TIDMVCP

RNS Number : 3969M

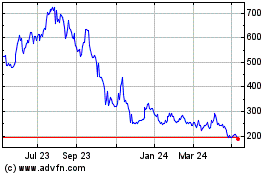

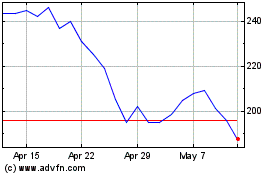

Victoria PLC

14 September 2023

Victoria PLC

('Victoria', the 'Company', or the 'Group')

Audited Results

for the year ended 1 April 2023

Record underlying revenue and EBITDA

Confident FY2024 outlook with a sharp increase in earnings and

free cash flow expected due to completion of major integration

projects

Victoria PLC (LSE: VCP) the international designers,

manufacturers and distributors of innovative floorcoverings,

announces its audited results for the year ended 1 April 2023,

which are unchanged from the key preliminary unaudited data

announced on 15 August and show the Company's tenth consecutive

year of revenue and underlying profit growth.

FY2023 Financial and Operational highlights

Year ended % Change

1 April Year ended

2023 2 April 2022

Underlying revenue GBP1,461.4m GBP1,019.8m +43.3%

Underlying EBITDA(1) GBP196.0m GBP162.8m +20.4%

Underlying operating profit(1) GBP118.8m GBP107.9m +10.1%

Operating (loss) / profit (GBP24.1m) GBP53.6m -145.0%

Underlying profit before tax(1) GBP76.9m GBP73.8m +4.2%

Net loss after tax (GBP91.8m) (GBP12.4m)

Underlying free cash flow(2) GBP71.3m GBP34.2m 108.3%

Net debt(3) GBP658.3m GBP406.6m

Net debt / EBITDA(4) 3.44x 2.66x

Earnings / (loss) per share:

- Basic (79.35p) (10.61p)

- Diluted adjusted(1) 39.06p 40.21p -2.9%

-- For the first time in the Company's history, the total volume

of flooring sold in FY2023 exceed 200 million square metres (more

than 29,500 football fields), generating record revenues of GBP1.46

billion.

-- Solid like-for-like organic revenue growth of 2.8 %, despite

challenging macro-economic conditions and following very strong

like-for-like organic growth of +19.2% in the previous 12

months.

-- Underlying EBITDA grew by + 20.4 % over the prior year to GBP 196.0 million.

-- Year-end net leverage was 3.44 x, with the Group's senior

debt consisting entirely of fixed rate, covenant-lite bonds falling

due in August 2026 and March 2028.

-- A resilient balance sheet, with cash and undrawn credit lines

at the year-end in excess of GBP 250 million.

-- FY2023's focus on the successful integration of acquisitions

has resulted in the projects' completion this month. The outcome is

anticipated to conservatively deliver a GBP20+ million per annum

increase in EBITDA.

-- T he Group's integration expenditure (exceptional expenses

and capex) of the last three years is coming to an end.

Consequently, the Board anticipates free cash flow to increase

sharply. For the five-year period FY2015-2019, the Group averaged

cash conversion of EBITDA to Net Free Cash Flow of 55% (5) , which

the Board believes is a sustainable, long-term ratio and one

management is focused on returning to in the near-term.

-- Whilst the Group's FY2024 financial outlook is largely based

on steady-state demand and underpinned by the various integration

projects, each future 5% increase in overall revenue, which is

Victoria's long-run organic growth rate, would be expected to

deliver earnings and cash flow growth of more than GBP25 million

per annum.

-- The "signs of life" in some geographies noted in earlier

market announcements, has continued to be seen - most noticeably in

the UK, where we believe the Group is benefitting from the service

it offers customers and its mid-high end product positioning and

underlying earnings year-to-date are ahead of both budget and the

same period last year.

Commenting on FY2024 Outlook and beyond, Geoff Wilding,

Executive Chairman, said:

"We expect FY2024 to be a year of two halves, with stronger H2

earnings as the productivity gains from completion of the major

integration projects are experienced. Completion of the projects is

also expected to result in Victoria's free cash flow increasing

sharply from H2 FY2024, with management focussed on returning to

our long-run average cash conversion of EBITDA to Net Free Cash

Flow of 55% (5) . Further ahead, FY2025 will see the full

integration benefits with an expected uplift in margins driving an

additional increase in earnings and free cash flow.

Victoria benefits greatly from being in a long-duration, steady

growth industry that will drive compounding organic growth for

decades. After making and integrating two-dozen acquisitions over

the last 10 years we have now achieved a scale that we anticipate

will result in higher productivity, more efficient logistics, wider

distribution, and lower input costs than almost all our

competitors. Coupling this scale advantage with the underlying

sectoral tailwinds will, the Board believes, deliver outsized

returns for our shareholders for a very long time."

(1) Underlying performance is stated before exceptional and

non-underlying items. In addition, underlying profit before tax and

adjusted EPS are stated before non-underlying items within finance

costs.

(2) Underlying free cash flow represents cash flow after

interest, tax and replacement capital expenditure, but before

investment in growth, financing activities and exceptional

items.

(3) Net debt shown before right-of-use lease liabilities,

preferred equity, bond issue premia and the deduction of prepaid

finance costs.

(4) Leverage shown consistent with the measure used by our

lending banks.

(5) Cash generated after replacement capex, interest, and tax as

a percentage of EBITDA.

For more information contact:

Victoria PLC www.victoriaplc.com/investors-welcome

Geoff Wilding, Executive Chairman Via Walbrook PR

Philippe Hamers, Group Chief Executive

Brian Morgan, Chief Financial Officer

Singer Capital Markets (Nominated Adviser

and Joint Broker)

Rick Thompson, Phil Davies, James Fischer +44 (0)20 7496 3095

Berenberg (Joint Broker) +44 (0)20 3207 7800

Ben Wright, Richard Bootle

Peel Hunt (Joint Broker) +44 (0)20 7418 8900

Adrian Trimmings, Andrew Clark

Walbrook PR (Media & Investor Relations) +44 (0)20 7933 8780 or victoria@walbrookpr.com

Paul McManus, Louis Ashe-Jepson, +44 (0)7980 541 893 / +44 (0)7747 515

Alice Woodings 393 /

+44 (0) 7407 804 654

About Victoria PLC ( www.victoriaplc.com )

Established in 1895 and listed since 1963 and on AIM since 2013

(VCP.L), Victoria PLC, is an international manufacturer and

distributor of innovative flooring products. The Company, which is

headquartered in Worcester, UK, designs, manufactures and

distributes a range of carpet, flooring underlay, ceramic tiles,

LVT (luxury vinyl tile), artificial grass and flooring

accessories.

Victoria has operations in the UK, Spain, Italy, Belgium, the

Netherlands, Germany, Turkey, the USA, and Australia and employs

approximately 7,300 people across more than 30 sites. Victoria is

Europe's largest carpet manufacturer and the second largest in

Australia, as well as the largest manufacturer of underlay in both

regions.

The Company's strategy is designed to create value for its

shareholders and is focused on consistently increasing earnings and

cash flow per share via acquisitions and sustainable organic

growth.

Victoria PLC

Chairman and CEO's Review

INTRODUCTION

Victoria's operational management philosophy during FY2023 is

probably best encapsulated by Winston Churchill's advice, "When you

are going through hell, keep going". Dramatic increases in the cost

of raw materials, unprecedented energy prices, labour cost

inflation, subdued consumer demand, and international shipping

disruption created a testing backdrop against which our management

team nevertheless delivered the 10(th) consecutive year of growth

as set out in the table below.

