TIDMKED

RNS Number : 8018A

Kedco PLC

15 October 2009

15 October 2009

Kedco plc

("Kedco" or the "Company")

Preliminary Results for the year ended 30 June 2009

Kedco plc (LSE: KED.L), the Irish-based energy group focusing on green energy

production in the UK, Ireland and Eastern Europe, announces today its

preliminary results for the year ended 30 June 2009.

Operational Highlights

* Successful introduction to AIM in October 2008:

* enhanced the profile of our products, services and business objectives

* secured a supportive portfolio of long-term investors

* Identified 30 projects, of which:

* 5 have full planning and permitting granted to Kedco and/or its partners, with 1

currently under construction for electricity generation by the end of 2009

* 1 is in advanced stages of planning and permitting

* 5 are in the early stages of the planning and permitting process

* 7 are in the pre-planning and permitting stage

* Continued to attract additional funding from the investment community in support

of our long-term strategic aims:

* raised a total of EUR8.8m during the financial year from a variety of local and

international sources

* Continued to invest capital in developing customer and partner relationships and

in furthering projects.

* Remain on track to generate electricity by the end of 2009: an Admission

Document goal.

Financial Highlights (*)

* Revenue of EUR5.9 million, in line with revised expectations (FY 2008: EUR9.0m).

* Loss (excluding one off costs) for the period of EUR4.7 million, a decrease on the

prior year (FY 2008: EUR5.4m).

* Additional capital of EUR8.8 million raised during the financial year:

* Post-period end a further EUR2.6 million sourced from a variety of private and

institutional investors.

* In addition, the Company has also been informed that Enterprise Ireland has

approved a proposed subscription of EUR0.5 million into a subsidiary company

subject to the finalisation of certain agreements.

(*)The like-for-like comparisons made in this statement compare the performance

for the 12 months ended 30 June 2009 with a period of 14 months ended 30 June

2008, the latter referred to throughout as "FY 2008".

Donal Buckley, Chief Executive Officer of Kedco, commented:

"We have made significant progress throughout the year, our first as a quoted

company, in taking the initial steps towards implementing our long-term

strategic aims. During the period we have grown the number of binding and

potential projects in our business pipeline and, as we stated in our Trading

Update in June, we are currently working towards five projects where full

planning permissions have been granted either to Kedco or to Kedco and its

partners."

For additional information please contact:

+-------------------------------------------------------+---------------------+

| Kedco plc | +353 (0)21 467 0427 |

| Donal Buckley, Chief Executive / Gerry Madden, | |

| Finance Director | |

| | |

+-------------------------------------------------------+---------------------+

| Financial Dynamics - London | +44 (0)20 7831 3113 |

| Matt Dixon / Edward Westropp / Alex Beagley | |

| | |

+-------------------------------------------------------+---------------------+

| Deloitte Corporate Finance - Nomad | +44 (0)20 7936 3000 |

| Jonathan Hinton / David Smith | |

| | |

+-------------------------------------------------------+---------------------+

Chairman's Statement

I am pleased to report our maiden set of preliminary results as a quoted

company: a year in which we have taken the bold first steps towards the

implementation of our long-term strategy. Since our admission to the Alternative

Investment Market (AIM) of the London Stock Exchange in October 2008 we have

signed further binding and non-binding project agreements; raised funding from a

range of investors; and commenced construction of our first power plant. Each of

these steps, and the many others we have taken, constitute good progress in our

strategy to generate shareholder value from the sale and operation in

partnership of biomass waste-to-energy power plants.

Kedco's business strategy is to design build and operate power plants with an

output greater than 1MW using two tried and tested technologies: gasifiation of

wood and wood waste; and anaerobic digestion of either food or agricultural

waste. Plants using anaerobic digestion and gasification conversion technologies

qualify for two Renewable Obligation Credits ("ROC's") under the UK renewable

energy regime. Plants under 1MW in size we intend to develop and sell as

turn-key operations. The Directors believe that by implementing this strategy

the environmental and financial costs relating to waste disposal are alleviated.

A key element of our business model is to establish relationships with

medium-sized waste operators, food companies, agricultural operators and local

municipal authorities who can act as feedstock and site providers and

potentially as financing partners in respect of the plants. For each project,

Kedco sources the relevant technology and project finance as well as designing,

developing and operating the installations.

