TIDMLRE

LANCASHIRE HOLDINGS LIMITED

10 August 2023

Hamilton, Bermuda

Lancashire Holdings Limited ("Lancashire" or "the Group") today announces its

results, under IFRS 17, for the six months ended 30 June 2023.

Highlights:

· Gross premiums written increased by 26.2% to $1,184 million,

insurance revenue of $720.9 million.

· Insurance service result $188.8 million; profit after tax $159.2

million.

· Discounted combined ratio 71.4%, undiscounted combined ratio 79.2%.

· Total net investment return of 2.2%.

· Interim dividend of $0.05 per common share.

For the six months ended 30 June 2023 2022

$m $m

Highlights

Gross premiums written 1,184.0 938.1

Insurance revenue 720.9 579.8

Insurance service result 188.8 141.5

Net investment return 63.2 (85.8)

Profit after tax 159.2 31.0

Financial ratios

Net insurance ratio 62.8% 64.3%

Combined ratio (discounted) 71.4% 72.6%

Combined ratio (undiscounted) 79.2% 77.1%

Net investment return 2.2% (3.8%)

Per Share data

Diluted book value per share $6.05 $5.75

Change in diluted book value per share 12.2% 2.6%

Dividends per common share for the financial year $0.05 $0.05

Diluted earnings per share $0.66 $0.13

Adoption of new accounting standards

The Group adopted IFRS 17, Insurance Contracts and IFRS 9, Financial

Instruments: Classification and Measurement, for the first time on 1 January

2023. The unaudited condensed interim consolidated financial statements for the

six months ended 30 June 2023 are being reported under these new accounting

standards, which have resulted in a change to some of the Group's long standing

Alternative Performance Measures (APMs). These are defined at the end of this

release. Comparatives have been restated to reflect the consistent application

of IFRS 9 and IFRS 17.

Alex Maloney, Group Chief Executive Officer, commented:

"We are very pleased with our performance in the first half of 2023. Our long

-term strategy to develop a more diversified and capital-efficient product

portfolio is delivering the expected benefits, with a half year change in

diluted book value per share of 12.2%.

Our philosophy has always been to grow when market conditions are favourable,

while maintaining our approach to underwriting discipline. During the first six

months of 2023 we continued to take advantage of the strong underwriting

environment with gross premiums written increasing 26.2% year-on-year. The

undiscounted combined ratio was a healthy 79.2%, or 71.4% on a discounted basis.

The rating environment remains positive across our product lines and we do not

see that changing during the remainder of the year.

Our investments have delivered a positive net return of 2.2% or $63.2 million as

we benefit from higher yields due to the short duration of the portfolio.

Lancashire has long been recognised as a business that actively manages the

underwriting cycle and, when it makes sense to do so, seeks new areas for

disciplined growth.

With that in mind, subject to all necessary approvals, we intend to expand our

international footprint and launch Lancashire Insurance U.S., which will operate

under a delegated underwriting arrangement with Lancashire's UK company

platform.

Lancashire Insurance U.S. will be complementary to our existing capabilities and

will give us the ability to write business that is within our appetite and that

we currently do not have access to.

The new operation in the U.S. is expected to begin underwriting in early 2024.

This is another positive development for Lancashire and, with our reputation for

underwriting excellence and service to our clients, we believe there are

significant long-term prospects for us in the U.S.

We are excited by the opportunities ahead of us during the remainder of 2023 and

into 2024. Our capital position remains strong, giving us the headroom to

continue to take advantage of the positive market conditions.

Of course, striving to deliver out-performance requires a committed and focused

team across the business. I would particularly like to mention our finance and

actuarial colleagues who have been exceptionally busy producing our first set of

results on an IFRS 17 basis. While this is a significant change in accounting

and presentation, IFRS 17 does not affect the fundamentals of our business or

our underlying profitability.

We always seek to attract, develop and retain good people and promote our talent

when the appropriate opportunities arise and during the first half of the year

we made a number of new senior appointments across our teams.

The Group also continues to focus on delivering on our environmental, social and

governance objectives. The Lancashire Foundation, which has been operating since

2007, makes a tangible difference through its support for charities that have a

positive impact on our communities and the environment. Additionally, we benefit

from being part of the insurance industry's discussions around climate change

through our membership of ClimateWise, which we joined last year.

Finally, I would like to take the opportunity to thank everyone at Lancashire

for their commitment to our business and, as always, our clients, brokers and

shareholders for their support."