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

---------------- ----- ----- ------ ------ ------ ------ ------ ---------- ---------- ---------- ----------

Underlying

Revenue

(GBP million) 70.9 71.4 127.0 255.2 330.4 417.5 566.8 621.5 662.3 1,019.8 1,461.4

Underlying 2.3 5.1 15.8 32.3 45.7 64.7 96.3 107.2(2) 112.0(2) 143.5(2) 171.3(2)

EBITDA(1)

(GBP million)

EBITDA margin

% 3.3 7.2 12.4 12.7 13.8 15.5 17.0 17.2 16.9 14.1 11.7(3)

(1) The KPIs in the table above are alternative performance

measures used by management along with other figures to measure

performance. Full financial commentary is provided in the Financial

Review below.

(2) Underlying EBITDA in FY20 through FY23 is stated before the

impact of IFRS 16 for consistency of comparison with earlier years.

IFRS-reported EBITDA for these years are GBP118m, GBP127m, GBP163m,

and GBP196m respectively.

(3) The decline in reported %margin was entirely due to the

acquisition mix effect; LFL organic margins increased by 0.2%

The objectives of this review are to help our shareholders

better understand the business and be able to reach an informed

view of the value of the company, its future prospects, and its

financial resilience.

To achieve these objectives requires data to be shared in a way

that communicates information and this will include both

IFRS-compliant and non-IFRS performance measures. The review

focuses on the underlying operating results of the business, which

delivered underlying EBITDA of GBP196.0 million (FY2022: GBP162.8m)

and underlying EBIT of GBP118.8 million (FY2022: GBP107.9m). The

Financial Review covers non-underlying items in detail, following

which IFRS reported operating loss was GBP24.1 million (FY2022:

profit GBP53.6m), and furthermore covers items in the income

statement below operating profit (financial items and tax).

Shareholders are of course free to accept or disregard any of

this data but we want to ensure that you have access to similar

information Victoria's board and management use in making

decisions.

FY2023 OPERATIONAL REVIEW

Overview

The global flooring market is c. USD 200 billion(1) (GBP 154

billion(2) ), and USD 66 billion (GBP 51 billion) in Victoria's key

markets of Europe and the US, with volume growth over the last 25

years of c. 2.6%(1) per annum. There are fundamental drivers that

sustain this long-term growth and, whilst somewhat subdued demand

was experienced in FY2023, this was due to near-term macroeconomic

conditions and we remain confident that the natural state of the

sector is continued expansion in the regions where Victoria

trades.

Before commenting specifically on each of the different

operating divisions, there were several Group-wide elements in

FY2023 which are worth highlighting.

(1) Freedonia Global Flooring Report 2021

(2) GBP/USD 1.29

Integration Projects

Integrating and reorganising an acquisition is expensive

(especially in Europe where mandated social payments must be made

to redundant workers) but necessary to realise the maximum value

from acquired businesses. Therefore, with the proviso that the

expected return on the investment must exceed our internal hurdle

rate, the Group is willing to invest heavily where required, in

integrating an acquisition in order to optimise future free cash

flow. (To be clear, although the restructuring cash outlay is made

post-completion, the quantum of the investment is scoped out prior

to making the acquisition and is factored into the purchase price

we pay for the business to ensure our targeted return on capital is

achieved).

We have had four major projects underway throughout FY2023, all

of which are now in their final stages and, when completed, are

expected to conservatively result in a GBP20+ million per annum

increase in EBITDA and a significant step down in exceptional

capital expenditures:

(i) Balta's integration consists of three key projects:

a. The relocation of Balta's carpet manufacturing from Belgium

to Victoria's existing UK factories, making full use of the

designed capacity. 80% of Balta's carpet is sold in the UK and this

move will lower production and transport costs whilst enabling

shorter delivery times, thereby improving customer service.

b. The consolidation of the Balta rug manufacturing operation

onto Victoria's large site at Sint-Baafs Vijve, Belgium, alongside

the relocation of some production to Usak, Turkey, where the Group

has two modern rug-making and yarn extrusion factories . These

changes will improve efficiency and lower production costs .

c. The divestment of non-core business and real estate assets

acquired with the Balta transaction where the opportunity for

synergies with the Group's existing businesses are minimal.

(ii) Saloni Ceramica. With the investment Victoria has made in

production technology in Spain over the last three years, we have

been able to close the Saloni factory and consolidate production

onto the very large Keraben and Ibero site. This move occurred

ahead of schedule and was completed during March 2023. The Saloni

brand continues, with the roll-out of high-end showrooms and social

media presence supporting a renewed focus on the Architect &

Design market.

(iii) Graniser, Victoria's low-cost Turkish ceramics producer,

has two integration projects in progress:

a. Reorganisation and integration with Victoria's Spanish and

Italian factories - increasing spare annual production capacity at

Graniser to 8 million sqm.

b. Investment in new printers and packaging lines alongside

integration into Victoria's existing ceramics distribution network

will increase higher-margin export revenue.

(iv) Cali Flooring's integration comprises :

a. Access to Victoria's supply chain lowering Cost of Goods Sold (COGS).

b. Integration into Victoria's US logistics platform, improving

delivery times and reducing costs.

c. Commercial excellence projects focussed on "gross to net"

enhancements, which have lifted gross margin by approximately 5%

since April 2022. These projects have covered restructuring

salesforce incentives to encourage maximising margins rather than

volume, minimising claim and product return related expenses,

renegotiating services contracts, and optimising workforce

productivity.

These projects fall into one or more of three broad categories:

investment in productivity-enhancing technology, rationalisation of

production facilities, and logistics integration - all of which are

only possible due to Victoria's scale and business model. Few of

our competitors have the size to justify the investment in

technology that makes these large efficiency gains possible.

Technology is expensive and without the large production volume of

Victoria, the cost cannot be recovered. For example, an energy

co-generation plant, capable of saving millions in energy costs,

requires annual ceramics production at the factory of c. 10 million

sqm to justify the investment - volume that few of our competitors

manufacture. However, without technology, a manufacturer's

production costs will remain permanently higher than that of

Victoria, putting them at a perpetual disadvantage.

In total, these integration projects have reduced headcount by

1,000 FTE's whilst we have maintained our production

capability.

The full GBP20+ million financial effect of these projects

(detailed in the Capital Allocation section below) will be seen in

FY2025, although the benefits will start flowing from later this

year and the anticipated productivity improvements, cost savings,

and working capital enhancements underpin the current year's

expected increased financial performance.

Cash Generation

It is the Board's view that creating wealth for shareholders is

best achieved by maximising the medium-term free cash flow per

share and every decision is viewed through this prism.

Consequently, we set a target of achieving GBP100 million of

cash generation in H2 FY2023. GBP117.0 million was generated from

operating profits and working capital improvement, although we fell

short of the overall target due to three timing related issues:

1. Delayed completion of the divestment of an unneeded factory

building arising from the reorganisation of Balta. Recent Belgium

legislation requires an environmental report prepared prior to

completion and local consultants have significant backlogs. The

report has been recently received and completion of the agreed

c.GBP27 million sale can now proceed.

2. Surprisingly (and pleasingly) fast progress of the

integration projects led to earlier payment of some large cash

reorganisation-related expenditure (largely redundancies and

expansionary capex) that was not expected until FY2024, totalling

c.GBP28 million. Saloni's reorganisation completed earlier than

anticipated in March and, due to the progress made in the last four

months of FY2023, Balta's integration is now expected to finish

this month although when it was acquired in April 2022 we advised

that integration could take 24-36 months.

3. Working capital (primarily excess ceramics inventory

stockpiled due to energy uncertainty last winter) reduction

proceeded somewhat slower than anticipated due to softer demand,

impacting H2 FY2023 by c GBP20 million although progress is now

well underway with targets and management incentive plans in place

for each business across the Group.

Whilst these factors collectively impacted H2 cash by c.GBP74

million, none represent any fundamental shift in Victoria's

financial position as the cash items paid out in FY2023 are a

saving in FY2024 and the delayed inflows will be received in

FY2024.

