TIDMKGP

RNS Number : 9528P

Kingspan Group PLC

26 August 2014

KINGSPAN GROUP PLC

HALF-YEARLY FINANCIAL REPORT

for the period ended 30(th) June 2014

KINGSPAN GROUP PLC

RESULTS FOR THE HALF YEAR 30 JUNE 2014

Kingspan the global leader in high performance insulation,

building fabric, and solar integrated building envelopes issues its

half-yearly financial report for the period ended 30 June 2014.

Highlights:

Financial Highlights:

-- Revenue up 4% to EUR889.3m, (pre-currency, up 5%).

-- Trading profit up 24% to EUR69.2m, (pre-currency up 24%).

-- Group trading margin of 7.8%, an increase of 120bps versus the same period in 2013.

-- Net debt of EUR113.4m (H1 2013: EUR165.1m). Net debt to EBITDA of 0.7x (H1 2013: 1.1x).

-- Basic EPS up 27% to 29.2 cent (H1 2013: 23.0 cent).

-- Interim dividend per share up 14% to 6.25 cent (H1 2013: 5.5 cent).

-- Increase in ROCE by 160 bps to 12.4% (H1 2013: 10.8%).

Operational Highlights:

-- Good performance overall with sales levelling off in quarter

two following a strong and unseasonal quarter one.

-- Insulated Panels sales up 9% and trading profit up 30%,

reflecting continuing penetration gains, a positive business mix,

and some improvement in end markets in certain regions.

-- Insulation Boards sales up 1% and trading profit up 32%, with

a good performance in the UK in particular and an improved business

mix. The Group's new facility in the Eastern region of Germany was

fully commissioned in the second quarter.

-- Environmental sales were flat overall and have stabilised.

-- Access Floor sales were down 11%, with weak US office

activity offsetting a good performance in UK office volumes.

Summary Financials:

H1'14 H1'13 Change

EURm EURm

---------------------- ------ ------ --------

Revenue 889.3 851.5 +4%

EBITDA 88.9 75.7 +17%

Trading Profit* 69.2 55.8 +24%

Trading Margin 7.8% 6.6% +120bps

EPS (cent per share) 29.2 23.0 +27%

---------------------- ------ ------ --------

*Operating profit before amortisation of intangibles

Gene Murtagh, Chief Executive of Kingspan commented:

"Kingspan has delivered strong growth in profitability,

notwithstanding a tougher EU construction sector in the second

quarter, and a global economic recovery that remains weak. Our

order book carried good momentum into the second half of the year,

driven by continued growth in the demand for low energy

buildings."

For further information contact:

Murray Consultants Tel: +353 (0) 1 4980 300

Douglas Keatinge

Business Review

Kingspan recorded a positive start to the first six months of

2014 resulting in sales revenue of EUR889.3m and a trading profit

of EUR69.2m, an increase of 4% and 24% respectively. Quarter one

activity, in particular, showed a significant improvement over the

same period in 2013, followed by a second quarter sales trend that

eased towards mid-year.

UK revenue, representing 38% of Group sales, grew materially in

the first half in the Insulated Panels, Insulation Boards and

Access Floors businesses as general building activity continued to

recover in the region. The trading environment in many of our other

markets has been quite mixed with the Benelux and France remaining

under some macro-economic pressure despite being enhanced by an

unseasonably mild first quarter. The German market was stable, as

was the Gulf region. The performance in Turkey was quite weak as a

result of recent political instability there. North American

non-residential activity was reasonably stable where our Insulated

Panels business continued to gain from further penetration growth

although this was countered somewhat by stubbornly weak office

construction in that region.

Earlier this month we announced that we had entered into an

agreement with Pactiv LLC to acquire its US building insulation

business, which manufactures and sells a range of XPS insulation

products throughout the USA under the GreenGuard(R) brand, for a

total consideration of US$72.0m plus US$10.0m of working capital.

This is a new and exciting frontier for Kingspan's Insulation Board

business in North America with particular exposure to the

residential sector. It provides a tremendous opportunity to build

upon the growing success of our existing Insulated Panel business

throughout the region at a time when North America's focus on

energy efficiency and security is at an all-time high.

Insulated Panels

H1 '14 H1 '13 Change

EURm EURm

---------------- ------- ------- -------

Turnover 526.1 482.5 +9%(1)

Trading Profit 43.7 33.5 +30%

Trading Margin 8.3% 6.9%

---------------- ------- ------- -------

(1) Comprising volume +7%, price/mix +2%, currency impact -1% and acquisitions +1%

UK

The majority of non-residential end-market applications for

Insulated Panels in the UK showed considerable improvement over the

same period in 2013, driven by a number of large scale retail and

manufacturing projects which combined to drive sales volumes up on

prior year. Our Kingspan Energy business, which delivers rooftop

solar solutions, also continued to gain traction and is on target

to deliver revenue in excess of EUR30m in its first full year.

Benchmark architectural specifications are well up on prior year

and should deliver an improved second half sales performance.

Mainland Europe and the Middle East

In Germany, Poland and Hungary the Group's combined sales volume

grew by mid-single digit percentages in the first half, even after

a sustained concentration on margin led to slight revenue

contraction in some products. There was solid progress in the

Nordics region where high performance insulation and building

envelopes are gaining a sustainable foothold. Volumes in the

Benelux region showed marginal gains, although order intake was

down slightly. Overall market penetration of insulated panels grew

again in France although this was countered by less buoyant

commercial & industrial and cold storage end markets. Volumes

in Turkey were impacted by recent political unrest and were in

stark contrast to a strong performance in our business in the wider

Middle East and Gulf regions.

North America

In the early part of the year the prolonged cold spell in the

North East impacted upon sales volumes although order intake has

been consistently strong. This clearly demonstrates the continuing

growth in market acceptance of low energy building fabrics with an

orderbook ending the period at a record high, and second half

volumes are expected to trend positively.

Australasia

As a market, notwithstanding the difference in scale, Australia

is evolving along similar lines to the US, showing compelling

growth in high performance building solutions. Volumes were well up

on prior year for the same period, and order intake grew

substantially, albeit compared to what was a slow start to

2013.

Ireland

Activity continues to improve in Ireland where both sales volume

and order intake grew substantially over 2013.

Insulation Boards

H1'14 H1 '13 (2) Change

EURm EURm

---------------- ------ ----------- --------

Turnover 221.1 218.8 +1% (1)

Trading Profit 17.7 13.4 +32%

Trading Margin 8.0% 6.1%

---------------- ------ ----------- --------

(1) Comprising volume -2%, price/mix +2% and currency impact +1%

(2) Restated to reflect adoption of IFRS 11 'Joint Arrangements'

UK

Revenue grew strongly in the first half of 2014, particularly in

the first quarter, as the general economy and new house

construction remain on a path of recovery. Growth has abated

somewhat in recent months, although sales of Kooltherm(R) have been

robust, and margins have benefitted considerably from this dynamic.