In June we updated the market on our progress and I am pleased to report that we

remain on track to meet the financial commitments that we set in our Trading

Update of 26 June 2009. Most importantly we expect to be generating electricity

by the end of 2009: which, when it occurs, will mark a significant milestone for

us and see us deliver one of our most important objectives.

As reported at the time of our Interim Results, the market for developing and

operating electricity generating plants is driven by growing regulation and

legislation toward the renewable energy needs of the countries in which we

operate. This continues to be the case and there is much evidence to suggest

that this regulatory pressure is growing. The European Union has committed

itself to the target of increasing the share of renewable energy in use to 20

per cent. by 2020. In Britain, the UK Government has enhanced its targets for

the ROC scheme: our products remain eligible for two ROC's per megawatt hour. At

the same time, the Feed In Tariffs introduced as part of the UK Government's UK

Energy Bill are expected to have a positive impact on our business from April

2010 onwards. All of this is encouraging and further supports the marketability

of our business model and the validity of our long-term strategy.

We continue to ensure that we have the right skills and platform in place to

support our ongoing development. Ours is a long-term goal that, as we stated

when we came to market in 2008, requires much up front investment, effort and

passion. I am pleased with the progress the Company has made this year in

attracting further funding from a variety of respected sources: a sum totalling

EUR8.8 million in the financial year, all of which will support the development of

our live and to-be-live projects in the year ahead.

This has been an important first year for us as a quoted company. On behalf of

the Board I would like to thank all Kedco employees for their continued

commitment and achievements in the past twelve months. I would also like to

thank our shareholders and funding partners for their continuing support of the

Company's aims. We look forward to continuing these relationships in the months

and years ahead.

William Kingston

Non-Executive Chairman

Chief Executive's Report

Operational Review

I am pleased to be able to report the progress we have made in our first year as

an AIM company. The Directors believe that the pace and scale of the change

undertaken by Kedco over the past year can be seen clearly, marked out in the

achievements we have made in the areas of financing, planning and permitting,

project pipeline development, project construction, and the building of

technology partner relationships. These achievements have not always been

easily won and we have seen many challenges, not least those posed by the

difficult market conditions the world has witnessed during the period.However,

we have continued to push forward with our plans and we remain on track to

deliver our commitment to generate electricity by the end of 2009.

During the year, we continued to invest capital in developing customer and

partner relationships and in furthering projects. We have also continued to

build up the pipeline of projects on which we are either planning our

involvement or already working towards a finished installation. We remain on

track with the progress reported in our Trading Update of 26 June, currently

working towards 30 identified projects. Of these projects, one has a signed

contract, two have binding letters of intent ("LoI") and 15 have a non-binding

LoI with joint venture partners. These 18 projects together represent a combined

72MW of potential capacity and, looking at them in more detail:

* 5 have full planning and permitting granted to Kedco and/or its partners, with 1

currently under construction

* 1 is in advanced stages of planning and permitting

* 5 are in the early stages of the planning and permitting process

* 7 are in the pre-planning and permitting stage

The Directors believe that Kedco is developing as a company that is well

structured to take a market leadership position as a developer in the key

renewable growth areas of anaerobic digestion and gasification in the UK. The

regulatory and political drivers for these technologies are many and growing -

not just in our markets in the UK and Ireland but further afield across the

European Union. I remain encouraged by these drivers, believing they will

continue to increase the attractiveness and exposure of our business model.

As evidence of our belief in these drivers, during the year the Company also

made significant advancements in its strategy of deploying smaller anaerobic

digestion and gasification plants (75KW to 1MW) to the marketplace. These plants

enable localised generation of electricity and heat on a small scale suitable

for businesses such as supermarkets, small hospitals and healthcare centres,

hotels, office buildings and food production companies. As we stated in our June

Trading Update, we anticipate that Kedco will have Europe's first proven,

small-scale containerised 75KW gasifier operational in the near future. This

plant is currently being commissioned. The Directors believe that the market for

this size of product is significant.