Six months Six months

ended 30 ended 30

June 2023 June 2022

Reinsurance Insurance Total Reinsurance Insurance Total

$m $m $m $m $m $m

Gross premiums 658.0 526.0 1,184.0 548.8 389.3 938.1

written

RPI% 123% 111% 117% 107% 105% 106%

Insurance 336.6 384.3 720.9 261.4 318.4 579.8

revenue

Insurance (88.1) (200.4) (288.5) (117.3) (176.5) (293.8)

service

expenses

Insurance 248.5 183.9 432.4 144.1 141.9 286.0

service result

before

reinsurance

contracts

held

Allocation of (89.3) (123.4) (212.7) (74.3) (109.5) (183.8)

reinsurance

premium

Amounts (66.0) 35.1 (30.9) (6.7) 46.0 39.3

recoverable

from

reinsurers

Net expense (155.3) (88.3) (243.6) (81.0) (63.5) (144.5)

from

reinsurance

contracts held

Insurance 93.2 95.6 188.8 63.1 78.4 141.5

service result

Gross premiums written

Gross premiums written increased by $245.9 million or 26.2% for the first six

months of 2023 compared to the same period in 2022. The Group's two principal

segments, and the key market factors impacting them, are discussed below.

Reinsurance segment

A significant portion of the increase in premiums in the reinsurance segment was

due to the continued build out of our casualty reinsurance lines as well as new

business written in our specialty reinsurance class. In property reinsurance we

saw the benefit of significant rate increases contributing to growth. Overall

the RPI was 123% for the segment.

Insurance segment

The growth in the insurance segment was primarily driven by property insurance

with substantial rate increases in the property direct and facultative line of

business, in addition to the build out of our Australia and construction teams.

New business written across all of our energy and marine insurance lines also

contributed to the strong premium growth. In specialty insurance, the Group

wrote more political risk business on a multi-year basis than the prior year

while really strong RPIs contributed to the growth in aviation insurance.

Overall the RPI was 111% for the segment.

Insurance revenue

Insurance revenue is a new measure introduced by IFRS 17 and is comparable to

IFRS 4 gross premiums earned less inwards reinstatement premium and is net of

commission costs. Insurance revenue increased by $141.1 million or 24.3% in the

first six months of 2023 compared to the same period in 2022. The market factors

driving the increase in gross premiums written also drove the increase in

insurance revenue. Gross premiums earned as a percentage of gross premiums

written was 69.8% compared to 68.0% in the prior year as more earned premium

came through in the current year from policies bound in the prior year.

Allocation of reinsurance premiums

Allocation of reinsurance premiums on an IFRS 17 basis is comparable to IFRS 4

ceded earned premium less outward reinstatement premiums and is net of outward

commission costs. Allocation of reinsurance premiums increased by $28.9 million

or 15.7% in the first six months of 2023 compared to the same period in 2022.

The increase in our outwards reinsurance spend was primarily driven by the

renewal of the Group's outward reinsurance programme at higher rates than in

2022. There was also a higher level of political risk and casualty quota share

reinsurance spend driven by the growth in inwards business and some new outwards

reinsurance contracts entered into as a result of the continued growth and

diversification in the inwards underwriting portfolio.

Net Claims environment (Insurance service expenses less amounts recoverable from

reinsurers)

During the first six months of 2023, the Group experienced net losses

(undiscounted, including reinstatement premiums) from catastrophe and large loss

events totaling $49.5 million. None of these events was individually material

for the Group.

During the first six months of 2022, the Group experienced net losses

(undiscounted, including reinstatement premiums) from the conflict in Ukraine,

the Australian floods and large loss events totaling $53.1 million.

Prior year favourable ultimate loss development for the first six months of 2023

was $46.3 million, compared to $64.6 million of favourable development in 2022.

The favourable development in 2023 was primarily due to releases on the 2022 and

2021 accident year across most lines of business due to a lack of reported

claims, as well as favourable development across some of the older accident

years. On an IFRS 17 basis, the prior year favourable development is $72.1

million. This includes $11.3 million favourable expense provision releases as

well as $13.6 million of reinstatement premium impact, largely due to a

reduction in outwards reinstatement premiums on catastrophe losses.

In the prior year the Group benefited from general reserve releases on the 2021

accident year due to a lack of reported claims, as well as some favourable

development on some large claims from the 2018 and 2017 accident years.

Net discounting benefit

The table below shows the total net impact of discounting, by financial

statement line item.