Specifications for Optim-R(R), our next generation insulation

board, have been growing steadily from a standing start earlier in

the year.

Mainland Europe

Despite the prevailing weakness in the Dutch economy, sales

improved in the first six months driven by penetration growth and

helped to an extent by an unseasonably mild first quarter. Revenue

has also grown in Germany, the Nordics and Central Europe, which

are now being supported by our recently commissioned facility in

the eastern region of Germany. Penetration of modern insulation

materials is relatively low in the Nordics and Central Europe but

these markets are showing clear and emerging signs of adapting to

rigid insulation as an efficient solution to increasingly stringent

building energy codes. These regions will become an increasing

focus for Kingspan in time.

Australasia

In recent years, Kooltherm(R) has been growing its position in

Australia, and select SEA markets, and sales revenue in the first

half increased further. It is our ambition to develop ongoing

demand to a level that requires a local manufacturing presence by

2016. Volume growth thus far has been trending on target to achieve

this goal.

Ireland

Whilst market volumes in Ireland have been improving gradually,

from its low recent base, pricing remains under significant

pressure. Our focus has been to drive conversion to Kooltherm(R)

which has been key in improving the profitability of our business

in the region even though it has been at the expense of volume in

the current year.

Access Floors

H1 '14 H1 '13 Change

EURm EURm

---------------- ------- ------- ---------

Turnover 70.5 78.9 -11% (1)

Trading Profit 7.6 8.1 -6%

Trading Margin 10.8% 10.3%

---------------- ------- ------- ---------

(1) Comprising volume +3%, price/mix -12% and currency impact -2%

Access Floors demand is derived primarily from office

construction activity, datacentre, and education applications.

A significant proportion of our sales revenue is in North

America where office starts remain at all time lows, weighing

heavily on the overall divisional sales volume. The project

pipeline, a barometer for medium term activity, has been improving

steadily and augurs well for late 2015 and beyond. In the nearer

term, we expect office applications to remain unexciting, balanced

to an extent by stable datacentre activity.

In contrast to North America, office construction in the UK has

improved markedly as has Kingspan's volume into this segment. This

trend is likely to continue over the coming twelve months as

London's skyline, in particular, continues to evolve.

Environmental

H1 '14 H1 '13

EURm EURm

---------------- ------- -------

Turnover 71.6 71.3

Trading Profit 0.2 0.8

Trading Margin 0.3% 1.1%

---------------- ------- -------

Sales of Environmental products remained stable in the first

half across the UK, Ireland and Mainland Europe. In the second

quarter, revenue from our Water Solutions business showed

improvement in the UK following a slower start to the year

resulting from an unusually wet season. Hot water products were

down slightly with new home construction assisting demand although

this was offset by intense competition and a structured volume

decline in the more traditional copper vessel market.

Our KW15 microwind offering was launched in the second quarter

and inquiries have accelerated in recent months. Deliveries

commenced during the third quarter and should compensate for

ongoing weakness in the Solar Thermal market, where volumes have

been under pressure in recent years.

In all, this division is positioned to deliver gradual

performance improvement into the future.

Financial Review

Overview of results

Group revenue increased by 4% to EUR889.3m (H1 2013: EUR851.5m)

and trading profit increased by 24% to EUR69.2m (H1 2013:

EUR55.8m). This represented a 5% increase in sales and a 24%

increase in trading profit on a constant currency basis. The

Group's trading margin increased by 120bps to 7.8% (H1 2013: 6.6%).

The amortisation charge in respect of intangibles was EUR2.2m

compared to EUR1.9m in the first half of 2013 with the increase

reflecting intangible assets acquired in respect of Dri-Design in

February 2014. Group operating profit after amortisation grew 24%

to EUR67.0m. Profit after tax was EUR50.0m compared to EUR39.2m in

the first half of 2013 driven, in the main, by the growth in

trading profit. Basic EPS for the period was 29.2 cent,

representing an increase of 27% on the first half of 2013 (H1 2013:

23.0 cent).

The Group's underlying sales and trading profit performance by

division is set out below:

Sales Underlying Currency Acquisition Total

------------------- ----------- --------- ------------ ------

Insulated Panels +9% -1% +1% +9%

Insulation Boards 0% +1% - +1%

Access Floors -9% -2% - -11%

Environmental -2% +2% - -

Group +4% -1% +1% +4%

----------- --------- ------------ ------

The Group's trading profit measure is earnings before interest,

tax and amortisation of intangibles:

Trading Profit Underlying Currency Acquisition Total

------------------- ----------- --------- ------------ ------

Insulated Panels +30% -2% +2% +30%

Insulation Boards +30% +2% - +32%

Access Floors -6% - - -6%

Environmental n/a n/a n/a n/a

Group +23% 0% +1% +24%

----------- --------- ------------ ------

Change in accounting policy and reclassification

IFRS 11 'Joint Arrangements' has been adopted as required by

IFRS for the half year ended 30 June 2014. All comparatives have

been restated accordingly. Further details are set out in note

14.

Finance costs

Finance costs for the year were modestly higher than the same

period last year at EUR7.0m (H1 2013: EUR6.8m). Finance costs

include a non-cash charge of EUR0.1m (H1 2013: EUR0.2m) in respect

of the Group's legacy defined benefit pension schemes. A net

non-cash charge of EUR0.1m was recorded in respect of swaps on the

Group's USD private placement notes (H1 2013: credit of EUR0.2m).

The Group's net interest expense on borrowings (bank and loan

notes) was EUR7.0m compared to EUR7.3m in the first half of 2013.

This decrease reflects a reduction in the floating interest rates

on the floating portion of the USD private placements and a

reduction in commitment fees on the Group's revolving credit

facility following its re-negotiation in March 2014.

Taxation

The tax charge for the first half of the year was EUR10.1m (H1

2013: EUR7.9m) which represents an effective tax rate of 16.2% on

earnings before amortisation (H1 2013: 16%).

Retirement benefits

The Group has two legacy defined benefit schemes which are

closed to new members and to future accrual. In addition, the Group

has assumed a defined benefit obligation in respect of certain

current and former employees of ThyssenKrupp Construction acquired

during 2012. The net pension liability in respect of all the

Group's defined benefit obligations was EUR6.4m as at 30 June 2014

(30 June 2013: EUR11.3m).

Free cashflow

Free cashflow H1'14 H1'13

EUR'm EUR'm

-------------------------------- ------- -------

EBITDA* 88.9 75.7

Movement in working capital (29.5) (40.2)

Net capital expenditure (21.0) (18.2)

Pension contributions (1.2) (1.3)

Finance costs paid (7.6) (6.3)

Income taxes paid (6.0) (5.3)

Other including non-cash items 5.1 5.4

------- -------

Free cashflow 28.7 9.8

------- -------

*Earnings before finance costs, income taxes, depreciation and

amortisation

Working capital increased by EUR29.5m in the first half of 2014

(in H1 2013 it increased by EUR40.2m). The Group typically

increases working capital in the first half reflecting seasonal

variability associated with trading patterns and the timing of

significant purchases for steel and chemicals. The average working

capital to sales % was 12.7% in H1 2014 compared to 12.8% in H1

2013.

