TIDMTFW

RNS Number : 4059C

Thorpe(F.W.) PLC

11 October 2022

Results

for the year ended 30 June 2022

FW Thorpe Plc - a group of companies that de sign, manufacture

and supply professional lighting systems - is pleased to announce

its preliminary results for the year ended 30 June 2022.

Key points:

Continuing operations 2022 2021 Exc.

Zemper

Acquisition

------------------------------------------- --------- --------- ----------- ------------

Revenue GBP143.7m GBP117.9m 21.9% 9.9%

increase increase

Operating profit (before 2021 exceptional GBP24.7m GBP19.2m 28.5% 20.3%

item) increase increase

Profit before tax (before 2021 exceptional GBP24.1m GBP18.6m 29.8% 25.6%

item) increase increase

Profit before tax GBP24.1m GBP20.1m 19.7% 15.8%

increase increase

26. 5 23.1%

Basic earnings per share 17.16p 13.57p % increase increase

------------------------------------------- --------- --------- ----------- ------------

-- Total interim and final dividend of 6.15p (2021: 5.80p) - an increase of 6.0%

-- Final dividend of 4.61p (2021: 4.31p) - an increase of 7.0%

-- Strong revenue and orders growth across the majority of the Group

-- Solid operating profit growth despite challenges with

component supply and inflationary cost pressures

-- Zemper, acquired in October 2021, has been successfully integrated

-- Entered into a joint venture investment in Ratio Electric

-- Net cash generated from operating activities, despite

increasing stock levels, remained strong - GBP19.7m (2021:

GBP21.9m)

-- Solid start to 2022/23, with operating performance ahead of the start of last year

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 (MAR) as supplemented

by The Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310)

("UK MAR").

For further information please contact:

FW Thorpe Plc

Mike Allcock - Chairman, Joint Chief Executive 01527 583200

Craig Muncaster - Joint Chief Executive, Group

Financial Director 01527 583200

Singer Capital Markets - Nominated Adviser

Steve Pearce /James Moat 020 7496 3000

Chairman's statement

Another year has passed without a return to a more stable

business climate, and with one crisis being replaced by another.

Nevertheless, I am again pleased to report that the Group has

increased its revenue and profitability (before and after the

effects of its acquisition of Zemper).

This positive performance is especially admirable considering

most companies in the Group suffered severe component shortages

throughout the financial year, hampering production output and

efficiency, and softening year-end results. Most Group companies

continue to face supply shortages, particularly for electronic

components and microchips, whilst having substantial order

books.

Component scarcities have inevitably affected the Group's

enviably high levels of customer service, but I hope the situation

is at last improving. In addition, of course, the Group is also

contending with significant cost inflation of materials, wages and

utilities.

The Annual Report and Accounts contains a more detailed

appraisal of each company's individual achievements and

challenges.

Group Results

Revenue increased by 22% to GBP144m, or by 10% excluding revenue

associated with the acquisition of Zemper. Operating profit

increased by 29% to GBP25m, or by 20% on a like-for-like basis

excluding the addition from Zemper and last year's exceptional

item. A 17% operating profit return on revenue is a good

achievement, under the circumstances, but the Board thinks that

improvements can be made, and all businesses are targeted to

improve.

A high proportion of growth within the Group is again

attributable to Thorlux Lighting in the UK and Famostar in the

Netherlands.

There was a notable downturn at TRT Lighting due to the lack of

a sizeable one-off project during the year and some factory

efficiency issues. TRT's order book has now returned to a good

level. A new operations director started at TRT in mid-August and

is addressing manufacturing performance.

Zemper made a solid start within the Group, despite facing

similar issues to other companies as referred to throughout this

report.

General Overview

All companies in the Group have significantly increased their

stock levels during the year - from a low point of GBP20m to GBP29m

on a like-for-like basis - to support their large order books as

well as to further mitigate the ongoing supply chain risk. It is

important that this stock is carefully managed to avoid overshoot

and obsolescence in coming months. Whilst stock has increased

significantly overall, it is rare for a fully populated bill of

materials to reach the assembly areas, causing the delays mentioned

and dampening Group performance as a whole.

Whilst order delivery lead times have increased dramatically,

for example at Thorlux Lighting, within the Group we are striving

to deliver on time where possible, notwithstanding the supplier

issues mentioned.

All companies have been affected by significant cost increases.

Whilst the intention has been to recover cost increases by making

selling price increases in a fair manner, some Group companies were

better than others in achieving this in a timely fashion. Within

the Group we need to be agile and react to market conditions, being

prepared to reverse price rises if the cost base changes again, as

well as driving through efficiency savings where practical.

Electrozemper S.A. (trading as Zemper) has settled nicely into

the Group. The timing of Zemper's financial reporting is now

aligned with that of the Group; consequently, only nine months of

its figures are included in this year's final results. The results

presented are dampened by the required acquisition accounting

adjustments. Technical teams from around the Group have embarked on

several synergy projects and some common sustainability and

circularity work. I hope this will improve productivity and enhance

margins too.

As mentioned in my interim report, in December 2021 the Group

purchased a 50% stake in Ratio Electric BV from the Netherlands - a

company that designs and manufactures electric vehicle chargers,

connecting leads and electrical wiring accessories. Figures for

Ratio are not included in the operating results of the Group, with

our share of profits included within profit before tax. Revenue

growth, as expected, has been significant, even though Ratio has

experienced component shortages like other companies. Profitability

has grown only slightly, but is in line with expectations due to

the investments required to develop the more high technology

chargers especially suited to the UK market and some of the Group's

commercial customers. Ratio now has a developing UK operation with

five employees, distribution and manufacturing space, and new

ranges of cloud-connected chargers which are targeted to be ready

in late autumn this year. These are exciting times for all

concerned.

