TIDMPFD TIDMIRSH

RNS Number : 1899N

Premier Foods plc

19 January 2023

19 January 2023

Premier Foods plc (the "Company" or the "Group")

A strong Quarter 3, well on track to deliver full year expectations

Premier Foods today provides its Quarter 3 trading update for

the thirteen weeks ended 31 December 2022

-- Q3 Group sales up 12.0% versus prior year; Q3 Branded sales

up 8.8%

-- Particularly strong Grocery performance, Q3 sales up 17.4%

-- Grocery business continues to grow faster than its markets,

gaining 66 basis points of value share(1)

-- Sweet Treats Q3 sales down (0.9%)

-- International sales up 10%(2) , another quarter of double-digit

growth

-- Announcing proposed closure of loss-making, predominantly

non-branded, Knighton manufacturing site

-- Well on track to deliver on FY22/23 expectations

Note: Headline results presented for the quarter exclude The

Spice Tailor unless otherwise stated

Alex Whitehouse, Chief Executive Officer

"We delivered a strong trading performance in our important

third quarter, with sales growth of 12% compared to the same period

last year. These results illustrate the continuing appeal of our

portfolio of market-leading brands in such a challenging

environment and demonstrate the strength and resilience of our

branded growth model."

"Our major Grocery brands produced a particularly good set of

results for us, continuing to grow faster than the market, taking

66 basis points of share(1) . Across the country, people got

cooking again this Christmas, demonstrating that the Best

Restaurant in Town really is at home. Many of our leading brands

grew strongly, with established seasonal favourites including

Ambrosia custard and new launches such as Bisto pigs-in-blankets

gravy granules all proving very popular. Mr Kipling had another

strong performance, with the introduction of our non-HFSS

Deliciously Good Festive Pies helping to grow our Mince Pie market

share. Meanwhile, our International business has now reported

another quarter of double-digit sales growth, with Sharwood's

growing over 20% following major new listings in Canada."

"Input cost inflation remains at elevated levels, and we

continue to take action to offset this inflation through a range of

measures. With strong trading momentum as we enter our final

quarter of the year, and with more brand investment and new product

launches to come, we are well on track to deliver on expectations

for the full year."

Trading update

================

Grocery

The Grocery business enjoyed a particularly strong quarter as

total sales increased by 17.4% and branded sales grew by 15.5%

versus last year. This growth was broad based, with all of the

Group's major brands performing strongly; demonstrating the

continued effectiveness of the Group's proven branded growth model.

Pricing contributed a significant proportion of revenue growth in

the quarter and demand was particularly buoyant running into the

key festive period. Sales of The Spice Tailor again grew by

double-digit and its integration into the Group continues to

progress well. Additionally, the 'Best Restaurant in Town'

campaign, which helps people cook and prepare tasty and affordable

meals, has been well received, and will be extended further in Q4 .

Non-branded sales grew by 29.6% due to pricing benefit in retailer

branded product categories and continued recovery in out of home

sales compared to the prior year.

Sweet Treats

Sweet Treats sales were (0.9%) lower in the period, with branded

sales down (10.8%) and non-branded sales up 22.8%. Mr Kipling sales

increased in the quarter helped by growth of Angel, Lemon and

Chocolate slices, and the launch of new non-HFSS(3) Mr Kipling

Deliciously Good Festive Pies delivered market share gains in the

Mince Pie category. Cadbury cake was impacted by some unscheduled

maintenance associated with one plant line, which has since been

completed and full production now resumed. The continued growth

trend in Non-branded Sweet Treats was again due to contract gains

in pies and tarts as well as pricing benefits.

International

International continues to progress strongly, reporting another

quarter of double-digit sales growth in Quarter 3. Sales increased

by 10%(2) in the period reflecting growth of Sharwood's and Mr

Kipling, notably in Canada and Europe. Sharwood's sauces growth was

particularly strong in Canada due to new listings in Walmart. In

Australia, Mr Kipling cake again increased sales in double-digit

percentage terms and continues to grow share and household

penetration. Following a successful test of Mr Kipling in US Target

stores, the Group is now exploring opportunities for further

distribution expansion.

Proposed closure of Knighton manufacturing site

================================================

Knighton manufactures predominantly non-branded powdered

beverages, so is not aligned to the Group's branded growth model

strategy and is marginally unprofitable at Trading profit.

Following a comprehensive review of the site, the Company is

entering into colleague consultation on its proposed closure.

Under these proposals, effective from mid-2023, non-branded

revenue contracts of c.GBP27m sales will be carefully managed for

exit. Cash exceptional costs of c.GBP10m associated with closure

are expected to be incurred in FY23/24. This proposed closure will

be accretive to Trading profit and increase branded sales mix by

270 basis points.

It is recognised that this will be an unsettling time for those

c.300 colleagues who are potentially affected by these proposals,

and they will be fully supported and consulted with throughout the

process.

Outlook

========

The Group has delivered another strong quarter of trading,

further demonstrating the strength and resilience of its branded

growth model, set against the backdrop of a particularly

challenging consumer environment. Input cost inflation remains at

elevated levels and is being offset through a combination of cost

savings and annual price increases. With strong momentum entering

the fourth quarter of the year, and more brand investment and new

product launches to come, the Group remains well on track to

deliver on expectations for this financial year. In the

medium-term, the Company expects to make further significant

strategic progress, through delivery of its five pillar growth

strategy.

Ends

As one of the UK's largest food businesses, we're passionate

about food and believe each and every day we have the opportunity

to enrich life for everyone. Premier Foods employs over 4,000

people operating from 15 sites across the country, supplying a

range of retail, wholesale, foodservice and other customers with

our iconic brands which feature in millions of homes every day.