Net Debt

Net debt increased by EUR6.7m during the first half to EUR113.4m

(31 December 2013: EUR106.7m). This is analysed in the table

below:

Movement in net debt H1'14 H1'13

EUR'm EUR'm

----------------------------------- -------- --------

Free cashflow 28.7 9.8

Acquisitions (23.4) -

Share issues 4.3 1.5

Dividends paid (14.6) (12.3)

-------- --------

Cashflow movement (5.0) (1.0)

Exchange movements on translation (1.7) 1.1

-------- --------

Decrease / (Increase) in net

debt (6.7) 0.1

Net debt at start of year (106.7) (165.2)

-------- --------

Net debt at end of period (113.4) (165.1)

-------- --------

Financing

The Group funds itself through a combination of equity and debt.

Debt is funded through a combination of a syndicated bank facility

and private placement loan notes. The primary debt facility is a

revolving credit facility of EUR300m, originally entered into in

April 2012 and amended in March 2014, with a syndicate of

international banks. The facility, which was undrawn at the period

end, was favourably amended from a pricing perspective with the

term extended to March 2019. The Group has two US Private Placement

loan notes for $400m, in aggregate, of which $158m matures in 2015,

$42m in 2017 with the balance of $200m maturing in 2021. The

weighted average maturity of debt facilities at year end was 4.3

years (June 2013: 4.3 years).

The Group has significant available undrawn facilities and cash

balances which provide appropriate headroom for potential

development opportunities.

Related Party Transactions

There were no changes in related party transactions from the

2013 Annual Report that could have a material effect on the

financial position or performance of the Group in the first half of

the year.

Principal Risks & Uncertainties

Details of the principal risks and uncertainties facing the

Group can be found in the 2013 Annual Report. These risks, namely

volatility in the macro environment, failure to innovate, product

failure, business interruption (including IT continuity), credit

risks and credit control, remain the most likely to affect the

Group in the second half of the current year. The Group actively

manages these and all other risks through its control and risk

management processes.

Dividend

The Board has declared an interim dividend of 6.25 cent per

ordinary share, an increase of 14% on the 2013 interim dividend of

5.5 cent per share. The interim dividend will be paid on 26

September 2014 to shareholders on the register on the record date

of 5 September 2014.

Outlook

The pace of economic recovery in the markets we serve,

notwithstanding some exceptions, has been glacial at best and

clearly not helped by the prevailing geo-political disquiet in some

markets. Building activity more particularly, which began the year

with positive momentum in many of our markets, has eased in more

recent months and we anticipate that trend to remain through the

second half of the year.

Against that backdrop, order intake at our larger businesses,

most notably in the UK, North America, and Australia has been

strong in the first half, which bodes well for the latter part of

2014 in those markets. Less positive has been the activity in some

Continental European markets, which could impact the topline growth

of the Group, although margins can still be expected to

improve.

Overall, Kingspan remains well poised to advance in a medium to

longer term environment that is likely to experience improvements

in both building activity and methods, sustained by the drive

towards achieving a more energy efficient living and working

environment.

RESPONSIBILITY STATEMENT

Directors' Responsibility Statement in respect of the

half-yearly financial report for the six months ended 30 June

2014

Each of the directors of Kingspan Group plc confirm our

responsibility for preparing the half-yearly financial report in

accordance with the Transparency (Directive 2004/109/EC)

Regulations 2007, the Transparency Rules of the Republic of

Ireland's Financial Regulator and with IAS 34 "Interim Financial

Reporting" as adopted by the EU. We confirm that to the best of our

knowledge:

a) the condensed consolidated Half-yearly Financial Statements

comprising the condensed consolidated income statement, the

condensed consolidated statement of comprehensive income, the

condensed consolidated statement of financial position, the

condensed consolidated statement of changes in equity, the

condensed consolidated statement of cash flows and related notes

have been prepared in accordance with the Transparency (Directive

2004/109/EC) Regulations 2007, the Transparency Rules of the

Republic of Ireland's Financial Regulator and with IAS 34 "Interim

Financial Reporting" as adopted by the EU.

b) The interim management report includes a fair review of the

information required by:

i) Regulation 8(2) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

ii) Regulation 8(3) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being related party transactions that have taken

place in the first six months of the current financial year and

that have materially affected the financial position or performance

of the entity during that period; and any changes in the related

party transactions described in the last annual report that could

do so.

On behalf of the Board

Gene Murtagh Geoff Doherty

Chief Executive Officer Chief Financial Officer

26 August 2014 26 August 2014

Kingspan Group plc

Condensed consolidated income statement (unaudited)

for the half year ended 30 June 2014

6 months 6 months

ended ended

30 June 2014 30 June

2013

Note EUR'000 EUR'000

Revenue 4 889,303 851,527

Cost of Sales (648,624) (631,338)

------------- ----------

Gross Profit 240,679 220,189

Operating Costs, excluding intangible

amortisation (171,476) (164,384)

------------- ----------

Trading Profit 4 69,203 55,805

Intangible amortisation (2,211) (1,897)

------------- ----------

Operating Profit 66,992 53,908

Finance expense 6 (7,147) (7,217)

Finance income 6 191 399

------------- ----------

Profit for the period before income

tax 60,036 47,090

Income tax expense 7 (10,085) (7,853)

------------- ----------

Net Profit for the period 49,951 39,237

------------- ----------

Attributable to owners of Kingspan

Group plc 49,880 38,824

Attributable to non-controlling

interests 71 413

------------- ----------

49,951 39,237

------------- ----------

Earnings per share for the period

Basic 11 29.2c 23.0c

Diluted 11 28.6c 22.5c

Kingspan Group plc

Condensed consolidated statement of comprehensive income

(unaudited)

for the half year ended 30 June 2014

6 months 6 months

ended ended

30 June 30 June

2014 2013

EUR'000 EUR'000

Net profit for financial period 49,951 39,237

Other comprehensive income:

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translating foreign

operations 21,882 (22,101)

Net change in fair value of cash flow hedges

reclassified to income statement (59) (194)

