TIDMKED

RNS Number : 5000S

Kedco PLC

03 December 2012

Press release 3 December 2012

Kedco plc

("Kedco" or the "Company")

2012 Preliminary Results

Kedco plc (AIM:KED), the renewable energy group focusing on the

production of clean energy in the UK and Ireland, today announces

its Preliminary Results for the full year ended 30 June 2012.

Operational Highlights

-- The Company achieved its objective of transitioning from a clean energy

project developer to an operational project owner with the commencement

of generation of electricity at the 4MW Newry Biomass project in Northern

Ireland

-- Significant progress has been made in relation to the ready-to-construct

12MW Enfield Biomass project in London, including detailed discussions

with EPC contractors and with potential debt and equity partners

-- Pre-planning consultation phase for the Clay Cross Biomass project

is now complete with a full planning application to be submitted by

the end of Q1 2013

-- Successfully negotiated the proposed acquisition of Reforce Energy

Limited ("Reforce"), a project developer with 60 active projects and

a capacity in excess of 40MW at various stages of development in the

UK and Ireland. It is anticipated that the acquisition will be completed

shortly

Financial Highlights

-- Revenue from continuing operations of EUR10.1 million (FY 2011 restated:

EUR 0.9 million)

-- Administrative costs reduced to EUR0.95million (FY 2011 restated:

EUR3.6 million)

-- Loss before tax from continuing operations for the period reduced

to EUR1.6 million (FY 2011 restated: Loss before tax EUR5.3 million)

-- Total loss for the period reduced to EUR2.5 million (FY 2011 restated:

Loss for period EUR4.5 million) includes one-off impairment cost of

EUR1.4 million arising on the revaluation of the Group's Latvian subsidiary,

SIA Vudlande

-- 0.6 cent loss per share for continuing operations (FY 2010 restated:

loss per share 2.3 cent)

Debt Restructuring

-- Successfully negotiated balance sheet restructuring with various lenders,

resulting in the conversion of debt to equity and a reduction of balance

sheet debt by approximately EUR10.8 million

-- Material reduction in ongoing annual interest of approximately EUR1.5

million

Asset Disposal

-- Completed the disposal of a further non-core asset being the entire

interest in Latvian subsidiary for EUR3.0 million, as part of debt

restructuring

Share Placing / Funding

-- Successful placings of shares to new investors in February 2012, May

2012 and November 2012 raising approximately EUR1.5 million

-- Negotiated and agreed term sheet for the provision of GBP1.5 million

in VCT funding for the Newry Biomass project

Gerry Madden CEO commented:

"In the 2011 preliminary announcement the Board promised

shareholders that the Company would successfully commission the

Newry Biomass. I am happy to report that we achieved this objective

on time and on budget in June of this year. We further promised

that we would aggressively pursue other opportunities in our

project pipeline. I am also pleased to report that we have made

substantial progress in adding further projects to the pipeline,

which the Board believes will add shareholder value in the short to

medium term.

"Against this positive backdrop, we have further refined and

refocused the Company's strategy with a clear aim of being one of

the largest independent renewable energy companies in the UK and

Ireland.

"The successful completion of a balance sheet restructuring will

further solidify this strategy and provide a springboard for the

Company to accelerate its project pipeline.

"I was also delighted to announce the impending acquisition of

Reforce Energy which is expected to close imminently; the

transaction is a key endorsement of our strategy. In addition to a

strong pipeline of renewable energy projects, Reforce has a strong

and experienced management team with over 10 years' experience

across 500MW+ of renewable energy projects. In agreeing to the

acquisition, the Reforce management team and shareholders are

demonstrating their belief that there is an attractive value

creation story for the combined group.

The Board has identified the following objectives for the coming

12 months:

1. To complete the financing and begin construction of the 12MW Enfield Biomass project.

2. To complete the financing and start installation of the

second stage of the 4MW Newry Biomass which will be fully

commissioned by end of the 2013.

3. To complete the planning process for a further 4MW extension

to the Newry Biomass project, thereby bringing the capacity up to

8MW.

4. Once the Acquisition of Reforce is finalised, complete the

financing and commissioning of the 800kw Pluckanes Windfarm

project.

5. To obtain planning permission for the 8MW Clay Cross Biomass project.

6. Once the Acquisition of Reforce is finalised, to bring the

Altilow 800kw wind project to a fully consented and

ready-to-construct stage.