4. The Board also decided to invest GBP11.4 million (the equity

component of the purchase) in the acquisition of Florida-based

ceramics distributor, IWT. Similarly, GBP1.6 million was invested

in buying back the Company's shares at prices the Board considered

to represent very good value for shareholders.

Other cash movements were broadly in line with expectations.

For the five year period FY2015-2019, the Group averaged cash

conversion of EBITDA to Net Free Cash Flow of 55%(3) and it is our

view that this is a sustainable, long-term ratio and one management

is focused on returning to in the near-term. Nevertheless, during

the last three years Victoria has chosen to invest heavily in three

areas, which the Board's expects to result in higher future free

cash flow conversion:

(i) Reorganisation/integration of acquisitions. The integration

cost is always factored into our purchase price.

(ii) Growth capex. Victoria has been steadily growing market

share for several years and additional plant has been required to

produce the increased volume. However, this investment, together

with productivity gains following completion of the integration

projects and selective outsourcing, means the Group now has

sufficient production capacity to cope with existing and

foreseeable demand and this category of expenditure will fall in

the future.

(iii) Ceramics inventory. During FY2023 the uncertainty about

the reliability of gas supplies during the winter months led

Victoria's ceramics businesses to build up additional inventory to

ensure we could maintain supply to customers and protect our

reputation as a reliable partner even in the event production was

suspended due to lack of gas deliveries for up to two months. Given

our ceramics division sells nearly GBP30 million (at cost) of

product per month, the additional six weeks-worth of inventory held

was a substantial commitment.

Gas remained available and, as noted above, we are now returning

inventory levels to normal, and the cash that was invested in the

excess inventory is being released throughout FY2024.

Consequently, it is the Board's expectation that Victoria's free

cash flow will return sharply back to the long-run average

(additional financial detail is provided in the Capital Allocation

section below), and accompanying this evolution is an increased

emphasis on free cash flow in senior management incentive

plans.

(3) Cash generated after replacement capex, interest, and tax as

a percentage of EBITDA.

Operating Margins

As forecasted to shareholders last year, operating margins

increased slightly (0.2% LFL) but remained below our long-term

expected (and historical) high-teen level. This was due partially

to a management decision to focus on protecting our cash margin

(rather than the percentage margin) and using the difficult

conditions to take further market share from struggling

competitors, but is primarily due to the mathematical effect of

acquisitions (Balta, Ragolle and IWT) - very large businesses with

single-digit margins, which were consequently margin dilutive

(-2.5%) prior to integration and benefitting from synergies with

Victoria. There was also some inevitable temporary impact from the

integration disruption (particularly at Balta where plant

relocation was underway).

However, as set out in this Review, the various integration

projects will be completed during H1 FY2024 and therefore we are

anticipating an uplift in margins beginning in the second half of

this financial year and the full benefit to flow in FY2025.

Inflation

Inflation has continued to be a significant factor throughout

FY2023. Labour costs increased by around 10%, and certain key raw

materials and energy costs increased by more than 100% during the

year. This has had two impacts on the Group during the year:

i. Margin pressure. The Group implemented price increases during

the year in order to protect our cash margin, whilst maintaining a

strong competitive position during a period when some market

participants were finding the operating environment very

challenging. We are confident that completion of our integration

projects alongside other actions, will subsequently deliver an

uplift in the percentage margin back to our historical high-teen

level.

ii. Working capital. Inflation-driven increases in raw material

and production costs means the same quantity of inventory costs

more to make and consequently ties up additional cash and, absent

any mitigating actions, reduces cash flow and lowers the return on

capital. Some of the critical cost inputs have returned to more

normal levels and the consequence of this will be that much of the

cash absorbed in working capital last year will return as stock is

sold and replaced with lower input cost inventory.

In summary the Board and management are alive to the risks

imposed by inflation and are carefully balancing the requirement to

increase prices sufficiently to ensure our cash return on equity

remains acceptable, whilst also maintaining our market share growth

momentum , which will help us drive long-term free cash flow

growth.

Demand

Demand softened in FY2023 following very strong volume growth

over the previous 18 months. We believe this to be a function of

(a) some pull-forward of spending in FY2021 and FY2022 (suggested

by sectoral volume growth of c.4.9% in 2021 versus the long-term

average of c.2.6% per annum) due to Covid lockdowns changing

consumer purchasing priorities; (b) lower consumer confidence

affecting spending levels, and (c) a level of de-stocking during

the year by some very large retailers. Nevertheless, Victoria

achieved 2.8% LFL revenue growth.

As can be seen from the FY2023 financial results, Victoria has

been impacted less by weaker demand than many of our

competitors:

-- As a manufacturer and distributor of typically mid to

high-end flooring, Victoria's core end-customers are less sensitive

to economic uncertainty and inflation.

-- Although de-stocking has been a feature of some larger retail

customers, most of our production is supplied to our customers

(retailers) based on end-consumer orders, not supplied for

inventory, reducing Victoria's exposure to de-stocking.

-- The Group has been deliberately structured with low

operational gearing, reducing the impact on earnings of lower

demand.

Although it is too early to make confident predictions, we have,

in recent months, seen some signs of life in certain markets. It is

our strong view that flooring remains a core consumer product and

any period of subdued demand will pass with little impact on the

long-term value of Victoria.

Whilst the Group's FY2024 financial outlook is largely based on

steady-state demand and underpinned by the various integration

projects, it is worthwhile noting that each future 5% increase in

overall revenue, which is Victoria's long-run organic growth rate,

would be expected to deliver earnings and cash flow growth of more

than GBP25 million per annum.

DIVISIONAL REVIEW

This section focuses on the underlying operating performance of

each individual division, excluding exceptional and non-underlying

items, which are discussed in detail in the Financial Review and

Note 2 to the accounts.

Everything we do operationally is about increasing productivity

- lowering the cost to manufacture and distribute each square metre

of flooring - and improving the customer (retailers and

distributors) experience, seeking to become an increasingly

valuable part of their business. Both are required in order to

achieve our goal of creating wealth for shareholders by maximising

the free cash flow per share and the purpose of this Divisional

Review is to outline some of the steps we have taken during FY2023

along these two vectors.

UK & Europe Soft Flooring - A year dominated by integration

of recent acquisitions

FY23 FY22 Growth

-------------------------- ------------------ ----------------- ----------

Underlying Revenue GBP 718.8 million GBP423.1 million + 69.9 %

Underlying EBITDA GBP 66.9 million GBP70.3 million -4 .8 %

Underlying EBITDA margin 9.3 % 16.6% -730bps

Underlying EBIT GBP27 .2 million GBP45.4 million -40 .1 %

Underlying EBIT margin 3 .8 % 10.7% - 695 bps

Victoria is now Europe's largest soft flooring manufacturer and

distributor. Following very strong growth in FY2022 (LFL organic

revenue growth of 31%), demand for soft flooring was weaker over

the past 12 months, although Victoria has benefitted from its

mid-high end product positioning with LFL revenue -4.7% for FY2023

.

The operating margin reflected the mathematical effect from the

acquisition of the low-margin Balta business (-4.2%) and higher

input costs - particularly polypropylene fibre (-3.4%). As detailed

below, cost savings achieved with the integration of Balta is

expected to address the acquisition-mix effect and many input costs

are returning to more sustainable levels.

Carpet and Underlay

-- The most significant activity in this division over FY2023

has been the integration of Balta's broadloom carpet business,

which was acquired in April 2022. The plan, relocating

manufacturing to the Group's UK facilities, has required extensive

trade union negotiations arising from the factory closures in

Belgium, re-siting of machinery to the UK, and expansion of one of

our UK factories. Although enormously disruptive in the short term

and resulting in little earnings contribution from Balta in FY2023,

the reorganisation is expected to complete shortly, with the

financial benefits showing almost immediately.

