TIDMPMI

RNS Number : 1086A

Premier Miton Group PLC

28 May 2021

28 May 2021

PREMIER MITON GROUP PLC

HALF YEAR RESULTS FOR THE SIX MONTHSED 31 MARCH 2021

Premier Miton Group plc ('Premier Miton', 'Company' or 'Group'),

the AIM quoted fund management group, today announces its half year

results for the six months ended 31 March 2021 (the 'Period').

Highlights

-- GBP12.6 billion closing Assets under Management (4) ('AuM') (2020 HY: GBP9.1 billion)

-- GBP13.1 billion closing AuM as at 30 April 2021

-- Net inflows of GBP359 million in the Period (2020 HY: GBP(389) million outflows)

-- 74% of funds have above median investment performance since launch or tenure (5)

-- Adjusted profit before tax (1,4) of GBP11.9 million (2020 HY: GBP12.2 million)

-- Profit before tax of GBP6.2 million (2020 HY: GBP5.3 million)

-- Proposed interim dividend of 3.7 pence per share (2020 interim: 2.5 pence per share)

Notes

(1) Adjusted profit before tax is calculated before the

deduction of taxation, amortisation, share-based payments, merger

related costs and exceptional costs. Reconciliation included within

the Financial Review section.

(2) Adjusted earnings per share is calculated before the

deduction of amortisation, share-based payments, merger related

costs and exceptional costs.

(3) Merger related costs totalled GBP1.2 million during the

period (2020 HY: GBP3.0 million).

(4) These are Alternative Performance Measures ('APMs').

(5) As at 31 March 2021. Based on Investment Association sector

classifications where applicable, with data sourced from FE

Analytics using the main representative post-RDR share class, based

on a total return, UK Sterling basis. Performance for investment

trusts is calculated on Net Asset Value ('NAV'), ranked against the

relevant Morningstar category for each investment trust.

Mike O'Shea, Chief Executive Officer of Premier Miton Group,

commented:

"We have made considerable progress as a business since our

merger in 2019 and it is pleasing to be able to report a return to

net positive flows for the Group over the period. Premier Miton is

now a well-diversified asset manager operating on a stable and

sustainable platform with a robust balance sheet."

"With attractive investment performance and a clear sense of

client service, coupled with a growing brand and targeted marketing

activity, this is an exciting time for the firm. I believe that the

business is well positioned to deliver for our investors and for

our wider stakeholders over the years ahead."

S

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Numis Securities Limited (NOMAD and Broker)

Charles Farquhar / Kevin Cruickshank 020 7260 1000

Liberum Capital Limited (Joint Broker)

Richard Crawley / Jamie Richards 020 3100 2000

Smithfield Consultants (Financial PR) 020 3047 2544 /

John Kiely / Andrew Wilde / Imogen Gardam 07785 275665

www.premiermiton.com

About Premier Miton

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

Chairman's Statement

I was delighted to be appointed Chairman of the Group in

February and am pleased to introduce these interim results. The

Group has made considerable progress over the past half year and is

well placed for further success.

Financial results

These are set out in more detail below and show a strong story

with Assets under Management ('AuM') standing at GBP12.6 billion at

31 March 2021, an increase of 19% on the opening position for the

period. AuM at the period end is split between single-strategy 56%,

multi-asset 31%, fixed income 4%, investment trusts 6% and

segregated mandates 3%.

This position reflects overall improving investment markets and

a return to positive net flows for the Group. Net inflows for the

period totalled GBP359 million (2020 HY: GBP(389) million outflow),

marking a real turn for the business.

We know that our clients have choices for their savings and will

only invest with us if we perform as they expect. We seek to charge

a fair fee for our services and keep a strong cost discipline to

balance the interests of our clients with those of our other

stakeholders. I am pleased that we are doing so and that our profit

before tax for the period was GBP6.2 million, up by 17% against the

comparative period last year.

We have declared an interim dividend of 3.7p per share

representing an increase of 48% on the comparative period and I

thank our shareholders for their ongoing support. The final

dividend for 2020 of 4.5p per share was paid on 12 February 2021

following Shareholder approval at the Group's Annual General

Meeting on 3 February 2021.

Our strong capital position protects the Group through market

cycles and allows us to take a long-term view of

business development. The Group has no external bank debt and

held net cash of GBP34.4 million as at 31 March 2021.

Strategy

Asset management is a large and fast-changing global industry

with attractive opportunities for growth. The UK remains well

placed to continue as an important centre for the industry and we

look forward to the future with confidence. Our clients are mainly

in the UK although many of our funds invest globally. We have a

resilient and well designed business platform which is highly

scalable and designed to support significant growth in AuM. We are

targeting a greater market share within the UK without material

change to our operating model or the immediate need to increase the

breadth of our product range, although of course we are always

interested in adding to our investment and distribution talent.

We have now successfully completed the merger of Premier and

Miton and our Group is far stronger and better placed. I believe

that our leadership team did an excellent job on the merger and has

accumulated valuable acquisition and integration experience.

The asset management industry is going through a period of

extensive strategic change which will mean good businesses, teams

and individuals becoming available. We continue to look for new

strategic or tactical opportunities to grow and add value to the

Group, using sensible and thought through criteria for pursuing

ideas.

Culture

I know that asset management firms need a healthy culture to be

successful over time. Put simply, we must do the right things, in

the right way and for the right reasons. As our business grows and

changes, we pay close attention to our own culture to make sure we

understand if and where any adjustments are needed. Our most recent

review which was led at Board level shows that overall our culture

is distinctive, healthy and valuable. We intend to keep it this way

through careful and thoughtful leadership.

Environmental, Social and Governance ('ESG')

I expect we are all feeling our way to a better understanding of

ESG matters and what we need to do as a Group. This is an essential

matter for a responsible asset management firm and, next to fund

performance, is increasingly relevant to determining our success as

a business. I believe we are taking the right steps, especially so

in the investment models for several of our funds, yet we have much

more to learn and do. I look forward to saying more on this in

future.

People

As at 31 March 2021, we employed 151 people and over the past

months their working lives have not been easy, yet I am proud of

how hard they have worked and how well they have coped. The coming

months are likely to be challenging as we decide together how a

modern, successful workplace will look and what this means for our

people. I am optimistic that, whatever the broader environment, we

will find ways to attract, retain and motivate our talented

people.

