TIDMKGP

RNS Number : 3094K

Kingspan Group PLC

20 August 2012

KINGSPAN GROUP PLC

HALF-YEARLY FINANCIAL REPORT

For the period 30(th) June 2012

Kingspan, the global leader in high performance insulation and

building envelope solutions, presents its half-yearly financial

report for the period to 30 June 2012

Highlights:

Financial Highlights:

-- Revenue up 3% to EUR757.4m, a decrease of 1% on a constant currency basis

-- Trading profit up 19% to EUR52.7m, an increase of 14% on a constant currency basis

-- Margin prioritised over volume, resulting in Group trading

margin of 7.0%, an increase of 100bps versus the same period in

2011

-- Basic EPS up 28% to 22.1 cent

-- Interim dividend per share up 11% to 5.0 cent

-- Net debt of EUR171.2m (H1 2011: EUR207.2m). Net debt to

EBITDA of 1.2x (2011:1.8x) and interest cover of 9.9x

(2011:12.2x)

-- Successful re-financing of a five year EUR300m syndicated

bank facility in April 2012 extending the weighted average maturity

of the Group's debt facilities to 5.3 years (June 2011: 2.8

years)

Operational Highlights:

-- Insulated Panels divisional sales up 3% and trading profit up

25% reflecting a higher specification sales mix and penetration

growth in developing markets

-- Insulation Boards divisional sales up 4% and trading profit

up 7% reflecting proportionately higher sales of Kooltherm(R)

somewhat offset by pricing pressure in PIR board

-- Access Floors divisional sales up 20% and trading profit up

31% reflecting strong datacentre volumes and a gradual improvement

in office activity

-- Environmental divisional sales down 12% and trading profit

flat on prior year due, predominantly, to the conclusion of a

contract in France and lower UK social housing refurbishment

-- Agreement reached in August to acquire the businesses of

Thyssenkrupp Construction in Europe and, separately, Rigidal

Industries LLC in the UAE. Combined revenue in 2011 was

approximately EUR340m

Summary Financials:

H1'12 H1'11 % change

EURm EURm

---------------------- ------ ------ ---------

Revenue 757.4 736.0 +3.0%

EBITDA* 71.9 63.5 +13.2%

Trading Profit** 52.7 44.2 +19.2%

Trading Margin 7.0% 6.0% +100bps

Profit after tax 37.2 29.2 +27.4%

EPS (cent per share) 22.1 17.3 +27.8%

---------------------- ------ ------ ---------

*Earnings before finance costs, income tax, depreciation and

intangible amortisation

**Earnings before amortisation of intangibles, finance costs and

income tax.

Gene Murtagh, Chief Executive of Kingspan commented:

"Kingspan is very pleased to report another period of progress

for the Group through a combination of organic growth and the

successful integration of acquisitions. The trading environment

across many of our geographies continues to be very uncertain which

is having a moderating impact, albeit with Kingspan continuing to

outperform the general markets in which we operate."

For further information contact:

Murray Consultants Tel: +353 (0) 1 4980 300

Ed Micheau

Business Review

The first six months of 2012 were characterised by a relatively

strong first quarter which flagged considerably towards mid-year.

This moderation in recent activity levels coincided with weakening

sentiment generally across Europe driven by interminable political

indecision. Against this backdrop, Group sales in the period grew

by 3% to EUR757.4m, while Group trading profit rose by 19% to

EUR52.7m. Trading margin improved year on year by 100bps from 6% to

7% reflecting a combination of higher specification sales mix and a

priortisation across the Group of margin over volume.

The Group posted robust performances in both the Insulated

Panels and Insulation businesses in the UK where, despite a

lacklustre backdrop, sales grew by 1%. North America also performed

satisfactorily across both Insulated Panels and Access Floors with

Australasia again growing well for the Group. In contrast to these

markets, Western Europe was hamstrung by an unusually weak

construction environment in the Netherlands, owing in the main to

sentiment driven weakness in the residential sector. Germany

performed well, as did the core central European markets but sales

declined in Russia and Turkey.

With regard to raw materials, chemical prices continued to

harden during the period impacting the cost base of the Group's

insulation businesses. Steel prices were more stable, and may

reduce during the second half, acting as some counterbalance to an

anticipated rise in chemical costs.

During August 2012 Kingspan entered an agreement to acquire the

Thyssenkrupp Construction business, based in Germany, and also

producing in France, Belgium, Austria and Hungary. The acquisition

provides Kingspan with a significant platform from which to grow

further in key continental European markets. Separately, the Group

agreed to acquire Rigidal Industries LLC, a Dubai based regional

leader in insulated roof and wall systems, again furthering the

Group's geographical reach. Combined 2011 turnover of these

businesses was approximately EUR340m.

Insulated Panels

HY '12 HY '11 Change

EURm EURm

---------------- ------- ------- -------

Turnover 361.1 350.4 +3%(1)

Trading Profit 27.1 21.7 +25%

Trading Margin 7.5% 6.2%

---------------- ------- ------- -------

(1) Comprising volume -5%, price/mix +5% and currency impact +3%

Overall, the division recorded a strong trading performance in

the period with an improved margin in all regions, up 130bps from

6.2% to 7.5%. This margin growth reflected, in the main, growing

sales of higher specification products including architectural

lines and operating leverage in newer, developing, markets such as

Australia.

UK

Sales revenue in the UK grew by 1%, while volume declined by 2%.

Although most end-market segments were steady, activity in the

retail and food segments was particularly robust as has been the

case in recent years. Additionally, Benchmark(R) architectural

sales improved well year on year, with some notable success in

specifications achieved. Growth in this product suite and other

recent product introductions are key to achieving sustainable

margin enhancement for the division more generally. The project

pipeline through to year end points towards a stable performance in

the second half across most sectors.

Mainland Europe

Sales revenue in the region grew by 1%, while volume declined by

6%, owing to a solid performance in Germany, Poland and the Czech

Republic where volume grew significantly through both penetration

and activity growth. Combined, the Netherlands and Belgium recorded

volume reductions, as did the Balkans and Turkey. This trading

pattern is likely to remain through the year, although the lower

sales volume in some regions will be offset by improved margins

through continuous improvement in the cost base and optimising the

sales mix.