-- Interfloor, the Group's underlay subsidiary, has exceeded

growth expectations in the European market, although labour

shortages in the UK held the business back during the year. This

issue is now resolved and we look forward to another strong result

in FY2024.

-- Prices for polypropylene fibre, a major raw material for soft

flooring products, increased more than 50% due to a global mismatch

between supply and demand. The high prices lasted for most of the

financial year, impacting margins, but have more recently returned

to more normal levels, with a benefit to the Group's production

costs and working capital levels.

Rugs (Balta Home)

-- Rugs is an entirely new flooring category for Victoria,

forming part of the Balta acquisition. With hard flooring growing

as a percentage of the total flooring area in Europe and the USA

(from 53.6 % in 2009 to 57.8 % in 2024), and the tendency for

consumers to then immediately cover their new hard floor with a

rug, we believe this to be a sustainably growing flooring

category.

-- The USA is the key market for the rugs manufactured by

Victoria and, after some softness in FY2023 (largely due to large

retailer de-stocking) we are anticipating modest revenue growth in

FY2024. However, the primary focus of the Balta Home management

team, led by Marc Dessein, continues to be finalising the

reorganisation of the business, which will have a materially

positive impact on earnings due to efficiency gains.

-- The reorganisation, which is on schedule, consists of the

consolidation of production facilities in Belgium alongside

transferring significant production capacity to Turkey, where the

company has two modern, certified and low-cost factories.

Logistics

-- Our logistics capability continues to provide Victoria with

what we believe to be an unassailable competitive advantage that

continues to drive market share gains. Retailers value service and

product availability over the last few pennies in price (no margin

at all is made by a retailer on unavailable product!).

-- The Group's state-of-the-art, carbon-neutral, purpose-built

185,000 ft(2) fulfilment centre in Worcester has been completed and

is fully operational, replacing the Kidderminster warehouse. It

also houses the Victoria Group HQ.

-- Apart from further enhancing Victoria service proposition,

our logistics operation, Alliance Flooring Distribution, is also

now generating third-party logistics income.

UK & Europe Ceramic Tiles - Extraordinary energy costs

successfully managed

FY23 FY22 Growth

-------------------------- ------------------ ----------------- ----------

Underlying Revenue GBP 453.3 million GBP371.6 million + 22.0 %

Underlying EBITDA GBP 105.8 million GBP71.4 million + 48.2 %

Underlying EBITDA margin 23.3 % 19.2% + 414 bps

Underlying EBIT GBP 77.5 million GBP47.5 million + 63.1 %

Underlying EBIT margin 17.1 % 12.8% + 431 bps

Successful ceramics production during FY2023 has been

exceptionally challenging due to the unprecedented energy costs and

generally soft demand. Energy costs normally comprise around 15-20%

of revenues for a ceramics business and dealing with prices that at

times were more than 900% of 'normal' levels was an industry-wide

problem that led to many of our competitors simply suspending

production.

Fortunately, Victoria's policy of hedging or contracting the

supply of key raw materials and other inputs (which is ongoing)

stood our ceramics division in very good stead during this

extraordinary period and the division continued to contribute

favourably to the Group's earnings with LFL revenue growth of 12.4%

and an organic margin improvement of 4.2%.

Italy

-- Demand continued throughout FY2023 (and into FY2024) for our

'Made in Italy' ceramics and we have an ongoing order backlog of

many months despite the significant capacity increase in 2022 .

-- We took advantage of the failure of a neighbouring competitor

to purchase their atomizer plant at a fraction of its replacement

cost. At a purchase cost of EUR5 million, this equipment reduces

the cost of atomized clay by c. EUR1.5 million per annum, alongside

securing its supply - vastly reducing our reliance on third-party

suppliers, which was becoming a potential risk to continued growth.

The Italian operation is now vertically integrated and more

resilient.

Spain

-- The final stage of our Spanish ceramics' integration was

completed during the year with the closure of the Saloni plant and

consolidation of production on the Keraben and Ibero sites. This

action, which maintained production capability, but with 15% fewer

employees, had been much delayed due to Covid-19 restrictions,

which lasted much longer in Spain than in other European countries.

However, the resulting higher productivity will help the business

remain competitive in the US market against ceramic tiles arriving

from India, Mexico, and Brazil.

-- The Saloni brand now focusses exclusively on high-end

commercial applications, with stylish new showrooms for the

Architecture & Design community opened in key locations in

Spain.

Turkey

-- Following the acquisition of Graniser in February 2022, we

have right-sized the business, whilst investing in some key

equipment to improve productivity, remove production bottle-necks,

and allow effective integration with our global ceramics

businesses. The result is an increase in spare capacity to 8

million sqm alongside a 30% reduction in FTEs and we are

anticipating an increased contribution from the business in the

current financial year.

Australia - Ongoing demand, some inflationary margin

pressure

FY23 FY22 Growth

-------------------------- ------------------ ----------------- ----------

Underlying Revenue GBP 120.9 million GBP109.5 million + 10.4 %

Underlying EBITDA GBP 15.3 million GBP16.4 million - 6.4 %

Underlying EBITDA margin 12.7 % 15.0% - 227 bps

Underlying EBIT GBP 10.0 million GBP11.8 million - 15.7 %

Underlying EBIT margin 8.3 % 10.8% - 255 bps

Although inflation had a small temporary impact on margins, the

Australian market continues to see good demand for flooring,

partially driven by ongoing buoyant residential construction due to

inwards migration. Permanent migration (excluding humanitarian

migrants) is consistently around 190,000 people per annum - all of

whom are of high economic value, creating consistent demand for

additional accommodation.

Australian consumers - particularly in the mid-high end of the

market - are paying increasing attention to sustainability when

selecting products and this has resulted in a strong recovery in

demand for wool-based carpet, which is Victoria Australia's core

manufacturing competency and is highly beneficial to the operating

margins of the Group's spinning mill at Bendigo.

North America - Continued profitable expansion

FY23 FY22* Growth*

-------------------------- ------------------ ----------------- --------

Underlying Revenue GBP 168.4 million GBP115.6 million n/a

Underlying EBITDA GBP 9.3 million GBP6.4 million n/a

Underlying EBITDA margin 5.5 % 5.6% n/a

Underlying EBIT GBP 6.0 million GBP5.2 million n/a

Underlying EBIT margin 3.6 % 4.5% n/a

* FY22 data is for 9 months only as Cali Flooring was not a

Victoria subsidiary until 23 June 2021 and growth comparisons are

not applicable

Our North American business continued to grow in FY2023 with the

acquisition of Florida-based ceramics distributor, International

Wholesale Tiles ("IWT"), bringing the Group's North

American-sourced annualised revenues (including exports to the US

from our European factories) to more than USD 400 million (GBP 308

million).

There is strong US-consumer demand for European-branded product

- partially because of the quality and style, and partially because

demand exceeds domestic production capacity by 50%. Ultra-high

quality artificial grass as manufactured by Victoria in Germany and

the Netherlands is a particular high-margin opportunity (as

outlined in last year's Annual Report) but we are also gaining

share in our ceramics business and are exporting increasing

quantities of ceramic tiles from our European factories to North

America. The US remains the single-largest market for our rugs

business.

The effectiveness of our strategy of acquiring US distribution

businesses and then driving higher margin organic growth for our

European factories via logistics and distribution synergies, whilst

massively disrupted by the pandemic during 2020 and 2021, shows

considerable promise - as set out in the table below:

Organic growth of US market exports from Victoria's European factories

2019 2023 Growth

Revenue (GBP thousands)(a) 4,585 45,322 +888%

(a) Excludes revenue from Balta Rugs, Cali Flooring, and IWT,

which were acquired businesses and do not form part of the Group's

US organic growth.