We know that managing other people's savings well gives everyone

in Premier Miton a strong purpose and carries broad

responsibilities. I thank our people for all that they do.

Board

Mike Vogel was Chairman of the Group for 13 years and

instrumental in our success and the healthy position we are now in.

We thank him deeply for his stewardship. Since announcing his

departure, the Nomination Committee

led the process of developing our Board composition, with

particular regard to opportunities to improve diversity, as well as

fulfill the requirement to identify a suitable candidate to chair

the Audit & Risk Committee. We set out to find candidates who

would bring a full contribution to the role, especially in view of

the changing nature of the industry and our ambitions. We have met

several excellent candidates and expect shortly to announce on

appointment.

Outlook

Premier Miton is a successful and ambitious business. We have a

clear plan for growth and profitability and an experienced

management team with the energy to achieve this. The market outlook

is still rather clouded and volatile yet there are encouraging

signs for us. I am confident that our Group will make the most of

our strong platform and distinctive investment styles as we,

hopefully, emerge from the wretched pandemic. I look forward,

alongside the other members of the Board, to making my own

contribution as your Chairman.

Robert Colthorpe

Chairman

27 May 2021

Chief Executive Officer's Statement

The half year ended 31 March 2021 has been an important period

for Premier Miton. Despite the challenging circumstances of the

global pandemic, the business has continued to grow, we have seen a

return to net positive fund flow across the Group, and our people

have successfully delivered on our goals of business continuity and

strong outcomes for our investors.

Business performance

The Group's AuM increased by 19% in the period, to GBP12.6

billion as at 31 March 2021. The average AuM was GBP11.8 billion

versus GBP9.9 billion for the comparative period, an increase of

19%.

Net inflows for the period were GBP359 million (2020 HY:

GBP(389) million outflow).

Pleasingly, the business demonstrated robust profitability with

adjusted profit before tax of GBP11.9 million and a resulting

profit before tax of GBP6.2 million.

During the period we saw continued growth from several of our

single strategy funds. The Premier Miton European Opportunities

Fund, launched in 2015, passed the milestone of GBP2 billion,

ending the period with AuM of GBP2.4 billion. Also growing strongly

was the Premier Miton US Opportunities Fund demonstrating a

consistent, active investment approach. It surpassed an important

AuM milestone ending the half year with GBP1.1 billion of AuM.

It was also pleasing to see a strong recovery for our UK smaller

companies fund, which has been one of the strongest performers in

its sector. AuM for this fund have now reached GBP234 million and

we have recently taken steps to restrict flows into the fund in

order to protect the long-term interests of investors in the fund.

Performance of the UK microcap investment trust has been similarly

impressive.

We see growth opportunities across many of our funds,

particularly where there has been top quartile investment

performance. Over the medium term, we believe that UK equities are

likely to reverse their long-term underperformance against global

equities. As investor interest in UK equities returns, our

UK-focused funds, which have very strong relative performance

records, are, we believe, well placed to capture significant market

share.

Our multi-asset multi-manager funds also have significant

exposure to UK equities in order to meet their income requirements

for investors. Whilst this exposure has been a headwind in

performance terms, although not in income generating terms, a

return to form for UK equities will be helpful looking forward.

It is also our belief that as we emerge from the pandemic the

long deflationary down wave that has been in place since the

financial crisis of 2008 will likely give way to a more

reflationary environment. This could persist for much longer than

many people expect with a significant impact on bond yields,

interest rates and inflation. In this environment, we believe that

genuinely active management will come to the fore, as investors

will have to work much harder to achieve their financial

objectives. Premier Miton's range of high active share, alpha

focused funds are well placed to help deliver for investors in this

environment.

Product development

During the period our funds maintained strong investment

performance, with 64% of AuM in first quartile and 75% performing

above median within their respective IA sectors since the tenure of

the fund manager. Shorter-term numbers also look promising and we

believe that this will support future fund flows. Over three years,

we have 63% above median. Over one year, we have 80% above median

and 78% in the first quartile.

The Group has continued to develop its product range during the

period. In November, Emma Mogford joined the Group from Newton

Investment Managers and assumed management of three UK equity

income funds. Emma has a disciplined style that we believe will do

well for investors over the long term.

In January 2021 we made changes to our multi-asset multi-manager

fund range, driven by the aim to reduce the costs borne by

investors. This team, led by David Hambidge and head of research,

Ian Rees, now offers nine funds covering all outcome objectives -

income, risk-targeted, growth and wealth preservation. Recently

Wayne Nutland, manager of the Premier Miton Managed Index Balanced

Fund, joined the multi-manager team. Wayne is an experienced fund

manager in asset allocation, portfolio construction and ETF

selection and the team will leverage his expertise to assist in the

multi-manager portfolios.

Further to these changes and with effect from 1 February 2021,

David Jane and Anthony Rayner assumed the management of Premier

Miton Multi-Asset Growth & Income Fund and the Premier Miton

Multi-Asset Conservative Growth Fund.

Neil Birrell, our Chief Investment Officer and manager of the

successful Diversified multi-asset fund range, became manager of

the Premier Miton Balanced Multi Asset Fund from 1 March 2021.

Building on the success of the Premier Miton Diversified Growth

Fund, the fund will have similar asset allocation but with a

planned focus on sustainable investments.

I am also pleased to report on the successful launch of the

Premier Miton Global Smaller Companies Fund. The fund launched on

the 22 March 2021 and is managed by the investment team of Alan

Rowsell and Imogen Harris who both joined us from Aberdeen Standard

Investments in 2020. This fund fits in well with our ethos and

offers investors active stock selection in the global smaller

companies universe. At the period end, this fund had GBP15 million

in AuM.

Lastly, in terms of product development, the new Premier Miton

European Sustainable Leaders Fund launched on 10 May 2021. The fund

is managed by the highly regarded investment team of Carlos Moreno

and Thomas Brown together with Russell Champion, who will be

joining the Group later in 2021. This fund broadens the team's

investment offering and builds on their successful Premier Miton

European Opportunities Fund.

Responsible investing

During the period, we have continued to develop our focus on

responsible investing. This includes integration of ESG factors

into our investment processes, the development of specialist

investment products in this area and building clearer responsible

investing reporting for our clients. We believe it is important

that we offer responsible investment products to our clients and,

as part of this, to actively and responsibly consider ESG issues

with the companies we invest in.

