TIDMKED

RNS Number : 2580P

Kedco PLC

23 March 2009

23 March 2009

Kedco plc

("Kedco" or the "Company")

Interim results for the six months ended 31 December 2008

Kedco plc, an Irish-based energy group focusing on green energy production in

the UK, Ireland and Eastern Europe, announces today its interim results for the

six months ended 31st December 2008.

Highlights

Operational

* Significant progress made towards the Compay's objective of commencing

electricity generation in 2009.

* Two 2MW gasification units together with gas conversion engines ordered from

preferred suppliers in the US and Europe and are expected to be commissioned in

2009.

* Offer received from Latvian Government to supply 4MW of electricity from

Vudlande plant with potential revenues of EUR24 million over a five-year initial

term (based on an indicative price of EUR150 per MWh).

* 25 identified projects of which 12 have non binding Letters of Intent ("LoI")

with potential aggregate capacity of 48MW.

* Of these LoI's :

* 5 are in early stages of the planning and permitting process

* 3 are in advanced stages of planning and permitting

* 2 are in advanced planning stages with equipment ordered

Financial

* Revenues of EUR3.2 million in line with expectations.

* Loss (excluding one-off listing costs) for the period reduced to EUR2.1 million

representing a 20 per cent. improvement on the prior year comparable period

(2007 loss: EUR2.6 million).

* Additional capital of EUR967,556 (before expenses) sourced from a variety of

institutional investors in February 2009.

* Total cash of EUR1.7 million at the period end

Donal Buckley, Chief Executive of Kedco, commented:

"We are extremely pleased with the progress we have made on our project pipeline

of which nearly half have signed, non-binding, letters of intent in place. This

was a key objective of the Board and we intend to convert the majority of these

into electricity generating plants in the medium-term.

"As well as significant progress with our pipeline of projects, we also admitted

the Company's shares to trading on AIM in October 2008, which we believe is a

significant step in taking the business to the next stage in it's development.

The Board of Kedco looks forward to the next year with confidence and

excitement."

For additional information please contact:

+-------------------------------------------------+----------------------+

| Kedco plc | +353 (0)21 467 0427 |

| Donal Buckley, Chief Executive | |

| Gerry Madden, Finance Director | |

+-------------------------------------------------+----------------------+

| Financial Dynamics - London | +44 (0)20 7831 3113 |

| Edward Westropp / James Melville-Ross / Alex | |

| Beagley | |

+-------------------------------------------------+----------------------+

| Deloitte Corporate Finance - Nomad | +44 (0)20 7936 3000 |

| Jonathan Hinton / David Smith | |

+-------------------------------------------------+----------------------+

| Lewis Charles Securities - Broker | +44 (0)20 7456 9100 |

| Kealan Doyle / Nicholas Nicolaides | |

+-------------------------------------------------+----------------------+

Chairman's Statement

I am delighted to report another period of solid progress for Kedco. Since our

admission to the Alternative Investment Market of the London Stock Exchange in

October 2008 we have made significant advances in developing and implementing

our strategy to deliver shareholder value from the sale and operation in

partnership of biomass waste-to-energy power plants.

Kedco acts as a platform-provider, sourcing waste-to-energy technolgies for sale

to a customer base that includes medium-sized waste operators, food companies,

agricultural operators and local municipal authorities. We partner with our

customers to own and operate electricity generating plants, utilising our

customers' waste as feedstock. In this way, the environmental and financial

costs relating to waste disposal are alleviated. We use two tried and tested

technologies, being gasifiation of wood and wood waste and anaerobic digestion

of either food or agricultural waste, to convert the waste into renewable

energy.

The alternative energy sector is currently being driven by regulation and

legislation and we believe that the new UK Energy bill will create additional

opportunities for Kedco when it comes into effect on 1 April 2009. In our view,

the most significant change to the regulatory regime is the shift to differing

levels of Government incentive dependent on the renewable technologies utilised.

We are delighted that the waste-to-energy sector will receive a doubling of such

incentives.

We have continued to progress those projects for which we had signed,

non-binding letters of intent at the time of our admission to AIM. In respect of

the two most advanced projects, we have entered into partnership contracts with

two medium-sized waste operators with the intention of building and operating

plants which will convert wood waste into electricity using gasification

technology. The gasification technology in respect of these projects has been

ordered and we intend it to be installed and operational in 2009.

I would like to thank all Kedco employees for their continued commitment and

achievements, especially over the past nine months. I would also like to thank

the growing number of shareholders for their continuing interest and ongoing

support of Kedco plc.

William Kingston

Chairman

Chief Executive's Report

Operational review

In the six months to 31 December 2008 the performance of the Company was in line

with our expectations.

We have made significant progress in our objective of commencing the generation

of electricity in the second half of 2009 and currently have 12 non-binding,

signed letters of intent in place with potential partners.

Two 2MW gasification units together with gas conversion engines have been

ordered from our preferred suppliers in respect of our two most imminent

projects. It is intended that these plants will be commissioned over the coming

months. Partnership agreements have been signed with the respective customers

and the remaining legal agreements are currently being finalised.

In respect of these and three other projects, we are engaged in the final stages

of the planning process. The three other projects utilise anaerobic digestion

technology.

An additional five letters of intent were announced to the market on 17 March

2009 and relate to projects that are at a relatively early stage of contract

negotiation and planning.

In total, these 12 LoIs have a potential aggregate capacity of 48MW. The 25

specific opportunities identified at the time of our admission to AIM, of which

the 12 LoIs form a part, have a potential aggregate capacity of 102MW.