FW Thorpe has successfully adapted to rapid changes in its

market in recent years, including the wholesale change to LED

technology, and now the change to wireless-enabled high technology

solutions that provide not only energy savings but many other

benefits such as energy and status reporting and data collection.

The Thorlux SmartScan system, for example, continues to mature and,

in my opinion, is the leading solution for the UK market and

beyond. The first-generation system was launched in 2016, and in

2019 won a Queen's Award for Enterprise in the Innovation category.

Generation 2 is now available, following successful site trials

over the last 12 months. The most recent system offers a raft of

new features to keep it ahead of the competition, and provides

customers with freedom to manage and communicate with their lights

in a much faster, more complete and even more robust way. The new

generation SmartScan system was developed in collaboration with

Thorlux's biggest customer and resulted in Thorlux winning the

lighting contract for one of the largest factories in Europe, in

central Germany. The majority of the software is developed in house

with Thorlux's own engineers and, as such, is now exclusively in

use in most Group companies.

The next challenge for FW Thorpe, which is certainly topical in

its industry, is the global one of sustainability. To that end,

within the Group we have a good head start, having commenced our

programme in 2010. In order to remain in a prime position, FW

Thorpe needs to continue to invest in greener solutions for its

factories, better sourcing and control of components, more

circularity to designs, and more energy efficient product

solutions. Apart from the well-publicised ongoing tree planting

projects, FW Thorpe will continue to roll out solar solutions for

its numerous factory roofs. Through good foresight and, probably,

fortunate timing, last year, before the energy crisis and

availability issues, FW Thorpe bought a further 3,000 large 2.094

by 1.038 metre PV panels at a cost of around GBP0.9m to cover the

roof of the main Thorlux facility in Redditch. These are in a

warehouse on standby for fitment. Prior to being able to mount them

to the 30-year-old roof, significant enabling works are being

completed - at a further cost of

GBP0.7m. At the time of writing, with such enormous rising

electrical costs, it is hoped that the panels will be commissioned

soon - hopefully they will be online around the time of this year's

AGM in November.

Efforts continue within the Group to improve companies'

sustainability credentials and move sooner towards Net Zero -

which, apart from being the right thing to do, will bring

commercial advantages. Initial third-party support and assessment

is now complete. I hope to be able to share the estimated CO(2) e

(total carbon footprint) number for the Group as a whole when the

Group is more certain of its direction. It has taken months of work

to collect and collate accounts for emissions from all Group

activities in scope 1, 2 and 3; the estimated CO(2) e number not

only includes emissions due to the Group's sales, manufacturing and

distribution activities, but also the emissions from the Group

going about its normal business - for example, including emissions

from the supply chain and from downstream use of products by

customers and the electrical energy the luminaires consume. To be

able to say the Group is Net Zero seems a distant dream, but every

watt saved in Group factories and saved by making its lights more

efficient is another watt that does not have to be reduced and

offset.

Apart from electrical energy consumption, sustainability

involves many other factors such as material selection, reduction,

re-use and recycling. Within the Group, all employees are involved:

they are being trained and developed, and receive a frequent

chairman's sustainability newsletter, with contributions from

around the Group; some employees have even been awarded with a 'Net

Zero Hero' tee shirt for special achievements. Many of the

efficiency gains in Group factories and at product level reduce

costs, make Group companies more successful at winning orders, and

improve the Group's reputation. For example, Thorlux was awarded

Manufacturer of the Year at the prestigious Lux Awards in 2020,

with specific mention of its tree planting and solar PV works in

the judges' comments.

Acquisition

I mentioned above that, following significant design and

engineering effort, the Group won a major German factory lighting

project, involving around 10,000 luminaires on the Thorlux

SmartScan generation 2 platform. The German customer for this

project, SchahlLED Lighting GmbH, has rapidly become the Group's

largest customer over the last 3 years or so. SchahlLED's

independent majority shareholder approached FW Thorpe to discuss

the sale of its shares; it was natural for FW Thorpe to have a keen

interest, as well as for SchahlLED's management to want to continue

to build on the trading relationship of the last few years.

Although members of the Board of FW Thorpe had planned for a few

years to be quieter on the acquisition front, we approached this

situation in both a defensive capacity to protect existing work,

but also in an opportunistic way, as we see good growth potential

in SchahlLED's business model of focusing on energy saving payback

projects, and think they could be adopted in some other

territories. So, I am pleased to announce that on 26 September

2022, FW Thorpe acquired an 80% shareholding in SchahlLED GmbH,

with the remaining shares to be acquired subject to performance

conditions over the next 3 years. FW Thorpe paid an initial

consideration from cash reserves, with the remaining shares

available in due course with certain earn-out conditions.

Last year, SchahlLED's revenue, which has grown rapidly in

recent years, was EUR15.9m, with an EBITDA of EUR2.8m. The company

has solid growth plans and will continue to focus on selling high

technology wireless lighting systems, in future supplied almost

exclusively by the Group.

Personnel

I would like to thank all Group employees for their dedication

and commitment throughout the financial year. All areas of the

business have been under significant pressure from dealing with the

current economic climate, including issues related to sourcing

difficulties and manufacturing capacity. Engineering teams have

faced the constant pressure of re-designs to accommodate

alternative components, and those facing customer service issues

have had their patience stretched. The diligence of Group employees

does not go unnoticed and is sincerely appreciated.

