TIDMSYNC

RNS Number : 0375C

Syncona Limited

13 June 2019

13 June 2019

Syncona Limited

Final Results for the Year Ended 31 March 2019

Strong performance driven by operational and financial progress

in our Life Science companies

Strong returns and NAV increase

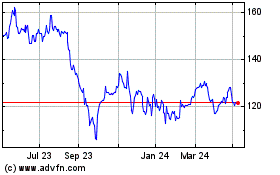

-- Net Asset Value ("NAV") of GBP1,455.1 million (2018: GBP1,055.8 million), 216.8 p per share

(2018: 158.9p per share), a total return of 37.9 per cent (2018: 18.7 per cent)

-- Life science portfolio valued at GBP1,055.4 million (2018: GBP514.5 million), a 77.9 per cent

return (2018: 57.2 per cent), primarily driven by valuation increases in Blue Earth, Autolus

and Nightstar

Operational and Clinical Highlights

-- Foundation of three highly innovative portfolio companies OMASS Therapeutics (drug discovery),

Anaveon (immuno-oncology), and Quell Therapeutics (cell therapy), in line with Syncona's strategy

to found, build and fund global leaders in healthcare

-- Ongoing progress in the clinical pipeline with eight live clinical trials at year end

- Positive data delivered in Blue Earth (Glioma), Freeline (Haemophilia B) and Autolus (AUTO3

pALL and DLBCL, AUTO1 pALL and adult ALL)

- Commenced two new clinical trials Autolus (AUTO4, T Cell Lymphoma) and Gyroscope (FOCUS

trial, Dry Age-related Macular Degeneration)

-- Merger of Gyroscope (retinal gene therapy), with Orbit Biomedical (sub-retinal surgical platform),

to create the world's first end-to-end retinal gene therapy company with clinical, delivery

and manufacturing capabilities

-- Blue Earth Diagnostics (Blue Earth) (commercial stage PET imaging agent) filed a supplemental

New Drug Application with the U.S Food and Drug Administration (FDA) for use of Axumin in

Glioma

-- Strong progress developing industrial scale throughout the portfolio, in particular by continuing

to invest in and develop key areas such as manufacturing and delivery in gene and cell therapy

Financial Highlights

-- Capital deployment into life science companies of GBP138.6 million (2018: GBP127.2 million)

-- Strategic capital pool of GBP399.7 million at year end to fund our growing Life Science portfolio

(2018: GBP541.3m)

-- Blue Earth Diagnostics continued to deliver strong performance with sales of GBP83.9 million[1]

(2018: GBP35.9 million) and EBITDA of GBP28.7 million, Syncona's 89 per cent stake is now

valued at GBP267.5 million (2018: GBP186.8 million), a gain of GBP94.9 million over the year,

including a GBP14.2 million distribution from the company

-- Nightstar (retinal gene therapy) targeting inherited forms of blindness, reached agreement

to be acquired by Biogen for $877.0 million during the year, representing a 4.5x return on

original investment for Syncona; GBP255.8 million[2] of proceeds received post year-end (2018

valuation: GBP124.5 million).

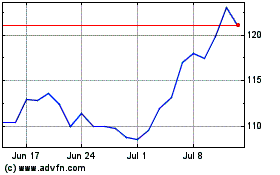

-- Autolus (CAR-T cell immunotherapy) completed a successful $172.2 million NASDAQ IPO (in which

Syncona invested $24.0 million) followed by a $109.0 million follow-on financing post period

end in which Syncona invested a further $24.0 million. Our holding increased in value by GBP225.0

million to GBP328.2 million at year end (2018: GBP85.1 million).

-- Freeline (systemic gene therapy) completed an GBP88.4 million Series B financing with an GBP85

million commitment by Syncona.

-- Annual charitable donation of GBP4.3 million - continued support for Institute of Cancer Research

and The Syncona Foundation.

Outlook - strong momentum across our companies and opportunities

to invest at scale

As we look to the year ahead we have a high level of conviction

in our companies. While clinical and regulatory development

processes involve significant risk we believe our portfolio is well

placed and we anticipate strong momentum across our pipeline of

eight clinical trials (see Table 2). Particularly important

clinical value drivers this financial year are:

-- Freeline: B-AMAZE - Haemophilia B - Phase 1/2 clinical trial ongoing

-- Autolus - AUTO 1 in paediatric ALL and adult ALL Phase 1/2; AUTO 3 in paediatric ALL and DLBCL

- Phase 1/2. Following these updates there is the potential to commence up to three Phase

2 registration studies in Autolus.

We also anticipate commencing three new trials in our companies

Blue Earth, Freeline and Achilles (see Table 3) and continued

progression in the pipeline of preclinical programmes across the

portfolio.

Additionally, we expect sales and earnings growth from Axumin in

prostate cancer from Blue Earth, and an outcome from the FDA on the

potential expansion into Glioma.

We believe there is a clear opportunity to invest at scale in

the growing healthcare sector. We have built a portfolio of 10

companies at year end in innovative areas of life science, eight of

which we founded. Our high-conviction approach means that we expect

to deploy significant further capital across the portfolio this

year.

We also see a strong pipeline of opportunities to found new

companies. Our aim is to build a portfolio of 15-20 companies and

we remain focused on areas where we are strategically positioned,

such as cell and gene therapy, but also look at opportunities more

broadly across a range of modalities and therapeutic areas.

As a result, we are increasing our guidance on annual capital

deployment to GBP100 - 200 million this year (2018 guidance:

GBP75-150 million).

Martin Murphy, CEO, Syncona Investment Management Limited, said:

"Syncona continues to perform strongly driven by significant

commercial, clinical and financial progress across our life science

companies this year. We have continued to demonstrate the benefits

of our differentiated model, in particular with ongoing positive

commercial progress in Blue Earth, and with the sale of our retinal

gene therapy company Nightstar, to Biogen, for $877 million, five

years after we founded the business.

"We enter this financial year with strong momentum across the

business, a globally differentiated cell and gene therapy platform

and a rich pipeline of opportunities to continue deploying capital

and generating returns in life science. Our companies are well

positioned as they scale and progress through the development

cycle. Our long-term, strategic capital pool underpins the

execution of our strategy to found, build and fund globally leading

companies as we aim to deliver transformational treatments to

patients and generate superior returns for shareholders."

[S]

Enquiries

Syncona Ltd

Annabel Clay / Siobhan Weaver

Tel: +44 (0) 20 3981 7940

FTI Consulting

Brett Pollard / Ben Atwell / Natalie Garland-Collins

Tel: +44 (0) 20 3727 1000

About Syncona:

Syncona is a leading FTSE250 healthcare company focused on

founding, building and funding global leaders in life science. Our

vision is to deliver transformational treatments to patients in

truly innovative areas of healthcare while generating superior

returns for shareholders.

We seek to partner with the best, brightest and most ambitious

minds in science to build globally competitive businesses. We take

a long-term view, underpinned by a deep pool of capital, and are

established leaders in gene and cell therapy. We focus on

delivering dramatic efficacy for patients in areas of high unmet

need.