For the six months ended 30 June 2023 2022

$m $m

Insurance service expenses 46.5 26.3

Amounts recoverable from reinsurers (7.1) (8.3)

Net discount included in insurance service result 39.4 18.0

Finance (expense) income from insurance contracts issued (37.7) 28.0

Finance income (expense) from reinsurance contracts held 14.1 (9.5)

Net discount included in insurance finance (expense) income (23.6) 18.5

Total net impact of discounting 15.8 36.5

The total impact of discounting was a benefit of $15.8 million for the first six

months of 2023 compared to $36.5 million in the prior year. The discount

included in the insurance service result is higher than the same period in 2022

primarily due to reserves established on the 2023 accident year applying higher

discount rates than the same period in the prior year. This is partly offset by

the unwind of previously booked discounting included in net finance income. The

majority of the Group's loss reserves are denominated in U.S. dollar where yield

curves, having decreased in the first quarter of 2023, have returned to levels

more aligned with the year-end position. The net effect is that the impact of

changes in yield curve assumptions has been relatively minor at $2.1 million.

In the prior year the discounting benefit was primarily driven by the impact of

a change in yield curve assumptions. There were significant increases in yield

curves throughout the year and across the majority of the Group's major

currencies.

Investments

For the six months ended 30 June 2023 2022

$m $m

Total net investment return 63.2 (85.8)

Total net investment return increased by $149 million in the first six months of

2023 compared to the same period in 2022.

The Group's investment portfolio, including unrealised gains and losses,

returned 2.2% for the first six months of 2023. The positive returns were driven

by $51.4 million of investment income as our portfolio benefitted from higher

yields. The majority of the unrealised gains were generated in the first quarter

on the fixed maturity portfolio due to a decline in treasury rates outside of

the one-year rate. In the second quarter, investment income mitigated the

negative returns from the upward shift in the yield curve. All asset classes

performed positively, with most of the returns in the second quarter driven by

the alternative asset classes.

The Group's investment portfolio, including unrealised gains and losses,

returned negative 3.8% for the first six months of 2022. The majority of the

losses were driven by the significant flattening of the yield curve and spread

widening for the investment grade corporate debt and bank loans.

The managed portfolio was invested as follows:

As at 30 June 2023 31 December 2022

Fixed maturity securities 2,157.3 1,964.9

Managed cash and cash equivalents 214.0 260.8

Private investment funds 112.7 108.1

Hedge funds 104.4 103.9

Index Linked securities - 28.2

Other investments (0.1) (0.2)

Total 2,588.3 2,465.7

Key investment portfolio statistics for our fixed maturities and managed cash

were:

As at 30 June 2023 31 December 2022

Duration 1.7 years 1.6 years

Credit quality AA- AA-

Book yield 3.7% 2.9%

Market yield 5.6% 5.0%

Other operating expenses

For the six months ended 30 June 2023 2022

$m $m

Total operating expenses 83.1 68.4

Directly attributable expenses (39.3) (35.7)

allocated to insurance service

expenses

Other operating expenses 43.8 32.7

Total operating expenses were $83.1 million in the first six months of 2023

compared to $68.4 million in the first six months of 2022. The higher level of

total operating expenses was primarily driven by employee remuneration costs,

which have grown as a result of the increase in headcount across the Group. Non

-employee costs increased to a lesser degree driven by increased IT expenditure,

consulting fees and costs associated with taking on additional London office

space.

The weakening Sterling/U.S. Dollar exchange rate relative to the prior year

partly offset this increase in the underlying cost base.

$39.3 million or 47% of operating expenses are considered directly attributable

to the fulfillment of (re)insurance contracts and have been re-allocated to

insurance service expenses and form part of the insurance service result.

Capital

As at 30 June 2023, total capital available to Lancashire was approximately $1.9

billion, comprising shareholders' equity of $1.5 billion and $0.4 billion of

long-term debt. Tangible capital was $1.7 billion. Leverage was 23.3% on total

capital and 25.7% on tangible capital. Total capital and total tangible capital

as at 30 June 2022 was $1.8 billion and $1.6 billion respectively.

Dividends

On 9 August 2023, Lancashire's Board of Directors declared an interim dividend

of $0.05 (approximately £0.04) per common share, which will result in an

aggregate payment of approximately $11.9 million. The dividend will be paid in

Pounds Sterling on 15 September 2023 (the "Dividend Payment Date") to

shareholders of record on 18 August 2023 (the "Record Date") using the £ / $

spot market exchange rate at 12 noon London time on the Record Date.