As stated in our Admission Document, as we seek to scale up and accelerate the

development of our project pipeline, there will also be a commensurate need for

us to increase the scale and timing of our fund-raising activities. Although as

our operational assets mature, we expect to be able to secure more readily bank

finance to fund the initial development of new projects, in the interim, we will

continue to have a requirement for equity and/or hybrid debt capital. In this

regard, Kedco believes it is prudent to consider all available funding options

and the Company will continue to execute to its strategy, where appropriate, of

seeking to raise additional finance by way of equity or structured debt

instruments.

Financial Review

The like-for-like comparisons made in this Financial Review compare the

performance for the 12 months ended 30 June 2009 with a period of 14 months

ended 30 June 2008 ("FY 2008").

Revenue in the period amounted to EUR5.9 million, in line with revised

expectations (FY 2008: EUR9.0m). The Company reported a loss (excluding one off

costs) for the period of EUR4.7 million: a decrease on the prior year figure of

EUR5.4 million for FY 2008.

The Company continues to invest in activities of the Kedco Power division and

awaits the commissioning of the first electricity generating plant. This

together with the current challenging economic environment and the costs of

admission to the AIM market has resulted in the Company reporting a loss for the

year

During the year the Company has continued to exercise tight control over costs

whilst, at the same time, continued to strengthen its Balance Sheet. During the

period the Company raised total additional capital of EUR8.8 million. Following

the period end, the Company has sourced a further EUR2.6 million from a variety of

private, and institutional investors. In addition to the Placing, the Company

has been informed that the Investment Committee of Enterprise Ireland, the Irish

government agency responsible for the global expansion of Irish companies, has

approved a proposed subscription of EUR0.5 million for cumulative redeemable

convertible preference shares in Kedco Power Limited, a wholly-owned subsidiary

of Kedco. This investment is subject to the finalisation of a share subscription

and shareholders' agreement which the Board hopes to conclude shortly. A further

announcement will be made in this respect in due course.

At 30 June 2009, the Company had net debt of EUR7.9 million (30 June 2008: EUR7.6

million) including cash balances of EUR340,242 (30 June 2008: EUR306,238).

Outlook

As we enter the new financial year, we remain on track to deliver our business

strategy. In our Admission Document we anticipated that we would commence

electricity generation in the second half of 2009. We remain on track to meet

that objective. We will also continue in the year ahead to keep building the

skills and financial capacity necessary to see Kedco take full advantage of

the exciting opportunities open to us in our markets.

The long-term outlook for our business model remains positive, supported by an

ever increasing amount of regulatory pressure in favour of localised, targeted

green-energy solutions. Economic conditions do remain uncertain and the impact

of tightened credit markets could continue to have some impact on the

availability of finance for new projects. However, in spite of this we have

continued to sucessfully raise further financing during the year and, in line

with our stated objectives, we expect to continue those efforts in the year

ahead.

The Board continues to look forward confidently to Kedco's long-term strategic

success.

Donal Buckley

Chief Executive Officer

Kedco plc

Consolidated income statement

for the year ended 30 June 2009

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

| | | | |

| | | 12 months ended | 14 months ended |

+------------------------------------------------+-----------+--------------------+--------------------+

| | Notes | 30 June 2009 | 30 June 2008 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | EUR | EUR |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Revenue | | 5,914,077 | 9,015,835 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Cost of sales | | (5,106,316) | (8,469,643) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Gross profit | | 807,761 | 546,192 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Operating expenses | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Administrative expenses: | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| One-off listing expenses | | (946,024) | - |

+------------------------------------------------+-----------+--------------------+--------------------+

| Other | | (5,525,791) | (5,099,159) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | (6,471,815) | (5,099,159) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Operating loss | | (5,664,054) | (4,552,967) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Finance costs | | (690,597) | (796,860) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Finance income | | 114,113 | 353 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Loss before taxation | | (6,240,538) | (5,349,474) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Income tax expense | | - | (20,562) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Net loss | | (6,240,538) | (5,370,036) |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Attributable to: | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Equity holders of the parent | | (6,132,743) | (5,398,245) |

+------------------------------------------------+-----------+--------------------+--------------------+

| Minority interest | | (107,795) | 28,209 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | (6,240,538) | (5,370,036) |

+------------------------------------------------+-----------+--------------------+--------------------+

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

| | | | |

| | | 12 months ended | 14 months ended |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | 30 June 2009 | 30 June 2008 |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | EUR | EUR |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | Euro per share | Euro per share |