7. To obtain at least another six planning permissions for small scale renewable energy projects.

8. To double the size of the Company's current development pipeline.

"The Board believes that the constraining factors of the past

are now behind the Company. With the restructuring, pipeline

progress and proposed acquisition of Reforce, we are more confident

than ever of being able to deliver real shareholder value in the

short to medium term."

-Ends-

Enquiries:

Kedco plc +353 (0)21 483 9104

Gerry Madden, CEO and Interim Finance Director www.kedco.com

Deloitte Corporate Finance - Nomad +44 (0)20 7936 3000

Byron Griffin / David Smith

SVS Securities plc - Broker +44 (0)20 7638 5600

Ian Callaway / Alex Mattey

Abchurch Communications +44 (0)20 7398 7707

Joanne Shears / Ashleigh Lezard / Shabnam Bashir

Chairman's Statement

I am pleased to present the 2012 Annual Report, which provides

an update on a year which has been one of significant development

for the Company. This financial year has without doubt been the

most important in the Group's history.

In September 2012 the Company announced that its biomass

electricity and heat generation plant in Newry, Northern Ireland,

commenced the exportation of power to the grid. This marked the

Company's transition from a pure development company to an operator

of renewable energy assets.

Operationally the Company completed the refocusing of the

business portfolio towards its core, renewable energy power

generation activities. Cost savings have been delivered through the

exit from non-core and non-profitable business segments, creating a

leaner, more efficient business structure with the focus purely on

the renewable energy power generation business.

Since 30 June 2012, the Company has carried out a restructuring

process, with the objectives of stabilising the Company's financial

affairs, positioning the Company in a manner which will enable it

to raise further capital, and enabling the Company to adopt a more

appropriate capital structure. This will facilitate the advancement

of its development project line through the planning and permitting

process. At the Extraordinary General Meeting held on 5 October

2012, shareholders approved resolutions regarding the restructuring

process. The Board is happy to report that this process in now

complete.

The Board took the opportunity to reposition the Company as a

'technology neutral' renewable energy business with a core focus on

developing and delivering operational electricity and heat

generation projects. The Company will focus on both large and

small-scale projects, providing flexibility to maximise existing

land positions whilst diversifying development and technology

risks. This flexible business model will deploy capital where it

can achieve the best return for shareholders whilst still keeping

the focus on the generation of clean energy from either electricity

or heat.

With this in mind the Company entered into negotiations to

acquire Reforce Energy Limited ("Reforce"), a renewable energy

development company focused on small-scale renewable projects

across various technologies. Reforce's key markets are the UK,

Ireland and Northern Ireland where it already has an active

pipeline of over 60 projects with a capacity of in excess of 40MW

at various stages of development. We expect to complete the

acquisition shortly.

The Company's ultimate aim is to be one of the UK and Ireland's

largest independent renewable energy companies, with a diverse

portfolio of operating and development assets across various

renewable energy technologies. To this end, the Company will focus

on developing its existing portfolio as well as considering

strategic bolt-on acquisition opportunities that add generating

potential to its project portfolio.

On behalf of my colleagues on the Board, we wish to express our

thanks to the management and staff who have worked so diligently

over the past year. I look forward to updating shareholders further

on the Company's progress at our Annual General Meeting in

December.

Dermot O'Connell

Non-Executive Chairman

Chief Executive's Report

Operational Review

Kedco's stated aim is to be one of the UK and Ireland's largest

independent renewable energy companies, with a diverse portfolio of

operating and development assets across various renewable energy

technologies.

The Company currently has 67MW of potential power at various

stages of development as set out below:

Newry Biomass - 4MW Biomass combined heat and power ("CHP")

The Company recently announced that its plant in Newry, Northern

Ireland, commenced the exportation of power to the grid. This marks

the Company's transition to an operator of renewable energy assets

from a pure development company. The electricity generated by the

plant is being sold to Bord Gais Eireann under a Power Purchase

Agreement ("PPA"). The Company now intends to move towards the

completion of the next 2MW phase of the project, which is expected

to come online in Q4 2013. The civil and on-site works for this

additional 2MW have already been completed and a deposit has been

paid to secure the expansion of the grid infrastructure for the

project. Kedco has invested GBP6 million through a combination of

equity and loan notes in the project corporate entity and owns 50

per cent. of the ordinary equity and 92 per cent. of the economic

return from the project. Our major shareholder, Farmer Business

Developments plc, owns the remaining 50 per cent. of the ordinary

equity but is only entitled to eight per cent. of the economic

return from the project. The balance of the project funding was

arranged through a financing deal with RBS Ulster Bank, which

committed project finance facilities of up to GBP8 million. Further

updates will be provided in the near future as the project moves

towards full commissioning of the first phase.