Financial Information

The Unaudited Condensed Interim Consolidated Financial Statements for the six

months ended

30 June 2023 are published on Lancashire's website at www.lancashiregroup.com.

Analyst and Investor Earnings Conference Call

There will be an analyst and investor conference call on the results at 3:00pm

UK time / 11.00am Bermuda time / 10:00am EST on Thursday 10 August 2023. The

conference call will be hosted by Lancashire management.

Participant Registration and Access Information:

Audio conference call access:

https://register.vevent.com/register/BI4bf0795bd1a54d1c9333eba85e482420

Please register at this link to obtain your personal audio conference pin and

call details

Webcast access:

https://onlinexperiences.com/Launch/QReg/ShowUUID=72EEDFFF-C6DA-4F6F-A31F

-90444D3F1059

Please use this link to register and access the call via webcast

A webcast replay facility will be available for 12 months and accessible at:

https://www.lancashiregroup.com/en/investors/results-reports-and

-presentations.html

For further information, please contact:

Lancashire

Holdings

Limited

Christopher +44 20 7264 4145

Head

chris.head@lancashiregroup.com (chris.head%40lancashiregroup.com)

Jelena +44 20 7264 4066

Bjelanovic

jelena.bjelanovic@lancashiregroup.com

FTI

Consulting

Edward Berry Edward.Berry@FTIConsulting.com

Tom Blackwell Tom.Blackwell@FTIConsulting.com

About Lancashire

Lancashire, through its UK and Bermuda-based operating subsidiaries, is a

provider of global specialty insurance and reinsurance products. The Group

companies carry the following ratings (unchanged from 2022):

Financial Financial Long Term Issuer

Strength Strength Rating(2)

Rating(1) Outlook(1)

A.M. Best A (Excellent) Stable bbb+

S&P Global Ratings A- Stable BBB

Moody's A3 Stable Baa2

(1) Financial Strength Rating and Financial Strength Outlook apply to Lancashire

Insurance Company Limited and Lancashire Insurance Company (UK) Limited.

(2) Long Term Issuer Rating applies to Lancashire Holdings Limited.

Lancashire Syndicates Limited benefits from Lloyd's ratings: A.M. Best: A

(Excellent); S&P Global Ratings: A+ (Strong); and Fitch: AA- (Very Strong).

Lancashire, through its UK and Bermuda-based operating subsidiaries, is a

provider of global specialty insurance and reinsurance products.

Lancashire's common shares trade on the premium segment of the Main Market of

the London Stock Exchange under the ticker symbol LRE. Lancashire has its head

office and registered office at Power House, 7 Par-la-Ville Road, Hamilton HM

11, Bermuda.

The Bermuda Monetary Authority is the Group Supervisor of the Lancashire Group.

For more information, please visit Lancashire's website at

www.lancashiregroup.com.

This release contains information, which may be of a price sensitive nature,

that Lancashire is making public in a manner consistent with the UK Market Abuse

Regulation and other regulatory obligations. The information was submitted for

publication, through the agency of the contact persons set out above, at 07:00

BST on 10 August 2023.

Alternative Performance Measures (APMs)

As is customary in the insurance industry, the Group also utilises certain non

-GAAP measures in order to evaluate, monitor and manage the business and to aid

users' understanding of the Group. Management believes that the APMs included in

the Financial Statements are important for understanding the Group's overall

results of operations and may be helpful to investors and other interested

parties who may benefit from having a consistent basis for comparison with other

companies within the industry. However, these measures may not be comparable to

similarly labelled measures used by companies inside or outside the insurance

industry. In addition, the information contained herein should not be viewed as

superior to, or a substitute for, the measures determined in accordance with the

accounting principles used by the Group for its unaudited condensed interim

consolidated financial statements or in accordance with GAAP.

In compliance with the Guidelines on APMs of the European Securities and Markets

Authority and as suggested by the Financial Reporting Council, as applied by the

Financial Conduct Authority, information on APMs which the Group uses is

described below. This information has not been audited.

Effective from 1 January 2023, the Group adopted IFRS 9, Financial Instruments:

Classification and Measurement and IFRS 17: Insurance Contracts. These new

accounting standards resulted in a change to some of the Group's long standing

APMs. Comparatives have been restated to reflect the consistent application of

IFRS 9 and IFRS 17 and to align with the current definition of the APMs.

All amounts, excluding share data, ratios, percentage or where otherwise stated,

are in millions of U.S. dollars.