Effective portion of changes in fair value

of cash flow hedges (2,347) 2,451

Income taxes relating to changes in fair 313 -

value of cash flow hedges

Items that will not be reclassified to

profit or loss

Actuarial losses on defined benefit pension - -

schemes

Income taxes relating to actuarial losses - -

on defined benefit pension schemes

Total comprehensive income for the period 69,740 19,393

--------- ---------

Attributable to owners of Kingspan Group

plc 69,592 18,913

Attributable to non-controlling interests 148 480

--------- ---------

69,740 19,393

--------- ---------

Kingspan Group plc

Condensed consolidated statement of financial position

(unaudited)

as at 30 June 2014

At 30 June At 30 June At 31 December

2014 2013 2013

(Restated)* (Restated)*

Note EUR'000 EUR'000 EUR'000

Assets

Non-current assets

Goodwill 398,945 375,793 368,464

Other intangible assets 19,215 18,206 16,204

Property, plant and equipment 12 494,931 494,136 487,751

Investment in joint ventures 8,972 8,359 8,323

Derivative financial instruments 1,471 10,971 674

Retirement benefit assets 7,315 3,276 6,099

Deferred tax assets 7,103 9,071 6,615

----------- ------------- ---------------

937,952 919,812 894,130

Current assets

Inventories 228,049 204,024 190,370

Trade and other receivables 390,689 361,466 308,132

Derivative financial instruments 45 3,999 26

Cash and cash equivalents 9 192,711 135,855 196,587

----------- ------------- ---------------

811,494 705,344 695,115

Non-current assets classified - 388 -

as held for sale

----------- ------------- ---------------

811,494 705,732 695,115

----------- ------------- ---------------

Total assets 1,749,446 1,625,544 1,589,245

----------- ------------- ---------------

Liabilities

Current liabilities

Trade and other payables 373,523 333,064 285,501

Provisions for liabilities 37,138 38,573 39,936

Derivative financial instruments 5,018 - 2,359

Deferred contingent consideration 7,159 484 7,474

Interest bearing loans and

borrowings 4,300 4,121 6,947

Current income tax liabilities 39,040 45,282 37,313

----------- ------------- ---------------

466,178 421,524 379,530

Non-current liabilities

Retirement benefit obligations 13,722 14,602 13,837

Provisions for liabilities 16,385 20,862 17,289

Interest bearing loans and

borrowings 296,971 310,681 290,730

Derivative financial instruments 3,303 - 4,481

Deferred tax liabilities 24,675 24,936 23,756

Deferred contingent consideration 5,193 7,379 -

----------- ------------- ---------------

360,249 378,460 350,093

----------- ------------- ---------------

Total liabilities 826,427 799,984 729,623

----------- ------------- ---------------

Net Assets 923,019 825,560 859,622

----------- ------------- ---------------

Equity

Share capital 22,914 22,695 22,747

Share premium 47,235 41,937 43,145

Capital redemption reserve 723 723 723

Treasury shares (30,707) (30,707) (30,707)

Other reserves (105,400) (113,614) (126,152)

Retained earnings 980,248 897,163 942,008

----------- ------------- ---------------

Equity attributable to owners

of Kingspan Group plc 915,013 818,197 851,764

Non-controlling interests 8,006 7,363 7,858

----------- ------------- ---------------

Total Equity 923,019 825,560 859,622

----------- ------------- ---------------

* IFRS 11 'Joint Arrangements' has been adopted as required by IFRS

for the half year ended 30 June 2014. The comparatives for the half

year ended 30 June 2013 and for the year ended 31 December 2013

have been restated (refer to note 14).

Kingspan Group plc

Condensed consolidated statement of changes in equity (unaudited)

For the half year ended 30 June 2014

Share Total

Capital Cash based attributable Non-

Share Share redemption Treasury Translation flow payment Revaluation Retained to owners controlling Total

capital premium reserve shares reserve hedging reserve reserve Earnings of the interests equity

reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1 January

2014 22,747 43,145 723 (30,707) (148,047) (682) 21,864 713 942,008 851,764 7,858 859,622

--------- --------- ------------ ----------- ------------- ---------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with owners recognised

directly in equity

Shares issued 167 4,090 - - - - - - - 4,257 - 4,257

Employee share based

compensation - - - - - - 3,957 - - 3,957 - 3,957

Exercise or lapsing of share

options - - - - - - (2,917) - 2,917 - - -

Dividends - - - - - - - - (14,557) (14,557) - (14,557)

Transactions with

non-controlling

interests:

Dividends paid to - - - - - - - - - - - -

non-controlling

interests

--------- --------- ------------ ----------- ------------- ---------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with owners 167 4,090 - - - - 1,040 - (11,640) (6,343) - (6,343)

--------- --------- ------------ ----------- ------------- ---------- --------- ------------- ---------- ------------- ------------- ----------

Total comprehensive income

for

the period

Profit for the period - - - - - - - - 49,880 49,880 71 49,951

Other comprehensive income

Items that may be reclassified subsequently to profit or loss

Cash flow hedging

in

equity

- current year - - - - - (2,347) - - - (2,347) - (2,347)

- reclassification

to profit - - - - - (59) - - - (59) - (59)

- tax impact - - - - - 313 - - - 313 - 313

Exchange differences on

translating

foreign operations - - - - 21,805 - - - - 21,805 77 21,882

Items that will not be reclassified to profit or loss

Defined benefit pension - - - - - - - - - - - -

scheme

Income taxes relating to - - - - - - - - - - - -

actuarial

gains/(losses) on defined

benefit

pension scheme

Total comprehensive income

for

the period - - - - 21,805 (2,093) - - 49,880 69,592 148 69,740

--------- --------- ------------ ----------- ------------- ---------- --------- ------------- ---------- ------------- ------------- ----------

Balance at 30 June

2014 22,914 47,235 723 (30,707) (126,242) (2,775) 22,904 713 980,248 915,013 8,006 923,019

--------- --------- ------------ ----------- ------------- ---------- --------- ------------- ---------- ------------- ------------- ----------

Kingspan Group plc

Condensed consolidated statement of changes in equity (unaudited)

For the half year ended 30 June 2013

Share Total

Capital Cash based attributable Non-

Share Share redemption Treasury Translation flow payment Revaluation Retained to owners controlling Total

capital premium reserve shares reserve hedging reserve reserve Earnings of the interests equity

reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1

January

2013 22,542 40,570 723 (30,707) (116,884) 97 24,013 713 865,196 806,263 7,115 813,378

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions

with owners

recognised

directly in

equity

Shares issued 153 1,367 - - - - - - - 1,520 - 1,520

Employee share

based

compensation - - - - - - 3,773 - - 3,773 - 3,773

Exercise or

lapsing of share

options - - - - - - (5,415) - 5,415 - - -

Dividends - - - - - - - - (12,272) (12,272) - (12,272)

Transactions with

non-controlling

interests:

Dividends paid to

non-controlling

interests - - - - - - - - - - (232) (232)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with

owners 153 1,367 - - - - (1,642) - (6,857) (6,979) (232) (7,211)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Total

comprehensive

income for

the period

Profit for the

period - - - - - - - - 38,824 38,824 413 39,237

Other

comprehensive

income

Items that may be

reclassified

subsequently to

profit or loss

Cash flow hedging

in equity

- current year - - - - - 2,451 - - - 2,451 - 2,451

-

reclassification

to profit - - - - - (194) - - - (194) - (194)