We also announced on 17 March 2009 that the Latvian Government had offered Kedco

an initial five-year contract to supply 4MW of electricity generated from

biomass renewable sources. It has always been the Board's ambition to build a

gasification plant on this site and the contract will allow Kedco to sell the

electricity it generates at a variable price referenced to the prevailing

wholesale gas price. The Board estimates that the project could generate up to

approximately EUR24m in revenues over the initial term (based on an indicative

price of EUR150 per MWh). We are currently considering the financing and timing

implications of the project and will make a further announcement in due course.

The current economic climate has been challenging for Kedco Energy where we

supply biomass boilers to domestic and commercial markets and produce and sell

wood and other biomass products. We have experienced encouraging demand for our

boilers albeit that this has tended to be in respect of our products for the

domestic market which have a lower retail value than commercial market products.

However, the increased demand for domestic boilers has been offset by reduced

demand for our wood and biomass products where market conditions remain

challenging.

The market conditions, together with our increased focus on the activities of

the Kedco Power division, has led to a decline in revenues in line with our

expectations.

Financial review

Revenues in the first half to 31 December 2008 related entirely to the Kedco

Energy division and decreased to EUR3,220,751, a reduction of 20 per cent. when

compared with the corresponding period for the prior year. The loss for the

period was EUR3,029,830 (2007: EUR2,611,997) which included one off listing costs of

EUR946,024. This loss includes costs that reflect the Company's continued use of

resource to grow and execute the electricity generating business in line with

the Company's stated strategy.

We continue to manage our financial resources prudently. Cash and bank balances

at the period end were EUR1.7m. This balance is stated after paying deposits of

approximately EUR2.7m to suppliers of gasification units. On 20 February 2009 the

Company raised EUR967,556 before expenses from a variety of institutional

investors.

Outlook

We believe that the outlook for Kedco in the waste-to-energy market is extremely

positive. The twin drivers of regulation in relation to waste disposal and

legislation in relation to the generation of renewable electricity, could

significantly enhance the performance of the Company in the future.

Looking forward to the remainder of the year, we consider the main areas of

uncertainty to be the continued effect of the downturn in the global economy on

Kedco Energy's trading activities and the impact of the tightening in credit

markets on the cost and availability of finance for new projects. With this in

mind the business has continued to exercise tight control over its cost base.

We are engaged with a select number of partners in the waste-to-energy sector. I

am confident that we are on course to execute commercial agreements with these

partners and to build electricity generating plants which will enhance Kedco

shareholder value.

The Board' and management of Kedco looks forward to the future with confidence

and excitement.

Donal Buckley

CEO

Independent Review Report to Kedco plc

Introduction

We have been engaged by the company to review the condensed set of financial

statements in the half-yearly financial report for the six months ended 31

December 2008 which comprises the Consolidated Income Statement, the

Consolidated Balance Sheet, the Consolidated Statement of Changes in Equity, the

Consolidated Cash Flow Statement and the related notes. We have read the other

information contained in the half-yearly financial report and considered whether

it contains any apparent misstatements or material inconsistencies with the

condensed set of financial statements.

This report is made solely to the company, in accordance with the International

Standard on Review Engagements, 2410 "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity". Our work has been

undertaken so that we might state to the company those matters we are required

to state to them in an independent review report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this report, or for

the conclusions we have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and has been approved

by, the directors. The directors are responsible for preparing the half-yearly

financial report in accordance with the Listing Rules of the London Stock

Exchange for companies trading securities on the Alternative Investment Market

which require that the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual accounts

having regard to the accounting standards applicable to such annual accounts.

As disclosed in note 1, the annual financial statements of the group are

prepared in accordance with IFRSs as adopted by the European Union. The

condensed set of financial statements included in this half-yearly financial

report has been prepared in accordance with International Accounting Standard

34, "Interim Financial Reporting", as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the company a conclusion on the condensed

set of financial statements in the half-yearly financial report based on our

review.

Scope of Review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Auditing

Practices Board for use in the United Kingdom and Ireland. A review of interim

financial information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying analytical and

other review procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing (UK and

Ireland) and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

Independent Review Report to Kedco plc

Conclusion

Based on our review, nothing has come to our attention that causes us to believe

that the condensed set of financial statements in the half-yearly financial

report for the six months ended 31 December 2008 is not prepared, in all

material respects, in accordance with International Accounting Standards 34 as

adopted by the European Union and the rules of the London Stock Exchange for

companies trading securities on the Alternative Investment Market.

DELOITTE & TOUCHE

Chartered Accountants and Auditors

Cork

Ireland

Date: 20th March 2009

Note: A review does not provide assurance on the maintenance and integrity of

the website, including controls used to achieve this, and in particular on

whether any changes may have occurred to the financial information since first

published. These matters are the responsibility of the directors but no control

procedures can provide absolute assurance in this area.

Legislation in Ireland governing the preparation and dissemination of financial

information differs from legislation in other jurisdictions.