As a Group, we currently manage five funds with specific

sustainable, ESG or ethical objectives designed to meet increasing

demand for a specialist responsible investing approach from our

investors. These funds include our

top-performing ethical fund managed by Benji Dawes and Jon

Hudson.

Additionally, we have announced the launch of a further

sustainable product during 2021. I am delighted that we will be

offering such a strong range of sustainable and responsible focused

funds. I would like to thank Helene Winch, our head of responsible

investing, and the many people involved in the launch or transition

of these funds.

There is more for us to do in this area, but we are making good

progress.

Distribution

Our distribution team has adapted well to the challenges of

working remotely and moving to a virtual world of meetings and

client contact. It is pleasing to see that high levels of client

contact have been maintained throughout the period and that we have

been able to effectively communicate the key features of our funds

to investors and their advisers.

The Group purposely structures its distribution to be

relationship-centric, split according to the key focus areas of the

discretionary and advisory intermediary markets. Our sales team

consists of 21 people and is geographically structured to provide

comprehensive coverage throughout the United Kingdom. The

distribution team has a detailed approach to sales data and this

has been enhanced through the successful integration of the

databases used by both the former Premier and Miton areas of the

business.

Our marketing team continued to focus on a broad range of

activities to build awareness of the Premier Miton brand and

familiarity across our investment range, as well as to keep our

clients informed. This work has included organising many digital

events, such as webinars, for existing and potential professional

investors. The Group's new website was launched in March 2021

reflecting our brand and offering enhanced information for our

different

client groups, including financial advisers and wealth

managers.

COVID-19

It has been a challenging period during lockdown and the welfare

of our people has been our highest priority. I have been impressed

with the adaptability and resilience our staff have shown across

all areas of the business.

The current indications are that the roadmap for easing

restrictions remains on target. We have been

thinking carefully about our working arrangements and the

availability of ongoing workspace flexibility to our staff.

As a Group we believe the office is a place of collaboration,

engagement and thought leadership. We also recognise the many

positive elements to working from home and the benefits of not

commuting every day. It is safe to say that we will endeavour to

adopt a more flexible approach to office-based working in the

future and create an arrangement that successfully combines the

benefits of home working with a dynamic office environment.

Outlook

With the completion of the operational aspects of the merger in

December 2020, we are now realising the benefits of our combined

platform and the hard work put in over the past 12 months.

Our operational platform has been streamlined to support

significant growth in AuM and our investment teams, with their

genuinely active ethos, are very well positioned to navigate market

trends as we hopefully emerge from the pandemic. We have an

experienced, effective distribution team working diligently to

communicate the benefits of our funds and deliver excellent client

service.

Mike O'Shea

Chief Executive Officer

27 May 2021

Financial Review

Assets under Management * ('AuM')

Opening Closing

AuM AuM

1 October Half year Market/ investment 31 March

2020 net flows performance 2021

GBPm GBPm GBPm GBPm

-------------------- ---------- ---------- ------------------ ---------

Equity funds 5,404 621 1,023 7,048

Multi-asset funds 4,119 (627) 445 3,937

Fixed income funds 486 20 14 520

Investment trusts 599 (18) 150 731

Segregated mandates - 363 3 366

-------------------- ---------- ---------- ------------------ ---------

Total 10,608 359 1,635 12,602

-------------------- ---------- ---------- ------------------ ---------

* Indicates Alternative Performance Measures ('APMs').

AuM ended the half year at GBP12,602 million, an increase of 19%

on the opening position for the period.

In the six months to 31 March 2021 the Group saw a return to net

inflows totalling GBP359 million (2020 HY: GBP(389) million

outflows).

The equity fund range experienced strong client demand driven

primarily by the European and US funds. Toward the end of the

period, the Group saw increased interest for the UK-focused funds

with inflows across these funds totalling GBP162 million.

The multi-asset funds continued to see outflows, GBP(627)

million (2020 HY: GBP(325) million outflows), however, in the

second quarter the level of outflows reduced to GBP(243) million.

During the period, the Group completed a number of changes to the

multi-asset multi-manager funds with the objective of reducing

overall costs for investors. These funds have also returned to

delivering strong investment performance over the last 12

months.

The fixed income team performed well during the period and

continued to gather AuM. At 31 March 2021, the two new funds

launched on 14 September 2020 had combined AuM of GBP145 million.

In addition to this, on 22 October 2020 the team were appointed to

manage two external mandates with AuM of GBP366 million at 31 March

2021.

Financial performance

Profit before tax was GBP6.2 million (2020 HY: GBP5.3 million).

The Group completed the operational aspects of the merger with a

further GBP1.2 million of non-recurring costs recognised during the

period (2020 HY: GBP3.0 million).

Adjusted profit before tax*, which is after adjusting for

amortisation, share-based payments, merger-related costs and

exceptional costs was GBP11.9 million (2020 HY: GBP12.2

million).

Adjusted profit and profit before tax Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBPm GBPm GBPm

-------------------------------------- ------------ ------------ -------------

Net revenue 38.5 33.4 66.8

Administrative expenses (26.6) (21.3) (44.4)

Adjusted profit before tax* 11.9 12.2 22.4

-------------------------------------- ------------ ------------ -------------

Amortisation (2.4) (2.1) (4.5)

Share-based payments (2.1) (1.6) (3.6)

Merger-related costs (1.2) (3.0) (4.5)

Exceptional costs (0.1) (0.1) (0.2)

-------------------------------------- ------------ ------------ -------------

Profit before tax 6.2 5.3 9.6

-------------------------------------- ------------ ------------ -------------

Net revenue Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBPm GBPm GBPm

----------------------------------- ------------ ------------ -------------

Net management fees(1) * 37.9 33.5 66.6

Other income 0.6 (0.1) 0.2

----------------------------------- ------------ ------------ -------------

Net revenue 38.5 33.4 66.8

----------------------------------- ------------ ------------ -------------

Average AuM(2) 11,819 9,928 10,110

----------------------------------- ------------ ------------ -------------

Net management fee margin3 (bps) * 64.2 67.4 65.9

----------------------------------- ------------ ------------ -------------

1 Being gross management fee income less trail/rebate expenses

and the cost of fund accounting and external Authorised Corporate

Director ('ACD') fees for the former Miton fund range where

applicable

2 Average AuM is calculated on a daily basis

3 Net management fee margin represents net management fees

divided by the average AuM

The Group's net management fee margin for the period was 64.2

basis points (2020 HY: 67.4 basis points). As noted in the 2020

Annual Report and Accounts, the merger with Miton Group plc

introduced a lower average margin business. The resulting change in

the business mix and the impact of flows and markets on our

existing business has driven the change in the net management fee

margin.