Exchange

differences on

translating

foreign

operations - - - - (22,168) - - - - (22,168) 67 (22,101)

Items that will

not be

reclassified

subsequently to

profit or loss

Defined benefit - - - - - - - - - - - -

pension scheme

Income taxes - - - - - - - - - - - -

relating to

actuarial

gains/(losses) on

defined benefit

pension scheme

Total

comprehensive

income for

the period - - - - (22,168) 2,257 - - 38,824 18,913 480 19,393

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Balance at 30

June

2013 22,695 41,937 723 (30,707) (139,052) 2,354 22,371 713 897,163 818,197 7,363 825,560

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Kingspan Group plc

Condensed consolidated statement of changes in equity (audited)

For the financial year ended 31 December 2013

Share Total

Capital Cash Based attributable Non

Share Share Redemption Treasury Translation flow Payment Revaluation Retained to owners Controlling Total

Capital Premium Reserve Shares Reserve Hedging Reserve Reserve Earnings of the Interests Equity

Reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1

January

2013 22,542 40,570 723 (30,707) (116,884) 97 24,013 713 865,196 806,263 7,115 813,378

-------- -------- ----------- ---------- ------------ -------- -------- ------------ --------- ------------- ------------ ---------

Transactions with owners recognised directly in equity

Shares issued 205 2,575 - - - - - - - 2,780 - 2,780

Employee share

based

compensation - - - - - - 7,227 - - 7,227 - 7,227

Tax on employee

share

based

compensation - - - - - - (233) - 2,089 1,856 - 1,856

Exercise or

lapsing

of share options - - - - - - (9,143) - 9,143 - - -

Dividends - - - - - - - - (21,570) (21,570) - (21,570)

Transactions with

non-controlling

interests:

Buy out of

non-controlling

interests - - - - - - - - (1,515) (1,515) (27) (1,542)

Dividends paid to

non-controlling

interests - - - - - - - - - - (442) (442)

-------- -------- ----------- ---------- ------------ -------- -------- ------------ --------- ------------- ------------ ---------

Transactions with

owners 205 2,575 - - - - (2,149) - (11,853) (11,222) (469) (11,691)

-------- -------- ----------- ---------- ------------ -------- -------- ------------ --------- ------------- ------------ ---------

Total

comprehensive

income for the

year

Profit for the

year - - - - - - - - 87,643 87,643 1,513 89,156

Other

comprehensive

income

Items that may be reclassified subsequently to profit or loss

Cash flow hedging

in equity

- current year - - - - - (1,028) - - - (1,028) - (1,028)

-

reclassification

to profit - - - - - 152 - - - 152 - 152

- tax impact - - - - - 97 - - - 97 97

Exchange

differences

on translating

foreign

operations - - - - (31,163) - - - - (31,163) (301) (31,464)

Items that will not be reclassified subsequently to profit or loss

Defined benefit

pension

scheme - - - - - - - - 1,350 1,350 - 1,350

Income taxes

relating

to actuarial

gains/

(losses) on

defined

benefit pension

scheme - - - - - - - - (328) (328) - (328)

Total

comprehensive

income for the

year - - - - (31,163) (779) - - 88,665 56,723 1,212 57,935

-------- -------- ----------- ---------- ------------ -------- -------- ------------ --------- ------------- ------------ ---------

Balance at 31

December

2013 22,747 43,145 723 (30,707) (148,047) (682) 21,864 713 942,008 851,764 7,858 859,622

-------- -------- ----------- ---------- ------------ -------- -------- ------------ --------- ------------- ------------ ---------

Kingspan Group plc

Condensed consolidated statement of cash flows (unaudited)

for the half year ended 30 June 2014

6 months 6 months

ended ended

30 June 2014 30 June

2013

(Restated)*

EUR'000 EUR'000

Operating activities

Profit for the period before income

tax 60,036 47,090

Depreciation of property, plant

and equipment and

amortisation of intangible assets 21,922 21,755

Employee equity-settled share options 3,957 3,773

Finance income (191) (399)

Finance expense 7,147 7,217

Non-cash items 1,739 1,917

Profit on sale of property, plant

and equipment (106) (104)

Change in inventories (33,539) (17,482)

Change in trade and other receivables (72,290) (63,638)

Change in trade and other payables 76,359 40,966

Pension contributions (1,227) (1,325)

---------- ---------

Cash generated from operations 63,807 39,770

Taxes paid (6,045) (5,298)

---------- ---------

Net cash flow from operating activities 57,762 34,472

---------- ---------

Investing activities

Additions to property, plant and

equipment (21,510) (18,612)

Proceeds from disposals of property,

plant and equipment 545 461

Purchase of subsidiary undertakings (23,404) -

Payment of deferred consideration (441) -

in respect of acquisitions

Interest received 191 329

---------- ---------

Net cash flow from investing activities (44,619) (17,822)

---------- ---------

Financing activities

Drawings / (Repayment) of bank loans (2,485) 505

Change in finance lease liability (135) (177)

Proceeds from share issues 4,257 1,520

Interest paid (7,832) (6,593)

Dividend paid to non-controlling

interest - (232)

Dividends paid (14,557) (12,272)

---------- ---------

Net cash flow from financing activities (20,752) (17,249)

---------- ---------

Decrease in cash and cash equivalents (7,609) (599)

Translation adjustment 3,733 (3,456)

Cash and cash equivalents at the

beginning of the period 196,587 139,910

---------- ---------

Cash and cash equivalents at the

end of the period 192,711 135,855

---------- ---------

Cash and cash equivalents at beginning

of period were made up of:

- Cash and cash equivalents 196,587 140,295

- Overdrafts - (385)

---------- ---------

196,587 139,910

---------- ---------

Cash and cash equivalents at end

of period were made up of:

- Cash and cash equivalents 192,711 135,855

- Overdrafts - -

---------- ---------

192,711 135,855

---------- ---------

* IFRS 11 'Joint Arrangements' has been adopted as required by

IFRS for the half year ended 30 June 2014. The comparatives for the

half year ended 30 June 2013 and for the year ended 31 December

2013 have been restated (refer to note 14).

Kingspan Group plc

Notes

forming part of the financial statements

1 Reporting entity

Kingspan Group plc ("the Company" or "the Group") is a public

limited company registered and domiciled in Ireland. The condensed

consolidated interim financial statements of the Company as at and

for the six months ended 30 June 2014 comprise the Company and its

subsidiaries (together referred to as the "Group") and the Group's

interests in jointly controlled entities.

The Group is primarily involved in the manufacture of high

performance insulation and building envelope solutions.

The financial information presented in the half-yearly report

does not represent full statutory accounts. Full statutory accounts

for the year ended 31 December 2013 prepared in accordance with

IFRS, as adopted by the EU, upon which the auditors have given an

unqualified audit report, are available on the Group's website

(www.kingspan.com).