Dividend

Performance as a whole for the year to 30 June 2022 allows the

Board to recommend an increased final dividend of 4.61p per share

(2021: 4.31p), which gives a total for the year of 6.15p (2021:

5.80p excluding special dividend).

Outlook

The dramatic rising cost of energy is a catalyst for customers

to study their lighting energy consumption and look for ways to

reduce it. In the media there is often mention of turning lights

off to reduce usage, but of course commercially, in most cases,

doing so is simply not practical and may be dangerous. The whole

Group, and especially Thorlux, is focused on designing energy

saving products; therefore, I anticipate that orders should be

resilient if a recession becomes inevitable. Customers' energy

costs have trebled in some instances, which means investment

payback periods could be one third of those a year ago.

FW Thorpe has a broad portfolio of customers; those in

government or blue-chip industries have usually found the capital

to invest in their assets when times get more difficult.

Within the Group we have taken actions to cover rising costs: we

continually strive to achieve better margins without unfairly

penalising our customers, ensuring long term retention rates. We

strive for further efficiency improvements and have the cash to

invest in energy saving and sustainability projects.

The Group has started the financial year with a robust order

book and some healthy projects on the horizon. The Group sees an

improving supply and operations picture and, as such, the Board

expects a good first half performance despite ongoing pressures on

operating costs.

Mike Allcock

Chairman and Joint Chief Executive

11 October 2022

Consolidated Results

Consolidated Income Statement

For the year ended 30 June 2022

2022 2021

Notes GBP'000 GBP'000

------------------------------------------------ ----- -------- --------

Continuing operations

Revenue 2 143,715 117,875

Cost of sales (80,440) (62,484)

------------------------------------------------ ----- -------- --------

Gross profit 63,275 55,391

------------------------------------------------ ----- -------- --------

Distribution costs (15,501) (13,598)

Administrative expenses (23,482) (22,855)

Other operating income 423 289

------------------------------------------------ ----- -------- --------

Operating profit (before exceptional item) 24,715 19,227

Exceptional item in respect of Lightronics fire - 1,566

------------------------------------------------ ----- -------- --------

Operating profit 2 24,715 20,793

Finance income 527 615

Finance expense (1,367) (1,267)

Share of profit of joint ventures 228 -

------------------------------------------------ ----- -------- --------

Profit before income tax 24,103 20,141

Income tax expense 3 (4,030) (4,329)

------------------------------------------------ ----- -------- --------

Profit for the year 20,073 15,812

------------------------------------------------ ----- -------- --------

Earnings per share from continuing operations attributable to

the equity holders of the Company during the year (expressed in

pence per share)

2022 2021

Basic and diluted earnings per share Notes pence pence

------------------------------------- ----- ------ ------

- Basic 8 17.16 13.57

- Diluted 8 17.13 13.52

------------------------------------- ----- ------ ------

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2022

2022 2021

Notes GBP'000 GBP'000

------------------------------------------------- ------ -------- --------

Profit for the year: 20,073 15,812

--------------------------------------------------------- -------- --------

Other comprehensive (expenses)/income

Items that may be reclassified to profit or loss

Exchange differences on translation of foreign

operations (268) (688)

--------------------------------------------------------- -------- --------

(268) (688)

Items that will not be reclassified to profit

or loss

Revaluation of financial assets at fair value

through other comprehensive income (57) 135

Actuarial gain on pension scheme 953 1,758

Movement on unrecognised pension scheme surplus (1,143) (1,940)

Taxation 14 (236)

--------------------------------------------------------- -------- --------

(233) (283)

-------------------------------------------------------- -------- --------

Other comprehensive expense for the year, net

of tax (501) (971)

--------------------------------------------------------- -------- --------

Total comprehensive income for the year 19,572 14,841

--------------------------------------------------------- -------- --------

Consolidated Statement of Financial Position

For the year ended 30 June 2022

2022 2021

Notes GBP'000 GBP'000

----------------------------------------------------------- ----- -------- --------

Assets

Non-current assets

Property, plant and equipment 5 33,818 28,251

Intangible assets 6 51,865 19,705

Investments in subsidiaries - -

Investment property 1,984 1,967

Financial assets at amortised cost 1,124 746

Equity accounted investments and joint arrangements 6,112 -

Financial assets at fair value through other comprehensive

income 3,470 3,764

Deferred income tax assets 120 -

----------------------------------------------------------- ----- -------- --------

Total non-current assets 98,493 54,433

----------------------------------------------------------- ----- -------- --------

Current assets

Inventories 32,758 20,389

Trade and other receivables 33,018 29,310

Financial assets at amortised cost 1,800 1,800

Short-term financial assets 7 5,079 23,603

Cash and cash equivalents 35,505 52,268

----------------------------------------------------------- ----- -------- --------

Total current assets 108,160 127,370

----------------------------------------------------------- ----- -------- --------

Total assets 206,653 181,803

----------------------------------------------------------- ----- -------- --------

Liabilities

Current liabilities

Trade and other payables (35,801) (39,198)

Financial liabilities (332) -

Lease liabilities (506) (226)

Current income tax liabilities (641) (1,040)

----------------------------------------------------------- ----- -------- --------

Total current liabilities (37,280) (40,464)

----------------------------------------------------------- ----- -------- --------