We intend to complete the planning process for a further 4MW

extension to the Newry Biomass project, bringing the capacity up to

8MW in the coming year.

Enfield Biomass - 12MW Biomass CHP

The Company's other key asset is the 12MW Enfield Biomass

project located in Enfield, London. This project has full planning

and permitting to convert 60,000 tonnes per annum of waste wood and

has entered into advanced discussions in relation to an offer to

connect to the national grid. The Company has already entered into

a 20 year lease in relation to the site. The Company has various

options available in relation to feedstock sourced locally for the

plant. The Directors believe that this project is one of the most

advanced biomass development projects located in the London region

and the Company intends to progress the project towards financial

close and commencement of construction. Advanced discussions are

currently taking place with potential debt and equity partners in

relation to the project. We intend to complete the financing and

starting construction of the 12MW Enfield Biomass project in the

coming year. A further update will be provided as appropriate.

Cork and Kerry Anaerobic Digestion ("AD") projects

The Company has full planning and permitting for two sites

located in the South of Ireland which could convert 40,000 tonnes

of agricultural and food waste per annum into up to 1.5MW of

electricity and 1.4MW of heat. These projects will qualify for the

Irish Government support scheme for renewable energy under REFIT

III, which covers biomass technologies for the period 2010 to 2015.

This scheme provides for a fixed feed in tariff rate of between

EUR0.10-0.13 per kilowatt hour ("kWh") produced, depending on the

use of heat generated from the plant. A strategic decision

regarding the development of these two projects is currently being

undertaken.

Clay Cross Biomass CHP and AD and Rutland AD

The Company has also invested heavily in planning and permitting

over the last 18 months and it is currently engaged in the

consenting process for an 8MW site in Derbyshire and 1.3MW AD site

in East Anglia, both in the UK.

Pluckanes Wind Farm

Reforce recently made an announcement that it has completed the

purchase of Pluckanes Windfarm Limited ("Pluckanes"), which has

developed a fully consented 800kw single wind turbine project

located in Cork, Ireland. The purchase of the Pluckanes project has

added a construction ready asset to the portfolio, which is

targeted to become operational during 2013. Once the Acquisition is

finalised and with the commissioning of the project next year, the

Company's operational capacity will increase by 40 per cent.

Project Portfolio

The Company is currently in discussion with a number of site

owners in the UK and Ireland regarding future sites for the

development of renewable energy projects. The intention is to

secure sites that will increase the development pipeline to a

minimum 300MW within the next three years.

Reforce whose acquisition will be completed shortly has a

pipeline of over 60 projects with a capacity of in excess of 40MW

across various technologies located in the UK, Ireland and Northern

Ireland.

Financial Review

Revenue in the period amounted to EUR10.1 million and was in

line with expectations (FY 2011 restated: EUR0.9m). The Company

reported a loss for the period of EUR2.5 million, a decrease on the

prior year loss of EUR4.5 million for FY 2011. Included in the loss

of EUR2.5 million is a one-off impairment cost of EUR1.4 million

arising on the revaluation of the group's Latvian subsidiary, SIA

Vudlande. The decrease in losses is attributable to a significant

reduction in administrative costs during the year and a decrease in

financing costs arising from the restructuring of debt.

At 30 June 2012, the Company had net debt of EUR11.9 million (30

June 2011: EUR11.8 million) including cash balances of EUR144,764

(30 June 2010: EUR616,285).

The Company has carried out a restructuring process since the

year end which has significantly strengthened the Group's balance

sheet through the reduction of approximately EUR10.8 million of

debt obligations of the Group, as well as a reduction of its annual

interest charge by approximately EUR1.5 million. The reduction of

EUR10.8 million was achieved through the conversion of debt into

equity and the sale of its Latvian subsidiary, SIA Vudlande.