Copies of this press release, a company results presentation,

and other corporate information can be found on the company website

at: www.synconaltd.com

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

Table 1: Valuation movements in year:

Company 31 Mar Net invest- Valuat- 31 Mar % NAV Valuat- Fully Focus area

2018 ment ion change 2019 ion basis diluted

Value in period (GBPm) value owner-

(GBPm) (GBPm) (GBPm) ship

stake

(%)

Life science portfolio companies

--------- ----------------

Established

Advanced

Blue Earth 186.8 (14.2) 94.9 267.5 18.4 rDCF 89 diagnostics

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Maturing

Nightstar 124.5 13.8 120.0 ***258.3 17.7 Quoted 38 Gene therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Autolus 85.1 18.1 225.0 328.2 22.6 Quoted 31 Cell therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Freeline 36.0 57.5 - 93.5 6.4 Cost 80 Gene therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Gyroscope* 19.6 9.0 0.3 28.9 2.0 Cost 81 Gene therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Developing

Achilles 6.6 9.6 - 16.2 1.1 Cost 69 Cell therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

SwanBio 4.9 - 0.4 5.3 0.4 Cost 72 Gene therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

OMASS - 3.5 - 3.5 0.2 Cost 46 Therapeutics

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Anaveon - 3.7 - 3.7 0.2 Cost 47 Immuno-oncology

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Quell - 8.3 - 8.3 0.6 Cost 69 Cell Therapy

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Open forward

currency

contracts - - (2.5) (2.5) (0.2)

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Life Science investments

CRT Pioneer Adj.

Fund 30.8 3.5 - 34.3 2.4 Third-party

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Adj.

CEGX 9.8 - (5.9) 3.9 0.3 PRI

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Endocyte 9.0 (13.9) 4.9 0.0 0.0 Quoted

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Adaptimmune 11.6 (6.7) 4.9 0.3 Quoted

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Syncona

Collaborations 1.4 - - 1.4 0.1 Cost

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

SUB-TOTAL 514.5 110.5 430.4 1,055.4 72.5

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Available

capital 550.3 - - **413.6 28.4

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Other net

liabilities (9.0) - - (13.9) (0.9)

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

Capital

pool 541.3 - - 399.7 -

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

TOTAL 1,055.8 1,455.1 100

-------- ------------ ------------ --------- ------ ------------- --------- ----------------

*Includes Orbit, following the merger of Gyroscope and Orbit

during 2019.

**Against which we have GBP121.5 million of uncalled

commitments. Refer to note 21

*** Expected proceeds as at 31 March 2019 of GBP258.3 million

with a foreign exchange loss of GBP2.5 million resulting in net

proceeds received of GBP255.8 million.

Table 2: Active clinical pipeline at year end*

Programme / Indication Status and next steps

Autolus - cell therapy / oncology

AUTO1 / Paediatric Phase 1/2 trials progressing, (assessing safety,

ALL dose and efficacy) data anticipated this financial

year

-----------------------------------------------------

AUTO1 / Adult ALL

-----------------------------------------------------

AUTO2 / Multiple

Myeloma

AUTO3 - Paediatric

ALL

AUTO3 - Adult DLBCL

AUTO4 - T cell Lymphoma

-----------------------------------------------------

Freeline

B-AMAZE - Haemophilia Phase 1/2 trial progressing (assessing safety,

B dose and efficacy, dose escalation and optimisation

phase), further data anticipated this financial

year

-----------------------------------------------------

Gyroscope

-----------------------------------------------------

FOCUS - Dry Age-Related Phase 1/2 trial progressing (assessing safety,

Macular Degeneration dose response and efficacy of two doses of

GT005). Anticipate completing first dose escalation

this financial year .

-----------------------------------------------------

*Excluding Nightstar, which has been acquired by Biogen

Table 3: Pre-clinical programmes anticipated to commence trials

in FY2020

Programme / Indication Status and next steps

Blue Earth - diagnostics

PSMA Phase 1 Expect to initiate and complete Phase 1 this

financial year

--------------------------------------------------

Freeline

Fabry's Expect to initiate Phase 1/2 trial in this

financial year

--------------------------------------------------

Achilles

--------------------------------------------------

Non-small cell lung Expect to initiate Phase 1/2 trial this financial

cancer year

--------------------------------------------------

Chairman's Foreword

I am delighted to report another year of strong growth and

significant progress. NAV increased to GBP1,455.1 million, or

216.8p per share[3], a 37.9 per cent total return for the 12

months. Performance was driven by the significant commercial and

financial progress of our life sciences companies, in particular

Biogen's recommended cash offer of $877.0 million for Nightstar in

March 2019.

We made significant strategic progress in 2019. At year end we

have 10 companies and a range of life science investments with a

combined holding value of GBP1,055.4 million, or 72.5 per cent of

net assets, and a capital pool of GBP399.7 million. Successful life

science companies scale rapidly and access to a strategic capital

pool allows the team to form a long-term view and take strategic

ownership stakes when founding and building our companies.

Well positioned to deliver superior returns

We have a differentiated model and a high conviction portfolio

of life science companies deeply enriched in advanced therapies,

and in particular cell and gene therapy.

Our life science companies continue to drive significant returns

for shareholders, building on the strong momentum of the last few

years. While the future is not without risk, we have an expert

multi-disciplinary team, a high-quality portfolio of life science

companies and a strategic pool of capital, which enables us to

drive strategy and execution across our portfolio.

Our long-term approach and strategy of founding, building and

funding businesses around exceptional science positions us well to

continue to deliver strong returns for shareholders.

Dividend and charitable donation

The Board has declared a final dividend of 2.3p per share (2018:

2.3p per share) for the year. We announced last year that the Board

would be reviewing the Company's dividend policy. Syncona's

investment objective is to achieve superior long-term capital

appreciation by founding, building and funding global leaders in

healthcare. Our companies are fast-growing and capital-intensive

and therefore moving forward the Directors believe it is no longer

appropriate for Syncona to pay a dividend.

Our charitable donations are an important part of what we do.

This year we are donating GBP4.3 million to support charities in

the field of healthcare, in particular cancer, and beyond, taking

total charitable donations since the Company was established in

2012 to GBP27.1 million. This funding is an important source of

income for the charities we support, and we are pleased to have

been able to assist them to continue the important work that they

do. We look forward to continuing to maintaining a charitable

donation in the years to come.

Continued Board evolution

It is important that the Board continues to evolve with our

strategy of building global leaders in life science. I have been

Chairman of the Company since its establishment in 2012 and plan to

step down from the Board later this financial year and I am

delighted Melanie Gee has joined the Board as a non-executive

director and Chair-designate. Melanie has a wealth of expertise

built from 30 years in investment banking and is an experienced

board member, serving on the boards of both FTSE 100 and 250

companies. Melanie is a fantastic addition and I welcome her to the

Board.

Jeremy Tigue, Chairman

13 June 2019

CEO Review

2019 was a year of significant progress for Syncona,

demonstrating that our model is working. We delivered financial and

operational milestones across the portfolio, encouraging early

clinical data in our key cell and gene therapy programmes, and

continued positive sales and earnings growth in our established

company, Blue Earth.