Net current assets 70,880 86,906

----------------------------------------------------------- ----- -------- --------

Non-current liabilities

Other payables (12,880) (78)

Financial liabilities (1,830) -

Lease liabilities (2,510) (435)

Provisions for liabilities and charges (2,536) (2,242)

Deferred income tax liabilities (4,264) (1,591)

----------------------------------------------------------- ----- -------- --------

Total non-current liabilities (24,020) (4,346)

----------------------------------------------------------- ----- -------- --------

Total liabilities (61,300) (44,810)

----------------------------------------------------------- ----- -------- --------

Net assets 145,353 136,993

----------------------------------------------------------- ----- -------- --------

Equity

Share capital 1,189 1,189

Share premium account 2,827 1,960

Capital redemption reserve 137 137

Foreign currency translation reserve 1,808 2,076

Retained earnings

----------------------------------------------------------- ----- -------- --------

At 1 July 131,631 122,686

Profit for the year attributable to the owners 20,073 15,812

Other changes in retained earnings (12,312) (6,867)

----------------------------------------------------------- ----- -------- --------

139,392 131,631

----------------------------------------------------------- ----- -------- --------

Total equity 145,353 136,993

----------------------------------------------------------- ----- -------- --------

Consolidated Statement of Changes in Equity.

For the year ended 30 June 2022

Foreign

Share Capital currency

Share premium redemption translation Retained Total

capital account reserve reserve earnings equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 1 July 2020 1,189 1,526 137 2,764 122,686 128,302

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year to 30 June

2021 - - - - 15,812 15,812

Actuarial gain on pension scheme - - - - 1,758 1,758

Movement on unrecognised pension

scheme surplus - - - - (1,940) (1,940)

Revaluation of financial assets

at fair value through other

comprehensive income - - - - 135 135

Movement on associated deferred

tax - - - - (59) (59)

Impact of deferred tax rate

change - - - - (177) (177)

Exchange differences on translation

of foreign operations - - - (688) - (688)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive income - - - (688) 15,529 14,841

Transactions with owners

Shares issued from exercised

options - 434 - - - 434

Dividends paid to shareholders 4 - - - - (6,631) (6,631)

Share based payment charge - - - - 47 47

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total transactions with owners - 434 - - (6,584) (6,150)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June 2021 1,189 1,960 137 2,076 131,631 136,993

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year to 30 June

2022 - - - - 20,073 20,073

Actuarial gain on pension scheme - - - - 953 953

Movement on unrecognised pension

scheme surplus - - - - (1,143) (1,143)

Revaluation of financial assets

at fair value through other

comprehensive income - - - - (57) (57)

Movement on associated deferred

tax - - - - 14 14

Exchange differences on translation

of foreign operations - - - (268) - (268)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive income - - - (268) 19,840 19,572

Transactions with owners

Shares issued from exercised

options - 867 - - - 867

Dividends paid to shareholders 4 - - - - (12,079) (12,079)

Share based payment charge - - - - - -

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Total transactions with owners - 867 - - (12,079) (11,212)

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June 2022 1,189 2,827 137 1,808 139,392 145,353

------------------------------------ ----- -------- -------- ----------- ------------ --------- --------

Consolidated Statement of Cash Flows

For the year ended 30 June 2022

2022 2021

Notes GBP'000 GBP'000

----------------------------------------- ----- -------- --------

Cash flows from operating activities

Cash generated from operations 9 24,789 25,726

Tax paid (5,049) (3,853)

----------------------------------------- ----- -------- --------

Net cash generated from operating

activities 19,740 21,873

----------------------------------------- ----- -------- --------

Cash flows from investing activities

Purchases of property, plant and

equipment (5,510) (2,932)

Proceeds from sale of property, plant

and equipment 423 290

Purchase of intangibles (2,366) (1,756)

Purchase of subsidiaries (net of

cash acquired) (14,625) -

Purchase of depositary receipts of

shares in subsidiaries (15,219) -

Purchase of investment property (36) -

Net sale of financial assets at fair

value through Other Comprehensive

Income 268 205

Investment in joint venture (4,958) -

Insurance proceeds re: property,

plant and equipment lost in fire - 3,057

Property rental and similar income 113 41

Dividend income 246 186

Net withdrawal/(deposit) of short-term

financial assets 18,524 (5,023)

Interest received 218 105

Net (issue)/receipt of loan notes (806) 59

----------------------------------------- ----- -------- --------

Net cash (used in)/received from

investing activities (23,728) (5,768)

----------------------------------------- ----- -------- --------

Cash flows from financing activities

Net proceeds from the issuance of

ordinary shares 867 434

Proceeds from loans 236 365

Repayment of borrowings (1,271) (958)

Payment of lease liabilities (535) (310)

Payment of lease interest (139) (39)

Dividends paid to Company's shareholders 4 (12,079) (6,631)

----------------------------------------- ----- -------- --------

Net cash used in financing activities (12,921) (7,139)

----------------------------------------- ----- -------- --------

Effects of exchange rate changes

on cash 146 (1,120)

----------------------------------------- ----- -------- --------

Net increase in cash in the year (16,763) 7,846

Cash and cash equivalents at beginning

of year 52,268 44,422

----------------------------------------- ----- -------- --------

Cash and cash equivalents at end

of year 35,505 52,268

----------------------------------------- ----- -------- --------

Notes

1 Basis of preparation

The consolidated and company financial statements of FW Thorpe

Plc have been prepared in accordance with UK adopted International

Accounting Standards and with the requirements of the Companies Act

2006 as applicable to companies reporting under those standards,

with future changes being subject to endorsement by the UK

Endorsement Board.