Administration expenses Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBPm GBPm GBPm

-------------------------- ------------ ------------ -------------

Fixed staff costs 9.1 8.3 16.7

Variable staff costs 7.8 3.9 10.9

Overheads and other costs 9.0 8.4 15.5

Depreciation 0.7 0.6 1.3

-------------------------- ------------ ------------ -------------

Administration expenses 26.6 21.3 44.4

-------------------------- ------------ ------------ -------------

Administration expenses (excluding share-based payments)

totalled GBP26.6 million (2020 HY: GBP21.3 million). The increase

reflects the inclusion of an additional one and a half months of

costs associated with the former Miton business, when compared to

the comparative period. This has, in part, been offset by synergies

realised post-merger.

Staff costs continue to be the largest component of

administration expenses, these consist of both fixed and variable

elements. Fixed staff costs, which includes salaries and associated

national insurance, employers'

pension contributions and other indirect costs of employment,

increased to GBP9.1 million (2020 HY: GBP8.3 million).

The Group continues to invest in new products and teams where it

believes it can generate good investment

outcomes for clients. The results for the period include a full

six months of costs for the fixed income and global smaller

companies teams.

Amortisation

The amortisation of intangible assets increased to GBP2.4

million (2020 HY: GBP2.1 million). The charge for the period

includes a full six months of amortisation relating to the

intangible assets recognised on completion of the merger.

Share-based payments

The share-based payment charge for the period was GBP2.1 million

(2020 HY: GBP1.6 million).

As at 31 March 2021 the Group's Employee Benefit Trusts ('EBTs')

held 10,421,565 ordinary shares representing 6.6% of the issued

ordinary share capital (2020 FY: 9,921,565 shares).

At the period end the outstanding awards totalled 13,213,920

(2020 FY: 9,329,115). The increase reflects 3,980,000 awards

granted during the period. See note 12 for further detail.

Exceptional costs and non-recurring merger-related costs

Merger-related and exceptional costs incurred in the period

amounted to GBP1.3 million (2020 HY: GBP3.1 million).

Of this balance, GBP1.2 million related to the merger (2020 HY:

GBP3.0 million). On 27 November 2020 the Group completed the

onboarding of all open-ended funds onto the in-house ACD platform.

The majority of the Group's funds are now named 'Premier

Miton'.

Capital management and dividends

At 31 March 2021 the Group held GBP34.4 million in cash (2020

HY: GBP29.3 million). The Group has no debt.

Dividends totalling GBP6.7 million were paid in the period (2020

HY: GBP10.6 million), see note 3 for further detail.

The Board is recommending an interim dividend payment of 3.7p

per share (2020 HY: 2.5p interim dividends). The interim dividend

will be paid on 13 August 2021 to shareholders on the register at

the close of business on 23 July 2021.

The Group seeks to maintain a dividend policy that targets an

ordinary dividend pay-out of approximately 50 to 65% of profit

after tax, adjusted for exceptional costs, share-based payments and

amortisation.

Piers Harrison

Chief Financial Officer

27 May 2021

Alternative Performance Measures ('APMs')

APM Unit Definition Purpose

Adjusted GBP Profit before taxation, Except for the noted costs, this

profit before amortisation, share-based encompasses all operating expenses

tax payments, merger-related in the business, including fixed

costs and exceptional and variable staff cash costs. Provides

costs. a proxy for cash generated and is

the key measure of profitability

for management decision making.

---- -------------------------- ----------------------------------------------

AuM GBP The value of external Management fee income is calculated

assets that are managed based on the level of AuM managed.

by the Group. The AuM managed by the Group is

used to measure the Group's relative

size against the industry peer group.

---- -------------------------- ----------------------------------------------

Net management GBP The net revenue of Provides a consistent measure of

fees the Group. Calculated the profitability of the Group and

as gross management its ability to grow and retain clients,

fee income, less the after removing amounts paid to third-parties.

cost of fund accounting,

external ACDs, OCF

caps and any enhanced

fee arrangements.

---- -------------------------- ----------------------------------------------

Net management bps Net management fees A measure used to demonstrate the

fee margin divided by average blended fee rate earned from the

AuM. AuM managed by the Group.

A basis point ('bps') represents

one hundredth of a percent, this

measure is used within the asset

management sector and provides comparability

of the Group's net revenue generation.

---- -------------------------- ----------------------------------------------

Adjusted p Profit after tax excluding Provides a clear measure to shareholders

earnings amortisation, share-based of the profitability of the Group

per share payments, merger-related from its underlying operations.

(basic) costs and exceptional The exclusion of amortisation, share-based

costs, divided by the payments, merger-related costs and

weighted average number exceptional items provides a consistent

of shares in issue basis for comparability of results

in the period. year on year.

---- -------------------------- ----------------------------------------------

Unaudited Condensed Consolidated Statement of Comprehensive

Income

for the six months ended 31 March 2021

Unaudited

Unaudited six months Audited

six months to to year to

31 March 31 March 30 September

2021 2020 2020

Notes GBP000 GBP000 GBP000

------------------------------------- ----- -------------- ----------- --------------

Revenue 4 43,878 38,514 77,721

Fees and commission expenses (5,386) (5,117) (10,948)

------------------------------------- ----- -------------- ----------- --------------

Net revenue 38,492 33,397 66,773

Administration expenses (26,573) (21,251) (44,408)

Share-based payment expense 12 (2,067) (1,636) (3,581)

Amortisation of intangible assets 8 (2,379) (2,055) (4,517)

Merger-related costs 5 (1,213) (2,982) (4,467)

Exceptional items 5 (64) (145) (216)

------------------------------------- ----- -------------- ----------- --------------

Operating profit 6,196 5,328 9,584

Finance revenue - 17 20

------------------------------------- ----- -------------- ----------- --------------

Profit for the period before

taxation 6,196 5,345 9,604

Taxation 6 (1,041) (2,140) (3,714)

------------------------------------- ----- -------------- ----------- --------------

Profit for the period after taxation

attributable to equity holders

of the parent 5,155 3,205 5,890

------------------------------------- ----- -------------- ----------- --------------

pence pence pence

--------------------------- ---- ----- ----- -----

Basic earnings per share 7(a) 3.48 2.35 4.14

--------------------------- ---- ----- ----- -----

Diluted earnings per share 7(a) 3.30 2.27 4.00

--------------------------- ---- ----- ----- -----

No other comprehensive income was recognised during 2021 or

2020. Therefore, the profit for the period is also the total

comprehensive income.