+------------------------------------------------+-----------+--------------------+--------------------+

| | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| Basic loss per share: | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| From continuing operations | 2 | (0.03) | (0.06) |

+------------------------------------------------+-----------+--------------------+--------------------+

| Diluted loss per share: | | | |

+------------------------------------------------+-----------+--------------------+--------------------+

| From continuing operations | 2 | (0.03) | (0.06) |

+------------------------------------------------+-----------+--------------------+--------------------+

Kedco plc

Consolidated balance sheet

At 30 June 2009

+------------------------------------------+-------+---------------+--------------+

| |Notes | At 30 June | At 30 June |

| | | 2009 | 2008 |

+------------------------------------------+-------+---------------+--------------+

| ASSETS | | EUR | EUR |

+------------------------------------------+-------+---------------+--------------+

| Non-current assets | | | |

+------------------------------------------+-------+---------------+--------------+

| Goodwill | | 549,451 | 549,451 |

+------------------------------------------+-------+---------------+--------------+

| Intangible assets | | 157,309 | 234,301 |

+------------------------------------------+-------+---------------+--------------+

| Property, plant and equipment | | 6,138,936 | 5,024,351 |

+------------------------------------------+-------+---------------+--------------+

| Share of gross assets of jointly | | 1,000,593 | - |

| controlled entities | | | |

+------------------------------------------+-------+---------------+--------------+

| | | 7,846,289 | 5,808,103 |

+------------------------------------------+-------+---------------+--------------+

| Assets classified as held for sale | | - | 1,602,256 |

+------------------------------------------+-------+---------------+--------------+

| Total non-current assets | | 7,846,289 | 7,410,359 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| Current assets | | | |

+------------------------------------------+-------+---------------+--------------+

| Inventories | | 1,327,324 | 1,625,316 |

+------------------------------------------+-------+---------------+--------------+

| Trade and other receivables | | 9,395,782 | 1,375,790 |

+------------------------------------------+-------+---------------+--------------+

| Cash and cash equivalents | | 340,242 | 306,238 |

+------------------------------------------+-------+---------------+--------------+

| Total current assets | | 11,063,348 | 3,307,344 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| Total assets | | 18,909,637 | 10,717,703 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| EQUITY AND LIABILITIES | | | |

+------------------------------------------+-------+---------------+--------------+

| Equity | | | |

+------------------------------------------+-------+---------------+--------------+

| Share capital | | 3,065,807 | 1,807,933 |

+------------------------------------------+-------+---------------+--------------+

| Share premium | | 15,096,219 | 7,084,737 |

+------------------------------------------+-------+---------------+--------------+

| Share based payment reserve | | 164,188 | - |

+------------------------------------------+-------+---------------+--------------+

| Retained earnings - deficit | | (14,252,107) | (8,133,321) |

+------------------------------------------+-------+---------------+--------------+

| Equity attributable to equity holders of | | 4,074,107 | 759,349 |

| the parent | | | |

+------------------------------------------+-------+---------------+--------------+

| Minority interest | | 490,467 | 596,651 |

+------------------------------------------+-------+---------------+--------------+

| Total equity | | 4,564,574 | 1,356,000 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| Non-current liabilities | | | |

+------------------------------------------+-------+---------------+--------------+

| Borrowings | | 6,746,220 | 5,178,679 |

+------------------------------------------+-------+---------------+--------------+

| Deferred income - government grants | | 56,662 | 71,501 |

+------------------------------------------+-------+---------------+--------------+

| Finance lease liabilities | | 50,324 | 243,009 |

+------------------------------------------+-------+---------------+--------------+

| Deferred tax liability | | 81,078 | 80,860 |

+------------------------------------------+-------+---------------+--------------+

| | | 6,934,284 | 5,574,049 |

+------------------------------------------+-------+---------------+--------------+

| Liabilities associated with assets held | | - | 1,743,986 |

| for sale | | | |

+------------------------------------------+-------+---------------+--------------+

| Total non-current liabilities | | 6,934,284 | 7,318,035 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| Current liabilities | | | |