The financial statements have been prepared on a going concern

basis, under the historical cost convention except for the

financial instruments measured at fair value either through other

comprehensive income or profit and loss per the provisions of IFRS

9 and contingent consideration that is measured at fair value.

There are no other standards that are not yet effective that are

expected to have a material impact on the Group in the current or

future reporting periods and on foreseeable future

transactions.

The consolidated financial statements are presented in Pounds

Sterling, which is the Company's functional and presentation

currency, rounded to the nearest thousand.

The preparation of financial information in conformity with the

basis of preparation described above requires the use of certain

critical accounting estimates. It also requires management to

exercise its judgement in the process of applying the Company's and

Group's accounting policies. The areas involving a higher degree of

judgement or complexity, or areas where assumptions and estimates

are significant to the consolidated financial information, are

disclosed in the critical accounting estimates and judgements

section.

The Company has elected to take the exemption under section 408

of the Companies Act 2006 from presenting the Company income

statement.

The directors confirm they are satisfied that the Group and

Company have adequate resources, with GBP35.5m cash and GBP5.1m

short term deposits, to continue in business for the foreseeable

future, including the effect of increased costs caused by the

Ukraine and Russia conflict, where the Group has no sales, and

other global events. They have also produced a severe, but

plausible downside scenario that demonstrates that the Group could

cover its cash commitments over the following year from approving

these accounts. For this reason, they continue to adopt the going

concern basis in preparing the accounts.

The financial information set out in this document does not

constitute the statutory financial statements of the Group for the

year end 30 June 2022 but is derived from the Annual Report and

Accounts 2022. The auditors have reported on the annual financial

statements and issued an unqualified opinion.

2 Segmental Analysis

(a) Business segments

The segmental analysis is presented on the same basis as that

used for internal reporting purposes. For internal reporting FW

Thorpe is organised into eleven operating segments based on the

products and customer base in the lighting market - the largest

business is Thorlux, which manufactures professional lighting

systems for industrial, commercial and controls markets. The

businesses in the Netherlands, Lightronics and Famostar, are

material subsidiaries and disclosed separately as Netherlands

companies. The businesses in the Zemper Group are also material and

disclosed separately as the Zemper Group.

The seven remaining operating segments have been aggregated into

the "other companies" reportable segment based upon their size,

comprising the entities Philip Payne Limited, Solite Europe

Limited, Portland Lighting Limited, TRT Lighting Limited, Thorlux

Lighting L.L.C., Thorlux Australasia Pty Limited and Thorlux

Lighting GmbH.

FW Thorpe's chief operating decision-maker (CODM) is the Group

Board. The Group Board reviews the Group's internal reporting in

order to monitor and assess performance of the operating segments

for the purpose of making decisions about resources to be

allocated. Performance is evaluated based on a combination of

revenue and operating profit. Assets and liabilities have not been

segmented, which is consistent with the Group's internal

reporting.

Inter- Total

Netherlands Zemper Other segment continuing

Thorlux companies Group companies adjustments operations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Year to 30 June 2022

Revenue to external customers 78,912 34,676 14,152 15,975 - 143,715

Revenue to other group

companies 5,171 377 - 5,794 (11,342) -

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Total revenue 84,083 35,053 14,152 21,769 (11,342) 143,715

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Depreciation and amortisation 3,378 1,043 1,525 1,045 - 6,991

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Operating profit 13,509 7,471 1,582 1,647 506 24,715

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Net finance expense (840)

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Share of profit of joint

ventures 228

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Profit before income

tax 24,103

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Year to 30 June 2021

Revenue to external customers 69,969 31,490 - 16,416 - 117,875

Revenue to other group

companies 3,304 290 - 5,238 (8,832) -

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Total revenue 73,273 31,780 - 21,654 (8,832) 117,875

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Depreciation and amortisation 3,509 1,182 - 973 - 5,664

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Operating profit (before

exceptional item) 11,694 5,402 - 1,722 409 19,227

Exceptional item in respect

of Lightronics fire - 1,566 - - - 1,566

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Operating profit 11,694 6,968 - 1,722 409 20,793

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Net finance expense (652)

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Profit before income

tax 20,141

------------------------------ -------- ----------- -------- ---------- ------------ -----------

Inter segment adjustments to operating profit consist of

property rentals on premises owned by FW Thorpe Plc, adjustments to

profit related to stocks held within the Group that were supplied

by another segment and elimination of profit on transfer of assets

between Group companies.

(b) Geographical analysis

The Group's business segments operate in four main areas, the

UK, the Netherlands, the rest of Europe and the rest of the World.

The home country of the Company, which is also the main operating

company, is the UK.