Unaudited Condensed Consolidated Statement of Changes in

Equity

for the six months ended 31 March 2021

Employee Capital

Share Merger Benefit redemption Retained

capital reserve Trust reserve earnings Total

Notes GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2020 60 94,312 (14,649) 4,532 45,439 129,694

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the period - - - - 5,155 5,155

Purchase of own shares held

by an EBT 12(a) - - (724) - - (724)

Share-based payment expense 12 - - - - 2,067 2,067

Other amounts direct to equity - - - - (134) (134)

Deferred tax direct to equity - - - - 70 70

Equity dividends paid 3 - - - - (6,660) (6,660)

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 31 March 2021 (Unaudited

half year) 60 94,312 (15,373) 4,532 45,937 129,468

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2019 50 - (6,944) 4,532 47,688 45,326

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the period - - - - 3,205 3,205

Issue of share capital on merger 10 94,312 - - - 94,322

Purchase of own shares held

by an EBT 12(a) - - (2,669) - - (2,669)

Shares issued to EBT as part

of the merger - - (5,178) - - (5,178)

Exercise of options - - 142 - (15) 127

Share-based payment expense 12 - - - - 1,636 1,636

Deferred tax direct to equity - - - - (4) (4)

Equity dividends paid 3 - - - - (10,589) (10,589)

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 31 March 2020 (Unaudited

half year) 60 94,312 (14,649) 4,532 41,921 126,176

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 1 October 2019 50 - (6,944) 4,532 47,688 45,326

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

Profit for the year - - - - 5,890 5,890

Issue of share capital on merger 10 94,312 - - - 94,322

Purchase of own shares held

by an EBT - - (2,669) - - (2,669)

Shares issued to EBT as part

of the merger - - (5,178) - - (5,178)

Exercise of options - - 142 - (15) 127

Share-based payment expense - - - - 3,581 3,581

Deferred tax direct to equity - - - - (6) (6)

Equity dividends paid - - - (11,699) (11,699)

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

At 30 September 2020 (Audited) 60 94,312 (14,649) 4,532 45,439 129,694

--------------------------------- ----- -------- -------- -------- ----------- --------- --------

Unaudited Condensed Consolidated Statement of Financial

Position

as at 31 March 2021

Unaudited Unaudited Audited

31 March 31 March 30 September

2021 2020 2020

Notes GBP000 GBP000 GBP000

--------------------------------------- ----- --------- --------- -------------

Non-current assets

Goodwill 8 70,948 71,478 70,948

Intangible assets 8 29,855 34,057 32,234

Other investments 100 100 100

Property and equipment 2,021 2,683 2,385

Right-of-use assets 2,091 2,777 2,414

Deferred tax asset 1,400 793 1,599

Trade and other receivables 791 152 367

--------------------------------------- ----- --------- --------- -------------

107,206 112,040 110,047

--------------------------------------- ----- --------- --------- -------------

Current assets

Financial assets at fair value through

profit and loss 3,319 1,618 2,697

Trade and other receivables 167,816 66,969 44,409

Cash and cash equivalents 9 34,402 29,259 35,992

--------------------------------------- ----- --------- --------- -------------

205,537 97,846 83,098

--------------------------------------- ----- --------- --------- -------------

Total assets 312,743 209,886 193,145

--------------------------------------- ----- --------- --------- -------------

Current liabilities

Trade and other payables (175,169) (74,021) (53,046)

Current tax liabilities (1,471) (1,924) (2,948)

Lease liabilities (871) (784) (857)

--------------------------------------- ----- --------- --------- -------------

(177,511) (76,729) (56,851)

--------------------------------------- ----- --------- --------- -------------

Non-current liabilities

Provisions 10 (389) (389) (389)

Deferred tax liability 8 (3,793) (4,104) (4,152)

Lease liabilities (1,582) (2,488) (2,059)

--------------------------------------- ----- --------- --------- -------------

Total liabilities (183,275) (83,710) (63,451)

--------------------------------------- ----- --------- --------- -------------

Net assets 129,468 126,176 129,694

--------------------------------------- ----- --------- --------- -------------

Equity

Share capital 11 60 60 60

Merger reserve 8 94,312 94,312 94,312

Own shares held by an Employee Benefit

Trust 12 (15,373) (14,649) (14,649)

Capital redemption reserve 4,532 4,532 4,532

Retained earnings 45,937 41,921 45,439

--------------------------------------- ----- --------- --------- -------------

Total equity shareholders' funds 129,468 126,176 129,694

--------------------------------------- ----- --------- --------- -------------

Unaudited Condensed Consolidated Statement of Cash Flows

for the six months ended 31 March 2021

Unaudited Unaudited

six months six months Audited

to to year to

31 March 31 March 30 September

2021 2020 2020

Notes GBP000 GBP000 GBP000

Cash flows from operating activities:

--------------------------------------------------- ----- ------------------------ ----------- --------------

Profit after taxation 5,155 3,205 5,890

Adjustments to reconcile profit to net cash

flow from operating activities:

Tax on continuing operations 6 1,041 2,140 3,714

Finance revenue - (17) (20)

Interest payable on leases 51 34 93

Depreciation - fixed assets 371 301 617

Depreciation - leases 285 327 689

Gain on sale of financial asset at fair value

through profit and loss - (13) (13)

(Gain)/loss on revaluation of financial assets

at fair value through profit and loss (242) 241 6

Increase in employee benefit liability 970 1,182 1,182

Purchase of plan assets (held for employee

benefits liability) (970) (1,182) (1,182)

Amortisation of intangible assets 8 2,379 2,055 4,517

Share-based payment expense 12 2,067 1,636 3,581

(Increase)/decrease in trade and other receivables (123,967) (13,866) 8,479

Increase/(decrease) in trade and other payables 122,123 1,419 (19,533)