However, we are also continually seeking to profitably expand

our US distribution. One example is the recent soft launch of the

Victoria Home brand on Wayfair.com with Balta rugs and other

flooring products available, although it will be early-2024 before

we plan to scale this effort to ensure the systems are in place to

efficiently manage the expected growth.

The well-publicised West Coast shipping disruption last year

constricted supply of LVT product for several months, impacting

sales. However, this has not continued into the current year and

normal product supply is being experienced.

In Q4 FY2023 the Group finalised the reorganisation of its US

logistics capabilities with four distribution centres across

Georgia (two), South Carolina, and Florida and the US-based

management is continuing to take advantage of revenue and cost

synergies with the wider Group, with opportunities for distribution

of Victoria's European-manufactured product and logistics

efficiencies.

CAPITAL ALLOCATION

Victoria's Board views every investment decision through the

prism of maximising the medium-term free cash flow per share. With

FY2023 being a very significant transformational year due to the

acquisition and integration of Balta, and the integration of Cali

and Graniser, growth/restructuring capex and restructuring costs

totalled GBP98.5 million . It is important to understand that these

costs were factored into the purchase price of the businesses and

are expected to result in higher earnings and free cash flow than

had the investment not been made. Equally significantly, the shift

in allocation of this free cash will be dramatic:

-- Upon completion of the integration projects capex (c.GBP99.6

million in FY2023) will reduce to normal maintenance levels (see

Table A below for details) and exceptional costs (c.GBP 40.8

million in FY2023) associated with reorganisation will be de

minimus (see Table B below for details of the major projects and

their associated costs).

-- With a much lower risk of energy disruption the cash invested

in excess ceramics inventory will flow back out as inventory levels

return to normal.

T able A sets out the breakdown of capex spending for the last

five years to help shareholders better understand normal

maintenance capex levels, with the last major reorganisation

project being in FY2019:

Capex FY19 FY20 FY21 FY22 FY23

GBPm GBPm GBPm GBPm GBPm**

------------------------- ----- ----- ----- ----- -------

Maintenance 23.5 25.4 20.9 40.9 45.5

Growth & Restructuring* 20.9 8.4 7.6 12.4 54.1

------------------------- ----- ----- ----- ----- -------

44.4 33.8 28.5 53.3 99.6

========================= ===== ===== ===== ===== =======

* Includes capital expenditure incurred as part of

reorganizational and synergy projects to drive higher productivity

and lower operating costs.

**The step-up in FY23 is due to the Balta acquisition, which has

both a short-term impact from integration, plus an ongoing increase

in quantum due to the increased size of the Group.

Table B summarises the exceptional expenditure items in FY2023,

which are expected to end as re-organisation/integration projects

complete this financial year.

Redundancy Legal & Asset removal/ Provisions

Exceptional Costs cash costs Professional Impairment /other Total

GBPm GBPm GBPm GBPm GBPm

------------------------ ------------ -------------- --------------- ----------- ------

Balta re-organisation 6.4 0.6 - 24.5 31.5

Saloni re-organisation 2.9 0.4 2.9 1.4 7.6

Graniser integration 0.3 - - - 0.3

Cali integration - - 1.2 0.2 1.4

------------------------ ------------ -------------- --------------- ----------- ------

Total 9.6 1.0 4.1 26.1 40.8

======================== ============ ============== =============== =========== ======

The Board will be prioritising allocation of the Group's free

cash flow to reducing net debt and redeeming preference shares (the

precise mix will depend on several factors). At all times the

allocation decision will be based on prudently optimizing the

Group's balance sheet while analysing what option will maximise the

medium-term free cash flow per share.

DIVIDS

For the reasons detailed in previous years' Annual Reports, it

remains the Board's view (as it has been for the last ten years)

that it can continue to successfully deploy capital to optimise the

creation of wealth for shareholders and therefore it has again

resolved not to pay a final dividend for FY2023.

LEVERAGE

Victoria has for the last 10 years maintained its leverage at

around 3-3.5x EBITDA - a policy that made sense to us given the

stable nature of our business, the terms of our debt

(covenant-lite, fixed-rate, long-dated bonds), and ultra-low

interest rates.

However, capital markets conditions have changed and, with the

higher interest rates that are likely to be experienced for the

foreseeable future, it is the Board's objective to (a) reduce the

Group's net debt/EBITDA ratio ahead of refinancing the current bond

issues; and (b) redeem preference shares .

These goals will be met by both reducing the numerator - the

absolute quantum of debt - from operating cash flow and the sale of

non-core assets and by increasing the denominator - the Group's

earnings - due to completion of the various integration projects

and other actions discussed elsewhere in this Review.

Shareholders will recall that the terms of the preference share

issue incorporated a call option that can be exercised by the

Company from November 2023, giving Victoria the right to repurchase

the preference shares in blocks of GBP25 million at par i.e. their

issue price.

OUTLOOK

Charlie Munger, the other half of the Berkshire Hathaway duo,

once observed that whilst some corporate problems seem large in the

moment, in time they will seem trivial. That is why he believes

long-term investing pays off and why Victoria's management focusses

on creating long-term value rather than reacting to short-term

market noise, which can distort issues out of all proportion to

their real effect on future prosperity. We are confident that all

our businesses benefit from strong economic fundamentals, and

skilled and dedicated management.

Operations

Completion of the various integration projects discussed in this

Review alongside tight cost management and productivity

improvements underpin the expected continued growth in earnings and

cash flow this year, notwithstanding ongoing challenging

macro-economic conditions.

The Board is therefore expecting FY2024 to be a year of two

halves, with the Group's financial performance in H2 being stronger

due to the synergy gains from the projects described in this Review

alongside limited recovery in demand in some markets.

Acquisitions

Although our focus is firmly on the integration projects,

acquisitions remain a core part of Victoria's long-term growth

strategy. Victoria has become a permanent home of choice for

flooring companies in Europe and the US - particularly family-owned

businesses - and the Group's potential pipeline of accretive

acquisitions continues to be compelling.

The worth of a business (or indeed any other investment asset)

is the present value of future cash flows and, with our firm belief

in Benjamin Graham's 'Margin of Safety', we are mindful of the

impact of higher interest rates and inflation on valuations and the

cost of capital.

Private company owners typically take time to adjust their

valuation expectations, but the same selling imperatives remain

(retirement being the most common) and so asking prices will, in

time, reflect the new reality . Consequently, at lower free cash

flow multiples, Victoria's acquisitions will continue to provide

the same Return on Capital as previously, notwithstanding a higher

cost of capital. Therefore, at the right time and within our

leverage policy, we will continue deploy capital to build scale,

expand distribution, broaden our product range, and widen the

economic moat around our business as we have successfully done over

the previous 10 years.

CONCLUSION

Victoria benefits greatly from being in a long-duration, steady

growth industry that will drive compounding organic growth for

decades. After making two-dozen careful acquisitions over the last

10 years we have now achieved a scale that, once we have completed

the current integration projects, will result in higher

productivity, more efficient logistics, wider distribution, and

lower input costs than almost all our competitors. Coupling this

scale advantage with the underlying sectoral tailwinds will, the

Board believes, deliver outsized returns for our shareholders for a

very long time.

Geoffrey Wilding Philippe Hamers

Executive Chairman Chief Executive Officer

13 September 2023

Strategic Report

BUSINESS OVERVIEW

Victoria PLC is a designer, manufacturer and distributor of

innovative flooring products. The Group is headquartered in the UK,

with operations across the UK, Spain, Italy, Belgium, the

Netherlands, Germany, Turkey, the USA, and Australia, employing

approximately 7,300 people at more than 30 sites.

The Group designs and manufactures a wide range of wool and

synthetic broadloom carpets, flooring underlay, ceramic tiles, LVT

(luxury vinyl tile) and hardwood flooring products, artificial

grass, carpet tiles and flooring accessories.

A review of the performance of the business is provided within

the Financial Review.