Our strategy in action

This year has seen us make continued progress towards achieving

what we set out to do at the foundation of Syncona - to deliver

transformational treatments for patients by founding leading

companies in exceptional areas of life science, building them for

global success and funding them over the long term. We focus on

technologies with the potential to deliver dramatic efficacy for

patients and support our companies with a strategic pool of capital

allocated with discipline against the best opportunities.

In line with this goal, in 2019 we:

-- Delivered positive sales growth and profitability growth from our established company Blue

Earth, demonstrating the commercial value of products which have a positive impact on patients'

lives

-- Delivered encouraging data in key clinical trials across our cell and gene therapy companies

Autolus, Nightstar and Freeline

-- Merged our companies Gyroscope and Orbit Biomedical to create the first end-to-end retinal

gene therapy company with clinical, delivery and manufacturing capabilities globally

-- Founded three new Syncona portfolio companies backing global academic leaders in areas of

high-innovation science

Validation of our model

The developments in Nightstar this year demonstrate the benefits

of our model. After founding the business in 2014, backing an

academic programme at Oxford University, Syncona spent five years

working in partnership with academic founder Robert MacLaren,

building the business and putting in place the strategy and team to

create a leading retinal gene therapy company. Over this time,

Nightstar delivered positive proof of concept studies across two

indications, built a strong clinical pipeline and commenced a

pivotal trial in Choroideremia. Syncona provided GBP56.4 million of

investment from Series A to post-IPO and remained a significant 38

per cent shareholder in the business when Nightstar agreed to be

acquired by Biogen for $877.0 million. The offer for Nightstar

represents a 4.5x multiple on original invested capital.

Our flexible, long-term ownership model ensures we have control

and flexibility over the management of our portfolio and we seek

never to be a forced seller. In this context, we were free to weigh

up the optimal outcome for Syncona. We are focused on risk-adjusted

returns for our shareholders and at the point of any portfolio or

investment decision we take into account the opportunity available

to the business, the market context, the level of scientific or

clinical risk, the level of funding required to take full advantage

of the opportunity and the potential return that could be delivered

today and in the future. It is our strategic capital pool that

allows us to take the best decisions for our companies and our

shareholders.

'Third Wave' gains momentum, Syncona is a strategic owner in

this space

The Third Wave of advanced therapies, in particular cell and

gene therapies, have continued to gain significant momentum this

year. We remain very encouraged by the strong regulatory support

and positive overall market setting for these undoubtedly

transformational medicines. It is our view that we are still in the

early days of the Third Wave, which has the potential to drive

decades of innovation in healthcare as personalised, tailored

medicines come to the fore powered by advances in genomic

understanding.

Syncona is a global leader in this area, and our portfolio

companies are very well placed to compete in a fast-growing space.

We have an early mover advantage and have made significant

strategic investments in areas like manufacturing and delivery,

which puts us in a strong position to enable the commercial success

of these emerging therapies.

We continue to have one of the world's leading gene therapy

platforms across multiple companies addressing the key tissue

compartments where gene therapy has delivered proof of concept,

namely the eye, the central nervous system and the liver. This

includes Gyroscope, our second retinal gene therapy company which

is seeking to be at the forefront of moving gene therapy from the

smaller monogenic diseases, like Choroideremia into more

genetically complex and more prevalent diseases.

In the year, we also further expanded our cell therapy franchise

through the creation of our new company, Quell Therapeutics,

focused on engineered T-Regulatory cells.

The important of a multi-disciplinary team: attracting

world-class leaders

Our team remains a key differentiator, with a central part of

our strategy being to take a hands-on approach and work in

partnership with our companies to deliver the best results. This

year the Syncona team have continued to work with company teams

across our portfolio to navigate and interrogate scientific,

clinical and commercial challenges in our existing companies, and

work with globally leading academics to found new businesses in

exciting areas of science.

As part of this, we continue our focus on bringing high-quality,

experienced people to develop the innovative technology within our

companies. Over the year we have continued to appoint world-class

leaders with the expertise to steward our companies through the

appropriate stage of their development cycle and who are attracted

by Syncona's long-term model and partnership approach.

Notably this year we appointed Khurem Farooq as Chief Executive

of Gyroscope. Khurem most recently held the position of Senior Vice

President of the Business Unit Immunology & Ophthalmology at

Genentech. Ian Clark, who most recently served as Chief Executive

of Genentech, has also been appointed as a Non-Executive

Director.

Dr Edwin Moses was also appointed as Chairman of Achilles. He

was most recently CEO of Ablynx NV which he built over 12 years

from a small R&D focused organisation to a commercial business

with a broad biologics pipeline, prior to its sale to Sanofi for

$4.8 billion in 2018. Dr Iraj Ali, a former Syncona Partner, also

became CEO of the business.

A series of other key commercial and operational hires were also

made into the portfolio. In OMASS, Ros Deegan moved from Boston to

join as Chief Executive, bringing more than 20 years' experience in

senior biotech roles, working alongside Dr Ali Jazayeri who was

appointed as Chief Scientific Officer and was formerly Chief

Technology Officer of Heptares. In Freeline, Brian Silver was

appointed CFO and Head of Corporate Development, joining from

healthcare group Perella Weinberg Partners.

Strategic capital pool central to our model

A strong balance sheet and certainty of funding is key to

delivering our strategy. Our capital pool is a strategic asset and

enables us to make long term commitments, for example in areas such

as manufacturing and delivery, and to attract world class

management teams as our companies scale. It also provides us with

the flexibility to support our companies for longer as we drive

long term decision making and navigate clinical risks. We believe

our capital pool needs to be sufficient to fund both new

opportunities and to scale our existing portfolio companies for a

minimum of two to three years, with our expected capital deployment

to be GBP100-200 million per year and, subject to the continued

progression of the portfolio, may exceed this amount in later

years.

As our companies' scale, we maintain a disciplined approach to

the allocation of capital to each portfolio company to maximise

risk adjusted returns for shareholders. As part of this process,

for any given company, we assess the risk and opportunities that

company faces to determine the optimum financing approach. We

typically remain the sole investor throughout initial rounds of

investments, however there will also be circumstances where the

right thing for the company, and Syncona's shareholders, will be to

bring in likeminded investors to support the company as it grows,

while maintaining a significant ownership stake.

Increasing momentum and scale in the portfolio

We continue to see exciting new opportunities for investment

both within the Third Wave and beyond, where new technological

advances are being applied to First and Second Wave modalities such

as small molecule drugs and biologics. We are focused on founding

companies in areas where the Syncona model can be applied to our

advantage as we seek to build a portfolio of 15-20 globally

competitive companies, adding new companies at a rate of

approximately 2-3 companies a year.

Our portfolio companies are scaling rapidly, and we believe they

are well-placed to continue to execute on strategy in line with

their development plans. Many of our companies are now conducting

clinical trials, where the data generated will be the core driver

of fundamental value. This process is never without risk, but we

believe our companies are positioned to navigate these processes as

they seek to deliver transformational treatments to patients.

Long term, we continue to focus on building a selective

portfolio companies and delivering 15 per cent IRR through the

cycle. We believe that our differentiated business model and

leading multi-disciplinary team, supported by our strategic pool of

capital, will enable us to capture superior risk-adjusted returns

for shareholders as we seek to build the next generation of

healthcare companies.