+----------------------------+--------+---------------+---------------+---------------+

| | Notes | | 31 December | 31 December |

| | | | 2008 | 2007 |

+----------------------------+--------+---------------+---------------+---------------+

| | | | EUR | EUR |

+----------------------------+--------+---------------+---------------+---------------+

| Continuing operations | | | | |

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Revenue | 4 | | 3,220,751 | 4,227,428 |

+----------------------------+--------+---------------+---------------+---------------+

| Cost of sales | | | (2,722,957) | (3,756,347) |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Gross profit | | | 497,794 | 471,081 |

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Operating expenses | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Administrative expenses | | | (2,356,953) | (2,688,479) |

| One-off listing costs | | | (946,024) | - |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Operating loss | | | (2,805,183) | (2,217,398) |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Finance costs | | | (323,834) | (394,940) |

+----------------------------+--------+---------------+---------------+---------------+

| Finance income | | | 99,187 | 341 |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Loss before taxation | | | (3,029,830) | (2,611,997) |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Income tax | 5 | | - | - |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Loss for the period | | | (3,029,830) | (2,611,997) |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Attributable to: | | | | |

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Equity holders of the | | | (2,989,249) | (2,642,702) |

| parent | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| Minority interest | | | (40,581) | 30,705 |

+----------------------------+--------+---------------+---------------+---------------+

| | | | | |

+----------------------------+--------+---------------+---------------+---------------+

| | | | (3,029,830) | (2,611,997) |

+----------------------------+--------+---------------+---------------+---------------+

+--+----------------------------+------+--------------+----------------+---------------+

| | Basic loss per share: | | | | |

+--+----------------------------+------+--------------+----------------+---------------+

| | From continuing operations | 6 | | (0.017) | (0.029) |

+--+----------------------------+------+--------------+----------------+---------------+

| | Diluted loss per share: | | | | |

+--+----------------------------+------+--------------+----------------+---------------+

| | From continuing operations | 6 | | (0.015) | (0.029) |

+--+----------------------------+------+--------------+----------------+---------------+

Condensed consolidated balance sheet at 31 December 2008

+-------------------------------+-------+------------+----------------+---------------+

| |Notes | | 31 December | 30 June 2008 |

| | | | 2008 | |

+-------------------------------+-------+------------+----------------+---------------+

| Assets | | | EUR | EUR |

+-------------------------------+-------+------------+----------------+---------------+

| Non-current assets | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Goodwill | 7 | | 549,451 | 549,451 |

+-------------------------------+-------+------------+----------------+---------------+

| Other intangible assets | | | 200,401 | 234,301 |

+-------------------------------+-------+------------+----------------+---------------+

| Property, plant and equipment | 8 | | 5,233,161 | 5,024,351 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | 5,983,013 | 5,808,103 |

+-------------------------------+-------+------------+----------------+---------------+

| Assets classified as held for | | | 1,602,256 | 1,602,256 |

| sale | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Total non-current assets | | | 7,585,269 | 7,410,359 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Current assets | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Inventories | | | 1,157,558 | 1,625,316 |

+-------------------------------+-------+------------+----------------+---------------+

| Trade and other receivables | 9 | | 4,817,679 | 1,375,790 |

+-------------------------------+-------+------------+----------------+---------------+

| Cash and bank balances | | | 1,747,422 | 306,238 |

+-------------------------------+-------+------------+----------------+---------------+

| Total current assets | | | 7,722,659 | 3,307,344 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Total assets | | | 15,307,928 | 10,717,703 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Equity and liabilities | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Equity | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Share capital | 10 | | 2,985,645 | 1,807,933 |

+-------------------------------+-------+------------+----------------+---------------+

| Share premium | 10 | | 13,974,589 | 7,084,737 |

+-------------------------------+-------+------------+----------------+---------------+

| Retained earnings - deficit | | | (11,094,880) | (8,133,321) |

+-------------------------------+-------+------------+----------------+---------------+

| Equity attributable to equity | | | 5,865,354 | 759,349 |

| holders of the parent | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Minority interest | | | 557,682 | 596,651 |

+-------------------------------+-------+------------+----------------+---------------+

| Total equity | | | 6,423,036 | 1,356,000 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Non-current liabilities | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Borrowings | | | 5,307,321 | 5,178,679 |

+-------------------------------+-------+------------+----------------+---------------+

| Deferred income - government | | | 59,448 | 71,501 |

| grants | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Finance lease liabilities | | | 175,513 | 243,009 |

+-------------------------------+-------+------------+----------------+---------------+

| Deferred tax liability | | | 81,078 | 80,860 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | 5,623,360 | 5,574,049 |

+-------------------------------+-------+------------+----------------+---------------+

| Liabilities associated with | | | 1,763,177 | 1,743,986 |

| assets as held for sale | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Total non-current liabilities | | | 7,386,537 | 7,318,035 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Current liabilities | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Trade and other payables | | | 798,844 | 1,318,627 |

+-------------------------------+-------+------------+----------------+---------------+

| Borrowings | | | 632,504 | 571,406 |

+-------------------------------+-------+------------+----------------+---------------+

| Deferred income - government | | | 24,495 | 24,431 |

| grants | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Finance lease liabilities | | | 42,512 | 129,204 |

+-------------------------------+-------+------------+----------------+---------------+

| Total current liabilities | | | 1,498,355 | 2,043,668 |

+-------------------------------+-------+------------+----------------+---------------+

| | | | | |

+-------------------------------+-------+------------+----------------+---------------+

| Total equity and liabilities | | | 15,307,928 | 10,717,703 |

+-------------------------------+-------+------------+----------------+---------------+