BUSINESS MODEL

Victoria's business model is underpinned by five integrated

pillars:

1. Superior customer offering

Offering a range of leading quality and complementary flooring

products across a number of different brands, styles and price

points, focused on the mid-to-upper end of the market or specialist

products, as well as providing market-leading customer service.

2. Sales driven

Highly motivated, independent and appropriately incentivised

sales teams across each brand and product range, ensuring delivery

of a premium service and driving profitable growth.

3. Flexible cost base

Multiple production sites with the flexibility, capacity and

cost structure to vary production levels as appropriate, in order

to maintain a low level of operational gearing and maximise overall

efficiency.

4. Focused investment

Appropriate investment to ensure long-term quality and

sustainability, whilst maintaining a focus on cost of capital and

return on investment.

5. Entrepreneurial leadership

A flat and transparent management structure, with income

statement 'ownership' and linked incentivisation, operating within

a framework that promotes close links with each other and with the

PLC Board to plan and implement the short and medium-term

strategy.

STRATEGY

The Group's successful strategy in creating wealth for its

shareholders has not changed and continues to deliver profitable

and sustainable growth, both from acquisitions and organic

drivers.

In terms of acquisitions, the Group continues to seek and

monitor good opportunities in key target markets that will

complement the overall commercial offering and help to drive

further improvement in our KPIs. Funding of acquisitions is

primarily sought from debt finance to maintain an efficient capital

structure, insofar as a comfortable level of facility and covenant

headroom is maintained.

Although acquisitions remain a core part of Victoria's growth

strategy, current focus involves completing integration projects to

strengthen cost management and improve productivity to support the

Group's overall strategy.

KEY PERFORMANCE INDICATORS

The KPIs monitored by the Board and the Group's performance

against these are set out in the table below and further commented

upon in the Financial Review.

2023 2022

GBP'm GBP'm

--------------------------------------------------- -------- --------

Underlying revenue 1,461.4 1,019.8

% growth at constant currency 42.9% 57.5%

--------------------------------------------------- -------- --------

Underlying EBITDA 196.0 162.8

% margin 13.4% 16.0%

--------------------------------------------------- -------- --------

Underlying operating profit 118.8 107.9

% margin 8.1% 10.6%

--------------------------------------------------- -------- --------

Operating cash flow(1) 157.8 111.8

% conversion against underlying EBITDA 92% 78%

--------------------------------------------------- -------- --------

Free cash flow(2) 71.3 34.2

% conversion against underlying operating profit 60% 32%

--------------------------------------------------- -------- --------

Underlying pre-IFRS 16 EBITDA per share (diluted) 112.29p 103.68p

Earnings per share (diluted, adjusted) 39.06p 40.21p

Operating cash flow per share(3) 136.38p 95.65p

--------------------------------------------------- -------- --------

Adjusted net debt / EBITDA(4) 3.44x 2.66x

--------------------------------------------------- -------- --------

(1) Operating cash flow shown before interest, tax and

exceptional items

(2) Before investment in growth capex, acquisitions and

exceptional items

(3) Operating cash flow per share based on current number of

shares outstanding (non-diluted)

(4) Applying our lending banks' measure of financial

leverage

SECTION 172(1) STATEMENT

Section 172 of the Companies Act 2006 requires a Director of a

company to act in the way they consider, in good faith would be

most likely to promote the success of the company for the benefit

of the members as a whole. In doing this, section 172 requires a

Director to have regard, among other matters, to:

-- The likely consequences of any decisions in the long-term;

-- The interests of the company's employees;

-- The need to foster the company's business relationships with suppliers, customers and others;

-- The impact of the company's operations on the community and the environment;

-- The desirability of the company maintaining a reputation for

high standards of business and conduct; and

-- The need to act fairly between shareholders of the company.

During the year ended 1 April 2023 the Directors consider they

have, individually and collectively, acted in a way that is most

likely to promote the success of the Company for the benefit of its

shareholders as a whole and have given due consideration to each of

the above matters in discharging their duties under section 172.

The stakeholders we consider in this regard are our employees, our

shareholders, bondholders and other investors, and our customers

and suppliers. The Board recognises the importance of the

relationships with our stakeholders in supporting the delivery of

our strategy and operating the business in a sustainable

manner.

When considering key corporate decisions, such as material

acquisitions or financing arrangements the Board considers the

interests and objectives of the Company's stakeholders, in

particular its shareholders. In doing so, the potential risk and

rewards of these transactions are carefully balanced. A careful and

consistent financial policy is employed, in particular focusing on

maintaining a level of financial leverage that the Board consider

to be sustainable through economic cycles, and long-dated and

flexible financing terms in relation to covenants and restrictions.

Where there are potential material financial costs or redemption

requirements within financing arrangements, for example the

make-whole provisions in the Company's senior notes and preferred

equity, or the change in control provisions in the preferred

equity, the Board considers the likelihood of these scenarios and

any potential mitigating actions.

Directors are briefed on their duties as part of their induction

and they can access professional advice on these from an

independent advisor throughout the period a director holds office.

The directors fulfil their duties partly through a governance

framework; the Board has adopted the Quoted Companies Alliance

("QCA") Code and the Group's application of this code is detailed

on the Group's website.

The Board recognises the importance of building and maintaining

relationships with all of its key stakeholders in order to achieve

long-term success.

Further details on the Company's strategy and long-term

decisions are set out in the Outlook and Conclusion sections of

Chairman and CEO's Review.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board and senior management team of Victoria identifies and

monitors principal risks and uncertainties on an ongoing basis.

These include:

Inflation - The issues surrounding inflation have the capacity

to impact companies' earnings by interrupting supply chains,

workforce sustainability, demand and rising interest costs.

The Group is well positioned to manage this risk and

uncertainty; the key reasons being:

1. Victoria has the ability to increase prices and implemented

price increases during the year ended 1 April 2023 to protect our

cash margin, whilst maintaining a strong competitive position

during a period some market participants found the operating

environment very challenging ;

2. Management is focussed on completing a number of integration

projects (set out in the Chairman and CEO's Review) that will

increase operating margins, mitigating some inflationary

pressures.

3. We actively hedge or otherwise manage key input costs to

provide management with time to adapt our business and prices to

higher input costs so that margins are protected;

4. The main component of the Group's debt (EUR750m) is Senior

Secured Notes ("bonds") and carry a fixed coupon, of which EUR500m

falls due in August 2026 and EUR250m falls due in March 2028.

Therefore, the key finance cost base of the Group is protected from

any short-term increases in interest rates.

On the demand side specifically, Victoria operates in the mid to

high-end of the flooring market, where customers are less sensitive

to economic uncertainty and inflation. Nonetheless, in the event of

lower demand for a period, Victoria is well placed to manage this

for the following reasons:

1. Victoria enjoys comparatively low operational gearing across its businesses;

2. Victoria has averaged 91.0% pre-tax operating cash conversion

in the last five years, and this high cash conversion (1) ensure

the Group continues to generate cash, even during periods of lower

demand;

3. Much of our production output is supplied to order, not

supplied for inventory. This reduces exposure to de-stocking

risks.

4. A resilient balance sheet with cash and undrawn credit lines

in excess of GBP250 million. Furthermore, the Group's senior debt

consists entirely of long-duration, fixed interest rate,

covenant-lite bonds.

(1) Cash flow before financing and investing items (including

capex), exceptional items and tax; Conversion from pre-IFRS 16

EBITDA

Competition - the Group operates in mature and highly

competitive markets, resulting in pressure on pricing and margins.

Management regularly review competitor activity to devise

strategies to protect the Group's position as far as possible.

Economic conditions - the operating and financial performance of

the Group is influenced by specific economic conditions within the

geographic areas within which it operates, in particular the

Eurozone, the UK, North America and Australia. Economic risks in

any one region are mitigated by the independence of the Group's

four divisions. The Group remains focused on driving efficiency

improvements, cost reductions and ongoing product development to

adapt to the current market conditions.

