United Utilities Grp Interim Management Statement and AGM

July 26 2013 - 2:00AM

UK Regulatory

TIDMUU.

United Utilities Group PLC

26 July 2013

UNITED UTILITIES GROUP PLC 2013 ANNUAL GENERAL MEETING

AND INTERIM MANAGEMENT STATEMENT

United Utilities issues an interim management statement, for the period 1 April

2013 to 25 July 2013, ahead of its annual general meeting to be held today at

The Midland Hotel, Peter Street, Manchester.

Trading update

Current trading is in line with the group's expectations. Revenue is higher,

reflecting the regulated price increase for 2013/14. However, as expected, this

increase is slightly below the allowed regulated price rise, principally

reflecting the continuing impact of a tough economic climate on commercial

volumes. The increase in revenue is partly offset by higher depreciation and

other operating costs, as expected.

As planned, capital investment has continued at high levels as United Utilities

invests to maintain and improve services for customers and deliver further

environmental benefits, as well as providing a positive contribution to the

regional economy. Regulatory capital investment for 2013/14, including

infrastructure renewals expenditure, is expected to be around GBP800 million.

We continue to deliver improvements in customer service, underpinned by good

operational performance. The ten water and sewerage companies have now

published their 2012/13 Ofwat key performance indicator reports and we are

pleased to report an above average performance across this range of operational

metrics. In addition, the ten companies have recently published their overall

service incentive mechanism (SIM) scores for 2012/13 and we were delighted to

note that United Utilities is again the most improved company over the year. We

have also made an encouraging start to the 2013/14 financial year, with our

first quarter performance on Ofwat's qualitative SIM score showing a further

improvement in customer satisfaction.

Financial position

United Utilities' financial position remains robust. Group net debt is

marginally lower, compared with the position at 31 March 2013, despite

continued high levels of capital investment. This is before payment of the

proposed 2012/13 final dividend, which is scheduled for 2 August 2013, and

totals approximately GBP156 million. Gearing remains stable and in the middle of

Ofwat's assumed range, supporting a solid A3 credit rating for United Utilities

Water PLC.

The UK Government, on 2 July 2013, substantively enacted the changes to

facilitate the staged reductions in the mainstream rate of corporation taxation

from 23% to 21%, with effect from 1 April 2014, and from 21% to 20%, with

effect from 1 April 2015. This is expected to result in a deferred taxation

credit of around GBP150 million, which will be recognised in the financial

statements for the first half of 2013/14.

Board changes

Paul Heiden will stand down at today's annual general meeting, after over seven

years as a non-executive director. Brian May, who joined the Board in September

2012, will take over Paul's position as chair of both the Audit and Risk

Committee and the Treasury Committee. Nick Salmon, who is senior independent

non-executive director, will be appointed as a member of the Audit and Risk

Committee. These appointments will become effective at the conclusion of

today's annual general meeting.

Outlook

The group expects to deliver a good underlying financial performance for 2013/

14. The business will continue with its strong focus on customer service

through sound operational performance and sees plenty of opportunities for

further improvements. The company remains well on track in delivering its

2010-15 regulatory outperformance targets. The board's dividend policy of

targeting 2% per annum growth above the rate of RPI inflation through to at

least 2015 continues to be underpinned by a robust capital structure.

In line with its usual practice, United Utilities intends to issue a pre-close

trading update on 19 September 2013.

United Utilities contacts:

Gaynor Kenyon, Corporate Affairs Director +44 (0) 7753 622282

Darren Jameson, Head of Investor Relations +44 (0) 7733 127707

Peter Hewer / Michelle Clarke, Tulchan Communications +44 (0) 20 7353 4200

This announcement is also available at:

http://corporate.unitedutilities.com/investors.aspx

END

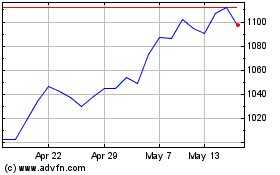

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2024 to Aug 2024

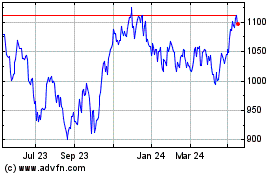

United Utilities (LSE:UU.)

Historical Stock Chart

From Aug 2023 to Aug 2024