860 42,669 35,574 Provision for

(benefit from) income taxes (166,971 ) 5,347 (155,727 )

17,214 Net income $ 182,033 $ 5,513 $ 198,396

$ 18,360 Net income per share: Basic $ 1.56 $

0.05 $ 1.71 $ 0.16 Diluted $ 1.52 $

0.05 $ 1.67 $ 0.16 Weighted average shares

used in per share calculation Basic 116,444 114,523

115,940 114,080 Diluted 119,542 118,206

118,997 117,540

_________

(1) Total stock-based compensation expense for the three and

nine months ended September 30, 2015 and 2014 is presented as

follows:

Three Months Ended

September 30,

Nine Months Ended

September 30,

2015 2014 2015 2014 Cost of revenue $

12 $ 12 $ 51 $ 34 Research and development $ 1,548 $ 1,648 $ 5,303

$ 5,574 Sales, general and administrative $ 2,008 $ 1,781 $ 6,395 $

5,587

Rambus Inc.

Supplemental Reconciliation of GAAP to

Non-GAAP Results

(In thousands)

(Unaudited)

Three Months Ended Nine Months Ended

September 30,

2015

June 30,

2015

September 30,

2014

September 30,

2015

September 30,

2014

Operating costs and expenses $ 56,139 $ 57,258 $ 55,244 $

168,419 $ 166,757 Adjustments: Stock-based compensation expense

(3,568 ) (4,415 ) (3,441 ) (11,749 ) (11,195 ) Acquisition-related

transaction costs and retention bonus expense — — (6 ) (2 ) (2,469

) Amortization expense (6,268 ) (6,323 ) (6,741 ) (18,914 ) (20,295

) Restructuring charges — — — — (39 )

Non-GAAP operating costs and expenses $ 46,303

$ 46,520 $ 45,056

$ 137,754 $ 132,759

Operating income $ 17,640 $ 15,554 $ 14,468 $ 51,086 $

57,761 Adjustments: Stock-based compensation expense 3,568 4,415

3,441 11,749 11,195 Acquisition-related transaction costs and

retention bonus expense — — 6 2 2,469 Amortization expense 6,268

6,323 6,741 18,914 20,295 Restructuring charges — — —

— 39

Non-GAAP operating income $

27,476 $ 26,292 $

24,656 $ 81,751 $

91,759 Income before income taxes $ 15,062 $

12,666 $ 10,860 $ 42,669 $ 35,574 Adjustments: Stock-based

compensation expense 3,568 4,415 3,441 11,749 11,195

Acquisition-related transaction costs and retention bonus expense —

— 6 2 2,469 Amortization expense 6,268 6,323 6,741 18,914 20,295

Restructuring charges — — — — 39 Impairment of investment — — 600 —

600 Non-cash interest expense on convertible notes 1,605

1,581 1,515 4,745 13,226 Non-GAAP

income before income taxes $ 26,503 $ 24,985 $ 23,163 $ 78,079 $

83,398 GAAP provision for (benefit from) income taxes (166,971 )

5,805 5,347 (155,727 ) 17,214 Adjustment to GAAP provision for

income taxes 176,512 3,190 2,992 183,836

12,810 Non-GAAP provision for income taxes 9,541

8,995 8,339 28,109 30,024

Non-GAAP net income $ 16,962 $

15,990 $ 14,824 $

49,970 $ 53,374

Non-GAAP basic net income per share $ 0.15 $ 0.14 $ 0.13 $

0.43 $ 0.47

Non-GAAP diluted net income per share $ 0.14 $

0.13 $ 0.13 $ 0.42 $ 0.45 Weighted average shares used in non-GAAP

per share calculation: Basic 116,444 116,027 114,523 115,940

114,080 Diluted 119,542 120,939 118,206 118,997 117,540

Supplemental Reconciliation of GAAP to

Non-GAAP Effective Tax Rate (1)

Three Months Ended Nine Months Ended

September 30,

2015

June 30,

2015

September 30,

2014

September 30,

2015

September 30,

2014

GAAP effective tax rate 1,109

%

46

%

49

%

365

%

48

%

Adjustment to GAAP effective tax rate

(1,073

)%

(10

)%

(13

)%

(329

)%

(12

)%

Non-GAAP effective tax rate 36

%

36

%

36

%

36

%

36

%

(1) For purposes of internal forecasting, planning and analyzing

future periods that assume net income from operations, the Company

estimates a fixed, long-term projected tax rate of approximately 36

percent, which consists of estimated U.S. federal and state tax

rates, and excludes tax rates associated with certain items such as

withholding tax, tax credits, deferred tax asset valuation

allowance and the release of any deferred tax asset valuation

allowance. Accordingly, the Company has applied the 36 percent tax

rate to its non-GAAP financial results for all periods to assist

the Company’s planning for future periods.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151019006369/en/

Rambus Inc.Linda Ashmore, 408-462-8411Corporate

Communicationslashmore@rambus.comorRambus Inc.Nicole Noutsios,

408-462-8050Investor Relationsnnoutsios@rambus.com

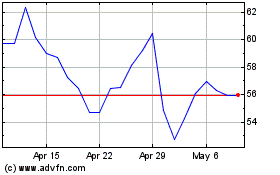

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Apr 2024 to May 2024

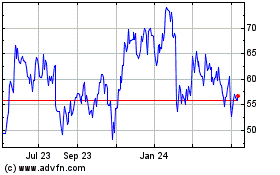

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From May 2023 to May 2024