2 Basis of preparation

This Half-Yearly Financial Report is unaudited but has been

reviewed by the auditors.

(a) Statement of compliance

These condensed consolidated interim financial statements (the

Interim Financial Statements) have been prepared in accordance with

IAS 34 Interim Financial Reporting and do not include all of the

information required for full annual financial statements.

The Interim Financial Statements were approved by the Board of

Directors on 22 August 2014.

(b) Significant accounting policies

The accounting policies applied by the Group in the Interim

Financial Statements are the same as those applied by the Group in

its consolidated financial statements as at and for the year ended

31 December 2013, except for the adoption of IFRS 10 Consolidated

Financial Statements, IFRS 11 Joint Arrangements, IFRS 12

Disclosure of Interests in Other Entities, IFRIC 21 Levies and

amendments to IAS 27, IAS 28, IAS 32, IAS 36 and IAS 39.

The effect of the adoption of IFRS 11 is set out in note 14. The

adoption of other new standards and interpretations (as set out in

the 2013 Annual Report) that become effective in the current period

did not have any significant impact on the interim financial

statements.

Comparative information has been restated, where applicable to

be consistent.

The Income Statement has been expanded to include cost of sales,

gross profit and operating costs in order to assist the reader to

better understand the components of profit.

(c) Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing the Interim Financial Statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

as at and for the year ended 31 December 2013.

The Interim Financial Statements are available on the Group's

website (www.kingspan.com).

3 Reporting currency

The Interim Financial Statements are presented in euro which is

the functional currency of the Company and presentation currency of

the Group.

Results and cash flows of foreign subsidiary undertakings have

been translated into euro at the average exchange rates for the

period, as these approximate the exchange rates at the dates of the

transactions. The related assets and liabilities have been

translated at the closing rates of exchange ruling at the end of

the reporting period.

The following significant exchange rates were applied during the

period:

Average rate Closing rate

H1 2014 H1 2013 FY 2013 30.06.14 30.06.13 31.12.13

Euro =

Pound Sterling 0.822 0.851 0.849 0.800 0.850 0.833

US Dollar 1.371 1.314 1.329 1.362 1.304 1.377

Canadian Dollar 1.504 1.333 1.369 1.457 1.360 1.464

Australian Dollar 1.499 1.295 1.378 1.446 1.400 1.540

Czech Koruna 27.443 25.687 25.976 27.468 25.887 27.401

Polish Zloty 4.175 4.176 4.195 4.154 4.331 4.151

Hungarian Forint 306.79 296.09 296.87 308.55 295.39 297.08

4 Operating segments

The Group has the following four reportable segments:

Insulated Panels Manufacture of insulated panels, structural framing

and metal facades.

Insulation Boards Manufacture of rigid insulation boards, building

services insulation and engineered timber systems.

Environmental Manufacture of distributed energy, water and environmental

management solutions.

Access Floors Manufacture of raised access floors.

Analysis by class of

business

Segment revenue

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Total revenue - H1 2014 526.1 221.1 71.6 70.5 889.3

Total revenue - H1 2013

(restated)* 482.5 218.8 71.3 78.9 851.5

Segment result (profit before finance expense)

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Trading profit - H1

2014 43.7 17.7 0.2 7.6 69.2

Intangible amortisation (1.4) (0.7) (0.1) - (2.2)

----------------- ----------------- ------------------ ---------- ---------

Operating result - H1

2014 42.3 17.0 0.1 7.6 67.0

----------------- ----------------- ------------------ ----------

Net finance expense (7.0)

---------

Profit for the period before income tax 60.0

Income tax expense (10.1)

---------

Profit for the period

- H1 2014 49.9

---------

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Trading profit - H1

2013 33.5 13.4 0.8 8.1 55.8

Intangible amortisation (1.1) (0.7) (0.1) - (1.9)

----------------- ----------------- ------------------ ---------- ---------

Operating result - H1

2013 32.4 12.7 0.7 8.1 53.9

----------------- ----------------- ------------------ ----------

Net finance expense (6.8)

---------

Profit for the period before income tax 47.1

Income tax expense (7.9)

---------

Profit for the period

- H1 2013 39.2

---------

Segment assets and liabilities

Total Total

Insulated Insulation Access 30 June 30 June

Panels Boards Environmental Floors 2014 2013

EURm EURm EURm EURm EURm EURm

Assets - H1 2014 804.6 451.0 156.3 136.2 1,548.1

Assets - H1 2013

(restated)* 732.8 438.8 160.1 133.8 1,465.5

Derivative financial

instruments 1.5 15.0

Cash and cash

equivalents 192.7 135.9

Deferred tax asset 7.1 9.1

--------- ---------

Total assets 1,749.4 1,625.5

--------- ---------

Liabilities - H1

2014 (270.6) (105.2) (39.5) (25.4) (440.7)

Liabilities - H1

2013 (restated)* (250.4) (96.2) (37.6) (22.9) (407.1)

Interest bearing loans and borrowings (current

and non-current) (301.3) (314.8)

Derivative financial instruments (current and

non-current) (8.3) -

Deferred consideration (current and non-current) (12.4) (7.9)

Income tax liabilities (current and deferred) (63.7) (70.2)

--------- ---------

Total liabilities (826.4) (800.0)

--------- ---------

Other segment information

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Capital Investment -

H1 2014 11.0 8.7 1.1 0.7 21.5

Capital Investment -

H1 2013 11.1 8.1 1.1 0.8 21.1

Depreciation included

in segment

result - H1 2014 (11.5) (5.7) (1.6) (0.9) (19.7)

Depreciation included

in segment

result - H1 2013 (restated)* (11.5) (5.4) (1.8) (1.1) (19.8)

Non cash items included

in segment result - H1

2014 (2.0) (1.2) (0.4) (0.4) (4.0)

Non cash items included

in segment result -H1

2013 (2.8) (1.5) (0.8) (0.5) (5.6)

Analysis of segmental data by

geography

Republic United Rest

of Ireland Kingdom of Americas Others Total

EURm EURm Europe EURm EURm EURm

EURm

Income Statement

Items

Revenue - H1 2014 35.1 335.3 314.2 113.7 91.0 889.3

Revenue - H1 2013

(restated)* 36.0 290.7 316.6 119.8 88.4 851.5

Statement of Financial Position Items

Non current assets

- H1 2014 51.8 336.4 298.8 177.2 65.2 929.4

Non current assets

- H1 2013 54.9 321.7 304.1 159.2 60.3 900.2

Capital Investment

- H1 2014 1.1 6.0 10.7 2.0 1.7 21.5

Capital Investment

- H1 2013 1.2 7.9 9.2 2.3 0.5 21.1

In presenting information on the basis of geographic segments,

segment revenue is based on the geographic location of

customers.

Segment assets are based on the geographic location of the

assets.