2022 2021

GBP'000 GBP'000

------------------ -------- --------

UK 83,242 74,363

Netherlands 30,323 28,879

Rest of Europe 27,344 12,499

Rest of the World 2,806 2,134

------------------ -------- --------

143,715 117,875

------------------ -------- --------

3 Income Tax Expense

Analysis of income tax expense in the year:

2022 2021

GBP'000 GBP'000

-------------------------------------------------- -------- ---------

Current tax

Current tax on profits for the year 4,717 4,128

Adjustments in respect of prior years (279) (564)

-------------------------------------------------- -------- ---------

Total current tax 4,438 3,564

-------------------------------------------------- -------- ---------

Deferred tax

Origination and reversal of temporary differences (408) 765

-------------------------------------------------- -------- ---------

Total deferred tax (408) 765

-------------------------------------------------- -------- ---------

Income tax expense 4,030 4,329

-------------------------------------------------- -------- ---------

The tax assessed for the year is lower (2021: higher) than the

standard rate of corporation tax in the UK of 19.00% (2021:

19.00%). The differences are explained below:

2022 2021

GBP'000 GBP'000

--------------------------------------------------------- -------- --------

Profit before income tax 24,103 20,141

--------------------------------------------------------- -------- --------

Profit on ordinary activities multiplied by the standard

rate in the UK of 19% (2021: 19%) 4,580 3,827

Effects of:

Expenses not deductible for tax purposes 329 1,077

Accelerated tax allowances and other timing differences (348) 238

Adjustments in respect of prior years (279) (564)

Patent box relief (812) (686)

Foreign profit taxed at higher rate 560 437

--------------------------------------------------------- -------- --------

Tax charge 4,030 4,329

--------------------------------------------------------- -------- --------

The effective tax rate was 16.72% (2021: 21.49%). Adjustments in

respect of prior years' relate to refunds received for prudent

assumptions on additional investment allowances and patent box

relief in the tax calculations.

The UK corporation tax rate of 19% (effective 1 April 2020) was

substantively enacted on 17 March 2020. The UK corporation tax rate

increase from 19% to 25% from 1 April 2023, was substantively

enacted in May 2021. Deferred tax assets and liabilities have been

calculated based on a rate at which they are expected to

crystalise.

In the Netherlands the rate of corporate income tax was

increased from 25% to 25.8%, this has resulted in an increase in

tax costs of GBP31,000. The recently announced intention in the UK

to reverse the decision to increase the corporation tax rate from

19% to 25% will reduce deferred tax liabilities by GBP303,000.

4 Dividends

Dividends paid during the year are outlined in the tables

below:

Dividends paid (pence per share) 2022 2021

--------------------------------- ----- ----

Final dividend 4.31 4.20

Special dividend (final) 2.20 -

Interim dividend 1.54 1.49

Special dividend (interim) 2.27 -

--------------------------------- ----- ----

Total 10.32 5.69

--------------------------------- ----- ----

A final dividend in respect of the year ended 30 June 2022 of

4.61p per share, amounting to GBP5,403,000 (2021: GBP5,028,000) is

to be proposed at the Annual General Meeting on 17 November 2022

and, if approved, will be paid on 25 November 2022 to shareholders

on the register on 28 October 2022. The ex-dividend date is 27

October 2022. These financial statements do not reflect this

dividend payable.

Dividends proposed (pence per share) 2022 2021

------------------------------------- ---- ----

Final dividend 4.61 4.31

------------------------------------- ---- ----

Special dividend - 2.20

------------------------------------- ---- ----

2022 2021

Dividends paid GBP'000 GBP'000

--------------------------- -------- --------

Final dividend 5,043 4,895

Special dividend (final) 2,574 -

Interim dividend 1,803 1,736

Special dividend (interim) 2,659 -

--------------------------- -------- --------

Total 12,079 6,631

--------------------------- -------- --------

2022 2021

Dividends proposed GBP'000 GBP'000

------------------- -------- --------

Final dividend 5,403 5,028

------------------- -------- --------

Special dividend - 2,567

------------------- -------- --------

5 Property, Plant and Equipment

Freehold Right-

land and Plant and of-use

buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ---------- ---------- -------- ----------

Cost

At 1 July 2021 22,094 27,662 895 50,651

Acquisition of subsidiary* 975 3,965 3,534 8,474

Additions 2,241 3,037 232 5,510

Disposals (1) (884) (303) (1,188)

Currency translation 45 15 (2) 58

------------------------------ ---------- ---------- -------- ----------

At 30 June 2022 25,354 33,795 4,356 63,505

------------------------------ ---------- ---------- -------- ----------

Accumulated depreciation

At 1 July 2021 4,638 17,345 417 22,400

Acquisition of subsidiary* 234 3,175 1,062 4,471

Charge for the year 600 2,703 456 3,759

Disposals - (714) (248) (962)

Currency translation 5 9 5 19

------------------------------ ---------- ---------- -------- ----------

At 30 June 2022 5,477 22,518 1,692 29,687

------------------------------ ---------- ---------- -------- ----------

Net book amount

------------------------------ ---------- ---------- -------- ----------

At 30 June 2022 19,877 11,277 2,664 33,818

------------------------------ ---------- ---------- -------- ----------

* Acquisition of subsidiary are the assets acquired from the

purchase of the Zemper companies.

Freehold Right-

land and Plant and of-use

buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ---------- ---------- -------- ----------

Cost

At 30 June 2020 23,552 26,933 856 51,341

Additions 133 2,435 364 2,932

Disposals (1,181) (1,548) (276) (3,005)

Transfers - - - -

Currency translation (410) (158) (49) (617)

------------------------------ ---------- ---------- -------- ----------

At 30 June 2021 22,094 27,662 895 50,651

------------------------------ ---------- ---------- -------- ----------

Accumulated depreciation

At 30 June 2020 4,362 15,955 450 20,767

Charge for the year 617 2,487 212 3,316

Disposals (283) (1,013) (221) (1,517)

Transfers - - - -

Currency translation (58) (84) (24) (166)