Martin Murphy, CEO Syncona Investment Management Limited

13 June 2019

Life Science review

Syncona's life science portfolio has performed strongly during

the year and our companies continue to make good progress against

their clinical and business plans, demonstrating strong momentum

across our portfolio. As at 31 March 2019, our portfolio was valued

at GBP1,055.4 million and had 10 companies: one Established company

delivering marketed products to patients, four Maturing clinical

stage companies and five Developing companies focused on

establishing operations and setting and implementing the strategic

vision.

Our progress during the year reinforces the benefits of our

highly-focused, hands-on and long-term approach. Our model means

that as we build our companies, the Syncona team is actively

involved operationally, bringing our differentiated,

multi-disciplinary skill set to bear across all aspects of the

businesses, from scientific development to clinical progression and

financial discipline and ultimately capturing the opportunity

available.

Established companies:

Blue Earth Diagnostics (18.4% NAV, 89% shareholding)

-- Strong financial performance with positive sales (GBP83.9 million) and EBITDA (GBP28.7 million)

in FY2019[4] and reaching a milestone dosing its 50,000(th) patient post year end.

-- Momentum in Axumin sales, with US units continuing to increase over the 2019 financial year

(Q1: 6,000, Q2: 6,500, Q3: 7,600, Q4 8,800).

-- Positive phase 3 clinical data in glioma; encouraging data from early clinical experience

in Blue Earth's second asset for the diagnosis of prostate cancer, rhPSMA-7, in an academic

setting

-- Expect continued positive earnings momentum, an FDA decision on filing for use of Axumin in

glioma in coming months and to initiate and complete a phase 1 clinical trial for rhPSMA-7

this financial year.

Blue Earth is a leading molecular imaging diagnostics company

focused on the development and commercialisation of novel PET

imaging agents. It has had another positive year delivering strong

financial performance with sales of GBP83.9 million and EBITDA of

GBP28.7 million for the year to 31 March 2019.[5] 50,000 patients

have now received an Axumin scan since the product was launched

commercially, enabling physicians to diagnose patients with

recurrent prostate cancer more effectively.

The business has continued to perform strongly in the US, with

US unit doses of 28,900 over the year, up from 13,000 doses over

the previous year. The US is Blue Earth's key market where the

opportunity is to treat approximately 70,000 patients annually.

Whilst Europe is a more fragmented market and challenging

reimbursement environment than the US, the company has expanded

access to Axumin in Europe over the year and it is now commercially

available in nine countries with more to follow. The company has

continued to progress development of its radio hybrid PSMA-targeted

agent, rhPSMA-7 reporting encouraging results from its early

clinical experience of the agent in an academic setting. Blue Earth

is expected to initiate and complete a Phase 1 trial this financial

year.

The company is also working towards a label extension for Axumin

in glioma, a form of brain cancer. During the year, the U.S. Food

and Drug Administration (FDA) has accepted a supplemental New Drug

Application (sNDA) for the expanded use of Axumin in adults for

glioma and we anticipate a decision in the coming months.

Maturing companies

Nightstar Therapeutics (17.7% NAV, 38% shareholding):

-- Agreement to be acquired by Biogen for $877.0 million.

-- Represents a 4.5x return and 72 per cent IRR for Syncona; GBP255.8

million[6] of proceeds received post year-end

Nightstar is our clinical-stage gene therapy company developing

treatments for rare inherited retinal diseases, and in March of

this year, we announced that the company had reached an agreement

to be acquired by Biogen.

Syncona founded Nightstar in 2013 with Professor Robert MacLaren

of Oxford University and took a hands-on, operational approach,

setting the business up for success over the long-term. It is a

strong example of our differentiated approach of founding, building

and funding innovative companies and we look forward to seeing

Nightstar work to deliver transformational treatments to patients

during the next phase of its development with Biogen.

Autolus (22.6% of NAV, 31% shareholding):

-- Significant year of clinical progress with data read-outs across four programmes

-- Data from six clinical trials expected to be delivered during the course of this financial

year and could move to up to three Phase 2 registration trials this financial year

Autolus, founded by Syncona in 2014, is our biopharmaceutical

company developing next-generation programmed T cell therapies for

the treatment of cancer. The company had a strong year, continuing

to progress its pipeline of therapies through the clinic and making

positive progress in developing its manufacturing capabilities.

During the year Autolus reported encouraging data in its AUTO3

programmes in paediatric Acute Lymphoblastic Leukaemia (pALL) and

Diffuse Large B-cell lymphoma (DLBCL), with the preliminary data

from both trials showing encouraging safety data and early clinical

efficacy. It also announced that it had dosed its first patient in

the Phase 1/2 trial of AUTO4 in T cell lymphoma. In the second

half, the company reported further positive data in AUTO1 pALL and

initial positive data in AUTO1 Adult ALL. Data from a number of

clinical trials will be delivered during the course of the year and

could result in the company moving in to up to three Phase 2 trials

this financial year.

The company has also continued to expand its manufacturing

capabilities, initiating manufacturing for clinical studies at the

Stevenage Catapult in mid-March 2019. It has announced plans for

further facilities in Enfield in the UK and Maryland in the US, the

latter of which will be a fully scaled commercial site. The company

is making good clinical progress on multiple fronts and has

established an economical and scalable product delivery platform,

which will enable it to ultimately commercialise its products for

patients.

Following completion of its successful IPO in July, the company

conducted a follow-on financing post period end, raising $109.0

million. Syncona invested in both the IPO and follow on offering

and retains a 30.0 per cent stake in the business.

Freeline (6.4% of NAV, 80% shareholding):

-- Reported encouraging initial data in December 2018 from two patients in first low dose cohort

for lead programme in Haemophilia B; the company has since entered the dose optimisation phase

-- Expect to report further data from Haemophilia B programme and initiate second programme in

Fabry disease over this financial year

Freeline, our gene therapy company focused on liver expression

for a range of chronic systemic disease is currently progressing

its lead programme in Haemophilia B through clinical development.

In December 2018, the company reported initial data from the first

two patients in programme, dosed in the lowest dose cohort and

reported mean FIX activity[7] levels of 45 per cent +/-5, with the

normal range being 50-150 per cent[8]. The company has since

entered the dose optimisation phase. During this period, dose

escalation is undertaken at a range of levels to establish the

optimal dose before commencing a registrational study. It will

report further data from this process this financial year.

The company has also continued to progress with its pipeline in

systemic diseases. Its second programme, Fabry disease, is expected

to enter the clinic in the coming months. Freeline has also

disclosed that the next programme in its pipeline will be in

Gaucher disease[9].

In 2016, Freeline made a significant early investment in

manufacturing capability, recognising the importance of a

commercial scale manufacturing platform in order to achieve its

ambition to take products all the way to market. Over the last

year, the business has made strong progress in developing this

platform to be able to deliver high-quality, consistent product at

commercial scale, notably securing suites at a leading contract

manufacturer and at the Cell and Gene Therapy Catapult centre,

which provides it with internal capability for its phase 1/2 trials

and will allow it to meet the commercial demand for its Haemophilia

B programme. Over the next financial year, the business is focused

on manufacturing GMP-grade[10] product, suitable for a pivotal

trial for its Haemophilia B programme, supporting its ambition to

ultimately deliver transformational treatments for patients.