Outlook

In the 2011 preliminary announcement the Board promised

shareholders that we would aggressively pursue other opportunities

in our project pipeline. I am pleased to report that we have made

substantial progress in adding further projects to the pipeline,

which I believe will add shareholder value in the short to medium

term.

Against this positive backdrop, we have further refined and

refocused the Company's strategy with a clear aim of being one of

the largest independent renewable energy companies in the UK and

Ireland. The successful completion of the balance sheet restructure

further solidifies this strategy and provides a springboard for the

Company to accelerate its project pipeline. In light of the

Company's expanding pipeline of development and acquisition

opportunities, the Directors anticipate undertaking a further

equity fundraising in 2013.

I was also delighted to announce the impending acquisition of

Reforce which is expected to close imminently. I feel that the

transaction provides a key endorsement of our strategy. In addition

to a strong pipeline of renewable energy projects, Reforce has an

experienced management team with over 10 years' experience across

500MW+ of renewable energy projects. The Reforce management team

and shareholders, by agreeing to the acquisition, believe there is

an attractive value creation story for the combined group.

The Board has identified the following objectives for the coming

12 months:

1. To complete the financing and starting construction of the 12MW Enfield Biomass project.

2. To complete the financing and start installation of the 2(nd)

stage of the 4MW Newry Biomass which will be fully commissioned by

end of the 2013.

3. To complete the planning process for a further 4MW extension

to the Newry Biomass project, thereby bringing the capacity up to

8MW.

4. Once the Reforce Acquisition is finalised, complete the

financing and commissioning the 800kw Pluckanes Windfarm

project.

5. To obtain planning permission for the 8MW Clay Cross Biomass project.

6. Once the Acquisition is finalised bring the Altilow 800kw

wind project to a fully consented and ready-to-construct stage.

7. To obtain at least another six planning permissions for small scale renewable energy projects.

8. To double the size of the Company's current development pipeline.

We believe the constraining factors of the past are now behind

the Company. With the restructuring, pipeline progress and proposed

acquisition of Reforce, we are more confident than ever of being

able to deliver real shareholder value in the short to medium

term.

We will continue to focus the Company's resources on bringing

projects to construction ready and financial close stages and in

managing the operations of these projects. Projects will sit in

their own individual special purpose entities and project funding

will take place in those entities. The Company intends to retain an

equity interest in all future projects to the benefit of

shareholders in the listed Company.

Gerry Madden

CEO

Kedco plc

Consolidated statement of comprehensive income and

expenditure

for the year ended 30 June 2012

(Restated)

Notes 2012 2011

EUR EUR

Revenue 10,083,158 936,435

Cost of sales (10,123,726) (1,059,127)

---------------------- ------------

Gross loss (40,568) (122,692)

Operating expenses

Administrative expenses (953,705) (3,617,547)

Other operating income 11,100 7,605

---------------------- ------------

Operating loss (983,173) (3,732,634)

Finance costs (414,424) (1,534,344)

Share of losses on joint ventures

after tax (213,923) (356,228)

Profit on disposal of share

in joint venture - 285,379

Finance income 333 287

---------------------- ------------

Loss before taxation (1,611,187) (5,337,540)

Income tax expense - -

---------------------- ------------

Loss for the year from continuing

operations (1,611,187) (5,337,540)

---------------------- ------------

Profit for the year from discontinued

operations 493,911 802,677

Losses arising on the remeasurement

of assets held for sale (1,364,082) -

---------------------- ------------

Net (loss)/profit for the year

from discontinued operations (870,171) 802,677

---------------------- ------------

Loss for the year - total (2,481,358) (4,534,863)

====================== ============

Loss attributable to:

Owners of the company (2,580,140) (4,698,241)

Non-controlling interest 98,782 163,378

---------------------- ------------

(2,481,358) (4,534,863)

====================== ============

2012 2011

EUR EUR

Euro per share Euro per share

Basic loss per share:

From continuing operations 2 (0.006) (0.023)

======================== ===============

From continuing and discontinued

operations 2 (0.009) (0.020)

======================== ===============

Diluted loss per share:

From continuing operations 2 (0.006) (0.016)

======================== ===============

From continuing and discontinued

operations 2 (0.009) (0.014)

======================== ===============

Kedco plc

Consolidated statement of profit or loss and other comprehensive

income

for the year ended 30 June 2012

2012 2011

EUR EUR

Loss for the financial year (2,481,358) (4,534,863)