Condensed consolidated statement of changes in equity

+---------------+------------+-----------+---+----+--+---+---+---+---+----------+---+-----+---+---+-----------+

| Six months ended 31 December 2007 | | | |

+-------------------------------------------------+--+--------------------------+---------+

| | | | | | | |

+---------------+------------+---------------+----+--+--------------------------+---------+

| | Share | Share | Retained | | Attributable | Minority | Total |

| | capital | premium | earnings | | to equity | interest | |

| | | | | | holders of | | |

| | | | | | the parent | | |

+---------------+------------+---------------+---------------+-------+--------------+-------------+-----------+

| | EUR | EUR | EUR | | EUR | EUR | EUR |

+---------------+------------+---------------+---------------+-------+--------------+-------------+-----------+

| Balance at 1 | 1,000,000 | 1,605,000 | (4,157,475) | | (1,552,475) | 573,498 | (978,977) |

| July 2007 | | | | | | | |

+---------------+------------+---------------+---------------+-------+--------------+-------------+-----------+

| Issue of | 214,838 | 1,273,847 | - | | 1,488,685 | - | 1,488,685 |

| ordinary | | | | | | | |

| shares | | | | | | | |

+---------------+------------+-----------+---------------+-------+------------------+-------------+-----------+

| (Loss)/profit | - | - | (2,642,702) | | (2,642,702) | 30,705 | (2,611,997) |

| for the | | | | | | | |

| period | | | | | | | |

+---------------+------------+-----------+---------------+-------+------------------+---------+---------------+

| Balance at | 1,214,838 | 2,878,847 | (6,800,177) | | (2,706,492) | 604,203 | (2,102,289) |

| 31 December | | | | | | | |

| 2007 | | | | | | | |

+---------------+------------+-----------+---+----+--+---+---+---+---+----------+---+-----+---+---+-----------+

+--------------+-------------+--------------+----------+---+--+-----+----+---+---+--+---+--------------+

| Six months ended 31 December 2008 | | | | |

+------------------------------------------------------+------------+----+-------+--+

| | | | | | | | |

+--------------+-------------+--------------+----------+------------+----+-------+--+

| | Share | Share | Retained | | Attributable | Minority | Total |

| | capital | premium | earnings | | to equity | interest | |

| | | | | | holders of | | |

| | | | | | the parent | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| | EUR | EUR | EUR | | EUR | EUR | EUR |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Balance at 1 | 1,807,933 | 7,084,737 | (8,133,321) | | 759,349 | 596,651 | 1,356,000 |

| July 2008 | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Issue of | 685,148 | 6,889,852 | - | | 7,575,000 | - | 7,575,000 |

| ordinary | | | | | | | |

| shares in | | | | | | | |

| Kedco Block | | | | | | | |

| Holdings | | | | | | | |

| Limited | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Ordinary | 1,994,465 | 32,908,669 | - | | 34,903,134 | - | 34,903,134 |

| shares | | | | | | | |

| issued by | | | | | | | |

| Kedco plc in | | | | | | | |

| a share for | | | | | | | |

| share | | | | | | | |

| exchange | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| A ordinary | 498,616 | - | - | | 498,616 | - | 498,616 |

| shares | | | | | | | |

| issued by | | | | | | | |

| Kedco plc in | | | | | | | |

| a share for | | | | | | | |

| share | | | | | | | |

| exchange | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Issue of A | 492,564 | - | - | | 492,564 | - | 492,564 |

| shares in | | | | | | | |

| Kedco plc | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Reverse | (2,493,081) | (32,908,669) | - | | (35,401,750) | - | (35,401,750) |

| acquisition | | | | | | | |

| adjustment | | | | | | | |

| under IFRS 3 | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Loss for the | - | - | (2,989,249) | | (2,989,249) | (40,581) | (3,029,830) |

| period | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Unrealised | - | - | 27,690 | | 27,690 | 1,612 | 29,302 |

| foreign | | | | | | | |

| exchange | | | | | | | |

| loss | | | | | | | |

+--------------+-------------+--------------+--------------+--+--------------+----------+--------------+

| Balance at | 2,985,645 | 13,974,589 | (11,094,880) | | 5,865,354 | 557,682 | 6,423,036 |

| 31 December | | | | | | | |

| 2008 | | | | | | | |

+--------------+-------------+--------------+----------+---+--+-----+----+---+---+--+---+--------------+

Consolidated cash flow statement for the six months ended 31 December 2008

+-----------------------------------+------+--------+------------------+------------------+

| | | | Six months ended | Six months ended |

| | | | 31 December 2008 | 31 December 2007 |

+-----------------------------------+------+--------+------------------+------------------+

| | | | EUR | EUR |

+-----------------------------------+------+--------+------------------+------------------+

| Cash flows from operating | | | | |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Loss before taxation | | | (3,029,830) | (2,611,997) |

+-----------------------------------+------+--------+------------------+------------------+

| Adjustments for: | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Depreciation of property, plant | | | 255,033 | 273,109 |

| and equipment | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Amortisation of intangible assets | | | 41,563 | 41,636 |

+-----------------------------------+------+--------+------------------+------------------+

| Unrealised foreign exchange loss | | | 16,587 | - |

+-----------------------------------+------+--------+------------------+------------------+

| Interest expense | | | 323,834 | 394,940 |

+-----------------------------------+------+--------+------------------+------------------+

| Interest income | | | (99,187) | (341) |

+-----------------------------------+------+--------+------------------+------------------+

| Operating cash flows before | | | (2,492,000) | (1,902,653) |

| working capital changes | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| (Increase)/decrease in: | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Trade and other receivables | | | (2,947,296) | 116,286 |

+-----------------------------------+------+--------+------------------+------------------+

| Inventories | | | 467,758 | 27,639 |

+-----------------------------------+------+--------+------------------+------------------+

| (Decrease)/increase in: | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Trade and other payables | | | (489,731) | 837,499 |