+------------------------------------------+-------+---------------+--------------+

| Share of gross liabilities of jointly | | 990,000 | - |

| controlled entities | | | |

+------------------------------------------+-------+---------------+--------------+

| Trade and other payables | | 4,925,895 | 1,318,627 |

+------------------------------------------+-------+---------------+--------------+

| Borrowings | | 1,371,176 | 571,406 |

+------------------------------------------+-------+---------------+--------------+

| Deferred income - government grants | | 15,033 | 24,431 |

+------------------------------------------+-------+---------------+--------------+

| Finance lease liabilities | | 108,675 | 129,204 |

+------------------------------------------+-------+---------------+--------------+

| Total current liabilities | | 7,410,779 | 2,043,668 |

+------------------------------------------+-------+---------------+--------------+

| | | | |

+------------------------------------------+-------+---------------+--------------+

| Total equity and liabilities | | 18,909,637 | 10,717,703 |

+------------------------------------------+-------+---------------+--------------+

Kedco plc

Consolidated cashflow statement

for the year ended 30 June 2009

+-------------------------------------------+-------+---------------+--------------+

| | | 12 months | 14 months |

| | | ended | ended |

+-------------------------------------------+-------+---------------+--------------+

| |Notes | 30 June 2009 | 30 June 2008 |

+-------------------------------------------+-------+---------------+--------------+

| | | EUR | EUR |

+-------------------------------------------+-------+---------------+--------------+

| Cash flows from operating activities | | | |

+-------------------------------------------+-------+---------------+--------------+

| Loss before taxation | | (6,240,538) | (5,349,474) |

+-------------------------------------------+-------+---------------+--------------+

| Adjustments for: | | | |

+-------------------------------------------+-------+---------------+--------------+

| Share based payments | | 164,188 | - |

+-------------------------------------------+-------+---------------+--------------+

| Depreciation of property, plant and | | 533,587 | 639,864 |

| equipment | | | |

+-------------------------------------------+-------+---------------+--------------+

| Amortisation of intangible assets | | 84,657 | 97,198 |

+-------------------------------------------+-------+---------------+--------------+

| Loss on disposal of property, plant and | | 30,619 | 32,376 |

| equipment | | | |

+-------------------------------------------+-------+---------------+--------------+

| Impairment of property, plant and | | 571,710 | - |

| equipment | | | |

+-------------------------------------------+-------+---------------+--------------+

| Unrealised foreign exchange loss | | 2,866 | 1,572 |

+-------------------------------------------+-------+---------------+--------------+

| Interest expense | | 690,597 | 796,860 |

+-------------------------------------------+-------+---------------+--------------+

| Interest income | | (114,113) | (353) |

+-------------------------------------------+-------+---------------+--------------+

| Operating cash flows before working | | (4,276,427) | (3,781,957) |

| capital changes | | | |

+-------------------------------------------+-------+---------------+--------------+

| | | | |

+-------------------------------------------+-------+---------------+--------------+

| (Increase)/decrease in: | | | |

+-------------------------------------------+-------+---------------+--------------+

| Trade and other receivables | | (7,523,890) | 373,009 |

+-------------------------------------------+-------+---------------+--------------+

| Inventories | | 297,992 | 406,588 |

+-------------------------------------------+-------+---------------+--------------+

| Increase/(decrease) in: | | | |

+-------------------------------------------+-------+---------------+--------------+

| Trade and other payables | | 3,576,237 | (152,841) |

+-------------------------------------------+-------+---------------+--------------+

| | | (7,926,088) | (3,155,201) |

+-------------------------------------------+-------+---------------+--------------+

| Income taxes paid | | - | (5,475) |

+-------------------------------------------+-------+---------------+--------------+

| Net cash used in operating activities | | (7,926,088) | (3,160,676) |

+-------------------------------------------+-------+---------------+--------------+

| | | | |

+-------------------------------------------+-------+---------------+--------------+

| Cash flows from investing activities | | | |

+-------------------------------------------+-------+---------------+--------------+

| Additions to property, plant and | | (770,552) | (2,293,791) |

| equipment | | | |

+-------------------------------------------+-------+---------------+--------------+

| Proceeds from sale of property, plant and | | 135,010 | 279,560 |

| equipment | | | |

+-------------------------------------------+-------+---------------+--------------+

| Additions to intangibles | | (7,665) | - |

+-------------------------------------------+-------+---------------+--------------+

| Interest received | | 110,573 | 353 |

+-------------------------------------------+-------+---------------+--------------+