Key input prices - material adverse changes in energy prices and

certain raw material prices - in particular wool and synthetic

yarn, polyurethane foam, and clay - could affect the Group's

profitability. Price increases, alongside other cost saving

measures, have largely mitigated the impact on operating profit.

Key input prices are closely monitored and the Group has a

sufficiently broad base of suppliers to remove arbitrage risk, as

well as being of such a scale that it is able to benefit from

certain economies arising from this. Whilst there is some foreign

exchange risk beyond the short-term hedging arrangements that are

put in place, the Group experiences a natural hedge from

multi-currency income as the vast majority of the Group's cost base

remains in domestic currency (Euros, Sterling and Australian

Dollars).

Acquisitions - acquisition-led growth is a key part of the

Group's ongoing strategy, and risks exist around the future

performance of any potential acquisitions, unforeseen liabilities,

or difficulty in integrating into the wider Group. The Board

carefully reviews all potential acquisitions and, before

completing, carries out appropriate due diligence to mitigate the

financial, tax, operational, legal and regulatory risks. Risks are

further mitigated through the retention and appropriate

incentivisation of acquisition targets' senior management. Where

appropriate the consideration is structured to include deferred and

contingent elements which are dependent on financial performance

for a number of years following completion of the acquisition.

Other operational risks - in common with many businesses,

sustainability of the Group's performance is subject to a number of

operational risks, including Health & Safety, major incidents

that may interrupt planned production, cyber security breaches and

the recruitment and retention of key employees. These risks are

monitored by the Board and senior management team and appropriate

mitigating actions taken.

On behalf of the Board

Geoffrey Wilding

Executive Chairman

13 September 2023

Financial Review

HIGHLIGHTS

With underlying revenue approaching GBP1.5bn this financial year

has been another record year for Victoria PLC with the Group

continuing to deliver organic revenue growth. In tough economic

conditions the Group has been focussed on maintaining margins,

integrating our latest acquisitions, managing the cost base and

reducing working capital.

Underlying revenue growth of GBP441.5 million (43%) was driven

by the acquisitions completed over the last two years along with

some organic growth. Underlying EBITDA growth of GBP33.1 million

(20%) was predominately organic with the Balta acquisition, as

expected, not contributing significantly in its first year as we

integrate and restructure it.

As inflation continued to drive raw material prices higher

during the year we implemented a number of actions which mitigated

the impact on margins. The actions included prices increases,

forward contracting of energy supplies in key markets and managing

the cost base in all of our divisions.

This Financial Review is structured into several sections. The

first parts focus on the underlying performance of the Group,

analysing the trends in underlying revenue and operating margin,

and providing an overview of acquisition and financing activities

in the year. Thereafter, the Exceptional & Non-Underlying Items

section provides an important, detailed report on all of the items

that bridge from the underlying results (for example, underlying

operating profit of GBP118.8 million) to the IFRS statutory

performance of GBP24.1 million operating loss and, ultimately,

GBP91.8 million loss after tax. The final parts set out the cash

flows of the Group on a basis consistent with past years, and the

year-end net debt position.

Underlying measures of performance are classified as

'Alternative Performance Measures' and should be reviewed in

conjunction with comparable IFRS figures. It is important to note

that these APMs may not be comparable to those reported by other

companies. Underlying results exclude significant costs (such a

significant legal, major restructuring and transaction items), they

should not be regarded as a complete picture of the Group's

financial performance, which is presented in its Total results. The

exclusion of other Adjusting items may result in Adjusting earnings

being materially higher or lower than Total earnings. In

particular, when significant impairments, restructuring changes and

legal costs are excluded, Adjusted earnings will be higher than

Total earnings.

A summary of the underlying and reported performance of the

Group is set out below.

2023 2022

Non- Non-

Underlying underlying Reported Underlying underlying Reported

performance items numbers performance items numbers

GBPm GBPm GBPm GBPm GBPm GBPm

------------- ------------ --------- ------------- ------------ ---------

Revenue 1,461.4 18.8 1,480.2 1,019.8 - 1,019.8

------------- ------------ --------- ------------- ------------ ---------

Gross Profit 474.8 (40.1) 434.7 362.3 (5.5) 356.8

Margin % 32.5% 35.5%

Amortisation of

acquired intangibles - (41.5) (41.5) - (32.4) (32.4)

Other operating

expenses (356.0) (61.3) (417.3) (254.4) (16.4) (270.8)

Operating profit

/ (loss) 118.8 (142.9) (24.1) 107.9 (54.3) 53.6

Margin % 8.1% 10.6%

Add back depreciation

& amortisation 77.2 54.9

Underlying EBITDA 196.0 162.8

Margin % 13.4% 16.0%

----------------------- ------------- ------------ --------- ------------- ------------ ---------

Preferred equity

items - (26.9) (26.9) - (33.0) (33.0)

Other finance costs (41.9) (17.7) (59.6) (34.1) 1.1 (32.9)

Profit / (loss)

before tax 76.9 (187.5) (110.6) 73.8 (86.3) (12.4)

------------- ------------ --------- ------------- ------------ ---------

Profit / (loss)

after tax 59.6 (151.4) (91.8) 55.7 (68.1) (12.4)

------------- ------------ --------- ------------- ------------ ---------

EPS basic 51.47p (79.35p) 47.62p (10.61p)

EPS diluted 39.06p (79.35p) 40.21p (10.61p)

Group EBITDA margin bridge

FY22 16.0%

Acquisition mix effect -2.8%

------

Organic impact +0.2%

------

FY23 13.4%

------

Victoria acquired three companies during the year. The largest

acquisition, the rugs and UK broadloom businesses of Balta,

completed at the start of the year. On 6(th) June we acquired

Ragolle, a rugs business in Belgium to complement Balta and on

17(th) October we acquired IWT, a ceramics distribution business in

Florida. Management has been focused on integrating these

businesses and those acquired in recent years to maximise the

synergies identified when the businesses were purchased.

As has been noted in prior years acquisitions tend to have lower

initial EBITDA margins at the point of acquisition and this is the

key driver of the margin decline in the year. This was partly

offset by an increase in organic margin despite operating in

challenging conditions.

The Group incurred GBP85.4 million of exceptional operating

costs during the year, primarily relating to the reorganisation of

the Balta which we planned as part of the acquisition, along with

other income and costs associated with acquisitions including the

write down of certain assets and negative goodwill arising on

acquisition. Whilst the charge for the restructuring was recognised

in FY23 the majority of the cash will be spent in FY24 and FY25. In

addition, the Group incurred GBP41.5 million of amortisation of

acquired intangibles (primarily customer relationships and brand

names) and GBP16.0 million of other non-underlying costs (primarily

the accounting impact of acquisition earn-outs, acquired balance

sheet fair value adjustments and hyperinflation accounting).

Further details are provided later in this Financial Review.

LIKE-FOR-LIKE PERFORMANCE

As with previous financial years, it is necessary to analyse the

underlying organic performance of each division of the Group

separately from the impact of acquisitions, both in terms of

revenue growth and margin trends.

Basis of analysis

In general, we undertake this assessment by (i) removing from

the current-year data the contribution from acquisitions made

during the year, and (ii) adding into the prior-year data

pre-acquisition financial performance (from target company records

and due diligence) for acquisitions made during that year in order

to include a full-year effect.

All of these adjustments have the impact of reducing the

calculated year-on-year growth - stripping out the acquisition

impact and showing like-for-like growth only - and presenting a

'normalised' profit margin for both the current and the prior year,

from which the organic movement (as opposed to acquisition mix

effect) can be determined. As part of this analysis, we also

normalise for translational currency differences between the two

years, and any differences in period length (note that the current

and prior reported financial years were both 52 weeks in

length).

