Mulberry Group PLC Trading Update (0212F)

April 17 2014 - 2:00AM

UK Regulatory

TIDMMUL

RNS Number : 0212F

Mulberry Group PLC

17 April 2014

Mulberry Group PLC ("Mulberry")

Trading update

Mulberry Group plc, the English luxury brand, following the

recent management changes and a review of the business, is updating

the market on trading for the year to 31 March 2014 and the outlook

for the current year.

Year ended 31 March 2014

Turnover for the year ended 31 March 2014 will be broadly in

line with expectations whilst on an underlying basis, profit before

tax is expected to be marginally below current expectations.

Following a detailed review, it has been decided to impair the

net carrying value of fixed assets of two US stores, creating a

non-cash charge for the year ended 31 March 2014 of GBP2.7m. This

combined with the costs of the recent management change mean that

the profit before tax for the year ended 31 March 2014 is expected

to be approximately GBP14 million.

Outlook

Since the appointment three weeks ago of Godfrey Davis as

Interim Executive Chairman, a review of operations and strategy has

been undertaken with the management team. The primary objective is

to reinvigorate sales by the introduction of more affordable new

product.

We remain committed to our strategy of international expansion,

but the rate of own store openings has been slowed down to five for

2014/15 from eight for 2013/14 in order to control costs whilst

existing stores achieve greater traction. The new factory in

Somerset, which opened in June, is fully operational with over 300

employees. The last of these joined during April 2014 and now

attention is being devoted to their training and maximising

production efficiency.

As a consequence of these factors, in particular the pricing

strategy, there will be a material adverse impact on profit whilst

brand momentum rebuilds.

Godfrey Davis, Interim Executive Chairman, commented:

"Following the recent change in management, we are focussing on

achieving sales growth through the reinforcement of our product

offering at more affordable prices to meet the expectations of our

loyal customers. This will have short term financial consequences

but is necessary to ensure the future strength of the Mulberry

brand. The Group remains profitable and cash generative, giving us

the resources to invest for the future."

For further details please contact:

Bell Pottinger

Dan de Belder 020 7861 3881 / 07977 927142

Altium

Ben Thorne / Katherine

Hobbs 020 7484 4040

Barclays

Marcus Jackson / Nicola

Tennent 020 3623 2323

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTQKADDABKDAQD

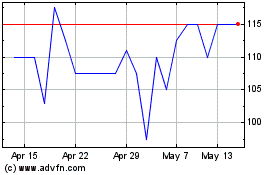

Mulberry (LSE:MUL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mulberry (LSE:MUL)

Historical Stock Chart

From Jul 2023 to Jul 2024