| Net cash used in investing activities | | (532,634) | (2,013,878) |

+-------------------------------------------+-------+---------------+--------------+

| | | | |

+-------------------------------------------+-------+---------------+--------------+

| Cash flows from financing activities | | | |

+-------------------------------------------+-------+---------------+--------------+

| Proceeds from borrowings | | 483,357 | 1,773,748 |

+-------------------------------------------+-------+---------------+--------------+

| Proceeds from issuance of ordinary shares | | 8,776,792 | 5,214,825 |

+-------------------------------------------+-------+---------------+--------------+

| Payments for purchase of preference | | - | (573,600) |

| shares in subsidiary company from third | | | |

| parties | | | |

+-------------------------------------------+-------+---------------+--------------+

| Payments of finance leases | | (213,214) | (208,597) |

+-------------------------------------------+-------+---------------+--------------+

| Interest paid | | (694,178) | (796,860) |

+-------------------------------------------+-------+---------------+--------------+

| Net cash from financing activities | | 8,352,757 | 5,409,516 |

+-------------------------------------------+-------+---------------+--------------+

| | | | |

+-------------------------------------------+-------+---------------+--------------+

| Net (decrease)/increase in cash and cash | | (105,965) | 234,962 |

| equivalents | | | |

+-------------------------------------------+-------+---------------+--------------+

| Cash and cash equivalents at the | | 105,713 | (129,249) |

| beginning of the financial year/period | | | |

+-------------------------------------------+-------+---------------+--------------+

| | | | |

+-------------------------------------------+-------+---------------+--------------+

| Cash and cash equivalents at the end of | | (252) | 105,713 |

| the financial year/period | | | |

+-------------------------------------------+-------+---------------+--------------+

Kedco plc

Notes to the consolidated financial statements

for the year ended 30 June 2009

1. Basis of preparation

The Group's consolidated financial statements have been prepared in accordance

with International Financial Reporting Standards ("IFRS") effective at 30 June

2009 for all periods presented as issued by the International Accounting

Standards Board. The consolidated financial statements are also prepared in

accordance with IFRS as adopted by the European Union ("EU").

The consolidated financial statements are prepared under the historical cost

convention. The principal accounting policies set out below have been applied

consistently by the parent company and by all of the Company's subsidiaries to

all periods presented in these consolidated financial statements.

The financial statements of the parent company, Kedco plc have been prepared in

accordance with accounting standards generally accepted in Ireland and Irish

statute comprising the Companies Acts 1963 to 2009.

As a consequence of applying reverse acquisition accounting, the results of the

Group to 30 June 2009 comprise the results of Kedco plc and its subsidiaries for

the period from 2 October 2008 to 30 June 2009, and those of Kedco Block

Holdings Limited and its subsidiaries from 1 July 2008 to 1 October 2008. The

comparative figures of the Group are those of Kedco Block Holdings Limited and

its subsidiaries for the fourteen month period ended 30 June 2008.

The Company's directors made a decision to change the ending date of the

accounting period in 2008 for administrative convenience. Consequently, the

comparative consolidated income statement and consolidated cash flow statement

presented is for the 14 month period from 1 May 2007 to 30 June 2008. As a

result, the comparative amounts for the income statement, cash flow statement

and the related notes are not entirely comparable.

As described in the Chief Executive's Report the Group continues to invest in

activities of the Kedco Power division and awaits the commissioning of the first

electricity generating plant. This together with the current challenging

economic environment and the costs of admission to the AIM market has resulted

in the Group reporting a loss for the year.

The directors have instituted measures to preserve cash and have secured

additional finance of EUR2.6 million together with investment committee approval

from a government agency for a further EUR0.5 million in October 2009.

The Group is in the process of finalising discussions with bankers in relation

to project finance on its immediate projects. It is likely that these

discussions will be completed shortly.

The directors are also pursuing other sources of funding with the objective of

securing a commitment in the near future.

After making enquiries and considering the items referred to above, the

directors have a reasonable expectation that the Group has adequate resources to

continue in operational existence for the forseeable future, and therefore, that

the Group is able to realise its assets and discharge its liabilities in the

normal course of business. On that basis, the directors are satisfied that it is

appropriate to continue to prepare the consolidated financial statements on the

going concern basis.