Following the year end, Anne Prener informed the board of

Freeline that she will step down as Chief Executive Officer having

completed her strategic objective of bringing Freeline into the

clinic with two programs. Under Anne's leadership, the Company has

made excellent progress, enrolling several cohorts of patients in a

Phase 1/2 study for Haemophilia B and preparing to enroll patients

in its Fabry program. The Company is now well positioned to attract

a new CEO with commercial experience to lead Freeline through

late-stage clinical development and product launch.

Gyroscope (2.0% of NAV, 81% shareholding):

-- Significant strategic progress creating leading retinal gene therapy platform through merger

with Orbit Biomedical

-- Clinical-stage company, dosing of first patient in lead programme for dry AMD in January 2019

-- Anticipates completing the first dose escalation for this programme in FY2020

Gyroscope is a retinal gene therapy company focused on

developing genetically-defined therapies for the treatment of eye

diseases linked to an unbalanced complement system. It is one of

the first companies globally to move gene therapy out of rare

diseases and in to more prevalent disease. It is now clinical-stage

having commenced dosing in its lead programme in one of the most

severe forms of dry AMD with the first patient successfully dosed

in January 2019. The company anticipates completing the first dose

escalation for this programme during this financial year.

The company has also made significant strategic progress in the

year, merging with Syncona's surgical device company, Orbit

Biomedical, and creating the first fully integrated retinal gene

therapy company with high quality manufacturing and a surgical

platform that can support accurate, safe and consistent sub-retinal

delivery of treatments to patients with blinding conditions. It is

focused on delivering a therapeutic in a way that ensures higher

consistency of dosing, whilst allowing patients to receive a less

invasive treatment, which will be key to widespread use and

clinical effectiveness. The merger ensures Gyroscope now has the

key platform capabilities it requires to develop and deliver its

therapeutics commercially.

Developing companies (2.6% NAV)

Achilles, our cell therapy company which is focused on

immunotherapy to treat solid tumours (initially lung cancer and

melanoma) has made good operational progress in the period,

strengthening the leadership team. The company has also received

approval from UK regulatory authority, the Medicines and Healthcare

products Regulatory Agency (MHRA) to conduct two Phase I/II trials

evaluating the safety and clinical activity of clonal neoantigen T

cells ("cNeT") in patients with advanced non-small cell lung cancer

(NSCLC) and melanoma respectively. It expects to enrol the first

patient in its first programme in NSCLC in H1 FY2020.

SwanBio, a gene therapy company focused on neurological

disorders, has made good progress over the course of the year,

appointing key members of the management team and building out its

operations. The company expects to nominate the candidate for its

lead programme in this financial year and make progress in building

out its manufacturing capabilities.

In June, Syncona led a GBP14.0 million Series A financing in

OMASS Therapeutics, a biopharmaceutical company using structural

mass spectrometry to discover novel medicines. We have worked

closely with the OMASS team to develop a plan for the company which

is seeking to use its suite of proprietary technologies, developed

in the lab of globally leading academic Professor Dame Carol

Robinson, in order to discover and develop innovative small

molecule drug therapeutics.

Syncona also led a CHF 35.0 million Series A financing in a new

immuno-oncology company, Anaveon. The financing supports the

development of a selective Interleukin 2 ("IL-2") Receptor Agonist,

a type of protein that could therapeutically enhance a patient's

immune system to respond to tumours. The Syncona team is working in

close partnership with the company to build the business, focusing

on developing the clinical plan and strategy.

We also announced the foundation of a new company, Quell

Therapeutics, bringing together six leading academics in the cell

therapy space with a GBP35 million Series A financing. Quell has

been established with the aim of developing engineered T regulatory

(Treg)[11] cell therapies to treat a range of conditions such as

solid organ transplant rejection, autoimmune and auto-inflammatory

diseases. The Syncona team will work in close partnership with the

founders from University College London, Kings College London and

Hannover Medical as the business builds out its operations and

management team. Post year end, Iain McGill was appointed Chief

Executive of Quell. Iain is a leading pharmaceutical executive and

has spent the majority of his 25 years in the industry in the area

of solid organ and cell transplantation.

Life science investments (3.1% NAV):

Beyond Syncona's portfolio companies, where we typically have a

significant ownership stake and are a partner with operational and

strategic influence, we also have a small number of life science

investments which represent good opportunities to generate returns

for shareholders or provide promising options for the future in

areas where Syncona has deep domain knowledge.

The largest holding is the CRT Pioneer Fund, a fund managed by

Sixth Element Capital, which is focused on early stage investments

in highly innovative oncology programmes which were primarily

sourced from its proprietary pipeline agreement with Cancer

Research UK. Its investment period closed in March 2018 and the

manager is now focused on supporting the existing 11 investments in

the portfolio. Syncona contributed a net GBP3.5 million during the

year, with a further GBP14.9 million of uncalled commitments

remaining that we expect to be called within the next 24

months.

Strong momentum across our portfolio and exciting opportunities

to found new companies

We have a high level of conviction in the fundamentals of our

companies having founded them around exceptional science and built

them ambitiously, bringing in strong leadership teams. Over the

next year, we will continue to work in close partnership with them

in advancing their business plans and strong pipelines and we

believe they are well-positioned to continue to make good progress

in the year ahead.

We continue to see a number of excellent opportunities in cell

and gene therapy, areas where we have built deep domain expertise,

are strategically positioned with an early mover advantage and have

strong platform capabilities. We also see attractive pipeline

opportunities more broadly across a range of therapeutic areas and

modalities where we can deliver our strategy to build global

leaders aiming to take their products to market.

We remain focused on continuing to support our companies over

the long-term as they scale and progress through the clinic and

ultimately seek to deliver treatments to patients.

Chris Hollowood, Chief Investment Officer, Syncona Investment

Management Limited

13 June 2019

Finance review

Strong financial performance and significant commercial

progress

We ended the year with net assets of GBP1,455.1 million, or

216.8p per share, a 37.9 per cent total return with performance

driven by significant financial and commercial progress in our life

science companies, which generated a return of 77.9 per cent over

the 12 months.

Performance was primarily driven by the valuation increases in

three of our Established and Maturing portfolio companies, Autolus,

Blue Earth and Nightstar, which together added GBP439.9 million to

the value of the portfolio. The most material of these uplifts,

Autolus, was driven by its successful IPO on NASDAQ in June 2018

and the subsequent 85.1 per cent increase in its share price, and

our holding was valued at GBP328.2 million at the year-end, an

increase of GBP225.0 million over the 12 months. Our holding in

Blue Earth has increased in value by GBP94.9 million to GBP267.5

million at 31 March 2019, following continued strong commercial

performance of Axumin, the licencing of a new PSMA agent and

distributions to Syncona totalling GBP14.2 million. Our holding in

Nightstar was valued at GBP258.3 million[12] at the year-end, a

gain of GBP120.0 million, reflecting its proposed acquisition by

Biogen for a total of $877.0 million, which was announced in March

2019. The transaction completed in June 2019.

Beyond our Syncona portfolio companies, we have a small number

of life science investments. During the year, we invested $15

million (GBP11.6 million) in NASDAQ-listed Adaptimmune, a leader in

the engineered TCR cell therapy space, at $10.00 a share. At year

end the share price was $4.30, a decrease of 57 per cent. We also

sold our holding in NASDAQ-listed, Endocyte, during the year,

resulting in a total realised gain of GBP10.2 million on an

original investment of GBP4.0 million. CEGX is held at GBP3.9

million on an adjusted discounted Price of Recent Investment basis

(2018: GBP9.8 million).