North America

Sales revenue in this region grew by 9%, while volume declined

by 6%. Activity in the commercial and industrial segment began the

year relatively muted but improved significantly during the second

quarter as larger projects in the pipeline were awarded. The

manufacturing and resources sectors have been particularly active

as has government funded infrastructure. The coldstorage segment

was weaker for Kingspan as, intentionally, volume was sacrificed

for margin.

Australasia

Sales revenue grew by 32%, and volume grew by 13%, as the market

conversion process evident over recent years generated real

traction. Despite general economic weakness in Australia, activity

in the resources and retail/distribution sectors drove much of the

growth in the first half. This pattern is likely to continue for

the foreseeable future and will be reinforced with further new

product introductions in the region.

Ireland

Sales revenue declined by 13%, while volume declined by 9%, as

the market slipped further downward. It now represents ca. 6% of

the division's volume and can be expected to stabilise at around

these levels.

Insulation Boards

HY '12 HY '11 Change

EURm EURm

---------------- ------- ------- --------

Turnover 232.1 222.6 +4% (1)

Trading Profit 15.5 14.5 +7%

Trading Margin 6.7% 6.5%

---------------- ------- ------- --------

(1) Comprising volume -9%, price/mix +10% and currency impact +3%

Overall, trading in the division in the early part of the year

was relatively strong, but weakened during the second quarter,

particularly in the UK and Netherlands which account for the lion's

share of divisional activity. Margins improved year on year from

6.5% to 6.7% reflecting a combination of a positive Kooltherm(R)

sales mix somewhat offset by margin pressure in PIR board.

UK

The early part of the year saw relatively buoyant activity in

the UK, which tapered off somewhat towards mid-year, resulting in a

year on year sales revenue increase of 1%, and a volume decline of

10%. The volume/value differential relates to a significant

improvement in Kooltherm(R) penetration as well as inflation

recovery over the same period a year earlier. Although private

newbuild residential is somewhat encouraging, the second half could

see a continuation of quarter two's performance as the timeframe

for government social housing and refurbishment initiatives is

extended further.

Mainland Europe

The division's primary Continental European presence is in the

Benelux and Germany with growing positions in CEE and France.

Similar to the UK, quarter one's performance was solid. However,

some market slippage was evident during the second quarter

resulting in volume for the first half decreasing by 8%, while

increasing by 5% in revenue. Belgium performed particularly well,

as did Germany, but the Netherlands weakened sharply toward

mid-year with no improvement anticipated in the near-term.

Australasia

Sales volume declined 4% in the period, while value grew 12%

driven by the process of transitioning the sales profile of the

business more towards the higher value, proprietary Kooltherm(R)

insulation. This dynamic was key to ensuring the business grew in

the first half, despite a notable deterioration in newbuild

residential activity in Australia and New Zealand.

Ireland

Sales volume declined again by 18%, or 9% by revenue, as the

wider construction market dipped further. Refurbishment and the

Kooltherm(R) product are the anchor drivers for this business

presently with newbuild housing reaching a low of ca. 5,000 units

per annum.

Access Floors

HY '12 HY '11 Change

EURm EURm

---------------- ------- ------- ---------

Turnover 77.9 65.1 +20% (1)

Trading Profit 8.9 6.8 +31%

Trading Margin 11.4% 10.4%

---------------- ------- ------- ---------

(1) Comprising volume +6%, price/mix -2%, currency impact +8% and acquisition +8%

Sales revenue in North America grew 22% in the period resulting

from continued robustness of the datacentre market, gradual

evidence of recovery in the office sector and a number of

attractive export contracts, including some to the Middle East and

South America. Margins, however, have come under some pressure

given what to-date has been the relentless weakness of the US

office construction market. Canada was somewhat weaker than

anticipated but recent contracts secured should see this trend

improve towards year end.

Sales revenue in Europe was down by 3% owing predominately to

weaker sales in Continental Europe and offset, to some extent, by

an improvement in office construction activity in the UK. Given the

late cycle nature of this business, the period from late 2012

through 2013 is likely to see continued gradual improvement in the

performance of access floor sales in Europe.

In Australia, where the Group made a entry platform acquisition

in January, a relatively weak start to the year should give way to

improved activity later in 2012.

Environmental

HY '12 HY '11 Change

EURm EURm

---------------- ------- ------- -------

Turnover 86.3 97.9 -12%

Trading Profit 1.2 1.2 -

Trading Margin 1.4% 1.2%

---------------- ------- ------- -------

During quarter one sales into France continued to perform

strongly, however as indicated previously, this contract has now

concluded. This, coupled with a sharp decline in UK social

refurbishment projects, resulted in a reduction in sales in quarter

two, generating a year on year sales decrease of 12%.

In excess of 50% of this division's revenues are currently

generated in the UK, which is likely to hamper progress somewhat in

the near-term. The division is expanding its presence in Mainland

Europe, the Nordics, and North America with a range of integrated

environmental solutions comprising solarthermal, micro wind power

and water management. This will ultimately shape the success of the

division in the coming years.

Financial Review

Overview of results

Group revenue increased by 3% to EUR757.4m (H1 2011: EUR736.0m)

and trading profit increased by 19% to EUR52.7m (H1 2011:

EUR44.2m). These measures were a 1% decrease in sales and 14%

increase in trading profit on a constant currency basis. This

resulted in an improvement of 100 basis points in the Group's

trading profit margin to 7.0% (2011: 6.0%). The amortisation charge

in respect of intangibles was EUR1.4m compared to EUR2.5m in the

first half of 2011 with the decrease reflecting balances fully

written off on expiration of their accounting useful lives. Group

operating profit, after amortisation grew 23% to EUR51.3m. Profit

after tax was EUR37.2m compared to EUR29.2m in the first half of

2011 driven in the main by the growth in trading profit. Basic EPS

for the period was 22.1 cent, representing an increase of 28% on

the first half of 2011 (H1 2011: 17.3 cent).