LFL revenue performance

Growth

------------------------------ -------

UK & Europe Soft Flooring

revenue -4.7%

UK & Europe Ceramics revenue +12.4%

Australia revenue +6.8%

North America revenue -4.4%

------------------------------ -------

Group revenue 2.8%

------------------------------ -------

Victoria continued to show organic revenue growth despite

challenging economic conditions in the second half of the year

which impacted all of our markets. Our UK & Europe Ceramics and

Australia divisions continued to show strong organic revenue growth

while our UK & Europe Soft Flooring and North America divisions

were impacted by lower footfall in UK carpet retailers and

destocking in North American customers.

We saw a decline in demand in all markets in the second half the

year and the business mitigated this by maintaining prices in an

environment where raw material prices were declining.

Divisional performance

UK & Europe Soft Flooring FY23 FY22 Growth

--------------------------- ---------- ---------- ---------

Underlying Revenue GBP718.8m GBP423.1m +69.9%

--------------------------- ---------- ---------- ---------

Underlying EBITDA GBP66.9m GBP70.3m -4.8%

Margin % 9.3% 16.6% -730 bps

--------------------------- ---------- ---------- ---------

Underlying EBIT GBP27.2m GBP45.4m -40.1%

Margin % 3.8% 10.7% -695 bps

--------------------------- ---------- ---------- ---------

UK & Europe Ceramics FY23 FY22 Growth

--------------------------- ---------- ---------- ---------

Underlying Revenue GBP453.3m GBP371.6m +22.0%

--------------------------- ---------- ---------- ---------

Underlying EBITDA GBP105.8m GBP71.4m +48.2%

Margin % 23.3% 19.2% +414 bps

--------------------------- ---------- ---------- ---------

Underlying EBIT GBP77.5m GBP47.5m +63.1%

Margin % 17.1% 12.8% +431 bps

--------------------------- ---------- ---------- ---------

Australia FY23 FY22 Growth

--------------------------- ---------- ---------- ---------

Underlying Revenue GBP120.9m GBP109.5m +10.4%

--------------------------- ---------- ---------- ---------

Underlying EBITDA GBP15.3m GBP16.4m -6.4%

Margin % 12.7% 15.0% -227 bps

--------------------------- ---------- ---------- ---------

Underlying EBIT GBP10.0m GBP11.8m -15.7%

Margin % 8.3% 10.8% -255 bps

--------------------------- ---------- ---------- ---------

North America FY23 FY22 Growth

--------------------------- ---------- ---------- ---------

Underlying Revenue GBP168.4m GBP115.6m +45.7%

--------------------------- ---------- ---------- ---------

Underlying EBITDA GBP9.3m GBP6.4m +44.7%

Margin % 5.5% 5.6% -4 bps

--------------------------- ---------- ---------- ---------

Underlying EBIT GBP6.0m GBP5.2m +16.9%

Margin % 3.6% 4.5% -88 bps

--------------------------- ---------- ---------- ---------

As noted above, actions taken by management in relation to the

organic business resulted in an increase in EBITDA margin for the

Group as a whole with the biggest impact being in UK & Europe

Ceramics. This was more than offset by the acquisition mix effect -

discussed earlier. This was particularly pronounced in UK &

Europe Soft Flooring given the scale of the Balta acquisition.

The underlying EBITDA margin charts below, which bridge from the

prior-year to the current year reported margin, strip out the

impact of acquisitions to show the underlying margin trend in

each.

UK & Europe Soft Flooring EBITDA margin bridge

FY22 16.6%

Acquisition mix effect -3.9%

------

Organic impact -3.4%

------

FY23 9.3%

------

UK & Europe Ceramic Tiles EBITDA margin bridge

FY22 19.2%

Acquisition mix effect -0.1%

------

Organic impact +4.2%

------

FY23 23.3%

------

Australia EBITDA margin bridge

FY22 15.0%

Acquisition mix effect 0.0%

------

Organic impact -2.3%

------

FY23 12.7%

------

North America EBITDA margin bridge

FY22 5.6%

Acquisition mix effect +1.7%

------

Organic impact -1.7%

------

FY23 5.5%

------

ACQUISITIONS AND INTEGRATION

Using the cash that we had built up in prior years, including

the issue of additional preferred equity, we completed three

acquisitions in FY23. The most significant acquisition was the rugs

and UK broadloom business of Balta in Belgium in April 2022 for

total consideration of circa EUR114.8m million (c. GBP95.7m). When

we acquired Balta we immediately began the process of restructuring

the business and integrating it into Victoria. This work consists

of three projects:

-- The relocation of Balta's carpet manufacturing from Belgium

to Victoria's UK factories, with a net reduction of 295

employees.

-- The consolidation of the Balta rug manufacturing operation

onto Victoria's large site at Sint-Baafs Vijve, Belgium, together

with the relocation of some production to Usak, Turkey, where the

Group has two very modern rug-making and yarn extrusion factories .

These changes will improve efficiency and lower production costs,

with the same output possible with 220 fewer employees.

-- The sale of non-core assets acquired with the Balta

transaction where the opportunity for synergies with the Group's

existing businesses are minimal.

The second acquisition, in June 2022, was of a rugs business

based in Belgium, Ragolle, for total consideration of circa EUR21.4

million (c. GBP18.2m). This business is highly complementary to

Balta's rugs business.

The third acquisition, in October 2022, was of a ceramic

distributor IWT, based in Florida in the US for total consideration

of circa $22.8 million (c. GBP20.4m). This adds to the Group's US

footprint, along with Cali which we acquired in FY22 and the rugs

business of Balta, with revenues over $400 million.

We also continued to integrate the businesses we acquired in

FY22 with projects in Graniser and Cali Flooring.

-- Graniser has integrated production into Victoria's Spanish

and Italian factories increasing spare production capacity to 38%

with 292 fewer FTE's and made investments in new printers &

packaging lines to allow more higher-margin exports.

-- Cali Flooring has been given access to Victoria's supply

chain lowering COGS and integrated into Victoria's US logistics

platform, improving delivery times and reducing costs.

Further details of these acquisitions are provided in Note 8 to

the Accounts.

FINANCING

Debt financing and facilities

Victoria has attractively priced, long dated facilities and

liquidity headroom in excess of GBP250m.

The Group's senior debt comprises EUR500 million (c. GBP440m) of

notes with a fixed coupon of 3.625% and maturity of August 2026,

and EUR250 million (c. GBP220m) of notes with a fixed coupon of

3.75% and maturity of March 2028 along with a GBP150m Revolving

Credit Facility which matures in 2026. The Revolving Credit

Facility was increased from GBP120m to GBP150m to provide

additional liquidity headroom after the acquisition of Balta.

Other debt facilities in the Group represent small, local

working capital facilities at the subsidiary level, which are

renewed or amended as appropriate from time to time. The total

outstanding amount drawn from these facilities at the year-end was

GBP32 million, as shown below in the Net Debt section of this

Financial Review.

Preferred equity

There have been no changes to the preferred equity arrangements

in the year. In FY22, in order to comply with the Board's own

financial policy and internal leverage limits, the acquisition of

Balta was partially funded by the issue of additional preferred

equity to Koch Equity Development in January 2022. Additional

preferred shares totalling GBP150 million were issued, bringing the

total in issue to GBP225 million (plus those issued for the

'Payment In Kind' of the fixed coupon, whereby new preferred shares

are issued as opposed to cash payment, at the Group's option).

Further details of the preferred equity and their accounting

treatment are provided in Note 6 to the Accounts.

EXCEPTIONAL AND NON-UNDERLYING ITEMS

This section of the Financial Review runs through all of items

classified as exceptional or non-underlying in the financial

statements. The nature of these items is, in many cases, the same

as the prior year as the financial policy around these items has