+-----------------------------------+------+--------+------------------+------------------+

| | | | (5,461,269) | (921,229) |

+-----------------------------------+------+--------+------------------+------------------+

| Net interest paid | | | (268,495) | (394,599) |

+-----------------------------------+------+--------+------------------+------------------+

| Net cash used in operating | | | (5,729,764) | (1,315,828) |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Cash flows from investing | | | | |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Additions to property, plant and | | | (518,717) | (1,009,870) |

| equipment | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Additions to intangibles | | | (7,660) | - |

+-----------------------------------+------+--------+------------------+------------------+

| Proceeds from disposal of | | | 67,582 | - |

| property, plant and equipment | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Net cash used in investing | | | (458,795) | (1,009,870) |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Cash flows from financing | | | | |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Net proceeds from borrowings | | | 147,833 | 826,269 |

+-----------------------------------+------+--------+------------------+------------------+

| Proceeds from issuance of | | | 7,575,000 | 1,255,000 |

| ordinary shares | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Payments of finance leases | | | (154,188) | (64,997) |

+-----------------------------------+------+--------+------------------+------------------+

| Net cash from financing | | | 7,568,645 | 2,016,272 |

| activities | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Net increase/(decrease) in cash | | | 1,380,086 | (309,426) |

| and cash equivalents | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Cash and cash equivalents at the | | | (265,168) | (123,489) |

| beginning of the financial period | | | | |

+-----------------------------------+------+--------+------------------+------------------+

| Cash and cash equivalents at the | | | 1,114,918 | (432,915) |

| end of the financial period | | | | |

+-----------------------------------+------+--------+------------------+------------------+

Notes to the condensed consolidated financial statements for the six months

ended 31 December 2008

1. Basis of preparation

The interim condensed consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS"), and are in

compliance with International Accounting Standard (IAS) 34 Interim Financial

Reporting.

The interim condensed consolidated financial statements are presented in Euro

and have been prepared under the historical cost convention.

The Kedco group has historically prepared its annual financial statements under

Irish Generally Accepted Accounting Practice ('Irish GAAP'); however, as

required by AIM rules, the Kedco group will in future prepare its annual

financial statements under International Financial Reporting Standards and

International Financial Reporting Council 'IFRIC' interpretations as adopted by

the European Union ('IFRS'). Kedco has adopted IFRS with effect from 14 March

2005 as part of the financial information included in the admission document,

which is publicly available. The Company will apply IFRS in its financial

statements in its Annual Report for the year ended 30 June 2009. Therefore these

interim statements for the six months ended 31 December 2008 are prepared using

accounting policies in accordance with IFRS in so far as concerns recognition,

measurements and presentation that are expected to be applicable to the

financial statements for the year ended 30 June 2009.

These standards remain subject to ongoing amendment and/or interpretation and

are therefore still subject to change. Accordingly, information contained in

these interim financial statements may need to be updated for subsequent

amendments to IFRS required for first time adoption or for new standards issued

after the balance sheet date.

The basis of preparation and accounting policies followed in the Interim Report

differ from those set out in the Annual Report and Financial Statements for the

year ended 30 June 2008, which were prepared in accordance with Irish GAAP.

This report has been prepared in accordance with IAS 34 'Interim Financial

Reporting'.

A detailed explanation of the impact of the transition from Irish GAAP to IFRS,

setting out the restatement of the comparatives for the year ended 30 June 2008,

was provided in the documents accompanying the admission document, and issued to

the Stock Exchange on 20 October 2008. Details of the significant accounting

policies used in the preparation of the Company's reported results under IFRS

and therefore applied in the preparation of this Interim Report were also

provided within the financial information of Kedco Block Holdings Limited

included in the admission document and are available on the Company's website at

www.kedco.com.

The financial information in this interim report does not comprise the statutory

financial statements of the Company, a copy of which is required to be annexed

to the Company's annual return to the Companies Registration Office. A copy of

the financial statements in respect of the financial period ended 30 June 2008

has been annexed to the Company's annual return for 2008. The auditors of the

Company have made a report, without any qualification on their audit, on the

financial statements of the Company in respect of the financial period ended 30

June 2008.

The results for the six months to 31 December 2008 and 31 December 2007 are

unaudited.

2. Basis of consolidation

The interim condensed consolidated financial statements include the financial

statements of the Company and all subsidiaries. The financial year ends of all

entities in the Group are coterminous.

The financial statements of subsidiaries are included in the interim condensed

consolidated financial statements from the date on which control over the

operating and financial decisions is

obtained and cease to be consolidated from the date on which control is

transferred out of the Group. Control exists where the Company has the power,

directly or indirectly, to govern the financial and operating policies of the

entity so as to obtain economic benefits from its activities.

On 13 October 2008, the Group, previously headed by Kedco Block Holdings Limited

underwent a re-organisation by virtue of which Kedco Block Holdings Limited's

shareholders, in their entirety, exchanged their shares, for shares in Kedco

plc, a newly formed company. Kedco plc then became the ultimate parent company

of the Group. Notwithstanding the change in the legal parent of the Group, this

transaction has been accounted for as a reverse asset acquisition under IFRS 3

Business Combinations and these interim condensed consolidated financial

statements are prepared on the basis of the new legal parent, Kedco plc, having

been acquired by the existing Group. As a result of applying reverse asset

acquisition accounting, the condensed consolidated financial statements are a

continuation of the financial statements of Kedco Block Holdings Limited and its

subsidiaries.

All inter-company balances and transactions, including unrealised gains arising

from inter-group transactions, have been eliminated in full. Unrealised losses

are eliminated in the same manner as unrealised gains except to the extent that

they provide evidence of impairment.

The interest of minority shareholders in the acquiree is measured at the

minority's proportion of the fair value of the assets, liabilities and

contingent liabilities recognised.