Three new investments and investment cashflow in line with

guidance

Three new companies were founded in the year, which together

with milestone payments to our existing life science companies and

other investments, resulted in capital deployed of GBP138.6

million, in line with prior year guidance of GBP75 million to

GBP150 million.

While the absolute level of deployment will be dependent on our

investment pipeline, our current expectation is that the Company

will invest between GBP100 million and GBP200 million over the next

12 months.

Uncalled commitments reflect new investments and financing

rounds

Uncalled commitments stood at GBP121.5 million at the year end,

of which GBP101.7 million relate to milestone payments associated

with the life science portfolio and GBP14.9 million to the CRT

Pioneer Fund over the next 24 months. The remaining GBP4.9 million

of the uncalled commitments relate to investments held in the

capital pool.

These payments are generally delivered over a number of tranches

linked to the relevant portfolio company achieving key strategic

and development goals set at the time of financing. This is a risk

management tool and enables Syncona to ensure companies are

tracking to their strategic plans.

Strategic capital base and significant liquidity in the capital

pool

Syncona has a strategic capital base with net cash resources of

GBP197.9 million (2018: GBP76.2 million) and GBP201.8 million of

further liquidity in investments (2018: GBP465.1 million in fund

investments). In addition, we received proceeds of GBP255.8

million[13] from the sale of Nightstar following the completion of

the transaction, taking proforma liquidity in the capital pool to

GBP655.5 million. Against this we have milestone payments to

existing portfolio companies of GBP101.7 million, visibility on a

number of financings across our portfolio in the coming 12-24

months and a strong pipeline of new opportunities

Successful life science companies scale rapidly, therefore

access to a deep capital pool allows the team to take a long-term

view and retain strategic ownership stakes when founding and

building our companies. Certainty of funding is key in delivering

our strategy and we believe our capital pool needs to be sufficient

to fund the investment pipeline and portfolio company financing

rounds for a minimum of two to three years.

Liquidity profile GBPm

Net Cash 197.9

------

< 1 month 21.5

------

1-3 months 23.1

------

3-12 months 82.5

------

> 12 months 74.7

------

TOTAL 399.7

------

Over the last two years, Syncona has evolved the investment

parameters of its capital pool to focus on liquidity and capital

preservation in order to support Syncona's strategy and key goal of

founding, building and funding global leaders in healthcare. To

support this strategy, we have further simplified the management of

the capital pool, redeeming all legacy fund investments except for

certain longer term funds. As part of this process, we have

increased our weighting to cash, cash equivalents and fixed income

products with higher liquidity and lower volatility. This year, our

fund investments generated a return of 1.43 per cent in the year

ended 31 March 2019.

Expenses

The Company's ongoing charges ratio was 0.92 per cent for the 12

months[14], which compares to 1.01 per cent in 2018, with the

decrease reflecting the growth in NAV, the absence of one-off

costs[15] and effective cost management as the Company has scaled.

Syncona Investment Management Limited's ("SIML") management fee is

capped at 1.1% of net assets and management fees paid to SIML in

2019 totalled GBP8.9 million (2018: GBP5.8 million), or 0.70 per

cent of NAV (2018: 0.79 per cent) [16]. Allowing for the costs

associated with the Company's Long-Term Incentive Plan, ongoing

charges increased to 1.84 per cent (2018: 1.58 per cent).

Long-Term Incentive Plan

To provide long-term alignment of interest with shareholders,

Syncona's Long-Term Incentive Plan ("LTIP") was adopted by

shareholders in December 2016 and replaced the original performance

scheme that was put in place at the time of the establishment of

Syncona in 2012.

The strong performance of the life science portfolio has

significantly exceeded the growth hurdle[17] for the LTIP. The LTIP

scheme vests on a straight-line basis over a four-year period with

awards settled in cash and Syncona shares. At the year end the

total liability for the cash settled element was revalued at

GBP17.2 million (2018: GBP5.4 million), of which GBP6.4 million

would be payable if all eligible MES were realised in the current

financial year, and the number of shares in the Company that could

potentially be issued increased by 10,046,397 shares, taking the

fully-diluted number of shares to 671,268,706. Further details on

the LTIP can be found in the Remuneration Report in the Annual

Report to be published in due course and in notes 2 and 13.

Dividend

The Board has declared a final dividend of 2.3p per share (2018:

2.3p per share) for the year. Syncona's investment objective is to

achieve superior long-term capital appreciation by founding,

building and funding global leaders in healthcare. The portfolio is

now predominantly invested in fast growing, capital intensive, life

science companies and during the year the Board reviewed the

dividend policy and has decided that it will no longer be

appropriate to pay a dividend moving forward.

Charitable donations

Syncona is donating GBP1.9 million to the Institute of Cancer

Research and GBP2.4 million to The Syncona Foundation (for onward

distribution to nominated charities) for the 2019 year. Syncona

commits a minimum of 0.3% of its net asset value to charitable

causes in the field of healthcare, in particular cancer, and

beyond. Further details on our charitable donations can be found in

the Corporate Social Responsibility statement in the Annual

Report.

Foreign exchange

At the year-end, we continued to hold the Company's foreign

exchange exposure in the life science portfolio unhedged with the

exception of the investment in Nightstar ahead of the anticipated

completion of its acquisition by Biogen in June 2019. Within the

capital pool we continue to hedge all of the euro-denominated share

classes, and 92.5 per cent of the exposure to US Dollar-denominated

share classes and cash balances. At the year end, the unrealised

loss on the associated forward contracts was GBP0.6 million.

Valuation policy

The valuation of investments is conducted in accordance with

International Private Equity and Venture Capital Valuation

Guidelines. At 31 March 2019, the life science investments were

valued at cost, Price of Recent Investment, rDCF, adjusted

third-party or quoted basis. In the case where Syncona is the sole

institutional investor and substantive clinical data which is

material to Syncona has been generated in life science portfolio

companies, we will use input from an independent valuations advisor

in our determination of the fair value of investments. Capital pool

investments are valued by reference to third-party pricing.

John Bradshaw, Chief Financial Officer, Syncona Investment

Management Limited

13 June 2018

Valuation policy for life science investments and clinical trial

disclosure process

Valuation policy for life science investments

The Group's investments in life science companies are, in the

case of quoted companies, valued based on bid prices in an active

market as at the reporting date.

In the case of the Group's investments in unlisted companies,

the fair value is determined in accordance with the International

Private Equity and Venture Capital ("IPEVC") Valuation Guidelines.

These include the use of recent arm's length transactions,

Discounted Cash Flow ("DCF") analysis and earnings multiples.