Cash generated from operations 9,263 (2,538) 8,020

Income tax paid (2,607) (1,791) (3,226)

--------------------------------------------------- ----- ------------------------ ----------- --------------

Net cash flow from operating activities 6,656 (4,329) 4,794

--------------------------------------------------- ----- ------------------------ ----------- --------------

Cash flows from investing activities:

Interest received - 17 20

Acquisition of assets at fair value through

profit and loss (1,216) (11,308) (12,166)

Proceeds from disposal of assets at fair value

through profit and loss 836 10,290 10,304

Purchase of property and equipment (7) (120) (138)

Cash acquired on merger - 27,296 27,296

--------------------------------------------------- ----- ------------------------ ----------- --------------

Net cash flow from investing activities (387) 26,175 25,316

--------------------------------------------------- ----- ------------------------ ----------- --------------

Cash flows from financing activities:

Lease payments (475) (145) (566)

Exercise of options - 127 127

Purchase of owns shares held an EBT 12(a) (724) (2,669) (2,669)

Equity dividends paid 3 (6,660) (10,589) (11,699)

Net cash flow from financing activities (7,859) (13,276) (14,807)

--------------------------------------------------- ----- ------------------------ ----------- --------------

(Decrease)/increase in cash and cash equivalents (1,590) 8,570 15,303

Opening cash and cash equivalents 35,992 20,689 20,689

--------------------------------------------------- ----- ------------------------ ----------- --------------

Closing cash and cash equivalents 9 34,402 29,259 35,992

--------------------------------------------------- ----- ------------------------ ----------- --------------

Notes to the Unaudited Condensed Consolidated Financial

Statements

for the six months ended 31 March 2021

1. Basis of accounting

These interim unaudited Condensed Consolidated Financial

Statements do not constitute statutory accounts within the meaning

of section 435 of the Companies Act 2006. They have been prepared

on the basis of the accounting policies as set out in the Group's

Annual Report for the year ended 30 September 2020.

The interim unaudited Condensed Consolidated Financial

Statements to 31 March 2021 have been prepared in accordance with

IAS 34 'Interim Financial Reporting' and the Listing Rules of the

Financial Conduct Authority.

Premier Miton Group plc (the 'Group') is the Parent Company of a

group of companies which provide a range of investment management

services in the United Kingdom and Channel Islands.

The Group's 2020 Annual Report is prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by

the European Union, and is available on the Premier Miton Group plc

website (www.premiermiton.com).

The Group has considerable financial resources and ongoing

investment management contracts. As a consequence, the Directors

believe that the Group demonstrates the financial resilience

required to manage its business risks successfully. The Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for a period of at least

twelve months after the date the interim financial statements are

signed. Thus, the Directors continue to adopt the going concern

basis of accounting in preparing the interim unaudited Condensed

Consolidated Financial Statements. The Directors note that the

Group has no external borrowings and maintains significant levels

of cash reserves. The Group has conducted financial modelling at

materially lower levels of AuM with the business remaining cash

generative. The Directors have also reviewed and examined the

financial stress testing inherent in the Internal Capital Adequacy

Assessment Process ('ICAAP').

These interim unaudited Condensed Consolidated Financial

Statements were approved and authorised for issue by the Board

acting through a duly authorised committee of the Board of

Directors on 27 May 2021.

The full-year accounts to 30 September 2020 were approved by the

Board of Directors on 25 November 2020 and have been

delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006. The figures for the

six months ended 31 March 2021 and the six months ended 31 March

2020 have not been audited.

The interim unaudited Condensed Consolidated Financial

Statements are presented in Sterling and all values are rounded

to the nearest thousand pounds (GBP000) except where otherwise

indicated.

Forward looking statements

These interim unaudited Condensed Consolidated Financial

Statements are made by the Directors in good faith based on

information available to them at the time of their approval of the

accounts. Forward looking statements should be treated with caution

due to the inherent uncertainties, including economic, regulatory

and business risk factors underlying any such statement. The

Directors undertake no obligation to update any forward looking

statement whether as a result of new information, future events or

otherwise. The interim unaudited Condensed Consolidated Financial

Statements have been prepared to provide information to the Group's

shareholders and should not be relied upon by any other party or

for any other purpose.

IFRS 16 'Leases'

The Directors have applied the IFRS 16 modified retrospective

approach with the cumulative effect of adopting IFRS 16 being

recognised as an adjustment to the opening balance of retained

earnings as at 1 October 2019. In the comparative period, the

adoption of IFRS 16 resulted in an increase in depreciation of

GBP326,730 and finance costs of GBP33,695. Other administration

expenses decreased by GBP184,425.

2. Segmental reporting

The Group has only one business operating segment, asset

management for reporting and control purposes.

IFRS 8 'Operating Segments' requires disclosures to reflect the

information which the Group's management uses for evaluating

performance and the allocation of resources. The Group is

managed as a single asset management business and as such, there

are no additional operating segments to disclose. Under IFRS 8, the

Group is also required to make disclosures by geographical

segments. As Group operations are solely in the UK and Channel

Islands, there are no additional geographical segments to

disclose.

3. Dividend

The final dividend for the year ended 30 September 2020 of 4.5p

per share was paid on 12 February 2021 resulting in a distribution

of GBP6,659,616. This is reflected in the Consolidated Statement of

Changes in Equity (2020 HY: GBP10,588,834).

4. Revenue

Revenue recognised in the Consolidated Statement of

Comprehensive Income is analysed as follows:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

---------------- ------------ ------------ -------------

Management fees 43,306 38,591 77,506

Commissions 267 3 7

Other income 305 (80) 208

---------------- ------------ ------------ -------------

Total revenue 43,878 38,514 77,721

---------------- ------------ ------------ -------------

All revenue is derived from the United Kingdom and Channel

Islands.

5. Exceptional items and merger-related costs

Recognised in arriving at operating profit from continuing

operations:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

-------------------------- ------------ ------------ -------------

Fund development costs - 51 52

Connect development costs 64 94 164

Total exceptional items 64 145 216

-------------------------- ------------ ------------ -------------

Merger-related costs 667 2,091 2,560

Merger employment restructuring costs 546 891 1,907

Total merger-related costs 1,213 2,982 4,467

-------------------------------------- ----- ----- -----

Exceptional items are those items of income or expenditure that

are considered significant in size and/or nature to merit separate

disclosure and which are non-recurring.