3. Significant accounting policies

Apart from the policies set out below, the principal accounting policies used in

preparing the interim condensed consolidated financial statements are unchanged

from those disclosed in the consolidated financial information included in the

admission document for the period ended 30 June 2008. The financial information

included in the admission document relates to Kedco Block Holdings Limited.

Prior to the incorporation of Kedco plc, Kedco Block Holdings Limited was the

ultimate holding company of the Kedco group.

Share-based payments

The Group operates an equity settled share-based Long Term Incentive Plan (the

"LTIP"). Group share schemes allow employees to acquire shares in the Company.

The fair value of share entitlements is recognised as an employee expense in the

income statement with a corresponding increase in equity. Share entitlements

granted by the Company under the LTIP are subject to non-market vesting

conditions. Non-market vesting conditions are not taken into account when

estimating the fair value of entitlements as at the grant date.

The expense for the share entitlements shown in the income statement is based on

the fair value of the total number of entitlements expected to vest and is

allocated to accounting periods on a straight-line basis over the vesting

period. The cumulative charge to the income statement is reversed only where

entitlements do not vest because all non-market performance conditions have not

been met or where an employee in receipt of share entitlements leaves the Group

before the end of the vesting period.

4. Segment reporting

Segment information is presented in respect of the Group's business segments.

This is based on the Group's management and internal reporting structure.

The Group's activity comprises two separate business segments, Kedco Power and

Kedco Energy.

The Kedco Power business segment is the main focus of the Group and specialises

in electrical power generation from biomass and waste.

Kedco Energy contains a number of ancillary businesses serving industrial and

residential customers, all with a renewable energy focus.

+----------------------------+--------+--------------+---------------+---------------+

| Segment information by | | | Six months | Six months |

| Business Segment | | | ended 31 | ended 31 |

| | | | December 2008 | December 2007 |

+----------------------------+--------+--------------+---------------+---------------+

| Revenue by business | | | EUR | EUR |

+----------------------------+--------+--------------+---------------+---------------+

| Continuing operations | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Kedco Power | | | - | - |

+----------------------------+--------+--------------+---------------+---------------+

| Kedco Energy | | | 3,220,751 | 4,227,428 |

+----------------------------+--------+--------------+---------------+---------------+

| | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Total Revenue | | | 3,220,751 | 4,227,428 |

+----------------------------+--------+--------------+---------------+---------------+

| | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Operating loss | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Continuing operations | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Kedco Power | | | (706,052) | (364,098) |

+----------------------------+--------+--------------+---------------+---------------+

| Kedco Energy | | | (715,414) | (1,075,359) |

+----------------------------+--------+--------------+---------------+---------------+

| | | | (1,421,466) | (1,439,457) |

+----------------------------+--------+--------------+---------------+---------------+

| | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Unallocated group costs | | | (437,693) | (777,941) |

+----------------------------+--------+--------------+---------------+---------------+

| Unallocated flotation | | | (946,024) | - |

| costs | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| | | | | |

+----------------------------+--------+--------------+---------------+---------------+

| Operating loss from | | | (2,805,183) | (2,217,398) |

| continuing operations | | | | |

+----------------------------+--------+--------------+---------------+---------------+

The Group's segmental information contains certain headings, which are not

defined under IFRS. For clarity, the following are the definitions as applied by

the Group in their management information:

* 'Operating loss' is profit before taxation and finance costs and represents the

result for each segment

The Group makes this distinction to give a better understanding of the

performance of the business.

5. Income tax

An income tax charge does not arise for the 6 months ended 31 December 2008 or

31 December 2007 as the effective tax rate applicable to expected to total

annual earnings is Nil as the Group have sufficient tax losses coming forward to

offset against any taxable profits. A deferred tax asset has not been recognised

for the losses coming forward.

6.Earnings per share

+-----+----------------------------+--+--------+--------------------+---------------------+

| | | | Six months ended | Six months ended |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | 31 December 2008 | 31 December 2007 |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | EUR | EUR |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | Euro per share | Euro per share |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Basic loss per share | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | From continuing operations | | (0.017) | (0.029) |

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Diluted loss per share | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | From continuing operations | | (0.015) | (0.029) |

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Basic loss per share | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | The earnings and weighted average number of ordinary shares used in the |

| | calculation of the basic loss per share are as follows: |

+-----+-----------------------------------------------------------------------------------+

| | | | Six months ended | Six months ended 31 |

| | | | 31 December 2008 | December 2007 |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | (Unaudited) | (Unaudited) |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | EUR | EUR |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Loss for year attributable | | (3,029,830) | (2,611,997) |

| | to equity holders of the | | | |

| | parent | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | Number | Number |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Weighted average number of | | 181,175,867 | 91,458,560 |

| | ordinary shares for the | | | |

| | purposes of basic loss per | | | |

| | share | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | Diluted loss per share | | | |

+-----+----------------------------+-----------+--------------------+---------------------+

| | The loss used in the calculation of the diluted loss per share measure is the |

| | same as that for the equivalent basic loss per share as outlined above. |

+-----+-----------------------------------------------------------------------------------+

| | The weighted average number of ordinary shares for the purposes of the diluted |

| | loss per share reconciles to the weighted average number of ordinary shares used |

| | in the calculation of basic loss per share as follows: |

+-----+-----------------------------------------------------------------------------------+

| | | | Six months ended | Six months ended 31 |

| | | | 31 December 2008 | December 2007 |

+-----+-------------------------------+--------+--------------------+---------------------+

| | | | Number | Number |

+-----+-------------------------------+--------+--------------------+---------------------+

| | Weighted average number of | | 181,175,867 | 91,458,560 |

| | ordinary shares used in the | | | |

| | calculation of basic loss per | | | |

| | share | | | |

+-----+-------------------------------+--------+--------------------+---------------------+

| | Share deemed to be issued in | | | |

| | respect of: | | | |

+-----+-------------------------------+--------+--------------------+---------------------+

| | Long-term incentive plan | | 16,418,777 | - |

+-----+-------------------------------+--------+--------------------+---------------------+

| | Weighted average number of | | 197,594,644 | 91,458,560 |

| | ordinary shares used in the | | | |

| | calculation of diluted loss | | | |

| | per share | | | |

+-----+----------------------------+--+--------+--------------------+---------------------+