Wherever possible, the Group uses valuation techniques which make

maximum use of market based inputs.

The following considerations are used when calculating the fair

value of unlisted life science companies:

-- The cost generally represents fair value as of the transaction date. Similarly, where there

has been a recent investment in the unlisted company by third parties, the Price of Recent

Investment ("PRI") generally represents fair value as of the transaction date, although further

judgement may be required to the extent that the instrument in which the recent investment

was made is different from the instrument held by the Group.

-- The length of period for which it remains appropriate to use cost or the PRI depends on the

specific circumstances of the investment and the stability of the external environment and

adequate consideration needs to be given to the current facts and circumstances. Where there

is objective evidence that an investment has been impaired or increased in value since the

investment was made, such as observable data suggesting a change of the financial, technical

or commercial performance of the underlying investment, the Group carries out an enhanced

assessment based on one of the alternative methodologies set out in the IPEVC Valuation Guidelines.

-- DCF involves estimating the fair value of an investment by calculating the present value of

expected future cash flows, based on the most recent forecasts in respect of the underlying

business. Given the difficulty involved with producing reliable cash flow forecasts for seed,

start-up and early-stage companies, the DCF methodology will more commonly be used in the

event that a life science company is in the final stages of clinical testing prior to regulatory

approval or has filed for regulatory approval.

-- Independent Adviser - the Group's determination of the fair values of certain investments

took into consideration multiple sources including management and publicly available information

and publications and certain input from independent advisers L.E.K. Consulting LLP ("L.E.K."),

who have undertaken an independent review of certain investments and have assisted the Group

with its valuation of such investments. The review was limited to certain limited procedures

that the Group identified and requested it to perform within an agreed limited scope.

-- As with any review of investments these can only be considered in the context of the limited

procedures and agreed scope defining such review and are subject to assumptions which may

be forward looking in nature and subjective judgements. Upon completion of such limited agreed

procedures, L.E.K. estimated an independent range of fair values of those investments subjected

to the limited procedures. In making such a determination the Group considered the review

as one of multiple inputs in the determination of fair value. The limited procedures within

the agreed scope are limited by the information reviewed and did not involve an audit, review,

compilation or any other form of verification, examination or attestation under generally

accepted auditing standards and was based on the review of multiple defined sources. The Group

is responsible for determining the fair value of the investments, and the agreed limited procedures

in the review performed to assist the Group in its determination are supplementary to the

inquiries and procedures that the Group is required to undertake to determine the fair value

of the said investments for which the Directors are ultimately responsible.

Where the Group is the sole institutional investor and until

such time as substantial clinical data has been generated

investment will be valued by reference to Cost or PRI subject to

adequate consideration being given to current facts and

circumstances. Once substantial clinical data has been generated

the Group will use input from an independent valuations advisor to

assist in the determination of fair value.

Valuation of the life science % of life science % of net assets

portfolio portfolio

------------------------------ ----------------- ---------------

Cost 15.2 11.1

------------------------------ ----------------- ---------------

Discounted Cash Flow 25.3 18.4

------------------------------ ----------------- ---------------

Quoted 55.9 40.6

------------------------------ ----------------- ---------------

Adjusted Price of Recent

Investment 0.4 0.3

------------------------------ ----------------- ---------------

Third Party 3.2 2.4

------------------------------ ----------------- ---------------

Clinical trial disclosure process

Currently, Syncona's portfolio companies are progressing with

eight clinical trials. These trials represent both a significant

opportunity and risk for each company and for Syncona Ltd.

Unlike typical randomised controlled pharmaceutical clinical

trials, currently all eight clinical trials are open-label trials.

Open label trials are clinical studies in which both the

researchers and the patients are aware of the drug being given. In

some cases the number of patients in a trial may be relatively

small. Data is generated as each patient is dosed with the drug in

a trial and is collected over time as results of the treatment are

analysed and, in the early stages of these studies, dose-ranging

studies are completed.

Because of the trial design, clinical data in open-label trials

is received by our portfolio companies on a frequent basis.

However, individual data points need to be treated with caution,

and it is typically only when all or substantially all of the data

from a trial is available and can be analysed that meaningful

conclusions can be drawn from that data about the prospect of

success or otherwise of the trial. In particular it is highly

possible that early developments (positive or negative) in a trial

can be overtaken by later analysis with further data as the trial

progresses.

Our portfolio companies may decide or be required to announce

publicly interim clinical trial data, for example where the company

or researchers connected with it are presenting at a scientific

conference, and Syncona will generally also issue a simultaneous

announcement about that clinical trial data. Syncona would also

expect to announce its assessment of the results of a trial at the

point we conclude on the data available to us that it has succeeded

or failed. We would not generally expect to announce our assessment

of interim clinical data in an ongoing trial otherwise, although we

will review all such data to enable us to comply with our legal

obligations such as under the EU Market Abuse Regulation or

otherwise.

Principal risks and uncertainties

The principal risks that the Board has identified are set out in

the following table, along with the consequences and mitigation of

each risk. Further information on risk factors is set out in note

19 to the Consolidated Financial Statements.

Description Impact Mitigation Changes in the

year

Failure to attract or retain key personnel (unchanged)

The expertise, If the Investment The Investment The Board

due diligence, Manager does not Manager recognises

risk management succeed in carries out that the execution

skills and integrity retaining regular of the Company's

of the staff at skilled personnel market investment

the Investment or is unable to comparisons strategy

Manager are key continue to for staff and is dependent

to the success attract executive on the specialist

of the Company. all personnel remuneration. expertise of

The industries necessary Senior a small number

in which the Investment for the executives are of key individuals

Manager operates development shareholders within the

are highly specialised and operation of in the Company Investment

and require highly their business, and Manager.

qualified and experienced it may not be staff of the Organisational

management and able Investment capability and

personnel. to execute the Manager succession

Given the relatively Company's participate planning

small size of the investment in the Syncona within the

team, the execution strategy Long Investment

of the Company's successfully. Term Incentive Manager is

investment strategy Plan. discussed

is dependent on In addition, the by the Board.

a small number Investment The Directors

of key individuals. Manager are focused on

There is a risk encourages ensuring that

that employees staff the Investment

could be approached development Manager retains

by other organisations and inclusion its existing

or could otherwise through key staff and

choose to leave coaching and is able to attract

the Investment mentoring additional staff

Manager. and carries out where needed

regular to deliver the

objective Company's

setting investment

and appraisals. strategy.

A central part

of

the Company's

strategy

is to bring in

high-quality

and experienced

people

to manage our

portfolio

companies. These

teams

are supported by

strong

Non-Executive

Directors,

typically global

leaders

in their fields,

to

work alongside

the

Investment

Manager

to drive success

in

the portfolio

companies.