The Group's underlying sales and trading profit growth by

division are set out below:

Sales Underlying Currency Acquisition Total

------------------- ----------- --------- ------------ ------

Insulated Panels - +3% - +3%

Insulation Boards +1% +3% - +4%

Access Floors +4% +8% +8% +20%

Environmental -16% +4% - -12%

Group -2% +4% +1% +3%

----------- --------- ------------ ------

The Group's trading profit measure is earnings before interest,

tax and amortisation of intangibles:

Trading Profit Underlying Currency Acquisition Total

------------------- ----------- --------- ------------ ------

Insulated Panels +20% +4% - +24%

Insulation Boards +3% +4% - +7%

Access Floors +26% +7% - +33%

Environmental -8% +7% - -1%

Group +14% +5% - +19%

----------- --------- ------------ ------

Finance costs

Finance costs for the half year increased by EUR1.3m to EUR6.8m

(H1 2011: EUR5.6m). Finance costs include a near neutral non-cash

item (H1 2011: EUR0.3m credit) in respect of the Group's legacy

defined benefit pension schemes. A net non-cash credit of EUR0.9m

was recorded in respect of swaps on the Group's USD private

placement notes (H1 2011: charge of EUR0.3m). The Group's net

interest expense on borrowings (bank and loan notes) was EUR7.7m

compared to EUR5.5m in the first half of 2011. This increase

reflects the USD private placement completed in August 2011 which

was used to repay the shorter term revolving credit bank facility

with the balance placed on deposit to fund the Group's future

development needs. In the near term this has increased the Group's

net interest expense but affords flexibility with an extended debt

maturity.

Taxation

The tax charge for the first half of the year was EUR7.3m (H1

2011: EUR7.0m) which represents an effective tax rate of 16% on

earnings before amortisation (H1 2011: 18%). The decrease in the

effective tax rate is primarily due to the geographic mix of

earnings and a reduction in the headline corporation tax rate in

the UK.

Retirement benefits

The Group makes pension provision for current pensionable

employees through defined contribution arrangements. The Group has

two legacy defined benefit schemes which are closed to new members

and to future accrual. The net pension deficit in respect of these

schemes was EUR0.6m as at 30 June 2012 (30 June 2011: deficit of

EUR0.1m).

Free cashflow

Free cashflow H1'12 H1'11

EUR'm EUR'm

-------------------------------- ------- -------

EBITDA* 71.9 63.5

Movement in working capital (17.8) (16.9)

Net capital expenditure (16.0) (10.7)

Pension contributions (0.8) (1.4)

Finance costs (9.5) (6.0)

Income taxes paid (6.8) (2.6)

Other including non-cash items 6.6 3.8

------- -------

Free cashflow 27.6 29.7

------- -------

*Earnings before finance costs, income taxes, depreciation and

amortisation

Working capital increased by EUR17.8m in the first half of 2012

(increase of EUR16.9m in H1 2011). This reflects seasonal

variability associated with trading patterns and the timing of

significant purchases for steel and chemicals.

Net debt

Net debt increased by EUR1.1m during the first half to EUR171.2m

(31 December 2011: EUR170.1m). This is analysed in the table below.

The amount recorded in respect of settlement of legal costs relates

to legal fees associated with the Group's unsuccessful litigation

in respect of the Borealis claim in the Environmental division.

Movement in net debt H1'12 H1'11

EUR'm EUR'm

----------------------------------- -------- --------

Free cashflow 27.6 29.7

Acquisitions (net of disposal

proceeds) (7.2) (107.4)

Settlement of legal costs (12.3) -

Share issues 1.4 0.2

Dividends paid (10.8) (9.8)

-------- --------

Cashflow movement (1.3) (87.3)

Exchange movements on translation 0.2 0.9

-------- --------

Increase in net debt (1.1) (86.4)

Net debt at start of year (170.1) (120.8)

-------- --------

Net debt at end of period (171.2) (207.2)

-------- --------

Financing

The Group funds itself through a combination of equity and debt.

Debt is funded through a combination of a syndicated bank facility

and private placement loan notes. The primary debt facility is a

revolving credit facility of EUR300m entered into in April 2012

with a syndicate of international banks and which matures in April

2017. The facility was undrawn at the period end and replaced a

pre-existing facility of EUR330m scheduled to mature in September

2013. The Group has two US Private Placement loan notes for $400m

in aggregate, of which $158m matures in 2015, $42m in 2017 with the

balance of $200m maturing in 2021. The weighted average maturity of

debt facilities at half year end was 5.3 years (June 2011: 2.8

years).

The Group has significant available undrawn facilities which

provide appropriate headroom for potential development

opportunities.

Key financial covenants

The majority of Group borrowings are subject to primary

financial covenants calculated in accordance with lenders' facility

agreements:

- A maximum net debt to EBITDA ratio of 3.5 times

- A maximum net debt to net interest coverage of 4 times

The performance against these covenants in the current and

comparative year is set out below:

June 2012 June 2011

Covenant Times Times

--------------------- ------------- ---------- ----------

Net debt/EBITDA Maximum 3.5 1.2 1.8

EBITDA/Net interest Minimum 4.0 9.9 12.2

--------------------- ------------- ---------- ----------

Related party transactions

There were no changes in related party transactions from the

2011 Annual Report that could have a material effect on the

financial position or performance of the Group in the first half of

the year.

Principal risks & uncertainties

Details of the principal risks and uncertainties facing the

Group can be found in the 2011 Annual Report. These risks in

particular macro-economic construction activity in key markets,

fluctuating raw material costs and volatile currencies, remain the

most likely to affect the Group in the second half of the current

year. The Group actively manages these and all other risks through

its control and risk management processes.

Dividend

The Board has declared an interim dividend of 5.0 cent per

ordinary share, an increase of 11.1% on 2011 interim dividend of

4.5 cent per share. The interim dividend will be paid on 21

September to shareholders on the register on the record date of 31

August 2012.

Looking Ahead

The macro backdrop in recent years has been variously described

as challenging and uncertain. This is the environment we now

operate in, and we remain focused on what we can influence,

continuing to make progress in that context.