Net insurance ratio:

Ratio, in per cent, of net insurance expenses to net insurance revenue. Net

insurance expenses represent claims related insurance service expenses less

amounts recoverable from reinsurers. Net insurance revenue represents insurance

revenue less allocation of reinsurance premium. This ratio gives an indication

of the underlying profitability per $1.00 of net insurance revenue in the

financial year.

Restated

For the six months ended 30 June 2023 30 June 2022

Insurance service expense 288.5 293.8

Amounts recoverable from reinsurers 30.9 (39.3)

Net insurance expense 319.4 254.5

Insurance revenue 720.9 579.8

Allocation of reinsurance premium (212.7) (183.8)

Net insurance revenue 508.2 396.0

Net insurance ratio 62.8% 64.3%

Operating expense ratio:

Ratio, in per cent, of other operating expenses, excluding restricted stock

expenses, to net insurance revenue. This ratio gives an indication of the amount

of operating expenses expected to be paid out per $1.00 of net insurance revenue

in the financial year.

Restated

For the six months ended 30 June 2023 30 June 2022

Other operating expenses 43.8 32.7

Net insurance revenue 508.2 396.0

Operating expense ratio 8.6% 8.3%

Combined ratio (discounted):

Ratio, in per cent, of the sum of net insurance expenses plus other operating

expenses to net insurance revenue.

Restated

For the six months ended 30 June 2023 30 June 2022

Net insurance ratio 62.8% 64.3%

Net operating expense ratio 8.6% 8.3%

Combined ratio (discounted) 71.4% 72.6%

Combined ratio (undiscounted):

Ratio, in per cent, of the sum of net insurance expense plus other operating

expenses to net insurance revenue. This ratio excludes the impact of the

discounting recognised within net insurance expenses. The Group aims to price

its business to ensure that the combined ratio (undiscounted) across the cycle

is less than 100%.

Restated

For the six months ended 30 June 2023 30 June 2022

Combined ratio 71.4% 72.6%

Discount included in net insurance expense 39.4 18.0

Net insurance revenue 508.2 396.0

Discounting impact on combined ratio 7.8% 4.5%

Combined ratio (undiscounted) 79.2% 77.1%

Diluted book value per share ('DBVS') attributable to the Group:

Calculated based on the value of the total shareholders' equity attributable to

the Group and dilutive restricted stock units as calculated under the treasury

method, divided by the sum of all shares and dilutive restricted stock units,

assuming all are exercised. Shows the Group net asset value on a diluted per

share basis for comparison to the market value per share.

Restated

As at 30 June 2023 31 December 2022

Shareholders' equity attributable to the Group 1,468,687,750 1,326,124,728

Common voting shares outstanding* 238,863,740 238,333,570

Shares relating to dilutive restricted stock 4,025,541 3,700,547

Fully converted book value denominator 242,889,281 242,034,117

Diluted book value per share $6.05 $5.48

*Common voting shares outstanding comprise issued share capital less amounts

held in trust.

Change in DBVS:

The internal rate of return of the change in DBVS in the period plus accrued

dividends. Sometimes referred to as RoE. The Group's aim is to maximise risk

-adjusted returns for shareholders across the cycle through a purposeful and

sustainable business culture.

Restated

As at 30 June 2023 31 December 2022

Opening DBVS ($5.48) ($5.70)

Q1 dividend per share - -

Q2 dividend per share $0.10 $0.10

Q3 dividend per share - $0.05

Q4 dividend per share - -

Closing DBVS $6.05 $5.48

Change in DBVS* 12.2% (1.2%)

*Calculated using the internal rate of return

Adjusted profit over average shareholders' equity:

During 2022, a review of financial metrics for annual bonus purposes was

undertaken. Shareholders were consulted on a proposal to move from Change in

DBVS to a simplified measure of RoE. For the 2023 annual bonus, financial

performance will be measured on the basis of simple ROE adjusted for unrealised

gains and losses and discounting with targets set by reference to the RFR based

on the average 13 week U.S. Treasury rates.