Merger-related costs in the period totalling GBP667,026 (2020

HY: GBP2,091,208) represented legal and professional fees

associated with the merger with Miton Group plc of GBP25,496 and

merger integration costs of GBP641,530.

Employment restructuring costs arising as a result of the merger

totalled GBP546,057 (2020 HY: GBP891,103).

6. Taxation

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

-------------------------------------------------- ------------ ------------ -------------

Corporation tax charge 1,130 1,760 4,244

Deferred tax (credit)/charge (89) 380 (530)

-------------------------------------------------- ------------ ------------ -------------

Tax charge reported in the Consolidated Statement

of Comprehensive Income 1,041 2,140 3,714

-------------------------------------------------- ------------ ------------ -------------

An increase in the UK corporation tax rate from 19% to 25% was

announced in the Budget on 3 March 2021 and the Finance Bill on 11

March 2021 and expected to be effective from 1 April 2023. Deferred

tax has been calculated on the current rate, had the new rates been

applied the impact would be to increase the deferred tax asset by

GBP523,317 and increase in the deferred tax liability by

GBP771,300.

7. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to ordinary equity shareholders of the

Parent Company by the weighted average number of ordinary shares

outstanding during the period.

The weighted average of issued ordinary share capital of the

Company is reduced by the weighted average number of shares held by

the Group's Employee Benefit Trusts ('EBT'). Dividend waivers are

in place over shares held in the Group's EBTs.

In calculating diluted earnings per share, IAS 33 'Earnings Per

Share' requires that the profit is divided by the weighted

average

number of ordinary shares outstanding during the period plus the

weighted average number of ordinary shares that would be

issued on conversion of all the dilutive potential ordinary

shares into ordinary shares during the period.

(a) Reported earnings per share

Reported basic and diluted earnings per share has been

calculated as follows:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

---------------------------------------------------- ------------ ------------ -------------

Profit attributable to ordinary equity shareholders

of the Parent Company for basic earnings 5,155 3,205 5,890

No.000 No.000 No.000

Issued ordinary shares at 1 October 157,913 105,801 105,801

-Effect of own shares held by an EBT (9,928) (8,517) (9,220)

-Effect of shares issued - 39,297 45,705

Weighted average shares in issue 147,985 136,581 142,286

---------------------------------------------------- ------------ ------------ -------------

-Effect of movement in share options 8,067 4,610 5,056

---------------------------------------------------- ------------ ------------ -------------

Weighted average shares in issue - diluted 156,052 141,191 147,342

---------------------------------------------------- ------------ ------------ -------------

Basic earnings per share (pence) 3.48 2.35 4.14

Diluted earnings per share (pence) 3.30 2.27 4.00

---------------------------------------------------- ------------ ------------ -------------

(b) Adjusted earnings per share

Adjusted earnings per share is based on adjusted profit after

tax, where adjusted profit is stated after charging interest but

before share-based payments, amortisation, merger-related costs and

exceptional items.

Adjusted profit for calculating adjusted earnings per share:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

----------------------------------------------------- ------------ ------------ -------------

Profit before taxation 6,196 5,345 9,604

Add back:

-Share-based payment expense 2,067 1,636 3,581

-Amortisation of intangible assets 2,379 2,055 4,517

-Merger-related costs 1,213 2,982 4,467

-Exceptional items 64 145 216

----------------------------------------------------- ------------ ------------ -------------

Adjusted profit before tax 11,919 12,163 22,385

----------------------------------------------------- ------------ ------------ -------------

Taxation:

-Tax in the Consolidated Statement of Comprehensive

Income (1,041) (2,140) (3,714)

-Tax effect of adjustments (1,118) (71) (936)

----------------------------------------------------- ------------ ------------ -------------

Adjusted Profit after tax for the calculation

of adjusted earnings per share 9,760 9,952 17,735

----------------------------------------------------- ------------ ------------ -------------

Adjusted earnings per share was as follows using the number of

shares calculated at note 7(a):

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

pence Pence pence

---------------------------- ------------ ------------ -------------

Adjusted earnings per share 6.60 7.29 12.46

Diluted adjusted earnings

per share 6.25 7.05 12.04

---------------------------- ------------ ------------ -------------

8. Goodwill and other intangible assets

Cost amortisation and net book value of intangible assets are as

follows:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

Goodwill GBP000 GBP000 GBP000

----------------------------- ------------ ------------ -------------

Cost:

At 1 October 77,927 22,576 22,576

Additions - 55,881 55,351

----------------------------- ------------ ------------ -------------

At 31 March/30 September 77,927 78,457 77,927

----------------------------- ------------ ------------ -------------

Amortisation and impairment:

At 1 October 6,979 6,979 6,979

Amortisation during the - - -

period

----------------------------- ------------ ------------ -------------

At 31 March/30 September 6,979 6,979 6,979

----------------------------- ------------ ------------ -------------

Carrying amount:

----------------------------- ------------ ------------ -------------

At 31 March/30 September 70,948 71,478 70,948

----------------------------- ------------ ------------ -------------

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

Other intangible assets GBP000 GBP000 GBP000

------------------------- ------------ ------------ -------------

Cost:

At 1 October 81,025 56,231 56,231

Additions - 24,155 24,794

------------------------- ------------ ------------ -------------

At 31 March/30 September 81,025 80,386 81,025

------------------------- ------------ ------------ -------------

Accumulated amortisation

and impairment:

At 1 October 48,791 44,274 44,274

Amortisation during the

period 2,379 2,055 4,517

------------------------- ------------ ------------ -------------

At 31 March/30 September 51,170 46,329 48,791

------------------------- ------------ ------------ -------------

Carrying amount:

------------------------- ------------ ------------ -------------

At 31 March/30 September 29,855 34,057 32,234

------------------------- ------------ ------------ -------------

The additions to goodwill and intangible assets in the

comparative period relate solely to the acquisition of Miton Group

plc.

Intangible assets acquired in the business combination related

to the investment management agreements between Miton Group plc and

the funds to which it was the investment manager and the value

arising from the underlying client relationships.