------------------------------ ---------- ---------- -------- ----------

At 30 June 2021 4,638 17,345 417 22,400

------------------------------ ---------- ---------- -------- ----------

Net book amount

------------------------------ ---------- ---------- -------- ----------

At 30 June 2021 17,456 10,317 478 28,251

------------------------------ ---------- ---------- -------- ----------

6 Intangible Assets

Development Brand Customer Fishing

Goodwill costs Technology name relationship Software Patents rights Total

Group 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Cost

At 1 July 2021 14,431 7,871 2,846 1,257 - 2,811 150 182 29,548

Acquisition

of subsidiary* 18,320 6,346 45 2,588 9,468 266 6 - 37,039

Additions - 2,096 - - - 267 3 - 2,366

Currency

translation 27 7 4 - (8) - - - 30

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 32,778 16,320 2,895 3,845 9,460 3,344 159 182 68,983

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Accumulated

amortisation

At 1 July 2021 241 4,415 2,179 1,006 - 1,852 150 - 9,843

Acquisition

of subsidiary* - 3,770 - - - 250 6 - 4,026

Charge for the

year - 1,820 308 262 465 358 - - 3,213

Currency

translation 11 4 8 5 8 - - - 36

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 252 10,009 2,495 1,273 473 2,460 156 - 17,118

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Net book amount

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2022 32,526 6,311 400 2,572 8,987 884 3 182 51,865

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

* Acquisition of subsidiary are the assets acquired from the

purchase of the Zemper companies, excluding goodwill.

Development Brand Customer Fishing

Goodwill costs Technology name relationship Software Patents rights Total

Group 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Cost

At 1 July 2020 15,116 7,357 3,000 1,323 - 2,573 150 182 29,701

Additions - 1,516 - - - 240 - - 1,756

Write-offs and

transfers - (964) - - - (5) - - (969)

Currency

translation (685) (38) (154) (66) - 3 - - (940)

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2021 14,431 7,871 2,846 1,257 - 2,811 150 182 29,548

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Accumulated

amortisation

At 1 July 2020 248 3,902 1,908 980 - 1,481 150 - 8,669

Charge for the

year - 1,508 373 74 - 373 - - 2,328

Write-offs and

transfers - (964) - - - (5) - - (969)

Currency

translation (7) (31) (102) (48) - 3 - - (185)

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2021 241 4,415 2,179 1,006 - 1,852 150 - 9,843

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

Net book amount -

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

At 30 June

2021 14,190 3,456 667 251 - 959 - 182 19,705

------------------ -------- ----------- ---------- -------- ------------- -------- -------- -------- --------

7 Short-Term Financial Assets

2022 2021

GBP'000 GBP'000

--------------------------- -------- --------

Beginning of year 23,603 18,580

Net (withdrawals)/deposits (18,524) 5,023

--------------------------- -------- --------

5,079 23,603

--------------------------- -------- --------

The short-term financial assets consist of term cash deposits in

sterling with an original term in excess of three months.

8 Earnings Per Share

Basic and diluted earnings per share for profit attributable to

equity holders of the Company

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year,

excluding ordinary shares purchased by the Company and held as

treasury shares.

Basic 2022 2021

----------------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in issue 116,953,866 116,511,580

----------------------------------------------------- ----------- -----------

Profit attributable to equity holders of the Company

(GBP'000) 20,073 15,812

----------------------------------------------------- ----------- -----------

Basic earnings per share (pence per share) total 17.16 13.57

----------------------------------------------------- ----------- -----------

Diluted 2022 2021

----------------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in issue

(diluted) 117,209,308 116,938,189

----------------------------------------------------- ----------- -----------

Profit attributable to equity holders of the Company

(GBP'000) 20,073 15,812

----------------------------------------------------- ----------- -----------

Diluted earnings per share (pence per share) total 17.13 13.52

----------------------------------------------------- ----------- -----------

9 Cash Generated from Operations

Group

------------------------------------------------------

2022 2021

Cash generated from continuing operations GBP'000 GBP'000

------------------------------------------------------ -------- --------

Profit before income tax 24,103 20,141

Depreciation charge 3,759 3,316

Depreciation of investment property 19 20

Amortisation of intangibles 3,213 2,328

Profit on disposal of property, plant and equipment (197) (115)

Exceptional item in respect of Lightronics fire - (1,566)

Insurance proceeds re inventory lost in fire - 5

Insurance proceeds re other costs - 318

Net finance expense/(income) 855 652

Retirement benefit contributions in excess of current

and past service charge (190) (182)

Share of joint venture (profit)/loss (228) -

Share based payment charge - 1,429

Research and development expenditure credit (306) (289)

Effects of exchange rate movements (520) 1,114

Changes in working capital

- Inventories (8,986) 4,878

- Trade and other receivables (603) (7,287)

- Payables and provisions 3,870 964

------------------------------------------------------ -------- --------

Cash generated from operations 24,789 25,726

------------------------------------------------------ -------- --------

10 Business Combination

In October 2021, the Group acquired 63% of the share capital of

Electrozemper S.A., an emergency lighting specialist in Spain. The

company was acquired for an initial consideration of GBP19.9m

(EUR23.1m) with a deferred consideration of GBP1.0m (EUR1.1m)

payable during 2022. There is a fixed commitment to acquire the

remaining shares, based on current best estimates, a further

GBP16.3m (EUR18.9m) could be payable which is subject to future

performance conditions. Amounts recognised in respect of this

acquisition are:

EUR'000 GBP'000

Intangible assets 17,062 14,693

Property, plant & equipment 1,783 1,531

Right of use assets 2,872 2,472

Financial assets at amortised cost 90 77

Financial assets fair value OCI 36 31

Inventories 3,879 3,341

Trade and other receivables 3,035 2,618

Cash 6,143 5,290

Trade and other payables (3,339) (2,873)

Financial liabilities (2,957) (2,546)

Lease liabilities (3,084) (2,656)

Provisions for liabilities and charges (157) (136)

Deferred tax (3,465) (2,984)

------------------------------------------- ----------- -------

Total identifiable assets 21,898 18,858

Goodwill 21,273 18,320

------------------------------------------- ----------- -------

Total purchase consideration 43,171 37,178

------------------------------------------- ----------- -------

Total purchase consideration satisfied by:

Cash 23,125 19,915

Redemption liability 13,851 11,928

Deferred consideration 1,123 967

Contingent consideration 5,072 4,368

------------------------------------------- ----------- -------

Total consideration 43,171 37,178

------------------------------------------- ----------- -------

Net cash flow arising on acquisition

Cash consideration 23,125 19,915

Less cash in subsidiary acquired (6,143) (5,290)

------------------------------------------- ----------- -------

Cash outflow on acquisition 16,982 14,625

------------------------------------------- ----------- -------

A fair value exercise has been performed; the book value of all

assets and liabilities except for raw materials and warranties are

considered to represent fair value. For raw material inventories

and provisions for warranties, reductions of EUR0.4m (GBP0.3m) and

EUR0.1m (GBP0.1m) were to reflect slow moving stock lines and

potential customer claims, respectively.

Fair value of intangible assets was assessed and determined on

the basis of the technology, brand name and customer relationships

acquired. Technology was determined using an industry typical

royalty rate over an eight years period; brand name elements were

determined using an industry typical royalty rate over a ten years

period and customer relationships were determined using an industry

typical royalty rate over a fifteen years period, all discounted to

the present day.

The goodwill relates to the on-going level of profitability of

the business model, opportunity to sell existing Group products

into the Spanish and French markets, sale of Electrozemper products

in other markets and potential sourcing benefits for the Group

companies.

For the nine months to 30 June 2022 the Electrozemper companies

contributed EUR16.7m (GBP14.2m) to Group revenue and EUR0.8m

(GBP0.8m) to Group profit before tax for the current financial

year.

If the acquisition had occurred on 1 July 2021 the consolidated

pro-forma revenue and profit before tax for the year ended 30 June

2022 would have been GBP148.0m and GBP24.6m respectively. These

amounts have been calculated using the subsidiary's results and

adjusting them for:

-- differences in accounting policies between the Group and the subsidiary; and

-- The additional depreciation and amortisation that would have

been charged, assuming that the fair value adjustments to property,

plant and equipment and intangible assets had applied from 1 July

2021, together with the consequential tax benefits.

11 Events after the Statement of Financial Position date

In September 2022, FW Thorpe acquired 80% of the share capital

of SchahlLED Lighting in Germany, a turnkey provider of intelligent

energy saving lighting products for the industrial and logistics

sector. The acquisition is expected to enhance earnings per share

in the financial year ending 30 June 2023, solidifying our business

in Germany and providing further growth opportunities. FW Thorpe

has paid an initial consideration of EUR14.6m (circa GBP12.8m) and

could pay an additional amount to be determined by SchahlLED's

EBITDA performance in the year ending 30 June 2023. The initial

consideration has been funded from the Company's existing cash

reserves, these reserves and the cash generated from SchahlLED over

the next few years will fund the purchase of the remaining share

capital in the future.

On 12 September 2022, the Group paid the second tranche of

payments for the acquisition of Electrozemper S.A. totalling

EUR6.1m (GBP5.3m).

12 Cautionary statement

Sections of this report contain forward looking statements that

are subject to risk factors including the economic and business

circumstances occurring from time to time in countries and markets

in which the Group operates. By their nature, forward looking

statements involve a number of risks, uncertainties and future

assumptions because they relate to events and/or depend on

circumstances that may or may not occur in the future and could

cause actual results and outcomes to differ materially from those

expressed in or implied by the forward looking statements. No

assurance can be given that the forward-looking statements in this

preliminary announcement will be realised. Statements about the

Chairman's expectations, beliefs, hopes, plans, intentions and

strategies are inherently subject to change, and they are based on

expectations and assumptions as to future events, circumstances and

other factors which are in some cases outside the Company's

control. Actual results could differ materially from the Company's

current expectations. It is believed that the expectations set out

in these forward looking statements are reasonable but they may be

affected by a wide range of variables which could cause actual

results or trends to differ materially, including but not limited

to, changes in risks associated with the Company's growth strategy,

fluctuations in product pricing and changes in exchange and

interest rates.

13 Annual report and accounts

The annual report and accounts will be sent to shareholders on

14 October 2022 and will be available, along with this

announcement, on the Group's website (www.fwthorpe.co.uk) from 14

October 2022. The Group will hold its AGM on 17 November 2022.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MMBPTMTMBBTT

(END) Dow Jones Newswires

October 11, 2022 02:00 ET (06:00 GMT)

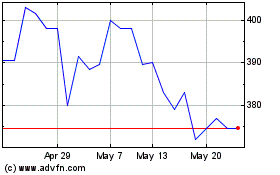

Thorpe (f.w.) (LSE:TFW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Thorpe (f.w.) (LSE:TFW)

Historical Stock Chart

From Nov 2023 to Nov 2024