Restated

As at 30 June 2023 31 December 2022

Profit (loss) for the 159.2 (15.5)

period

Net unrealised (gains) (18.3) 103.0

losses on investments

Total net impact of (15.8) (85.9)

discounting

Adjusted profit (loss) 125.1 1.6

for the period

Opening shareholders' 1,326.1 1,393.4

equity

Q1 shareholders' equity 1,380.7 1,386.6

Q2 shareholders' equity 1,468.7 1,391.9

Q3 shareholders' equity - 1,425.0

Q4 shareholders' equity - 1,326.1

Average shareholders' 1,391.8 1,384.6

equity

Adjusted profit over 9.0% 0.1%

average shareholders'

equity

Total investment return:

Total investment return in percentage terms, is calculated by dividing the total

investment return by the investment portfolio net asset value, including managed

cash on a daily basis. These daily returns are then annualized through geometric

linking of daily returns. The return can be approximated by dividing the total

investment return excluding foreign exchange by the average portfolio net asset

value, including managed cash. The Group's primary investment objectives are to

preserve capital and provide adequate liquidity to support the Group's payment

of claims and other obligations. Within this framework we aim for a degree of

investment portfolio return.

For the six months ended 30 June 2023 2022

$m $m

Total investment return 63.2 (85.8)

Average invested assets* 2,527.0 2,271.7

Approximate total investment return 2.5% (3.8%)

Reported total investment return 2.2% (3.8%)

*Calculated as the average between the opening and closing investments and our

externally managed cash.

Gross premiums written:

The Group adopted IFRS 17 on I January 2023. Under IFRS 4, the previous

insurance accounting standard, the Group reported gross premiums written on the

consolidated income statement as amounts payable by the insured, excluding any

taxes or duties levied on the premium, including brokerage and commission

deducted by intermediaries and any inwards reinstatement premiums. The Group

continues to report gross premiums written as a growth metric and non-GAAP APM.

The table below reconciles gross premiums written on an IFRS 4 basis to

insurance revenue on an IFRS 17 basis.

For the six months ended 30 June 2023 2022

$m $m

Gross premiums written1 1,184.0 938.1

Change in unearned premiums1 (357.6) (300.5)

Gross earned premium1 826.4 637.6

Less reinstatement premium and expected premium (4.2) (7.2)

Less commission and non-distinct investment components (101.3) (50.6)

Total insurance revenue 720.9 579.8

1 Numbers presented in the table above for the comparative period are as

previously reported for the six month period 30 June 2022.

Gross premiums written under management:

The gross premiums written under management equals the total of the Group's

consolidated gross premiums written plus the external names portion of the gross

premiums written in Syndicate 2010 plus the gross premiums written in Lancashire

Capital Management Limited on behalf of Kinesis Reinsurance Limited. The Group

aims to operate nimbly through the cycle. We will grow in existing and new

classes where favourable and improving market conditions exist, whilst

monitoring and managing our risk exposures and not seek top-line growth for the

sake of it in markets where we do not believe the right opportunities exist

For the six months ended 30 June 2023 2022

$m $m

Gross premiums written by the group 1,184.0 938.1

LSL Syndicate 2010 - external Names portion 92.8 100.0

of gross premiums written (unconsolidated)

LCM gross premiums written (unconsolidated) - 38.4

Total gross premiums written under 1,276.8 1,076.5

management

NOTE REGARDING RPI METHODOLOGY

THE RENEWAL PRICE INDEX ("RPI") IS AN INTERNAL METHODOLOGY THAT MANAGEMENT USES

TO TRACK TRS IN PREMIUM RATES OF A PORTFOLIO OF INSURANCE AND REINSURANCE

CONTRACTS. THE RPI WRITTEN IN THE RESPECTIVE SEGMENTS IS CALCULATED ON A PER

CONTRACT BASIS AND REFLECTS MANAGEMENT'S ASSESSMENT OF RELATIVE CHANGES IN

PRICE, TERMS, CONDITIONS AND LIMITS AND IS WEIGHTED BY PREMIUM VOLUME. THE RPI

DOES NOT INCLUDE NEW BUSINESS, TO OFFER A CONSISTENT BASIS FOR ANALYSIS. THE

CALCULATION INVOLVES A DEGREE OF JUDGEMENT IN RELATION TO COMPARABILITY OF

CONTRACTS AND THE ASSESSMENT NOTED ABOVE. TO ENHANCE THE RPI METHODOLOGY,

MANAGEMENT MAY REVISE THE METHODOLOGY AND ASSUMPTIONS UNDERLYING THE RPI, SO THE

TRS IN PREMIUM RATES REFLECTED IN THE RPI MAY NOT BE COMPARABLE OVER TIME.

CONSIDERATION IS ONLY GIVEN TO RENEWALS OF A COMPARABLE NATURE SO IT DOES NOT

REFLECT EVERY CONTRACT IN THE PORTFOLIO OF CONTRACTS. THE FUTURE PROFITABILITY

OF THE PORTFOLIO OF CONTRACTS WITHIN THE RPI IS DEPENT UPON MANY FACTORS

BESIDES THE TRS IN PREMIUM RATES.