The Group has determined that it has a single cash-generating

unit ('CGU') for the purpose of assessing the carrying value of

goodwill. Impairment testing is performed at least annually whereby

the recoverable amount of the goodwill is analysed via the

value-in-use method and compared to the respective carrying value.

During the period no impairment was identified.

9. Cash and cash equivalents

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2021 2020 2020

GBP000 GBP000 GBP000

------------------------- ------------ ------------ -------------

Cash at bank and in hand 34,402 29,259 35,992

------------------------- ------------ ------------ -------------

10. Provisions

GBP000

----------------------------- ------

At 1 October 2020 389

Additions -

----------------------------- ------

At 31 March 2021 (Unaudited) 389

----------------------------- ------

Current -

Non-current 389

----------------------------- ------

389

----------------------------- ------

At 1 October 2019 -

Arising on merger 389

------------------------------------------------------------- ---

At 31 March 2020 (Unaudited) and 30 September 2020 (Audited) 389

------------------------------------------------------------- ---

Provisions primarily relate to dilapidations for the offices at

6th Floor, Paternoster House, London, and the Group's disaster

recovery office in Reading. The lease on Paternoster House runs to

28 November 2023 and the provision for dilapidations on this office

has been disclosed as non-current.

11. Share capital

Ordinary

shares 0.02 Deferred

Allotted, called up and fully paid: pence each shares

Number of shares Number Number

------------------------------------------------------------- ------------ --------

At 1 October 2020 157,913,035 1

Issued - -

------------------------------------------------------------- ------------ --------

At 31 March 2021 (Unaudited) 157,913,035 1

------------------------------------------------------------- ------------ --------

At 1 October 2019 105,801,310 1

Issued on merger 52,111,725 -

------------------------------------------------------------- ------------ --------

At 31 March 2020 (Unaudited) and 30 September 2020 (Audited) 157,913,035 1

------------------------------------------------------------- ------------ --------

Ordinary shares Deferred

Allotted, called up and fully paid: 0.02 pence each shares Total

Value of shares GBP000 GBP000 GBP000

---------------------------------------------- ---------------- -------- -------

At 1 October 2020 31 29 60

Issued - - -

---------------------------------------------- ---------------- -------- -------

At 31 March 2021 (Unaudited) 31 29 60

---------------------------------------------- ---------------- -------- -------

At 1 October 2019 21 29 50

Issued on merger 10 - 10

---------------------------------------------- ---------------- -------- -------

At 31 March 2020 (Unaudited) and 30 September

2020 (Audited) 31 29 60

---------------------------------------------- ---------------- -------- -------

On 14 November 2019 the Company completed an all-share merger

with Miton Group plc. The Company issued 52,111,725 new ordinary

shares on 15 November 2019 ranked pari passu in all respects with

the Company's existing ordinary shares in issue.

12. Share-based payment

The total expense recognised for share-based payments in respect

of employee services received during the period to 31 March 2021

was GBP2,067,110 (2020 HY: GBP1,636,455).

During the period 3,980,000 (2020 HY: 2,075,000) nil cost

contingent share rights over ordinary shares of 0.02p in the

Company

were granted to 36 employees (2020 HY: nine). Of the total

award, 550,000 (2020 HY: 150,000) nil cost contingent share rights

were awarded to Executive Directors. The awards will be satisfied

from the Group's EBTs.

The share-based payment expense is calculated in accordance with

the fair value of the contingent share rights on the date of grant.

The price per right at the date of grant was GBP1.44 on 10 March

2021 for 3,680,000 and GBP1.42 on 17 March 2021 for 300,000,

resulting in a fair value of GBP5,725,200 to be expensed over the

vesting periods of three to five years.

The key features of the awards include: a three to five-year

vesting term, automatic vesting at the relevant anniversary date

with the delivery of the shares to the participant within 30 days

of the relevant vesting date.

After the period end on 12 April 2021, 664,795 nil cost

contingent share rights over ordinary shares of 0.02p in the

Company were exercised by 30 employees; of the total nil were

exercised by an Executive Director.

(a) Employee Benefit Trusts

Premier Miton Group plc established an EBT on 25 July 2016 to

purchase ordinary shares in the Company to satisfy share awards to

certain employees.

During the period 500,000 (2020 HY: 1,894,043) shares were

acquired and held by the Group's EBTs at a cost of GBP723,670

(2020 HY: GBP2,668,525).

At 31 March 2021 10,421,565 (2020 HY: 9,921,565) shares are held

by the Group's EBTs, all shares (2020 HY: 7,324,487) relate to

outstanding awards.

At 31 March 2021, the cost of the shares held by the EBTs of

GBP15,372,639 (2020 HY: GBP14,648,840) has been disclosed as own

shares held by an EBT in the Consolidated Statement of Changes in

Equity and the Consolidated Statement of Financial Position.

13. Subsequent events post balance sheet

(a) COVID-19

As at 27 May 2021 the ongoing coronavirus ('COVID-19') pandemic

is being kept under review by the Group. Premier Miton Group plc

continues to carefully manage its cost base and communicate

regularly with employees, shareholders, clients, IFAs and

intermediaries and other suppliers. COVID-19 is monitored in the

context of the Group's risk and control framework.

(b) Employee Benefit Trust

After the period end and as at 25 May 2021, the last practicable

date prior to publication of this Interim Report, 1,981,572 shares

were acquired and held by the Group's EBTs at a cost of

GBP3,073,367.

On 10 May 2021 226,395 Management Equity Incentive ('MEI')

awards over ordinary shares of 0.02p in the Company held

by an Executive Director lapsed.

Management currently assesses these events to represent

non-adjusting subsequent events as at the interim reporting

date

of 31 March 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUBUAUPGGRM

(END) Dow Jones Newswires

May 28, 2021 02:00 ET (06:00 GMT)

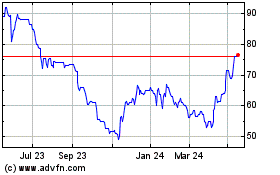

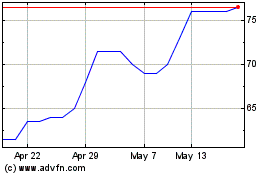

Premier Miton (LSE:PMI)

Historical Stock Chart

From Jul 2024 to Aug 2024

Premier Miton (LSE:PMI)

Historical Stock Chart

From Aug 2023 to Aug 2024