Kedco plc

Notes to the consolidated financial statements

for the year ended 30 June 2009

+-----+------------------------------+------------------+---------------+---------------+

| 2. | Loss per share | | 12 months | 14 months |

| | | | ended | ended |

+-----+------------------------------+------------------+---------------+---------------+

| | | | 30 June 2009 | 30 June 2008 |

+-----+------------------------------+------------------+---------------+---------------+

| | | | EUR | EUR |

+-----+------------------------------+------------------+---------------+---------------+

| | Basic loss per share | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | From continuing operations | | (0.03) | (0.06) |

+-----+------------------------------+------------------+---------------+---------------+

| | | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | Diluted loss per share | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | From continuing operations | | (0.03) | (0.06) |

+-----+------------------------------+------------------+---------------+---------------+

| | | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | Basic loss per share | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | The loss and weighted average number of ordinary shares used in the calculation |

| | of the basic loss per share are as follows: |

+-----+---------------------------------------------------------------------------------+

| | | | 12 months | 14 months |

| | | | ended | ended |

+-----+------------------------------+------------------+---------------+---------------+

| | | | 30 June 2009 | 30 June 2008 |

+-----+------------------------------+------------------+---------------+---------------+

| | | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | Loss for year attributable | | (6,132,743) | (5,398,245) |

| | to equity holders of the | | | |

| | parent (EUR) | | | |

+-----+------------------------------+------------------+---------------+---------------+

| | Weighted average number of | | 192,591,780 | 95,588,560 |

| | ordinary shares for the | | | |

| | purposes of basic loss per | | | |

| | share | | | |

+-----+------------------------------+------------------+---------------+---------------+

Diluted loss per share

The loss used in the calculation of all diluted earnings per share measures is

the same as those for the equivalent basic earnings per share measures, as

outlined above.

The weighted average number of ordinary shares for the purposes of diluted loss

per share reconciles to the weighted average number of ordinary shares used in

the calculation of basic loss per share as follows:

+-----+-----------------------------------------------+--+---------------+---------------+

| | | | 12 months | 14 months |

| | | | ended | ended |

+-----+-----------------------------------------------+--+---------------+---------------+

| | | | 30 June 2009 | 30 June 2008 |

+-----+-----------------------------------------------+--+---------------+---------------+

| | | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | Weighted average number of ordinary shares | | | |

| | used in the | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | calculation of basic loss per share | | 192,591,780 | 95,588,560 |

+-----+-----------------------------------------------+--+---------------+---------------+

| | | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | Shares deemed to be issued in respect of long | | | |

| | term incentive | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | plan | | 32,837,555 | - |

+-----+-----------------------------------------------+--+---------------+---------------+

| | | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | Weighted average number of ordinary shares | | | |

| | used in the | | | |

+-----+-----------------------------------------------+--+---------------+---------------+

| | calculation of diluted earnings per share | | 225,429,335 | 95,588,560 |

+-----+-----------------------------------------------+--+---------------+---------------+

Share warrants which could potentially dilute basic earnings per share in the

future have not been included in the calculation of diluted earnings per share

as they are anti-dilutive for the periods presented. The dilutive effect as a

result of share warrants in issue as at 30 June 2009 would be to increase the

weighted average number of shares by 130,483 (2008: Nil).

Kedco plc

Notes to the consolidated financial statements

for the year ended 30 June 2009

3. Events after the balance sheet date

During October 2009, the Company raised EUR2.6 million from a placing with a

variety of investors including the Kedco directors. The proceeds from the

placing will be used to develop identified opportunities for joint ventures and

working capital purposes.

In addition to the placing, the Company has been informed that the Investment

Committee of Enterprise Ireland, the Irish government agency responsible for the

global expansion of Irish companies, has approved a proposed subscription of

EUR0.5 million for cumulative redeemable convertible preference shares in Kedco

Power Limited, a wholly-owned subsidiary of Kedco. This investment is subject to

the finalisation of a share subscription and shareholders' agreement.

The annual report and financial statements for the year ended 30 June 2009 will

be posted to shareholders shortly. The annual report and financial statements

will also be available on the Company's website - www.kedco.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR CKQKQCBDDOKD

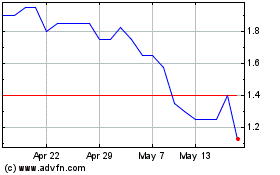

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024