NOTE REGARDING FORWARD-LOOKING STATEMENTS:

CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS

SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR

HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION,

STATEMENTS CONTAINING THE WORDS "BELIEVES", "AIMS", "ANTICIPATES", "PLANS",

"PROJECTS", "FORECASTS", "GUIDANCE", "INTS", "EXPECTS", "ESTIMATES",

"PREDICTS", "MAY", "CAN", "LIKELY", "WILL", "SEEKS", "SHOULD", OR, IN EACH CASE,

THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. SUCH FORWARD LOOKING STATEMENTS

INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT

COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE

MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED

OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. FOR A DESCRIPTION OF SOME OF

THESE FACTORS, SEE THE GROUP'S ANNUAL REPORT AND ACCOUNTS FOR THE YEARED 31

DECEMBER 2022 AND THE GROUP'S UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS FOR THE SIX MONTHSING 30 JUNE 2023. IN ADDITION TO THOSE FACTORS

CONTAINED IN THE GROUP'S 2022 ANNUAL REPORT AND ACCOUNTS AND THE GROUP'S

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHSING 30 JUNE 2023, ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS RELEASE

MAY BE AFFECTED BY: THE IMPACT OF THE ONGOING CONFLICT IN UKRAINE, INCLUDING ANY

ESCALATION OR EXPANSION THEREOF, ON THE GROUP'S CLIENTS, RESERVES, THE CONTINUED

UNCERTAINTY OF THE SITUATION IN RUSSIA, INCLUDING ISSUES RELATING TO COVERAGE

AND THE IMPACT OF SANCTIONS, THE SECURITIES IN OUR INVESTMENT PORTFOLIO AND ON

GLOBAL FINANCIAL MARKETS GENERALLY, AS WELL AS ANY GOVERNMENTAL OR REGULATORY

CHANGES, ARISING THEREFROM; THE NUMBER AND TYPE OF INSURANCE AND REINSURANCE

CONTRACTS THAT THE GROUP WRITES OR MAY WRITE; THE GROUP'S ABILITY TO

SUCCESSFULLY IMPLEMENT ITS BUSINESS STRATEGY DURING `SOFT' AS WELL AS `HARD'

MARKETS; THE PREMIUM RATES WHICH MAY BE AVAILABLE AT THE TIME OF SUCH RENEWALS

WITHIN ITS TARGETED BUSINESS LINES; INCREASED COMPETITION ON THE BASIS OF

PRICING, CAPACITY, COVERAGE TERMS OR OTHER FACTORS; AND CYCLICAL DOWNTURNS OF

THE INDUSTRY. ALL FORWARD-LOOKING STATEMENTS IN THIS RELEASE OR OTHERWISE SPEAK

ONLY AS AT THE DATE OF PUBLICATION. LANCASHIRE EXPRESSLY DISCLAIMS ANY

OBLIGATION OR UNDERTAKING (SAVE AS REQUIRED TO COMPLY WITH ANY LEGAL OR

REGULATORY OBLIGATIONS INCLUDING THE RULES OF THE LONDON STOCK EXCHANGE) TO

DISSEMINATE ANY UPDATES OR REVISIONS TO ANY FORWARD-LOOKING STATEMENT TO REFLECT

ANY CHANGES IN THE GROUP'S EXPECTATIONS OR CIRCUMSTANCES ON WHICH ANY SUCH

STATEMENT IS BASED. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS

ATTRIBUTABLE TO THE GROUP OR INDIVIDUALS ACTING ON BEHALF OF THE GROUP ARE

EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THIS NOTE. PROSPECTIVE INVESTORS SHOULD

SPECIFICALLY CONSIDER THE FACTORS IDENTIFIED IN THIS RELEASE AND THE REPORT AND

ACCOUNTS AND THE UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

NOTED ABOVE WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER BEFORE MAKING AN

INVESTMENT DECISION.

