Kedco PLC Issue of Convertible Senior Loan Note (2384U)

November 29 2013 - 2:01AM

UK Regulatory

TIDMKED

RNS Number : 2384U

Kedco PLC

29 November 2013

Press release 29 November 2013

Kedco plc

("Kedco" or the "Company")

Issue of EUR2 million Convertible Senior Loan Note

Kedco plc, (AIM:KED) the renewable energy developer and operator

focusing on the production of clean energy in the UK and Ireland,

announces that it has issued an unsecured EUR2 million Convertible

Senior Loan Note ("loan note") to fund its ongoing development and

working capital requirements. The loan note is being issued to its

26.79% shareholder, Farmer Business Developments plc

("Farmers").

The Company has two existing facilities with Farmers as

announced on 20 August and 28 March respectively.

1. A working capital facility, which has no maturity date

and is repayable on demand, is unsecured and any drawdowns

accrue interest at a rate of 5 per cent. per annum. The

facility is capped at EUR500,000 but may be increased

by agreement between the parties. This facility has been

drawn down in full.

2. A GBP400,000 unsecured loan with a three year term repayable

on 1 April 2016; an interest rate of 10% per annum on

outstanding capital balances, such interest to be accrued

and rolled up to 1 April 2016; and which is convertible

at the discretion of the holder at any time after 15

April 2013. The conversion price here being the average

of the closing mid-market price of the ten working days

prior to conversion or the placing price achieved under

any future equity fundraising. This facility has been

drawn down in full.

The total amounts owing under these facilities including capital

and interest of EUR1,016,250 will form the consideration for the

initial subscription for the new loan note. The balance will be

subscribed for on a monthly basis with a minimum cash subscription

of EUR150,000.

The key terms of the loan notes are as follows:

-- Quantum of EUR2,000,000;

-- The loan will be repayable upon the note holder giving 30

days written notice to the company;

-- Interest rate of 5% per annum on outstanding capital

balances, such interest to be accrued and rolled until

repayment;

-- Initial subscription of EUR1,016,250 will be made through the

transfer of the existing facilities into this loan note

-- Additional subscriptions for loan notes under the instrument

will be on a monthly basis with a minimum subscription of

EUR150,000

-- Convertible at the discretion of the holder at any time after

1 January 2014 with the conversion price being the average of the

closing mid-market price of the ten working days prior to

conversion or the placing price achieved under any future equity

fundraising. Farmers will not be able to convert any proportion of

the loan notes into Kedco ordinary shares; if to do so would result

in Farmers holding in excess of 29.9% of Kedco's issued share

capital.

Farmers is a substantial shareholder of the Company and as such

the entry into the loan note instrument is a related party

transaction for the purposes of Rule 13 of the AIM Rules. The

Independent Directors (being the directors other than Dermot

O'Connell), having consulted with Shore Capital and Corporate

Limited (the Company's nominated adviser), consider that the terms

of the loan note are fair and reasonable insofar as shareholders of

Kedco are concerned.

- Ends -

For further information:

+353 (0)21

Kedco plc 483 9104

Gerry Madden, CEO

+44 (0)20

Shore Capital -- Nomad & Broker 7408 4090

Pascal Keane / Anita Ghanekar

Abchurch Communications -- Financial +44 (0)20

PR 7398 7707

Janine Brewis/Joanne Shears/ Shabnam

Bashir

For further information:

About Kedco plc

Kedco Group is a renewable energy portfolio developer and

operator whose business strategy is to identify, develop, build,

own and operate renewable energy electricity and heat generation

plants in the UK and Ireland.

The Group possesses significant knowledge of renewable energy

markets, clean technologies, fuel sources, project development,

project finance and project delivery.

Kedco was admitted to trading on AIM, a market operated by the

London Stock Exchange, in October 2008 (AIM: KED).

(www.kedco.com)

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBCBDBCGDBGXI

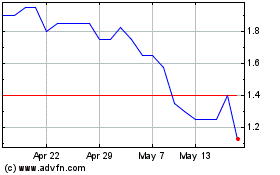

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024