As outlined, after an encouraging start to the year markets

moderated through the second quarter. Without looking too far

ahead, it is likely that the Group's trading environment for the

remainder of the year will weaken further from that experienced in

the second quarter. That said, the Group enters the second half

with a positive orderbook overall. In Insulated Panels the

orderbook at the end of June 2012 was ahead of the same period last

year in North America by +3%, in the UK and Western Europe by +13%

and CEE by +22%. In Insulation Boards, the trend seen in the year

to date of overall volume weakness relieved somewhat by a positive

sales mix can be expected to continue in the near-term, although

activity in the Netherlands is likely to ease further. Our

Environmental division is likely to record more pronounced weakness

in the second half, versus the same period last year, at which time

sales to France were at a peak. Somewhat encouraging in the year to

date were sales of Access Floors and, in the second half,

performance could be modestly ahead of the same period last

year.

Overall, the Group will continue to drive its conversion

approach with the objective of increasing market penetration for

higher performance insulation and building envelope solutions. Our

focus will continue on iteratively rebuilding margin and returns on

capital through greater efficiency, product specification,

innovation and operating leverage, not alone in Kingspan's existing

businesses, but in the recently acquired TK Construction businesses

across Europe. The Group has a strong, well capitalised balance

sheet and, overall, is well placed to progress in the years

ahead.

RESPONSIBILITY STATEMENT

Directors' Responsibility Statement in respect of the

half-yearly financial report for the six months ended 30 June

2012

Each of the directors, whose names and functions are listed in

the 2011 Annual Report (with the exception of Mr Danny Kitchen, who

retired on 10 May 2012) confirm our responsibility for preparing

the half yearly financial report in accordance with the

Transparency (Directive 2004/109/EC) Regulations 2007, the

Transparency Rules of the Republic of Ireland's Financial Regulator

and with IAS34 "Interim Financial Reporting" as adopted by the EU.

We confirm that to the best of our knowledge:

a) the condensed consolidated interim financial statements

comprising the condensed consolidated income statement, the

condensed consolidated statement of comprehensive income, the

condensed consolidated statement of financial position, the

condensed consolidated statement of changes in equity, the

condensed consolidated statement of cash flows and related notes

have been prepared in accordance with the Transparency (Directive

2004/109/EC) Regulations 2007, the Transparency Rules of the

Republic of Ireland's Financial Regulator and with IAS 34 "Interim

Financial Reporting" as adopted by the EU.

b) The interim management report includes a fair review of the

information required by:

i) Regulation 8(2) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

ii) Regulation 8(3) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being related party transactions that have taken

place in the first six months of the current financial year and

that have materially affected the financial position or performance

of the entity during that period; and any changes in the related

party transactions described in the last annual report that could

do so.

On behalf of the Board

Gene Murtagh Geoff Doherty

Chief Executive Officer Chief Financial Officer

20 August 2012 20 August 2012

Kingspan Group plc

Condensed consolidated income statement

for the half year ended 30 June 2012

6 months 6 months

ended ended

30 June 2012 30 June

2011

(Unaudited) (Unaudited)

Note EUR'000 EUR'000

Revenue 4 757,391 735,950

Costs of sales (533,824) (533,109)

------------- ------------

Gross Profit 223,567 202,841

Operating costs, excluding intangible

amortisation (170,846) (158,596)

------------- ------------

Trading Profit 4 52,721 44,245

Intangible amortisation (1,378) (2,518)

------------- ------------

Operating Profit 51,343 41,727

Finance expense 6 (7,278) (5,980)

Finance income 6 454 415

------------- ------------

Profit for the period before income

tax 44,519 36,162

Income tax expense 7 (7,344) (6,962)

------------- ------------

Net Profit for the period 37,175 29,200

------------- ------------

Attributable to owners of Kingspan

Group plc 37,033 28,786

Attributable to non-controlling

interests 142 414

------------- ------------

37,175 29,200

------------- ------------

Earnings per share for the period

Basic 10 22.1c 17.3c

Diluted 10 21.7c 16.7c

Kingspan Group plc

Condensed consolidated statement of comprehensive income

for the half year ended 30 June 2012

Note 6 months 6 months

ended ended

30 June 30 June

2012 2011

(Unaudited) (Unaudited)

EUR'000 EUR'000

Net profit for financial period 37,175 29,200

Other comprehensive income:

Effective portion of changes in fair value

of cash flow hedges (1,046) 2,946

Net change in fair value of cash flow hedges 188 -

reclassified to income statement

Actuarial losses on defined benefit pension

schemes - 128

Exchange differences on translating foreign

operations 23,904 (18,878)

Total comprehensive income for the period 60,221 13,396

------------ ------------

Attributable to owners of Kingspan Group

plc 59,884 12,980

Attributable to non-controlling interests 337 416

------------ ------------

60,221 13,396

------------ ------------

Kingspan Group plc

Condensed consolidated statement of financial position

as at 30 June 2012

At 30 June At 30 June At 31 December

2012 2011 2011

(Unaudited) (Unaudited) (Audited)

Note EUR'000 EUR'000 EUR'000

Assets

Non-current assets

Goodwill 388,715 358,330 373,959

Other intangible assets 7,254 11,149 8,530

Property, plant and equipment 11 451,484 444,140 443,240

Financial assets - 10 -

Derivative financial instruments 23,607 - 14,163

Deferred tax assets 6,858 4,507 7,576

------------ ------------ ---------------

877,918 818,136 847,468

Current assets

Inventories 176,134 178,129 160,661

Trade and other receivables 321,857 303,789 281,802

Derivative financial instruments 2,895 6,803 2,947

Cash and cash equivalents 140,666 95,342 141,067

------------ ------------ ---------------

641,552 584,063 586,477

Non-current assets classified

as held for sale 409 - 392

------------ ------------ ---------------

641,961 584,063 586,869

------------ ------------ ---------------

Total assets 1,519,879 1,402,199 1,434,337

------------ ------------ ---------------

Liabilities

Current liabilities

Trade and other payables 285,209 310,487 253,055

Provisions for liabilities 36,037 39,035 45,955

Derivative financial instruments 1,342 - 21

Deferred consideration 18 489 480

Interest bearing loans and

borrowings 6,711 24,914 10,430

Current income tax liabilities 40,254 36,688 39,363

------------ ------------ ---------------

369,571 411,613 349,304

Non-current liabilities

Retirement benefit obligations 625 67 1,389

Provisions for liabilities 8,060 9,857 9,857

Interest bearing loans and

borrowings 331,651 272,943 317,796

Derivative financial instruments - 11,475 -

Deferred tax liabilities 20,040 21,631 20,662

Deferred consideration 354 956 344

------------ ------------ ---------------

360,730 316,929 350,048

------------ ------------ ---------------

Total liabilities 730,301 728,542 699,352

------------ ------------ ---------------

Net Assets 789,578 673,657 734,985

------------ ------------ ---------------

Equity

Share capital 22,454 22,332 22,344

Share premium 39,314 37,960 38,059

Capital redemption reserve 723 723 723

Treasury shares (30,707) (32,565) (30,707)