Consolidated statement of comprehensive income

Restated

For the six months ended 30 June 2023 2022

$m $m

Insurance revenue 720.9 579.8

Insurance service expenses (288.5) (293.8)

Insurance service result before reinsurance contracts held 432.4 286.0

Allocation of reinsurance premium (212.7) (183.8)

Amounts recoverable from reinsurers (30.9) 39.3

Net expense from reinsurance contracts held (243.6) (144.5)

Insurance service result 188.8 141.5

Net investment return 63.2 (85.8)

Finance (expense) income from insurance contracts issued (37.7) 28.0

Finance income (expense) from reinsurance contracts held 14.1 (9.5)

Net insurance and investment result 228.4 74.2

Share of profit of associate 5.2 2.5

Other income 1.1 2.3

Net foreign exchange (losses) gains (1.0) 6.2

Other operating expenses (43.8) (32.7)

Equity based compensation (7.2) (3.7)

Financing costs (15.5) (14.7)

Profit before tax 167.2 34.1

Tax charge (8.0) (3.1)

Profit after tax 159.2 31.0

Earnings per share

Basic 0.67 0.13

Diluted 0.66 0.13

Consolidated statement of financial position

Restated

As at 30 June 2023 31 December 2022

$m $m

Assets

Cash and cash equivalents 620.3 548.8

Accrued interest receivable 14.0 11.3

Investments 2,374.3 2,204.9

Reinsurance contract assets 427.5 474.3

Other receivables 27.2 30.0

Corporation tax receivable - 1.1

Investment in associate 24.3 59.7

Property, plant and equipment 4.4 1.1

Right-of-use assets 18.6 20.3

Intangible assets 177.5 172.4

Total assets 3,688.1 3,523.9

Liabilities

Insurance contract liabilities 1,678.0 1,673.5

Other payables 54.9 44.6

Corporation tax payable 3.3 -

Deferred tax liability 13.7 10.3

Lease liabilities 23.2 23.3

Long-term debt 446.3 446.1

Total liabilities 2,219.4 2,197.8

Shareholders' equity

Share capital 122.0 122.0

Own shares (30.8) (34.0)

Other reserves 1,226.0 1,221.9

Retained earnings 151.5 16.2

Total shareholders' equity 1,468.7 1,326.1

Total liabilities and shareholders' equity 3,688.1 3,523.9

Consolidated statements of cash flows

Restated

For the six months ended 30 June 2023 2022

$m $m

Cash flows from operating activities

Profit before tax 167.2 34.1

Adjustments for:

Tax paid (0.1) (1.3)

Depreciation 1.8 1.5

Interest expense on long-term debt 12.9 12.9

Interest expense on lease liabilities 0.8 0.5

Interest income (41.4) (17.2)

Dividend income (5.1) (3.5)

Net realised losses 3.7 14.0

Net unrealised (gains) losses (18.3) 93.8

Equity based compensation 7.2 3.7

Foreign exchange losses (gains) 0.6 (11.0)

Share of profit of associate (5.2) (2.5)

Changes in operational assets and

liabilities

- Insurance and reinsurance contracts 44.2 (49.3)

- Other assets and liabilities 18.0 (0.4)

Net cash flows from operating 186.3 75.3

activities

Cash flows used in investing

activities

Interest income received 38.7 16.0

Dividend income received 5.1 3.5

Purchase of property, plant and (3.4) -

equipment

Internally generated intangible asset (5.1) (4.4)

Investment in associate 40.6 33.5

Purchase of investments (551.0) (700.7)

Proceeds on sale of investments 398.3 507.7

Net cash flows used in investing (76.8) (144.4)

activities

Cash flows used in financing

activities

Interest paid (12.9) (12.9)

Lease liabilities paid (2.0) (1.8)

Dividends paid (23.9) (24.3)

Share repurchases - (11.7)

Distributions by trust - (0.4)

Net cash flows used in financing (38.8) (51.1)

activities

Net increase (decrease) in cash and 70.7 (120.2)

cash equivalents

Cash and cash equivalents at 548.8 517.7

beginning of period

Effect of exchange rate fluctuations 0.8 (6.9)

and other on cash and cash

equivalents

Cash and cash equivalents at end of 620.3 390.6

period

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/lancashire-holdings-ltd/r/q2-2023-earnings-release,c3815617

END

(END) Dow Jones Newswires

August 10, 2023 02:00 ET (06:00 GMT)

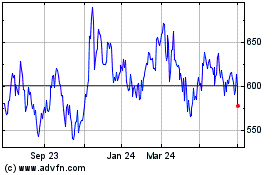

Lancashire (LSE:LRE)

Historical Stock Chart

From Apr 2024 to May 2024

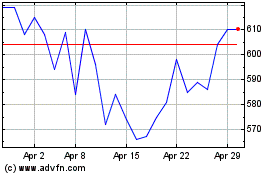

Lancashire (LSE:LRE)

Historical Stock Chart

From May 2023 to May 2024