Through some of the nation's best-loved brands, including

Ambrosia, Batchelors, Bisto , Loyd Grossman, Mr. Kipling, Oxo and

Sharwood's, we're creating great tasting products that contribute

to healthy and balanced diets, while committing to nurturing our

people and our local communities, and going further in the pursuit

of a healthier planet , in line with our Purpose of 'Enriching Life

Through Food'.

Contacts:

Institutional investors and analysts:

Duncan Leggett, Chief Financial Officer

Richard Godden, Director of Investor Relations

Investor.relations@premier foods.co.uk

Media enquiries:

Lisa Kavanagh, Director of Communications

Headland

Ed Young +44 (0) 7884 666830

Jack Gault +44 (0) 7799 089357

Conference call

================

A conference call for investors and analysts hosted by Alex

Whitehouse, CEO and Duncan Leggett, CFO, will take place today, 19

January 2023, at 9.00am, details of which are outlined below. A

replay of the conference call will be available on the Company's

website later in the day:

www.premierfoods.co.uk/investors/results-centre

Telephone number: 0800 640 6441 (UK toll free)

+44 20 3936 2999 (standard international access)

Access code: 216675

- Ends -

This announcement may contain "forward-looking statements" that

are based on estimates and assumptions and are subject to risks and

uncertainties. Forward-looking statements are all statements other

than statements of historical fact or statements in the present

tense, and can be identified by words such as "targets", "aims",

"aspires", "assumes", "believes", "estimates", "anticipates",

"expects", "intends", "hopes", "may", "would", "should", "could",

"will", "plans", "predicts" and "potential", as well as the

negatives of these terms and other words of similar meaning. Any

forward-looking statements in this announcement are made based upon

Premier Foods' estimates, expectations and beliefs concerning

future events affecting the Group and subject to a number of known

and unknown risks and uncertainties. Such forward-looking

statements are based on numerous assumptions regarding the Premier

Foods Group's present and future business strategies and the

environment in which it will operate, which may prove not to be

accurate. Premier Foods cautions that these forward-looking

statements are not guarantees and that actual results could differ

materially from those expressed or implied in these forward-looking

statements. Undue reliance should, therefore, not be placed on such

forward-looking statements. Any forward-looking statements

contained in this announcement apply only as at the date of this

announcement and are not intended to give any assurance as to

future results. Premier Foods will update this announcement as

required by applicable law, including the Prospectus Rules, the

Listing Rules, the Disclosure and Transparency Rules, London Stock

Exchange and any other applicable law or regulations, but otherwise

expressly disclaims any obligation or undertaking to update or

revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.

Notes to editors:

Q3 Sales FY22/23 The Spice FY22/23 FY21/22 Change vs

(GBPm) Tailor 1 year ago

(including (excluding (excluding

TST) TST) TST)

Grocery

Branded 201.6 3.7 197.9 171.3 15.5%

Non-branded 34.0 - 34.0 26.2 29.6%

----------- --------- ----------- -------- -----------

Total 235.6 3.7 231.9 197.5 17.4%

Sweet Treats

Branded 52.2 - 52.2 58.5 (10.8%)

Non-branded 30.2 - 30.2 24.6 22.8%

----------- --------- ----------- -------- -----------

Total 82.4 - 82.4 83.1 (0.9%)

Group

Branded 253.8 3.7 250.1 229.8 8.8%

Non-branded 64.2 - 64.2 50.8 26.3%

----------- --------- ----------- -------- -----------

Total 318.0 3.7 314.3 280.6 12.0%

----------- --------- ----------- -------- -----------

Q3 YTD Sales FY22/23 The Spice FY22/23 FY21/22 Change vs

(GBPm) Tailor 1 year ago

(including (excluding (excluding

TST) TST) TST)

Grocery

Branded 458.8 5.0 453.8 416.2 9.0%

Non-branded 80.8 - 80.8 65.4 23.5%

----------- --------- ----------- -------- -----------

Total 539.6 5.0 534.6 481.6 11.0%

Sweet Treats

Branded 154.5 - 154.5 158.5 (2.5%)

Non-branded 43.7 - 43.7 34.6 26.4%

----------- --------- ----------- -------- -----------

Total 198.2 - 198.2 193.1 2.6%

Group

Branded 613.3 5.0 608.3 574.7 5.9%

Non-branded 124.5 - 124.5 100.0 24.5%

----------- --------- ----------- -------- -----------

Total 737.8 5.0 732.8 674.7 8.6%

----------- --------- ----------- -------- -----------

1. Market share data sourced from IRI, 12 weeks ended 31 December

2022

2. International sales stated on a constant currency basis

3. Non-HFSS: Food or drinks not high in fat, salt or sugar

4. Sales data is for the thirteen weeks to 31 December 2022 and

the comparative period, the thirteen weeks ended 1 December

2022. Headline results in the statement are stated excluding

The Spice Tailor

5. All financial data detailed above is unaudited and has not been

subject to review by the Company's auditors

6. Additional notes on the Knighton manufacturing site proposed

closure:

-- Group revenue branded mix will increase by c.270 basis points to c.89% (on FY21/22 pro forma

basis)

-- Cash exceptionals of c.GBP10m are expected to be incurred in FY23/24 to cover redundancy and

restructuring costs. These costs will be provided for in FY22/23 under non-trading items within

Operating profit. There will be no cash exceptional costs incurred in FY22/23.

-- Certain branded products currently manufactured at Knighton will be transferred to other Group

sites, with no changes expected to take effect until mid-2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFETLVITLIV

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

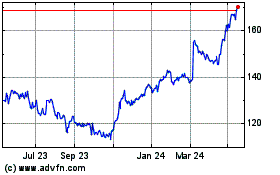

Premier Foods (LSE:PFD)

Historical Stock Chart

From May 2024 to Jun 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Jun 2023 to Jun 2024