Other reserves (83,948) (142,843) (107,715)

Retained earnings 835,268 782,686 806,144

------------ ------------ ---------------

Equity attributable to owners

of Kingspan Group plc 783,104 668,293 728,848

Non-controlling interest 6,474 5,364 6,137

------------ ------------ ---------------

Total Equity 789,578 673,657 734,985

------------ ------------ ---------------

Kingspan Group plc

Condensed consolidated statement of changes in equity

For the half year ended 30 June 2012 (unaudited)

Share Total

Capital Cash based attributable Non-

Share Share redemption Treasury Translation flow payment Revaluation Retained to owners controlling Total

capital premium reserve shares reserve hedging reserve reserve Earnings of the interest equity

reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1

January

2012 22,344 38,059 723 (30,707) (129,386) 1,577 19,381 713 806,144 728,848 6,137 734,985

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions

with owners

recognised

directly

in equity

Shares issued 110 1,255 - - - - - - - 1,365 - 1,365

Employee share

based

compensation - - - - - - 3,854 - - 3,854 - 3,854

Exercise or

lapsing

of share options - - - - - - (2,938) - 2,938 - - -

Dividends - - - - - - - - (10,847) (10,847) - (10,847)

Transactions with

non-controlling

interests:

Dividends paid to - - - - - - - - - - - -

non-controlling

interest

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with

owners 110 1,255 - - - - 916 - (7,909) (5,628) - (5,628)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Total

comprehensive

income for the

period

Profit for the

period - - - - - - - - 37,033 37,033 142 37,175

Other

comprehensive

income

Cash flow hedging

in

equity

- current year - - - - - (1,046) - - - (1,046) - (1,046)

-

reclassification

to profit - - - - - 188 - - - 188 - 188

Defined benefit - - - - - - - - - - - -

pension

scheme

Tax on defined - - - - - - - - - - - -

benefit

pension scheme

Exchange

differences

on translating

foreign

operations - - - - 23,709 - - - - 23,709 195 23,904

Total

comprehensive

income for the

period - - - - 23,709 (858) - - 37,033 59,884 337 60,221

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Balance at 30

June

2012 22,454 39,314 723 (30,707) (105,677) 719 20,297 713 835,268 783,104 6,474 789,578

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Kingspan Group plc

Condensed consolidated statement of changes in equity

For the half year ended 30 June 2011 (unaudited)

Share Total

Capital Cash based attributable Non-

Share Share redemption Treasury Translation flow payment Revaluation Retained to owners controlling Total

capital premium reserve shares reserve hedging reserve reserve Earnings of the interest equity

reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1

January

2011 22,325 37,739 723 (32,565) (147,411) 2,570 14,895 713 763,008 661,997 4,948 666,945

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions

with owners

recognised

directly

in equity

Shares issued 7 176 - - - - - - - 183 - 183

Employee share

based

compensation - - - - - - 2,922 - - 2,922 - 2,922

Exercise or

lapsing

of share options - 45 - - - - (598) - 553 - - -

Dividends - - - - - - - - (9,789) (9,789) - (9,789)

Transactions with

non-controlling

interests:

Capital - - - - - - - - - - - -

contribution

Dividends paid to - - - - - - - - - - - -

non-controlling

interest

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with

owners 7 221 - - - - 2,324 - (9,236) (6,684) - (6,684)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Total

comprehensive

income for the

period

Profit for the

period - - - - - - - - 28,786 28,786 414 29,200

Other

comprehensive

income

Cash flow hedging

in

equity

- current year - - - - - 2,946 - - - 2,946 - 2,946

- - - - - - - - - - - - -

reclassification

to profit

Defined benefit

pension

scheme - - - - - - - - 128 128 - 128

Exchange

differences

on translating

foreign

operations - - - - (18,880) - - - - (18,880) 2 (18,878)

Total

comprehensive

income for the

period - - - - (18,880) 2,946 - - 28,914 12,980 416 13,396

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Balance at 30

June

2011 22,332 37,960 723 (32,565) (166,291) 5,516 17,219 713 782,686 668,293 5,364 673,657

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Kingspan Group plc

Condensed consolidated statement of changes in equity

For the financial year ended 31 December 2011(audited)

Share Total

Capital Cash based attributable Non-

Share Share redemption Treasury Translation flow payment Revaluation Retained to owners controlling Total

capital premium reserve shares reserve hedging reserve reserve Earnings of the interest equity

reserve parent

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance at 1

January

2011 22,325 37,739 723 (32,565) (147,411) 2,570 14,895 713 763,008 661,997 4,948 666,945

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions

with owners

recognised

directly

in equity

Shares issued 19 320 - - - - - - - 339 - 339

Employee share

based

compensation - - - - - - 5,427 - - 5,427 - 5,427

Tax on employee

share

based

compensation - - - - - - 255 - - 255 - 255

Exercise or

lapsing

of share options - - - - - - (1,196) - 1,196 - - -

Transfer of

shares - - - 1,858 - - - - (58) 1,800 - 1,800

Dividends - - - - - - - - (17,473) (17,473) - (17,473)

Transactions with

non-controlling

interests:

Capital

contribution - - - - - - - - - - 200 200

Dividends paid to

non-controlling

interest - - - - - - - - - - (51) (51)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Transactions with

owners 19 320 - 1,858 - - 4,486 - (16,335) (9,652) 149 (9,503)

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Total

comprehensive

income for the

year

Profit for the

year - - - - - - - - 61,835 61,835 1,035 62,870

Other

comprehensive

income

Cash flow hedging

in

equity

- current year - - - - - (1,292) - - - (1,292) - (1,292)

-

reclassification

to profit - - - - - 299 - - - 299 - 299

Defined benefit

pension

scheme - - - - - - - - (3,179) (3,179) - (3,179)

