Kedco PLC Issue of Convertible Loan Notes (0717B)

March 28 2013 - 3:03AM

UK Regulatory

TIDMKED

RNS Number : 0717B

Kedco PLC

28 March 2013

Press release 28 March 2013

Kedco plc

("Kedco" or the "Company")

Issue of Convertible Loan Notes

Kedco plc (LSE: KED.L), the renewable energy developer and

operator focusing on the production of clean energy in the UK and

Ireland, is pleased to announce that it has agreed a GBP400,000

unsecured loan to fund its ongoing development and working capital

requirements. The loan which is being provided by its 26.79%

shareholder, Farmer Business Developments plc ("FBD") will be

structured as the Convertible Loan Notes.

The key terms of the Convertible Loan Notes are as follows:

-- quantum of GBP400,000;

-- three year term repayable on 1 April 2016;

-- interest rate of 10% per annum on outstanding capital

balances, such interest to be accrued and rolled up to 1 April

2016;

-- convertible at the discretion of the holder at any time after

15 April 2013 with the conversion price being the average of the

closing mid-market price of the ten working days prior to

conversion or the placing price achieved under any future equity

fundraising.

FBD will not be able to convert any proportion of the

Convertible Loan Notes into Kedco ordinary shares if to do so would

result in FBD holding in excess of 29.9% of Kedco's issued share

capital.

By virtue of FBD's existing shareholding in the Company, the

Convertible Loan Notes constitute a related party transaction for

the purposes of Rule 13 of the AIM Rules for Companies. The

independent directors of Kedco (comprising Gerry Madden, Steve

Dalton, Eddie Barrett and Brendan Halpin consider, having consulted

with Deloitte (the Company's nominated adviser), that the terms of

the Convertible Loan Notes are fair and reasonable insofar as the

Company's other shareholders are concerned.

In addition, another existing Kedco investor has irrevocably

undertaken to subscribe GBP100,000 at a future equity fundraising

to be undertaken by the Company.

- Ends -

For further information:

Kedco plc +353 (0)21 483 9104

Gerry Madden, CEO

Deloitte Corporate Finance - Nomad +44 (0)20 7936 3000

David Smith / Byron Griffin

SVS Securities plc - Broker +44 (0)20 7638 5600

Ian Callaway / Alex Mattey

Abchurch Communications +44 (0)20 7398 7707

Janine Brewis/Joanne Shears/ Shabnam Bashir

About Kedco plc

Kedco plc's business strategy is to identify, develop, build,

own and operate renewable energy electricity and heat generation

plants in the UK and Ireland. These plants will contribute to the

need for sustainable energy from renewable sources. The Company

possesses significant knowledge of renewable energy markets, clean

technologies, fuel sources, project development, project finance

and project delivery. Kedco has a strong pipeline of renewable

energy projects at varying stages of operation and development,

including a 4MW plant in Newry in Northern Ireland whose initial

phase has commenced operation and a site in North London with full

Planning and Environmental Permission for the conversion of 60,000

tonnes of waste timber per annum into up to 12MW of electricity and

heat. The Company has a construction ready 800kW Wind project in

County Cork in Ireland and is currently engaged in the planning

process for proposed renewable energy projects in Rutland, East

Anglia and Clay Cross, Derbyshire and for three Wind projects and

two Solar projects on the island of Ireland. Kedco was admitted to

trading on AIM, a market operated by the London Stock Exchange, in

October 2008 (AIM:KED).

www.kedco.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCJRMRTMBITBLJ

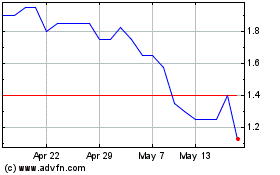

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024