5 Seasonality of operations

Activity in the global construction industry is characterised by

cyclicality and is dependent to a significant extent on the

seasonal impact of weather in some of the Group's operating

locations. Activity is second half weighted.

6 Finance expense and finance income

6 months 6 months

ended ended

30 June 30 June

2014 2013

EUR'000 EUR'000

Finance expense

Bank loans 1,123 1,347

Private placement 5,869 5,956

Net defined benefit pension scheme 91 157

Fair value movement on derivative

financial instruments (1,760) (99)

Fair value movement on private placement

debt 1,824 (144)

--------- ---------------------------------

7,147 7,217

Finance income

Interest earned (191) (399)

Net finance cost 6,956 6,818

--------- ---------------------------------

No borrowing costs were capitalised during the period (H1 2013:

Nil).

7 Taxation

Taxation provided for on profits is EUR10.1m which represents

16.2% of the profit before tax and amortisation for the period (H1

2013: 16%). The full year effective tax rate in 2013 was 13.8%. The

taxation charge for the six month period is accrued using an

estimate of the applicable rate for the year as a whole.

8 Analysis of net debt

At At

30 June 30 June

2014 2013

EUR'000 (Restated)*

EUR'000

Cash and cash equivalents 192,711 135,855

Derivative financial instruments (4,852) 13,859

Current borrowings (4,300) (4,121)

Non-current borrowings (296,971) (310,681)

Total net debt (113,412) (165,088)

------------ -------------

Net debt, which is a non GAAP measure, is stated net of interest

rate and currency hedges which relate to hedges of debt. Foreign

currency derivatives which are used for transactional hedging are

not included in the definition of net debt.

9 Financial instruments

The following table outlines the components of net debt by

category:

Loans & Receivables Liabilities

& Other Financial at Fair Derivatives

Assets/(Liabilities) Value Designated Total

at Amortised through as Hedging Net Debt

Cost Profit Instruments by Category

EUR'm or EUR'm EUR'm

Loss

EUR'm

Assets:

Interest rate swaps - - 1.5 1.5

Cash at bank and in

hand 192.7 - - 192.7

---------------------- ------------ -------------- --------------

Total assets 192.7 - 1.5 194.2

---------------------- ------------ -------------- --------------

Liabilities:

Interest rate swaps - - (6.4) (6.4)

Private placement notes (177.2) (119.4) - (296.6)

Other bank loans (4.6) - - (4.6)

---------------------- ------------ -------------- --------------

Total liabilities (181.8) (119.4) (6.4) (307.6)

---------------------- ------------ -------------- --------------

At 30 June 2014 10.9 (119.4) (4.9) (113.4)

---------------------- ------------ -------------- --------------

Loans & Receivables Liabilities

& Other Financial at Fair Derivatives

Assets/(Liabilities) Value Designated Total

at Amortised through as Hedging Net Debt

Cost Profit Instruments by Category

EUR'm or EUR'm EUR'm

Loss

EUR'm

Assets:

Interest rate swaps - - 13.9 13.9

Cash at bank and in

hand 135.9 - - 135.9

---------------------- ------------ -------------- --------------

Total assets 135.9 - 13.9 149.8

---------------------- ------------ -------------- --------------

Liabilities:

Private placement notes (31.7) (278.8) - (310.5)

Other bank loans (4.4) - - (4.4)

---------------------- ------------ -------------- --------------

Total liabilities (36.1) (278.8) - (314.9)

---------------------- ------------ -------------- --------------

At 30 June 2013 (restated)* 99.8 (278.8) 13.9 (165.1)

---------------------- ------------ -------------- --------------

For information on the currency and maturity profile of net debt

please refer to note 21 in the 2013 annual report.

Fair Value of financial instruments carried at fair value

Financial instruments recognised at fair value are analysed

between those based on quoted prices in active markets for

identical assets or liabilities (Level 1), those involving inputs

other than quoted prices that are observable for the assets or

liabilities, either directly or indirectly (Level 2); and those

involving inputs for the assets or liabilities that are not based

on observable market data (Level 3). The following table sets out

the fair value of all financial instruments whose carrying value is

at fair value:

Level 1 Level 2 Level 3

30 June 30 June 30 June

2014 2014 2014

EUR'm EUR'm EUR'm

Financial assets

Interest rate swaps - 1.5 -

Foreign exchange contracts for

hedging - - -

Financial liabilities

Deferred contingent consideration - - (12.4)

Interest rate swaps - (6.4) -

Foreign exchange contracts for

hedging - (2.0) -

---------- --------- ---------

At 30 June 2014 - (6.9) (12.4)

---------- --------- ---------

Level 1 Level 2 Level 3

30 June 30 June 30 June

2013 2013 2013

EUR'm EUR'm EUR'm

Financial assets

Interest rate swaps - 13.9 -

Foreign exchange contracts for

hedging - 1.1 -

Financial liabilities

Deferred contingent consideration - - (7.9)

Interest rate swaps - - -

Foreign exchange contracts for

hedging - - -

---------- --------- ---------

At 30 June 2013 - 15.0 (7.9)

---------- --------- ---------

All derivatives entered into by the Group are included in level

2 and consist of foreign currency forward contracts, interest rate

swaps and cross currency interest rate swaps.

Where derivatives are traded either on exchanges or liquid

over-the-counter markets, the Group uses the closing price at the

reporting date. Normally, the derivatives entered into by the Group

are not traded in active markets. The fair values of these

contracts are estimated using a valuation technique that maximises

the use of observable market inputs, e.g. market exchange and

interest rates.

Deferred contingent consideration is included in level 3.

Further details on deferred contingent consideration is set out in

notes 20 and 24 of the 2013 Annual Report. The EUR4.9m increase in

deferred contingent consideration in the period since December 2013

arises from the Dri Design acquisition (see note 15), the effect of

movement in exchange rates and a small payment. The contingent

element is measured on a series of trading performance targets, and

is adjusted by the application of a range of outcomes and

associated probabilities.

During the period ended 30 June 2014, there were no significant

changes in the business or economic circumstances that affect the

fair value of financial assets and liabilities, no

reclassifications and no transfers between levels of the fair value

hierarchy used in measuring the fair value of the financial

instruments.

Fair Value of financial instruments at amortised cost

Except as detailed below, it is considered that the carrying

amounts of financial assets and financial liabilities recognised at

amortised cost in the condensed consolidated interim financial

statements approximate their fair values.

Private placement notes Carrying amount Fair value

EUR'm EUR'm

At 30 June 2014 296.6 313.3

At 30 June 2013 310.5 312.0

10 Dividends

A final dividend on ordinary shares of 8.5 cent per share in

respect of the year ended 31 December 2013 (31 December 2012:

7.25c) was paid on 15 May 2014.

The Directors are proposing an interim dividend of 6.25 cent

(2013: 5.5 cent) per share in respect of 2014, which will be paid

on 26 September 2014 to shareholders on the register on the record

date of 5 September 2014.