Tax on defined

benefit

pension scheme - - - - - - - - 815 815 - 815

Exchange

differences

on translating

foreign

operations - - - - 18,025 - - - - 18,025 5 18,030

Total

comprehensive

income for the

year - - - - 18,025 (993) - - 59,471 76,503 1,040 77,543

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Balance at 31

December

2011 22,344 38,059 723 (30,707) (129,386) 1,577 19,381 713 806,144 728,848 6,137 734,985

--------- --------- ------------ ----------- ------------- --------- --------- ------------- ---------- ------------- ------------- ----------

Kingspan Group plc

Condensed consolidated statement of cash flows

for the half year ended 30 June 2012

Note 6 months 6 months

ended ended

30 June 2012 30 June

2011

(Unaudited) (Unaudited)

EUR'000 EUR'000

Operating activities

Profit for the period before income

tax 44,519 36,162

Depreciation of property, plant

and equipment and

amortisation of intangible assets 20,561 21,800

Employee equity-settled share options 3,854 2,922

Finance income (454) (415)

Finance expense 7,278 5,980

Non-cash items 2,819 1,177

Profit on sale of property, plant

and equipment (99) (415)

Settlement of legal costs (12,272) -

Change in inventories (10,035) (35,532)

Change in trade and other receivables (27,308) (52,391)

Change in trade and other payables 19,977 73,204

Pension contributions (784) (1,365)

-------------- -------------

Cash generated from operations 48,056 51,127

Taxes paid (6,756) (2,577)

-------------- -------------

Net cash flow from operating activities 41,300 48,550

-------------- -------------

Investing activities

Additions to property, plant and

equipment (16,374) (12,429)

Additions to intangible assets - (41)

Proceeds from disposals of property,

plant and equipment 404 1,803

Purchase of subsidiary undertakings,

net of disposals (7,169) (107,374)

Payment of deferred consideration

in respect of acquisitions (482) (2,202)

Interest received 416 120

-------------- -------------

Net cash flow from investing activities (23,205) (120,123)

-------------- -------------

Financing activities

Drawdown of bank loans - 67,535

Repayment of bank loans (1,433) -

Discharge of finance lease liability (148) (293)

Proceeds from share issues 1,365 183

Interest paid (9,786) (5,808)

Dividends paid (10,847) (9,789)

-------------- -------------

Net cash flow from financing activities (20,849) 51,828

-------------- -------------

Decrease in cash and cash equivalents (2,754) (19,745)

Translation adjustment 4,716 (3,613)

Cash and cash equivalents at the

beginning of the period 137,374 99,481

-------------- -------------

Cash and cash equivalents at the

end of the period 139,336 76,123

-------------- -------------

Cash and cash equivalents at beginning

of period were made up of:

- Cash and cash equivalents 141,067 104,402

- Overdrafts (3,693) (4,921)

-------------- -------------

137,374 99,481

-------------- -------------

Cash and cash equivalents at end

of period were made up of:

- Cash and cash equivalents 140,666 95,342

- Overdrafts (1,330) (19,219)

-------------- -------------

139,336 76,123

-------------- -------------

Kingspan Group plc

Notes

forming part of the financial statements

1 Reporting entity

Kingspan Group plc ("the Company" or "the Group") is a public

limited company registered and domiciled in Ireland. The condensed

consolidated interim financial statements of the Company as at and

for the six months ended 30 June 2012 comprise the Company and its

subsidiaries (together referred to as the "Group") and the Group's

interests in jointly controlled entities.

The Group is primarily involved in the manufacture of high

performance insulation and building envelope solutions.

The financial information presented in the half-yearly report

does not represent full statutory accounts. Full statutory accounts

for the year ended 31 December 2011 prepared in accordance with

IFRS, as adopted by the EU, upon which the auditors have given an

unqualified audit report, have been filed with the Registrar of

Companies.

2 Basis of preparation

The interim results for the half year to 30 June 2012 and 30

June 2011 are unaudited.

(a) Statement of compliance

These condensed consolidated interim financial statements (the

Interim Financial Statements) have been prepared in accordance with

IAS 34 Interim Financial Reporting and do not include all of the

information required for full annual financial statements.

The Interim Financial Statements were approved by the Board of

Directors on 17 August 2012.

(b) Significant accounting policies

The accounting policies applied by the Group in the Interim

Financial Statements are the same as those applied by the Group in

its consolidated financial statements as at and for the year ended

31 December 2011.

The adoption of other new standards and interpretations (as set

out in the 2011 Annual Report) that became effective for the

Group's financial statements for the year ended 31 December 2012

did not have any significant impact on the interim financial

statements.

(c) Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing the Interim Financial Statements, the significant

judgments made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

as at and for the year ended 31 December 2011.

The Interim Financial Statements are available on the Group's

website (www.kingspan.com).

3 Reporting currency

The Interim Financial Statements are presented in euro which is

the functional currency of the Company.

Results and cash flows of foreign subsidiary undertakings have

been translated into euro at the average exchange rates for the

period, as these approximate the exchange rates at the dates of the

transactions. The related assets and liabilities have been

translated at the closing rates of exchange ruling at the end of

the reporting period.

The following significant exchange rates were applied during the

period:

Average rate Closing rate

H1 2012 H1 2011 FY 2011 30.06.12 30.06.11 31.12.11

Euro =

Pound Sterling 0.823 0.868 0.868 0.806 0.90 0.840

US Dollar 1.30 1.40 1.39 1.26 1.44 1.30

Canadian Dollar 1.31 1.37 1.38 1.29 1.40 1.32

Australian Dollar 1.26 1.36 1.35 1.24 1.36 1.27

Czech Koruna 25.13 24.32 24.53 25.81 24.30 25.80

Polish Zloty 4.24 3.94 4.10 4.26 4.00 4.45

Hungarian Forint 294.78 269.00 278.00 288.08 266.00 311.55

4 Operating segments

The Group has the following four reportable segments:

Insulated Panels Manufacture of insulated panels, structural framing

and metal facades.

Insulation Boards Manufacture of rigid insulation boards, building

services insulation and engineered timber systems.

Environmental Manufacture of environmental, pollution control and

renewable energy solutions.

