United Utilities Grp Interim Management Statement

January 30 2014 - 2:00AM

UK Regulatory

TIDMUU.

United Utilities Group PLC

30 January 2014

UNITED UTILITIES INTERIM MANAGEMENT STATEMENT

United Utilities today issues an interim management statement covering the

period from 1 October 2013.

Trading update

Current trading is in line with the group's expectations. Customer service is

continuing to improve, as measured by Ofwat's service incentive mechanism,

underpinned by good operational and environmental performance. We continue to

narrow the gap to sector leading performance. Revenue has increased, reflecting

the regulated price change for 2013/14. This revenue increase is only partly

offset by higher depreciation and other operating costs, as the company

continues to tightly manage its cost base.

United Utilities continues to make good progress on its regulatory capital

investment programme and remains on track to invest at least GBP800 million in

its asset base in 2013/14, delivering benefits for customers, the environment

and the regional economy. We intend to undertake transitional investment in

2014/15 to de-risk key projects due to be delivered in the next regulatory

period. In light of this, expenditure on our 2014/15 capital investment

programme, including spend relating to private sewers, is expected to be

similar to 2013/14.

Financial position

United Utilities' financial position remains robust and its regulatory capital

asset base continues to grow, reflecting high levels of capital investment and

the impact of RPI inflation. Group net debt is slightly higher compared with

the position at 30 September 2013. This principally reflects expenditure on the

regulatory capital investment programme and payments in relation to interest

and taxation, largely offset by operational cash flows and fair value gains on

the group's debt and derivative instruments. Gearing remains stable and

comfortably within Ofwat's assumed range (55% to 65% net debt to regulatory

capital value), supporting a solid A3 credit rating for United Utilities Water.

The group now has headroom to cover its projected financing needs into 2016,

following the recent agreement of a GBP500 million term loan with the European

Investment Bank to support the delivery of our capital investment programme.

The loan, which can be taken in either fixed or floating interest rate form,

will have an average maturity of 10 years and is expected to be drawn down via

a number of tranches within the next 12 months.

Regulatory developments

On 2 December 2013, we submitted a business plan to Ofwat covering the 2015-20

period. The plan would allow our customers to benefit from below inflation

changes to average household bills for the decade to 2020, coupled with

substantial capital investment to maintain and improve services, as well as

providing significant benefits to the environment and the local economy.

Development of the plan included extensive research, involving around 27,000

customers and other stakeholders.

On 19 December 2013, Ofwat published a revised price review process and

timetable. As part of this process, on 27 January 2014, Ofwat published risk

and reward guidance for the industry. This included guidance on certain

financial parameters for the 2015-20 period, which we are currently reviewing.

Board changes

Mark Clare was appointed as a non-executive director of both United Utilities

Group PLC and United Utilities Water PLC with effect from 1 November 2013 and

is a member of the Audit Committee and the Nomination Committee. Mark is Group

Chief Executive at Barratt Developments PLC, a position that he has held since

2006.

Outlook

United Utilities is confident of delivering a good underlying financial

performance for the year ending 31 March 2014 and is ahead of schedule in

meeting its 2010-15 regulatory outperformance targets. We are encouraged by our

operational and customer service performance improvements and believe we can

improve further. We will continue to actively engage with our regulators, ahead

of the draft and final determinations from Ofwat later this year.

In line with its usual practice, United Utilities intends to issue a pre-close

trading update on 20 March 2014.

United Utilities contacts:

Gaynor Kenyon, Corporate Affairs Director +44 (0) 7753 622282

Darren Jameson, Head of Investor Relations +44 (0) 7733 127707

Martin Pengelley / Michelle Clarke, Tulchan +44 (0) 20 7353 4200

Communications

This announcement is also available at: http://corporate.unitedutilities.com/

investors.aspx

END

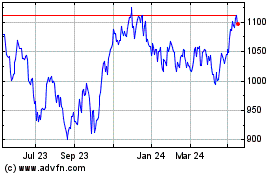

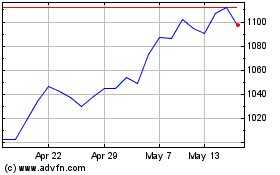

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2024 to Aug 2024

United Utilities (LSE:UU.)

Historical Stock Chart

From Aug 2023 to Aug 2024