=========================================================== ================== ================= ==================

Risk in making early stage investments (unchanged)

The Company invests The Company may The Investment It is increasingly

in and builds life not realise an Manager clear that the

science businesses. attractive return employs highly best businesses

In many cases these or, in some experienced require

are at a very early cases, personnel, with significant

stage, in many may not realise deep capital to be

cases before there its original cost scientific committed from

is any or any substantial or any value from expertise the outset, to

clinical evidence its investment. and considerable enable a robust

of effectiveness In addition the experience business plan

or a commercially Company may need of building and to be executed

viable way to deliver to invest developing by a high quality

the technology. significant early-stage life team. The overall

Evaluating such additional time, science result for any

opportunities is capital and businesses, who one business

inherently uncertain management are is to improve

and may require resources in therefore its chances of

significant capital order well-positioned success, but

to be invested to realise any to evaluate the it also materially

before these uncertainties return. risks increases the

can be resolved. Failures of and capital at risk

investments opportunities. if there is a

may affect the Before making failure. We

Company's wider any believe

reputation for investment, the our existing

building Investment processes are

successful Manager performs appropriate to

life science extensive address and

businesses due diligence mitigate

and impact our covering the evolving

share price, make all the major risk profile

it more difficult scientific but keep this

to recruit high and business under review.

quality personnel risks,

to the Investment and develops an

Manager or our operational

businesses, or plan to mitigate

have other these.

negative This will

impacts. typically

involve the

Investment

Manager's

personnel

working closely

with

the portfolio

company,

taking

non-executive

and at times

executive

roles on

portfolio

company boards.

The Investment

Manager

has a robust and

disciplined

financing and

capital

allocation

framework,

and investments

may

involve seed

funding

or tranching to

identify

and mitigate

early

risks before

proceeding

with more

substantial

investments.

=========================================================== ================== ================= ==================

Clinical trial risks (increased)

The Company's life A failure to This is the key We have separated

science investments demonstrate risk our clinical

are typically development that a clinical that underpins trials as a

stage businesses product is our separate

engaged or seeking effective, business model risk, to recognise

to engage in clinical or the discovery and that a growing

trials of new products. of material drives returns. number of our

There are risks toxicity To life science

arising from any issues, is likely manage it we companies are

clinical trial: to result in a need progressing

* Risk of negative results from clinical trials decline in the to have a strong clinical

value of the management trials. There

portfolio team, with is risk inherent

* Risk of adverse events from clinical trials company, or even robust in this activity,

lead to the culture and as companies

portfolio process, test pre-clinical

company failing. and hire the hypotheses in

Even where a best a human setting.

clinical people within Results from

trial the clinical trials

demonstrates portfolio will either enable

some efficacy, companies. our companies

data may be The Investment to progress

insufficiently Manager further

clear to satisfy employs highly with development

regulatory experienced if positive,

requirements personnel with or can result

or to establish deep in failure both

commercial scientific at a programme

differentiation, expertise and company level

and in that case and considerable if negative or

further studies experience if there are

may be required of building and adverse events.

incurring delay developing During the year,

and expense. This early-stage life two new clinical

in turn may science trials launched,

impact businesses. The taking the total

the value of such Investment number of clinical

portfolio Manager's trials across

company. personnel our portfolio

A significant work closely to eight.

adverse with

event during a portfolio

clinical trial companies,

may result in taking both

material executive

harm to one or and

more individuals. non-executive

It may also roles on

result portfolio

in a halt or company boards,

delay monitoring

to the clinical progress and

trial, or require ensuring

additional familiarity with

studies issues

to ascertain the and risks.

cause of the Members of the

event. portfolio

It may also companies'

result management

in significant teams have

reputational significant

issues experience in

for Syncona. the

management of

clinical

programmes and

have

dedicated

internal

resource to

establish

and monitor each

of

the clinical

programmes

in order to

maximise

successful

outcomes.

Business and

clinical

strategies will

seek

to mitigate

development

risk, for

example

by carefully

considering

trial design, or

by

seeking to have

multiple

trials in

different

indications.

In addition, the

Investment

Manager's team

can

assist the

management

teams of the

portfolio

companies with

arranging

specialist

advice.

=========================================================== ================== ================= ==================

General, commercial and technological risks (unchanged)

The Company's life All of these The Investment We have separated

science investments risks Manager out these risks

are exposed to could potentially employs highly from the clinical

a wide range of lead to a decline experienced trial risks above.

general, commercial in the value of personnel with Given that only

and technological a portfolio deep one of our life

risks. In particular: company, scientific science companies

* Intellectual property may fail to be granted or may or even lead to expertise has a product

be infringed or copied the portfolio and considerable that has completed

company experience clinical trials,

failing. of building and these risks are

* Failure of a technology platform in an early-stage developing typically a less

company early-stage life significant factor

science for us at the

businesses. The current time,

* Failure to obtain regulatory approval for new Investment but we expect

products developed Manager's these risks to

personnel become a greater

work closely focus as our

* Failure to sell products profitably or in sufficient with life science

volumes portfolio companies progress

companies, through the clinic

taking both towards

* Changes in pharmaceutical pricing practices executive commercialisation.

and

non-executive

* Launch of competing products roles on

portfolio

company boards,

* Reputational damage monitoring

progress and

ensuring

* Targeted public campaigns familiarity with

issues

and risks.

* Latent product defects resulting in claims

------------------ ----------------- ------------------

Dominance of portfolio by a few larger investments and/or sector

focus (increased)

Within its life If a portfolio The Board The Company's

science portfolio, company considers strategy is to

the Company is experiences the performance build successful

seeking to build financial or of life science

a focused portfolio operational its largest companies, and

of 15-20 leading difficulties, portfolio during the year

life science companies. fails companies and we have seen

Accordingly, a to achieve the significant value

large proportion anticipated portfolio's creation in

of the overall results or, where concentration several

value of the life relevant, suffers in specific of our life

science portfolio from poor stock sub-sectors science

may, at any time, market conditions on a quarterly companies. While

be accounted for and if, as a basis. this does create

by one, or a few, result, Business and a greater

portfolio companies. its value were clinical concentration

The Company's life to be adversely strategies seek risk, we believe

science portfolio affected, this to it to be in line

may also be focused could have an diversify the with our strategy.

on a small number adverse concentration During the year

of sub-sectors impact on the risk in any one shareholders

within the life overall portfolio approved changes

science sector. value of the life company, for to our investment

Accordingly, a science example policy that gave

material proportion investment by seeking to us more

of the overall portfolio. have flexibility

value of the life Similarly, if the multiple to hold a

science investment technology or products significant

portfolio may, technologies under part of our

at any time, be utilised in a development portfolio

invested in a specific specific in different in a small number

sub-sector. sub-sector prove indications. of life science

This risk has increased to be At 31 March companies, to

as a result of commercially 2019, support us in

positive developments unproductive or the Company's delivering our

within portfolio unsuccessful, three strategy.

companies that then largest

have resulted in the value of the investments

the Company recognising Company's in its life

value increases investments science

and committing in the respective portfolio are

further investment. sub-sector(s) valued

could at GBP854.0

be negatively million

impacted. representing

58.7

per cent of the

net

asset value of

the

Company. One of

these

companies,

Nightstar,

received an $877

million

approach from

Biogen,

which completed

in

June 2019.

------------------ ----------------- ------------------

Financing and exit risk (unchanged)

Life science businesses Lack of funding The Company During the year

are capital intensive. may restrict the maintains we have more

Instability in ability of a a strong clearly set out

equity and debt portfolio liquidity our desired

markets and/or company in the position to fund capital