+----+----------------------------------+--------------------+------------------+

| 7. | Goodwill | At 31 December | At 30 June 2008 |

| | | 2008 | |

+----+----------------------------------+--------------------+------------------+

| | | EUR | EUR |

+----+----------------------------------+--------------------+------------------+

| | Balance at beginning and end of | 549,451 | 549,451 |

| | the period | | |

+----+----------------------------------+--------------------+------------------+

The goodwill of EUR549,451 in the Kedco Energy business segment arose on the

acquisition in February 2006 of an 80% shareholding in SIA Vudlande, a limited

liability company incorporated in Latvia.

Goodwill is subject to impairment testing on an annual basis. Impairment testing

is carried out by comparing the carrying value of the goodwill to its

recoverable amount, generally its current value-in-use.

The cash flow forecasts employed for the value-in-use comparisons are based on

budgeted figures for the first year and on a three-year forecast approved by the

Board for the following three years. Cash flow is then projected forward for the

following ten years based on an assumed growth of 3% per annum. The discount

factors applied to future cash flows range from 9% to 12% as deemed appropriate.

The directors' believe that any reasonably possible change in key assumptions on

which the value-in-use is based would not cause the aggregate carrying amount to

exceed the aggregate recoverable amount of the cash-generating unit. A 1%

increase in the discount rate would not result in an impairment charge for the

periods presented.

No impairment losses have arisen in any financial period to date.

8. Property, plant and equipment

During the period, the Group invested EUR438,282 in improving the efficiency of

its biomass wood processing plant in Latvia. This investment was financed

through debt.

9. Trade and other receivables

Included in trade and other receivables at 31 December 2008 are deposits paid to

suppliers of gasification units totalling EUR2,678,769 and unpaid share capital of

EUR492,563 relating to the issue of 49,256,332 A Shares of EUR0.01 each as part of

the Long Term Incentive Plan for employees.

10. Share capital

Kedco plc

+---------------+----------------+-------------+-------------+-------------+

| At 31 | Authorised | Allotted | Authorised | Allotted |

| December 2008 | Number | and called | EUR | and called |

| (Unaudited) | | up | | up |

| | | Number | | EUR |

| | | | | |

+---------------+----------------+-------------+-------------+-------------+

| Ordinary | 10,000,000,000 | 199,446,480 | 100,000,000 | 1,994,465 |

| shares | | | | |

| of EUR0.01 each | | | | |

+---------------+----------------+-------------+-------------+-------------+

| A shares | 10,000,000,000 | 99,117,952 | 100,000,000 | 991,180 |

| of EUR0.01 each | | | | |

+---------------+----------------+-------------+-------------+-------------+

| | | | | |

+---------------+----------------+-------------+-------------+-------------+

Kedco Block Holdings Limited

+--------------+---------------+---------------+--------------+--------------+

| At 30 June | Authorised | Allotted | Authorised | Allotted |

| 2008 | Number | and called up | EUR | and called |

| (Audited) | | Number | | up |

| | | | | EUR |

+--------------+---------------+---------------+--------------+--------------+

| Ordinary | 100,000,000 | 1,807,933 | 100,000,000 | 1,807,933 |

| shares | | | | |

| Of EUR1.00 | | | | |

| each | | | | |

+--------------+---------------+---------------+--------------+--------------+

| At 31 | | | | |

| December | | | | |

| 2008 | | | | |

| (Unaudited) | | | | |

+--------------+---------------+---------------+--------------+--------------+

| Ordinary | 100,000,000, | 2,493,081 | 100,000,000 | 2,493,081 |

| shares of | | | | |

| EUR1.00 each | | | | |

+--------------+---------------+---------------+--------------+--------------+

The holders of the ordinary shares are entitled to receive dividends as declared

and are entitled to one vote per share at meetings of the company. All ordinary

shares are fully paid up.

The Company was incorporated on 2 October 2008 with an initial authorised share

capital of EUR100,000,000 divided into 100,000,000 ordinary shares of EUR1.00 each

of which 38,100 ordinary shares of EUR1.00 each fully paid up were issued.

On 14 October 2008 the ordinary shares were subdivided so that each Ordinary

Share had a nominal value of EUR0.01 each as opposed to the previous nominal value

of EUR1.00 each.

Reverse asset acquisition

On 13 October 2008, the Company acquired the entire issued share capital of

Kedco Block Holdings Limited ("KBHL") in consideration for the allotment and

issue of 2,493,081 ordinary shares of EUR1.00 each to the former members of KBHL.

Pursuant to the agreement, the Company allotted and issued one ordinary share of

EUR1.00 each in consideration for the transfer to it of each share held in KBHL.