Other comprehensive income

Exchange differences arising

on retranslation

of foreign operations (310,844) 21,063

-------------------- ------------

Total comprehensive income

and expense

for the year (2,792,202) (4,513,800)

==================== ============

Attributable to:

Owners of the company (2,890,984) (4,677,178)

Non-controlling interests 98,782 163,378

-------------------- ------------

(2,792,202) (4,513,800)

==================== ============

Kedco plc

Consolidated statement of financial position

At 30 June 2012

Notes 2012 2011

ASSETS EUR EUR

Non-current assets

Goodwill - 549,451

Intangible assets - 505

Property, plant and equipment 757,329 5,060,243

Financial assets 7,608,687 990,000

Total non-current assets 8,366,016 6,600,199

------------------- -------------

Current assets

Inventories 50,000 1,613,026

Amounts due from customers under construction

contracts 1,355,212 9,425,279

Trade and other receivables 1,605,518 2,848,088

Cash and cash equivalents 144,764 616,285

------------------- -------------

Total current assets 3,155,494 14,502,678

Assets classified as held for sale 6,584,239 -

------------------- -------------

Total current assets 9,739,733 14,502,678

=================== =============

Total assets 18,105,749 21,102,877

=================== =============

EQUITY AND LIABILITIES

Equity

Share capital 4,106,808 3,543,999

Share premium 19,375,525 19,038,300

Shared based payment reserves - 492,580

Retained earnings - deficit (25,207,673) (22,316,689)

------------------- -------------

(Deficit)/equity attributable to equity

holders of the parent (1,725,340) 758,190

Non-controlling interest 898,010 799,228

------------------- -------------

Total (deficit)/equity (827,330) 1,557,418

------------------- -------------

Non-current liabilities

Borrowings 2,425,025 7,958,393

Deferred income - government grants - 36,915

Finance lease liabilities - 373

Share of net liabilities of jointly

controlled entities 509,599 18,867

Deferred tax liability - 268,062

Total non-current liabilities 2,934,624 8,282,610

------------------- -------------

Current liabilities

Amounts due to customers under construction

contracts 1,110,090 1,272,735

Trade and other payables 2,595,766 5,481,674

Borrowings 9,661,645 4,494,676

Deferred income - government grants - 9,444

Finance lease liabilities 373 4,320

------------------- -------------

13,367,874 11,262,849

Liabilities associated with assets 2,630,581 -

held for sale

------------------- -------------

Total current liabilities 15,998,455 11,262,849

------------------- -------------

Total equity and liabilities 18,105,749 21,102,877

=================== =============

Kedco plc

Consolidated statement of cash flows

for the year ended 30 June 2012

Notes 2012 2011

EUR EUR

Cash flows from operating activities

Loss for the financial year (2,481,358) (4,394,977)

Adjustments for:

Income Tax 69,731

Share based payments (492,580) 164,197

Depreciation of property, plant and equipment 596,418 634,734

Amortisation of intangible assets 2,275 71,396

Profit on disposal of property, plant

and equipment (67,236) (88,881)

Impairment of property, plant and equipment - 424,668

Impairment of intangible assets - 94

Impairment of assets held for sale 1,364,082 -

Write off of unpaid share capital 492,563

Unrealised foreign exchange gain 163,677 6,941

Share of losses of jointly controlled

entities after tax 213,923 356,228

Decrease in provision for impairment

of trade receivables (71,924) (166,014)

(Decrease)/increase in impairment of

inventories (294,715) 281,921

Decrease in deferred income (10,302) (10,303)

Interest expense 506,754 1,627,690

Profit on disposal of share in joint

venture - (285,379)

Interest income (338) (364)

------------ ------------

Operating cash flows before working capital

changes (9,030) (1,378,049)

(Increase)/decrease in:

Amounts due from customers under construction

contracts 8,070,067 (133,368)

Trade and other receivables 4,336 (174,720)

Inventories 276,377 (284,932)

(Decrease)/increase in:

Amounts due to customers under construction

contracts (162,645) (29,622)

Trade and other payables (2,476,219) (717,781)

Cash from/(used in) operations 5,702,886 (2,718,472)

Income taxes paid (9,108) (55,968)

------------ ------------

Net cash from/(used in) operating activities 5,693,778 (2,774,440)

------------ ------------

Cash flows from investing activities

Additions to property, plant and equipment (644,737) (573,181)