Access Floors Manufacture of raised access floors.

Analysis by class of

business

Segment revenue

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Total revenue - H1 2012 361.1 232.1 86.3 77.9 757.4

Total revenue - H1 2011 350.4 222.6 97.9 65.1 736.0

Segment result (profit before finance costs)

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Trading profit - H1

2012 27.1 15.5 1.2 8.9 52.7

Intangible amortisation (0.3) (0.8) (0.3) - (1.4)

---------- ----------- ---------------- -------- --------

Operating result - H1

2012 26.8 14.7 0.9 8.9 51.3

---------- ----------- ---------------- --------

Net finance expense (6.8)

--------

Profit for the period

before income tax 44.5

Income tax expense (7.3)

--------

Profit for the period

- H1 2012 37.2

--------

Attributable to:

Owners of the Company 37.0

Non-controlling interest 0.2

--------

37.2

--------

Segment result (profit before finance costs)

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Trading profit - H1

2011 21.7 14.5 1.2 6.8 44.2

Intangible amortisation (1.2) (0.9) (0.4) (0.0) (2.5)

---------- ----------- ---------------- -------- --------

Operating result - H1

2011 20.5 13.6 0.8 6.8 41.7

---------- ----------- ---------------- --------

Net finance expense (5.6)

--------

Profit for the period

before income tax 36.1

Income tax expense (7.0)

--------

Profit for the period

- H1 2011 29.2

--------

Attributable to:

Owners of the Company 28.8

Non-controlling interest 0.4

--------

29.2

--------

Segment assets and liabilities

Total Total

Insulated Insulation Access 30 June 30 June

Panels Boards Environmental Floors 2012 2011

EURm EURm EURm EURm EURm EURm

Assets - H1 2012 569.8 450.5 184.1 141.4 1,345.8

Assets - H1 2011 559.6 435.7 184.6 115.7 1,295.6

Derivative financial

instruments 26.5 6.8

Cash and cash equivalents 140.7 95.3

Deferred tax asset 6.9 4.5

--------- ---------

Total assets 1,519.9 1,402.2

--------- ---------

Liabilities - H1

2012 (166.9) (96.0) (40.6) (27.7) (331.2)

Liabilities - H1

2011 (172.1) (116.2) (68.0) (14.6) (370.9)

Interest bearing loans and borrowings (current

and non-current) (338.4) (297.9)

Deferred consideration (current and non-current) (0.4) (1.4)

Income tax liabilities (current and deferred) (60.3) (58.3)

--------- ---------

Total liabilities (730.3) (728.5)

--------- ---------

Other segment information

Insulated Insulation Access

Panels Boards Environmental Floors Total

EURm EURm EURm EURm EURm

Capital Investment -

H1 2012 10.9 3.3 0.7 1.3 16.2

Capital Investment -

H1 2011 7.2 54.3 2.1 0.5 64.1

Depreciation included

in segment

result - H1 2012 (9.8) (6.1) (2.1) (1.2) (19.2)

Depreciation included

in segment

result - H1 2011 (9.8) (6.2) (2.1) (1.2) (19.3)

Non cash items included

in segment result - H1

2012 (1.7) (1.0) (0.8) (0.4) (3.9)

Non cash items included

in segment result -H1

2011 0.1 0.2 0.1 - 0.4

Analysis of segmental data by

geography

Republic United Rest

of Ireland Kingdom of Americas Others Total

EURm EURm Europe EURm EURm EURm

EURm

Income Statement

Items

Revenue - H1 2012 32.8 303.9 259.7 110.7 50.3 757.4

Revenue - H1 2011 36.2 308.1 258.6 100.0 33.1 736.0

Statement of Financial Position Items

Non current assets

- H1 2012 67.8 344.8 230.9 165.6 38.8 847.9

Non current assets

- H1 2011 70.8 311.5 251.2 147.2 32.9 813.6

Capital Investment

- H1 2012 0.5 8.1 3.6 3.3 0.7 16.2

Capital Investment

- H1 2011 2.4 5.1 53.4 2.6 0.6 64.1

In presenting information on the basis of geographic segments,

segment revenue is based on the geographic location of

customers.

Segment assets are based on the geographic location of the

assets.

5 Seasonality of operations

Activity in the global construction industry is characterised by

cyclicality and is dependent to a significant extent on the

seasonal impact of weather in some of the Group's operating

locations. Activity is second half weighted.

6 Finance expense and finance income

6 months 6 months

ended ended

30 June 30 June

2012 2011

(Unaudited) (Unaudited)

EUR'000 EUR'000

Finance expense

Bank loans 1,769 2,254

Private placement 6,365 3,364

Finance leases 9 25

Fair value movement on derivative

financial instruments (8,405) 10,524

Fair value movement on private placement

debt 7,540 (10,187)

------------- -------------

7,278 5,980

Finance income

Interest earned (416) (120)

Net defined benefit pension scheme (38) (295)

Net finance cost 6,824 5,565

------------- -------------

There were no borrowing costs capitalised during the period (H1

2011: Nil).

7 Taxation

Taxation provided for on profits is EUR7.3m which represents 16%

of the profit before tax and amortisation for the period (H1 2011:

18%). The full year effective tax rate in 2011 was 18%. The

taxation charge for the six month period is accrued using an

estimate of the applicable rate for the year as a whole.

8 Analysis of net debt

At At

30 June 30 June

2012 2011

(Unaudited) (Unaudited)

EUR'000 EUR'000

Cash and cash equivalents 140,666 95,342

Derivative financial instruments 26,456 (4,672)

Current borrowings (6,711) (24,914)

Non-current borrowings (331,651) (272,943)

Total net debt (171,240) (207,187)

------------- -------------

Net debt, which is a non GAAP measure, is stated net of interest

rate and currency hedges which relate to hedges of debt. Foreign

currency derivatives which are used for transactional hedging are

not included in the definition of net debt.

9 Dividends

A final dividend on ordinary shares of 6.5 cent per share in

respect of the year ended 31 December 2011 (31 December 2010: 6.0c)

was paid on 17 May 2012.

The Directors are proposing an interim dividend of 5.0 cent

(2011: 4.5 cent) per share in respect of 2012, which will be paid

on 21 September 2012 to shareholders on the register on the record

date of 31 August 2012.