11 Earnings per share

6 months 6 months

ended ended

30 June 30 June

2014 2013

EUR'000 EUR'000

The calculations of earnings per

share are based on the following:

Profit attributable to owners

of the Company 49,880 38,824

--------------- -----------

Number of Number

shares ('000) of

6 months shares

ended ('000)

30 June 6 months

2014 ended

30 June

2013

Weighted average number of ordinary

shares for

the calculation of basic earnings

per share 170,790 169,105

Dilutive effect of share options 3,605 3,440

--------------- -----------

Weighted average number of ordinary

shares

for the calculation of diluted

earnings per share 174,395 172,545

--------------- -----------

EUR cent EUR cent

Basic earnings per share 29.2 23.0

Diluted earnings per share 28.6 22.5

Adjusted basic (pre amortisation)

earnings per share 30.5 24.1

The number of options which are anti-dilutive and have therefore

not been included in the above calculations are 613,012 (H1 2013:

1,207,684).

12 Property, plant & equipment

At At At

30 June 30 June 31 Dec

2014 2013 2013

(Restated)* (Restated)*

EUR'000 EUR'000 EUR'000

Cost or valuation 1,116,647 1,111,551 1,084,016

Accumulated depreciation

and impairment charges (621,716) (617,415) (596,265)

------------ ------------- ---------------

Net carrying amount 494,931 494,136 487,751

------------ ------------- ---------------

Opening net carrying amount 487,680 503,761 503,761

Acquisitions through business

combinations 179 - (1,000)

Additions 21,343 21,105 43,770

Disposals (471) (359) (2,581)

Reanalysed from "held for

sale" - - 395

Depreciation charge (19,711) (19,808) (39,661)

Impairment charge (1,214) - (5,623)

Effect of movement in exchange

rates 7,125 (10,563) (11,310)

Closing net carrying amount 494,931 494,136 487,751

------------ ------------- ---------------

The disposals generated a profit of EUR0.1m (H1 2013: EUR0.1m

profit) which has been included within Operating Costs.

13 Reconciliation of net cash flow to movement in net debt

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2013

2014 2013

(Restated)* (Restated)*

EUR'000 EUR'000 EUR'000

(Decrease)/increase in cash

and bank overdrafts (7,610) (598) 60,876

(Increase)/decrease in debt 2,485 (505) (3,804)

(Increase)/decrease in lease

finance 135 177 423

------------ ------------- -------------

Change in net debt resulting

from cash flows (4,990) (926) 57,495

Translation movement - relating

to US dollar loans (6,188) 3,503 23,515

Translation movement - other 3,706 (3,475) (4,049)

Derivative financial instruments

movement 806 1,032 (18,485)

------------ ------------- -------------

Net movement (6,666) 134 58,476

Net debt at start of the

period (106,746) (165,222) (165,222)

------------ ------------- -------------

Net debt at end of the period (113,412) (165,088) (106,746)

------------ ------------- -------------

14 Change in accounting policy and reclassification

The Group adopted IFRS 11 'Joint Arrangements' from 1 January

2014 with retrospective application to 2013, as required by the

standard. Previously the Group reported its share of the results

from Joint Arrangements separately on each line of the Income

Statement and its share of the assets and liabilities separately on

each line of the Statement of Financial Position. The standard now

requires that the Group report only its share of the profit after

tax and the net investment in the Joint Arrangements. The share of

the profit after tax from Joint Arrangements for the half year

ending 30 June 2014 was EUR365,000 (half year ending 30 June 2013:

loss of EUR89,000). Due to the relative size of these amounts, the

share of results from Joint Arrangements has been included within

the Operating Costs line of the Income Statement. The adoption of

IFRS 11 on the individual line items in the Statement of Financial

Position and the Statement of Cash Flows is not material.

15 Acquisitions

On 28 February 2014 the Group acquired 95% of the share capital

in Dri-Design Inc., a high-end architectural facades business in

the US. This acquisition will allow the Group to expand its product

offering to customers in its Panels division. The provisional fair

value of the acquired assets and liabilities at that date are set

out below:

EUR'000

Non-current assets

Intangible assets 5,118

Property, plant and equipment 179

Deferred tax assets 485

Current assets

Inventories 954

Trade and other receivables 2,879

Current liabilities

Trade and other payables (2,107)

Provisions for liabilities (702)

---------

Total identifiable assets 6,806

Goodwill 21,761

---------

Total consideration 28,567

---------

Satisfied by:

Cash 23,404

Deferred contingent consideration 5,163

---------

28,567

---------

Since the valuation of the fair value of assets and liabilities

recently acquired is still in progress, the above values are

determined provisionally.

The acquired goodwill is attributable principally to the profit

generating potential of the business, together with cross-selling

opportunities and other synergies expected to be achieved from

integrating the acquired company into the Group's existing

business.

The gross value, before impairment provisions, of trade and

other receivables at acquisition was EUR4.4m. The deferred

contingent consideration includes a potential amount payable to the

former owners if certain trading targets are achieved and an

estimate for the buy-out of the non-controlling interest. There are

put and call option arrangements in place that are exercisable

between years 3 and 5 and are based on a multiple of EBITDA. As

these options are expected to be exercised, the Group has

consolidated the acquired entity as a 100% subsidiary.

In the post-acquisition period to 30 June 2014, the acquired

business contributed revenue of EUR5.4m and a trading profit of

EUR0.75m to the Group's results.

16 Capital and reserves

Issues of ordinary shares

1,283,257 ordinary shares (H1 2013: 1,176,516) were issued as a

result of the exercise of vested options arising from the Group's

share option schemes (see the 2013 Annual Report for full details

of the Group's share option schemes). Options were exercised at an

average price of EUR3.32 per option.

17 Significant events and transactions

There were no individually significant events or transactions in

the period which contributed to the material changes in the

Statement of Financial Position; the more significant movements are

described below:

-- the changes in Inventories, Trade & other receivables and

Trade & other payables reflect the normal business cycle;

-- the fair value of derivatives moved as a result of the

movements in the US dollar exchange rate against both sterling and

the euro; and

-- the positive currency translation movement of EUR21.8m

reflected in the Consolidated Statement of Comprehensive Income

reflects primarily the strengthening of sterling, partially offset

by the weakening of US dollars, Australian dollars and Canadian

dollars.

18 Related party transactions

There were no changes in related party transactions from the

2013 Annual Report that could have a material effect on the

financial position or performance of the Group in the first half of

the year.

19 Subsequent events

There have been no material events subsequent to 30 June 2014

which would require disclosure in this report.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDILBDBGSU

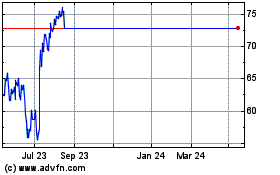

Kingspan (LSE:KGP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kingspan (LSE:KGP)

Historical Stock Chart

From Jul 2023 to Jul 2024