Proceeds from sale of property, plant

and equipment 126,951 113,229

Additions to intangible assets (1,770) -

Additions to investments in jointly controlled (6,660,010) -

entities

Proceeds from disposal of share in joint

venture - 134,840

Interest received 338 364

------------ ------------

Net cash used in investing activities (7,179,228) (324,748)

------------ ------------

Cash flows from financing activities

Proceeds from borrowings 2,896,483 4,142,687

Repayments of borrowings (2,293,628) (1,583,381)

Proceeds from issuance of ordinary shares 644,250 1,932,815

Payments of finance leases (58,496) (36,803)

Interest paid (255,842) (590,526)

------------ ------------

Net cash from financing activities 932,767 3,864,792

------------ ------------

Net increase/(decrease) in cash and cash

equivalents (552,683) 765,604

Cash and cash equivalents at the beginning

of the financial year 208,587 (557,017)

------------ ------------

Cash and cash equivalents at the end

of the financial year (344,096) 208,587

============ ============

Kedco plc

Notes to the consolidated financial statements

for the year ended 30 June 2012

1. Basis of Preparation

The Group's consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) effective at 30 June 2012 for all periods presented as

issued by the International Accounting Standards Board. The

consolidated financial statements are also prepared in accordance

with IFRS as adopted by the European Union ('EU').

The consolidated financial statements are prepared under the

historical cost convention. The principal accounting policies set

out below have been applied consistently by the parent company and

by all of the Company's subsidiaries to all periods presented in

these consolidated financial statements.

The financial statements of the parent company, Kedco plc have

been prepared in accordance with accounting standards generally

accepted in Ireland and Irish statute comprising the Companies

Acts, 1963 to 2012.

As described in the Chief Executive's Report, the Company

continues to invest capital in developing customer and partner

relationships in the UK and Ireland. The Company has also continued

to develop and expand its pipeline of projects. These activities

resulted in the Company continuing to report reduced losses for the

year to 30 June 2012.

Since 30 June 2012, the Company has carried out a restructuring

process, with the objective of stabilising the Company's financial

affairs, position the Company in a manner which will enable it to

raise further capital, and enable the Company to adopt a more

appropriate capital structure, which will facilitate the

advancement of its development project line through the planning

and permitting process. Resolutions approving the restructuring

process were agreed by the members of the Company at an

Extraordinary General Meeting of the Company held on 5 October

2012.

The restructuring has significantly strengthened the Group's

balance sheet through the reduction of approximately EUR10.8

million of Debt Obligations from the group and a reduction of its

annual interest charge by approximately EUR1.5 million. The

reduction in EUR10.8 million was achieved through the conversion of

debt into equity (EUR5.8 million) and the sale of its Latvian

subsidiary, SIA Vudlande.

In conjunction with the above restructuring, the Company raised

approximately EUR0.95 million in an equity placing in November

2012. The proceeds of the Fundraising will be used by the Company

to meet its on-going working capital requirements including the

continued development of its project pipeline. The Company also

announced in November 2012 that it had secured a conditional offer

of further financing of GBP1.5 million for the further development

of its Newry Power Plant.

The financial statements have been prepared on a going concern

basis. The Directors have given careful consideration to the

appropriateness of the going concern concept in the preparation of

the financial statements. The validity of the going concern concept

is dependent upon finance being available for the Group's working

capital requirements and for the continued investment in the

Group's strategy of identifying, developing, building and operating

power generating plants so that the Group can continue to realise

its assets and discharge its liabilities in the normal course of

business. The financial statements do not include any adjustments

that would result should the above conditions not be met.

After making enquiries and considering the matters referred to

above, the Directors believe that solid progress towards securing

finance has been and is being made. The Directors have a reasonable

expectation that the Group will have adequate resources to continue

in operational existence for the foreseeable future. For these

reasons the Directors continue to adopt the going concern basis of

accounting in preparing the financial statements.