The fair value of the shares in Kedco Block Holdings Limited received as

consideration for the issue of these shares in Kedco plc was EUR34,903,134 which

resulted in a share premium in the Company of EUR32,908,669. From a group

perspective, since the acquisition is being accounted for as a reverse asset

acquisition, the shares of the new legal parent (Kedco plc) were recognised and

the shares of the accounting parent (Kedco Block Holdings Limited) were

derecognised. A reverse acquisition adjustment has been made for the share

capital of the accounting parent and is offset against the share premium of the

new legal parent.

Movements in the six months to 31 December 2008

Kedco Block Holdings Limited:

* On 22 August 2008 Kedco Block Holdings Limited issued 685,148 ordinary shares of

EUR1.00 each at a premium of EUR6,889,852.

* Kedco plc:

* On 14 October 2008 the ordinary shares were subdivided so that each Ordinary

Share had a nominal value of EUR0.01 each as opposed to the previous nominal value

of EUR1.00 each.

* On 14 October 2008 a new class of shares was created, namely 10,000,000,000 A

Shares, in connection with the Long-Term Incentive Plan.

* On 14 October 2008 20% of the existing issued ordinary shares were converted and

re-designated as A Shares.

* On 15 October 2008, the Company acquired, for no consideration, 3,048,000

ordinary shares and 762,000 A shares held by the subscriber shareholders of the

Company and the shares acquired were subsequently cancelled.

* On 16 October 2008, the Company allotted and issued 49,256,332 A shares with a

nominal value of EUR0.01 per share to certain employees of the Group pursuant to

the Long Term Incentive Plan.

11.Share-based payments

On 16 October 2008 the Group established a Long Term Incentive Plan (the "LTIP")

under the terms of which certain employees subscribed for A Shares at a

subscription price being the par value of EUR0.01 each that reflected the

restricted nature and contingent value attaching to such shares.

All A Shares will convert into Ordinary Shares with full voting and dividend

rights following the achievement by management of the Group of any one of the

following performance related targets:

* the Group, for any financial year ending on or prior to 30 June 2011, achieving

EBITDA of at least EUR14 million in respect of such financial year; or

* the Group, for any financial year ending on or prior to 30 June 2011, achieving

EBITDA of at least EUR7 million in respect of such financial year (conversion only

taking place after 30 June 2011 notwithstanding the achievement of the relevant

target in an earlier year); or

* the Group, for the financial year ending on 30 June 2011 and for the financial

year ending on 30 June 2012, achieving cumulative EBITDA of at least EUR14 million

over the period of such financial years.

EBITDA in respect of any relevant financial period means the earnings of the

Group before interest, taxation, depreciation and amortisation by reference to

the profit and loss account of the Group for the relevant financial period

(based on the audited financial statements of the Group for such financial

period) which shall be calculated both in accordance with IFRS and in accordance

with the same accounting principles and policies applied by the Group in

previous years (IFRS prevailing in the case of conflict).

If the EBITDA targets referred to above are not met then the conversion of the A

Shares shall not occur and the Group may redeem these A Shares, subject to

adequate reserves, at the par value thereof.

If a successful offer is made to acquire control of a majority of the shares in

the Group or all, or substantially all, of its assets, immediately prior to

completion of such an offer, the A Shares will convert into Ordinary Shares so

that they become eligible to participate in such an offer notwithstanding if

such an offer occurs prior to 30 June 2012.

The Group will have an option to redeem all A Shares (at the original

subscription price) held by a member of management who leaves the Group's

employment for whatever reason before the date of conversion save for:

* where a member of management ceases to be an employee of the Group by reason of

death or permanent disability. In this instance the A Shares will pass to the

deceased's estate (in the case of death) or will be retained by him/her (in the

case of permanent disability) pending confirmation as to whether conversion

shall occur; and

* where a member of management ceases to be an employee of the Group (for any

reason whatsoever) after the end of a particular financial year (or years), but

before EBITDA is determined based on the audited accounts for that year (or

years), then if the relevant Targets are achieved for such financial year (or

years) such person will, notwithstanding his/her departure from the Group,

remain entitled to benefit under this incentive scheme and have his/her A Shares

converted and re-designated into Ordinary Shares.

Details of the LTIP shares are as follows:

+------------+-------------+-------------+--------------+-----------+

| Issue Date | Number of | Issue Price | Fair Value | Expense |

| | LTIP A | | at issue | in |

| | shares | | date | Income |

| | | | | Statement |

| | | | | 2008 |

+------------+-------------+-------------+--------------+-----------+

| 16 October | 49,256,332 | EUR0.01 | EUR0.01 | EURNil |

| 2008 | | | | |

+------------+-------------+-------------+--------------+-----------+

The fair value assigned to the LTIP shares is the par value of the shares issued

based on the short length of time that has elapsed between their issue on 16

October 2008 and the date of this report 31 December 2008.

No amount has been charged to the income statement in the period to recognise

the fair value as the directors do not consider such charge to be material based

on the short length of the vesting period which has elapsed between the issue of

the A shares and the date of this report.

12. Events after the balance sheet date

During February 2009 the Company raised EUR967,556, before expenses, from a

selection of institutional investors. The proceeds from the placing will be used

to develop further projects, as the business continues to deliver its strategy

of identifying joint venture partners for its waste to energy solutions in the

UK and Ireland.

13. Approval of financial statements

The financial statements for the six months ended 31 December 2008, which comply

with IAS 34, were approved by the Board of Directors of the Company on 20th

March 2009.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFLTVLIIFIA

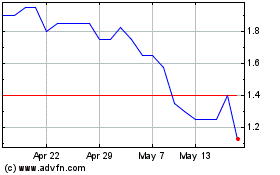

Eqtec (LSE:EQT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Jul 2023 to Jul 2024