10 Earnings per share

6 months 6 months

ended ended

30 June 30 June

2012 2011

(Unaudited) (Unaudited)

EUR'000 EUR'000

The calculations of earnings per

share are based on the following:

Profit attributable to owners

of the Company 37,033 28,786

--------------- -------------

Number of Number

shares ('000) of

6 months shares

ended ('000)

30 June 6 months

2012 ended

30 June

2011

Weighted average number of ordinary

shares for

the calculation of basic earnings

per share 167,298 166,568

Dilutive effect of share options 3,162 5,453

--------------- -------------

Weighted average number of ordinary

shares

for the calculation of diluted

earnings per share 170,460 172,021

--------------- -------------

EUR cent EUR cent

Basic earnings per share 22.1 17.3

Diluted earnings per share 21.7 16.7

Adjusted basic (pre amortisation)

earnings per share 23.0 18.8

The number of options which are anti-dilutive and have therefore

not been included in the above calculations are 1,709,597.

11 Property, plant & equipment

At At At

30 June 30 June 31 December

2012 2011

(Unaudited) (Unaudited) 2011

EUR'000 EUR'000 (Audited)

EUR'000

Cost or valuation 937,076 876,217 905,432

Accumulated depreciation

(and impairment charges) (485,592) (432,077) (462,192)

------------- ------------- -------------

Net carrying amount 451,484 444,140 443,240

------------- ------------- -------------

Opening net carrying amount 443,240 408,632 408,632

Acquisitions through business

combinations 66 52,592 48,974

Additions 16,150 11,507 28,793

Disposals (305) (1,313) (3,368)

Reanalysed as "held for sale" - 1,658 (232)

Depreciation charge (19,183) (19,282) (37,914)

Impairment charge - (75) (1,702)

Effect of movement in exchange

rates 11,516 (9,579) 57

Closing net carrying amount 451,484 444,140 443,240

------------- ------------- -------------

The disposals generated a profit of EUR0.1m (H1 2011: EUR0.4m

profit) which has been included within Operating Costs.

12 Reconciliation of net cash flow to movement in net debt

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2011

2012 2011

(Unaudited) (Unaudited) (Audited)

EUR'000 EUR'000 EUR'000

(Decrease)/increase in cash

and bank overdrafts (2,754) (19,745) 37,022

Increase/(decrease) in debt 1,704 (65,332) (85,453)

Decrease in lease finance 148 293 666

------------- ------------- -------------

Change in net debt resulting

from cash flows (902) (84,784) (47,765)

Translation movement - relating

to US dollar loans (14,127) 10,187 (16,037)

Translation movement - other 4,491 (4,390) 171

Derivative financial instruments

movement 9,387 (7,384) 14,358

------------- ------------- -------------

Net movement (1,151) (86,371) (49,273)

Net debt at start of the

period (170,089) (120,816) (120,816)

------------- ------------- -------------

Net debt at end of the period (171,240) (207,187) (170,089)

------------- ------------- -------------

13 Acquisitions

In January 2012 the Group acquired an Access Floors business in

Australia for a cash consideration of EUR7.2m. The fair value of

the net assets of the acquired business totalled EUR3.0m (mainly

working capital assets of inventory, debtors and creditors)

resulting in goodwill of EUR4.2m.

14 Capital and reserves

Issues of ordinary shares

846,912 ordinary shares were issued as a result of the exercise

of vested options arising from the Group's share option schemes

(see the 2011 annual report for full details of the Group's share

option schemes). Options were exercised at an average price of

EUR1.61 per option.

15 Significant events and transactions

On 1 May 2012 judgment was issued in respect of the Borealis

case in which Kingspan was plaintiff and the Group's claim was

unsuccessful. The defendant's legal costs of EUR12.3m were settled

in full by the Group before the period end. Adequate provision

overall had been made in the 31 December 2011 Statement of

Financial Position and hence the judgment had no impact on the

Income Statement for the period.

There were no other individually significant events or

transactions in the period which contributed to the material

changes in the Statement of Financial Position; the more

significant movements are described below:

-- the changes in Inventories, Trade & other receivables and

Trade & other payables reflect the normal business cycle;

-- the fair value of derivatives moved as a result of the

movements in the US dollar exchange rate against both sterling and

the euro; and

-- the positive currency translation movement of EUR23.7m

reflected in the Consolidated Statement of Comprehensive Income

reflects primarily the strengthening of sterling (closing rate

0.806 for the period compared to 0.84 at 31 December 2011).

16 Related party transactions

There were no changes in related party transactions from the

2011 annual report that could have a material effect on the

financial position or performance of the Group in the first half of

the year.

17 Subsequent events

During August 2012, Kingspan entered agreements to acquire two

separate businesses, the Thyssenkrupp Construction Group and

Rigidal Industries LLC.

ThyssenKrupp Construction Group, which includes brands including

Hoesch, Isocab and EMS, has seven manufacturing plants in Germany,

France, Belgium, Austria and Hungary. The business had sales in the

year to 31 March 2012 of EUR315m and recorded an operating loss of

EUR5.7m in the period. It has gross assets of circa EUR101m. The

purchase consideration is circa EUR65m, of which circa EUR50m is

payable in cash on completion and circa EUR15m represents assumed

past service pension liabilities. The consideration is based on

acquiring the business free of cash and bank debt and will vary

depending on the timing of completion. The agreement is subject to

local regulatory approval.

Separately, the Group has agreed to acquire 100% of the share

capital of Rigidal Industries LLC, a leading Middle Eastern

manufacturer of composite panels and roofing systems based in

Dubai. It had sales of US$39m in the year to 30 June 2012. The

consideration, on a debt free cash free basis, is US$38.6m of which

US$30m is payable in cash on completion. Completion of the

acquisition is subject to local approval.

There have been no other material events subsequent to 30 June

2012 which would require disclosure in this report.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDIUGBBGDR

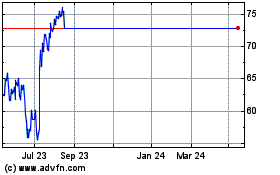

Kingspan (LSE:KGP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kingspan (LSE:KGP)

Historical Stock Chart

From Jul 2023 to Jul 2024