2. (Loss)/Earnings per share 2012 2011

EUR EUR

Euro per Euro per

share share

Basic (loss)/earnings per share

From continuing operations (0.006) (0.023)

From discontinued operations (0.003) 0.003

--------- ---------

Total basic loss per share (0.009) (0.020)

========= =========

Diluted (loss)/earnings per share

From continuing operations (0.006) (0.016)

From discontinued operations (0.003) 0.002

--------- ---------

Total diluted loss per share (0.009) (0.014)

--------- ---------

Basic (loss)/earnings per share

The loss and weighted average number of ordinary shares used in

the calculation of the basic (loss)/earnings per share are as

follows:

2012 2011

EUR EUR

Loss for year attributable to equity

holders of the parent (2,580,140) (4,698,241)

-------------- --------------

(Loss)/profit for the year from

discontinued operations used in

the calculation of basic earnings

per share from discontinued operations. (870,171) 802,677

-------------- --------------

Losses used in the calculation of

basic loss per share from continuing

operations (1,709,969) (5,500,918)

-------------- --------------

Weighted average number of ordinary

shares for

the purposes of basic loss per share 274,612,376 236,242,380

-------------- --------------

Diluted (loss)/earnings per share

The loss used in the calculation of all diluted earnings per

share measures is the same as those for the equivalent basic

earnings per share measures, as outlined above.

The weighted average number of ordinary shares for the purposes

of diluted loss per share reconciles to the weighted average number

of ordinary shares used in the calculation of basic loss per share

as follows:

2012 2011

Weighted average number of ordinary

shares used

in the calculation of basic loss

per share 274,612,376 236,242,380

"A" Shares in issue 99,117,952 99,117,952

------------ ------------

Weighted average number of ordinary

shares used in the

calculation of diluted earnings

per share 373,730,328 335,360,332

------------ ------------

Share warrants which could potentially dilute basic earnings per

share in the future have not been included in the calculation of

diluted earnings per share as they are anti-dilutive for the

periods presented. The dilutive effect as a result of share

warrants in issue as at 30 June 2012 would be to increase the

weighted average number of shares by 27,392,915 (2011:

30,672,924).

Convertible preference shares, which could potentially dilute

basic earnings per share in the future, have not been included in

the calculation of diluted earnings per share as they are

anti-dilutive for the periods presented. The dilutive effect as a

result of preference shares in issue as at 30 June 2012 would be to

increase the weighted average number of shares by 3,125,000 (2011:

3,125,000).

Convertible loans which could potentially dilute basic earnings

per share have not been included in the calculation of diluted

earnings per share as they are anti-dilutive for the periods

presented. The dilutive effect as a result of loans in issue as at

30 June 2012 would be to increase the weighted average of shares by

21,942,154 (2011: 9,500,000).

3. Events after the balance sheet date

In its circular to Shareholders on 10 September 2012, the Group

announced details of a proposed restructuring which would remove

debt obligations from the Company such that it will have a suitable

basis on which to raise further equity finance in the future. The

restructuring has significantly strengthened the Group's balance

sheet through the reduction of approximately EUR10.8 million of

Debt Obligations from the group and a reduction of its annual

interest charge by approximately EUR1.5 million. The reduction in

EUR10.8 million was achieved through the conversion of debt into

equity (EUR5.8 million) and the sale of its Latvian subsidiary, SIA

Vudlande. Enfield Biomass, a company in which Kedco did hold a 50

per cent. interest, will as a result of the restructuring become a

wholly-owned subsidiary of the Group. In conjunction with the above

restructuring, the Company raised approximately GBP0.8 million in

an equity placing in November 2012.

On 12 September 2012, the Group announced that the Company's

plant in Newry, Northern Ireland, which will produce a total of

4MW, has commenced the exportation of power to the grid from its

biomass electricity and heat generation plant. This marks the

Company's transition to an operator of renewable energy assets from

a pure development company.

On 18 September 2012, the Group announced that it had signed a

heads of agreement with Reforce Energy Limited, in relation to the

acquisition of its entire share capital. Both parties are now

proceeding to final legal contracts and the completion of all

pre-conditions relating to the Acquisition. The consideration for

the Acquisition, if completed, would be satisfied by the issue of

new Kedco ordinary shares and would not involve cash consideration.

Reforce Energy Limited is a renewable energy development company

focused on small-scale renewable projects across various

technologies. The company's key markets are the UK, Ireland and

Northern Ireland where it already has an active pipeline of over 60

projects with a capacity of in excess of 40MW at various stages of

development.

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR WGGBAGUPPGQU

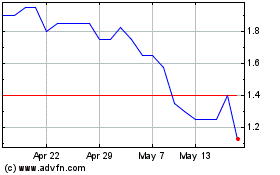

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024